WEATHER REMAINS BULLISH BUT CROP CONDITIONS DISAPPOINT

Overview

Soybeans continue their rally, back over $14 after trading below $12.85 less than 3 weeks ago. Corn follows beans higher, up nearly 9 cents as both gap open higher. While the wheat market continues to disappoint, trading lower across the board as we look to test our recent lows.

The trades main focus has been on the weather, which we will get to in a moment.

We saw a few sales of both corn and beans this morning which was supportive. Today marked the 6th straight Monday in a row that we saw a sale of beans.

Crop conditions came out after and close. They were highly disappointing for the bulls. As soybean rating dropped ONLY 1% from last week to 58% rated good to excellent, while corn dropped 2% from last week to 56%. Both of these were 1% to 2% better than the trade was expecting.

Everyone, even the bears of the industry were expecting a larger decline, especially to the bean crop.

Will be interesting to see how the trade reacts and if they discount the damage from the last week or trade the dry & hot forecasts.

The weather is slightly cooler to start this week, but heats right back up this weekend into next week. As majority of the corn belt is expecting anywhere from 8 to 11 days a row in the 90's, with many areas especially in the western belt seeing temps above 100.

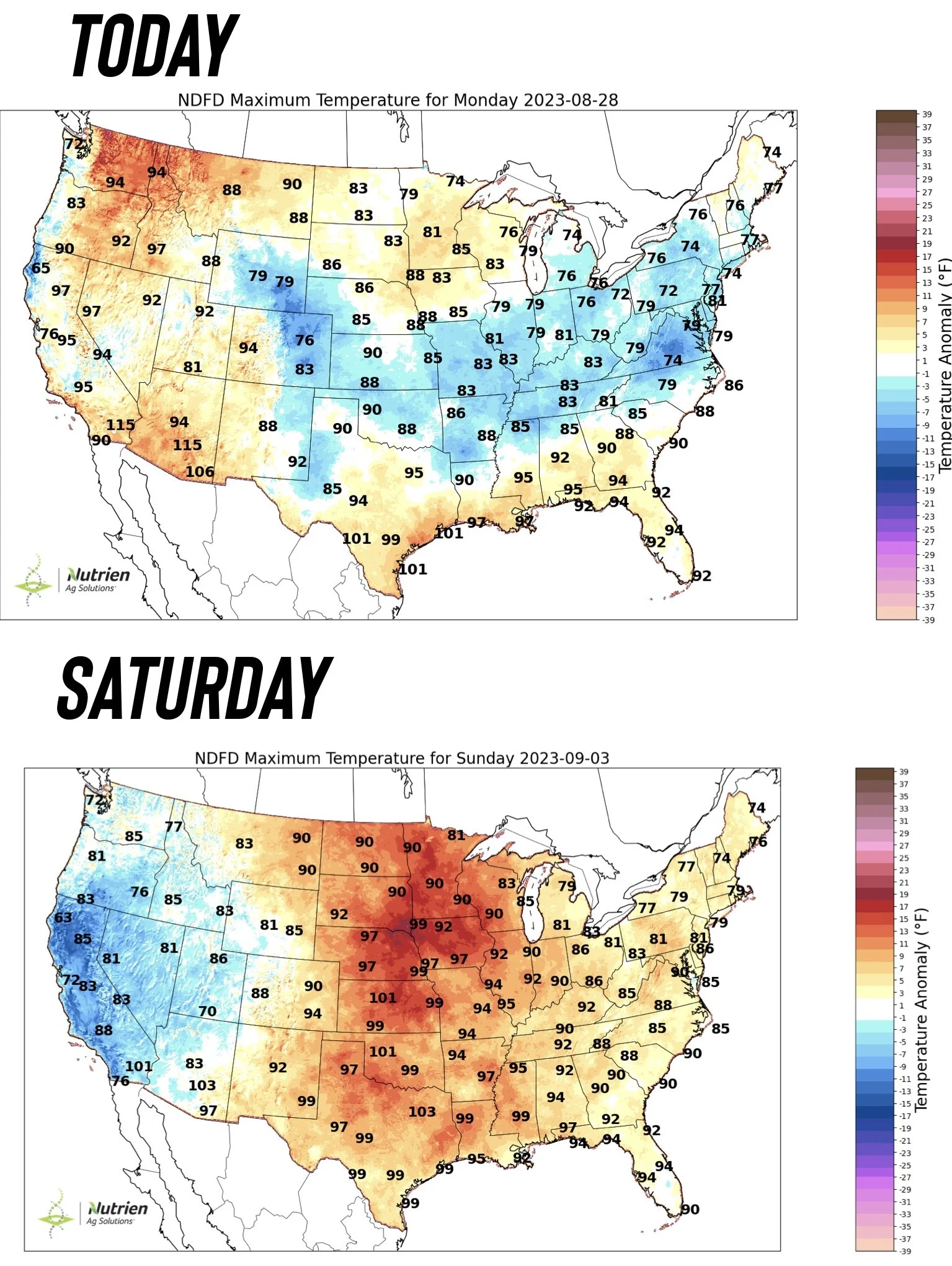

Here is the maximum temps from today and next Saturday.

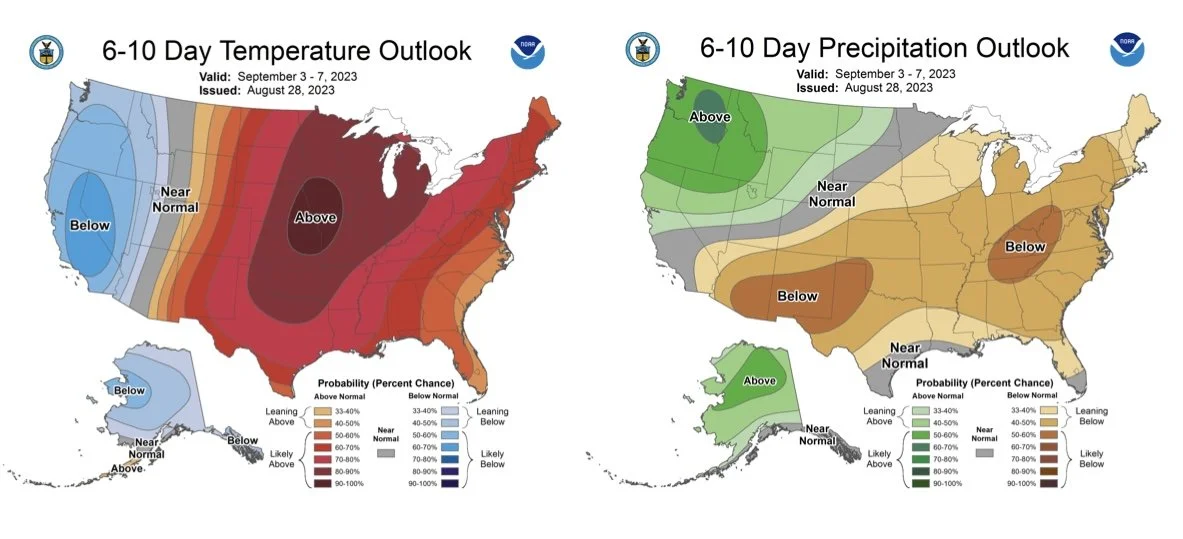

Here is the 6 to 10 and the 8 to 14 day outlooks.

