MONEY FLOWING INTO GRAINS?

AUDIO COMMENTARY

Bullish price action

Money leaving other investments and flowing into grains

Are forecasts more important than actual crop progress

Setting up a hedge account

Explanation of our services

Listen to today’s audio below

Overview

Grains higher across the board despite some pressure from the outside markets. Support came from two main things today.

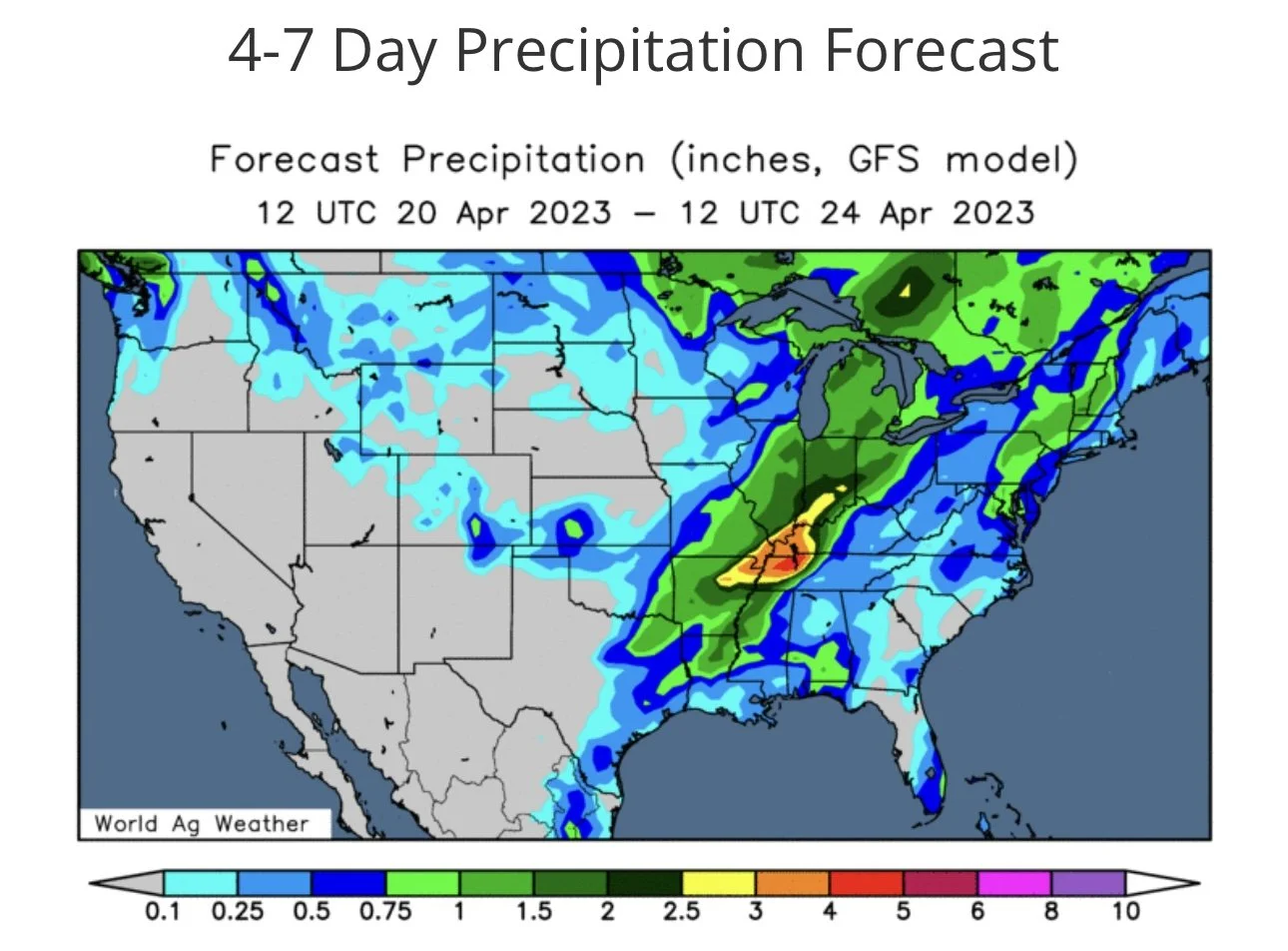

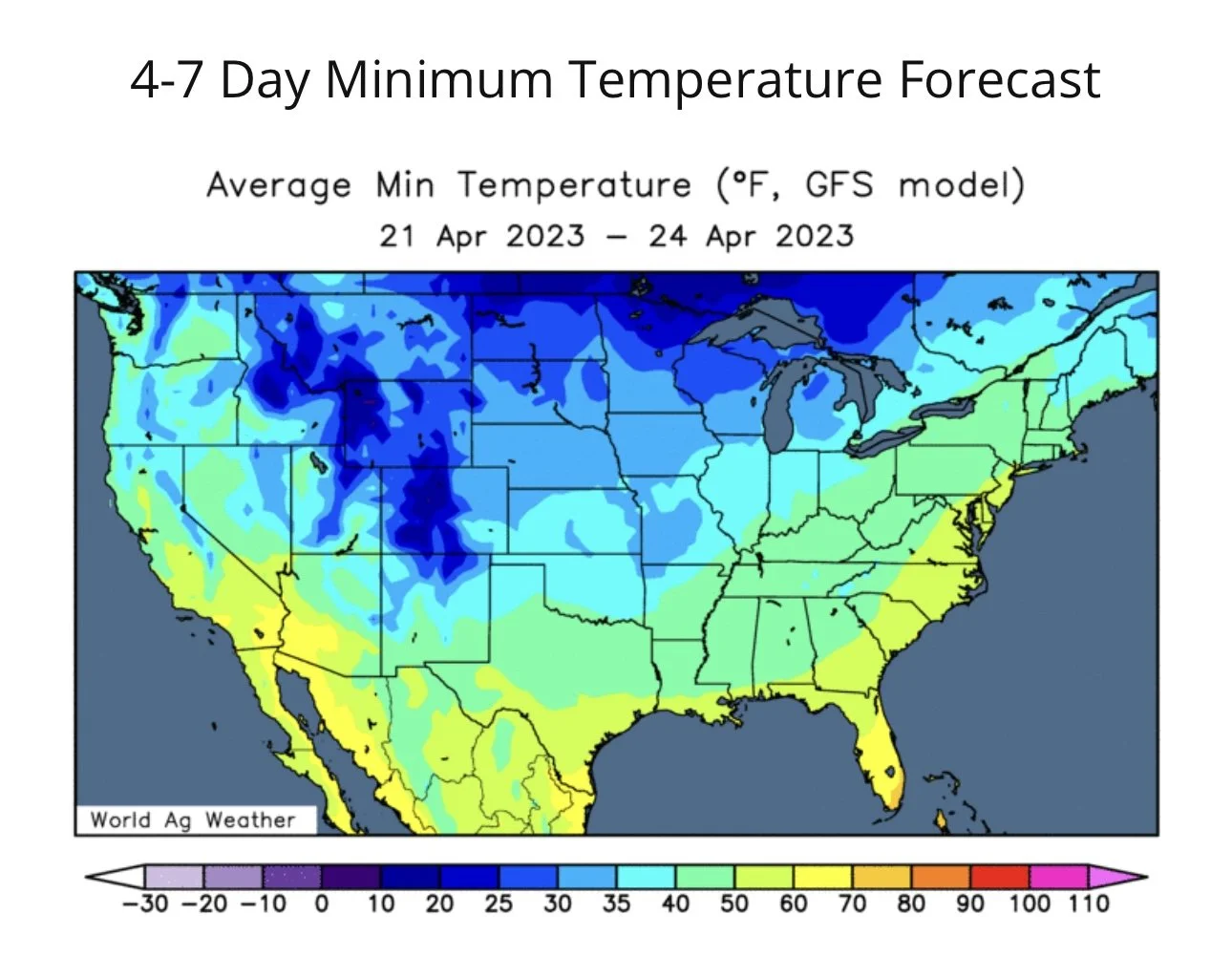

