WEATHER HAMMERS THE GRAINS

Overview

Grains get hammered with beans down 50 cents, and wheat futures down 38 to 43 cents. The biggest thing that had pressure on the grains was simply rain make grains. We had good rains across part of the corn belt. We have also seen some big improvement in the forecasts, as the forecasts are showing much cooler and wetter conditions than we have recently seen following this heat wave.

We also didn’t get much escalation in the war which had the trade disappointment. There was some attacks Saturday but the trade had quickly put that in the past. Russia hit more ports, but the trade doesn't seem to care. It is still clear the war is far from being resolved.

We saw some export business in the beans this morning. Some would’ve thought that might’ve added some support but the trade completely ignored the news.

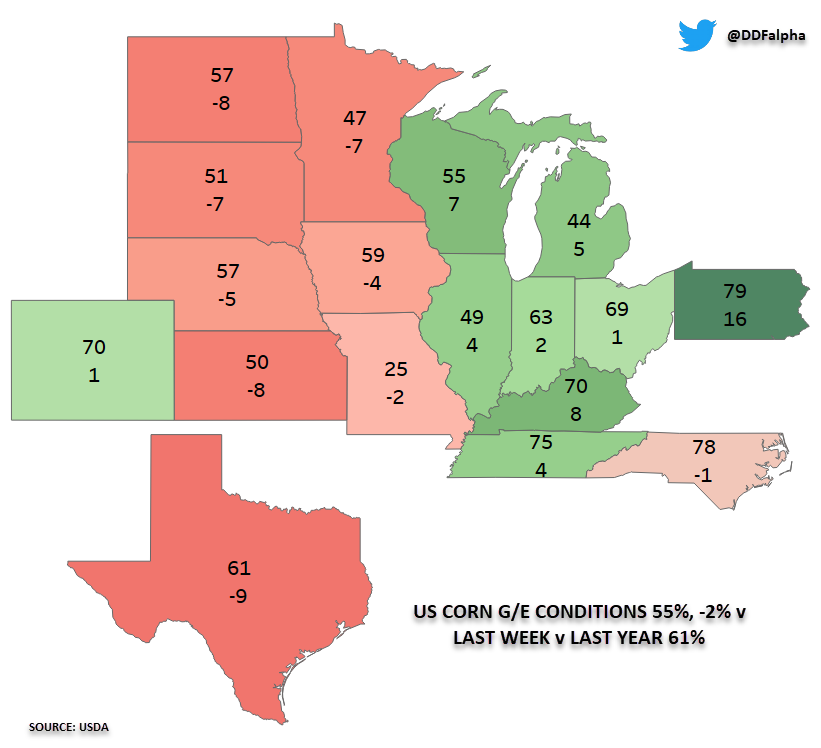

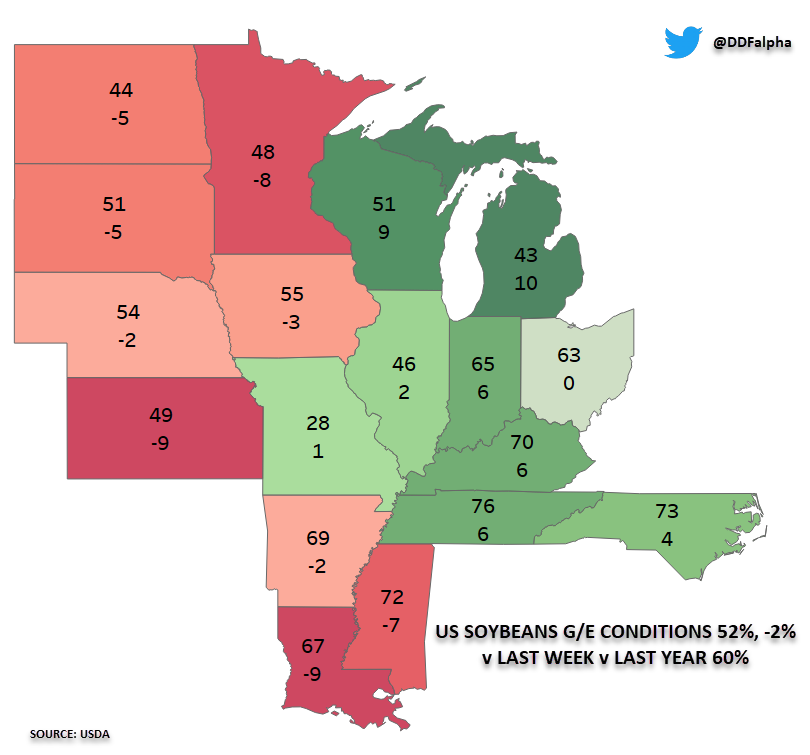

Crop conditions came in after close. As I mentioned in yesterday's newsletter, they did indeed come in lower than the trade was expecting. But not by a wide margin. As both corn and beans come in 1% lower than estimates. Spring wheat on the other hand came in a big 6% lower than the estimates. (Full numbers below).

