BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

AUDIO COMMENTARY

Grains get nice rebound

Record NOPA crush numbers

Strength in US dollar is weighing on wheat

Effects of dollar & demand

Trade war & Trump

Things to consider when making sales

Basis contracts & options exp

If corn demand isn’t front loaded

Record ethanol production

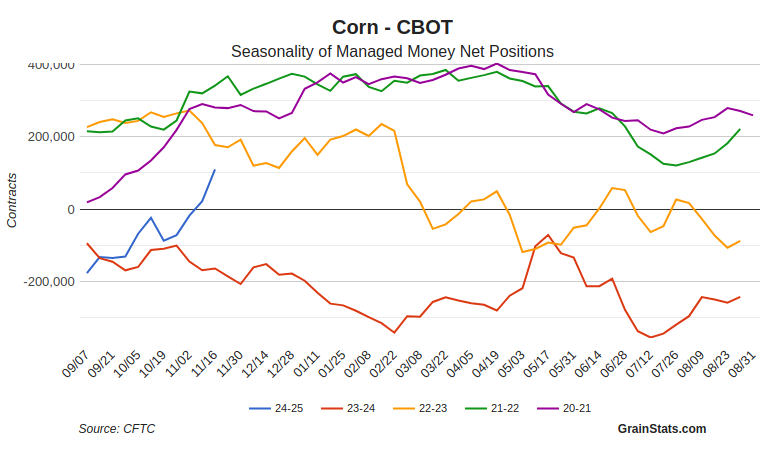

Funds long 100k corn

Funds follow the trends

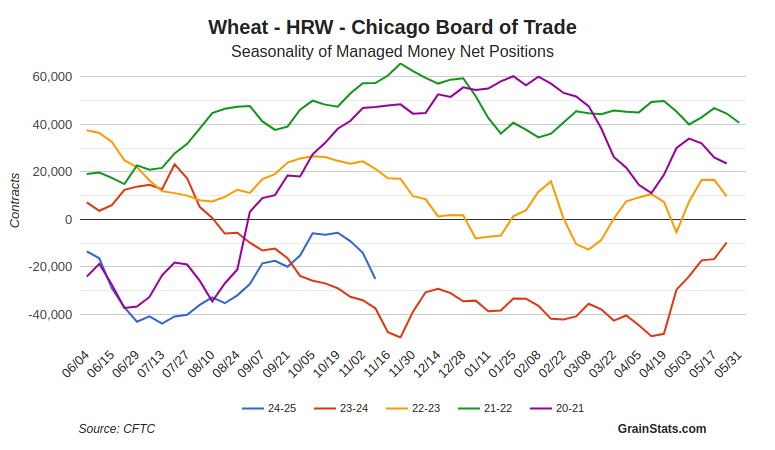

Great spot to re-own wheat sales for some

Biggest thing need to be prepared for

What will you do if prices do not rally?