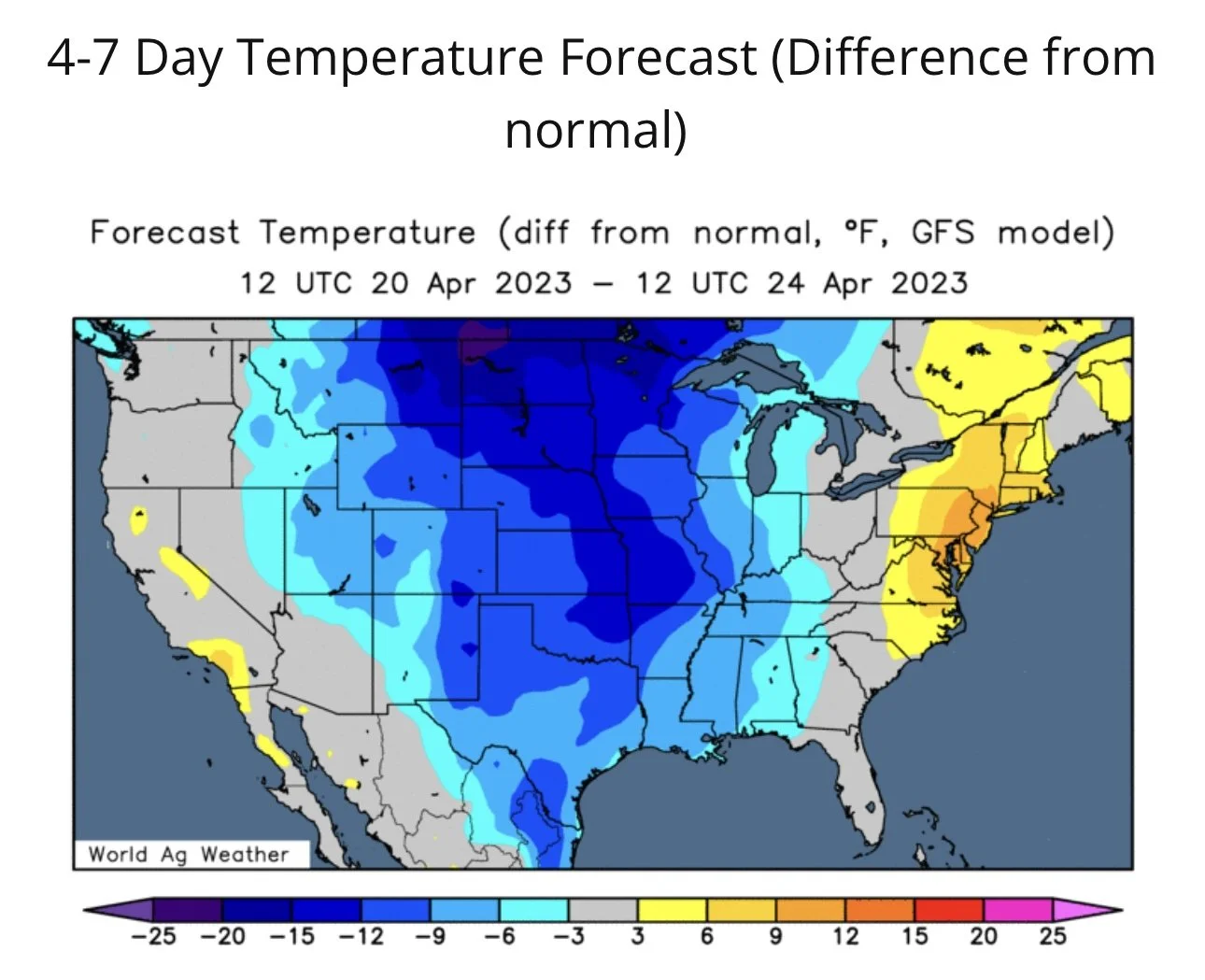

The first being that it was much cooler and wetter over the weekend vs last week, and that pattern could continue throughout the end of April leading to planting seeing some delays.

