RUSSIA HALTING WHEAT & SUNFLOWER EXPORTS?

AUDIO COMMENTARY

Russia banning wheat and sfs exports

Funds short and China's buying

Will China buy exports that we don't have

Is wheat too cheap for Russia?

What to expect from USDA report next week

Being patient

Listen to today’s audio below

MARKET UPDATE

Futures Prices Close

Overview

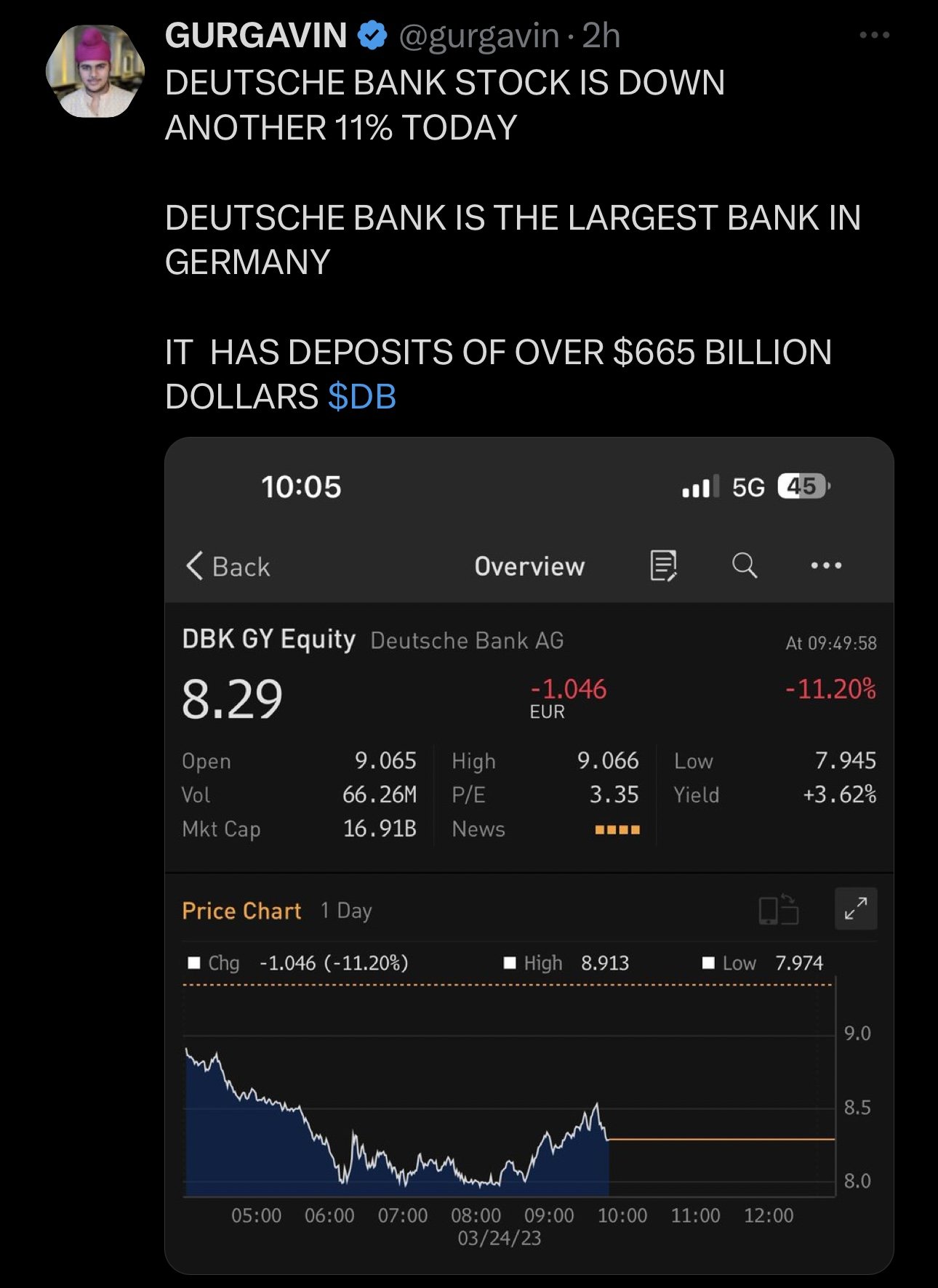

Grains showing strength to close out the week following our week long sell off. Today’s price action was led by a rally in the wheat market, as at one point May Chicago was up a massive +40 cents early in the session. Corn and beans both trading higher as well, as beans finally find some support after the funds continued to liquidate their large position, leading to a sharp decline through out the week.

We saw yet again another sale of corn to China. Bringing the total for the last 10 days to 2.752 million metric tons.

The reason for the rally in wheat was likely the rumor that Russia is looking to halt wheat exports, thinking that wheat prices are too low. Of course, any sort of stop in exports from the worlds leading exporter will be beneficial to the U.S. market.

From Reuters, "Russia could recommend a temporary halt in wheat and sunflower exports after a sharp drop in global prices in recent weeks."

With the funds heavily being short, having a sharp turn around like this could catch the funds off guard. We will have to see what side of the field they want to play, and if they continue to sell or look to buy.

