GRAINS FAIL TO GAIN MOMENTUM

Today's update will be a tad shorter and different format from our typical ones. We will have a ton of more info and thoughts in Sunday's Weekly Grain Newsletter.

This morning the grains opened up with a much firmer tone. At one point July corn was up 17 cents, July beans were up 12, Chicago was up 10, KC was up 9, and Minneapolis was up 12.

However, we weren’t able to hold on to those gains whatsoever. As all of the grains gave up those early gains and ended the day in the red. With Beans and KC wheat leading us to the downside, as July beans closed down 26 cents (-38 cents off highs) and KC took it on the chin again. Ending down nearly 33 cents and roughly 40 cents off those earlier highs. Minneapolis joined KC lower, closing down 24 1/2 cents while fading 33 cents off their highs. Corn and Chicago held up fairly well, as corn ended down just under a penny and Chicago was down 6 cents.

Initially it looked like we were going to see some short covering or profit taking from those short sellers going into the weekend, but that just wasn’t the case as the early rally was sold hard. A lot of the reason for pressure was simply due to technical selling and the funds.

The markets were already significantly oversold, so another round of losses today left the bulls scratching there heads. There isn't a ton of fresh news, which can often lead to lower prices. Sometimes the market wants to flush out both the buyer and the seller and do what it did today.

KC wheat got hammered for the second day in a row despite the wheat tours confirming an absolutely horrible crop. Perhaps it was just seeing some profit taking, and we got a "buy the rumor, sell the fact". As everyone bought the rumor that the tour would show a terrible crop, the results were confirmed.

