GRAINS FADE OFF HIGHS

Overview

Grains closed lower once again here today. The biggest reason for the weakness today was simply the outside markets. We had crude oil hammered, down $4 a barrel. The Dow was down over 500 points at one point.

Outside markets are fearful that the collapse of the First Republic Bank over the weekend won't be the last of the bank failures. As that fear and pressure from the outside markets leaked over into the grains. The collapse of the First Republic Bank was the 4th regional US lender to fall apart since early March, and the 2nd biggest bank failure in history.

The grains actually looked like they were going to try and rally, with some strength overnight. At one point beans were up 13 cents before ultimately closing down nearly 17. Corn and wheat were trading anywhere from 6 to 8 cents higher at one point before all closing lower on the day. As all classes of wheat closed down nearly double digits.

The Feds meet tomorrow and will release its decision on interest rates. They are looking for a 1/4% increase, with some thinking it could actually be 1/2%.

Russia, Ukraine, Turkey, and the UN will meet tomorrow to discuss if they will be renewing the Black Sea deal or not.

***

Sunday's Weekly Grain Newsletter

Why We Will Thank Market For Lower Prices

Read Here

Today's Main Takeaways

Corn

Corn futures slip again, but manage to hold up the best amongst the grains. Losing 4 1/2 cents on the day after trading 6 cents higher early on.

Yesterday we got the crop progress report. It showed US corn planting at 26% complete, which is right on par with the 5 year average pace, but well ahead last year's 13% at the same time last year. But from what I've been hearing is that a lot of guys might have to wind up replanting.

Some states running behind include; Iowa, South Dakota, North Dakota, Wisconsin, Minnesota, and Michigan. I provide all of the actual numbers at the end of today's update.