Taking a look at next week, we have the USDA report Friday. Which is expected to be a bearish one with big acres, so don’t be surprised if we see the markets under some pressure when that report comes. But again we want to be patient as we head into spring and summer. More on this in today’s audio.

Listen to Yesterday's Audio

Chinese vs the Funds - Listen Here

Today's Main Takeaways

Corn

Conr following the rest of the grains higher here today, up over a dime and well off early lows.

Yesterday corn was unable to continue its upward momentum, as we started off hot ultimately closed over a dime off our highs closing in the red. Today corn is right back where it left off, pushing past our recent highs and trading at its level all March.

Corn continues to fund support from Chinese demand. As mentioned we saw yet another sale to China, as they continue to purchase U.S. corn. Making that the 8th sale since March 14th. The fact that China is buying and that their "buddy" Russia is saying we shouldn’t be selling is some pretty big news. We go over this more in the audio commentary today.

Yesterday's weekly export sales numbers came in very strong, as they posted their largest weekly sale of the year and the largest weekly sale of corn since May 2021. Next week's export sales report will likely also be strong with the recent flash sales we've seen.

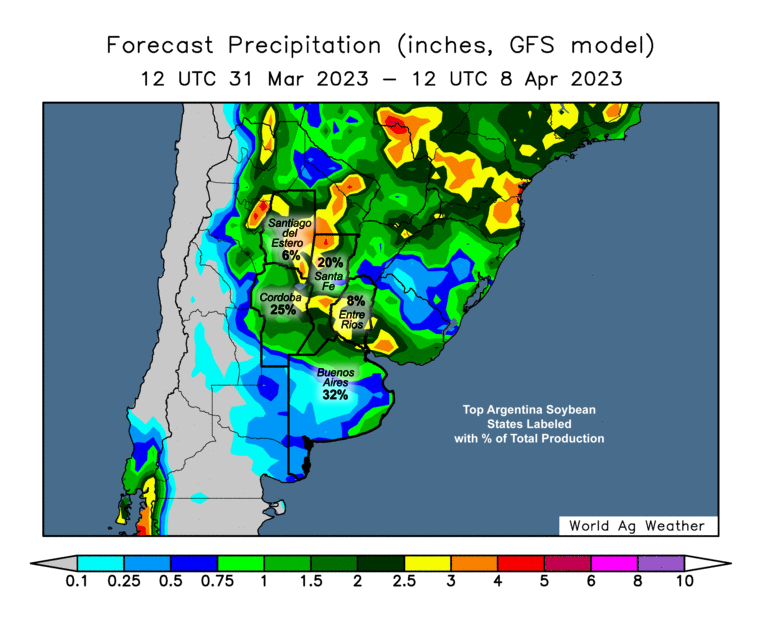

Outside the strong exports, bulls are also looking at the problems in Argentina and the chance of some overly wet conditions in the U.S. that could delay or cause some problems in the U.S. new crop corn acres.

