TRADE WAR BEGINS. 8TH DAY OF PAIN FOR GRAINS

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Overview & Tariffs: 0:00min

Corn: 5:20min

Soybeans: 8:45min

Wheat: 10:15min

Want to talk or put together a market plan?

(605)295-3100

Futures Prices Close

Overview

The 8th straight day of pain in grains continues as the trade war officially begun today.

However, grains all managed to close well off their lows leaving some nice long wicks especially in the corn market. So some possible signs of life and reversals.

So what is happening?

A bunch of negative factors essentially hit the markets all at once.

This weakness started off from first notice day pressure, then we got the tariff headlines. Creating this liquidation style of event where the market just continues to fall as everyone panic sells and as the funds exit that long position in corn.

This isn’t just the grain markets, it is all markets.

The US stock market erased it's entire 2025 rally now red on the year and has erared all of it's post election gains.

The stock market and the corn market both marked their highs on the exact same date Feb 19th. Further letting us know that this isn’t just a concern for the grain markets.

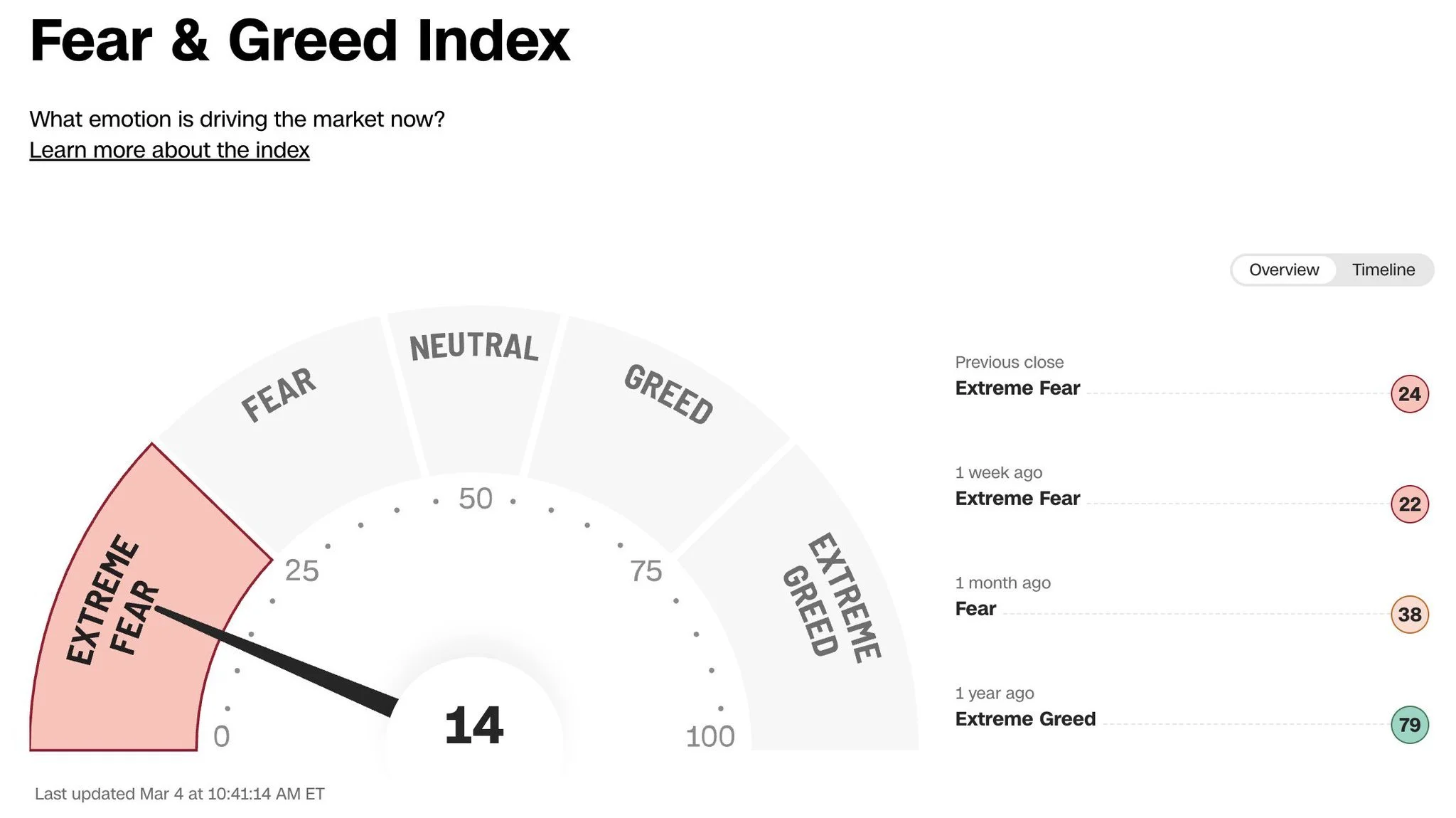

The fear and greed index for the stock market fell to 14 out of 100.

Anything below 25 is considered extreme fear.

Anything above 75 is considered extreme greed.

Last time the index was this low was the 2022 bear market.

So all of the markets are scared, not just the grain markets.

Which is leading to money pouring out of everything.

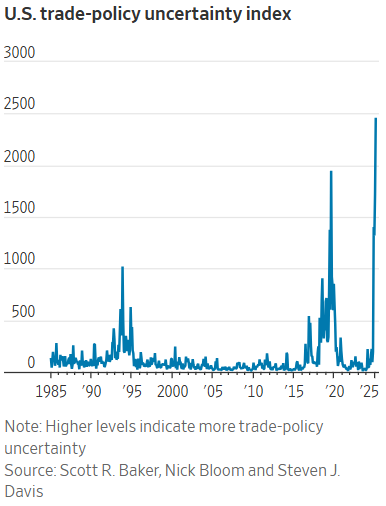

Here is the US policy trade uncertainty index.

It is the highest of all time. Higher than the first trade war.

So everyone is uncertain of how these tariffs will shake out.

However, keep in mind that this is about the time where everyone turns super bearish on everything only for the White House to leak a bullish trade war deal.

An example of this was today.

The stock market was getting oblitered, then news broke out that the US and Ukraine are planning on signing a minerals deal today. This led to the stock market rallying back. The grain markets are going to trade the same way.

What is the tariff situation now?

Today the following tariffs went into effect:

🇲🇽 25% on Mexico

🇨🇦 25% on Canada

🇨🇳 20% on China (up another 10% from previous 10%)

The markets must have thought we'd see some agreements arranged before they came into effect. The market has been selling off on this same story for a week. So it is not new news.

China Retaliations:

However, the main pressure today came from retalation tariffs from China.

Overnight China announced:

15% tariffs on corn, wheat, cotton and chicken imports from the US.

