USDA REPORT PREVIEW

AUDIO & MARKET UPDATE

Audio Highlights

Sfs market update

What could the USDA surprise us with

What are basis and spreads telling us

Overview

Grains slightly lower for the most part today as traders prepare for tomorrow’s USDA report. Outside of the report tomorrow, focus around the grains remains South American weather, planting/harvest delays, China & U.S. relations, and war headlines.

USDA Report Preview

Tomorrow is the big day of the highly anticipated USDA WASDE Report.

Taking a look at U.S. ending stocks. Analysts are estimating corn stocks to be a tad higher than last month's report. This is due to an anticipation of weaker demand. Soybeans on the other hand are expected to see minimal changes if any.

These numbers will be a focal point of the report tomorrow. Almost everyone can agree we will see rather large cuts to Argentina estimates. But the real question is just how big of a cut will we see?

The trade is expecting a -2.5 MMT cut (52 to 48.5) for Argentina corn. Now there is discussion over the possibility that we see a number as low as 46, which would be a huge cut. Last month we saw the USDA lower their estimate from 55 to 52 MMT.

They are estimating a -3.16 MMT cut (45.5 to 42.34) in Argentina soybeans. Last month we saw a -4 MMT cut from 49.5 to 45.5 million. Some are actually throwing put numbers sub-40. Will the USDA make that big of cut here, probably not, but there is always the possibility. Either way we will see cuts across the board for Argentina as they continue to face problems.

Estimates for Brazil on the other hand are a complete different story. Estimates are expected to come in unchanged to perhaps slightly larger. Bulls are just hoping not to see a large increase if any. As Brazil is still expecting a massive crop. The consensus seems to think the USDA is taking a slow approach to Brazilian estimates.

Taking a look at world carry out. Looks like they are expecting numbers to shrink from last month for both corn and beans but are expecting wheat to be a tad higher. The majority of traders main focus will be on the South African numbers but you always have to keep an eye out on global demand.

A few of the other things to be watching out for are Russia and Ukraine estimates. Will we see Russian wheat production raised? Now for Ukraine, there is obviously a ton of uncertainties surrounding both of these countries going at war. But with the war, it makes it difficult to make any sizeable adjustments without proven evidence and everything going on. There is also still a chance both Russia and Ukraine's numbers are being slightly over exaggerated. Even if they are I think this is a story for the future and don’t expect any massive changes tomorrow.

Today's Main Takeaways

Corn 🌽

A very quiet day for corn, trading a mere 4 1/2 cent range on the day, ultimately closing at the very bottom of their range -4 cents to $6.74

AgRural said that 12% of the Brazilian safina corn crop has been planted. This is only half of last years progress of 24% during the same time. The rains in Brazil are giving bulls hope, as if they continue to receive an over abundance of ain't they will continue to see delays. Again, this isn’t a huge problem right now but definitely has the potential to turn into one down the road.

Another debate being thrown out there is whether or not the losses in Argentina and lack of acreage in the U.S. this year is going to be enough to offset the decline in exports and ethanol usage here in the U.S.

Going into the report tomorrow, demand estimates are the big question mark. Is export and ethanol numbers being over estimated. The USDA estimate is looking for a 20 million bushel on overall demand decrease.

Factors outside of the report will continue to be South American weather, planting delays, Chinese appetite, demand, and the funds.

Corn March-23

Soybeans 🌱

Soybeans trading in a wide 20-cent range today, closing 15 cents off their highs and finishing near the session lows, closing down -6 cents at $15.15

Outside of the USDA report tomorrow, one thing traders are keeping a very close eye on is the Chinese spy balloon situation and how this affects the U.S.'s relationship with the worlds number one importer, China. The shooting of the ballon drew some protests by the Chinese government. The Chinese have been fairly big buyers as of recent so we will have to see if that continues as Brazil harvest gets underway.

Another story that goes hand in hand with delayed corn planting in Brazil is Brazil's bean harvest also being delayed. Beans in Mateo Grasso were only 24% harvested vs last year's 46.7%. Brazil's massive expected crop is the number one concern surrounding the future of the bean market. So bulls would love to continue to see problems and harvest delays in Brazil. Forecasts are calling for some more heavy rain and flooding.

Following the recent rains and the last few weeks of relatively decent weather, the Argentina forecasts are turning on the heater. Beans were rated 46% poor to very poor, with only 12% sitting good to excellent.