Taking a look at the charts, corn closed above its 20-day moving average for the first time since February 21st, as we got that break into the $6.37 to $6.40 range I mentioned earlier this week. If strength continues and we do break higher from this range, the next upside target is around $6.60 and our 100 & 200-day moving averages.

Corn May-23

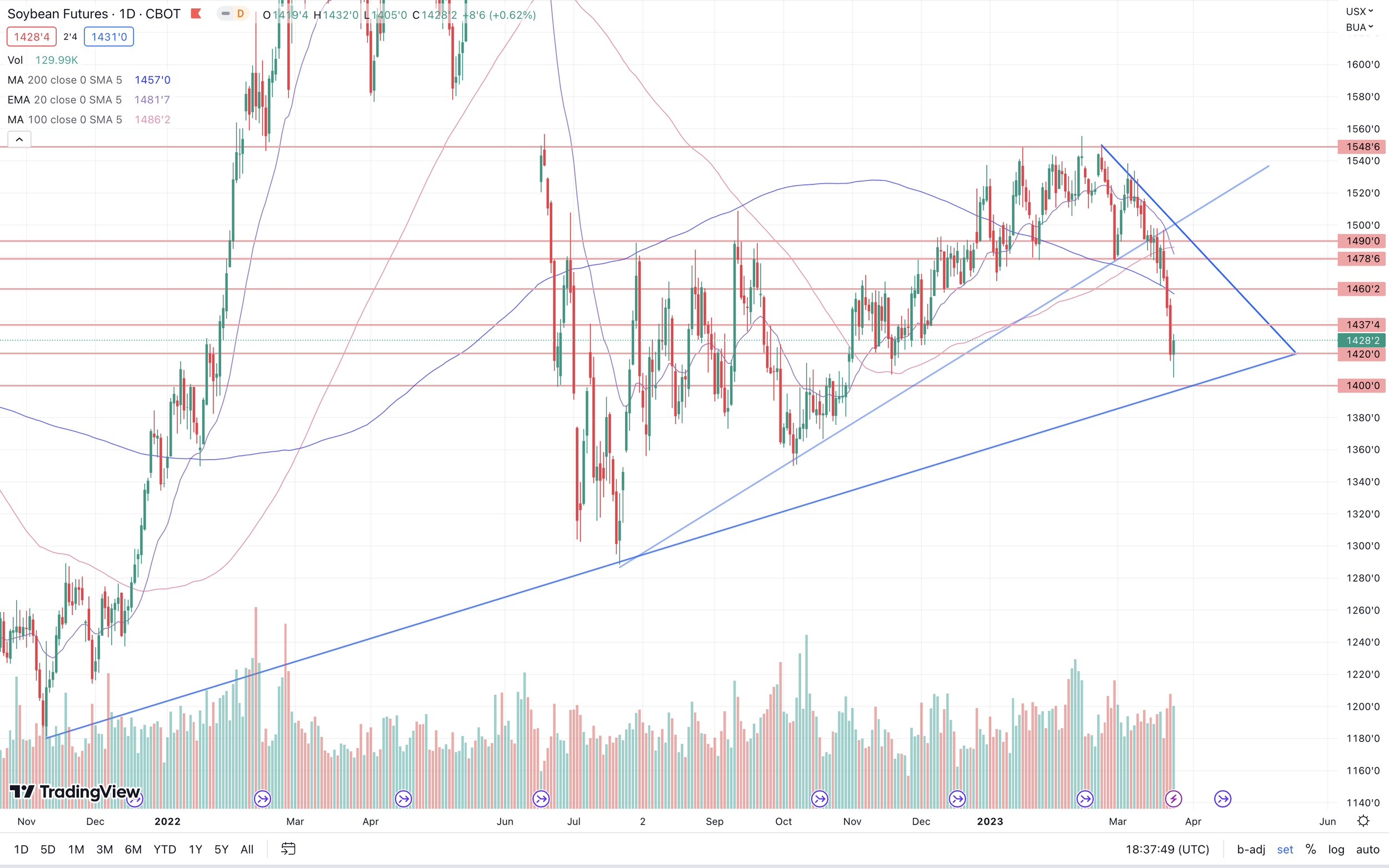

Soybeans

Beans finally finding support, following the funds brutal week of liquidating their longs. Which at one point had May beans down nearly -90 cents from where we were just a week ago last Friday.

However, following the early losses this morning where we reached a low of $14.05, beans have seen an impressive rebound. Up over +20 cents off our early lows, closing at $14.28.

The main reason for the recent sell of was that we had all this weather premium built in from problems in Argentina, and now the trade is looking at the talk of cheap and abundant supply out of Brazil with their expected record crop.

The last commitment of traders showed a rather large long position in beans unlike that of corn and wheat. We will have to see where the funds are at now with this massive liquidation.

From Wright on the Markets;

Soybeans in Brazil continue to be piled in wet fields or left standing in the fields as there is no place to put newly harvested soybeans. Their basis continues to drop and that pulls futures lower, but the waiting list to get a shipload of Brazilian beans delivered is in the three month range. That is really quite friendly for US beans, the only place for immediate ship load of beans.

Taking a look at next week's report, we do have the chance to see acres slightly higher, which is something bears will be pointing at. As there is talk that some producers may be forced to switch from corn to beans due to overly wet fields.

From a technical standpoint, we bounced just about where we needed to. Through out the week I said that I thought we would likely go to test that long term trendline and heavy psychological level of $14. We got fairly close, hitting a low of $14.05. Bulls would like to see a break above this short-term downward trendline and a hold above the long-term upward trendline, but we shouldn’t be too surprised if we do again decide to go and test that bottom trendline.

