QUIET DAY FOR GRAINS

Overview

It's been a pretty quiet last two days with limited news. Grains trading both sides today, with extremely tight ranges. Perhaps a bit of a risk-off day as crude, energies, metals, and the rest of the outside markets take a hit. With crude down -2%.

Any time crude oil gets hit as hard as it did today, and we see the grains shake it off and wind up closing higher, is typically a sign of strength.

Kansas City wheat continues to grind higher with dry weather concerns.

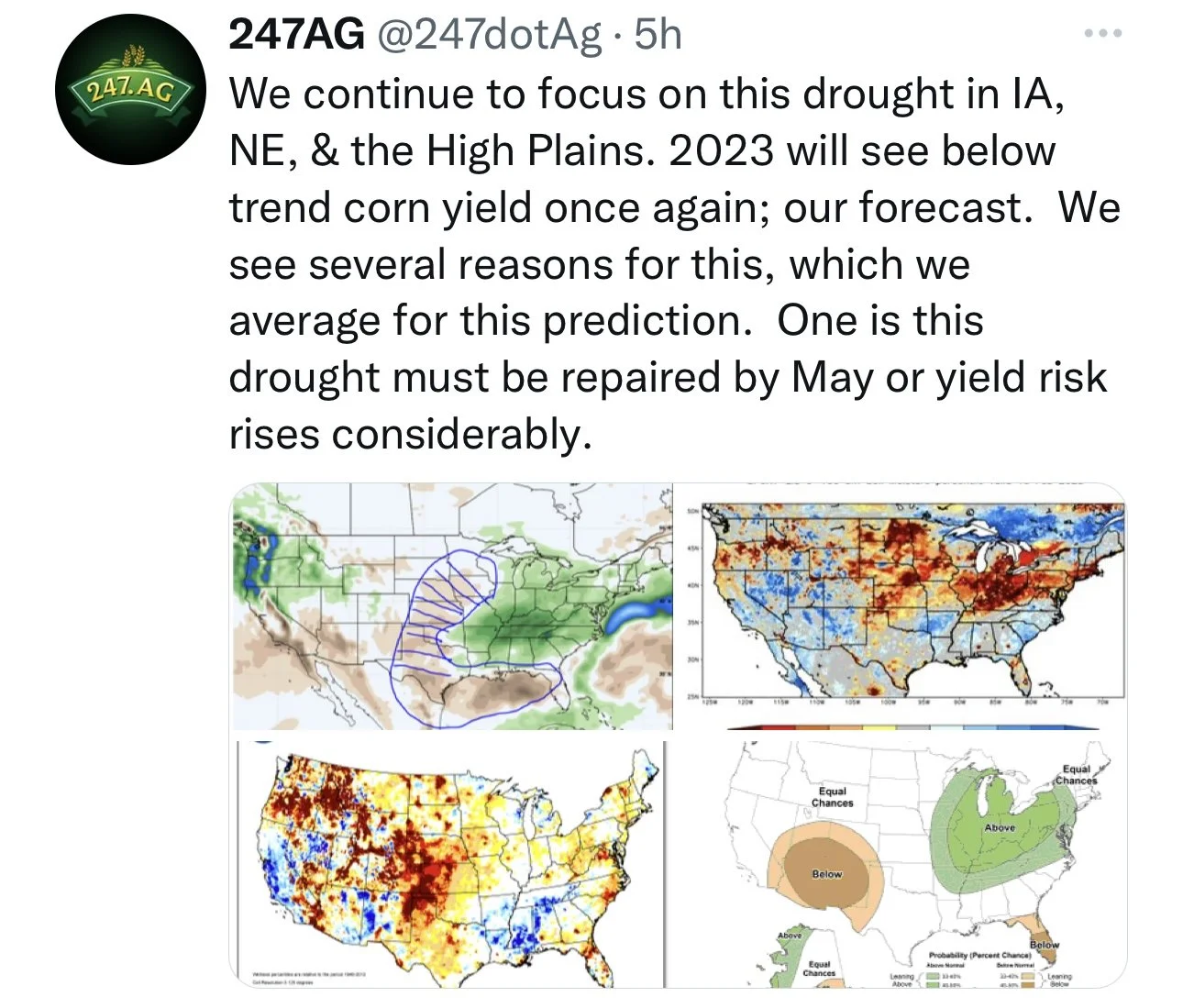

The main things the trade continues to analyze is South American weather, escalation and news surrounding the war in Ukraine, and the Chinese economy and appetite. Acres and planting here in the U.S. will start becoming a hotter topic and point of discussion going forward.

