POST USDA COOL OFF

MARKET UPDATE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

Want to talk? (605)295-3100

Futures Prices Close

Overview

Very little fresh news in the grains.

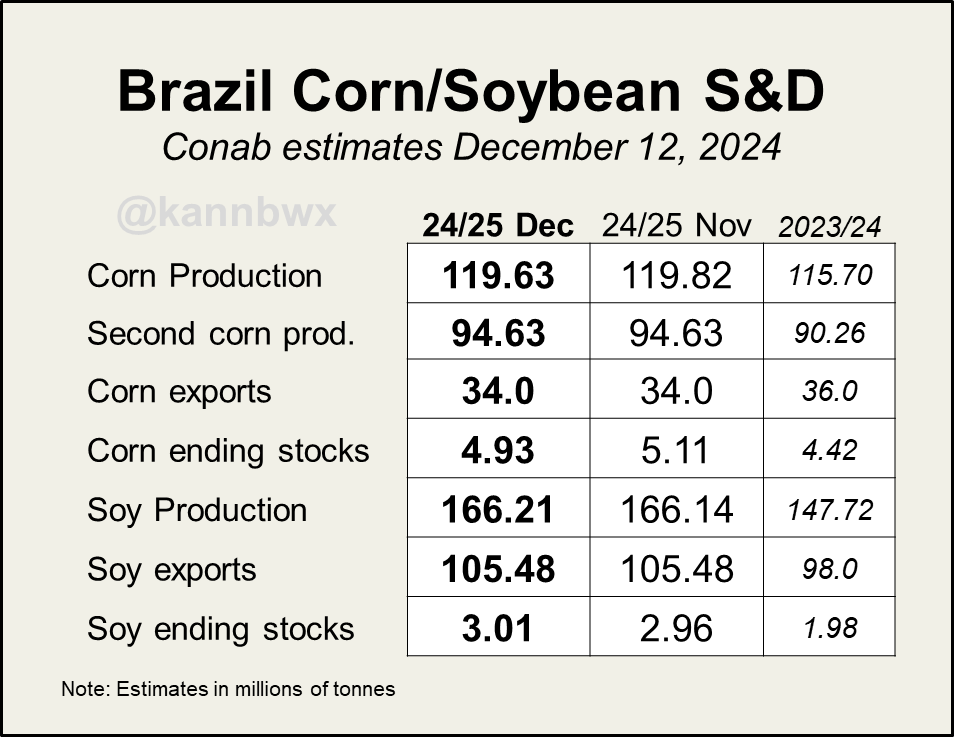

One of the only pieces of news we received was the CONAB report.

They made very little changes to either corn or soybeans from last month.

However, these numbers suggest Brazil is set to produce +12.5% more soybeans and +3.4% more corn last year.

USDA vs CONAB (MMT's)

USDA Corn: 127

CONAB Corn: 119.63

USDA Beans: 169

CONAB Beans: 166.21

As for price action, today was a poor day across the board.

Corn was lower but did manage to battle back. Trading as low as $4.40 but bouncing to $4.42 1/2. Closing down just -1 cent.

This correction in corn is something we thought would happen hence our sell signal Wednesday.

Some of you may be disappointed in the past 2 days of price action in corn given how bullish of a report we saw. But this action isn’t surprising at all.

Yes we got a big cut to demand on the USDA report. But the trade was already very aware of the exports, so a good portion of that bump in demand was priced in on this recent rally.

To add on to that, the algos hit the sell button right at that 200-day MA target.

Soybeans were down -7 cents but essentially still just trapped in a tight range near the recent lows.

Soybeans have been putting up a better fight than some would have guessed given all of the tailwinds from the monster crop in Brazil.

It feels like the market has already priced in a Brazil crop somewhere in the realm of 170 MMT. (CONAB 166 vs USDA 169).

The wheat market gave back most of it's gains from the mini bounce it saw this week. Hovering right back down near the lows.

As the wheat market is struggling to find a story to build any momentum behind.

(Scroll to read rest of update)*

Black Oil Sunflowers Offers:

We are looking for black oil sunflower offers.

Shoot Jeremey a call or text at (605)295-3100 with any new crop black oil sunflowers you have for sale.