10% tariffs on soybeans, pork, beef, fruit, veggies and dairy.

So this was the reason for today's weakness. This was on of those headlines we did not want. Tariffs on ag imports.

If it wasn't for this headline, grains might’ve actually traded higher today.

China Suspends Bean Imports from US:

China also suspended soybean imports from 3 of the largest US exporters. LDC, CHS, and EGT.

China said they are ready to go the whole way if the US wants a trade war.

Trump Threatens Canada:

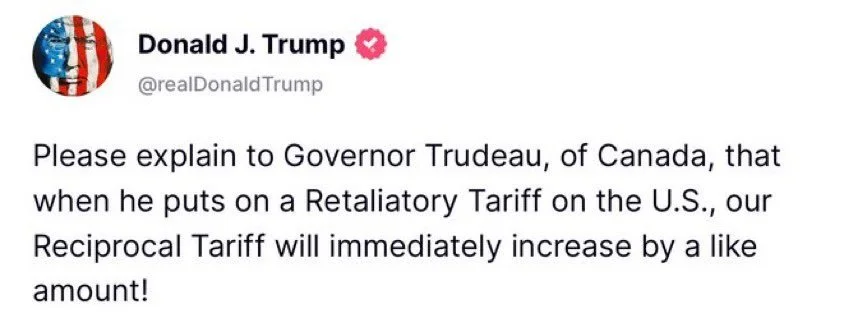

Trump said if Canada retaliates with tariffs of their own, he will immediately increase their 25% tariffs by a large amount.

Justin Trudeau said: "Trump wants to destroy the Canadian economy."

What about Mexico?:

We have not seen any update out of Mexico yet.

They said they will announce their counter measures on Sunday.

I would assume Mexico wants to cut a deal. Their economy simply can’t afford to retaliate and have a trade war.

Fun Fact:

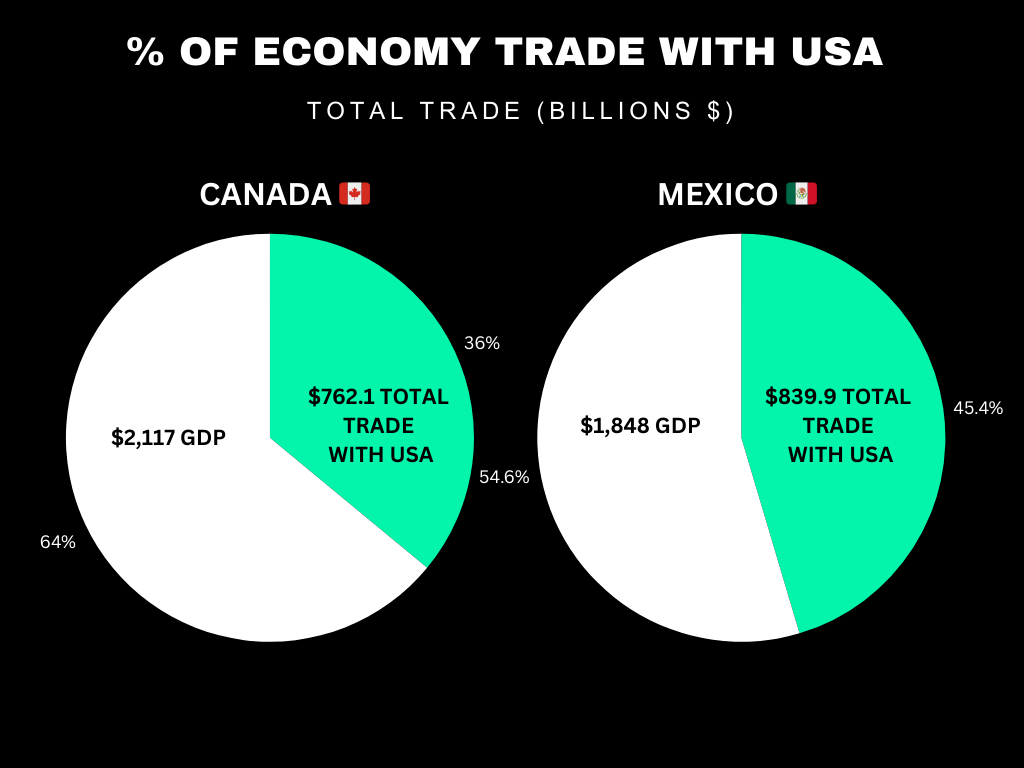

45% of Mexico's economy is trade with the US.

36% of Canada's economy is trade with the US.

If tariffs last, it could send both into a recession. This has me thinking we will get a deal done between these two.

After Market Close Lutnick Announced:

The news is changing every 30 minutes. This news broke as I was writing.

It looks like they think Canada and Mexico will meet in the middle.

How Tariffs Effect Each Market:

China accounts for 40% of all US exports.

Which means that China directly equates to 20% of all US soybean demand.

A massive number.

