MIXED DAY FOR THE GRAINS

Overview

Mixed day for the grains as traders prepare for the highly anticipated USDA WASDE report on Wednesday. Some big questions going into the report are;

How big of a decrease will we see in Argentina estimates

Will Russian wheat production be raised

Will corn for feed use and bean exports see an increase

Today's Main Takeaways

Corn

Corn closed the first day of the week in the green after trading lower for the majority of the session, closing 7 cents off its lows and right at its highs which was a good sign of strength.

Corn continues to chop around struggling to push past our recent highs as March keeps running into resistance around the $6.85 range.

Forecasts in Argentina continue to look drier but are looking very hot, with Brazil continuing to get rain. The planting of the safrinha corn crop is underway but is being delayed due to the harvest delays in bean harvest. We will have to see if this develops into a bigger problem down the line.

Despite recent focus being on South America, the biggest thing that will influence the markets this week is the USDA WASDE report. There is a lot of discussion around the demand side of the balance sheet. Bears are making the argument that export and ethanol estimates may be a tad overly optimistic. Some also seem to think we might see the USDA raise its ending stocks by 20 million bushels or so with the lower demand.

Traders will also be watching South America and Ukraine numbers from the report. As most think we will again see a reduction in Argentina production. Last report we saw the USDA lower their estimate from 55 to 52 MMT. But there is talks we see that numbers cut as low as 46 MMT, which is a sizeable cut. Now as for Ukraine, it might be a little more difficult to make any sizeable changes given the war and everything going on makes it harder to make huge changes without sufficient evidence.

Outside of the report, the main things influencing the corn market remain South America and overall demand. We will have to see if we get any curveballs that push us past our recent resistance and propel us to $7, or if we get a disappointing report and work our way to the lower end of our trade range.

Corn March-23

Soybeans

Soybeans lower again, seeing the most lost amongst the grains losing almost -11 cents.

Last week we saw beans rally to the high end of their recent range, testing highs. But ultimately has come off those highs trading lower for the second day in a row.

All eyes will be on the USDA report. As the report might push us higher and send us past our recent resistance into new highs. Or if we get an overly bearish report there is a chance to see this uptrend from October come to an end. However, its looking like most aren’t expecting any ground shaking changes in the report. Bears are thinking the U.S. crush number needs to be reduced. On the other hand bulls are suggesting we need to see a raise in the U.S. export number.

Trade guesses for the WASDE report are out. The trade is looking at U.S. bean carryout at 0.211 bbu. With Brazil production at 153 MMT and Argentina at 42.3 MMT, and world bean stocks at 102 MMT.

As for South America estimates. Most seem to think we likely see the USDA leave Brazil numbers unchanged. But we will almost certainly see another cut to Argentina production estimates. Last report we saw the USDA make a -4 million cut from 49.5 to 45.5 million metric tons. Some are throwing out numbers below 40 million.

One thing people are closely monitoring is the relationship between the U.S. and China. As a Chinese spy balloon was shot down over the weekend, capturing headlines left and right. China wasn’t too happy with the U.S. decision to shoot it down. So we will have to see how this plays out and what kind of impact it has on demand from the world importer of soybeans.

Weather and forecasts in Argentina have turned slightly drier following a week or two of impactful rains a few weeks ago. Current outlook is more dryness and warmer temps for Argentina while Brazil on the other hand is expected to continue to get an over abundance of rain.

The rain in Brazil brings us to another topic. Harvest delays. If they continue to get a ton of rain, we could continue to see their harvest fall behind. This won't be having a huge impact right now but if definitely something to watch out for going forward.

After the USDA report in two days, the main focus will shift back to South America forecasts and Chinese headlines. With Brazils expected record crop, I'm still slightly concerned when we creep into the mid $15 range, that is unless we continue to see South America weather concerns.

Soybeans March-23

Wheat

Wheat closed mixed with KC being the only of the three to finish in the green. Despite the war headlines and good export inspections, we saw Chicago close lower, -16 off its highs. Looks like the funds just want to keep selling wheat. Can’t imagine we see this continue for much longer.