Dr. Cordonnier lowered his Argentina bean estimate again. This time lowering it an additional 1 million metric tons down to 38 million.

Along with the USDA South American numbers, we will also get CONAB's latest estimates before the USDA report.

We will have to see how tomorrow's report pans out, but ultimately the report, South American weather, and China will decide if we see a break to the upside and reach new highs, or if we break below our uptrend. I'm still slightly nervous about the massive crop in Brazil going forward, but we will have to see how serious these harvest delays get.

Soybeans March-23

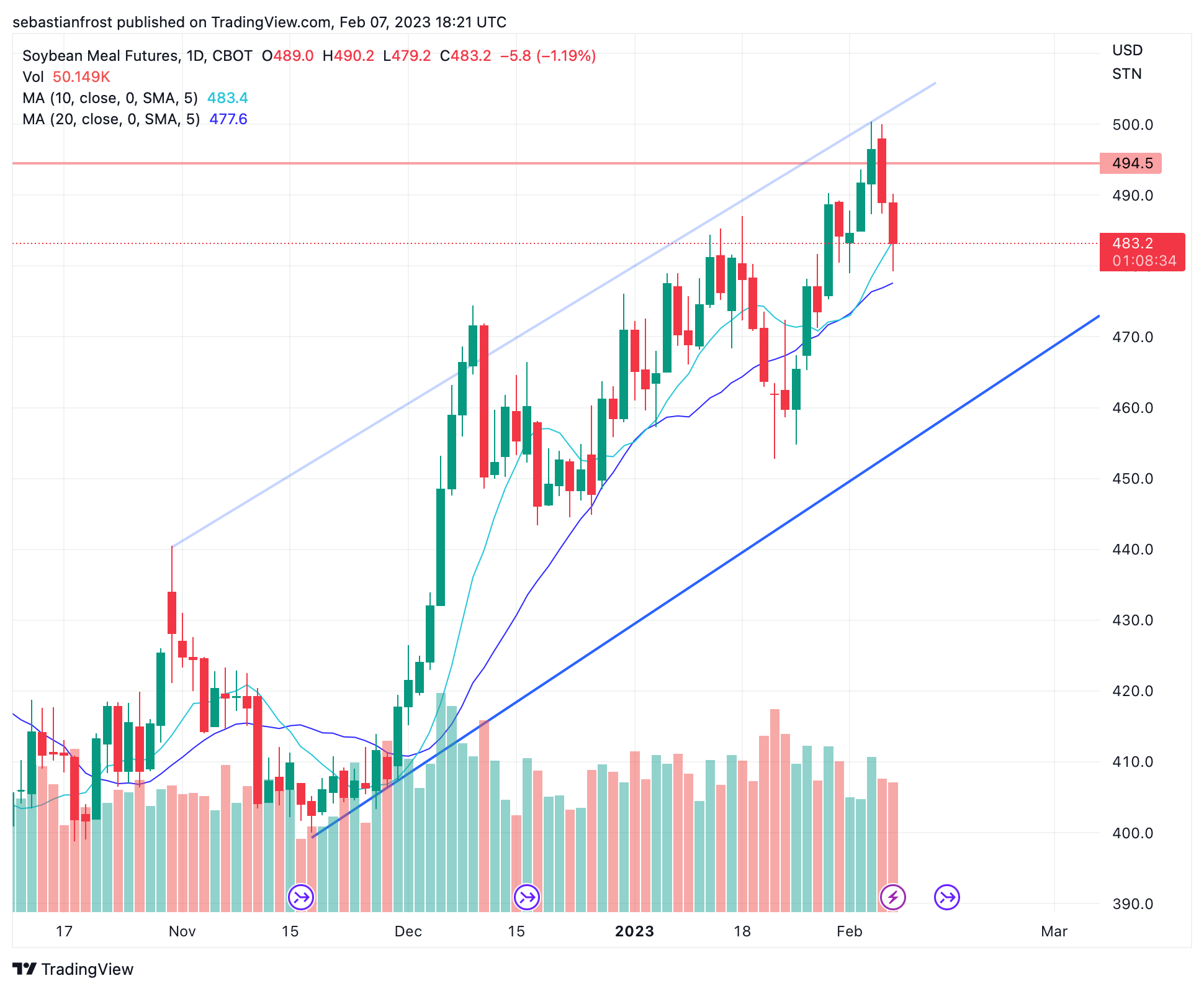

Soymeal

Soymeal March-23

Wheat 🌾

Wheat futures mixed with KC seeing another rally today. Chicago and Minneapolis seeing minimal losses. Wheat still trying to break out of is downtrend.