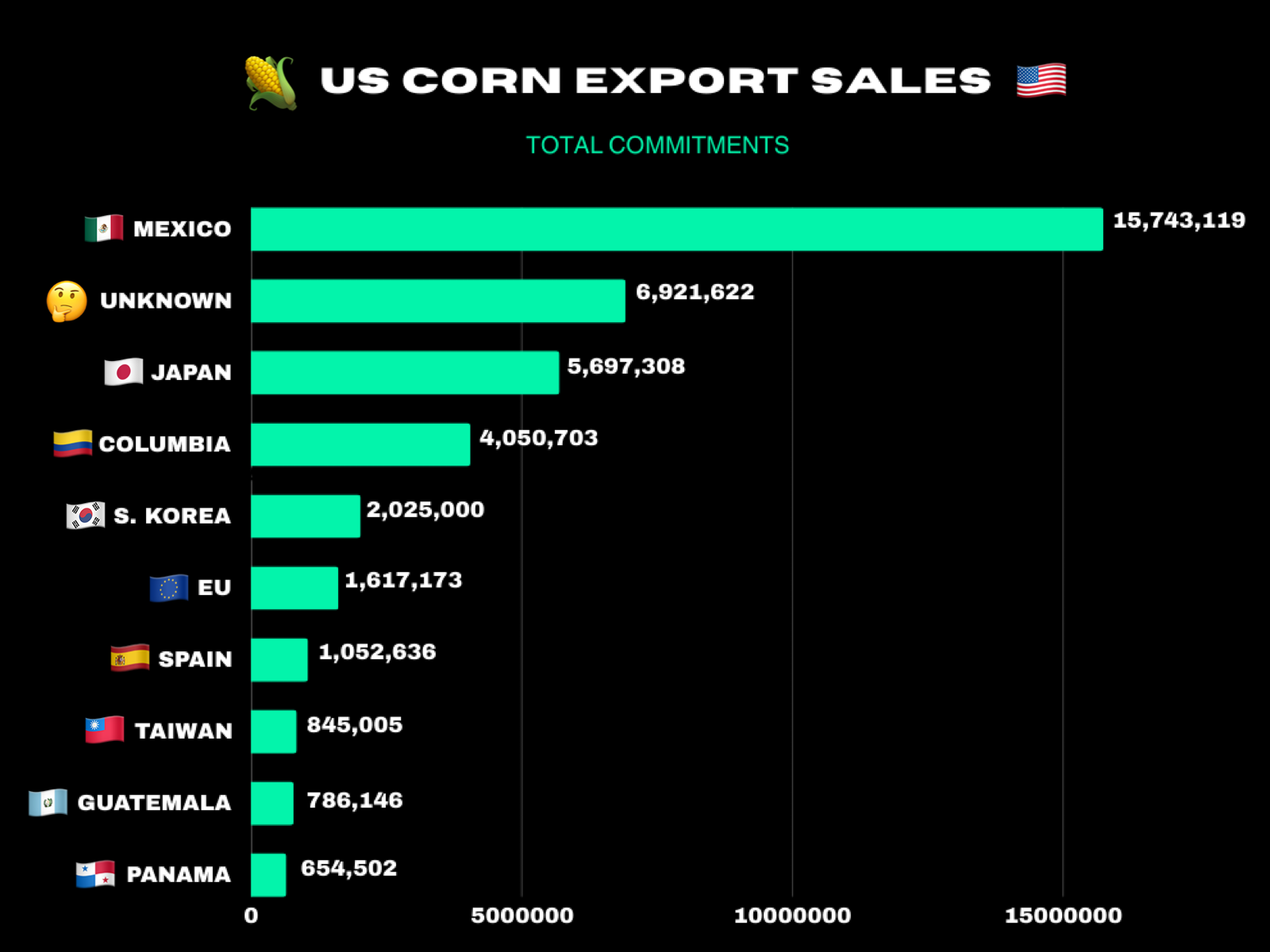

For corn, tariffs on Mexico of course hurt the most.

As they have been far and away the biggest buyer of US corn.

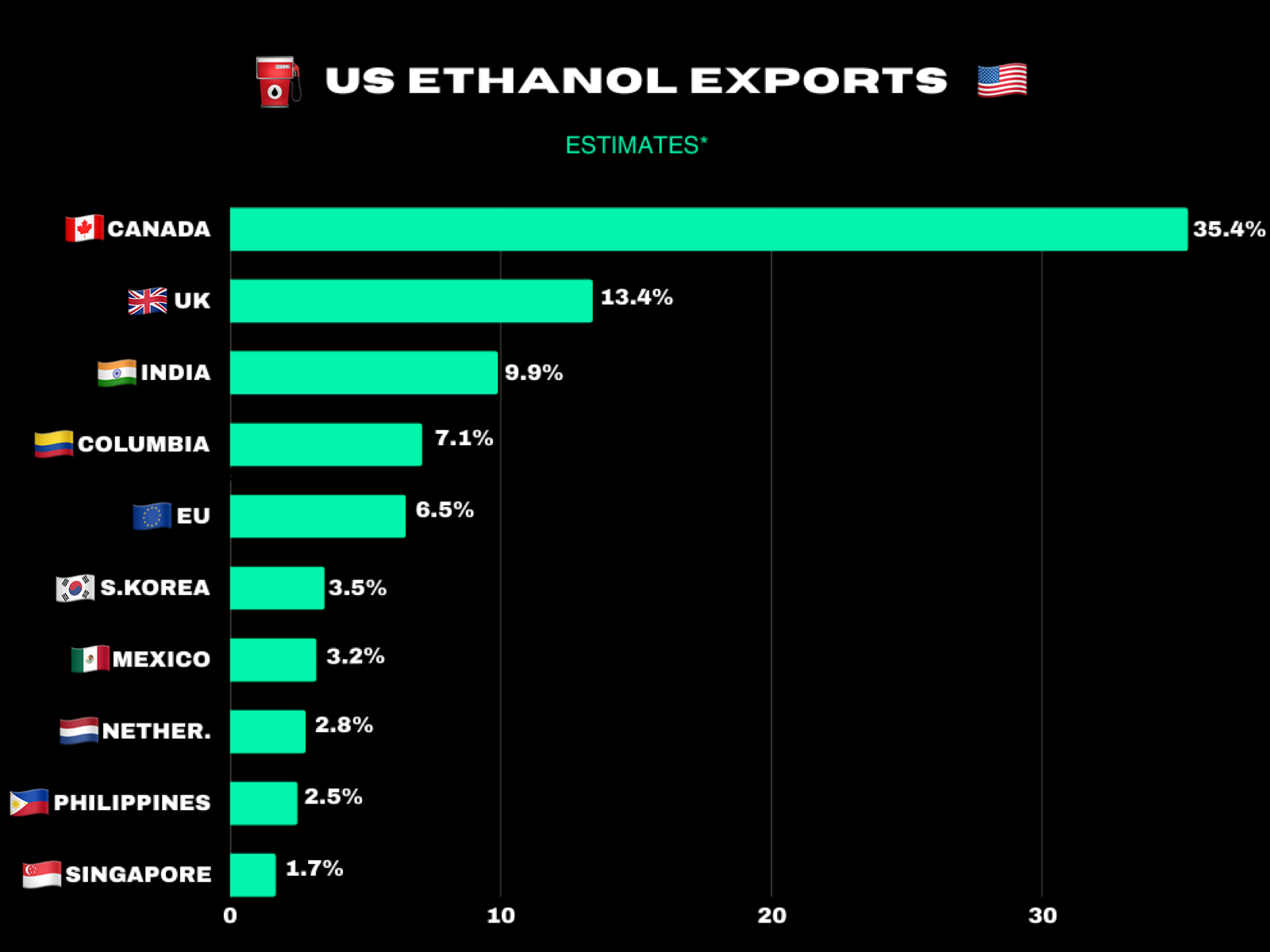

Tariffs on Canada won’t directly impact grains, but it wouldn’t be good for ethanol.

As Canada accounts for 35% of our ethanol exports.

What about retaliation tariffs?