With the heat, I actually expected corn and bean conditions to get hit a little harder than that. So slightly disappointing for bulls even though they were slightly below estimates.

Weather is the only thing the trade cares about right now. I think this move was far overdone to the downside. We will have to see if we can get a turnaround Tuesday tomorrow and if these drops in conditions add some support, or if the trade completely discounts them due to the weather. Because at the end of the day weather will continue to trump nearly every other factor.

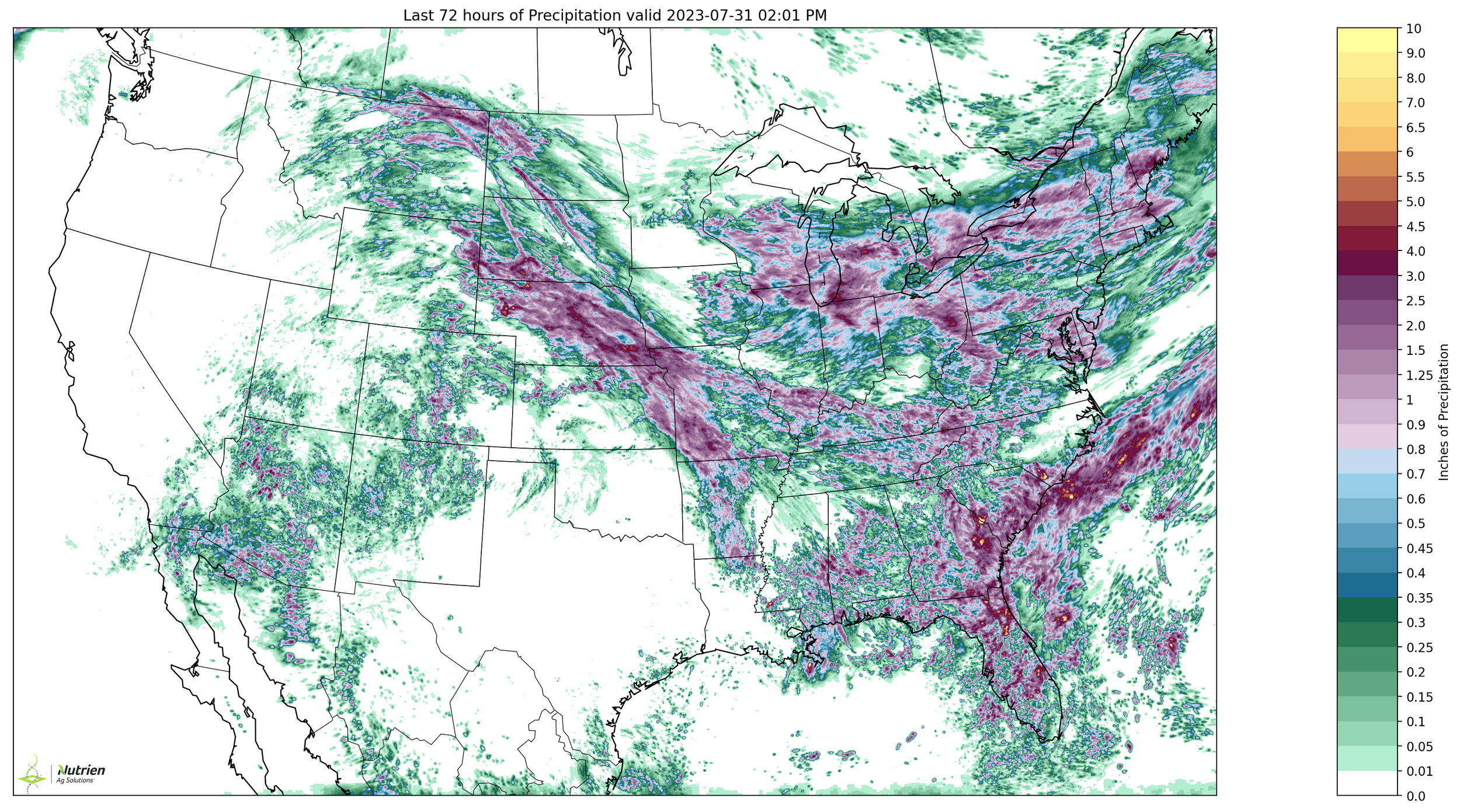

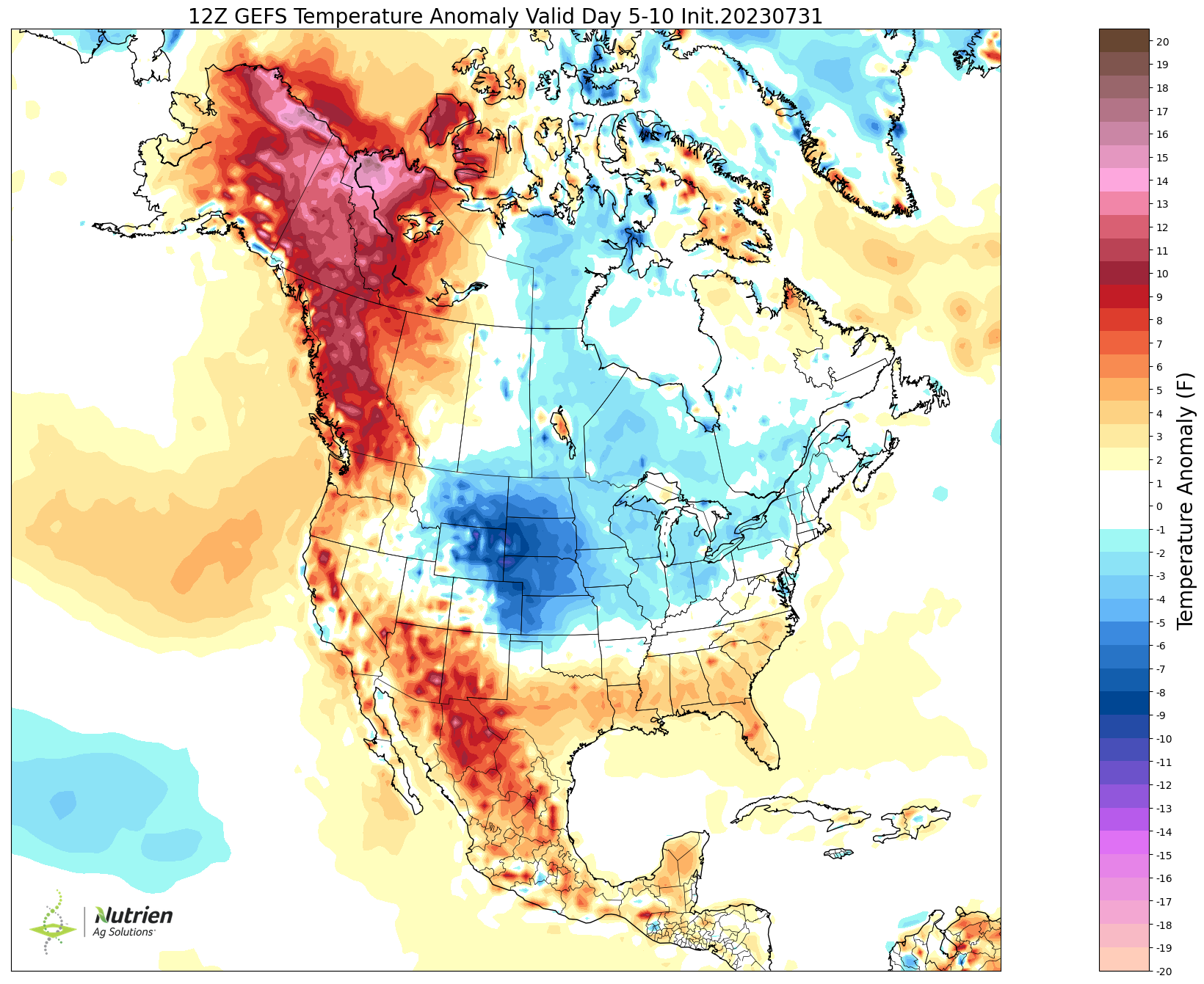