Have a Marketing Plan

With harvest over, this is the time where you need to be proactive and have a marketing plan.

So if you'd like to talk through your operation, please feel free to reach out to us. It doesn’t cost you anything. We'd be happy to help.

(605)295-3100

Today's Main Takeaways

Corn

Corn gets that correction we were talking about happening.

Here is a tweet from a well respected trader:

He is bearish corn as he feels like the market has already priced in everything.

He makes a decent argument. What is the story now?

One one hand yes, the farmer still has plenty on farm corn that could cap major rallies.

Yes, export demand is slowing. But that is also seasonal and nothing unusual. We still remain well ahead of USDA projection.

We all know just how picky the USDA is at making adjustments. They usually do not make changes in December. Yet, they bumped exports by +150 million. So they must be pretty confident these exports are here to stay.

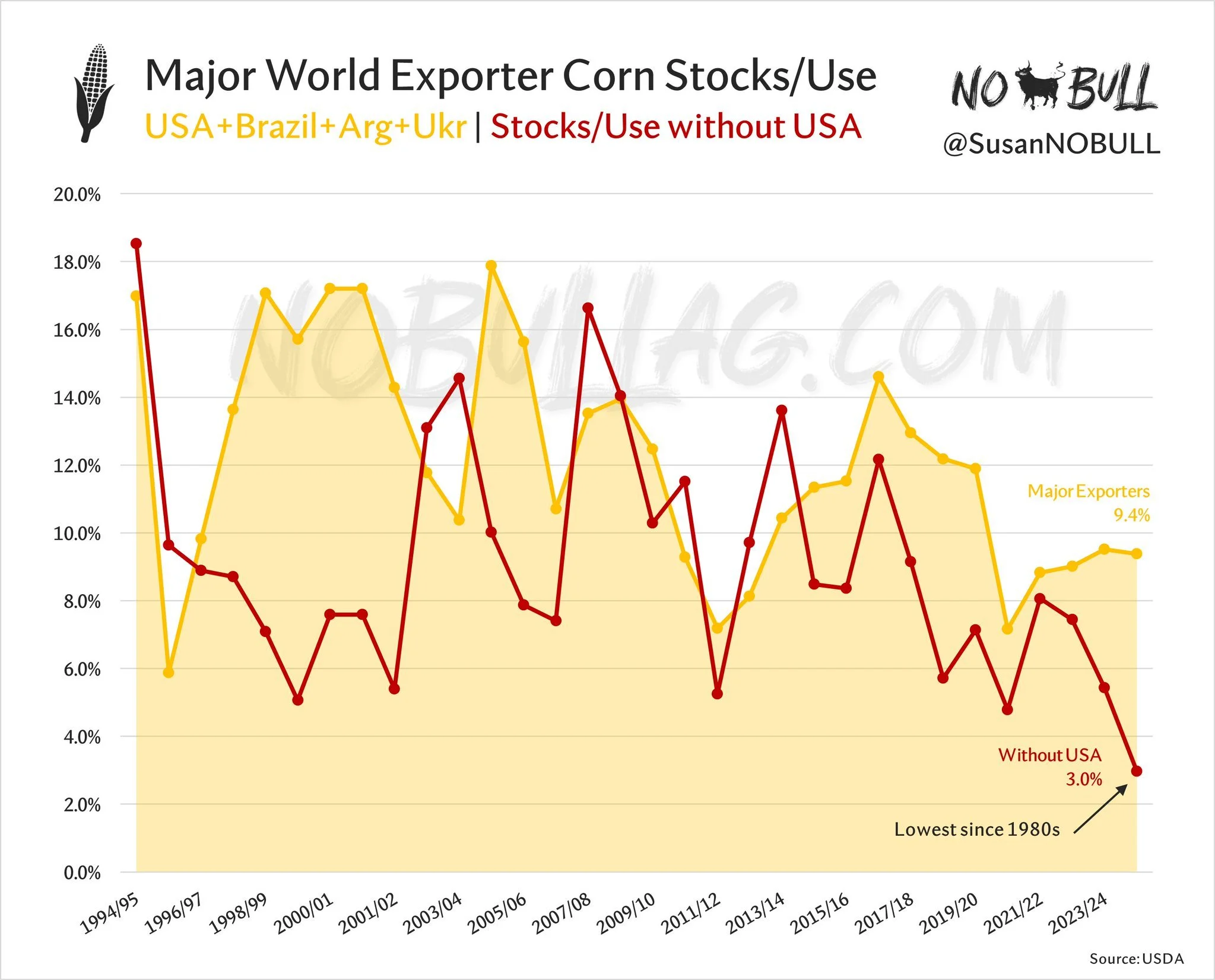

Here is a great chart from Susan of NoBull Ag.