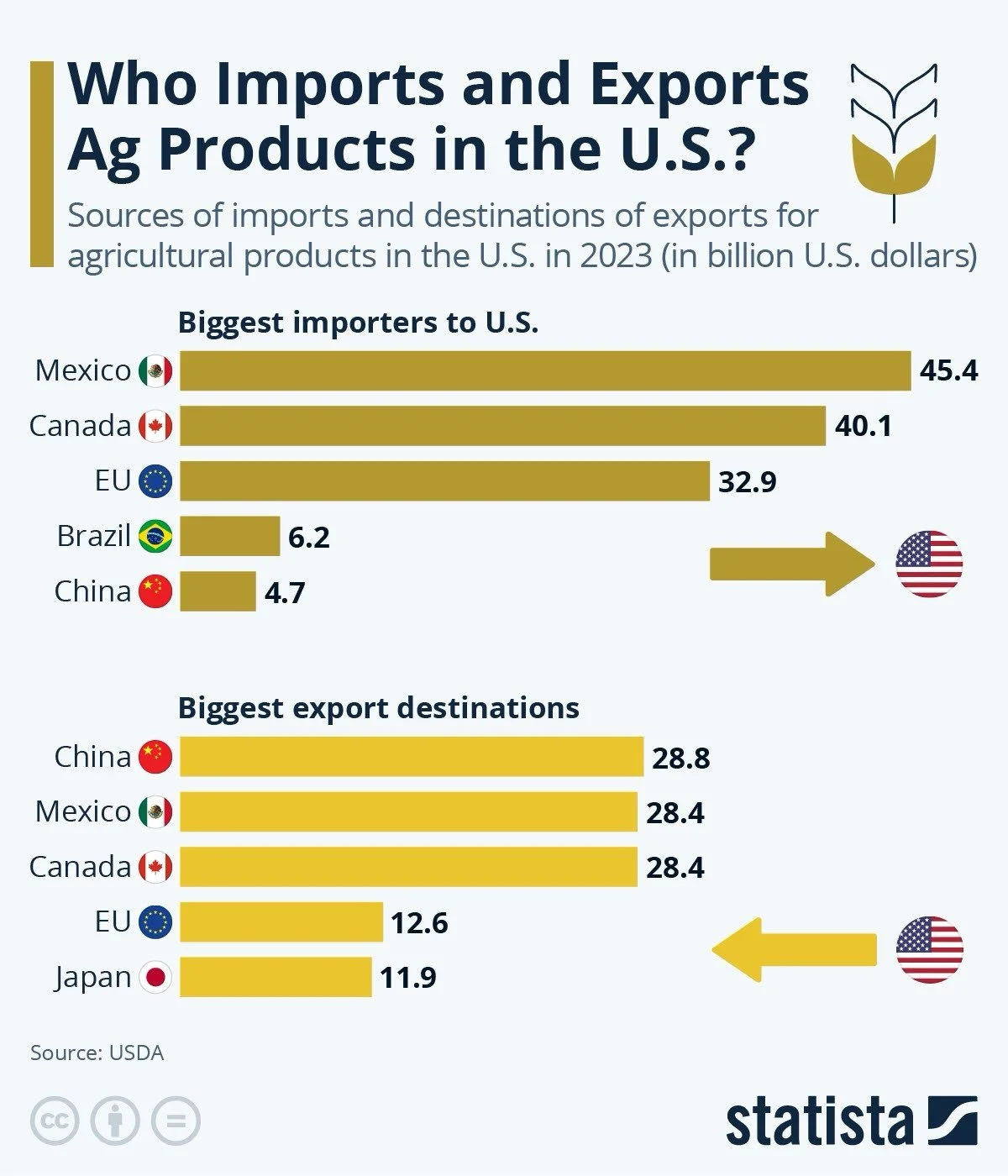

Here is a graph that show cases how the US imports vs exports.

Our two biggest countries we import from are Mexico and Canada.

Retaliations from them would not be good.

But again, I think both both Mexico and Canada will fold as they can’t afford a trade war.

Today's Main Takeaways

Corn

Fundamentals:

The funds have puked out a good portion of that long position.

If we come to an agreement with Mexico, I don’t see any reason why corn isn’t at a good value here. Personally, I'd say it's on sale if anything.

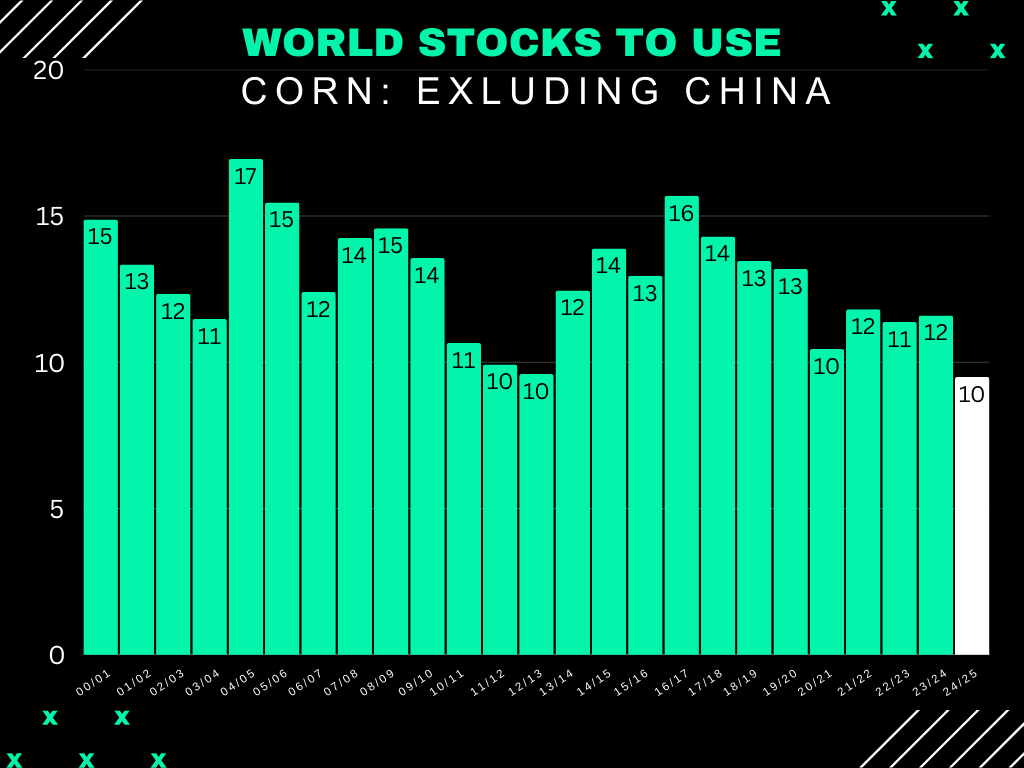

The global balance sheet is still the tightest in a decade.

Removing China from the eqaution makes it the tightest of all-time.

The situation in the US is not bearish.

We are at levels for new crop where they is very little incentive for farmers to sell.

It is so early still. We haven’t planted a single acre. We have an entire growing season ahead and there is so many unknowns. We are simply just caught trading these headlines that happen to be be full of fear.