Soybeans May-23

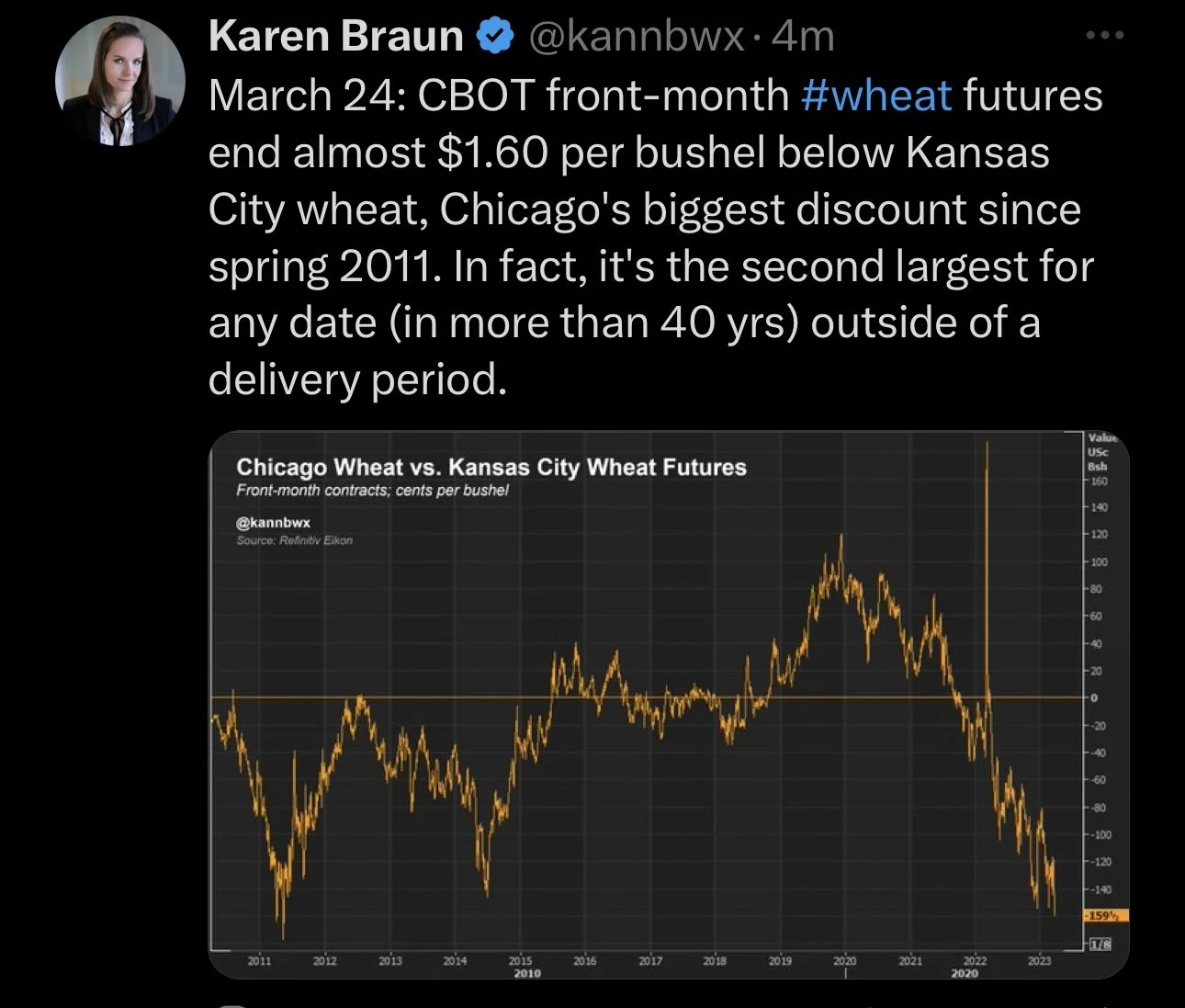

Wheat

Wheat rallies off the back of Russia headlines. Today's gains recouping nearly all of the losses we saw on this three day sell off. All classes of wheat trading with gains of well into the double digits. Chicago and KC up 26 to 28 cents, while Minneapolis not far behind, closing up 16 1/2.

Russia Halting Exports?

This was the key reason in wheat's rally today. As overnight we got reports and rumors that the Russian Ag Ministry is considering halting their exports of both wheat and sunflowers due to the low price levels. Keep in mind Russia is the worlds leading exporter in wheat and makes up for about 25% of the worlds wheat exports. We will have to see how much of this rumor has marit or if Putin is just using his own leverage to inflate prices.

Rueters said later in the day;

"Russia has no plans to halt wheat exports, but wants exporters to ensure prices paid to farmers are high enough to cover average production costs."

Funds are still incredibly short. I've been saying for weeks that we are one major war or weather headline away from things excalating quickly to the upside. Perhaps this was the catalyst, or maybe it wasn’t. But when the funds do decide to become buyers once again, I still think we could see the markets push higher quick. Now again, it's hard to catch a falling knife when the funds decide to do anything but buy wheat, but one would assume we do see them make that shift from heavy sellers. Nonetheless, we still have plenty of factors that have the potential to push us higher. If this export ban is just a rumor, then sure we probably see prices correct a little lower from here, but nobody knows what's going on Putin's head.

Right now the war headlines are pretty much being discounted. But I think we still definitely have the possibility for more bullish wild cards from the war situation down the road. As some of these problems could prove to be a major ones later on.

