3RD DAY OF GRAINS FALL OUT

MARKET UPDATE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

Want to talk? (605)295-3100

Futures Prices Close

Overview

Grains continue to get absolutely hammered for the 3rd day in a row.

Why have we been hit so hard this week?

The first reason is simply a lack of bullish news. Especially in soybeans & wheat.

We have the US dollar continuing to surge. As it rallies to +1 year highs. Trading at it's highest level since October 2023.

This is bad for exports and makes us less competitive. Strength in the dollar effects all of the grains, but usually impacts the wheat market the most. Hence the recent heavy sell off.

We also have uncertainties surrounding what a Trump Presidency will mean.

How will it effect our relationship with China? Will they support bio fuel? Will we get a trade war and tariffs?

Altough bean demand has stagnated here, corn demand remains very solid. As we continue to see daily flash sales.

The market seems more concerned about "future demand". Meaning they are wondering how much of this demand was front ran in anticipation of a Trump presidency and how much of this demand will stay.

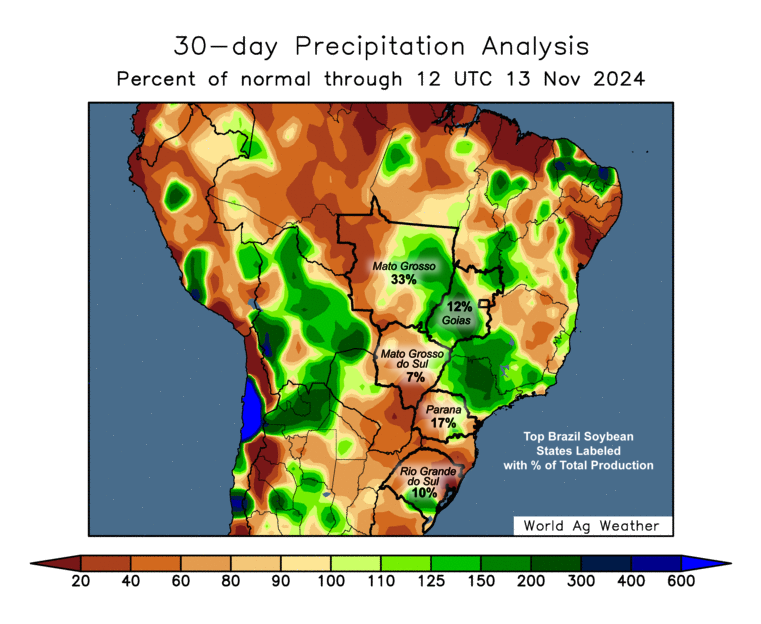

We also have South America weather still looking ideal. With all signs pointing to record bean production if weather remains normal.