We will have our Weekly Grain Newsletter sent out on Monday instead of Sunday, as markets are closed Monday.

Listen to yesterday’s audio about supply & demand, corn basis, and more. Listen Here

50% OFF President’s Day Sale

Today's Main Takeaways

Corn

Corn sees small gains as it continues to chop around in its recent range as prices sit just below their 20 day moving average.

Yesterday we saw new crop beans gain on new crop corn with the idea that there is going to be more corn acres.

Bulls were happy to see IGC reduced its global corn production estimate by 8 million tons, with most of the reduction coming from the U.S. and Argentina. To go along with this, there is more weather worries in Argentina, with some potential frost to be the cherry on top of all of the Argeninta concerns.

We also have Brazil continuing to receive an over abundance of rain, which has continued to lead to bean harvest delays resulting in their second crop corn being delayed. So the trade will continue to keep an eye on this, as its still a little early to know how big of an impact this will have on their production. Nonetheless, this could lead to a smaller second corn crop as its pushed into an unfavorable planting window.

We saw some strong export sales yesterday along with some small Chinese buying. But U.S. corn export sales continue to sit behind the USDA pace. As they currently trail the pace by 13% (240 million bushels). The USDA decided to not change their corn export estimate this month, so we will have to see if that changes in the next report.

Next week we will see the USDA Agricultural Outlook Forum, it appears that the trade is looking for new crop corn acres to come in around 90 to 92 million.

Taking a look at the charts, corn continues to chop around and find very stiff resistance at the $6.85 level. We are getting close to end of our pendant, so which way do we break out to?

*We will be switching over to the May contracts next week

Corn March-23

Soybeans

Soybeans also seeing small gains on the quiet trading day today.

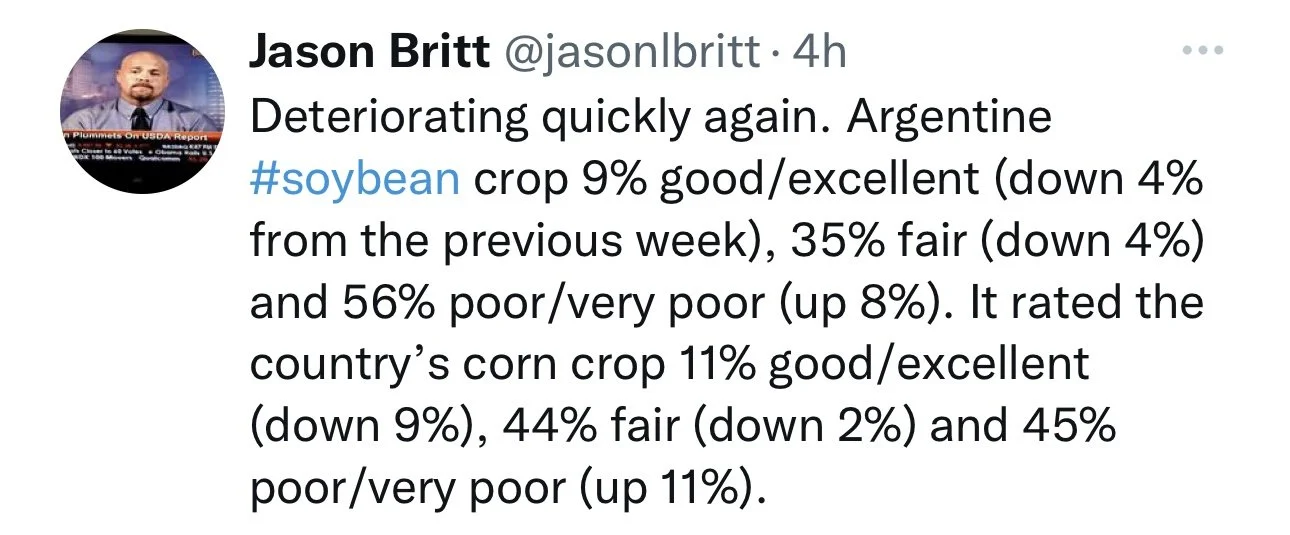

Headlines supporting beans are more of the same. Dry weather in Argentina and southern Brazil. An belief that we might continue to see production estimates continued to be lowered.