I think we could very well be in for extreme chop until planting. I am talking 30 to 50 cent ranges in the corn market as we constantly trade the headlines. But until planting we won’t see much fundamental change.

Fundamentals for corn aren’t bearish.

Technicals:

Now down over -60 cents from our $5.14 sell signal.

The market is overcooked.

We closed the airgap lower. Now we have an airgap higher just like before.

We are sitting right around the 61.8% retracement of the entire rally, which is a standard correction when you zoom out.

This was old resistance. It would make sense to bounce here. Hence why we alerted a very rare buy signal last night. Our first ever buy signal for corn.

Our sell signal was at 61.8% of the contract highs. Our buy signal yesterday is at 61.8% of the entire rally.

We left a nice looking reversal type candle closing nearly +10 cents off our lows today.

The bottom might or might not be in. Depends on the headlines.

But I think corn is at good value here and from a technical standpoint I think this is where we should bounce.

We somehow managed to keep the uptrend from the contract lows in place.

Just like May corn, Dec corn is also sitting right around the 61.8% retracement.

Again, if we are going to bounce this would be the area I would look for us to do it.

61.8% is the most common retracement level. It is considered the "standard" correction

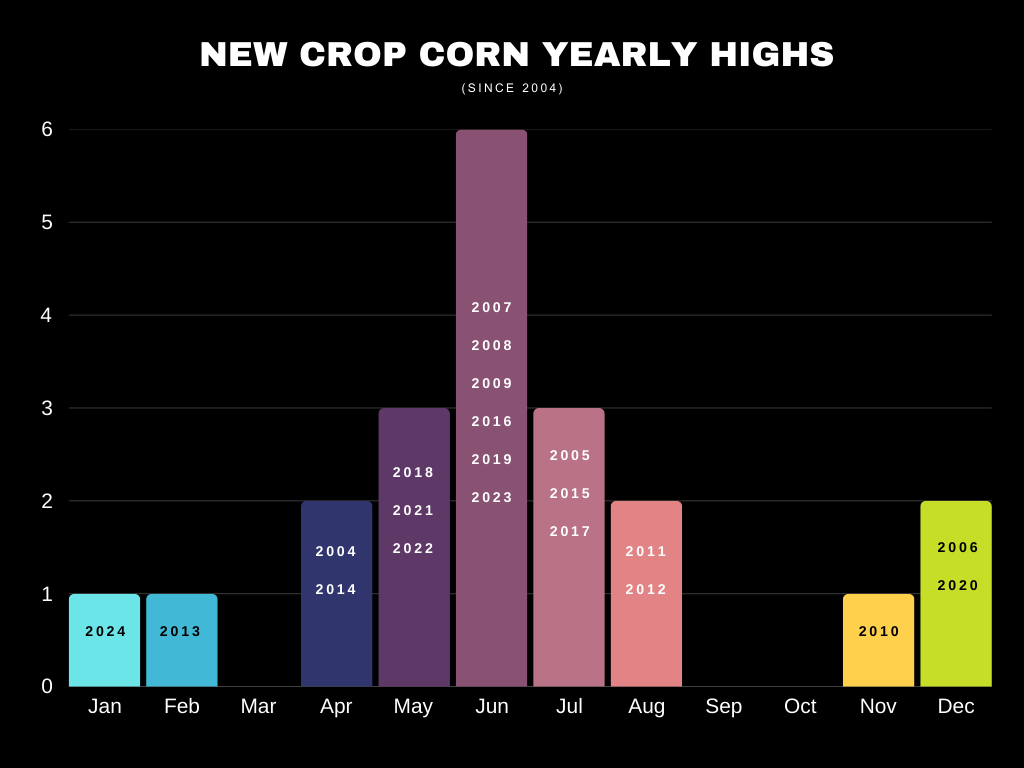

New Crop Corn Highs by Month

I showed this a week or two ago but wanted to give you some hope.

It's possible we put in our highs for year, but we almost always get some sort of opportunity in the spring/summer.

The only years where we didn’t really get an opportunity was 2013 where we topped out in February, and then last year we got that little wet planting story in May but it wasn’t really a big opportunity.

May to Dec Spread

This is why we had been preaching to utilize old crop puts to protect your new crop corn on our sell signals.

The spread went from a +40 cent inverse to now just +5 cents.

May corn has dropped -67 cents.

Dec corn has only dropped -33 cents.

Protection on May corn would’ve paid significantly more than on Dec corn.

When we are in a market like this one, old crop is going to lead the way both higher and lower.

Soybeans

Fundamentals:

The biggest wild card is China.

If we wake up one morning and they come to a trade agreement, soybeans are going to rally.

But there is of course the risk this trade deal lasts forever like the last one.

Outside of the trade war, yes Brazil still has a monster crop.

Yes the global situation is bearish.

BUT we are going to be looking at a lot less acres in the US.

The impact less acres is going to have on the US balance sheet could huge. It could realistically create a scenario where the balance sheet gets too tight to where the USDA has to cut demand thus rationing higher prices.

I think the downside is somewhat limited UNLESS China goes crazy. We've already endured the largest Brazil harvest of all time.

Seasonlly we do struggle here however. But I think we will get an opportunity in the coming months.

Technicals:

We broke below that 100-day MA which resulted in another leg lower.

Soybean bulls want a bounce NOW or the next support level is those contract lows.

Just like corn, we are sitting right around the 61.8% retracement. So a bounce here would make sense.

We still have a "potential" inverse head & shoulders pattern. But we need a bounce tomorrow to keep it alive.

Just like May beans, Nov beans also sitting right at the 61.8% retracement.

Again, bulls need a bounce right now. Or the next support is those old lows.

As this is a heavy support level bulls can’t afford to lose.

Wheat

Fundamentals:

