MARKETS PLAYING LEAP FROG

AUDIO & MARKET UPDATE

Very disappointing close with gap higher overnight

Why couldn’t we hold the early gains?

Heat situation still hasn’t changed

Crop tours are starting in areas that are good. Which was expected.

What will the rest of the crop tours show?

What do the charts say?

Factors in the markets

The long term wheat and corn story

Listen to today's audio below

Overview

Very disappointing day for the grains today. Following our bounce Friday, it looked like we were going to see a continuation of strength today, with a gap open higher across the board. Overnight corn was up 14 cents while beans were up 27 cents.

However, we were unable to take out any of our overnight highs, as we gave back all of the gains in corn and nearly all the gains we saw in beans. Corn and wheat both broke 25 cents off of last nights highs, both ending the day down double digits. Beans managed to close 7 cents higher, but this was well of our highs.

Now why did we break so hard? Well the market wasn't entirely ignoring the heat. The markets were more concerned with Ukraine nearing a deal to get shipping insurance on vessels moving between the Black Sea ports. So this was why wheat and corn were pressured so heavily.

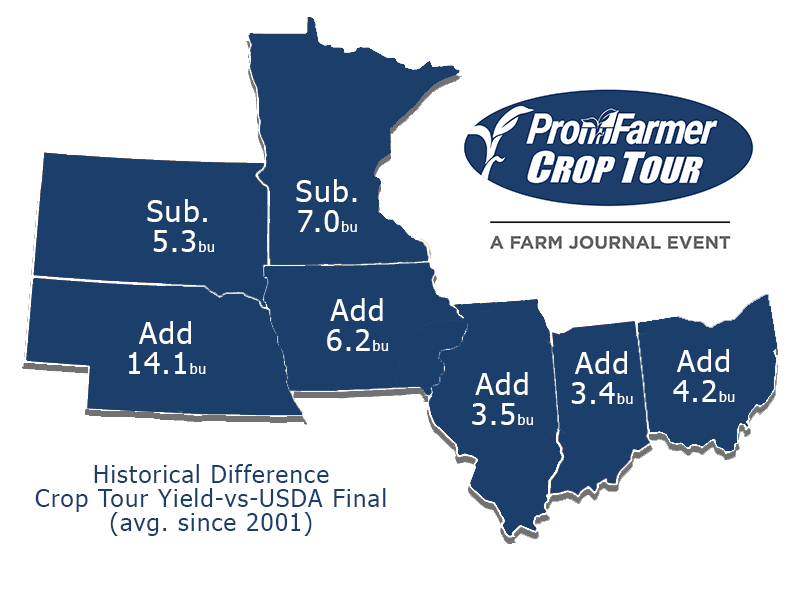

To add on to this, corn was also seeing pressuring from some decent results in the Pro Farmer crop tours. As they were touring Ohio and South Dakota today and in areas that are very likely better than a year ago. So the results for day one shouldn’t came as a surprise if they show things much better than a year ago. As the week rolls on, we could very easily see much more spotty results.

Now there is talk that the crop tours could very likely come out with yields far too high for both corn and beans, as we have yet to see the damage the heat this week will do to the crops. Some say this could be a big mistake, and we might have to take these results with a slight grain of salt this year simply due to this.

Crop Tours

The crop tours this week will be very important events to watch this week. We tend to see surprises every year. Will have to wait to see what kind of surprises we see this week. The results from Day 1 will be released at 8pm CT tonight. However, we did see some buzz on social media.

One from Karen Braun. She said she got a yield of 180.7 bpa for South Dakota after 8 stops. She took her same route she did in 2020 when they had a record 189.5 bpa. So she indicates that the crop looks better than the past 2 years but still nowhere near the record.

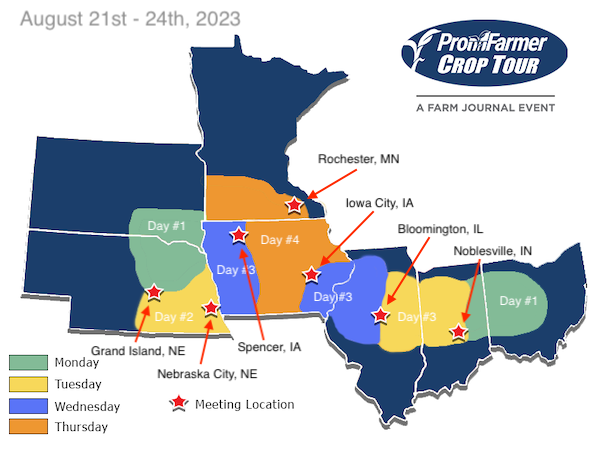

Here is the schedule of the tours.