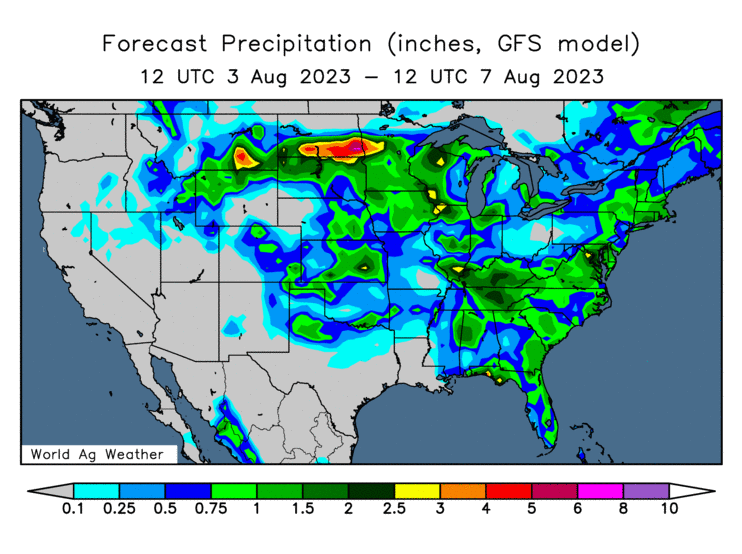

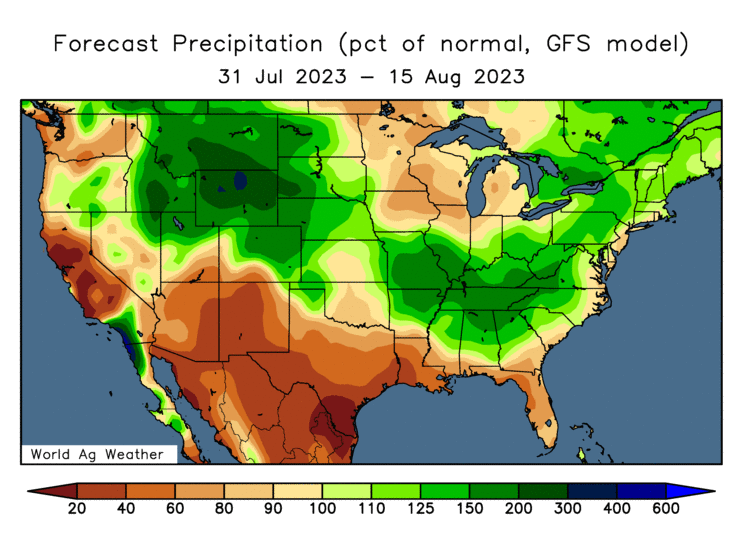

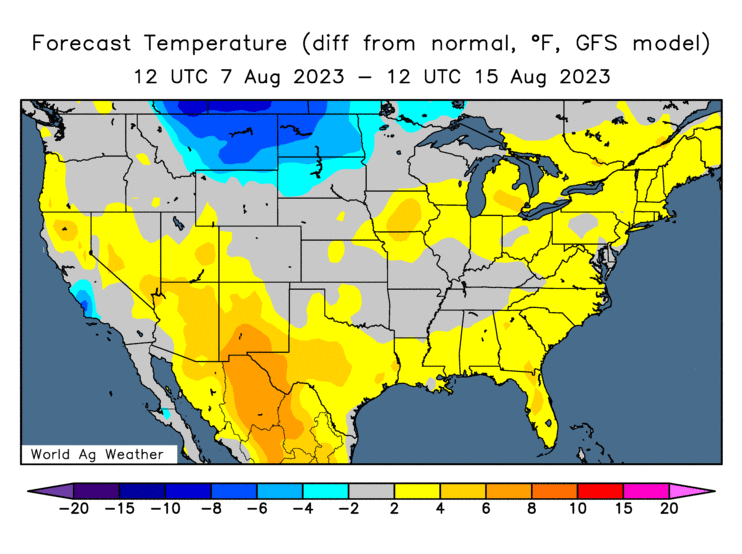

Here are the current forecasts as well as the precipitation over the last 72 hours this weekend.

Past 72 Hours

Forecasts

Crop Progress & Conditions

Corn 🌽

Rated G/E: 55%

Trade: 56%

Last Week: 57%

Last Year: 61%

Soybeans 🌱

Rated G/E: 52%

Trade: 53%

Last Week: 54%

Last Year: 60%

Spring Wheat 🌾

Rated G/E: 42%

Trade: 48%

Last Week: 49%

Last Year: 70%

Winter Wheat 🌾

Harvested: 80%

Trade: 79%

Last Week: 68%

Last Year: 81%

Average: 83%

State By State Map (% Change)

- From Darrin Fessler -

Corn 🌽

Beans 🌱

Today's Main Takeaways

Corn

Corn follows the rest of the grains lower today, down 17 cents after gapping lower. But did hold up better compared to the 40 to 50 cent losses in beans and wheat. We also did manage to close a nickel off our lows.

After hitting our $5.50 target and nearly hitting $5.75, corn is now nearly 60 cents off of those recent highs from just a week ago.

The two main things that drove corn lower today were of course weather and war.

As mentioned, we got some good rains over the weekend, to add on to that the forecasts are looking far cooler and wetter than they have compared to the past few weeks of scorching temps.

