OPTIMISTIC BOUNCE IN GRAINS

MARKET UPDATE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

Want to talk? (605)295-3100

Futures Prices Close

Overview

Really optimistic price action in the grains today.

As soybeans & wheat both rallied +10 cents and corn posted a nice reversal (trading below yesterdays lows but then closing above yesterdays highs).

Overall since the holiday, we have seen very little fresh news and the markets have remained quiet and mostly sideways.

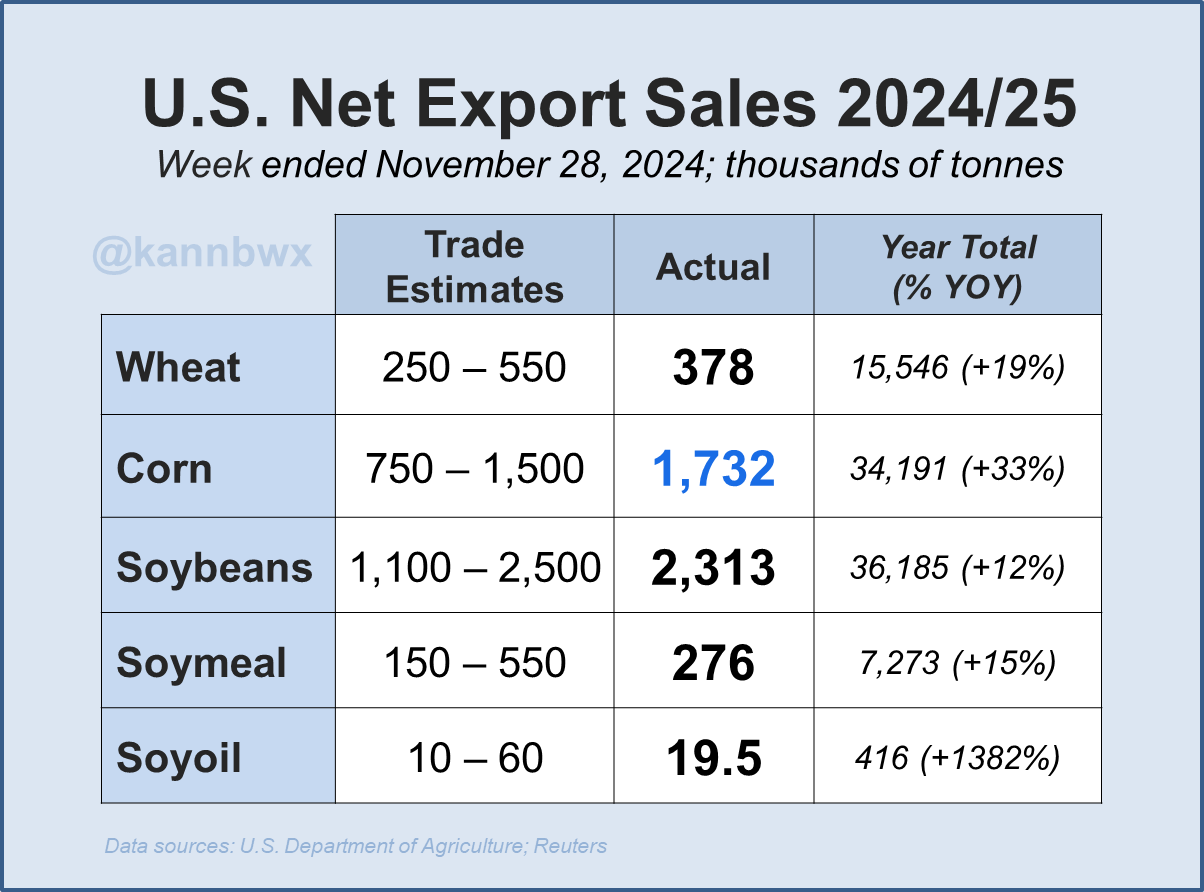

We did see export sales for both corn & soybeans impress this morning. The numbers were more surprising given the lack of daily flash sale announcements lately.

Chart from Karen Braun

The US dollar is starting to take a breather after it's recent massive rally post election. So this weakness does add a small amount of support to the grains, especially the wheat market.

