WHEAT CONTINUES TO FALL

Overview

Grains mixed, with corn down a hair and soybeans finding some strength. While wheat on the other hand saw some heavy selling despite some nuclear comments from Russia.

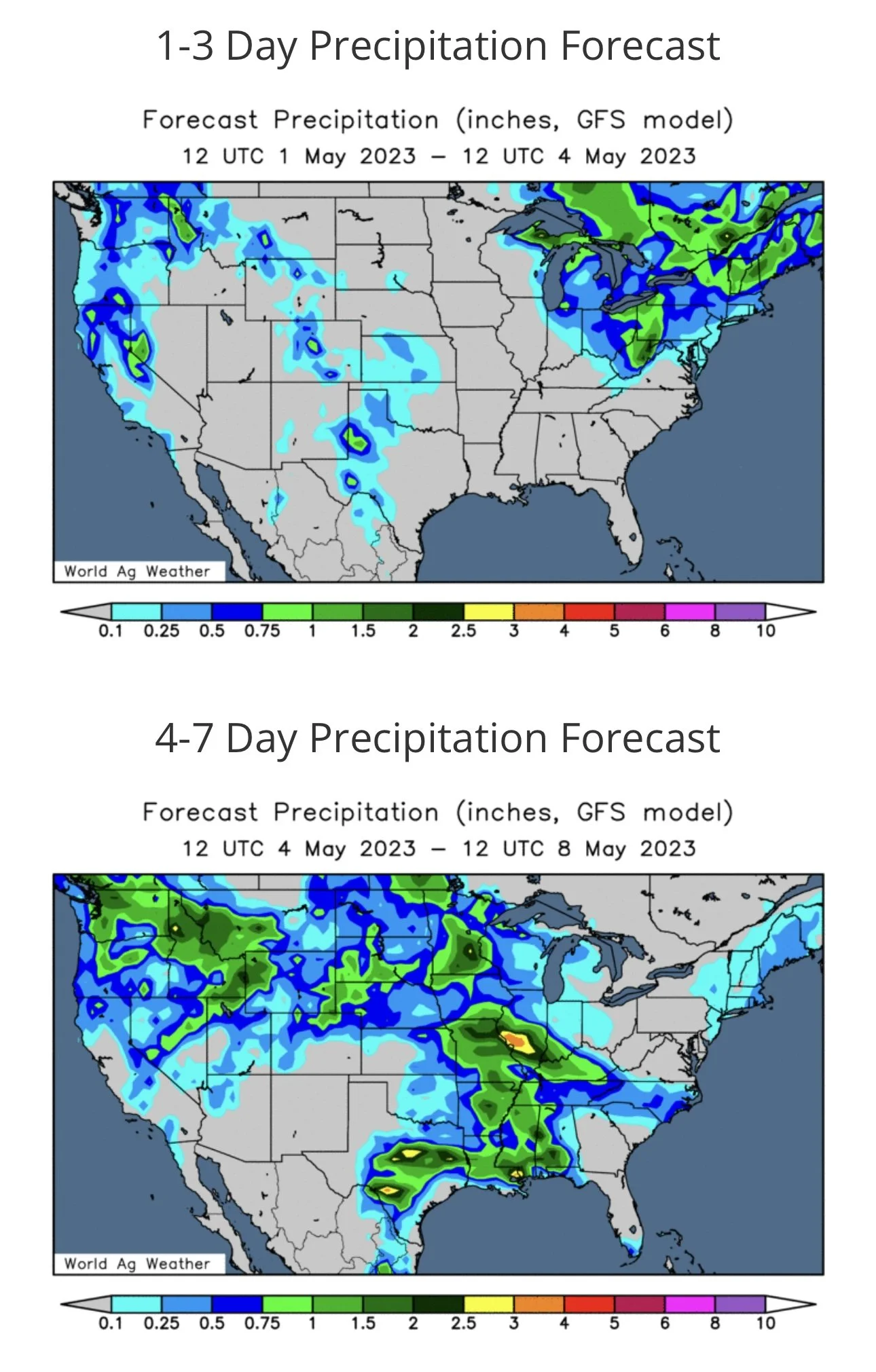

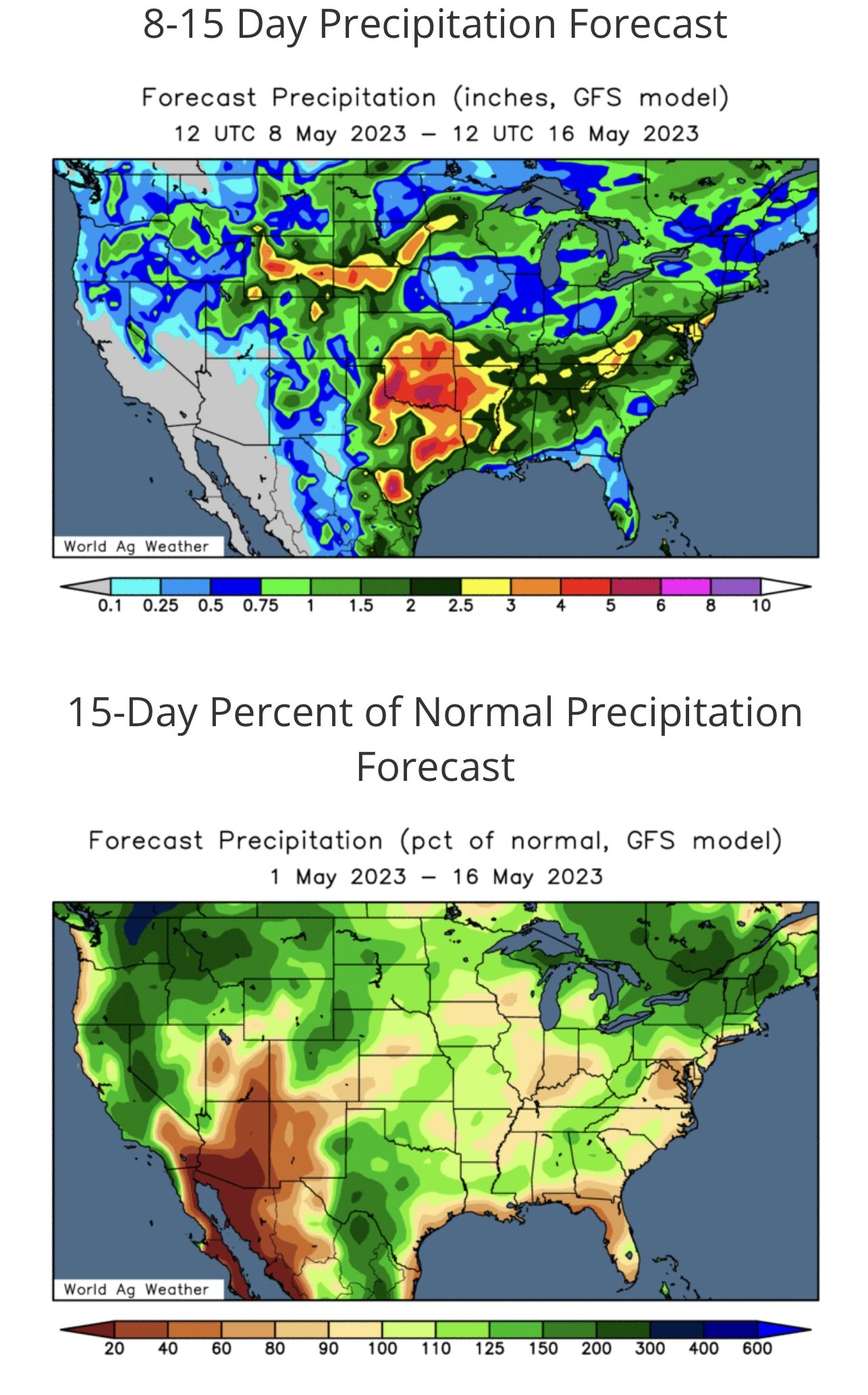

One would have thought throwing that word out would possibly cause a spark and some support for wheat here but that hasn’t been the case. We also don’t have any clear indications surrounding the Black Sea agreement and an extension. As wheat continues to be pressured by improved forecasts that are expecting some pretty good rains through out much of Kansas.

Funds were heavy net sellers across the board last week on the sell-off. Funds now holding a short position in corn as they were sellers of 65k contracts.

Export inspections fairly strong this morning, with corn hitting a marketing year high.