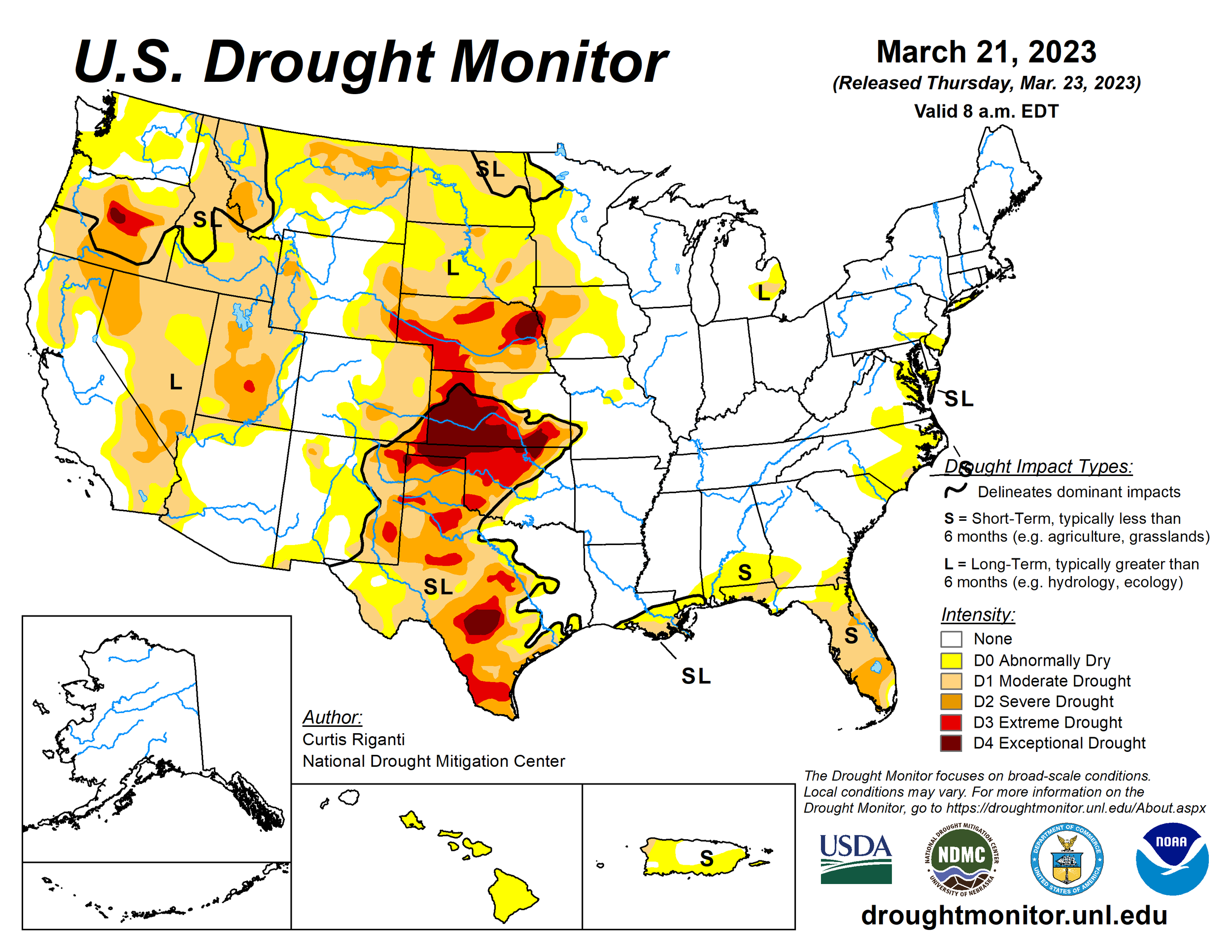

Outside of all the Russia, war, and funds headlines. We still have some weather concerns here in the U.S. Yes we have actually seen some fairly good improvement in drought conditions the past few months. As back in November we had over 80% of the country experiencing drought. Now that number is closer to 50%. However, down in the southern plains they still aren’t seeing much if any drought relief, especially in areas such as Kansas. Weather headlines will likely start to play a bigger role in the direction of the the wheat market.