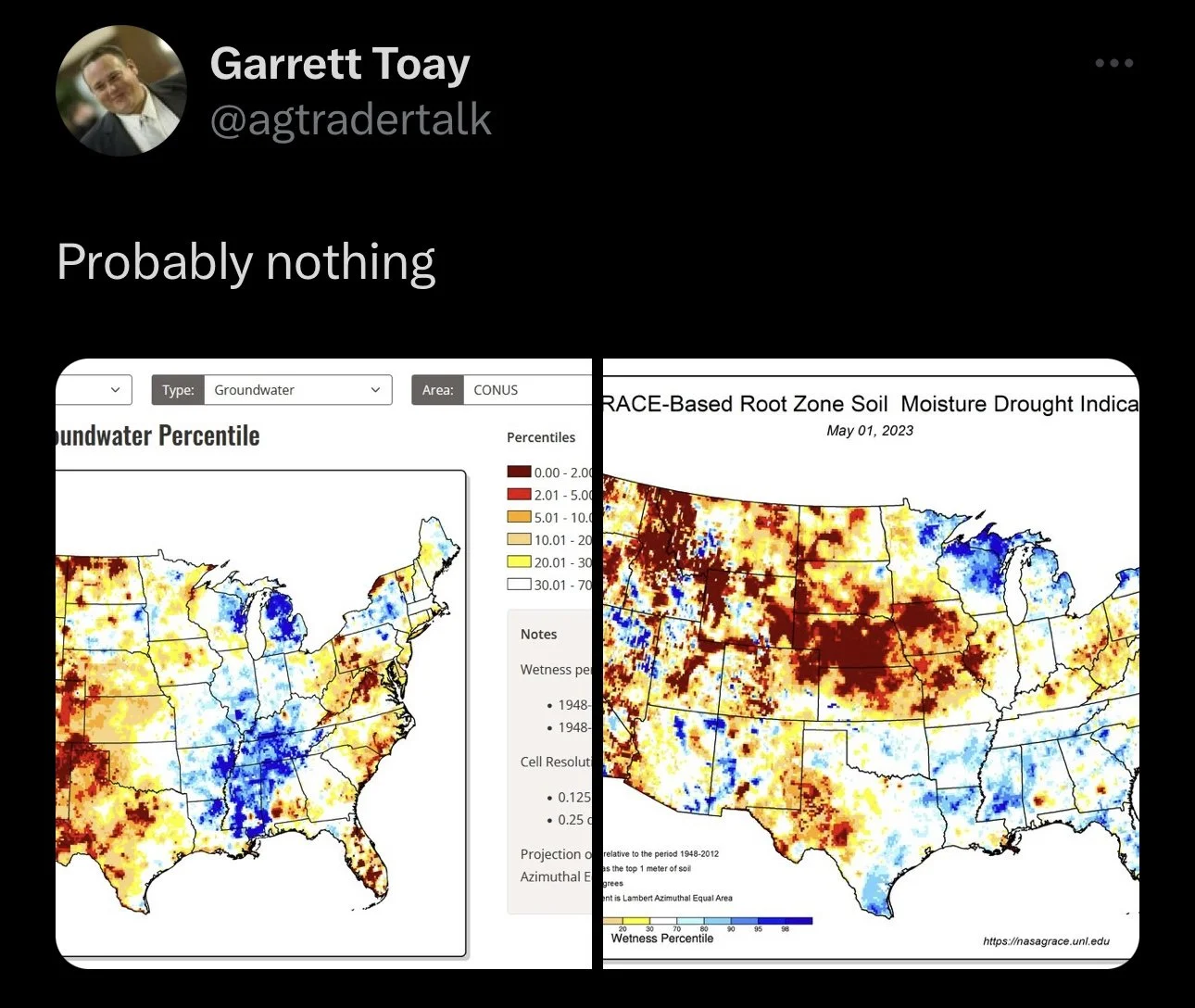

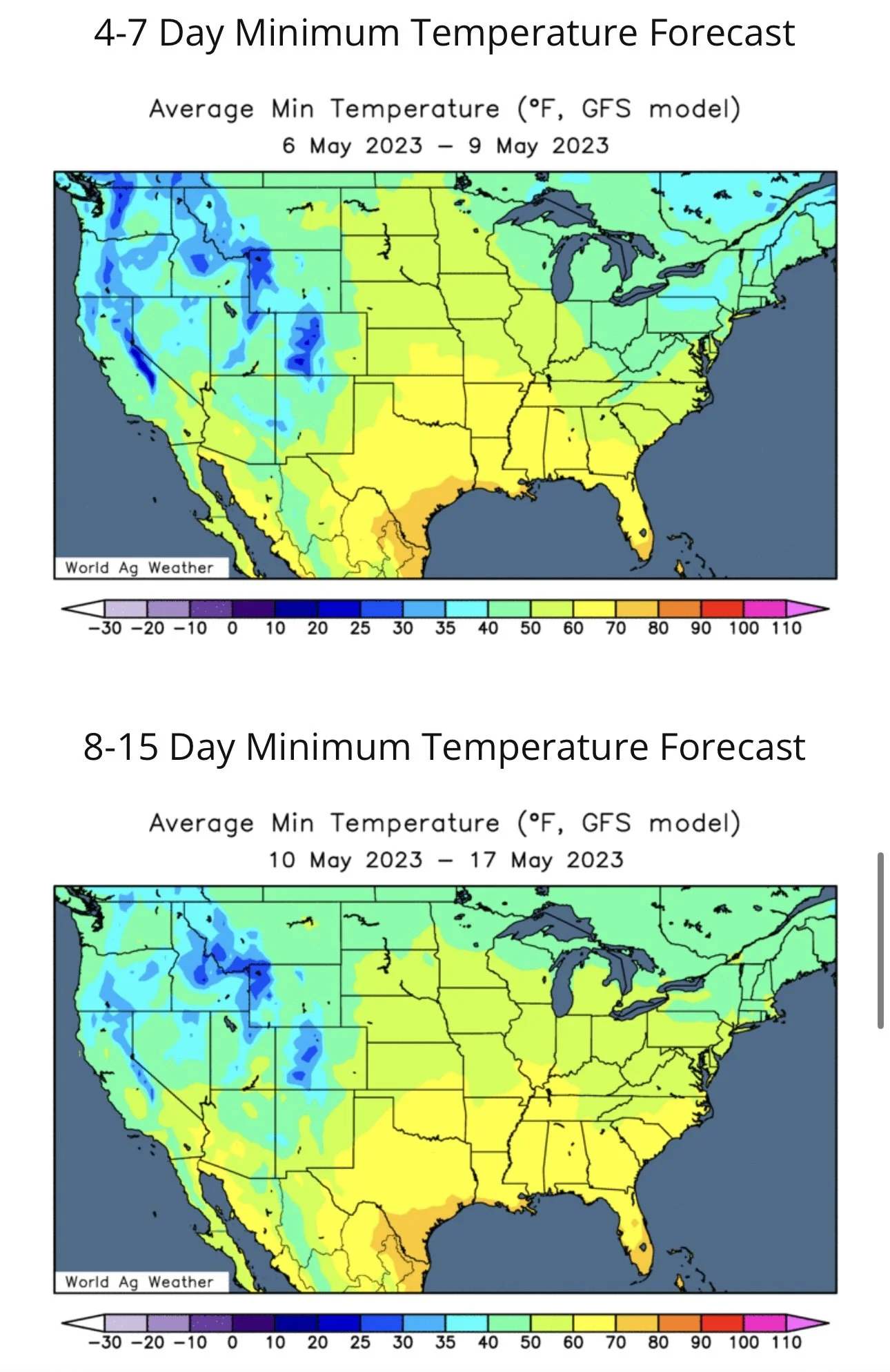

Taking a look at weather, the planting weather looks pretty open for most of the Midwest and a good portion of the corn belt for the next week or so.

Export inspections have been really back and forth as of late. Some weeks are great, but then those are followed by a lackluster week. Last week's inspections hit a marketing year high of 1.52 million tons. If next week's numbers come in strong that could be a good sign for a trend change.