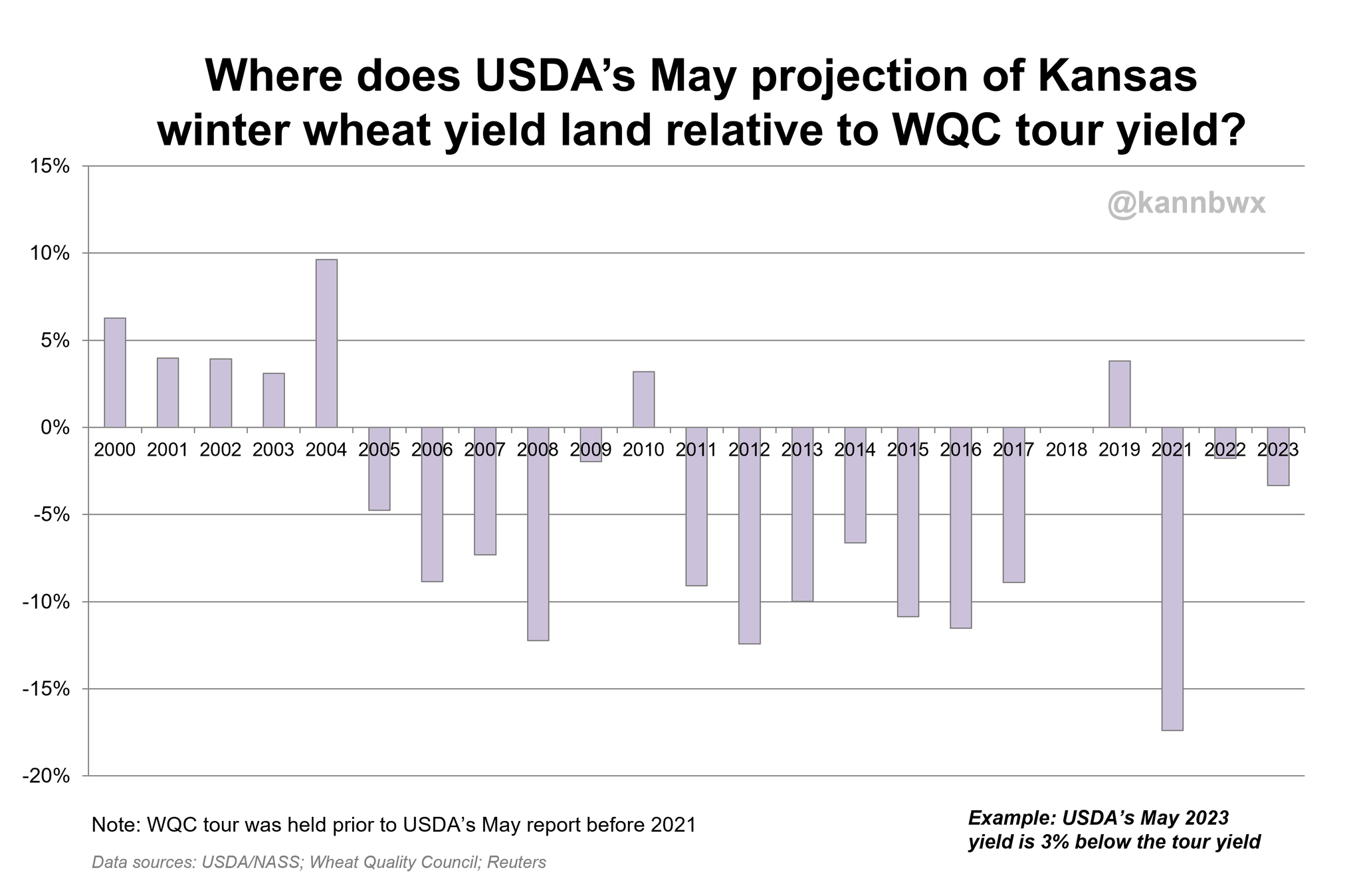

The crop tours in Kansas wrapped up yesterday and the numbers showed 30 bushels per acre. When compared to the 5-year average of 45.6, that is a 34% decrease. Production was 178 million bushels vs the USDA's 191.4 million. That would be the smallest crop for Kansas in over 65 years, and implies an abandonment rate of nearly 27%. Keep in mind, the 30 bpa doesn’t take into account the huge amount of abandoned acres.

If you take a look at the chart below, you'll see that the final yield has been lower than the May crop tours the past 15 of 18 years. One could assume this will be year 16.

Nationwide, we have 46% of the winter wheat production in drought conditions. Which is a slight improvement from last week's 48%.

One would like to imagine that we see KC wheat well supported with how poor the crop tours were. But with the KC and Chicago spread, I wouldn’t be surprised to see Chicago gain a little bit on KC with the funds being as short as they are. Currently short around 135k contracts of Chicago. One things bears will also argue is that we could see some wheat rallied capped simply due to us having adequate global supplies. But I still lean towards us getting more short covering in Chicago. How long will it be before we get that massive short covering rally? It’s hard to say, as I have called the bottom in wheat and been flat wrong before.

Here is what Andrey Sizov had to say about a bottom in wheat. Andrey is a well respected Black Sea wheat market guru. He said;

"Im bullish fundamentally. The problem is the funds don't care. Short term I won't be catching that knife. When we see a big disruption and headlines we could see a massive rally.. When exactly? I don't want to guess"

So he is essentially saying that fundamentally, wheat is bullish. But the funds want to do anything besides buy wheat right now. But all it takes to spark a massive rally is one disruption. With war and weather being the most likely.

Now as for the Black Sea agreement. It got extended earlier this week, which added some pressure to both the corn and wheat markets. Now Russia is coming out and saying that they will not extend the deal after July 17th when this renewal expires if the problematic issues are not solved. I don't think we can really trust anything they say, but nonetheless we could still be in for some more wildcards surrounding the war situation.

Even though the trade has mostly taken into account the atrocious crop in Argentina. We did again see Buenos Aires Grain Exchange lower their bean estimate to 21 million metric tons. It looks like the USDA still has some work to do, as they opted to leave their estimate of 27 million unchanged in our USDA report. Although most of this is already baked in, I could still see this being a problem down the road especially if Brazil’s massive crop were to happen to run into any issues.