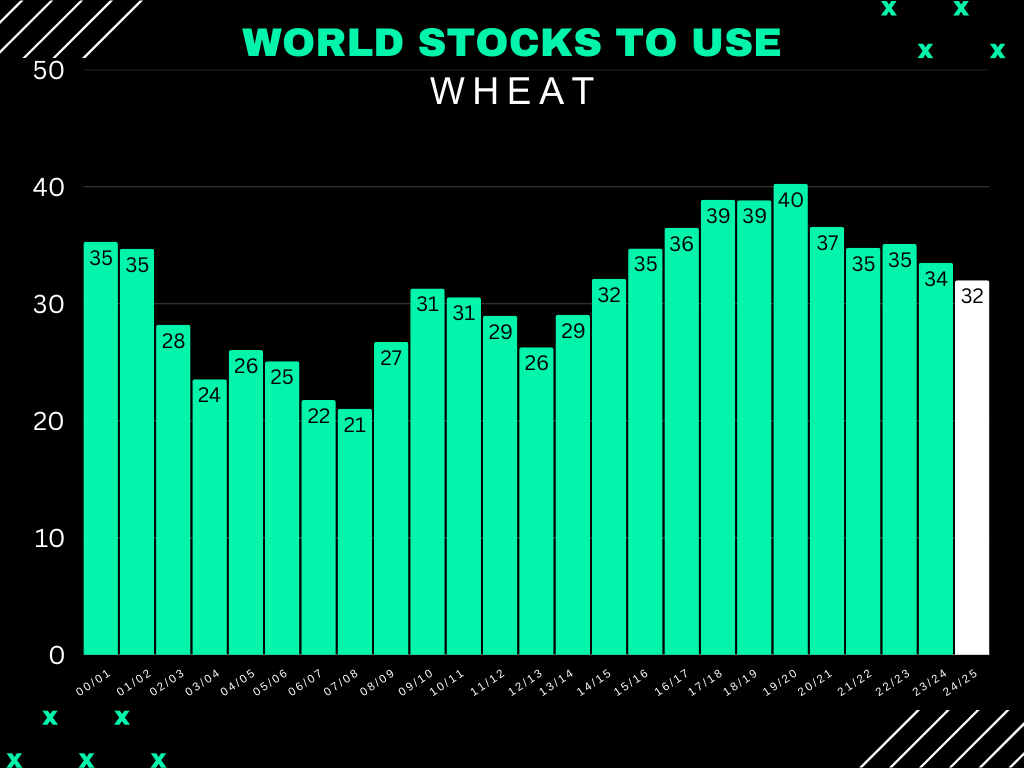

The fundamentals for wheat still aren’t bearish.

We still have the tightest global balance sheet in a decade.

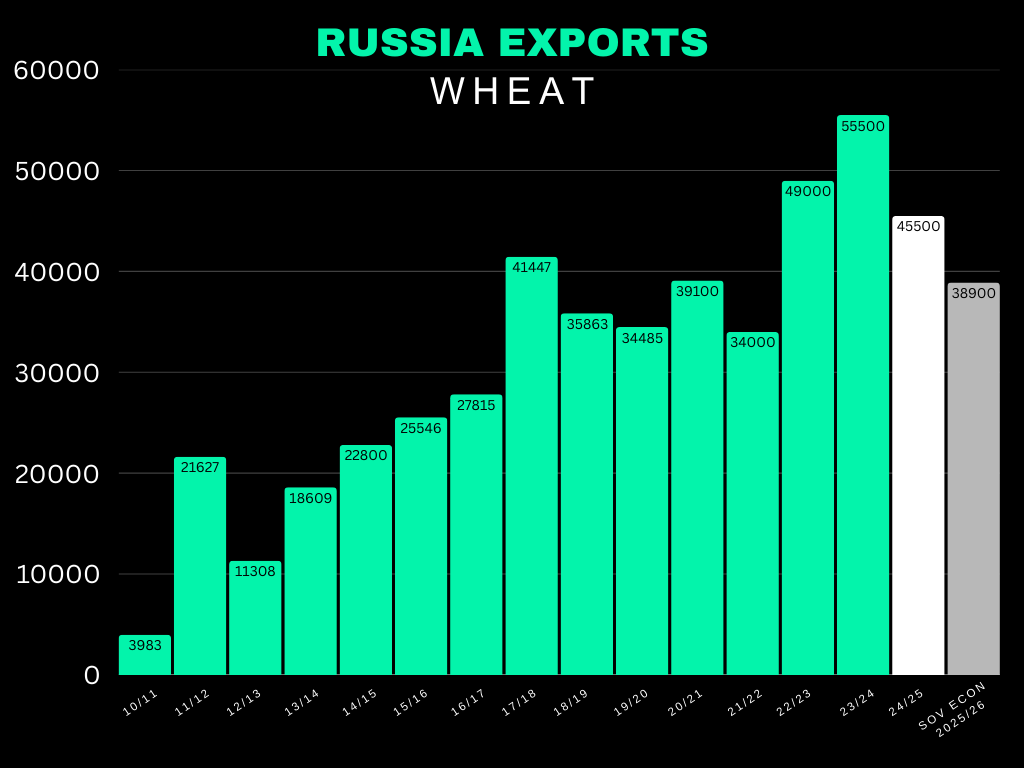

Russia's wheat exports continue to drop. Forecasted to be down -30% the past two years.

India who is the world's 3rd largest producer is having a critical drought that has some saying they might need to start importing wheat. India never imports wheat.

Their rainfall has been -80% below average to start the year.

Technicals:

I can’t get bearish wheat at these levels.

Could we post another new low? Sure.

But I think the upside outweighs the downside.

KC wheat is now down -90 cents from our sell signal. As it gave back the entire rally.

Currently sitting right in this big support box.

Would like to think we bounce here. If not.. we would simply be trying to catch a falling knife.

Important level to hold.

Chicago wheat actually posted a new low but still sitting just under support.

The continuous chart gives a better view of Chicago wheat however (scroll to view)*

We are still holding support on the continuous chart.

This support has held dozens of times for +1 year.

I would like to think it will hold once again.