Monday - South Dakota & Ohio

Tuesday - Nebraska & Indiana

Wednesday - Western Iowa & Illinois

Thursday - Iowa & Minnesota

Here is a map that shows schedule and what days they will be touring which area.

Below is a map that showcases the average difference between these crop tours and the USDA's final yield numbers.

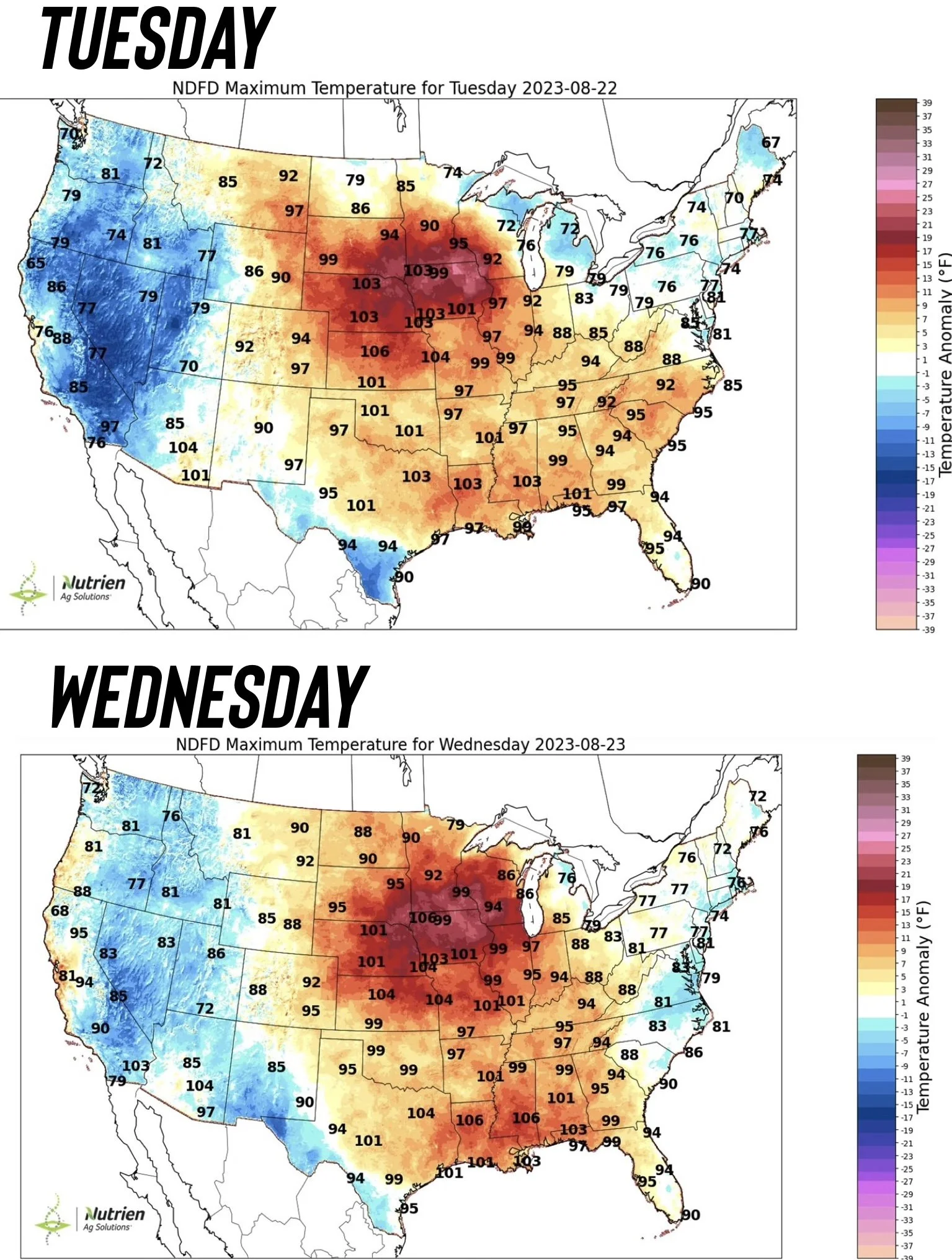

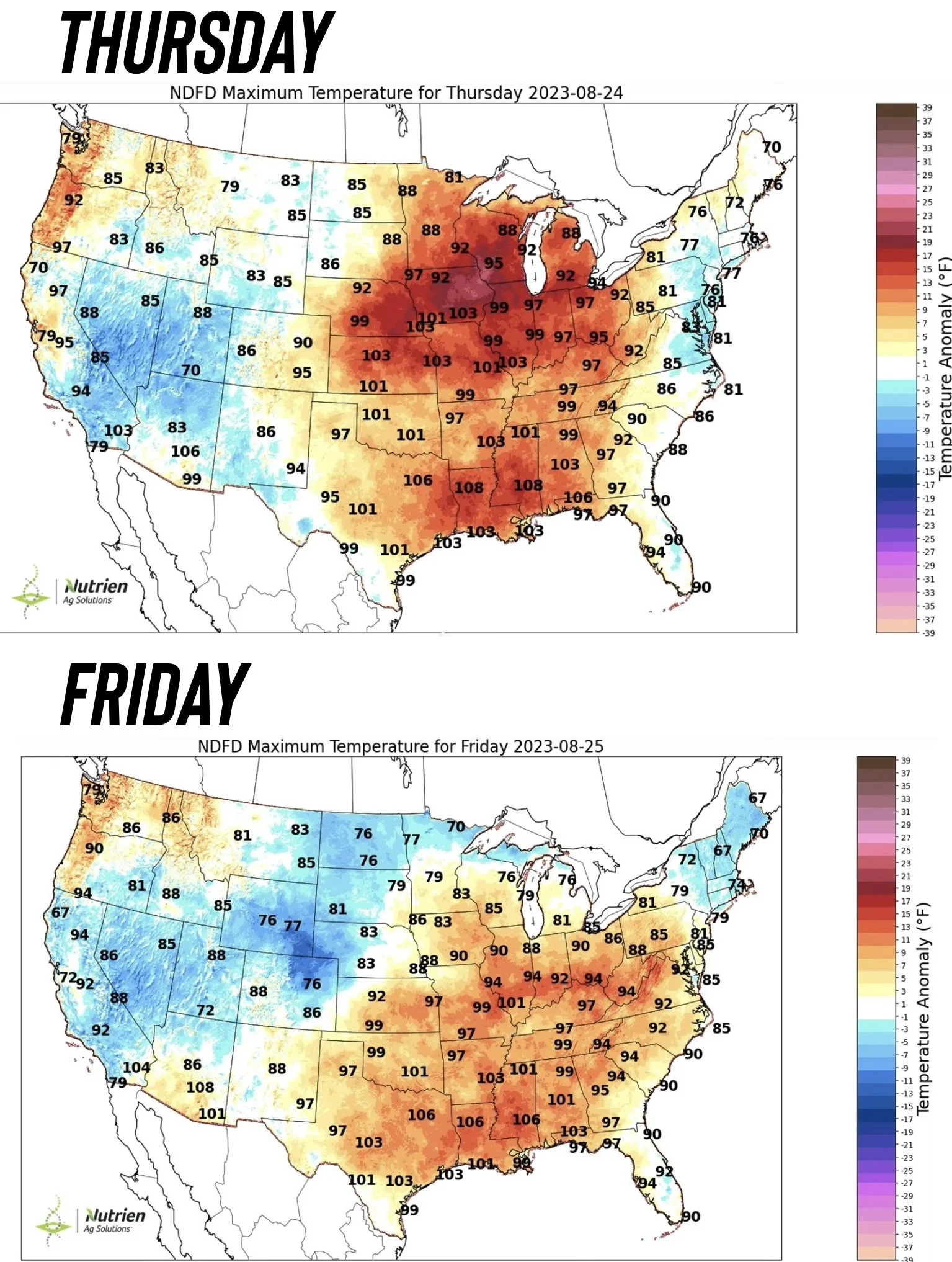

This week is still a very hot one. Here are maps showing the maximum temps for the rest of the week. These temps "feel like 130 degrees". What kind of effect will this have on maturation and yield?

