WHY THIS IS MORE THAN A DEAD CAT BOUNCE..

WEEKLY GRAIN NEWSLETTER

Here are some not so fearless comments for www.dailymarketminute.com

Did the dead cat bounce or our are markets still alive?

That was the question for wheat and corn as we ended the week, while the bean market showed strong demand to go along with some heat scares.

Overall the markets still have to be considered disappointing for the bulls. But as the charts below show at least we have a little life.

This first chart is a weekly September corn chart. The first thing that sticks out to me is that we left a hammer on the weekly charts, which is similar to what we did a few weeks ago when we left a doji on the charts. It is a bullish signal, last time we rallied 60 plus cents. Don’t be surprised if we can get back 50-75% of what we have lost in the past couple of weeks back. The hot and dry forecast is one that could spark some short covering.

Look at this December corn weekly chart. Notice the tails when we made new lows, followed by the reversal higher.

The weekly soybean chart looks like it wants to fill the gap we left a few weeks ago and then perhaps test the highs we had. With demand solid, dry and hot in the forecast don’t rule out new highs despite us getting closer to harvest.

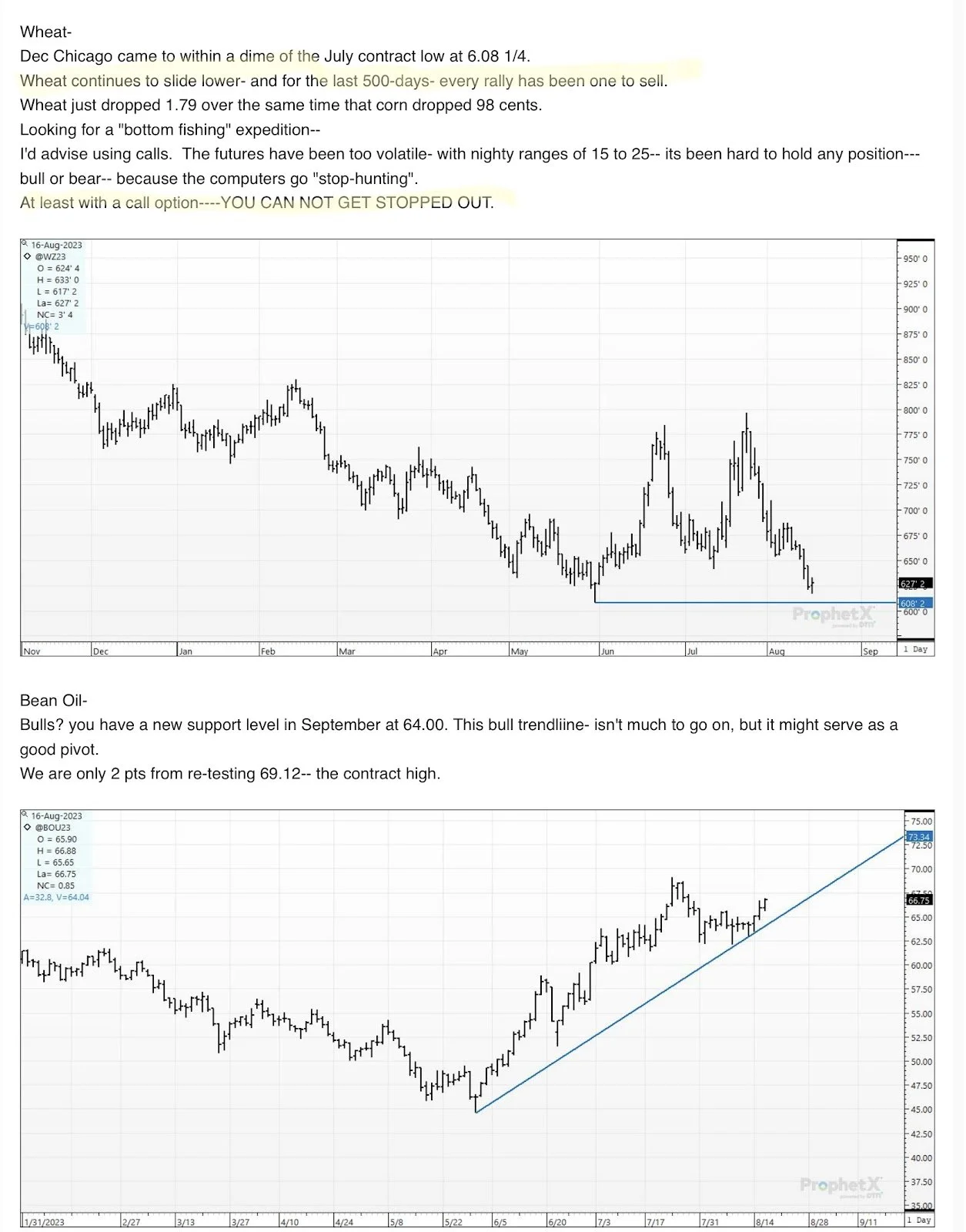

The bean oil situation remains very bullish.. This chart. Is close to an upside breakout.

The weekly soybean oil chart is one that has the demand behind it to go after the all time highs. Don't rule this out. It seems given our fundamental situation it is just a matter of time before we go nuclear or see bean oil prices go parabolic.

Here is a weekly CBOT wheat chart. Notice the hammer we left. Also a bullish signal. Look for us to run back up to 7-7.50 area.

KC wheat also left a hammer. Look for KC wheat to rally back towards 8.00

MPLS wheat should test 9.00 again in the near future.

Canola is at a good crossroads; it wouldn't take much to make new highs in the near future.