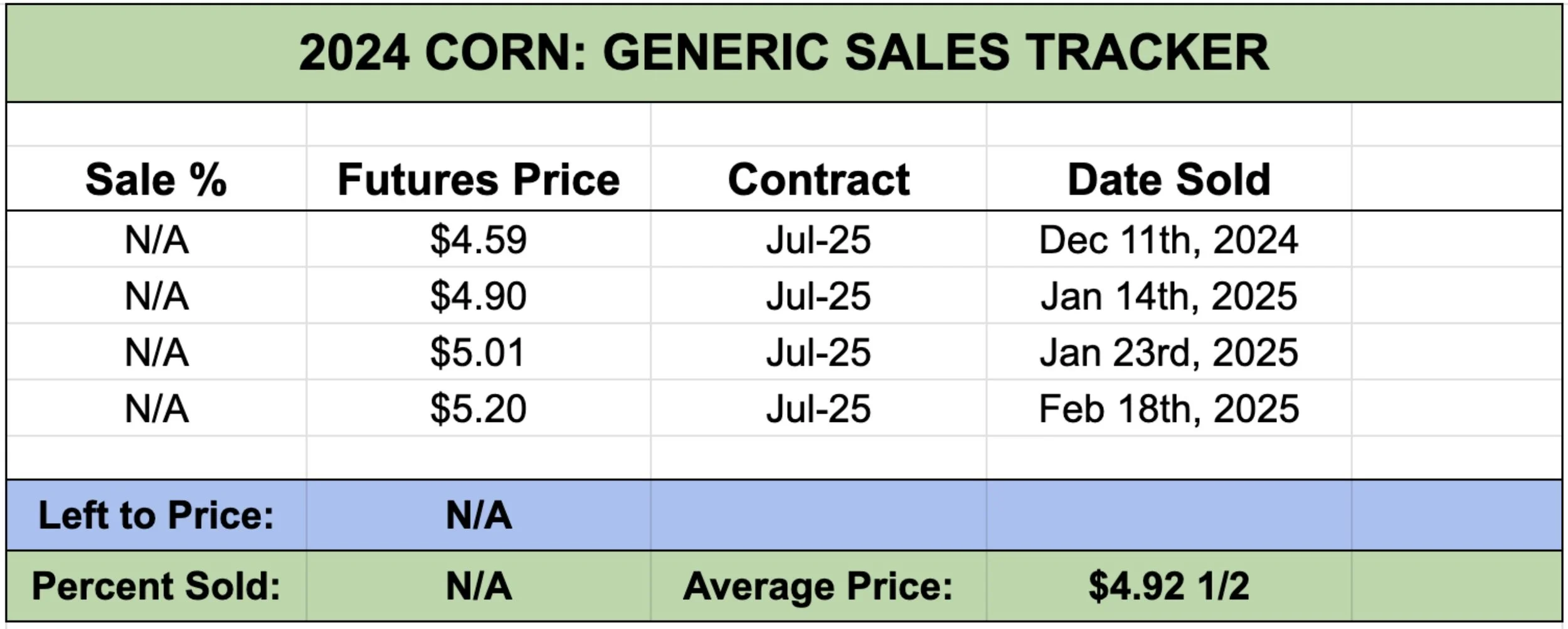

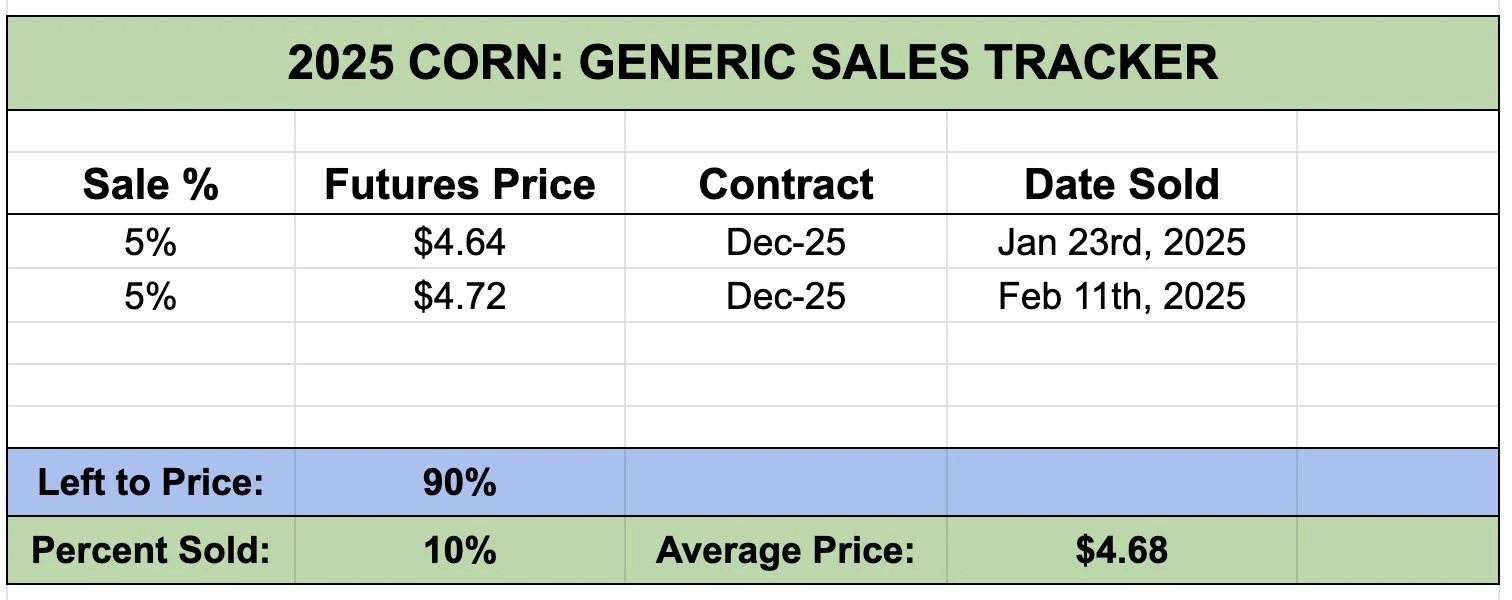

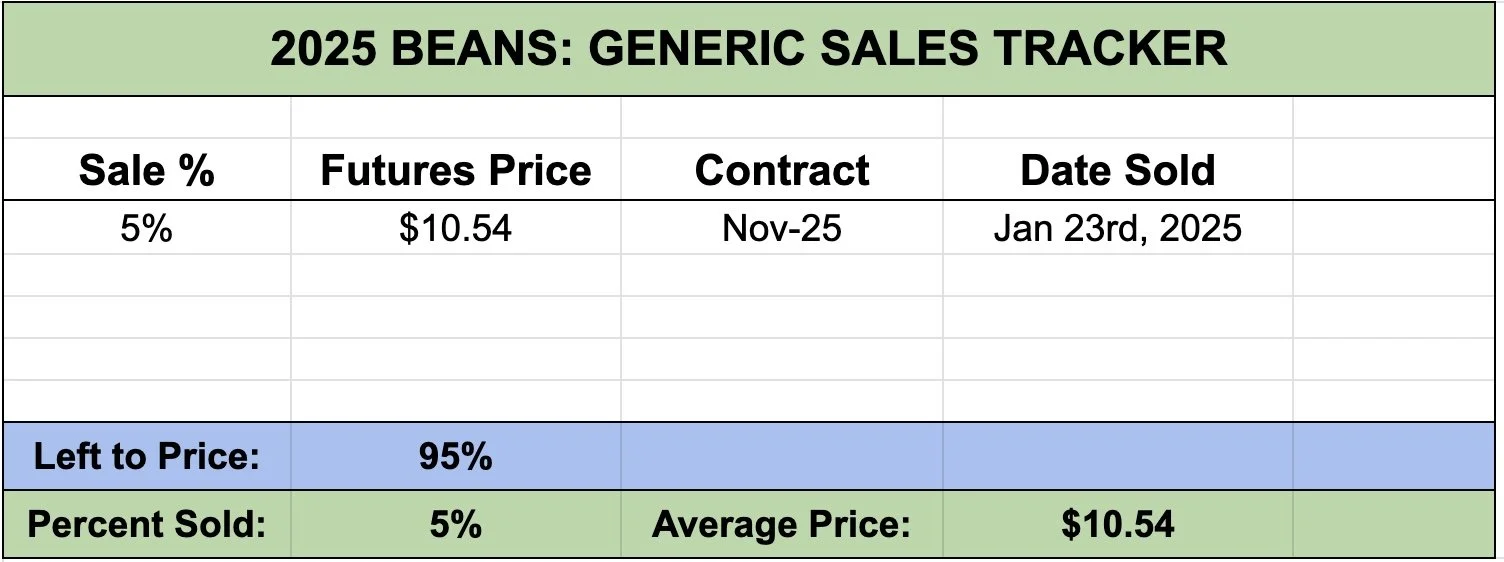

Generic Cash Sales Tracker

Due to requests here is our generic cash sales trackers.