The dry forecast headlines surrounding Argentina beans might be behind us. But now there is talk about a possible scattered frost out in Argentina, which might have been the reason we saw beans firm overnight. So there is a chance that this adds flame to fire on Argentina's already awful crop. We will have to see what happens over the weekend, as a big weather scare could lead to a higher open come Tuesday.

Yesterday we saw the Buenos Aires grain exchange lower their Argentina crop conditions from 13% down to a dismal 9% rated good to excellent, while raising their poor to very poor estimates up to 56%. Roughly 44% of the crop has set pods, so theoretically there is some crop that could be saved. But I don't think anyone in their right mind thinks we see a 40 million metric ton crop.

We will likely continue to see the USDA cut its Argentina estimates for both corn and beans. At the very least most think we see a 2 to 3 million cut. But then again, we have to wonder how much of this is already priced it.

Ag rural lowered their Brazil crop estimate by 2 million metric tons down to 150.9 million, this was due to the ongoing drought concerns in Southern Brazil. Brazil is suffering its 3rd coldest summer in 50 years, as Argentina deals with record heat.

Taking a look at the charts, beans remain in their clear upward channel. I wouldn’t be too surprised to see us test the bottom of the trendline here short term, but Argentina forecasts could definitely have us testing our recent highs once again. So we will have to see what the long weekend brings.