WASDE estimates have U.S. carryout at 0.576 bbu with world stocks at 266.6 MMT. Trade is looking for a small increase in U.S. ending stocks, but it wouldn’t be too surprising to see this left unchanged. Overall, most aren’t expecting any massive changes but there is always that chance to see a curve ball.

There is some debate that we see Russia's crop estimates lowered as there is still uncertainty to whether both Ukraine and Russia's estimates are being overestimated. But even if they are, we just don't know when or even if we will see those estimates changed.

Currently giving wheat some support is the weather forecasts for U.S. winter wheat look pretty dry in important growing regions for both the Southern plains and the Midwest. If the drought conditions continue this will continue to support the wheat market.

There has been some more war headlines as news broke that Russia might launch a large-scale offensive in Ukraine in the coming weeks. This didn’t help push prices higher today, but if Russia does launch more attacks one would think we see wheat pushed higher when they do so. We also have the grain corridor deal that expires in a little over month. There is talks that it might not be renewed.

I still remain bullish as I have been for quite some time now. We have weather concerns here in the U.S., this war isn't going anywhere, and I think it's a matter of time before we see the funds shift into buyers. I can't help but think we see higher prices in the coming weeks as we approach spring.

Chicago March-23

KC March-23

MPLS March-23

USDA Estimates

Cattle Outlook

This is a short write up from Farms.com Risk Management where they go over the cattle market and their outlook going forward.

The battle for cattle is on in the U.S. Plains. U.S. 2023 cattle inventory at 29.8 (lower than 2014) a new record low down 4%. The January 2023 USDA Semi Annual Cattle Inventory report was very bullish. Beef replacement heifer down 6% vs. expectations for a 3,5% decline. Milk heifer replacements down 2% vs. expectations for a 0.1% gain! This news is already basked in short-term but prices will rise further long-term.

December U.S. Cattle on Feed indicated it was -3% below Y/Y, or 312,000 short. Dec marketings of US cattle were 6% lower, hit by a late December snowstorm impacting hauling and slaughter facilities.

Western U.S. states that had been liquidating cows in 2020 and 2021 appeared to slow that pace in 2022 but did not add significant cows to depleted herds. Central U.S. lost the bulk of the breeding herd. Very few states increased beef cow replacements on hand with the majority showing large declines.

USDA’s estimate for U.S. beef production for 2023 is currently forecast at 26.513 billion pounds, 170 million pounds higher than the previous forecast but still 1.857 billion pounds lower (‐6.5%) than the previous year.

USDA remains apprehensive about 2023 U.S. beef export potential, forecasting a 452-million-pound decline (‐12.8% Y/Y). Lower supply available likely drives these forecasts as well as more competition from Australia in key markets, such as Japan and S. Korea but higher exports from China could offset.

Managed money funds have been raising their net length in live cattle positions since the summer 2022. Live cattle futures remain in an upward sloping uptrend since bottoming out in April of 2020.

High prices are needed to ration more demand as the global consumer remains very resilient despite higher beef prices out the available supply. A continued shrinking of the U.S. herd the lowest since 1962 means that we could get a runaway bull market in 2023 that surpasses the highs seen in 2014. But a continued drought over the next 3-5 years means we are bullish not only short-term but also long term as well.

Along the way manage your inputs and feed costs otherwise you will get blindsided and may not survive Mother Natures wrath. Be aware and prepare to take advantage of the upcoming opportunities. Cattle/feeder futures will rise but may not offset the rise in higher feed costs.