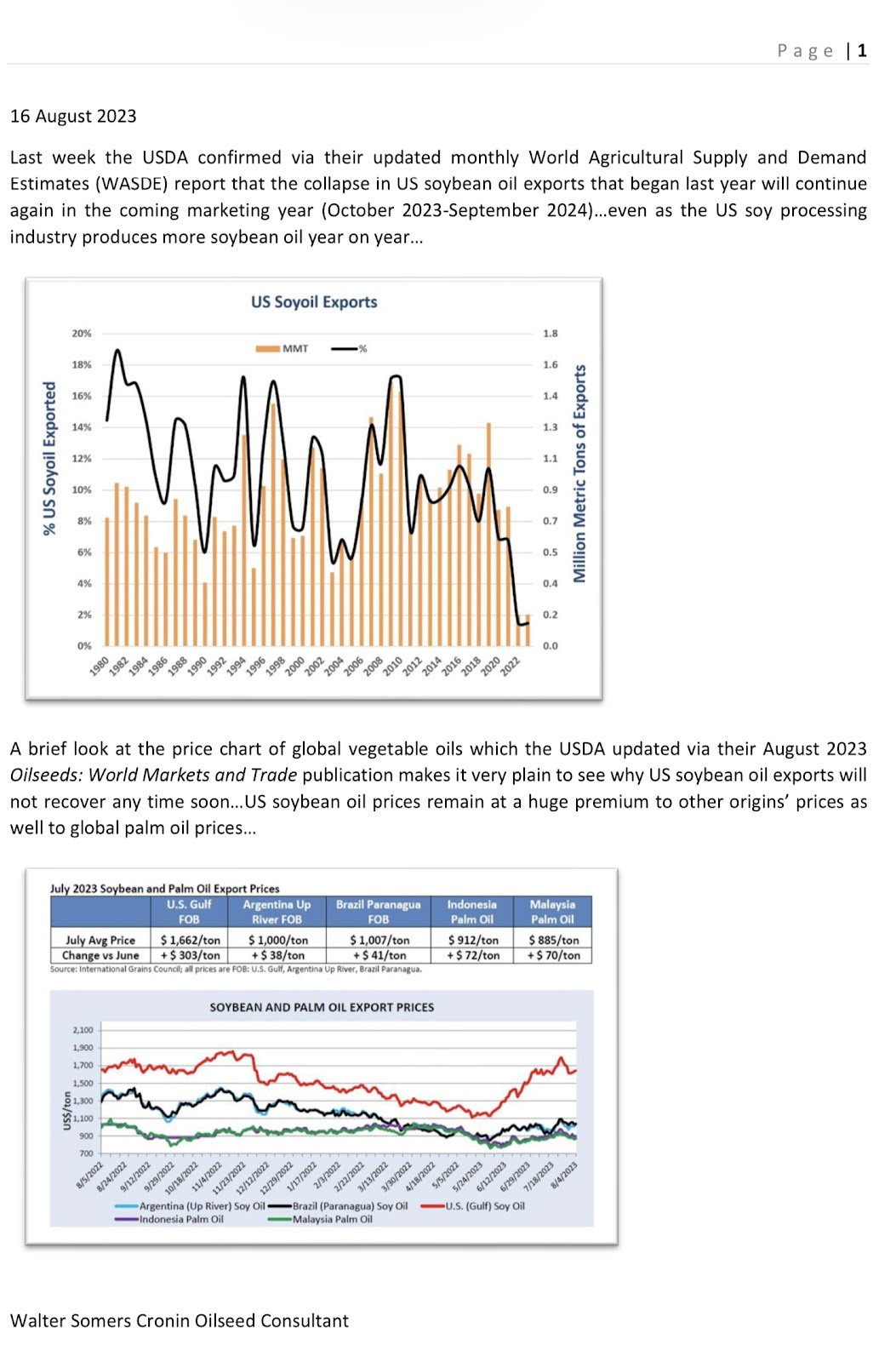

Here is an insert from Walter Cronin. Take a look as it is very informative and builds the bullish fundamental backdrop that longer term will support our markets.

Below are some screenshots from Robinson Ag from a couple of days ago. Notice a couple of the highlighted sentences. The first one I feel is very key is that we had a whole 7 days to make corn sales north of 6.00 this year. That shows that when one calls market direction you are going to have a lot of days of being wrong.7 out of 240 days or so. That is a very small percentage. So those of you shooting for higher prices remember they come and go fast, you have to be disciplined.

The other comment that really hits how is “Why would you buy some calls down here?”

I want to thank all of you that stopped by our booth at Dakota Fest.

Here are a couple of pictures. Thanks again and congratulations to those that won the God Made a Farmer's Wife signs. A special thanks to my wife and mother who made both of them. Thanks and congrats to the winners.

