WHY THE BULL RUN IN BEANS ISN’T OVER

AUDIO & MARKET UPDATE

Crop conditions didn’t drop as much as expected

These numbers are often delayed. So watch out for next week.

Exactly why beans bull run isn’t over

What is the market not expecting in yield?

Time for courage calls?

The market is not pricing in the upside risk

Hedging, not chasing. What to do in each market

Make sure you scroll to read today's market update*

Listen to today's audio below

Overview

Grains lower across the board, as corn and beans see pressure from yesterday's crop conditions dropping but coming in quiet a bit better than most expected. As soybeans only dropped 1% and corn dropped 2%. The majority expected at least a 4% to 5% drop.

Wheat continues to fall, making new lows for the year. Seeing some pressure from news that Russian wheat is in a downtrend after 12 weeks of gains. Demand for wheat is declining, and exporters are also purchasing less figuring they will have plenty to go around and sell for the time being. This weakness in the Russian market is spilling over into the US market.

Overall, it wasn’t a great close on the charts, as we saw a big drop across the board in the last 15 minutes of trade. As corn fails to close above $5, failing for the 8th time this month. As corn has an outside down day, taking out yesterday's high but closing below yesterday's low. This is often a negative technical indicator and opens the door to lower prices.

Soybeans also fail to stay above that $14 level, but didn’t fill that gap to the downside so that was a positive.

Today’s weakness wasn't a surprise in corn and beans, as yesterday I mentioned the crop conditions report would likely cause some selling today. But I can imagine the next few weeks will paint a different story when it comes to crop conditions.

I have heard some individuals say that this weather isn’t going to affect our corn crop. Here is what some people on Twitter had to say, I agree, this weather certainly still cause some problems.

From Tim Gregerson,

"65-75% of the bushels of corn in the US are at a stage where they could lose 10-20% yield from dropped ears. Realistically if you have a field drop 50% ears prematurely you could lose 8-10% of yield. Nebraska & Iowa are dropping ears since last Wednesday."

From 247 AG,

"Corn yield is worse than most have anticipated in those areas running short on moisture. Many more surprises ahead." Which brings me to another argument regarding how dry or not dry this year has been and what the soil moisture situation looks like.

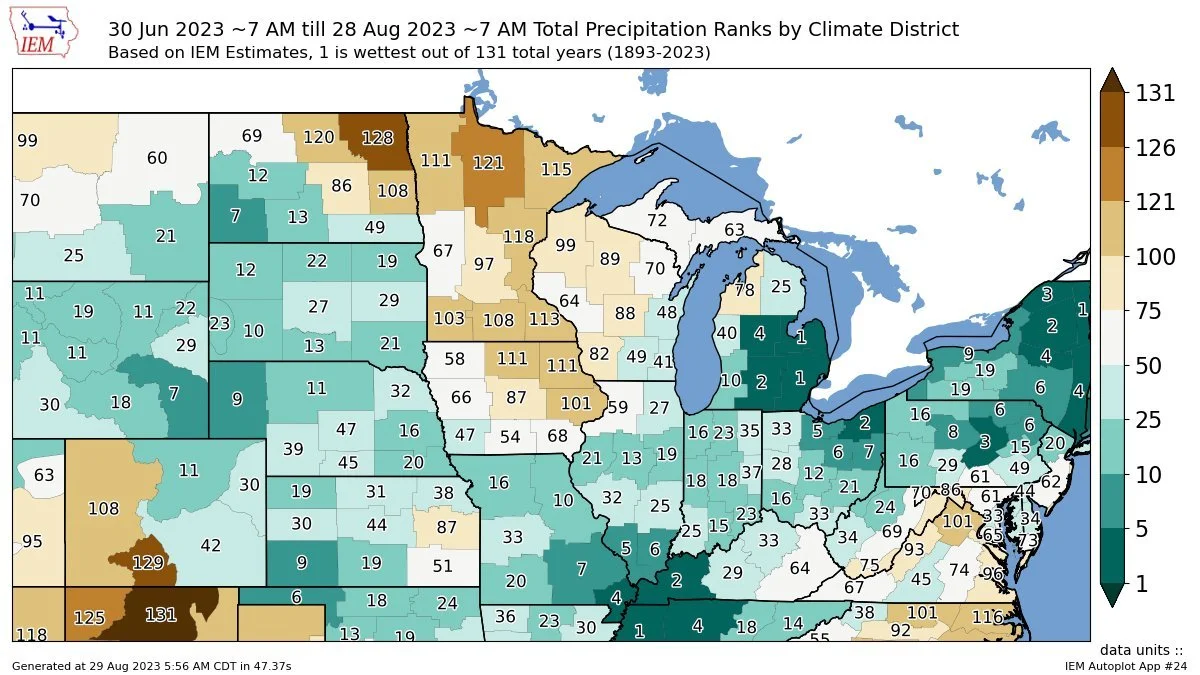

Here is how the month of August ranks precipitation wise out of the past 131 years. Some great moisture in parts of the corn belt, with the exception of north east Iowa, and Minnesota amongst a few others.