India made the announcement that instead of the expected increase in wheat plantings, they actually have year over year increases of rapeseed production.

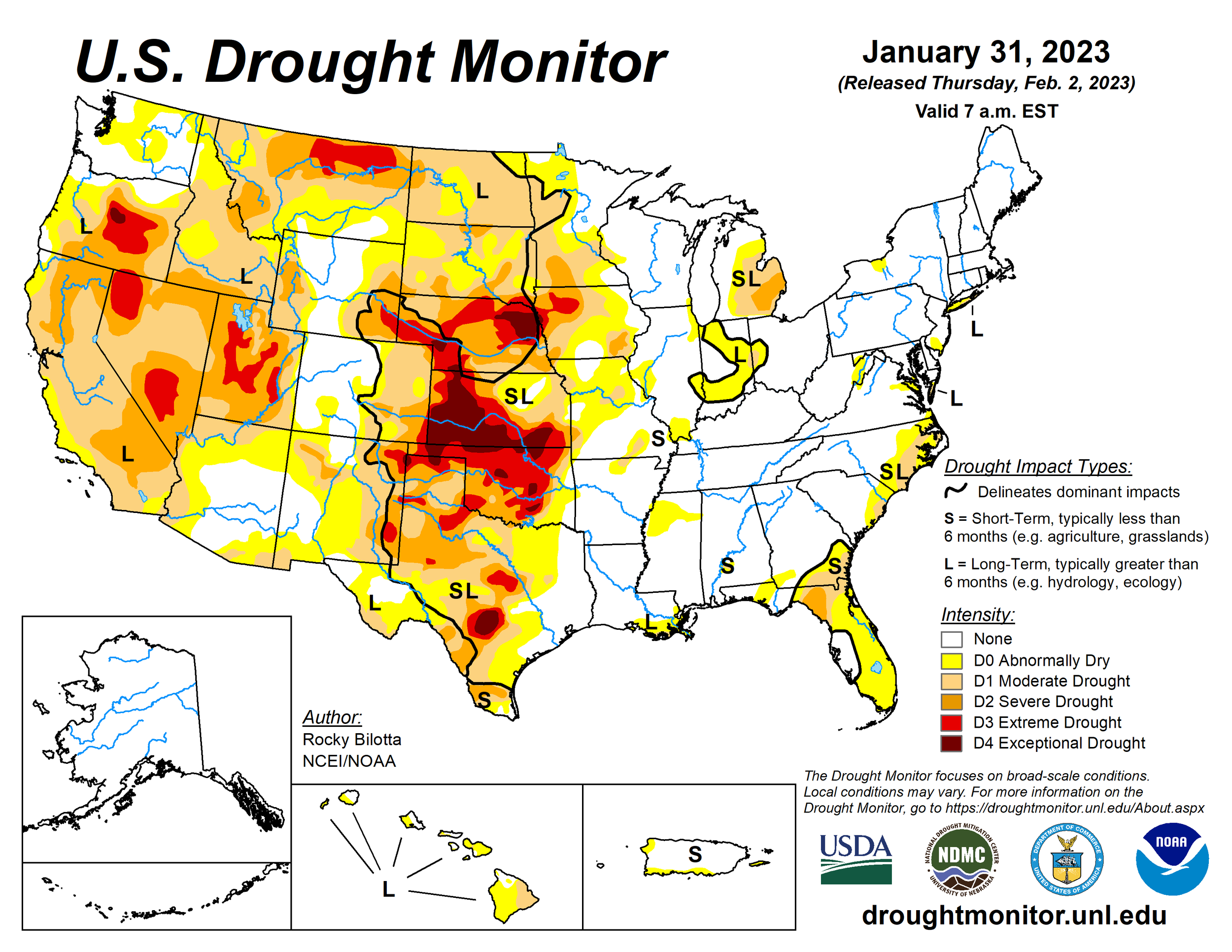

Kansas winter wheat ratings are the worst they've been in 25 years. We will have to see if crop conditions across the U.S. improve or worsen as overall we still have a crop on the poorer side which could continue to support wheat down the line.