The scorching temps are expected to see a cool down come Friday. However, the first 3 days are coming during the crop tours. Isn’t going to be a ton of fun for those on the tours.

According to Dr. Rachel Vann of NC State:

85 degrees is the magical number. Any temp that exceeds this number can lead to heat stress for bean crops. Especially if it is for consecutive days in a row.

Day time heat can cause damage to crops, but night time heat can be catastrophic for production.

Soybeans are less impacted by high night time temps than corn. Nonetheless, isn’t going to help.

Here is the minimum temperature for this week including today.

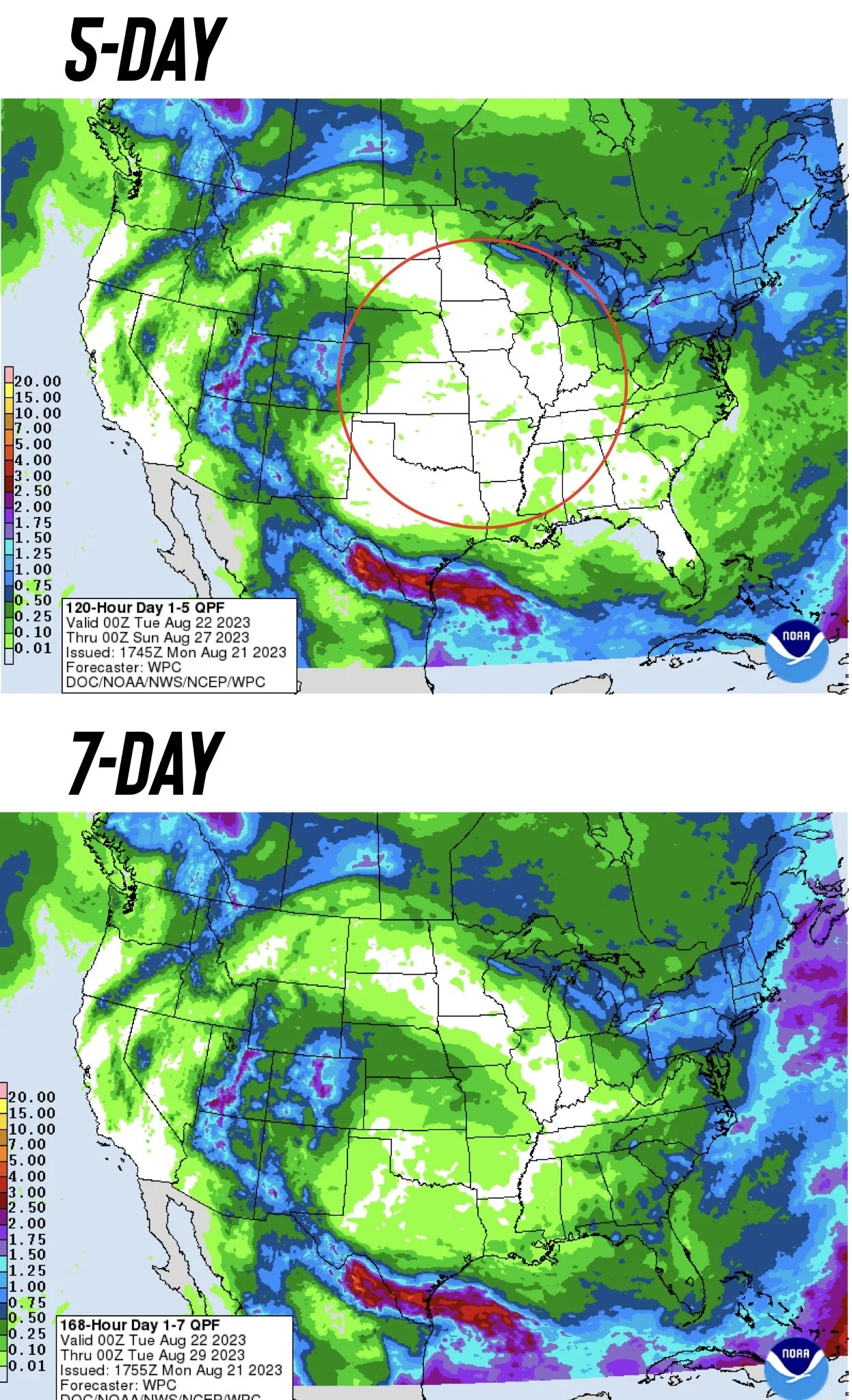

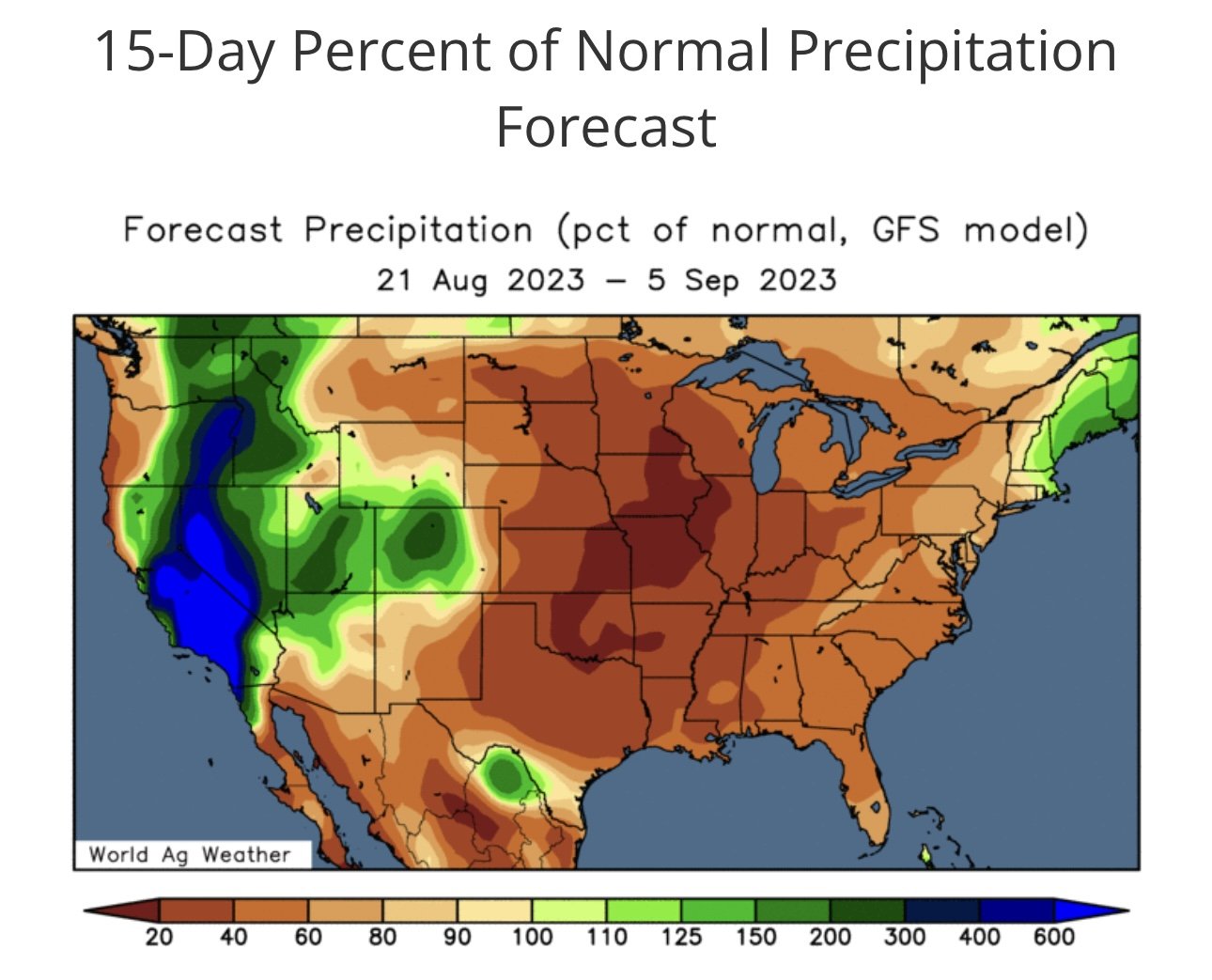

Here is the 5 and 7 day precipitation outlooks. Notice that big hole in precipitation. Coupled with scortching temps. Certainly isn’t helping the crops.