It shows the USDA raising exports to 2.475 million bushels. A 4 year high and our 2nd largest ever only behind 2020/2021's record.

The most interesting thing to note is that all of this was done with virtually zero help from China.

In 2020/2021, China accounted for 1/3 of all of our sales. Today, they account for ONLY 1 million bushels.

Now no, we likely won’t get a 2020 type rally out of nowhere because China isn’t buying corn. That rally was led by China feasting on US corn.

But here is another great chart from Susan. It is major world exporters stocks to use ratio.

If you exclude the US, it is at an all time low of 3%.

So the rest of the world is low on corn relative to past.

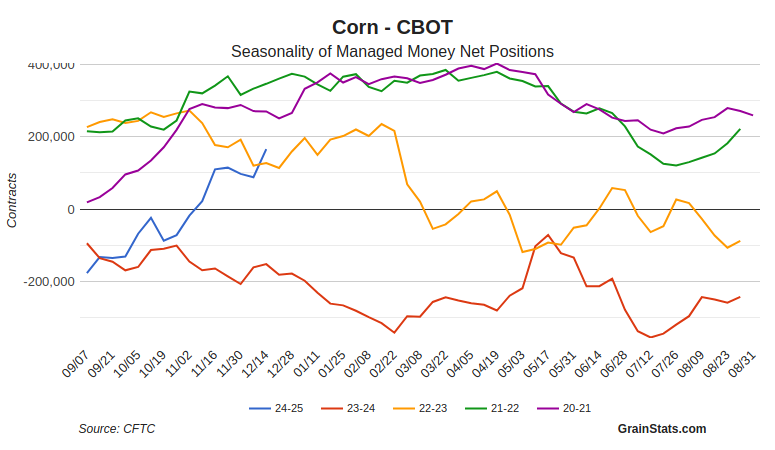

Lastly I do not see why the funds would give up their recently long positon in corn. So that should help add a floor.

They are now long +166k contracts (+78k from last week). The largest in a long time.

Chart from GrainStats

Carryout just dropped -10%. What reason would they have to get short after being short the entire 23/24 marketing year?

I am not saying we are going to blast past $5. But corn is no longer valued below $4 like it once was just a few months ago.

Exactly a year ago, corn was trading $4.80. Yet our carryout was +2 billion bushels vs 1.738 billion today.

Looking at the chart, we perfectly hit our 200-day MA target & sell signal.

I am looking for support between $4.41 to $4.35 (our golden zone retracements of 38.2% to 61.8% of the recent rally).

This also coincides with a back test of the symetrical triangle we broke out of.

Often times when you break out of a range of resistance, you go back and test that point seeing if it will become support.

The stochastics still have quiet a ways to come down, which signals this correction is not over and momentum remains lower for now.

Soybeans

Beans continue sideways, chopping around these recent lows.

It feels like a good portion of this monster crop in Brazil is already priced in.

Exports have been good. Crush has been fantastic.

However, the problem here is the future of exports.

It is going to be very very hard for the US to steal much if any business away from Brazil when their crop comes online after January.

The US Dollar vs the Brazil Real is sitting at all-time highs. (Meaning the real is cheap vs the dollar). As the exchange rate has jumped +23% year to date.

Current $1 = 6 Brazil Reals. Last year at this time $1 = 4.9 Brazil Reals. This makes us less competitive against Brazil on exports.

If Brazil has a 170 MMT crop it's going to make it real tough on our exports.

I am still not overly concerned with the potential war. The Brazil crop is by far a more burdensome factor that could weight down beans.

China really doesn’t have as much bargaining power as they did last Trump presidency. Because their economy is extremely weak right now.

An example of this weakness:

China's banks reported November loans totaling $79.7 billion. Far below the $136 billion estimates. Missing expectations by -40%.