The crop progress and crop conditions came out after market close today. Corn planting came in on par with the 5-year average, but soybeans are running ahead of pace. Spring wheat planting is behind but winter wheat conditions saw some slight improvements.

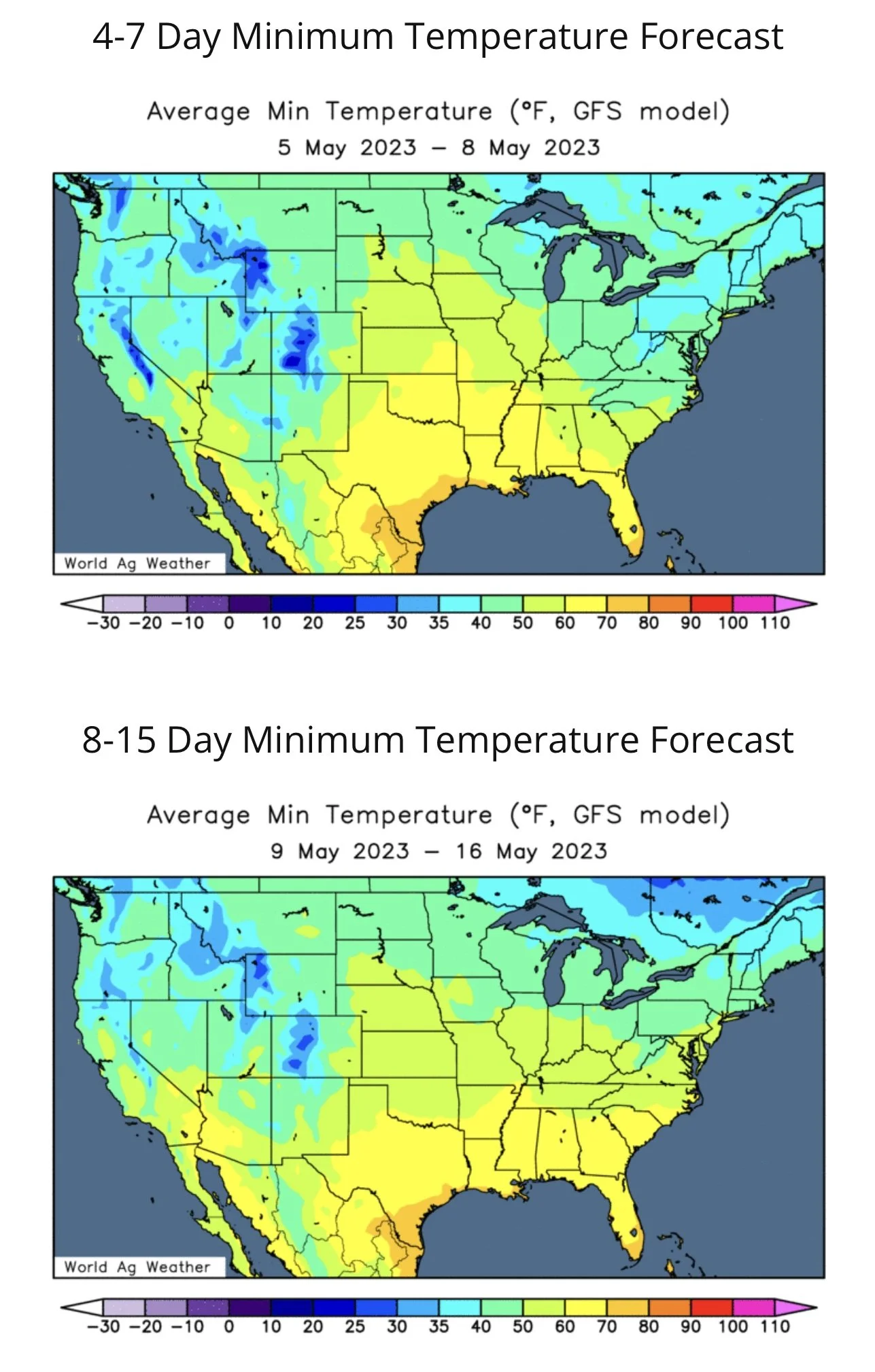

Overall I think these markets are definitely oversold, so I think we at the very least see a small relief rally. Could we see some additional pressure looking short term? Absolutely. But a thing to note is that we do not have any weather premium built into these markets at all just yet.