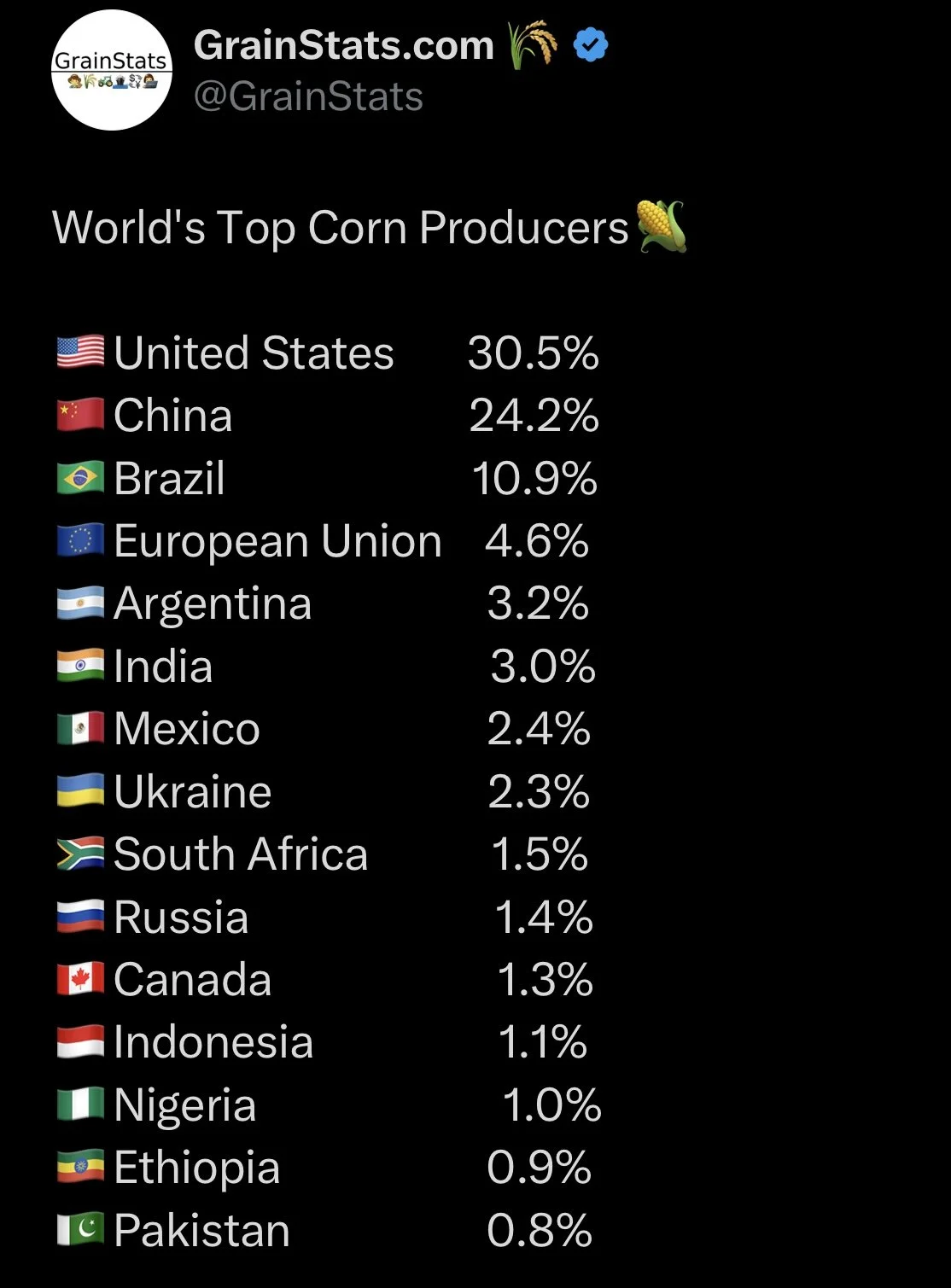

Taking a look at South America, it’s a little more of the same. Bulls continue to look at all the losses in Argentina. Where their crop sits at XXX, and the crop is forecasted to be 14 million metric tons smaller than last year. On the other side of things, bears continue to make Brazil argument, where their crop is expected to be 9 million tons larger than last year.

As mentioned, we have Russia, Ukraine, and other countries meeting this week to discuss the future of the Black Sea agreement. Bulls are still looking at Ukriane as a possible bullish wild card, making the argument that their production and exports will be moving lower rather than higher.

Going forward, our stance remains the same. The market is incredibly oversold here. But the next few weeks we could still definitely see some more downside. Our belief is that we make our lows towards the end of the month of May and go much higher from there.

Corn July-23

Soybeans

Beans opened up the day strong, and at one point where trading 13 cents higher before giving back all of those gains and getting hit the hardest out of the grains. Ending the day down nearly 17 cents and almost 30 cents off their early highs.

In yesterday's planting progress update, beans were the only one of the 3 crops that were ahead of pace. As they came in at 19% complete, which is nearly double the 5-year average of 11%.

Even with today’s losses, bulls did get a nice little bullish surprise. As the fats and oils report showed that the US soybean crush reached a record 198 million bushels for March, with oil stocks coming in lower. This is what gave some support to beans before we gave it all away. This also means that domestic demand is still strong, which could look to add support in the future.

Bears of course continue to look at Brazil and their record cheap crop. They are essentially done harvesting their massive crop, and the biggest problem is still the fact it is being offered at a discount to that of the US. Now actually getting the crop of out of the country is still a potential problem for down the road.

Argentina's crop is terrible, and is expected to be nearly half of what it was last year. Down 20 million metric tons to 24 million vs last year's 44 million. However, some argue that Brazil's massive crop will counter act this, as their crop is forecasted to be nearly 24 million bigger than last year.

Going forward bulls would like to see a greater demand story for China. Taking a look at the chart, we still hold that upward trendline despite the losses today. Bulls would like to continue to hold that level and get a break out of this short term downward trend from February.

Soybeans July-23

Wheat

Wheat continues its recent downfall. To start the session we had wheat futures 6 to 8 cents higher before getting hammered with the rainy forecasts and pressure from the outside markets. Resulting in Chicago closing down 9 cents and KC and Minneapolis both down 17.

As mentioned, Russia, Ukraine, Turkey, and the UN will all be meeting this week to discuss the future of the Black Sea agreement in attempts to decide whether it will be renewed or not. The deadline for an extension is May 18th. Russia continues to say they want sanctions renewed and continue to threaten to back out of the deal if their requests aren’t met. So this meeting is really just a wild card.