From Jason Britt - President of Central States Commodities,

"Better see higher crop ratings today with all the talk from improvements from the rain last week, because they are falling like a rock next Monday if these current conditions and forecasts hold true."

Which brings us to the crop conditions which were released this afternoon after close at 3pm CT.

Corn conditions came in 1% lower than last week. Coming in at 58% vs 59% last week. Soybeans came in unchanged at 59%. While spring wheat came in down 3% to 39% rated good to excellent. Winter wheat harvest sits at 96% complete.

I agree with Jason Britt. We will likely see this numbers take a bit hit next week. Definitely something to keep your eyes on.

Today's Main Takeaways

Corn

Recommendation:

Do you have a basis contract against the September futures? Are you wondering if you should roll it or cash it in? This is a perfect example of when one should utilize a hedge account. Via using a hedge account once a basis contract is delivered you become a much more proactive grain price maker.

Local basis? Do you have a local basis that is much more for old crop than new crop corn/soybeans? Unless you are expecting a local squeeze before harvest hits it is strongly reccomended to get basis locked in. As for the futures this is where one utilizes a hedge account to help enhance the sale, thus becoming a price maker. YOU NEED TO MAKE SURE YOU GET THE BASIS LOCKED IN IF YOU HAVE A MAJOR PRICE DIFFERENCE BETWEEN OLD AND NEW CROP. If you have questions on why you need to do this please give Jeremey a call 605-295-3100

Do you have old crop corn or beans on PRICE LATER or DELAYED PRICE? Price it sooner then later before the buyers really steal it from you in the form of widening out the basis. Then simple utilize your hedge account to establish you ending price. DO NOT LEAVE GRAIN IN PRICE LATER or FREE DP. It is the most expensive thing one can do. Control your grain and boycott price later or delayed price storage and become a price maker.

Overnight we saw corn follow beans and gap higher as the dry and hot weather continues. However, just like the rest of the markets they were unable to hold their gains.

Corn gave back their gains based off of two headlines. The first was the Ukraine insurance situation we touched on. Secondly, the expectations that we get some pretty good results from the crop tours today.

Crop conditions came in 1% lower than last week. Which is friendly, but I fully expect these conditions to drop far more significantly next week, which should support us.

The crop tours from today likely won’t help support us, but taking a look to later this week, we could definitely see a lot more holes and problems from other areas.

Bears are pointing out that if we don’t find fresh new demand headlines, the upcoming harvest may limit our upside, which is a reasonable argument. Bulls will need some demand if we want to hold any significant rally here.

Taking a look at the chart, corn had an outside day. Which is seen as a bearish indicator. But we did hold last week's lows as well as that $8.81 support level, which is a good sign.

We tried, but still failed to close over $5. This is what I had to say in Friday's update.

Bulls would like to see a break and close above $5 which hasn't happened since August 2nd, perhaps the funds would then decide to push this thing a little higher from here and get that gap fill to $5.25.

Is the bottom in? Hard to say. When looking for a bottom, if we haven't already made the bottom, I would expect us to find a bottom in the $4.60 range if we were to continue lower.

Nonetheless, we can expect some heavy volatility with the crop tours, weather, and any other headlines we see. Waiting to see how the crop tours this week shake out and how much weather premium the trade wants to put in.

Corn Dec-23

Soybeans

Beans opened the night session screaming hihger, with a 20 cent gap. Trading nearly 30 cents higher at one point reaching highs of $13.81. However, we came well of those highs, ending the day up just 8 1/2 cents.

Last week bulls were able to catch 40 cents, looking to add on to the gains with the hot and dry forecasts.

One thing that didn’t help prices today was talk that Brazil is pricing beans for December, which is unusual. This could potentially hurt our export business to China if they continue to do so.