So in all reality, there is a decent chance that a trade agreement could involve China ending up purchasing more ag products & commodities.

One positive factor beans have going for them is we will likely be looking at a loss less acres next year, but this isn’t going to be a factor for a few more months.

Bottom line, I am simply just watching the charts.

We still desperately need to hold these lows. This descending wedge is getting VERY tight. It is just a matter of time before it picks a direction.

If it breaks higher, we will be looking for opportunities.

If it breaks lower, sub $9 beans is a real possibility. As that is still the implied move down.

A few days ago the indicators were indicating a bounce. We got a small bounce but nothing meaningful.

The stochastics actually topped out today.

Which signals we might need to go lower from here and indicates momentum is shifting lower.

The MACD is also on the verge of flipping bearish.

If these indicators are right this time, we have -13 cents between those lows we have to hold.

Wheat

Not much to talk about in the wheat market.

We are back to battling those recent lows.

We simply lack any major news or a driving factor in this market. It's that time of year where there isn’t much for bulls or bears to chew on.

Overall, still think wheat has potential LONG TERM.

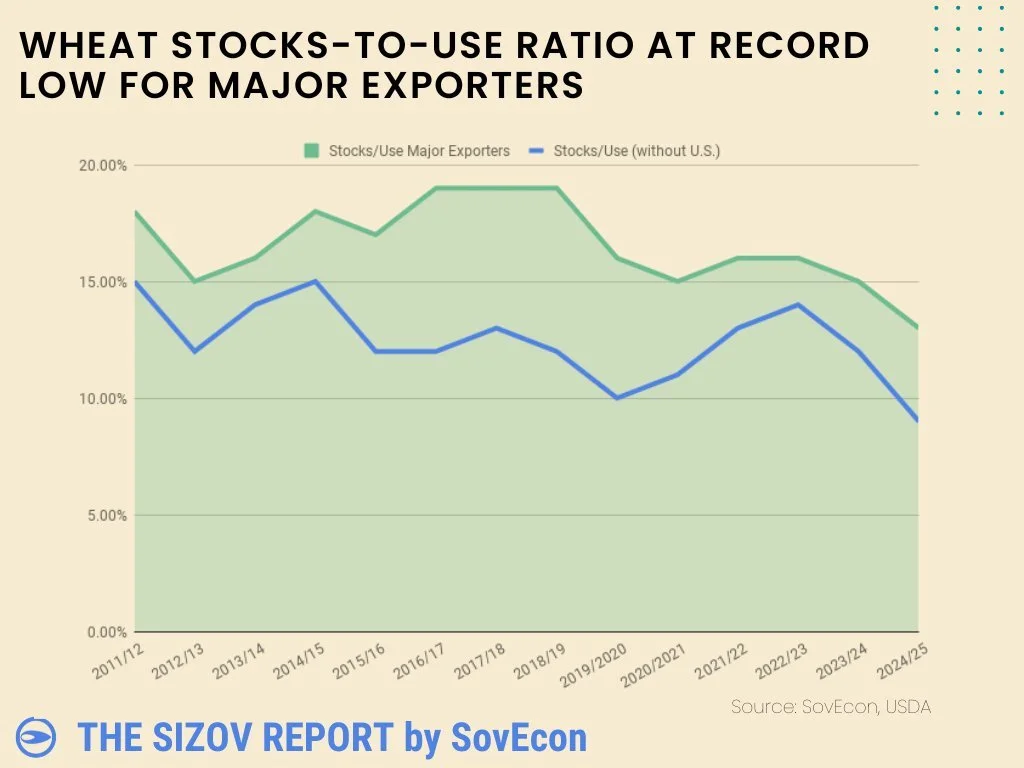

Here is a chart from Aundrey Sizov that shows wheat stocks to use ratio from major exporters.

He captioned this chart by saying this:

"Wheat is cheap guys. The global stocks to use ratio chart says it all. Plus, US export numbers likely need a further upward revision."