However.. this doesn’t tell the whole story.

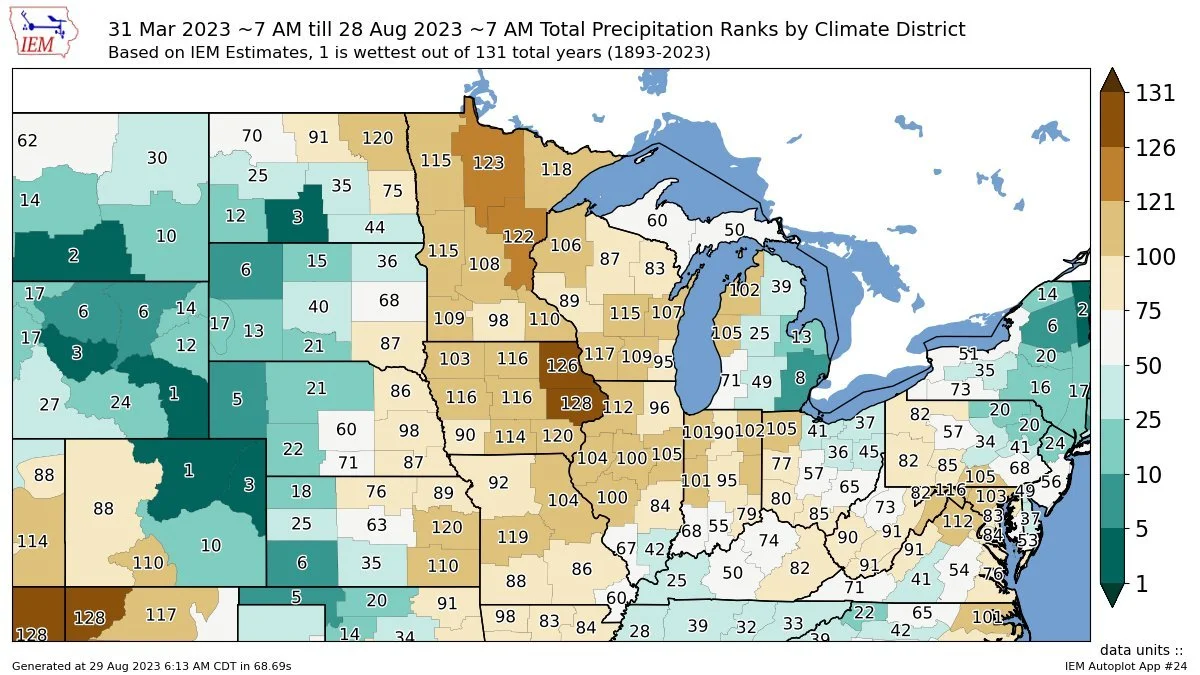

Let's figure around April 1st as the start of growing season.

Here is how March 31st until today shapes up to the past 131 year's in terms of precipitation. Still one of the driest growing seasons in history. Add on to this that it's been dry since 2020.