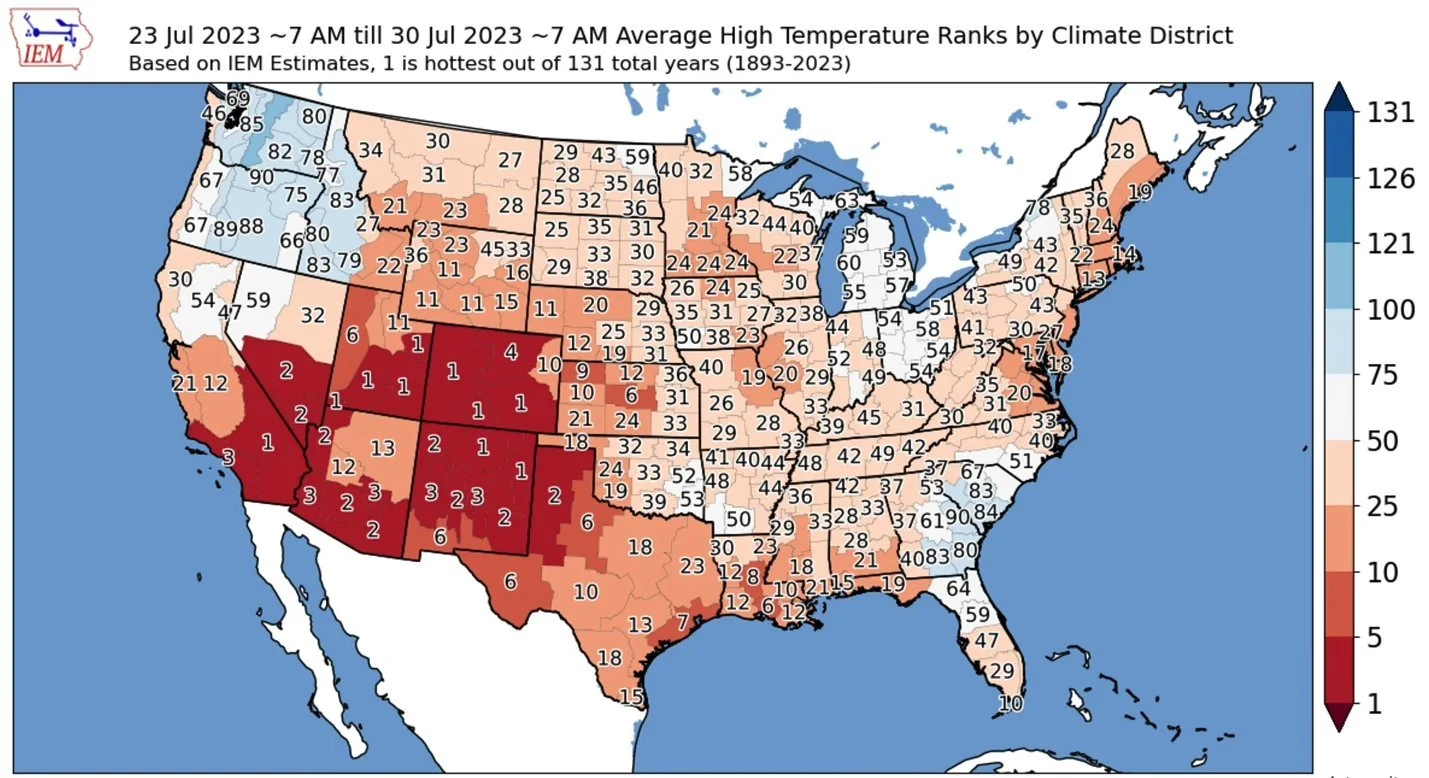

Here is how the last week's heat compares to that of the last 131 years. A big portion of the corn belt saw temps in the top 30 to 20 years of heat.

The concern with that past heat was the pollination as we enter the last third of that. However, these cooler temps that we are expected to see are going to take away a very big amount of that risk.

