NEW ALL-TIME HIGHS?

WEEKLY GRAIN NEWSLETTER

This is Jeremey Frost with some not so fearless comments for www.dailymarketminute.com

Choppy trade or fireworks?

Last week was a rather choppy two sided trading week, up until Friday when all of the sudden the same news that started a massive rally a year ago came back to the forefront. That being the Black Sea war between Russia and Ukraine, as it appears Russia got much more aggressive as numerous reports are that will continue in the next several weeks.

Magically it mattered again and we saw our big 3 take off on Friday with wheat up around 30, beans up nearly a quarter, and corn nearly a dime.

The price action left the charts for wheat looking very positive, with upside breakouts. Beans had a new high close for the move, while bean meal made another new contract high.

This all happened at a time when the CFTC has stopped reporting and it appears they won’t have a report this week either. Typically that uncertainty does not keep investors at home. How much fund short covering has happened in wheat and how much could happen in the near future is a harder question to answer when you start playing cards in the dark.

Will the Ukraine-Russia escalation continue to increase? That is a question that only time will tell, but I think we will see history repeat itself.

Momentum and History

As mentioned I think history repeats itself, I think the reasons we had massive rallies starting around this time last year will once again come to the forefront. Including the tensions in the Black Sea, the issues with world production, along with the funds driving prices higher. Seasonally we are ready for our markets to start rocking and rolling much higher in the coming months.

The fact that so many elevators and advisors have been preaching for farmers to fear selling for months, has been able to help us get to where we need to be to actually get much higher prices. See typically we don't see higher prices when everyone has sold nothing, we see higher prices after plenty of grain has been marketed.

They used to say once the American Farmer had thrown in the towel then we would rally higher. I think plenty of farmers have sold plenty of new crop grain. I know talking to various end users they seem to have a pretty good book on. Some are well ahead of typical in terms of the amount of coverage they have.

To go higher sometimes we need to have things checked off of a list so to speak. Such as;

Farmers having sold a high percentage

Both bears and bulls, if everyone has bought who is left to buy?

Funds interest

Fundamentally reasoning

Take out certain resistance points on the charts…..such as

3 month high

6 month high

Calendar high

Contract high

Multi year high

All time high

Demand or Fear based

Demand rallies can live longer than fear of supply based rallies.

Final Destination - New All-Time Highs?

We haven’t recently made new all time highs in any of the grains, but we do have several that have started building momentum in a manner where I believe our final destination is going to be new all time highs.