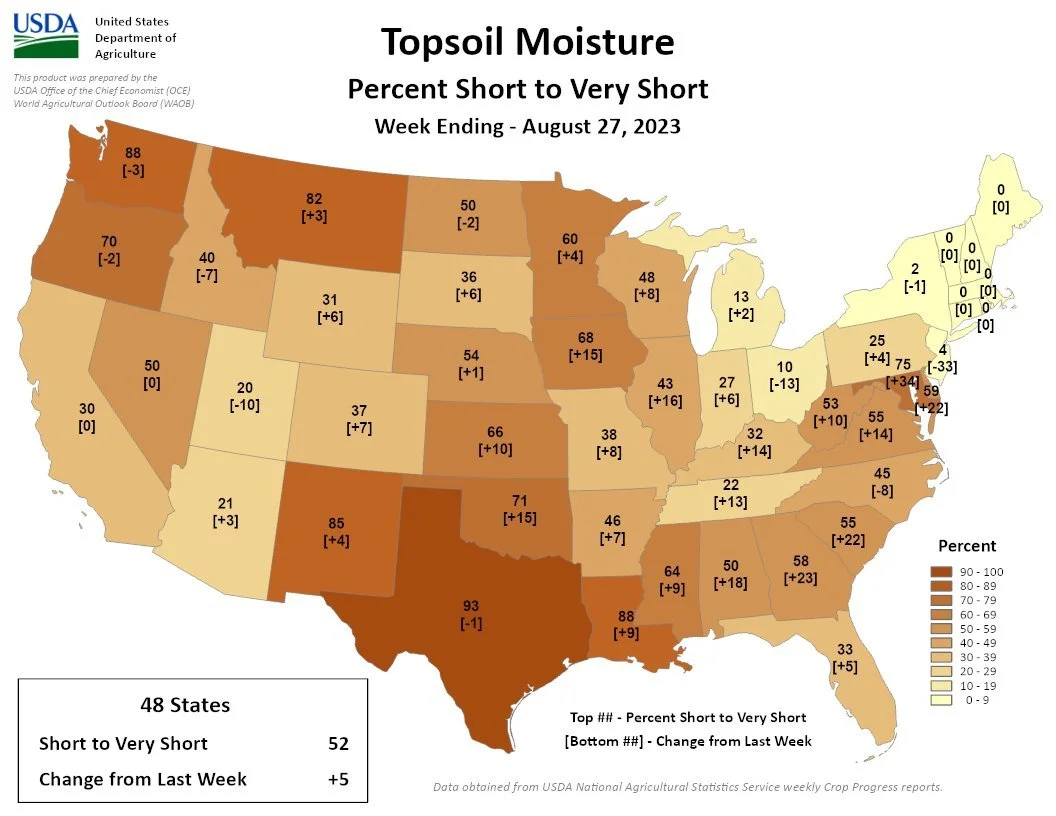

Now here is the results of such a dry growing season. This is how our topsoil moisture situation looks like.