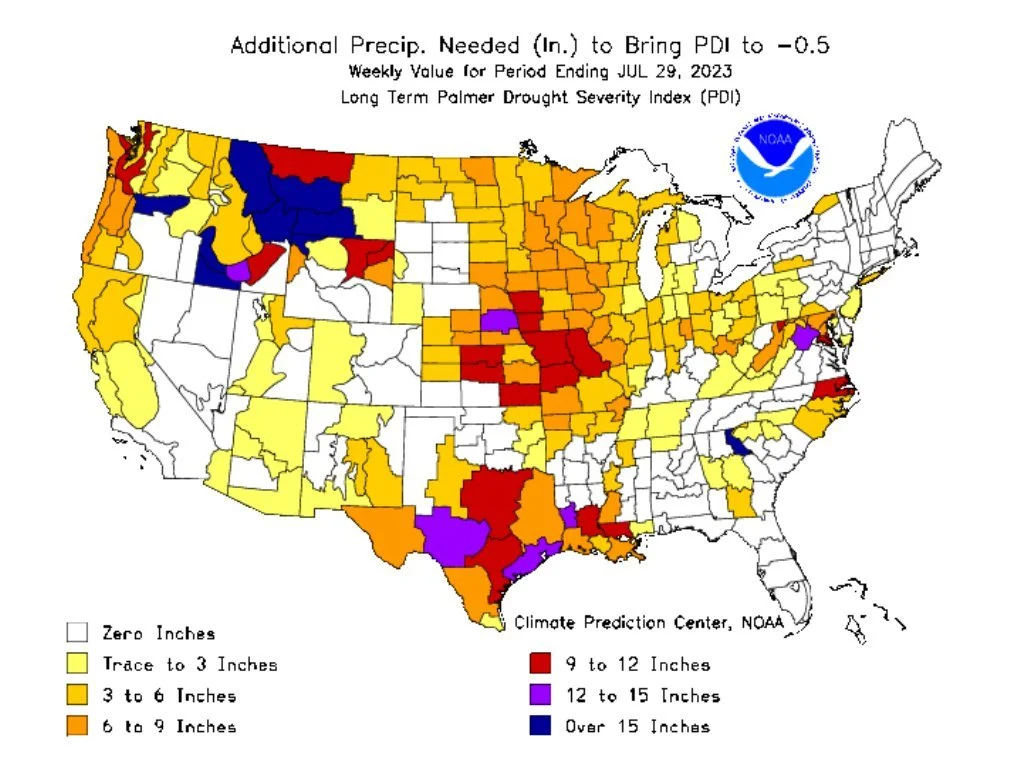

If we take a look at this map below, it shows the amount of precipitation to bring us to average. The majority of the corn belt still needs 3 to 9 inches, while parts of Iowa and Missouri actually need closer to 12 inches.

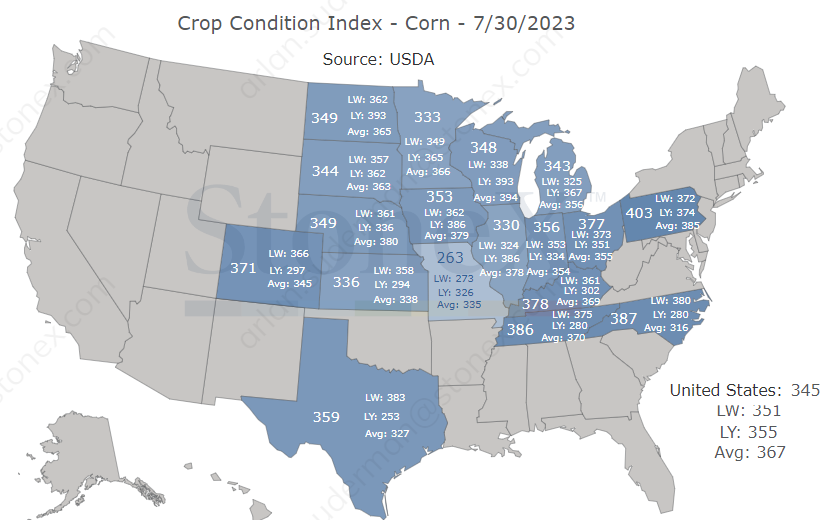

Here is the updated crop condition index score for corn from Arlan Suderman. Take a look, nearly every major corn state is far worse than last year. Does anybody really think this crop is better than last year? Especially by the amount, the USDA says it is? Even though weather looks cooperative, it's still doubtful.

As for war, we saw some Russian attacks but nothing too major. The trade's main fear was if Ukraine retaliated, but they did not. So now, the entire war premium is gone from both corn and wheat.

The war is escalating to a new level. It may not be a factor today, but the risk this presents to the grains will continue to rise the further this escalates, if it escalates. I don’t think we have seen the last of a war rally. But I also don't want to hold my breath and bank on it happening either. The entire thing is a big wild card.

The next big market mover outside some major changes to weather and war might be our USDA report. Our crop is still worse than last year, so one would expect our yield to be at least be closer to last year's 173 instead of the USDA's current 177.5.

The number one thing for bears outside of the recent shift in weather is ultimately the lack in demand. Bulls would like to see Ukraine push more business to the US, an increase in Chinese appetite, or some logistical problems out of Brazil.

Looking at our charts, we did break some key support. Unless we get a bounce tomorrow, our next level of support might be $5.

Corn Dec-23

Soybeans

Beans completely fall apart, gapping lower overnight and continuing the weakness throughout the day. Closing down over 50 cents and now roughly $1 off our recent highs from last Monday. We closed nearly a dime off the lows, but still a blood bath of a day for beans.

Weather. That is the only thing the trade is looking at right now. As mentioned, we saw some export business this morning but the trade completely ignored it.