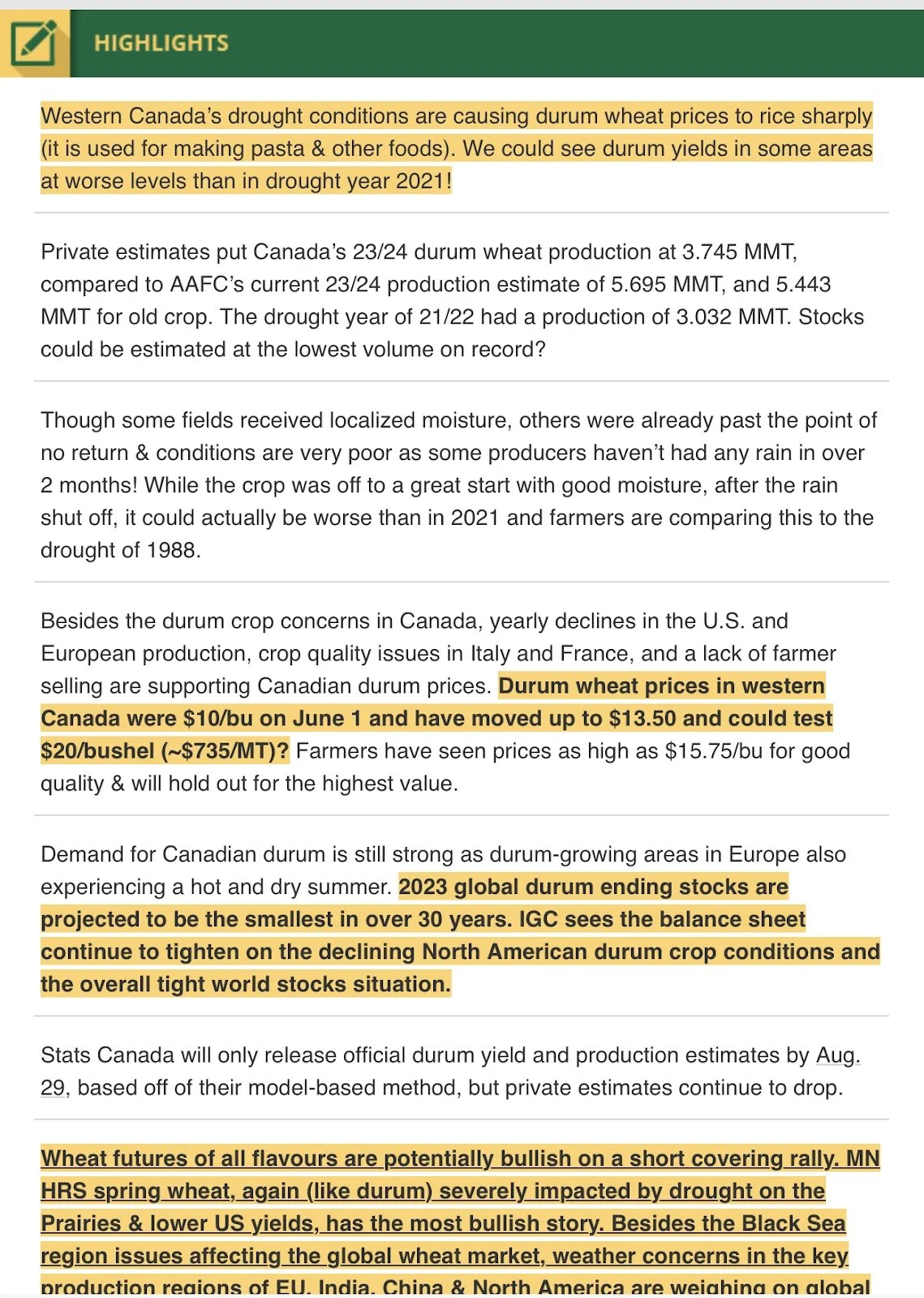

The bottom line is despite a disappointing week the outlook this week remains very positive. The charts look positive as mentioned above. Weather remains bullish and here are some more bullish fundamentals for the big picture of the wheat market.

Recommendation is to get your courage calls bought asap. Renown previous sales asap. Don’t wait and chase after we have rallied.

If you need help opening a hedge account give me a call at 605-295-3100

Here is also a link to get started.

https://www.dormanaccounts.com/eApp/user/register?brokerid=332

Take a look at the below write up on Austrian wheat from hedge point. Bullish?

War is still happening as well.

Quality wheat situation is also bullish with the Durum market in Candace. Take a look at the best from Farms.com risk management

Weather maps say enough. How much damage is being done to the soybean yield? I don’t know if we have a good barometer or history to know for sure. Same goes with corn. But my guess is this isn’t adding bushels.

Won’t be fun for those on the Pro Farmer Crop tour.

Now is the time to become a price maker, don’t give up leverage. For those of you with basis contracts, do yourself a favor and re-own futures instead of letting your buyers use your money.

Some areas are offering some attractive free price later or delayed price storage also. If you want to become a price maker you can not put bushels into these programs. They make no sense and they take away demand and competition for your grain. Become a price maker today via no longer utilizing delayed price or price later storage programs. Also start using futures instead of HTA or Futures Fixed. Make buyers compete.

Past Updates

8/18/23 - Market Update

GRAINS BOUNCE. WEATHER REMAINS BULLISH

Read More

8/18/23 - Audio

WEATHER,WAR, & MANAGING RISK

Read More

8/16/23 - Audio

CAN DEMAND & WEATHER LEAD TO A BOUNCE?

8/15/23 - Audio

GRAINS LOWER WITH IMPROVEMENT TO CROPS

8/14/23 - Audio

BEANS RALLY BUT CONDITIONS IMPROVE & WHEAT DISAPPOINTS

8/13/23 - Weekly Grain Newsletter

WHAT’S NEXT FOLLOWING DISAPPOINTING USDA REPORT?

8/11/23 - Audio & Report Recap

USDA REPORT BREAKDOWN

Read More

8/10/23 - Audio