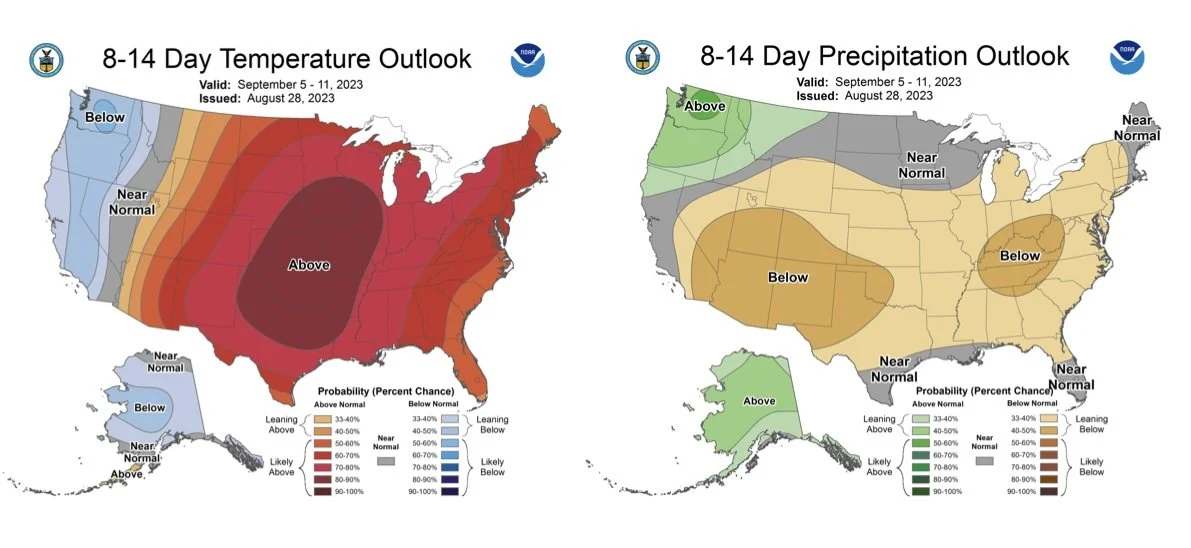

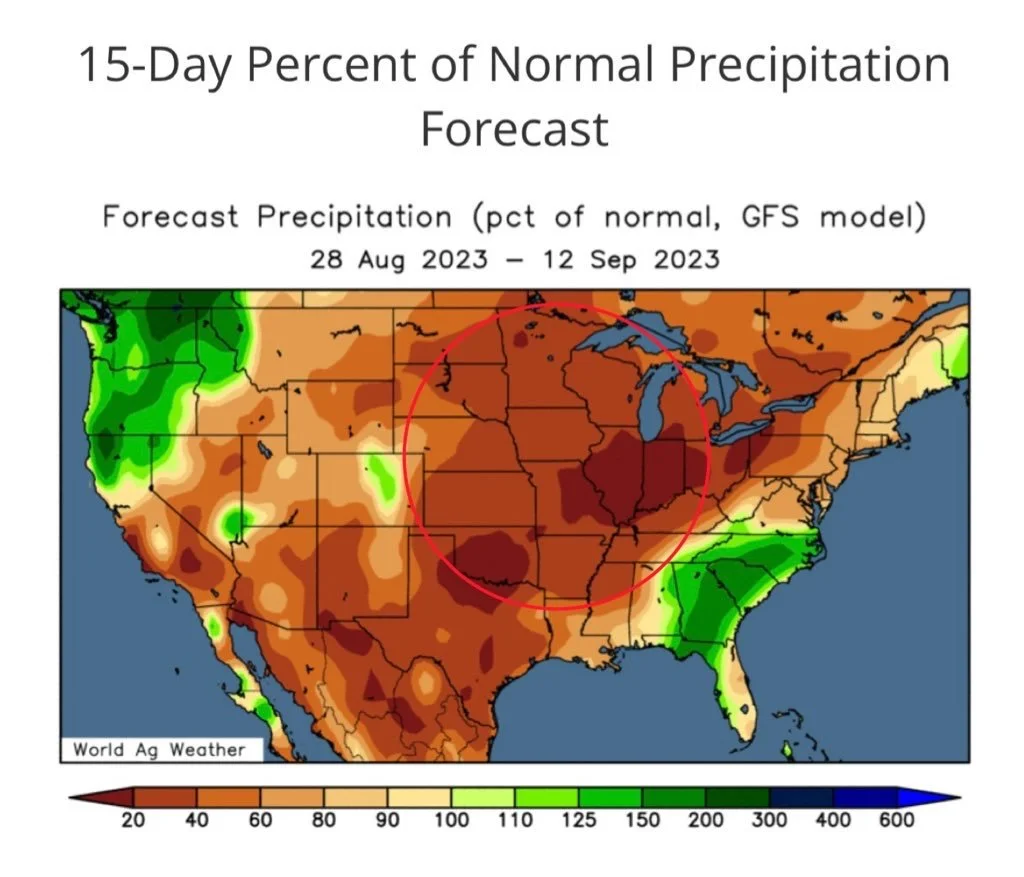

Not only does the heat continue, but look at the lack of moisture.

Zero rain forecasted for the corn belt over the course of the next week.

Not a good look for the bean crops. As mentioned last week, at this point in the maturation