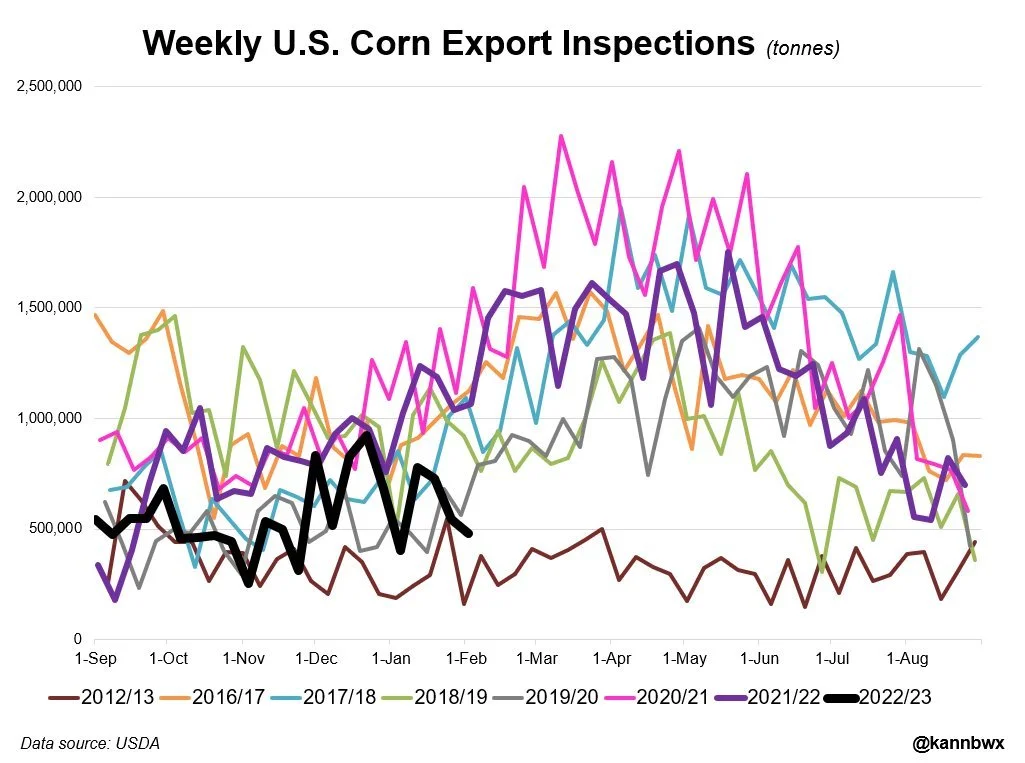

Export Inspections

Another big week for soybean export inspections. Wheat came in above expectations as well. Corn on the other hand was pretty disappointing, coming in at the lowest for a week since 2016.

Numbers Millions of Tons

Corn

Actual: 480

Trade Range: 440 to 800

Soybeans

Actual: 1,830

Trade Range: 800 to 1,900

Wheat

Actual: 536

Trade Range: 300 to 525

Highlights & News

Ukraine prepares for potential Russia attacks.

Over the weekend, the U.S. shot down a balloon that appeared to be a Chinese spy device.

Urea and other fertilizer prices are in a freefall and are expected to continue to decline.

According to CNBC, 50% of all six-figure earners are living paycheck to paycheck. An all-time high.

Argentina's soybean meal exports in January were the lowest in 20 years.

Ag Rural estimate Brazil soybean harvest at 9% complete, behind 16% last year.

World food prices have declined for the 10th month in a row.

IKAR cut its Russian wheat harvest forecast to 84 million metric tons, down from 87 million.

Next week is calling for very dry Argentina forecasts.

Bloomberg predicts China's oil consumption will be a record this year.

Other Markets

Crude oil up +0.94 to 74.33

Dow Jones down -30

Dollar Index up +0.735 to 103.490

Cotton down -2.16 to 83.27

In Case You Missed It..

Here are a few of our past updates in case you missed them

2/5/23 - Weekly Grain Newsletter

IS THE TREND YOUR FRIEND?

2/2/23 - Market Update

BEANS BOUNCE BACK

2/1/23 - Market Update

BRAZIL HARVEST DELAYS & WHEAT OUTLOOK

1/31/23 - Market Update

DID WHEAT BREAK ITS DOWNTREND?

1/30/23 - Audio Commentary

MEAL MADE CONTRACT HIGHS. WILL OTHER GRAINS FOLLOW SUIT?

1/29/23 - Weekly Grain Newsletter

WHAT DOES ADM THINK ABOUT CHINESE DEMAND

Livestock

Live Cattle up +0.350 to 164.475

Feeder Cattle up +1.600 to 187.700

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service