***

Sunday's Weekly Grain Newsletter

Why We Will Thank Market For Lower Prices

Read Here

Crop Conditions & Progress

(Released After Close)

Corn 🌽

26% planted

27% trade estimate

14% last week

13% last year

26% 5-year average

Beans 🌱

19% planted

17% trade estimate

9% last week

7% last year

11% 5-year average

Spring Wheat 🌾

12% planted (3rd slowest all-time for date)

14% trade estimate

5% last week

18% last year

22% 5-yr average

Winter Wheat 🌾

28% rated good to excellent

26% last week

27% last year

42% rated poor to very poor

41% last week

43% last year

Notable Corn Planting Progress by State (Compared to 5-yr average)

Behind

Iowa (-5%)

Wisconsin (-9%)

Minnesota (-18%)

South Dakota (-9%)

North Dakota (-1%)

Michigan (-5%)

Ahead

Nebraska (+8%)

Illinois (+11%)

Indiana (+5%)

Ohio (+3%)

Today's Main Takeaways

Corn

Corn ended the start to the week down just half a penny, but managed to close 7 cents off our early lows as bulls look to regain some of our 30 cent losses incurred last week.

As mentioned, the funds were sellers of 65k contracts of corn last week. Which has now flipped them back into a net short position in corn.

The trade has for now mostly put war and Argentina headlines in the rearview mirror. As these two factors had been bullish supporters in the past but are stories of the past now. However, there is a chance we do see some problems arise in the future that could provide support. But the markets focus has shifted to weather and demand driven headlines.

Bears continue to point at overall slower demand and the 2 cancellations of Chinese sales. But in all reality, would you rather have us sell zero corn to China and see no cancellations, or see us sell over 4 million metric tons and cancel just half a million. The market seems to forget that China bought over 4 million tons of corn the first week of March. These cancellations could lead to China buying back even more corn at a lower price.

Going forward, it is all going to be about the weather here in the US, overall demand in the US, and the funds. We still think we see a weather scare come into these markets and provide support. With the funds now short corn, this opens the door for a bigger short covering rally.

We have also seen a pretty hot start to planting thus far. But from what we have been hearing, those who have gotten off to a fast start are also those that are worried about the dryness. So short term, the fast start to planting could lead to some additional pressure, but looking a month or two from now, we could be looking at a completely different story. Remember, in 2012 we got off to an even faster start to planting and saw prices take it on the chin for months before drought came to into the game. We still think there is a chance we see Mother Nature catch the bears and funds off guard again this year.

From Yesterday's Newsletter:

"You have to find a way to be comfortable. One way to make one more comfortable is the use of options. Presently options for corn are cheap in my opinion. With a 6.00 July corn call a little over a dime. Owning those might make one more comfortable to sell corn and lock in a strong basis. While buying puts might make one comfortable via creating a price floor at a minimum price level." You can read the full newsletter HERE.

Short term, even though I think we are definitely oversold, I wouldn’t be surprised to see us struggle to catch a massive rally, and perhaps we chop around for the next few weeks. But we have to remember, there is currently essentially zero weather premium built into these markets. I think that leaves us plenty of future weather scares to be built into the future with a long growing season ahead of us. I expect us to have our lows in near the end of May or possibly even as late as early June before we get that big bull run we've been talking about.

From a technical standpoint, we found support at $5.74 and our lows from last July. Creating a possible double bottom which is a bullish indicator.

Corn July-23

Soybeans

Beans post a solid day of gains following the brutal past two weeks of lower prices, ending the day 8 cents higher and 14 cents off their lows. Today’s strong day adds on to Friday's gains, as July beans are already over 30 cents off their lows made on Friday.

Beans found some support with persistent planting problems in the Northen Plains. While planting has been favorable in most areas, acres returning from prevent plant acres in the Dakotas and Minnesota are still faced with fields that are too wet - World Weather Inc reported.

With last week's losses, the funds continued to liquidate their long position in beans. Selling 47.5k contracts and trimming their long position by roughly 1/3.

Bulls continue to look at just how big of a failure the Argentina crop had, and continue to question just how many problems this could lead to down the road. This crop was the biggest disappointment the country has ever seen. The crop went from an expected 51 million metric tons, all the way down to Buenos Aires's 22.5 million. That is nearly a 60% decrease. While the USDA went from 51 to 27 million.