This does not include any hedge recommendations etc. Simply cash.

This is futures prices.

For old crop there is no percentages as we only recently started tracking our generic sell signals. Future new crop sales will have percentages as we continue to make sales.

This will be included at the bottom of every update.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

3/3/25

TARIFFS ON TOMORROW. BUY SIGNAL

3/3/25

BUY SIGNAL

2/28/25

WHEN WILL THE BLEEDING STOP?

2/27/25

CORN AT CRITICAL SPOT. USDA ACRE REPORT. WAY TOO EARLY DROUGHT TALK

2/26/25

HISTORY SUGGESTS CORN TOP ISN’T IN? ACRE OUTLOOK TOMORROW

2/25/25

POSITIVE CLOSE. WHAT TO KNOW ABOUT USDA OUTLOOK

2/24/25

USDA OUTLOOK, FIRST NOTICE DAY & BRAZIL

2/21/25

WHAT TO EXPECT MOVING FORWARD IN GRAINS

2/20/25

FIRST NOTICE DAY CONCERNS. MASSIVE CORN ACRES OR NOT?

2/19/25

HOW TIGHT IS THE CORN SITUATION?

2/18/25

MORE DETAILS ON TODAYS SELL SIGNAL

2/18/25

OLD CROP KC WHEAT & CORN SELL SIGNAL

2/14/25

WHEAT BREAKING OUT ON WEATHER RISK. TECHNICALS & FUNDAMENTALS

2/12/25

GLOBAL GRAIN SITUATION, ACRE TALK, CHARTS & MORE

2/11/25

USDA: NOT A BEARISH REPORT. DISAPPOINTING PRICE ACTION

2/10/25

USDA TOMORROW. LONG TERM PATH FOR SUB 10% CORN STOCKS TO USE?

2/7/25

WHY WOULD THE FUNDS EXIT THEIR LONGS?

2/6/25

WHEAT FINALLY CATCHING A BID

2/5/25

COMPLETE THOUGHTS ON MARKETS: BACK & FORTH DISCUSSION

2/4/25

STRONG JANUARY LEAD TO STRONG YEAR? TARIFFS, CHARTS & MORE

2/3/25

TARIFFS PUSHED BACK

1/31/25

TARIFF NEWS ALL OVER THE PLACE. ARE YOU PREPARED FOR POSSIBILITIES?

1/30/25

WHEAT BULL ARGUMENT. TRUMP ADDS TARIFFS

1/29/25

CORN APPROACHES $5.00

1/28/25

TARIFFS, CORN FUNDS, SOUTH AMERICA & MORE

1/27/25

HEALTHY CORRECTION WE TALKED ABOUT & TARIFF NEWS

1/24/25

GRAINS DUE FOR SHORT TERM CORRECTION?

1/23/25

OUR ENTIRE NEW CROP SALES THOUGHTS & OLD CROP SELL SIGNAL

1/22/25

GRAINS TAKE A BREATHER. IS CORN IN A BULL OR BEAR MARKET?

1/21/25

HUGE DAY IN GRAINS. WHAT TO DO WITH OLD CROP VS NEW CROP

Read More

1/20/25

VIDEO CHART UPDATE

1/17/25

TRUMP, CHINA, ARGY & USING THE SPREADS INVERSE

1/16/25

OLD CROP LEADS US LOWER. MARKETING THOUGHTS

1/15/25

SIGNAL & HEDGE ALERT QUESTIONS EXPLAINED. IS $6 CORN EVEN POSSIBLE?

1/14/25

MORE DETAILS ON TODAYS HEDGE ALERT & SELL SIGNAL

1/14/25

CORN & SOYBEANS HEDGE ALERT/SELL SIGNAL

1/13/25

USDA GAME CHANGER OR NOT?

1/10/25

BULLISH USDA FOR CORN & BEANS

1/9/25

USDA OUT TOMORROW

1/8/25

2 DAYS UNTIL USDA. BE PREPARED

1/7/25

THE HISTORY OF THE JAN USDA & MORE

1/6/25

MAJOR USDA REPORT FRIDAY

Read More

1/3/25

UGLY DAY ACROSS THE GRAINS

1/2/25

LONG TERM CORN UPTREND? JANUARY DROP OFF IN BEANS? LONG TERM WHEAT FACTORS

1/2/25

CATTLE HEDGE ALERT

12/31/24

MASSIVE DAY FOR GRAINS. FLOORS? 2025 SALES? GAME PLAN? CHART BREAKDOWNS

12/30/24

GRAINS FADE EARLY HIGHS

12/27/24

STILL LONG TERM UPSIDE POTENTIAL, BUT TAKE ADVANTAGE OF 6 MONTH CORN HIGH

12/26/24

CORN ABOVE 200-DAY MA. ARGY DRY. BEANS +44 CENTS OFF LOWS

12/23/24

CORN & BEANS TALE OF 2 STORIES. BEANS REJECT OLD SUPPORT

12/20/24

PERFECT BOUNCE IN CORN. SIMPLE BEAN BACKTEST BEFORE LOWER?

12/19/24

THE SOYBEAN PROBLEM. NEW WHEAT LOWS. CORN UPTREND

12/18/24

BEANS BREAK SUPPORT & OPEN FLOOD GATES

12/17/24

SINK OR SWIM TIME FOR SOYBEANS

12/16/24

SOYBEANS & WHEAT FIGHTING LOWS. WILL CORN DEMAND CONTINUE

12/13/24

POST USDA COOL OFF

12/12/24

CORN CORRECTION. WHY WE ALERTED SELL SIGNAL YESTERDAY

12/11/24

USDA PRICED IN? FAIR VALUE OF CORN? BEAN BREAKOUT?

12/11/24

CORN SELL SIGNAL

12/10/24

USDA BREAKDOWN

12/9/24

USDA TOMORROW

12/6/24

CORN TRYING TO BREAKOUT. MAKING MARKETING DECISIONS

12/5/24

OPTIMISTIC BOUNCE IN GRAINS

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24