The dollar weaker due to the Fed's comments yesterday about interest rates indicating we may not see the size of cuts some had thought.

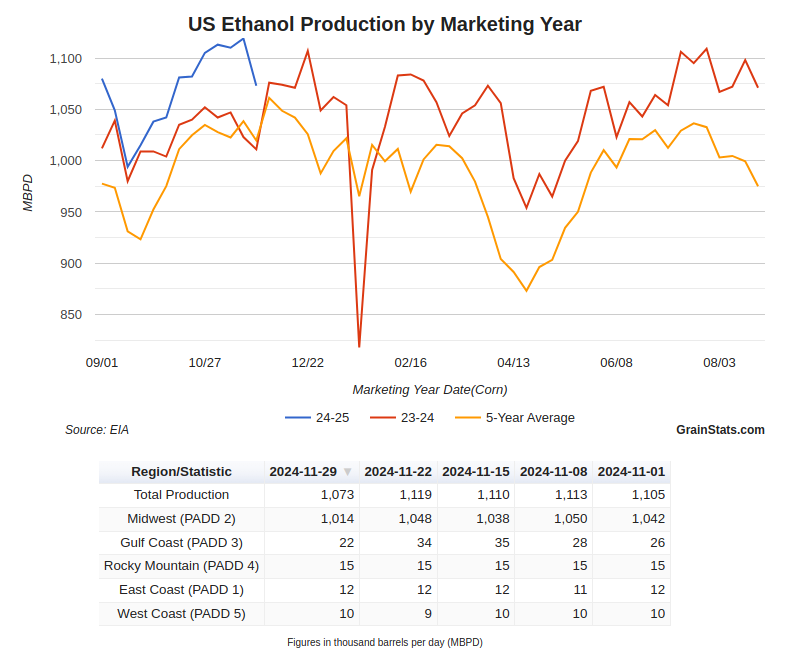

We saw corn ethanol production come in smaller than expected.

As it dropped for the first time in over 2 months. Down -4% on the week.

However, it is still +4% ahead of last year's pace while the USDA still projects corn ethanol demand to be worse than last year.

So the consensus is that the USDA should almost be forced to raise ethanol demand in the next USDA report.

IF we were to keep this current pace, it alone would add +200 million bushels of demand to the corn balance sheet.