The second was Russia headlines. As Russia blocks shipping inspections in Turkey. Countries such as Hungry, Poland, and Bulgaria are all banning Ukrainian grain. Russia also continues to threaten that the black sea deal will not be extended. Nobody knows if it will be extended or not, but just the thought of it not being extended is enough to provide support. The deal expires May 17th, exactly a month from now.

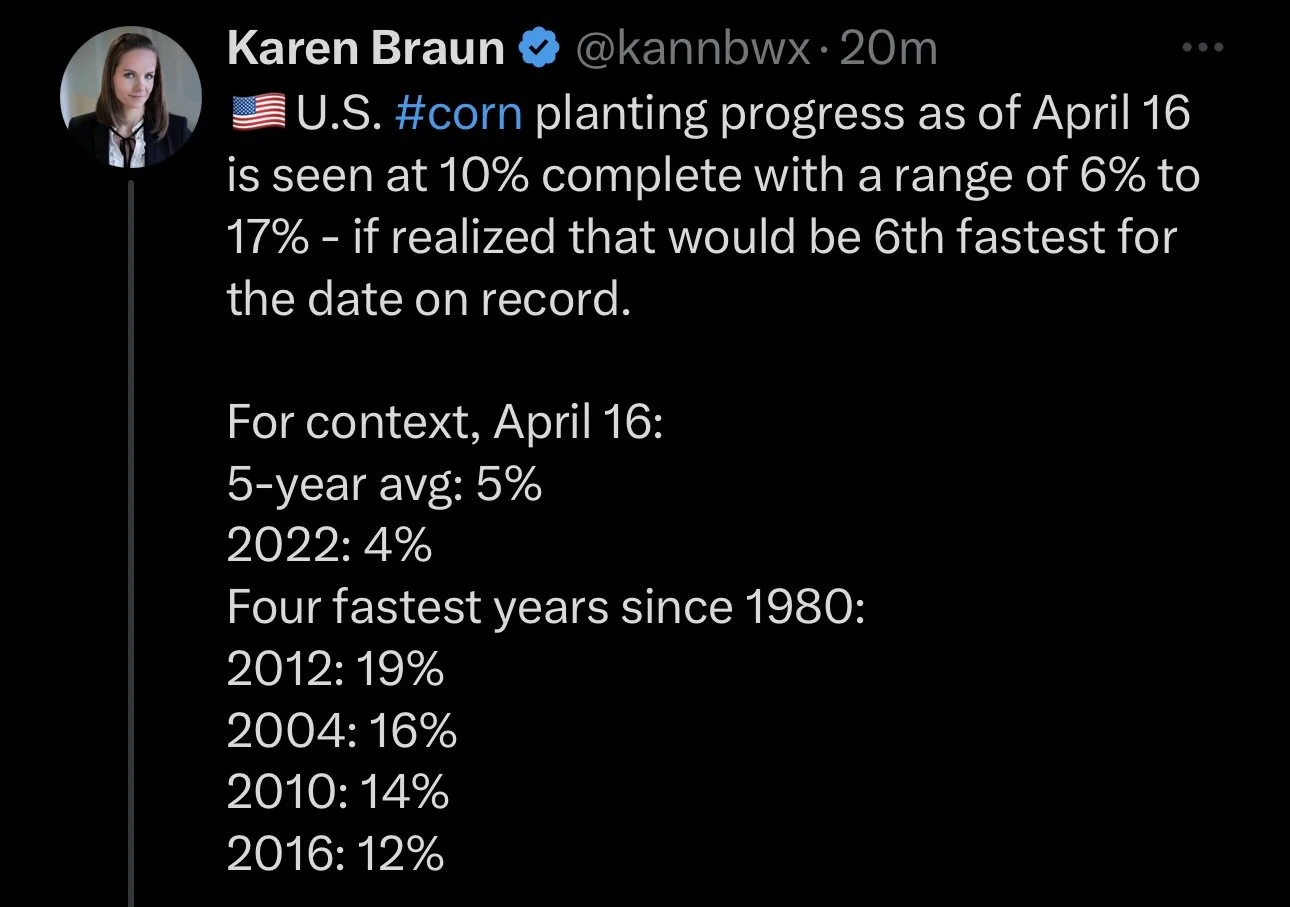

As long as the weather forecast stays cool, we should see grains well supported. But keep in mind, planting conditions came in hot for corn after close today, coming in at the 6th fastest pace on record, so don’t be surprised to see some pressure tomorrow. Planting progress came in slightly faster for beans as well, while spring wheat was slower than expected.

***

Yesterday's Weekly Grain Newsletter

Why We Could See New All-Time Highs

Read Here

Today's Main Takeaways

Corn

Corn futures close up 6 to 10 cents, with July corn up 6 3/4 cents. While May finished up over a dime.

Export inspections came in strong for corn, coming in above estimates at 1.215 million tons.

The main thing supporting the corn market today was the weather. As last week we had some really nice weather, but over the weekend we had some pretty cool temps which has some questioning if we see delays in corn planting. Forecasts are showing below average temps for the next week or so. The corn market will continue to be dominated by weather headlines and forecasts going forward. If the forecasts stay cool one would expect to see strength in corn continue.

However, after market close today we got updated planting progress. As of April 16th, corn planting is sitting at 10% complete due to the cooperative weather last week. This number would be the 6th fastest pace on record, and well above last years 4%. So be prepared tomorrow, as we could see corn take it on the chin.

Going forward, we still have the chance for more planting delays which would be supportive. As we do have another round of winter weather expected for areas such as the Dakota's and Minnesota.

We touched on this earlier, but corn also found support from countries such as Hungary and Poland banning Ukraine grains from entering their country.

Seasonally, we are in a time where we typically have made our lows and continue higher. We think the lows are in and believe we could go a lot higher from here. I say this all the time, but the path to the top isn’t going to be a straight path. So be prepared for pressured for weakness due to the hot planting progress, but remember we have plenty of possible weather scares left.