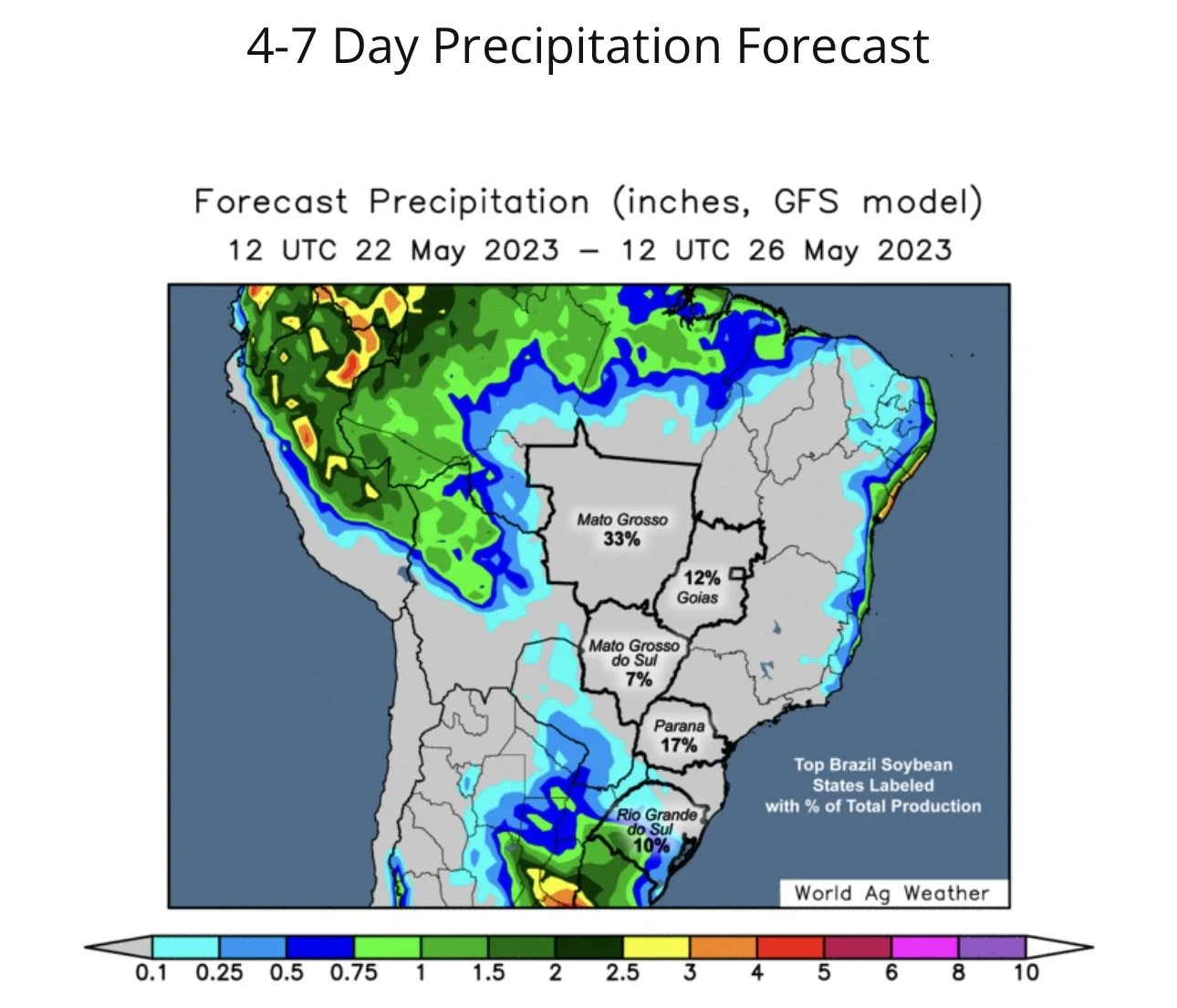

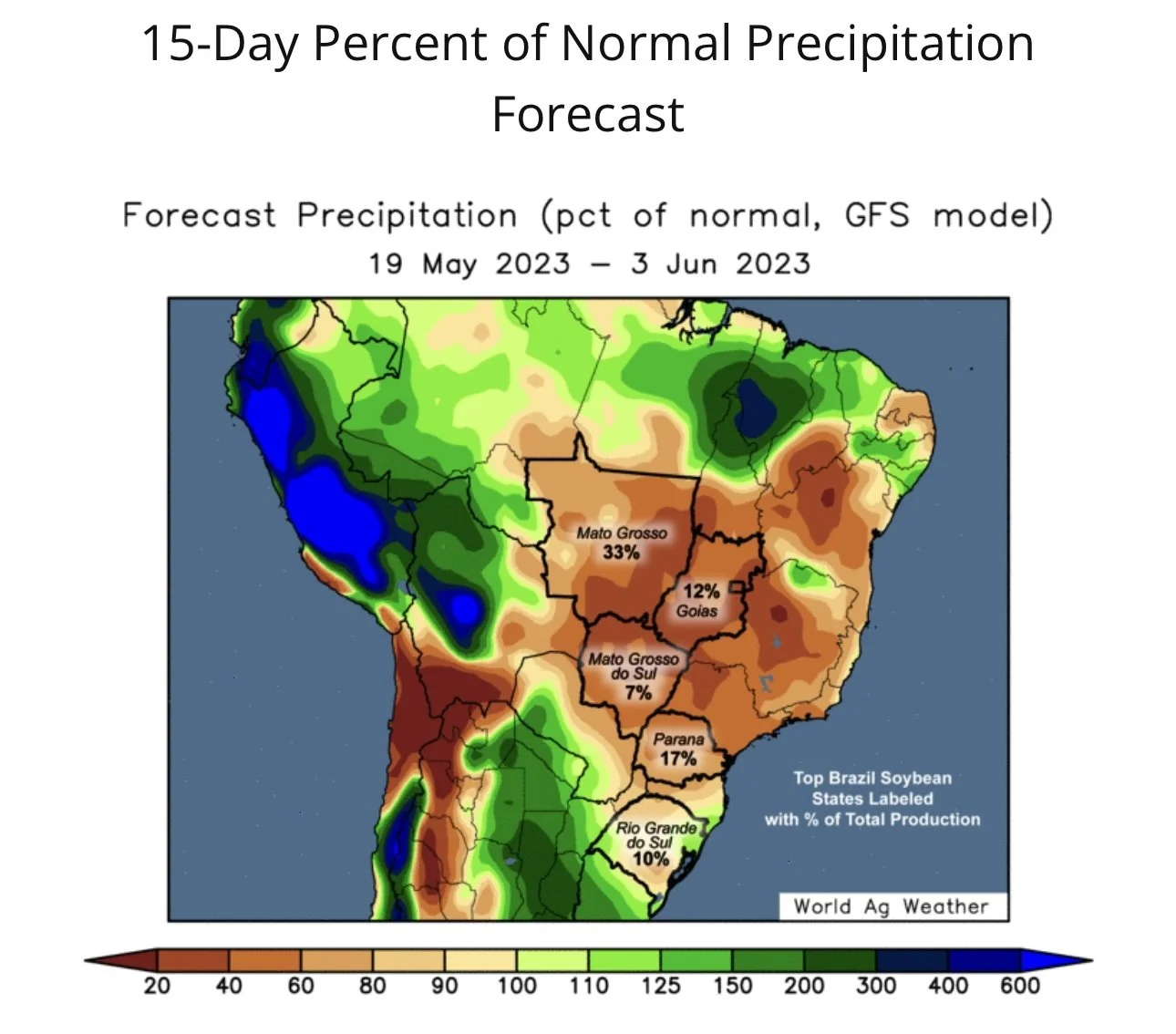

As for the big crops in Brazil. A big reason we got those corn cancellations from China, was due to them anticipating grabbing Brazil’s massive crop at a discount to that of the US. But the USDA could’ve jumped tha gun when they rose their estimate for Brazil's corn crop in last week's report. What if Brazil stays dry? If you take a look at the forecasts, they are showing it being very dry in Brazil. Second season corn in Brazil has zero rain in the forecast and has been dry over the past few weeks.