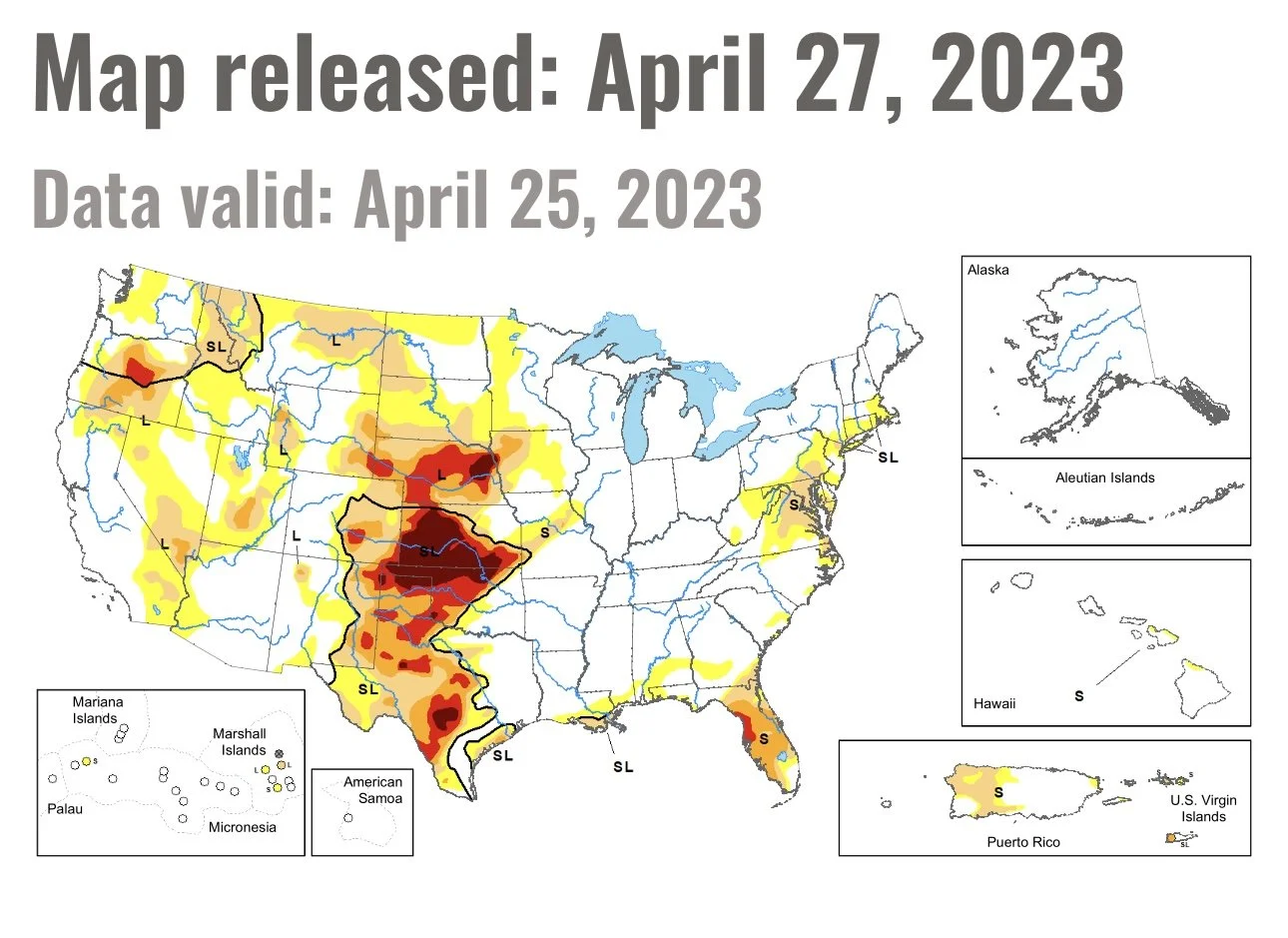

After close yesterday we got the updates planting progress and crop conditions. As for the conditions of the winter wheat crop, it was a little bit of a mixed bag with some slight improvements. We saw the overall good to excellent ratings upped 2% from 26% to 28%, while on the other hand we also saw the poor to very poor rating bumped 1% higher to 42%. If we take a look at the states in the western plains. Kansas saw their crop rating drop from 14% to 13% rated good to excellent. With Texas, Oklahoma, and Nebraska all seeing decreases as well.

Taking a look at spring wheat planting, it came in at just 12%. This is an increase from last week's 5% but trails last year's 18%. Overall, this is the 3rd slowest start to planting for spring wheat on record. Additionally, due to the late snows we saw North Dakota at just 6% complete while Minnesota hasn’t even officially gotten started yet.

Over the weekend we saw an escalation of attacks from Russia and Ukraine, but the market pretty much entirely ignored this. As the markets viewed the winter wheat rains as more of a negative than war. Sure we got some rain and we have some more rain in the forecasts, but the biggest question is do these rains even matter at this point? It is tough to say how much these rains will help, but I have heard rumors that these rains are going to be too late for a vast majority of Kansas wheat. I just don’t think these rains will be much of a game changer.

We will get the mid-May crop tours which will provide a lot more insight on the crop, but there have been reports that 80 to 90% of spring wheat acres will be abandoned and some experts are forecasting Kansas wheat production to fall by 100 million bushels. Keep in mind, Kansas makes up for 25% of total US production.