Weather remains bullish for at least the rest of the week or so.

So now that we have rallied 75 cents or so the past 2 weeks alone. The question is, can beans continue their rally through harvest and will their be enough bullish headlines to feed the bulls?

Typically, beans do struggle to hold momentum through harvest. However, the next week, everything is fairly bullish aside from the potential for better than expected results from the crop tours.

If results come in better than expected, we probably see this news offset the weather complications, making it hard to see a weather rally. Vice versa. I expect the results from today to come in pretty good. So tomorrow we could be in for some pressure if that is the case.

However, taking a look at the rest of the tours, we could be in for some more spotty results, Definitely something to keep our eyes on.

Crop conditions came in unchanged this week for soybeans. So nothing there for bulls to really chew on. However, taking a look at next Monday. That is where bulls could really see things heat up. If these forecasts and growing conditions stay true this week, we could be looking at some significant declines to crop conditions come next week.

If you need to make sales, then make some. There is absolutely nothing wrong with taking risk off the table especiallypecially on a 75 cent rally. We are still closer to $14 than $12, and are over $2 higher than we were just a few short months ago. Although, weather is bullish and demand remains strong, which leads me to thinking we can go higher from here, we simply don’t know how these crop tours will shake out. There is a chance that they come in better than expected. Which in my opinion would likely be a mistake especially given the weather this week. But that is not necessarily how the trade looks at it.

So do what makes you comfortable. Chris Robinson from the Robinson report said that if you made any sale north of $13.34, that puts you in the 1/3 of available prices this year. He also wanted to remind us of the $1.50 drop from $14.35 to $12.82 that we just saw. So do what makes the most sense for your personal operation. If you want some help or specific advise, shoot us a text or call at 605-295-3100 anytime.

If we take a look at the charts, we perfectly hit my $13.63 target and $13.78 gap fill target I had been talking about all week long last week. After filling that gap, we then went lower and already filled the gap we had left to the downside from last night. So we will just have to wait and see how the trade reactions to the crop tour results as well as how much weather premium they want to add here. We have some support at the 50% retractement of $13.59 and then 38% at $13.41.

Soybeans Nov-23

Wheat

Wheat bulls still struggle to find any momentum, following our bounce Friday.

On one hand, we are starting to see some war headlines escalate as we are seeing more attacks on Russia from Ukraine. On the other hand, we had the insurance headline.

Right now, there just isn’t a ton of reason for wheat to see this huge rally outside of a major war headline. Bulls just don’t have a major demand story to do the heavy lifting right now, nor the interest from the funds.

However, the story in wheat is a marathon. Longer term, there is a much more bullish story developing.

We have the durum wheat situation in Canada. The problems in Australia amongst others.

The market is ignoring these problems for now, as they are more concerned about the big crop over Russia.

So yes, long term there is definitely more wild cards that could cause a rally. The big question is just when?

It is hard to say when these problems will unfold, and it is even harder to catch a falling knife. Currently staying patient and optimistic that we will eventually see these bullish weather stories across the globe unfold.

Taking a look at the charts, we held our lows from last week in both KC and Chicago, while Minneapolis did take out it's low. So perhaps we could be looking at a potential double bottom. Nonetheless, US harvest is winding down and the problems in global weather will start to make a lot more noise looking at the road ahead.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

8/20/23 - Weekly Grain Newsletter

WHY THIS IS MORE THAN A DEAD CAT BOUNCE..

Read More

8/18/23 - Market Update

GRAINS BOUNCE. WEATHER REMAINS BULLISH

8/18/23 - Audio

WEATHER,WAR, & MANAGING RISK

Read More

8/16/23 - Audio

CAN DEMAND & WEATHER LEAD TO A BOUNCE?

8/15/23 - Audio

GRAINS LOWER WITH IMPROVEMENT TO CROPS

8/14/23 - Audio

BEANS RALLY BUT CONDITIONS IMPROVE & WHEAT DISAPPOINTS

8/13/23 - Weekly Grain Newsletter

WHAT’S NEXT FOLLOWING DISAPPOINTING USDA REPORT?

8/11/23 - Audio & Report Recap

USDA REPORT BREAKDOWN

Read More

8/10/23 - Audio