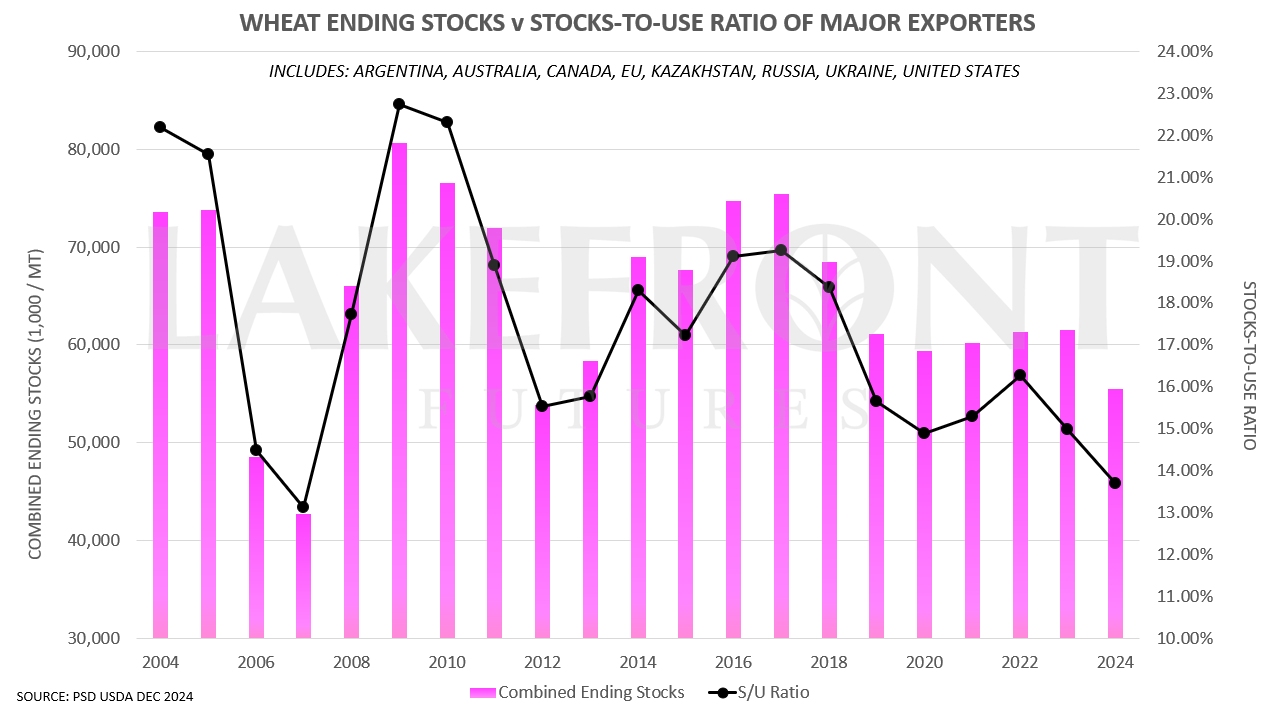

Here is another view from Darrin Fessler of Lake Front Futures.

Major Global Exporters:

Ending Stocks: 12 year lows

Stocks to Use Ratio: 17 year lows

Bottom line, I am remaining patient in wheat. Long term I believe we are undervalued.

Could we go lower from here? Absolutely. If we fail to hold these lows, it could open the flood gates down to $5.00

To call a bottom, I need $5.84 still.

Same thing with KC.

Need to hold the lows and break above $5.89

Until then we are simply range bound.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

12/11/24

USDA PRICED IN? FAIR VALUE OF CORN? BEAN BREAKOUT?

12/11/24

CORN SELL SIGNAL

12/10/24

USDA BREAKDOWN

12/9/24

USDA TOMORROW

12/6/24

CORN TRYING TO BREAKOUT. MAKING MARKETING DECISIONS

12/5/24

OPTIMISTIC BOUNCE IN GRAINS

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24

CORN SPREADS, CRUCIAL SPOT FOR BEANS, SEASONALITY SAYS BUY

11/26/24

TARIFF TALK PRESSURE

11/25/24

HOLIDAY TRADE, SEASONALS, TARGETS & DOWNSIDE RISKS

11/22/24

CORN TARGETS & CHINA CONCERNS

11/21/24

BEANS NEAR LOWS. CORN NEAR HIGHS. 2025 SALE THOUGHTS

11/19/24

WHAT’S NEXT FOR GRAINS

11/18/24

WHEAT LEADS THE GRAINS REBOUND

11/15/24

BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24