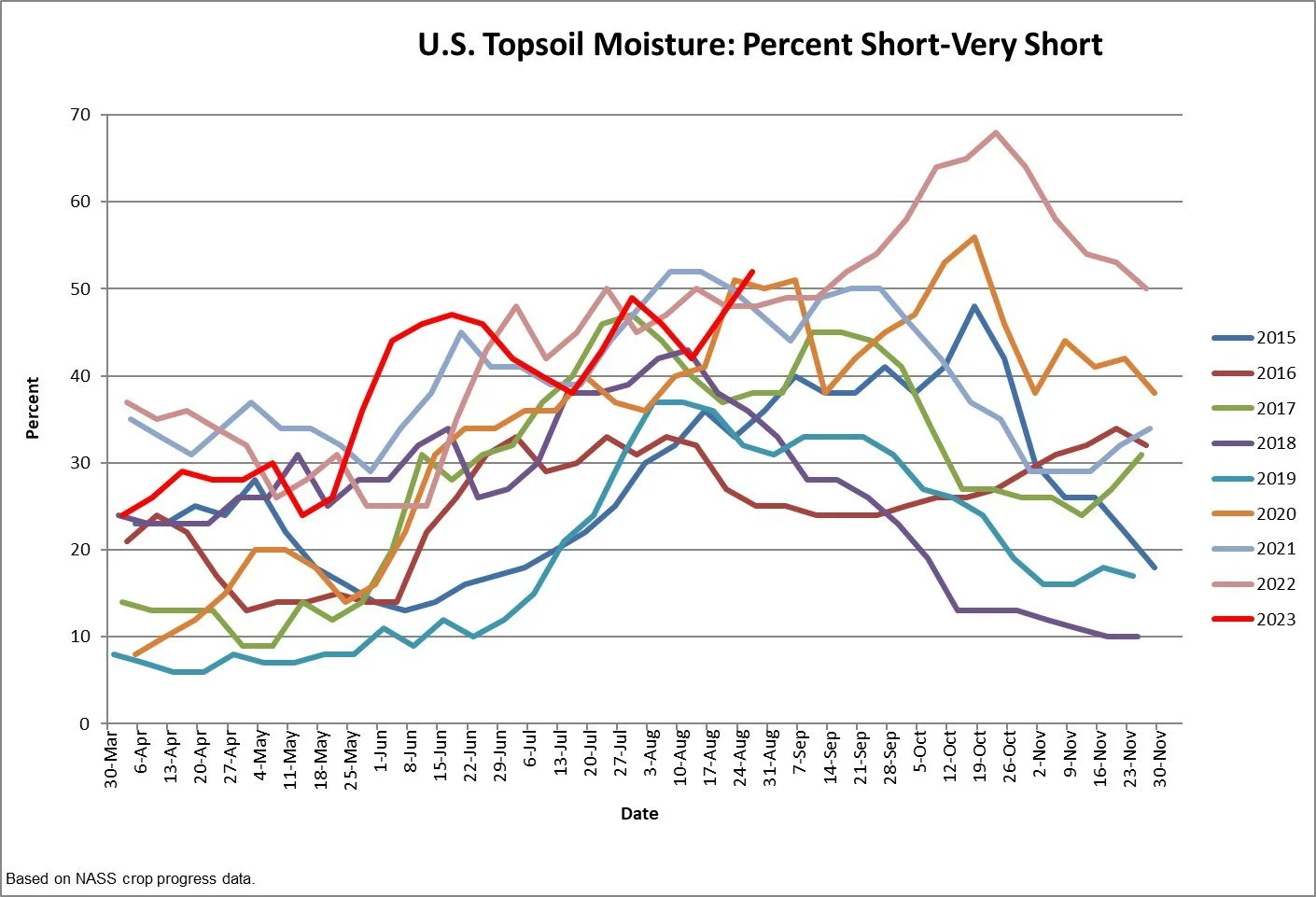

52% of the US is very short to short topsoil currently. A 5% increase from last week. This is the highest number for the end of August since the USDA began tracking this data back in 2015.