Despite the string of new export business, the reason this is being somewhat ignored is due to the fact that we are still behind last year's pace of sales.

There is some talk that if prices continue to drop we could possibly see some cancellations of those sales, as a lot of them were made at much higher prices. So there is definitely some risk there and something to keep in mind.

On the demand side of thing, the bean situation is a better one than that of course for the time being.

Over the past week, I said multiple times that weather was going to the be the thing that drove us to $15 or all the way back down to $12. After this recent sell off, $12 is now closer than $15 as the weather is looking pretty bearish heading into August, which is the key month for soybeans hence the heavy sell off.

The past two weeks when we were around the $14 level I recommended getting rid of any old crop and to make new crop sales if you needed to and if that's what makes you comfortable even though there was a chance for us to go higher if weather stayed hot and dry, but it didn’t.

We said there was potential for beans to go higher, which there still is (although the chances are looking much slimmer now at least short term) but we continued to ask the question last week: would you be more upset if you sold and we rallied, or if you didn’t and we dropped $2.

Can we still hit $15 or make new all-time highs? It is possible. But there are a ton of factors at play here. If we do, it will unlikely be in August, but perhaps later in the year if we get some hiccups in South America to go along with our bean situation still being extremely tight. But short term here, it doesn’t look great.

Here is a good little summary from Chris Robinson,

***

We have dropped 82 cents in 5 days. If you sold on the rally as we suggested, congratulations.

If you bought puts on the rally, we may get a chance to roll down your $13.50 puts if you have them this week.

If you did nothing? You are still $2.20 above the May low. Don't let a big chunk of that disappear as well.

Since no one knows what the market has in store- we take what Mr. Market gives us when its on our plate.

There is a ton of 2023 left.

I am certainly not arrogant enough to say "The top is in" That's a fool's game.

But what I do know- is $2.20 of revenue- is still something. It's not the $3.05 we had last week? But it's still something worth protecting.

We hedge because we don't know what will happen.

Who would have thought that Putin possibly escalating the war in Ukraine would be bearish for grain prices? Certainly not me..

***

I agree with what he is saying. We don't know what will happen with the weather and war. All you can do is try to be as comfortable and profitable as possible no matter which direction the market goes. This is why I recommended making old crop sales last week. Because if we were to go higher, you could have grabbed puts. Heck you could have even just grabbed some, although I didn’t think the sell off would be quite this dramatic.

I'm optimistic that we get a rebound. The rebound might not be to our recent highs, but we still need to keep in mind that our recent lows were still $2 lower than where we closed today. So do what makes you comfortable. If that means making sales, then make a few. But we don’t want to panic sell this recent sell off. I personally don’t want to be too short here and think this move was far overextended to the downside, but that doesn’t mean we couldn’t see this thing continue to fall, as it certainly could.

Now that these wet and cool forecasts are priced in. The question is what happens if the rains miss or it's not as cool as they are forecasting? Guess we will have to see.

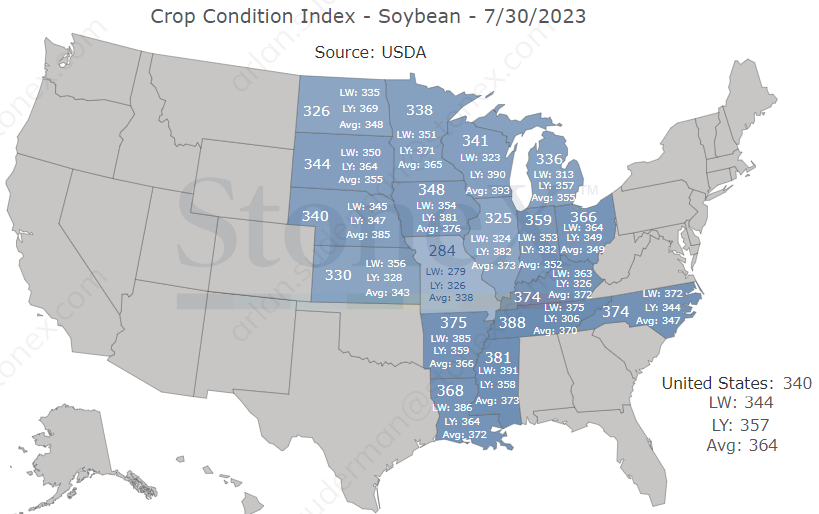

Similar to corn, here is the crop condition index score. Are we really above last year's yield?

As always, if you want specific advise to your operation or need any help at all shoot us a call or text anytime at (605) 295-3100.

From a technical standpoint, the charts don’t look too hot either. As we broke some good support levels. If we don’t bounce here, we might not find major support until $13 range.