Chart from GrainStats

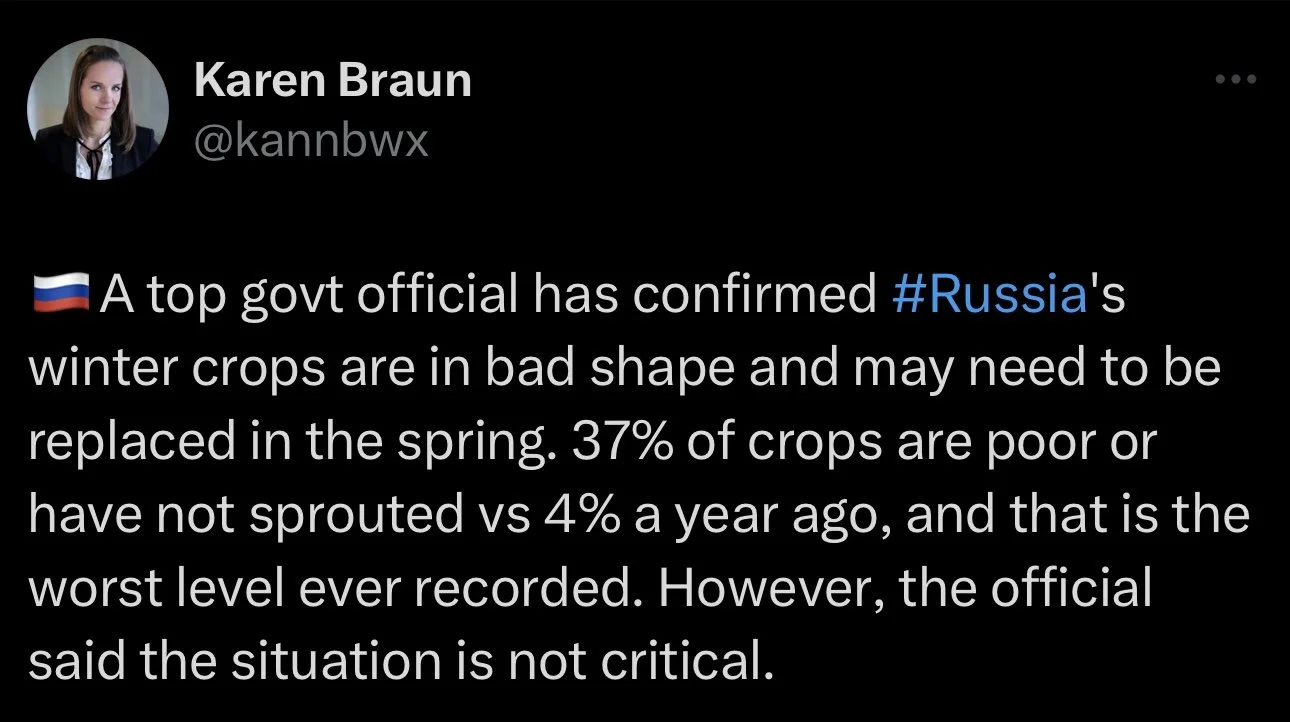

We also saw news reports that Russia's wheat crop is the worst on record.

The wheat market hasn’t seemed to care a whole lot, but this maybe was part of today's strength.

The reports say Russia's winter wheat crop is rated at 37% poor. Last year it was 4% and the average is 8% poor.

The crop was rated 31% good, which is the lowest in 23 years and well below last year's 74% rating.

I think this could wind up being a bigger factor down the road as Russia is by far the worlds leading wheat exporter.

But the market doesn’t seem to care today.

Black Oil Sunflowers Offers:

We are looking for black oil sunflower offers.

Shoot Jeremey a call or text at (605) 295-3100 with any new crop black oil sunflowers you have for sale.

With harvest over now, this is the time where you need to be proactive and have a marketing plan.

So if you'd like to talk through your operation, please feel free to reach out to us. It doesn’t cost you anything.

(605) 295-3100

Today's Main Takeaways

Corn

Not much fresh news. Ethanol production declined but is still way ahead of pace. Exports were surprisingly good.

One negative factor out there is the possibility for more 2nd crop corn acres being planted in Brazil.

As spot corn in Mato Grosso is at $4.35, which is $1.65 better than last year. So this could definitely lead to more acres than originally expected.

Then in the US, if bean prices stay depressed it could lead to more corn acres next year. Another thing we have to keep in mind.

Overall, I think corn still has potential and I think we could see demand lead us higher.

Depending on if all of this demand was actually front ran or not, we could very easily see a bump in export demand from the USDA. We will almost have to see ethanol demand bumped.

So there is definitely still a demand story case to be made.

I don’t see many farmers letting go of bushels here, end users will likely push basis to secure bushels if they them.

We also just had first notice day, which often correlates to a lot of pressure in the market. Yet corn held in really well. So a positive sign.

But for now, we are essentially range bound (aka sideways) until we pick a direction from this symmetrical triangle.

That will decide where we go from here.

My first area to take risk off is still the 200-day MA

If you would’ve made corn sales every time it hit the 200-day MA, you would’ve made some decent sales over the past few years.

This is Dec-24 corn, not March-25. As I wanted to show just how big of a lid it has been since almost 2022.

Soybeans

Altough we do seasonally go higher from here in beans, it is still hard to make any bullish argument whatsoever.

Demand has actually been pretty decent. So demand isn’t the problem.

We could see a trade war, but I am still by far more concerned with the monster crop in Brazil.