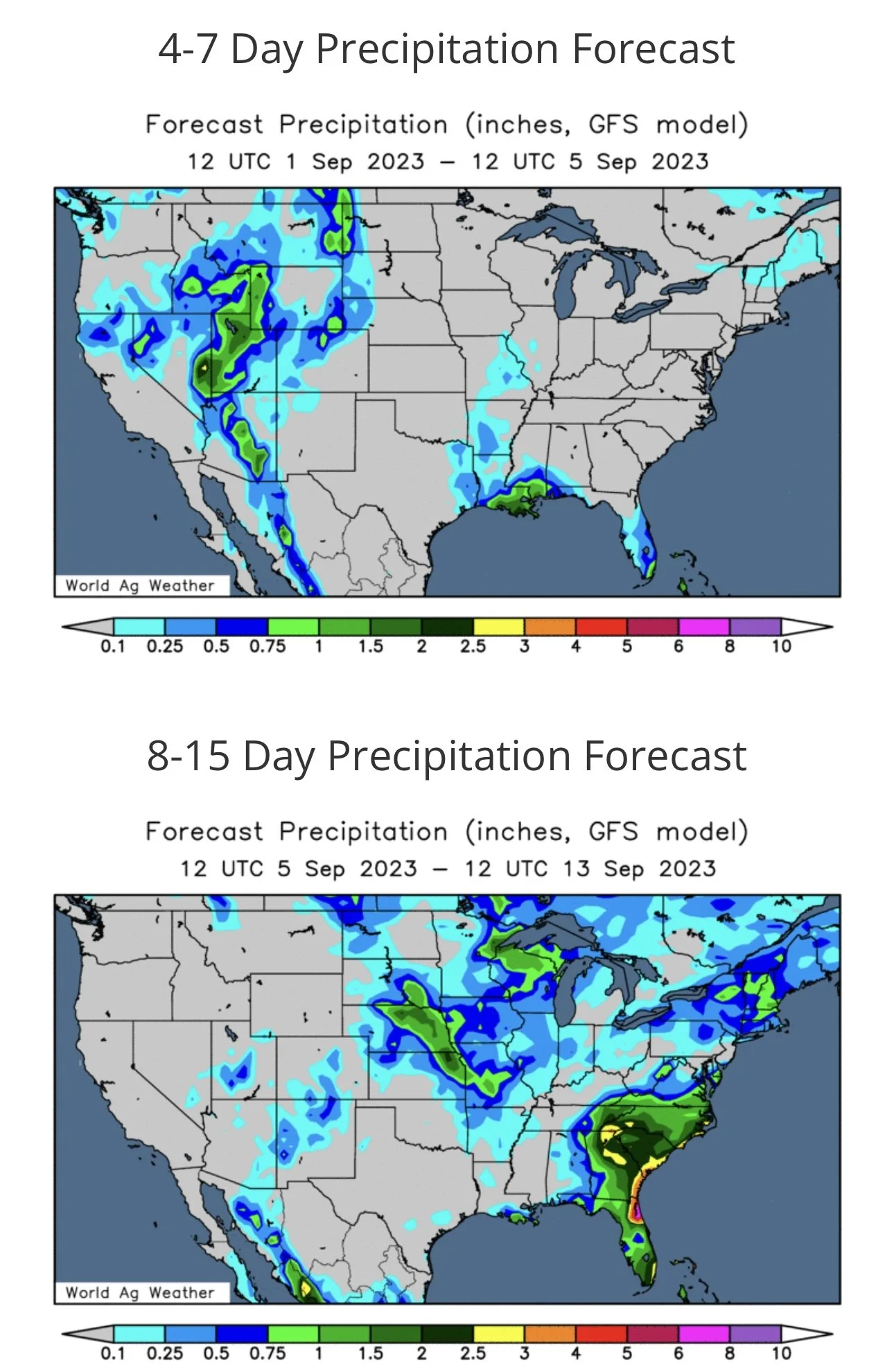

The forecasts are still bullish.