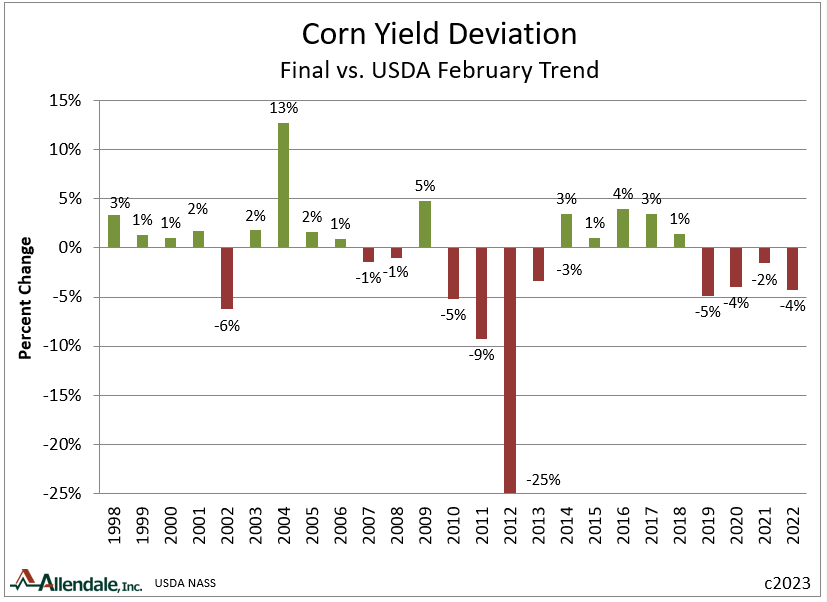

The International Grains Council upped their world corn estimate by 9 million metric tons, up to a total of 1.217 billion. Everyone is expecting near perfect weather for corn this year. What happens if weather isn't perfect but the expectations for our crop are so high? Rewind back to 2012 and you will find a similar situation.

Below is a chart showcasing the last 25 years of corn yield. It shows the USDA February number vs the final yield.

In 2012 we planted at the fastest pace in history. It looked like it was going to be a perfect year. Weather conditions were favorable, everything was rolling. Then drought hits. I'm not saying the exact same situation will happen this year. But we have to point out the similarities.

The USDA gave us such an unrealistically high yield to start this year. What happens if we raise nowhere close to what they think we will?

We will touch more on this in this weekends newsletter, but there are various sources calling for this summer to be one of the hottest ones on record.

A good portion of the corn and bean areas are dry. Are they starving for moisture at this very moment and time? Probably not. But it is still drier than most believe. If you take a look at the forecasts, they are starting to shift more and more dry for the next month or so. Most of the midwest is expected to see limited rainfall through out at least the first half of June.

There is an awful lot of growing season left, with plenty of weather headlines ahead. Are the lows in? It's hard to catch a falling knife and call the lows. But I personally think we will make our lows near the end of this month, but it could even be early June before we do so. I think we could very easily see some brutal choppy trade for the next few weeks before we take off.

Did China or US Cancel Corn?

I saw an interesting tweet this morning. From 247 Ag. It said,

"A financial institution shared that the most recent corn cancellation by China was not them canceling but a cancellation by the US, because there were not sufficient supplies at the US port grain facilities to fill said orders."

247 Ag didn’t have confirmation on if this was true, but if so.. this is a huge deal.

Corn Technical Audio

Here is an audio from Vince Irlbeck. Where he goes over targets for December corn, a potential dollar rally, and more.

US Weather

Again, I just want to point out the corn belt. It might be a lot drier than some realize, with a good chance we continue to get drier.

The Charts

Corn 🌽

Corn July-23

Beans 🌱

Soybeans July-23

Chicago 🌾

Chicago July-23

Kansas City 🌾

KC July-23

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

5/18/23 - Market Update

KC Joins Sell Off

Read More

5/17/23 - Audio

Black Sea Pressure & Games From China

5/16/23 - Market Update

Beans Collapse

5/15/23 - Audio

If You're Short Wheat.. Be Ready to Sleep On Street

5/14/23 - Weekly Grain Newsletter