Taking a look at the chart, we held support at that $6.55 area. I would like to see a break above that bottom trendline and then the $7.13 range to see higher prices as we work out of trying to escape this downtrend.

Chicago March-23

KC March-23

MPLS March-23

Tidbits

From Wright on the Markets (Yesterday Morning),

Vladimir Putin and his Chinese counterpart Xi Jinping concluded a three day summit yesterday and presented the picture of best buddies. They agreed to work together to develop a new nuclear technology that the US military thinks would give them a leg-up on the USA. No word if China will provide weapons to Russia, but even if they are they would not say it.

The USDA will issue its Quarterly Grain Stocks and Intended Plantings on March 31st, a week from tomorrow. Ever since 2019, the market action has been weak going into major USDA reports and next Friday’s report is a major report. It is possible the current weakness reflects that fear and the selling is over, but do not expect a rally of any significance until after the 31st. Do not be selling cash grain or forward pricing, but selling a futures contract or buying put on a rally might be a good deal until Thursday. If you do, take profit before the report is issued at 11 AM Central Friday.

The settlements on the September soybean meal puts yesterday with September meal at $420.80 per ton:

$350 $ 2.65

$360 $ 3.75

$370 $ 5.30

$380 $ 7.45

$390 $ 10.30

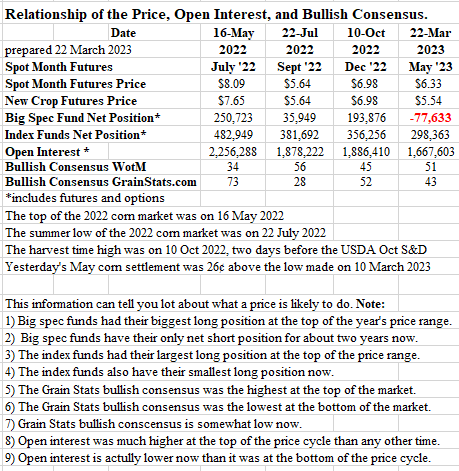

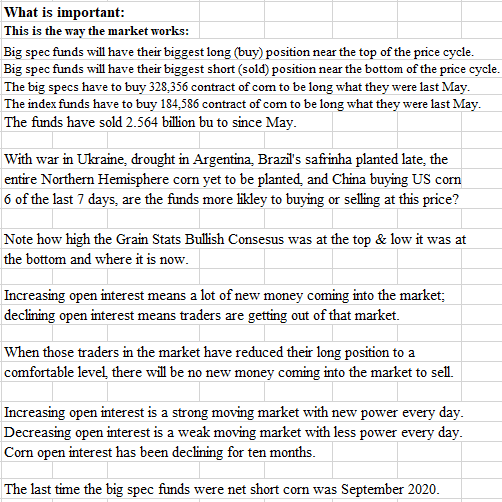

Open Interest and Bullish Consensus Analysis of the Corn Market

Think very seriously about your answer to these questions:

Do you want to buy corn when bullish consensus is very high?

Meaning "everybody" thinks the market will go higher.

If so, you might be the very last person to buy the rally.

Do you want to sell corn when bullish consensus is very low?

Meaning "everybody" thinks the market will go lower.

If so, you might be the last one to sell the down trend.

Check Out Past Updates

3/23/23 - Audio Commentary

CHINESE VS THE FUNDS

3/22/23 - Marker Update

BEANS & WHEAT SELL OFF CONTINUES

3/21/23 - Market Update

BEANS & WHEAT CONTINUE TO DISAPPOINT

3/19/23 - Weekly Grain Newsletter

MOTHER NATURE & BLACK SWANS

3/17/23 - Audio Commentary

DO WE HAVE ENOUGH GRAIN / CHINESE DEMAND

Social Media

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

U.S. Weather

Source: National Weather Service