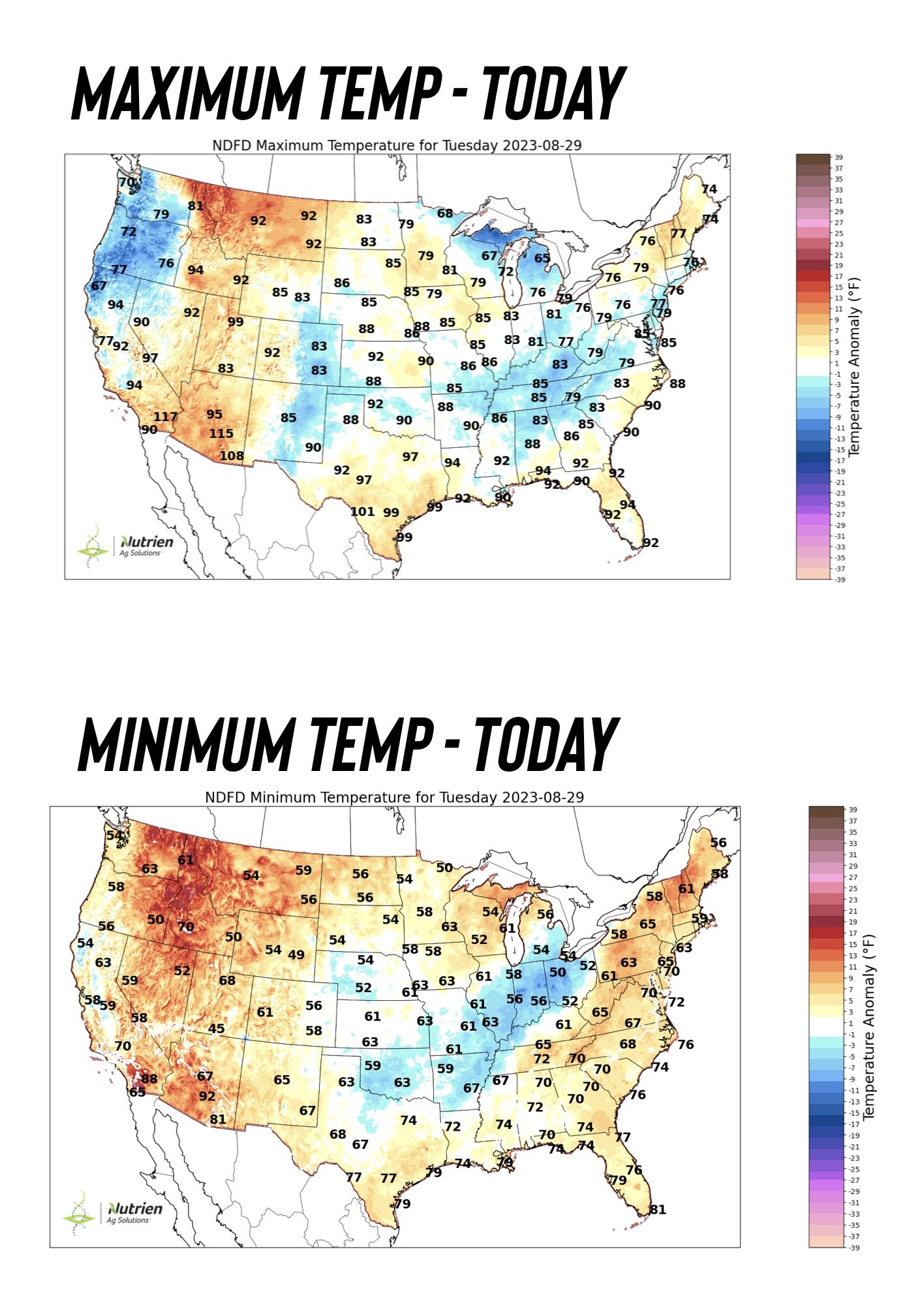

The rest of this week is relatively cooler. But that heat we just had is making a quick come back this weekend and into next week.

Here is the minimum and maximum temps compared from today to next Monday.

Still practically zero moisture for the next week.

Couple that with the heat, and we could definitely see these crops take more damage than some realize.

Overall, today's lower price action was no surprise. Could there be more downside? Of course. But I think the forecasts will continue to provide support in pushing us higher as we head into September, as the weather outlook is still bullish throughout at least mid-September.

I also am fully expecting to see crop conditions take a bigger hit over the course of the next few weeks rather than what we saw yesterday, which should ultimately provide support and help the trade realize these crops aren’t made and that this weather could indeed cause damage.

I included an oats chart yesterday, but oats were up another 2% today, as they continue to trade at their highest levels all year long.

An indication of higher prices for the grains?

Today's Main Takeaways

Corn

Corn loses nearly a dime in today’s lower price action. On the charts, today was not a great look for corn.

We had an outside down day. Meaning we took out yesterday's highs, but then closed below yesterday's lows. This was the 4th outside down day this month. Often times this is an indication of lower prices. So we will have to wait and see if bulls can hold or if we do indeed see some further downside.

This was the 8th time this month that corn has tried to close over $5 and failed, as today we had a high of $4.99 1/2, and we still haven't got a close above $5 since August 2nd. More on the charts a little later. First let's go over yesterday's crop conditions.

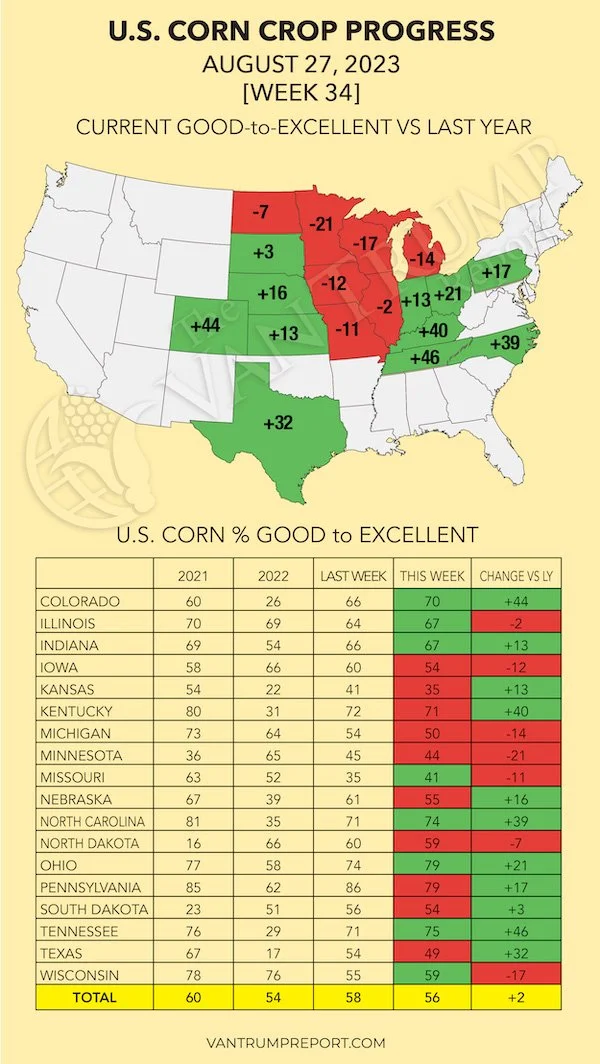

Corn's conditions report wasn’t quiet as big of a disappointment as beans were. Corn conditions fell 2% while the trade was expecting a 3% drop.

We saw Nebraska, Iowa, and Kansas all fall 6% this week. Missouri actually improved by 6%, but this improvement only brings them to a sub par 41% rated G/E.