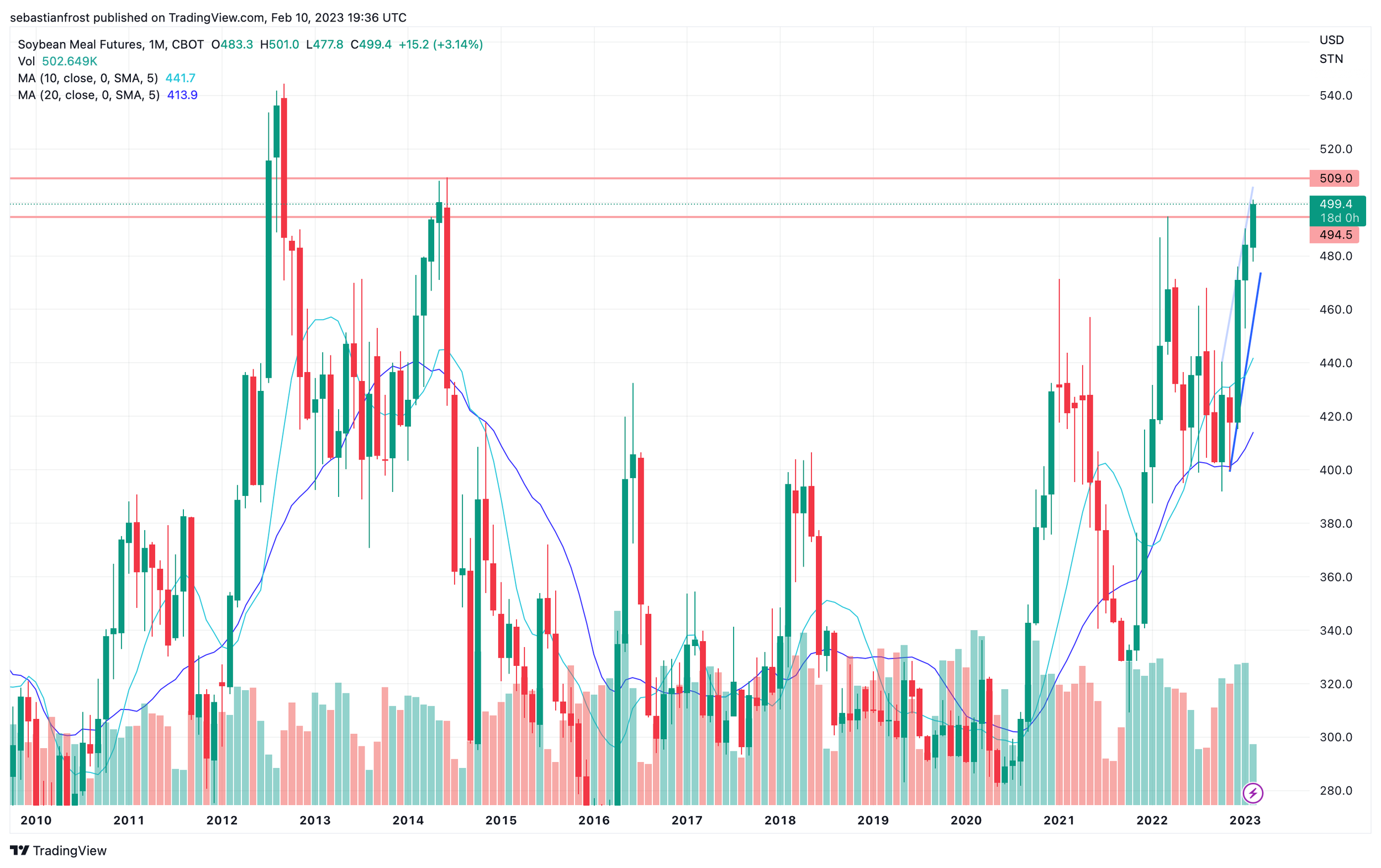

Let’s look at a few soybean and soybean meal charts. This first couple of charts are just from a one year perspective. Just notice the difference between beans and bean meal. Would it be possible for beans to do what bean meal did?

Next is 3 month charts, you can notice how they are working similarly and look like they are following each other a little bit.

These last two are for about 25 years. The main thing to take from here is the fact that we really are within striking distance of new all time highs.

The bottom line in looking at these charts is just to help guys open their minds to the possibilities. Going back to the first two charts, ask yourself where could we see prices go if beans decide to have the type of rally that bean meal had in the past year.