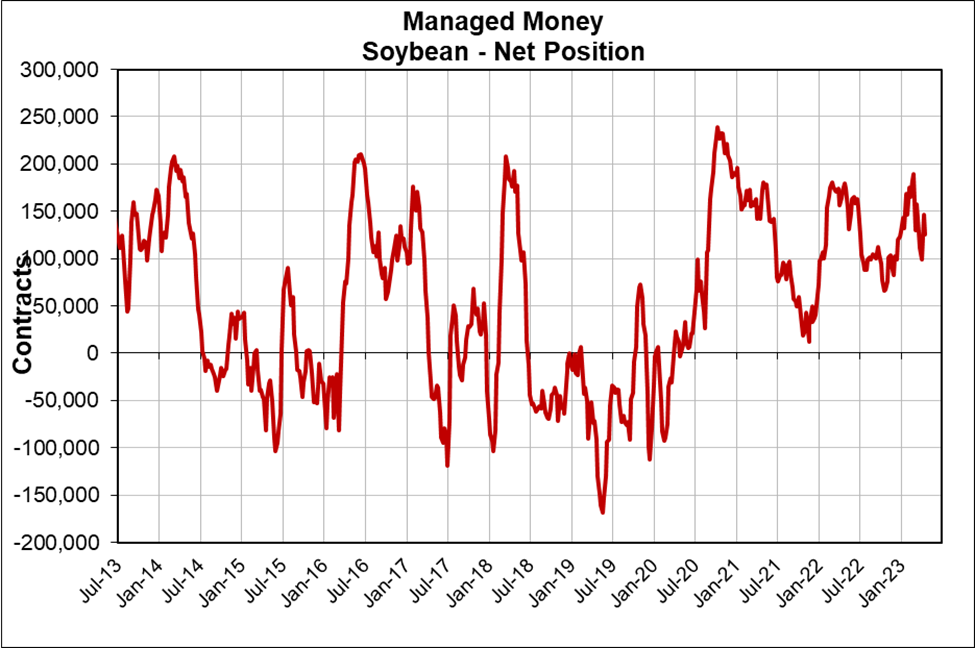

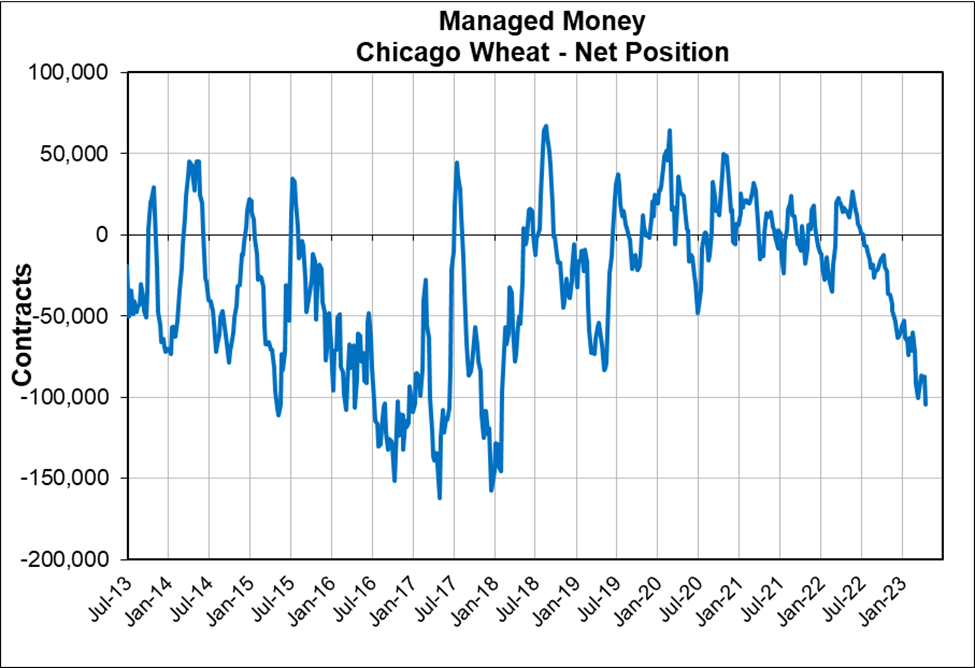

The past two weeks the funds have built a long position in corn following three weeks of selling where they had became net sellers. Last week funds bought nearly 5,600 contracts, increasing their long position to 27,100 contracts. To put things into perspective and to anyone wondering just how big of a position the funds can actually build, two years ago they were holding over a 400,000 contract long position.