Here are the top 5 producing states and changes they saw:

Iowa: 54% (-6%)

Illinois: 67% (+3%)

Nebraska: 55% (-6%)

Minnesota: 44% (-1%)

Indiana: 67% (+1%)

Here is the conditions compared to last year from the Van Trump Report.

One thing that's not priced in? Demand from China being far better than expected. We pointed this out the past few days, but the spread between our corn and theirs is the largest it has been in 2 years. I don’t see why we wouldn't start to see them look to us for business.

From a technical standpoint, I wouldn’t be surprised to see us go and test the $4.74 range and even perhaps look to the $4.60 area before putting in a September harvest low. Bottom line though, we are nearing the lows even if that low isn’t in as of today.

Corn Dec-23

Soybeans

Beans rally takes an unsurprising breather following this $1+ bounce. We were unable to stay above $14, but on the bright side, we did bounce off of our overnight lows and didn’t close that gap to the downside.

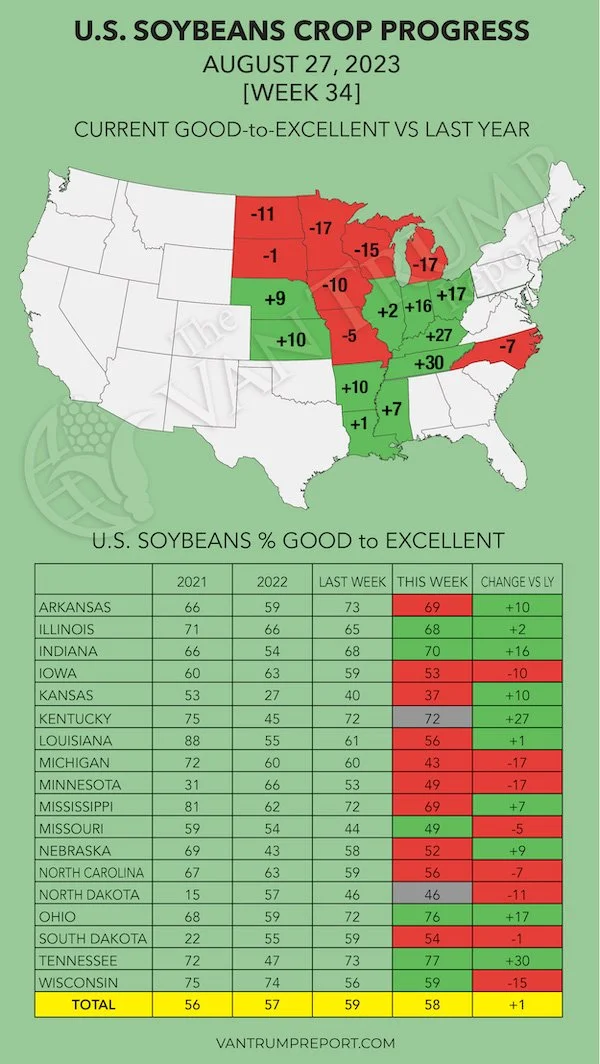

The downside today was simply due to the crop conditions yesterday not being as bullish as most including myself expected them to be. Sure they dropped, but nothing close to what a majority had expected. Especially with the heat and absence of rain in states such as Iowa, Nebraska, and Minnesota.

Some major changes we did see included; a massive 17% drop to Michigans bean ratings, now at 43% G/E. Both Iowa and Nebraska dropped 6%, while Missouri improved by 5% to 49% rated G/E.

Here was the changes for the top 5 producing states:

Illinois: 68% (+3%)

Iowa: 53% (-6%)

Minnesota: 49% (-4%)

Indiana: 70% (+2%)

Nebraska: 52% (-6%)

Yes, these results were disappointing for bulls. But that doesn’t mean the next few weeks will be. Here is what Kevin over at the Van Trump Report had to say,

"Most traders I know are taking the USDA's updated crop conditions with a grain of salt. I live in Missouri and trust me when I say I experienced record breaking heat, yet somehow the overall crop conditions in Missouri improved by +5%. How is that possible when the same report showed weekly corn conditions deteriorating by -6%?"

He also went on to say that St. Louis broke the long standing heat index record of +110 degrees that lasted 6 straight days of blistering heat. It wasn't just Missouri, there were heat records broken across the midwest.

Highly respected crop consultant Dr. Cordonnier cut his US soybean yield estimate by 1 bushel down to 50 bushels an acre. He also stated that he has a neutral to lower bias towards the crop.