Soybeans March-23

Soymeal

Soymeal March-23

Wheat

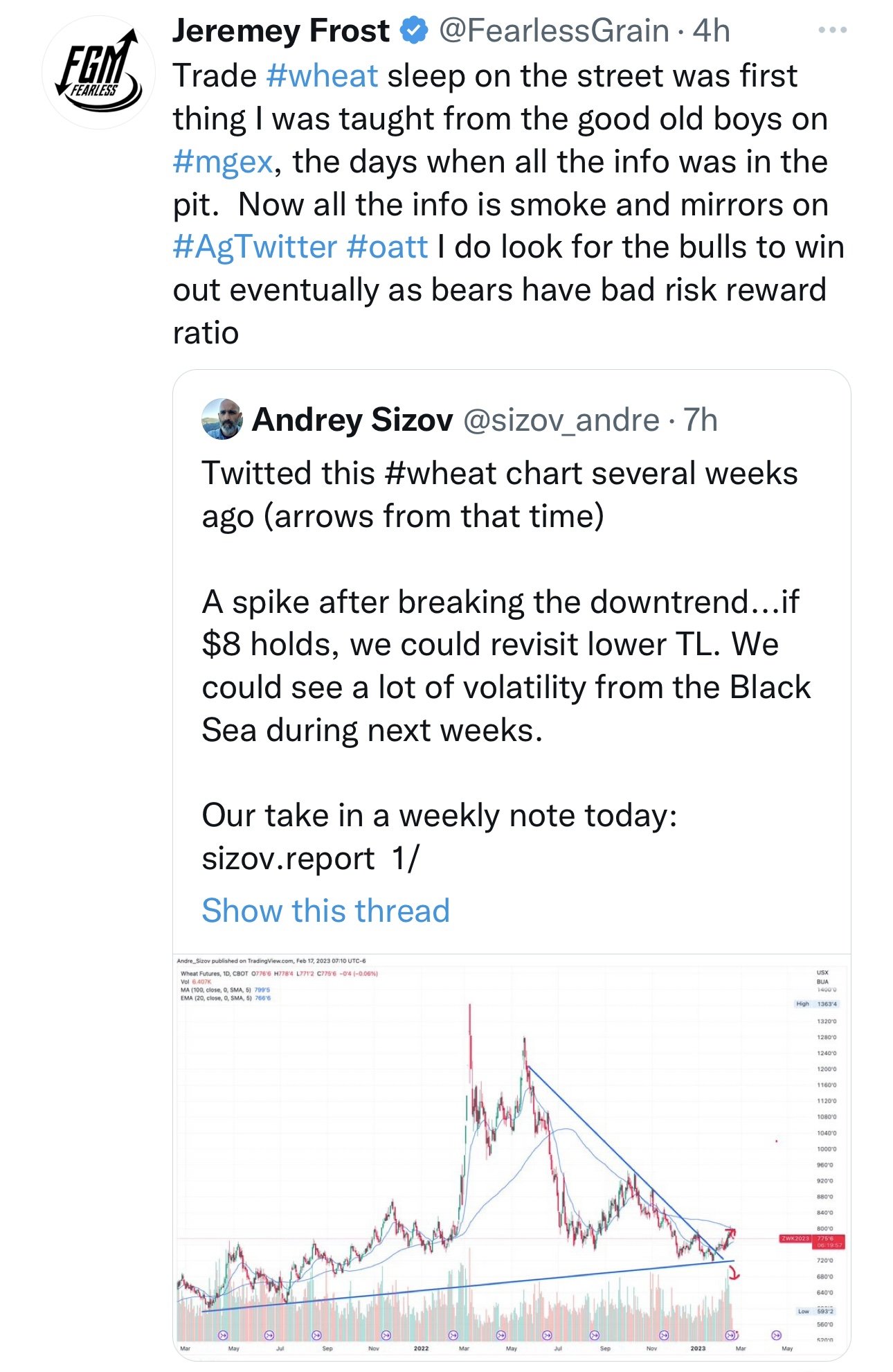

Wheat mixed today, with small changes to either side for Chicago and Minneapolis. While KC continues its rally.

The last two days the big move we saw was the KC and Chicago spread. As Chicago got hit from the selling in the matif wheat market, while KC found support in the dry forecasts across the plains. KC continuing higher today again. I think we continue to see KC strong.

Export sale numbers were also fairly disappointing for wheat yesterday. We did manage to come in roughly in the middle of the trade range, but we are still far behind the USDA pace.