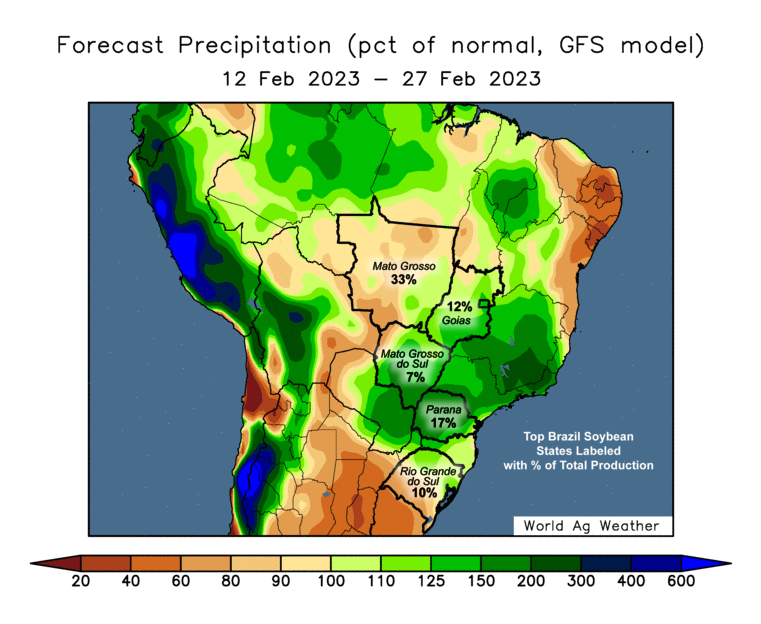

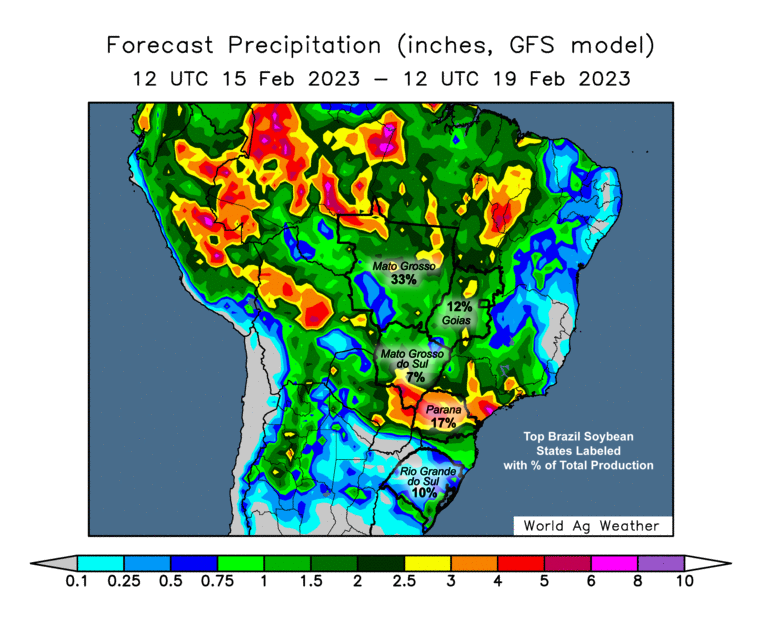

Weather

South America weather is one more catalyst that we have that could lead to much higher prices in the future. It appears that some of the hot weather will relax in Argentina for a bit, but with little to no moisture. While it appears we continue to push back second crop corn planting further and further with every forecast in Brazil.

The Bottom Line

I want to be patient in making sales and doing much if any marketing, but I am getting closer with everyday that goes by when I want to start making sales and getting aggressive with adding some protection.

Look for us to start placing orders soon. Last year we saw highs hit in late April for old crop corn, and in May for new crop corn. We will look to add protection in those time periods. How aggressively and by what method will be determined by what the market is telling us.

One thing I do want to watch out for is if we get an early start to planting. An early start to planting is what happened in 2012 and this caused the funds to not be paying attention to how dry it was.

HiOleic Sunflowers

We are still looking for some old crop HiOleic sunflowers out of North Dakota. Please give me a call at (605) 295-3100 or Wade at 605-870-0091 if you have any that you are looking to move.

Charts

Corn 🌽

With Friday's bounce, if we continue to see strength this week and get a break to the upside my eyes are set on $7

Soybeans 🌱

Looking at the charts, beans again are looking to test that stiff resistance around the $15.50 range. If we do happen to get a break to the upside, there is room to run as we have a massive gap to $16.80

Soymeal 🐮

Meal is approaching highs we haven’t seen since 2014.. Will Argentina concerns allow us to keep climbing?

Chicago Wheat 🌾

Taking a look at the charts, our first point of resistance is right under $8.00 which is where we saw prices reverse following our December rally. Once we break that key $8.00 level the we present ourselves with a ton of more upside. I wouldn’t be surprised to see us climb to $9.00 if we continue to break higher. Nonetheless, I think its safe to say we broke our downtrend.

Factors to Watch This Week

War

Will we continue to see tension and an escalation? If we do, we have the chance for another rally backed by war headlines.

South American Weather

Will Brazil continue to get rain? Will we continue to see planting and harvest delays?

Will Argentina continue to suffer from drought? If so, how much worse will their already poor crop get.

China

Will we see an increase in Chinese appetite for U.S. product, or will they look to get sales from other countries.

The spy balloon situation. Do we continue to see these type of headlines? How will this effect the relationship between the U.S. and China.

Funds

The funds are very long corn, beans, and meal. While being extremely short wheat.

Will the war scare the shorts in wheat, leading to a short covering rally?

Will they continue to add to their record long meal position.

As always, if there is ever anything we can do for you or if you have questions about marketing or your operation don’t hesitate to give us a call free of charge as we always love to help.

Jeremey (605)295-31000

In Case You Missed It

Here are a few past updates in case you missed them or want to go back read/listen to past updates.