From Wright on the Market,

"Speaking of bullish, the November to July bean carry lost a whopping 6½¢ Monday! The futures market is paying only 6¢ to store soybeans from November to July. Corn futures are paying 25¾¢ to store corn from December to July, which is down from 28¼¢ one day last week."

Now is still a great place to take risk off the table if you need to do so. Whether that is because you haven’t made any sales or need to put a floor in. We are right around $14, and we have all seen just how quickly we can drop if the forecasts change. Yes, I think we are in for higher prices, but you need to be comfortable. If that means making sales, then make some. Some would suggest you be somewhere around 50% sold of your expected new crop production. However, we realize every single operation is different and everyone has different needs. If you want specific advise on your situation shoot us a call at 605-295-3100 and we will gladly help you.

Demand is solid. The weather remains bullish. We can’t afford to lose bushels on this crop. So I do expect us to keep climbing even though it it usually a difficult task for beans to lead us higher going into harvest. But given the circumstances, they might just be able to do so. We are going to see a not so favorable end to the growing season which will further pressure yield as well as seed size. The recent damage could also very well be being underestimated.

I just don’t think this bull run is over yet. The funds are still long, and there isn’t much reason for them not to continue to pile on here.

Soybeans Nov-23

Wheat

The free fall in wheat continues as wheat makes contract lows and Chicago trades to it's lowest levels in 33 months.

Bulls look at some slightly better export inspections and of course the uncertainty regarding war, while bears are looking at some improvements over in Argentina's weather, as well as rumors that Turkey is trying to resolve the Black Sea situation between Russia and Ukraine.

As mentioned, we also saw some pressure from the weakness over in the Russian wheat market which has bled into our market.

Stats Canada estimates that their wheat production is down 14.2% from last year. As they have their wheat production at 29.5 MMT which is 900k MT less than the average pre-report estimates

Winter wheat harvest is essentially over, while spring wheat harvest is now over half way done.

Overall, there isn't a ton of news or things for bulls to chew on here which typically results in lower prices. There just isn’t a huge reason for wheat to see this massive rally out of nowhere aside from the possible war wild card.

Seasonally, the trend turns upwards starting next week for the wheat market. So we could potentially be looking at our lows very soon.

Sure, there isn’t a reason for wheat to rally today. But there will be. Australia's crop is far worse than last year. We have global problems. The funds are extremely short as they have been for nearly a year now.

So many could look at this as a great buying opportunity when taking a bigger picture and long term outlook. At the same time I am not trying to catch a falling knife and pick out a bottom.

Chicago Dec-23

KC Dec-23

MPLS Dec-23

SA Weather Webinar

We will be participating in a webinar with Texas Hedge Risk Management about South American Agriculture on September 6, 2023, at 2:00pm.

If you would like to register for this event, please click the link below. We look forward to hearing from you!

Webinar Registration Link

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

8/28/23 - Market Update

WEATHER REMAINS BULLISH BUT CROP CONDITIONS DISAPPOINT

Read More

8/27/23 - Weekly Grain Newsletter

ECON 101 APPLIED TO GRAIN SALES

Read More

8/25/23 - Market Update

BEANS CONTINUE BULL RUN

Read More

8/24/23 - Audio

BEAN DEMAND STORY CONTINUES TO GROW AS CROPS GETTING SMALLER

8/23/23 - Market Update

CROP TOURS, BRUTAL HEAT, & NO RAIN

8/22/23 - Audio

DON’T PANIC. TODAY REINFORCED HIGHER PRICE OUTLOOK

8/21/23 - Audio & Market Update

MARKETS PLAYING LEAP FROG

8/20/23 - Weekly Grain Newsletter

WHY THIS IS MORE THAN A DEAD CAT BOUNCE..

Read More

8/18/23 - Market Update

GRAINS BOUNCE. WEATHER REMAINS BULLISH

8/18/23 - Audio

WEATHER,WAR, & MANAGING RISK

Read More

8/16/23 - Audio

CAN DEMAND & WEATHER LEAD TO A BOUNCE?

8/15/23 - Audio

GRAINS LOWER WITH IMPROVEMENT TO CROPS

8/14/23 - Audio

BEANS RALLY BUT CONDITIONS IMPROVE & WHEAT DISAPPOINTS

8/13/23 - Weekly Grain Newsletter

WHAT’S NEXT FOLLOWING DISAPPOINTING USDA REPORT?

8/11/23 - Audio & Report Recap

USDA REPORT BREAKDOWN

Read More

8/10/23 - Audio