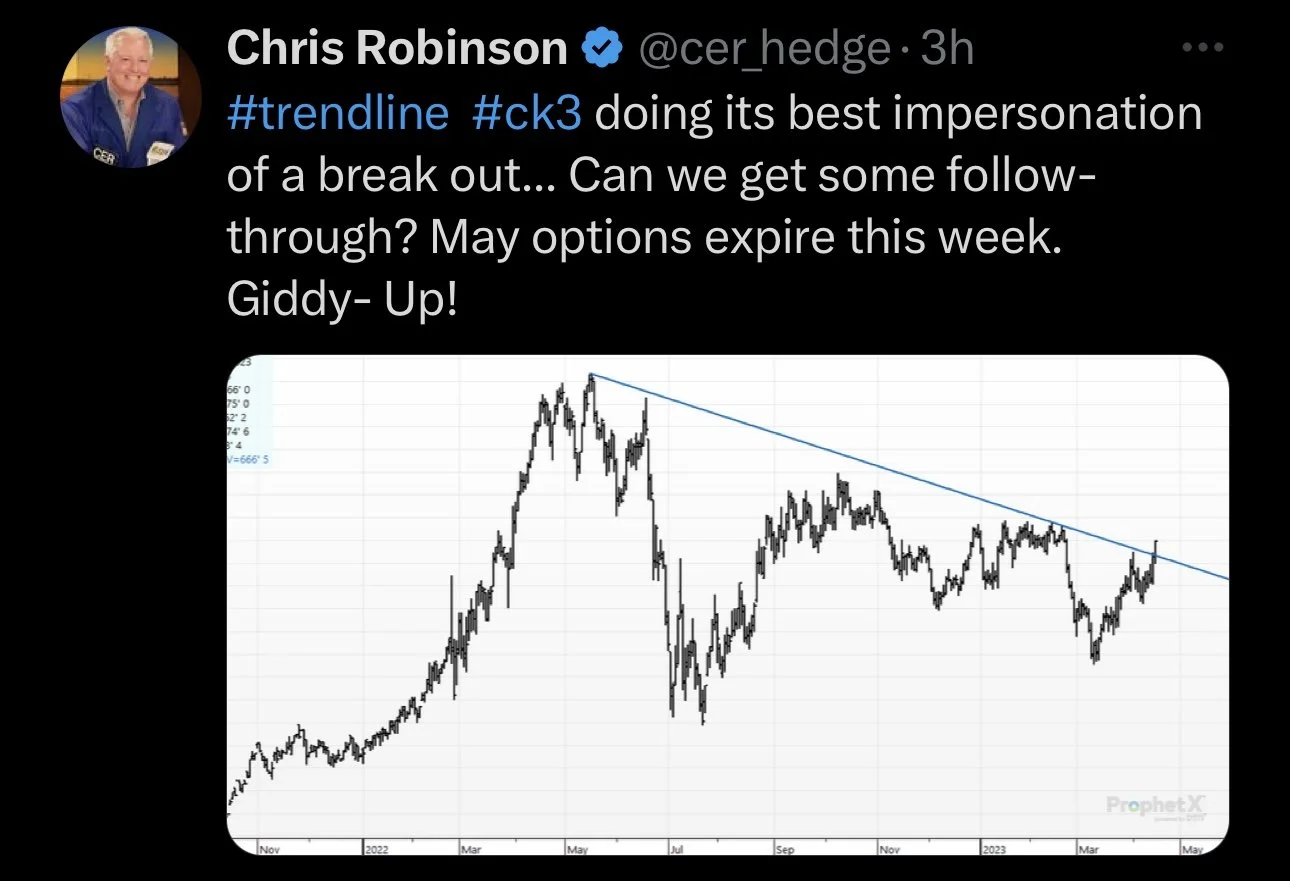

Taking a look at the charts. The first chart is July corn and the second chart is May corn. Both remain in a very solid uptrend. May corn finally broke out of our long-term downtrend from October. The next target for July would be our 100 and 200 day moving averages which sit around the $6.50 level.

Corn July-23

Corn May-23

Soybeans

Soybeans lead the way higher today for the grains. Closing up 16 to 18 cents to start the week.

Crush came in 2 million above the average guess, with soy oil stocks lower which provided support today.

Similar to corn, planting progress came in higher than estimates. Not quiet to the extend of corn. Coming at 4% planted vs expectations of 2%.

Taking a look at South America, which had been the talk of the trade for months. We haven’t seen a ton of changes. The crop in Argentina continues to get smaller rather than larger. Brazil's massive crop is still expected and sits around 90% complete.

One thing bears are looking at is more talk of US buyers importing beans from Brazil at cheaper prices. This is bearish because it means Brazil is cheaper than we are. Last week we also had Brazil looking to replace the US dollar with its own currency in international trade.

Short term we could see some pressure, but looking long term the fundamentals are very bullish.

Taking a look at the chart, we have made a clear reversal from our lows. Bulls would like to break that short term downtrend we have created. We closed just under that line today. A clean break above and one could argue we go and test our recent highs from February. First level of support is the $14.70 level.

Soybeans July-23

Wheat

Wheat futures higher across the board, all closing up double digits. Kansas City wheat closed nearly 30 cents off its lows.

Wheat was mainly supported by Russian headlines once again. We touched on this earlier, but there are plenty of problems going around. Russia is threatening to not extend the deal. They are blocking inspections in Turkey. I think there are still plenty of bullish wild cards left in the deck when talking about Russia and war. Nobody knows what Russia plans to do next, but it definitely feels like there are more bullish possibilities rather than that of bearish ones.