From Farms.com Risk Management

"High abandonment and lower yields could see ending stocks fall to a record low despite a 1-time rain event of 1-3 inches at the end of April after 18 months of hot and dry weather. It was too much too little too late."

Going forward, it’s still tough to jump on the bear train even after our complete fall out, but it is just as difficult to try and catch a falling knife and predict a bottom here. We have winter wheat conditions sitting at near record lows, being the worst since 1989, and could possibly rival 2007/2008's record low wheat yields of 31 bushels an acre. I think the market is overplaying the rain card, and we still have the chance for war to be a factor at play. I don’t quite know where the bottom is, but we have plenty of bullish cards left to be played down the line.

Chicago July-23

KC July-23

MPLS July-23

Seasonality in Wheat & Bottom Line

From Farms.com Risk Management,

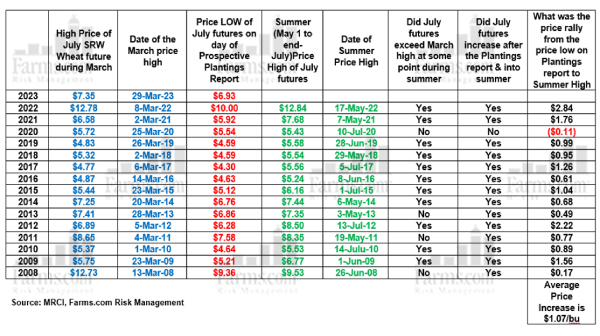

The 15-year average price rally from the low of the USDA March intentions report day, to the summer high is $1.07/bu and works 14 out of 15 years. (Please see chart below)

The 2023 new crop July 2023 gain of $1.07 would put futures at a summer high of US $8/bu (currently at U.S. $6.1825/bu.

Technically, if on a weekly basis, July SRW wheat can close back above the resistance at $7.0975/bu, the upside pivot point is $7.3975 that could see a rally back to the mean/average at $7.94/bu as we remain very oversold with an RSI (relative Strength Index) at 29.90- it is a buy & not a sell.

There are no May seasonal trade recommendations for Chicago SRW wheat futures.

Strong seasonals this time of the year have not kicked in yet, & the wheat market continues to be subject to macro market recessionary (fear) malaise. Funds will need to shift some of their focus from big tech stocks to commodities.

Bottom Line

Though strong seasonals are indicated for the summer by past futures action, post COVID seasonality has not been the same as pre COVID for all commodities. A looming economic recession continues to overshadow grain fundamentals.

Wheat futures continued lower as ample global supplies nearby, plus beneficial rains in the U.S. Plains, had traders looking beyond Russia’s threats to pull out of the Black Sea grain deal. Russia will produce a smaller wheat crop in 2023 of 85 mmt, down from a record last year at 105 mmt, and exports should be down as they continue to implement export taxes and limit the amount that farmers will net. Continued uncertainty will only add to the volatility.

But markets can stay irrational a lot longer than we can stay solvent. Longer-term bullish fundamentals in MW/HRW markets will matter more. KC wheat might have to do the bulk of the heavy lifting to support the wheat complex initially, & spring wheat will have to take over as we go into summer. Net Managed Money Funds are expected to be near record short in Chicago SRW wheat- once we bottom (sooner rather than later), there is opportunity for new value-hunting fund money to come in at oversold conditions & propel it higher?

Crop Conditions & Progress

Corn 🌽

26% planted

27% trade estimate

14% last week

13% last year

26% 5-year average

Beans 🌱

19% planted

17% trade estimate

9% last week

7% last year

11% 5-year average

Spring Wheat 🌾

12% planted (3rd slowest all-time for date)

14% trade estimate

5% last week

18% last year

22% 5-yr average

Winter Wheat 🌾

28% rated good to excellent

26% last week

27% last year

42% rated poor to very poor

41% last week

43% last year

Notable Corn Planting Progress by State (Compared to 5-yr average)

Behind

Iowa (-5%)

Wisconsin (-9%)

Minnesota (-18%)

South Dakota (-9%)

North Dakota (-1%)

Michigan (-5%)

Ahead

Nebraska (+8%)

Illinois (+11%)

Indiana (+5%)

Ohio (+3%)

Check Out Past Updates

5/1/23 - Market Update

Wheat Continues to Fall

Read More

4/30/23 - Weekly Grain Newsletter

Why We Will Be Thanking Market for Lower Prices

4/28/23 - Market Update

Grains Green for First Time in 10 Days

4/27/23 - Audio Commentary