Next 2 Weeks

Past 30 Days

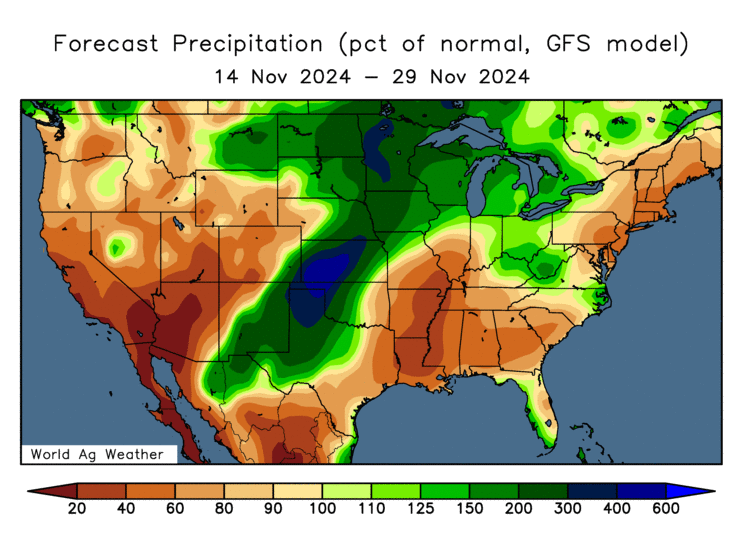

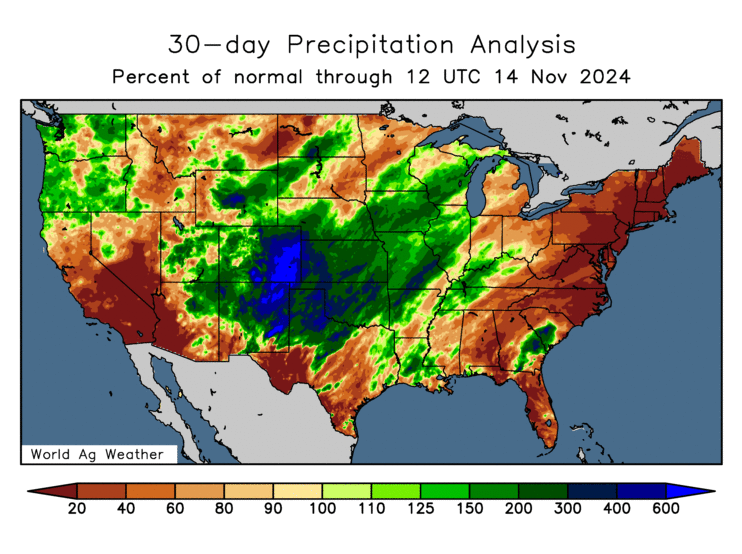

Then the wheat market is also seeing pressure due to the rain in the US plains.

We have received great rain with more on the way. So those drought concerns are going away as winter wheat crop ratings have been seeing a big improvement.

Next 2 Weeks

Past 30 Days

In my opinion, the biggest reason for the wheat sell off besides the dollar rally & rain in the plains was simply technical selling.

We broke that key $5.65 support level I had mentioning for a very long time. Once that broke, it opened the flood gates lower and the selling accelerated. As I had been saying there is very little support beneath that level if it broke.

Soybean meal prices have dropped to some historically low levels as the entire soy complex falls apart.

So as a livestock producer it makes sense to be an aggressive buyer here.

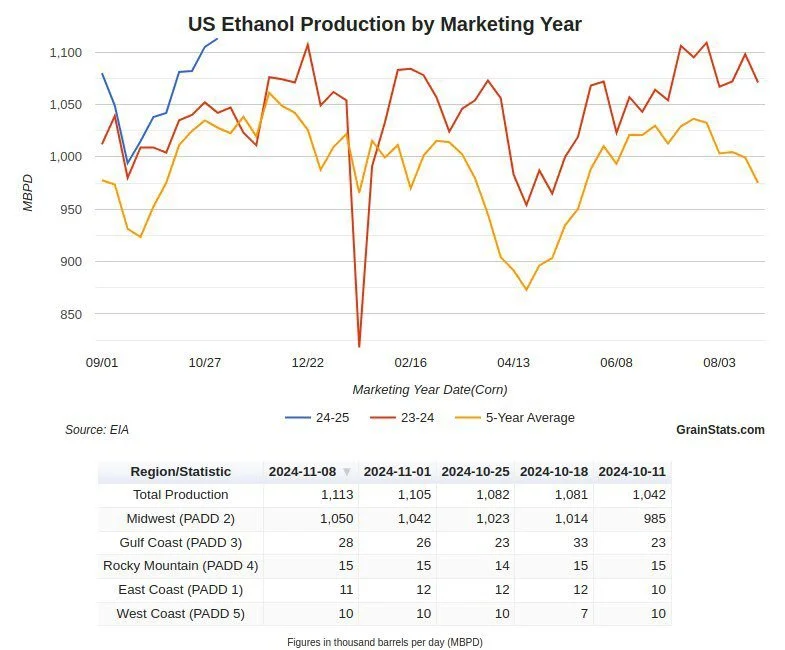

On a positive note.. corn ethanol production came in at a RECORD.

As ethanol production reached 1,113 thousand barrels per day.

This is such a friendly potential factor given that currently the USDA projects ethanol production to be worse than last year.. but we are well ahead.

This alone could very well be enough to add anywhere around +100 million bushels of corn demand on the balance sheet if pace stays this way.

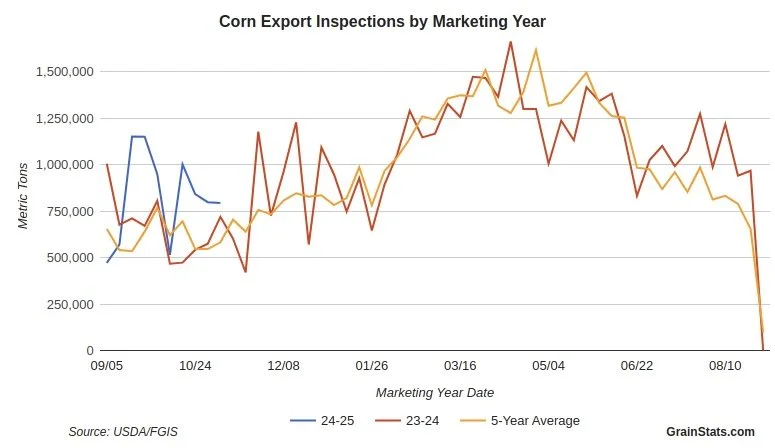

Chart from GrainStats

Today's Main Takeaways

Corn

Corn sees it's largest daily loss in a month. Following the rest of the markets lower.