Bulls are also pointing at this next round of winter weather looking to add support. As these forecasts are causing some possible concern around spring wheat areas. The dry conditions lead to everyone continuing to debate just how many acres will get harvested this year.

We can’t forget just how poor of a crop we already have here in the US. Our top producing state of Kansas saw crop conditions of just 13% rated good to excellent last week. With our total US crop being rated just 27% good to excellent while 37% of our crop is standing in the poor to very poor range.

The funds added to their net short position in Chicago wheat last week. Holding over 100,000 short contracts. One still has to imagine what the market will do when they decide to liquidate these and jump ship.

Going forward, we have the dollar continuing to look weak which is beneficial to the grains, we have a ton of uncertainty in Russia, and a terrible crop here int he US, with the chance for more bullish surprises. I just can’t help but have a bullish tilt here. Even though seasonally we typically go lower from here, the past year or so have been anything but typical.

Taking a look at the chart, wheat continues to further indicate a reversal with the inverse head and shoulders we had been talking about forming the past few weeks. As we bounced exactly where we needed. Bulls would like to break out of this long term downtrend from October.

Chicago July-23

KC July-23

MPLS July-23

Market Comments

From Jon Scheve at Wright on the Market,

Corn Market Observations

May corn finished the week strong. Prices have not been this high since late February. Some global announcements contributed to this rally, including China’s buying of more US old crop corn and Russia indicating they may not renew the Ukraine grain deal next month.

Looking forward there are still some additional factors indicating old crop corn futures values may still be too low.

End User Needs for The Next Few Months

The May corn contract is gaining on the July contract. This suggests that end users are aggressively looking for corn now to meet their summer needs. Plus, basis values have been increasing the last few weeks too, incentivizing grain movement sooner than later. End users in the US seem to have good coverage on for April and May. However, it seems that they do not have much covered for June, July, and August.

Limited Supply in Storage

Since harvest, the market has not really incentivized commercial elevators to hold grain. Instead, it suggested grain facilities should move the grain as fast as possible once farmers turned over ownership.

This was illustrated in the March 31st USDA stock report with a big decrease in Iowa elevator inventories since December. Plus, Nebraska and the northwest corn belt are showing low overall inventory when comparing year over year. It may be just a matter of time before western corn belt end users have a hard time procuring more corn for their operations.

Farmers Will Not Sell Much During Planting Season

With elevators out of grain and farmers likely down to their last 25% of unsold grain still in storage, there could be a summer price stand-off. For the next two months farmers will be focused on planting and spraying and not much selling. Once summer weather is more known, then they will probably consider selling the last of their old crop. For instance, farmers in the southwest will likely wait to see if they will have enough precipitation to raise a crop this summer. Northern corn belt farmers will wait to see if they get their crops planted before prevent plant dates at the end of May.

Spreads And Basis Indications

Both the big May/July corn inverse and June/July basis values suggest July futures are undervalued. If July futures do not rally, then basis may have to do all the work to get corn moving to end users in June, July, and even August.

Bean Market Observations

While old crop bean prices have been erratic, it seems few farmers have much left to sell. This may be one reason the market has had a 20-cent trading range during 27 of the last 30 trading days. Anyone that does have old crop beans left unsold should be concerned that the first ship loaded with Brazilian beans, priced $2 per bushel below US beans, arrives in North Carolina later this month.

___

Jon Scheve

Superior Feed Ingredients, LLC

Funds

Chart Credit: Roach Ag

Check Out Past Updates

4/16/23 - Weekly Grain Newsletter

Why We Could See New All-Time Highs

4/14/23 - Market Update

Funds Cover Wheat Shorts

4/13/23 - Audio Commentary

Planting - Is It Dry or Wet?

4/12/23 - Market Update

Grains Strong Despite Bearish Report

4/11/23 - Audio & Report Recap

USDA Kicks Can Down Road

Social Media

U.S. Weather

Source: National Weather Service