Russia's Ministry of Ag forecasted its 2023 wheat production to be between 80 and 85 million metric tons. Which is a 20% decrease from last year's 102 million.

Russia & Ukraine continue to stir the pot and headlines. According to a ton of sources, it appears that Russia is going to launch a wide scale offensive into Eastern Ukraine in the coming weeks. Two months ago Putin did say he would do this. If they do follow through with this, we could expect wheat futures to be strong and some of that strength should also carry over to the corn market as well.

With the spring weather ahead and possibilities to see more war escalation I still think we see higher prices here in the coming weeks. Funds are still incredibly short. Leaving plenty of upside when they start to become buyers.

Chicago March-23

KC March-23

MPLS March-23

Highlights & News

Saudi raised their price of crude oil to Asian buyers by 20 cents a barrel.

The first quarter of GDP growth for China will be the strongest in 4 years. Which could lead to increased Chinese demand.

The CNN Stock Market Fear & Greed Index has moved to extreme greed.

Global food prices decline for the 10th straight month.

Indonesia cancelled up to 80% of the previously issued palm oil export permits for shipment into May.

The FAS lowered Mexico's corn production in 2022.

Other Markets

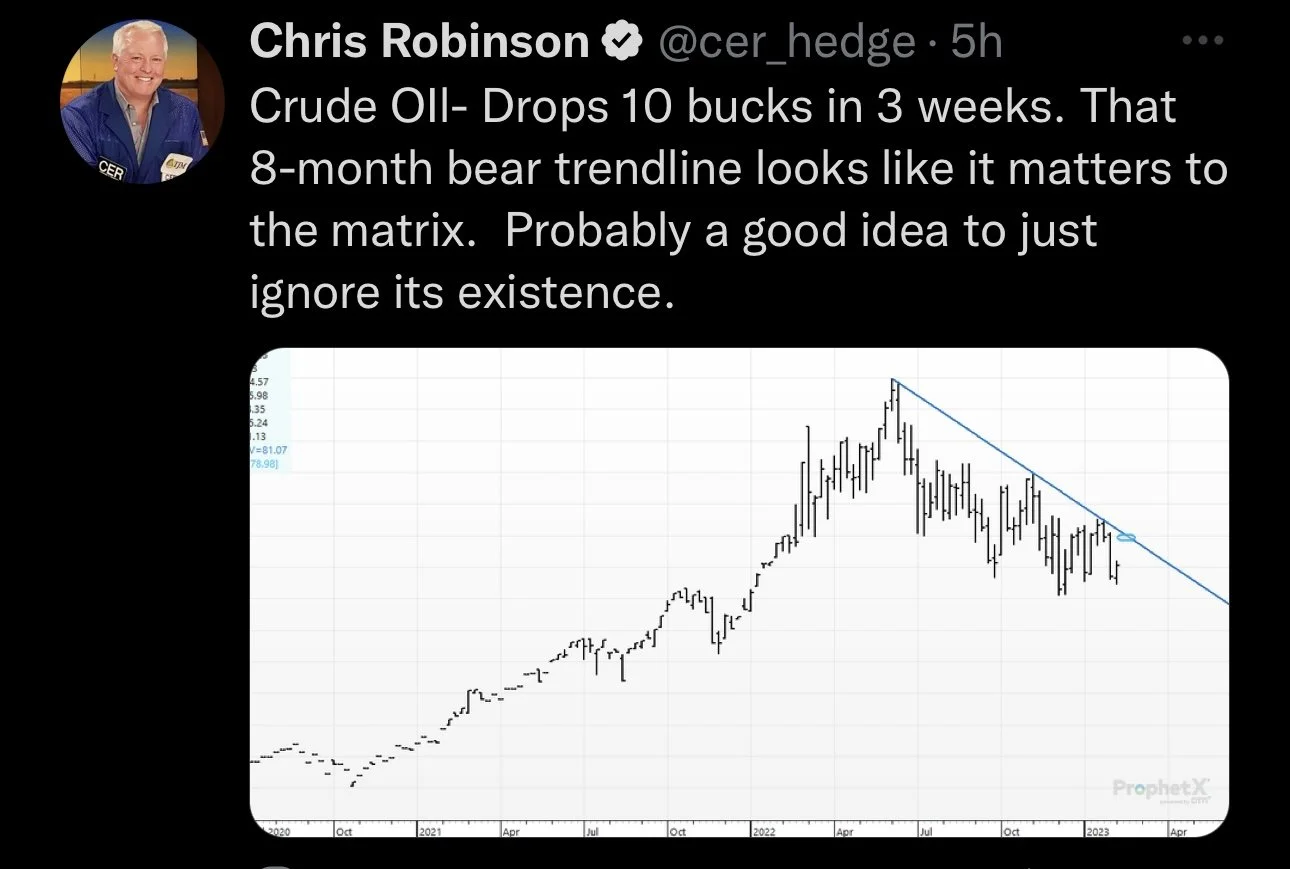

Crude oil up +3.20 to 77.30

Dow Jones up +200

Dollar Index down -0.183 to 103.315

Cotton up +2.36 to 85.63

In Case You Missed It..

Here are a few of our past updates in case you missed them

2/6/23 - Market Update

2/5/23 - Weekly Grain Newsletter

2/2/23 - Market Update

2/1/23 - Market Update

BRAZIL HARVEST DELAYS & WHEAT OUTLOOK

1/31/23 - Market Update

DID WHEAT BREAK ITS DOWNTREND?

1/30/23 - Audio Commentary

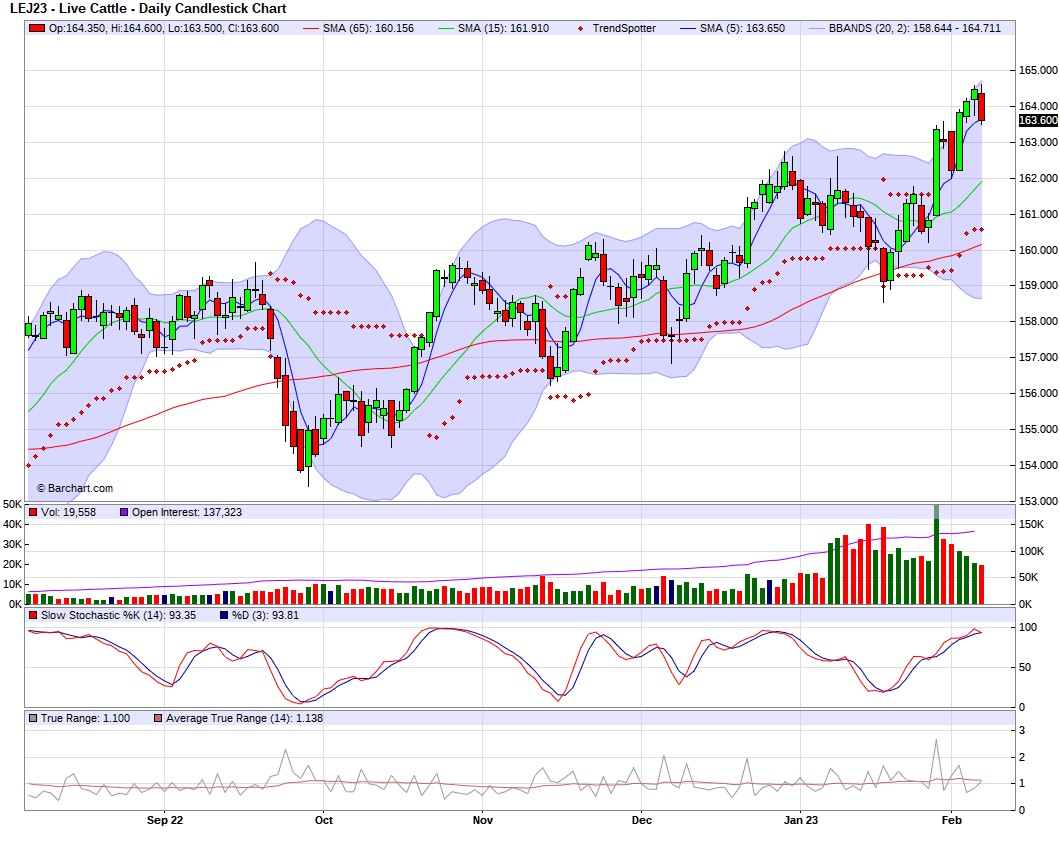

Livestock

Live Cattle down -0.875 to 163.600

Feeder Cattle down -0.500 to 187.200

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service