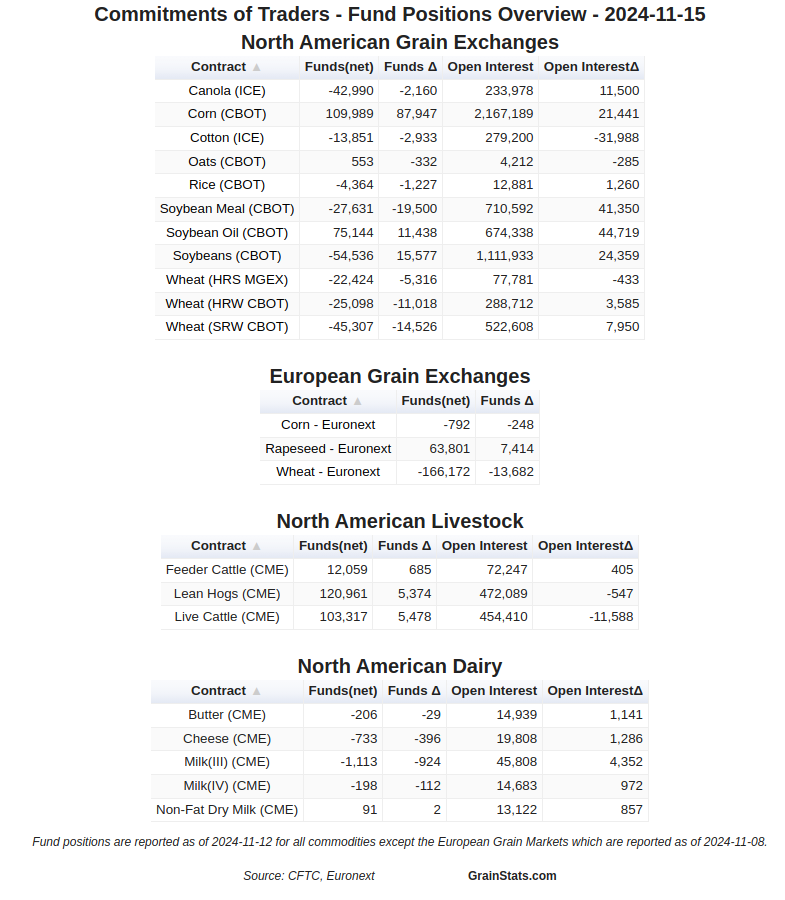

Fund positions from GrainStats below*

Chart breakdowns below*

Listen to today’s audio below

Want to talk? (605)295-3100

FUNDS UPDATE

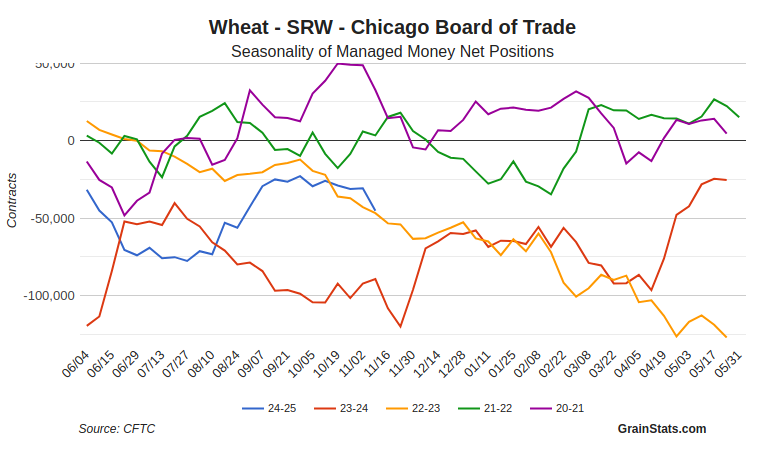

Here are the funds positions from Grainstats.

Make sure you go give them a follow & subscribe to their Twitter (@GrainStats on X). They put out great info all of the time and you can get charts like these anytime new data in the markets is available.

Fund Position (Weekly Change)

Corn: Long 110k (+88k)

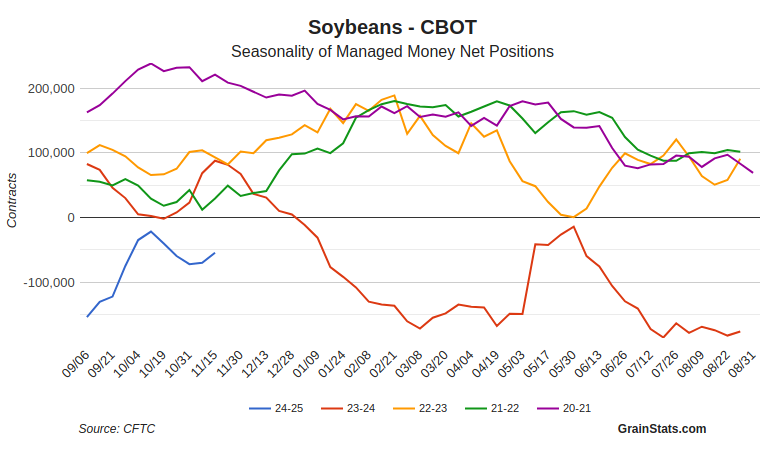

Beans: Short -54.5k (+15.5k)

Wheat SRW: Short -45k (-14.5k)

Wheat HRW: Short -25k (-11k)

CHARTS

Dec Corn 🌽

Chart still looks the friendliest.

Got a bounce right in that golden zone we mentioned yesterday.

One day is not a trend. But my first target to re-hedge or make sales for those that need to if $4.39 to $4.46

Jan Beans 🌱

Good bounce today, looks like we are now finding resistance at that key volume area around $10.00

Still need to hold those $9.76 lows.

Until I feel confident we are making another move higher, I do not have another target to take risk off the table yet.

Dec Wheat 🌾

We broke the key $5.65 support. So that opened the flood gates to quick heavy selling. As I mentioned there was little support beneath if it broke.

Good bounce today, but good chance it was just a relief bounce.

The indicators were well over cooked to the downside (next chart).

Wheat is still very oversold here, so I could see this bounce going a little higher.

Longer term, wheat fundamentals are friendly and there’s plenty of potential. But the technicals still look very ugly today.

Currently stuck in this downward channel. A break out would a good step in the right direction.

The stochastics and RSI are completely bottomed out.

This is a sign that this bounce could go a little higher.

Dec KC 🌾

Just like Chicago, watching this channel.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24