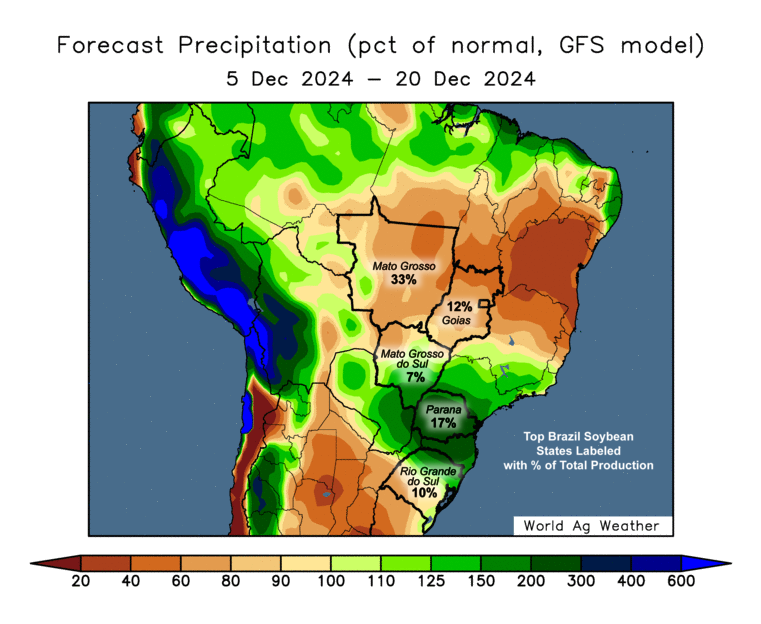

Could we get a weather scare opportunity? It is possible but unpredictable.

The next 2 weeks look a little drier than normal, but nothing to really note of.

We have to keep in mind that last year Brazil saw one of their worst droughts in a long time and they were still able to produce a great crop.

If weather in January and December cooperate, they are going to have a massive crop being added to the world balance sheet.

I guess we will just have to wait and see if we get that seasonal pricing opportunity or not.

All I am watching is the charts for now. Soybeans have continued to hold these lows for a whopping 10 weeks now.

Still a must hold level. If we break below, we could see sub $9.00. As $8.63 is the implied move if we do.

If we bust that downward trend, perhaps we will get an opportunity.

As for marketing, I don’t think anyone wants to be selling here. So if you made sales, you could possibly consider re-owning and have a stop at those lows. So if we take out the lows you are not still long.

If you have to move something in Jan-Feb-March you have to be proactive. Give us a call if you want to walk through your specific situation (605)295-3100.

Despite lack of bullish catalysts, the MACD suggests a bounce could be coming.

It flipped bullish for the first time since November 4th. (blue line crosses the yellow)

The past 2 times it did so, it led to a bounce or rally. (Last 2 times are circled)

Wheat

Wheat market sees a nice bounce after posting contract lows yesterday. Now up +18 cents off yesterdays lows of $5.40

I think the Russia winter wheat crop story will come more into play later next year as it affects the global balance sheets, but for now the market doesn’t care about it.

Short term, sure we could go lower. But I still think wheat has plenty of potential looking towards next year.

We still have a bullish global balance sheet that shows ending stocks for major exporters is the lowest since 2012 and the stocks to use ratio for major exporters is the lowest since 2008. That doesn’t scream bearish.

We also have Russia adding price floors. Russia flooding the world with cheap wheat was one of the biggest reasons wheat prices have sucked the past few years.

So all of this is positive, but it does not have to happen on my time table or your time table. As short term wheat doesn’t really have a major story or reason to rally here.

Looking at the chart, we got a nice bounce off these lows. I'd like to see us bust this downward to get some momentum going. But to be more confident the lows are in I still need to see a close above $5.85

If this level fails to hold, there is still the possibility we go test that long term support.

As for marketing, no one wants to sell here. But re-owning past sales at support makes sense for some. So you could consider re-owning here and having a stop at those lows.

The same goes for KC wheat.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24

CORN SPREADS, CRUCIAL SPOT FOR BEANS, SEASONALITY SAYS BUY

11/26/24

TARIFF TALK PRESSURE

11/25/24

HOLIDAY TRADE, SEASONALS, TARGETS & DOWNSIDE RISKS

11/22/24

CORN TARGETS & CHINA CONCERNS

11/21/24

BEANS NEAR LOWS. CORN NEAR HIGHS. 2025 SALE THOUGHTS

11/19/24

WHAT’S NEXT FOR GRAINS

11/18/24

WHEAT LEADS THE GRAINS REBOUND

11/15/24

BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24