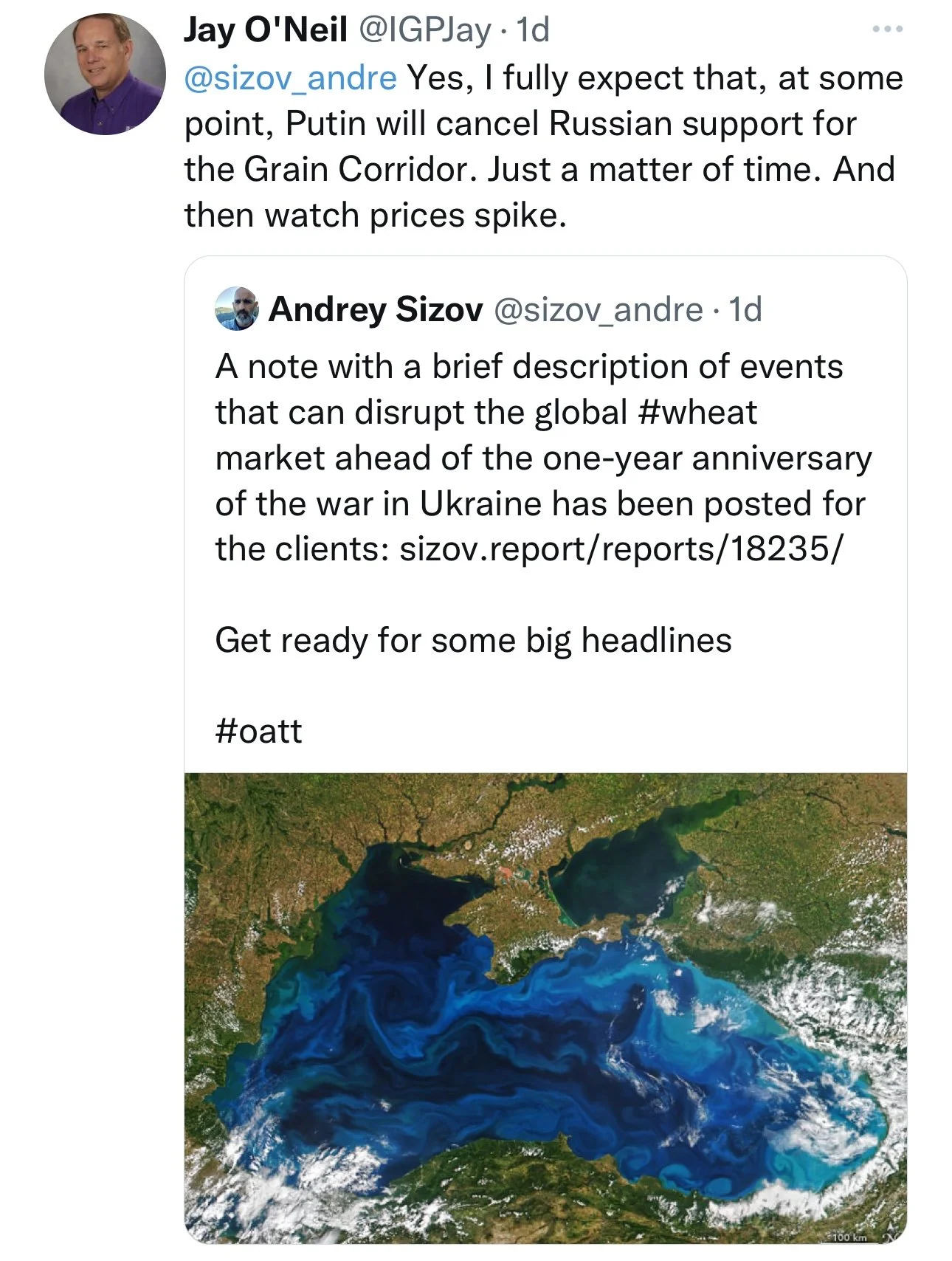

The biggest thing going forward has to be war. We know there is rumors that Russia claims they are unhappy with the grain agreement and might opt to not renew the deal when it expires next month. I still think we likely ultimately see Russia go ahead and renew the deal. But this doesn’t mean that the thought of them potentially choosing not to can’t continue to support the market until a decision is made, ad nobody ever knows what Putin will do either. So we cant count out them not renewing the deal.

The war itself will also likely continue to give us support as there is no signs of this thing even being remotely close to over. We are just one major war headline from seeing wheat futures sharply higher.

Along side war and the grain deal headlines, we also are starting to see bigger problems arise in Ukraine. As the trade is now looking at a smaller crop due to less acres.

We also have some potential dry weather concerns over in the EU, that could ultimately lead to cuts in production.

Bears are pointing at some more favorable weather here in the U.S., as we saw some snow this week, but overall it was light across states like Kansas and Oklahoma where they need it the most. Nonetheless, we still have pretty poor conditions and two thirds of growing regions are still suffering from drought.

From a technical standpoint, Chicago is testing its February uptrend. Will have to see if we hold here. Nonetheless, I can’t help but have a bullish tilt with war and other bullish wild cards at play.

Chicago March-23

KC March-23

MPLS March-23

Highlights & News

Combine sales in the U.S. more than doubled in January from 2022.

Ukraine grain exports down nearly 30% so far.

Wisconsin dairy farm closures hit 3-year high.

Yesterday Russia launched missle strikes across a wide area of Ukraine. The markets mostly ignored this.

The International Grains council cut its world corn production by 8 million metric tons and its soybean estimate by 7 million while leaving wheat unchanged.

Negations to extend the Russia and Ukraine grain deal will begin next weeks, with 31 days remaining on current agreement.

Commitments of traders report delayed again.. Next report is February 24th.

Livestock

Live Cattle dup +0.575 to 164.650

Feeder Cattle up +0.300 to 186.525

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service