On the flip side of things, bears argue that Argentina headlines are a thing of the past. While Brazil just finished harvesting their monster bean crop. To go along with some questionable Chinese appetite.

Sure, most of the Argentina head winds are priced in and aren’t currently as big of a factor as they once were. But we can’t ignore just how poor that crop was. There is definitely a chance we again see this production fall out lead to a bullish demand story down the road.

Going forward, the bean market will continue to be mainly influenced by the weather here in the US to go along with Chinese demand. Similar to corn, I could see us struggle to hold on to a rally looking near term. But it is still early and I think we see a more demand driven story develop in the future.

From a technical standpoint, we found support right at that upward trendline. Bulls would like a break out of this downtrend from February.

Soybeans July-23

Wheat

Wheat futures continue to get hammered, adding onto last week's already brutal losses with improved US weather. As Chicago closes down 15 cents, KC down 19 cents, and Minneapolis down almost 13 cents.

The main thing that pressured wheat today was forecasts showing some good rains in Kansas. The big question now is whether these rains are too little too late. It’s hard to imagine these rains are anything crop saving.

The funds continue to do anything but buy wheat. Adding on to their already massive short position by 10k contracts last week. The funds are now nearing a record large short position and are currently the shortest they have been since January of 2018.

It was somewhat surprising to see this much pressure across the wheat market today solely due to the fact that we saw Russia talk about nuclear war. Typically when a country in war throws that word out it causes some panic and see some support, but that just wasn't the case today as the market continues to trade the weather.

The war really just remains a wild card, no one really know how it will all shake out. The war has been a factor for well over a year and doesn't show any real signs of resolution. Bulls are still waiting out for that one headline to scare the funds.

One thing that everyone is excited for is the crop tours come mid-May. These will give us a better understanding of the crop pretty soon.

Going forward, wheat will continue to be influenced by the weather here in the US, the ongoing war and Russia headlines, and lastly the funds. Bulls are still patiently waiting for a bullish catalyst to cause a short covering rally, but we just haven’t got one as we continue to trickle lower and make new lows. I would like to think we see our lows made soon given the fact that winter wheat ratings came in at their worst ratings ever last month, spring wheat is going to be planted late and spring wheat acres are forecasted at a 50 year low, and we still have a war going on. But as a bull the markets have continued to prove us wrong.

Chicago July-23

KC July-23

MPLS July-23

Soy Market

From Wright on the Market,

Kory Melby is a former Minnesota farmer who immigrated to Brazil about 22 years ago and became a consultant for everything related to agriculture. Roger first met Kory in February 2003 and has come to respect his judgment and thoughts. Kory eats and sleeps world soybean and corn market news. Here are his comments yesterday afternoon as the soybean harvest in Brazil came to an end:

The soy market has been a tri-pod of sorts. Brazil 150 million mt; USA 125 million mt; China 125 million mt (imports + domestic production). If they are all in balance- life is good. However, with Argentina’s reserve pouch gone, I still say sometime in the next 12 months the soy market and or sub products will get caught with her pants off. One of the three legs of tripod will have soy and the other two will not. And we will have an "ohh shit" moment. How come we did not see?

Argentina does not have any soy to sell even at 1000 pesos to 1 US dollar. Once Brazil is done puking soybeans (likely over with), that last 30% or so of 2023 soy production will be in very tight hands. This can be summer 2023 positive, but long term terrible if Brazil carry's soy forward into 2024.

Long story short, if the USA comes in "light", we will see a nut-cruncher rally out of the blue one day. But, agreed, at the moment, the USA fine.

Other Highlights & News

The EU ban on Ukraine ag imports comes into effect tomorrow.

Western Europe is expected to face unually warm temps next month, as they see no signs of drought relief.

The US is ending COVID-19 vaccine requirements for federal employees.

An air raid alert was issued for the entire country of Ukraine.

Check Out Past Updates

4/30/23 - Weekly Grain Newsletter

Why We Will Be Thanking Market for Lower Prices

4/28/23 - Market Update

Grains Green First Time in 10 Days

4/27/23 - Audio Commentary

Will Markets Reverse the Second You Throw in the Towel?

4/26/23 - Market Update

6th Straight Day of Losses

4/25/23 - Audio Commentary