Unlike soybeans & wheat who really do not have much of a bull story here at least short term, corn does.

It has a very real demand story looking longer term towards next year.

As I mentioned, ethanol alone could add a ton of demand to our balance sheets and eat into that carry out.

Exports are another thing that could potentially eat into the carryout.

Chart from GrainStats

Current Balance Sheet

Some are questioning how much of that demand was front ran, which is a valid argument to be made. Nobody knows.

Regardless, ethanol numbers will have to be bumped. And if demand was not front ran, exports will also have to be bumped.

High prices cured high prices. Low prices will cure low prices at some point.

This does not mean corn has to go higher tomorrow, or even next month.

It doesn’t even mean it's not impossible for us to test those old lows.

It means that long term demand will lead us higher. Demand rallies are rallies that last. Unlike a supply weather scare rally.

Overall I am remaining patient here.

If you have something you have to move then keep a floor under here. As we do have some questionable price action.

There is a chance we simply put in a double top and are going to make another leg lower.

Or we could bounce right here, as we did hit the golden zone retracement area from our $4.09 to $4.35 rally (50-61.8% retracements are $4.22 and $4.19).

Or we could just as easily go and test the $4.10 area and that peak volume support on the right.

It's not called guessing, it is called hedging.

My next spot to re-hedge or make sales for those that need to is $4.39 to $4.46

Big picture, the chart looks friendly unlike beans & wheat. We remain in an uptrend for now. We are well above the 50-day and 100-day moving averages.

The indicators suggest we might still a little more downside from here.

The stochastic has not bottomed out and the MACD is on the verge of flipping bearish.

Soybeans

Soybeans continue to fall apart.

Getting awfully close to resting those recent lows.

There is simply no story here for soybeans.

Brazil weather is ideal.

China doesn’t seem too interest in buying for now.

We have the Trump uncertainties.

We have a decently large crop here in the US despite the recent cut to yield.

The world carry out is amongst the largest ever.

For soybeans to find a real rally, it almost seems like they will have to get a weather scare out of Brazil. If Brazil does not get a scare and raises a bumper crop, the world could be swimming in beans.

The other factor that has the potential to save beans is China. Their economy is not in a good place. Do they bazooka more stimmy money to try to boost it? It is simply unknown.

The risk is still to the downside in beans.

The chart looks ugly. As we broke below $10.00

I do not have another upside target yet to take risk off the table until I feel like we have put in bottom.

We need to hold $9.76 otherwise we will just be trying to catch a falling knife.

As I had been mentioning the past few days, the indicators still suggest might go a little lower from here.

The stochastic has not bottomed out, and the MACD is on the verge of flipping bearish (blue line crosses below yellow line).

The RSI is getting close to oversold, but not there yet.

Here is a continuation chart.

You can see just how significant level $9.61 is. It was trade war resistance. Hopefully it will now be support.

I would be lying if there wasn’t $1.00 downside risk in soybeans if none of the wild cards such as Brazil or China wind up in the bulls favor.

$8.50 is essentially those bear market lows.

Wheat

Wheat continues to fall apart along with soybeans.

Just like soybeans, wheat lacks any bullish story here. So the path of least resistance is lower.

As mentioned, we have the massive dollar rally and rain in the US which initially started this sell off.

Short term, we could definitely see more downside.

We are not in a seasonally strong time period wheat. Nobody wants or needs wheat right now.

Long term, I still think wheat has plenty of potential.

We still have a bullish global balance sheet that continues to shrink year or over year.

But for now the tailwinds are the US dollar and better weather.

The biggest reason for the magnitude of this brutal sell off was simply technically driven.

I have been mentioning for weeks about how important that $5.65 level is. We finally broke below it.

So once we did that, big money is like "oh snap" so they took more risk off. Us breaking below such a significant level triggers them into selling even more.

Looking at the indicators, wheat is VERY oversold here.

Which signals that we "should" at the very least get a little relief bounce soon.

The stochastic has bottomed out. The RSI is well into oversold territory. The last 2 times the RSI was this low, it led to at least a small bounce.

But the MACD is still bearish, signalling the trend is lower for now.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24