Soybeans Nov-23

Wheat

Wheat futures join the sell-off in beans, as they get hit hard down nearly 40 cents across all three.

The main thing was the lack of war headlines. Bulls just didn’t get any fresh new headlines to chew on.

All of that war premium we had built in is completely gone, it's like the war never happened. Over the weekend we only saw Russia make attacks on one Ukraine port. We didn't get any follow through from Ukraine attacks, which is the biggest threat if it were to happen.

The market doesn’t appear to be concerned about a shortage due to them exporting via truck and rail, even though that entire situation still doesn’t a ton of sense.

Putin is actually making claims that he is ready to start peace talks. But Kyiv is unwilling to negotiate to end the conflict. Bottom line, doesn’t look like it is going away anytime soon. But the market has lost that initial shock factor. So for wheat to see another war rally it would have to be something a lot more major than we have been dealing with lately.

The biggest thing would still be if Ukraine attacked Russia and disrupted their exports. Now that would major. But, there are a ton of what if's when it comes to war. This was actually the reason we saw that initial spike Friday. It was the fear that Ukraine would counter Russia's attacks.

Overall, war headlines are extremely difficult to navigate. Nobody knows when a headline is a rumor or a fact.

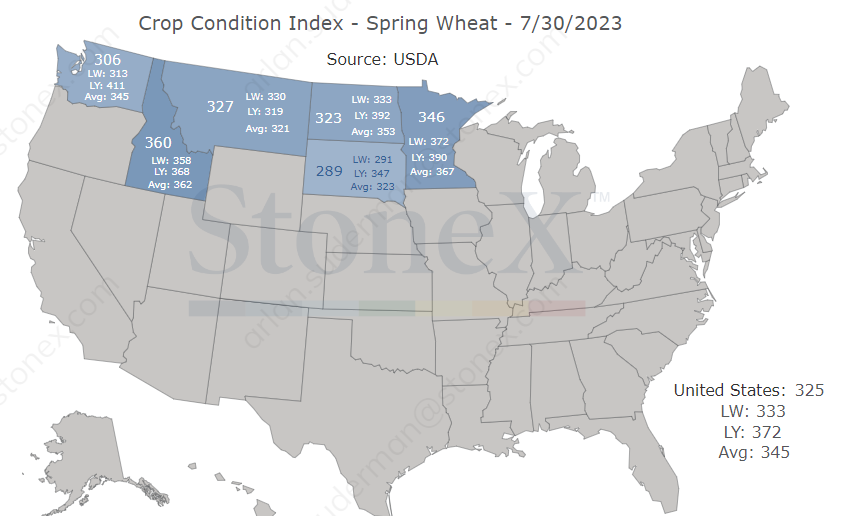

As for crop conditions today. Spring wheat was the biggest story. Coming in a whopping 7% lower than last week and 6% lower than the trade was anticipating. This should support spring wheat. There is also talk that spring wheat yields might be poorer than most are realizing.

Although the past two weeks I said the $9 level would be a good area to lay off some risk for Minneapolis, the concerns surrounding the crop might continue to be supportive. We have a crop here in the US that is getting worse, to go along with the obvious problems in Canada.

Below is a map that shows the crop index scores for spring wheat. Some pretty big decreases from last week as well as last year.

Taking a look at the charts, we are actually still in an uptrend in all three classes of wheat. We will have to see if we continue lower and look to test the trends, which wouldn’t be all that surprising. Maybe then we can find support.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

7/30/23 - Weekly Grain Newsletter

HOW MUCH DAMAGE WAS DONE FROM RECENT HEAT?

7/28/23 - Audio

DO CURRENT PRICES HAVE ENOUGH WEATHER & WAR PREMIUM BUILT IN?

7/27/23 - Market Update

GRAINS FADE OFF EARLY HIGHS

7/26/23 - Audio

WHAT HOLDS MORE GRAIN? A TRUCK, RAIL, BARGE, OR VESSEL?

7/25/23 - Market Update

GRAINS MIXED BUT WELL OF LOWS

7/24/23 - Market Update & Audio

WAR, WEATHER, & WHEAT LIMIT UP

Read More

7/24/23 - Audio

WAR & WEATHER SURGE GRAINS

7/23/23 - Weekly Grain Newsletter

ARE THE HIGHS IN?

7/21/23 - Market Update

RALLY TAKES A BREATHER

7/20/23 - Audio

BEING COMFORTABLE NO MATTER HOW THIS SHAKES OUT

7/19/23 - Market Update & Audio

THE RALLY CONTINUES

7/18/23 - Audio

WEATHER & WAR

7/17/23 - Market Update

RUSSIA EXITS GRAIN DEAL. BUY THE RUMOR SELL THE FACT

7/16/23 - Weekly Grain Newsletter