cycle, moisture is so crucial. If we don’t get moisture, it could very well result in some pretty heavy losses to yield.

If the forecasts stay true, I can only imagine we are in for some much larger declines to crop conditions the next few weeks than we saw today.

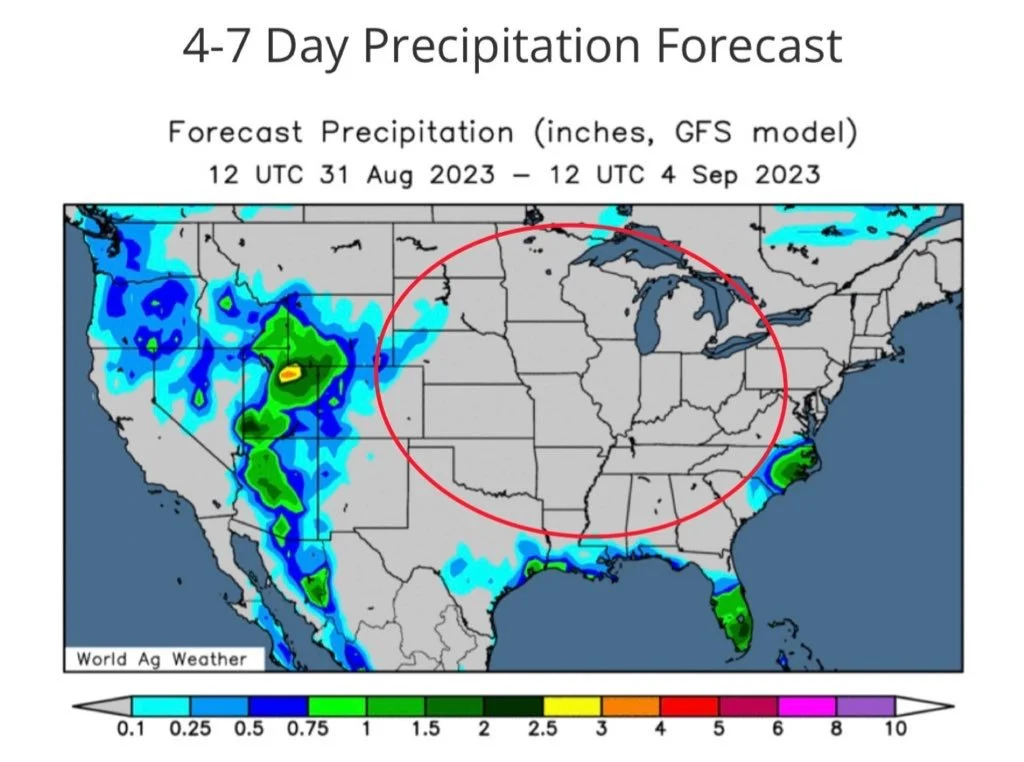

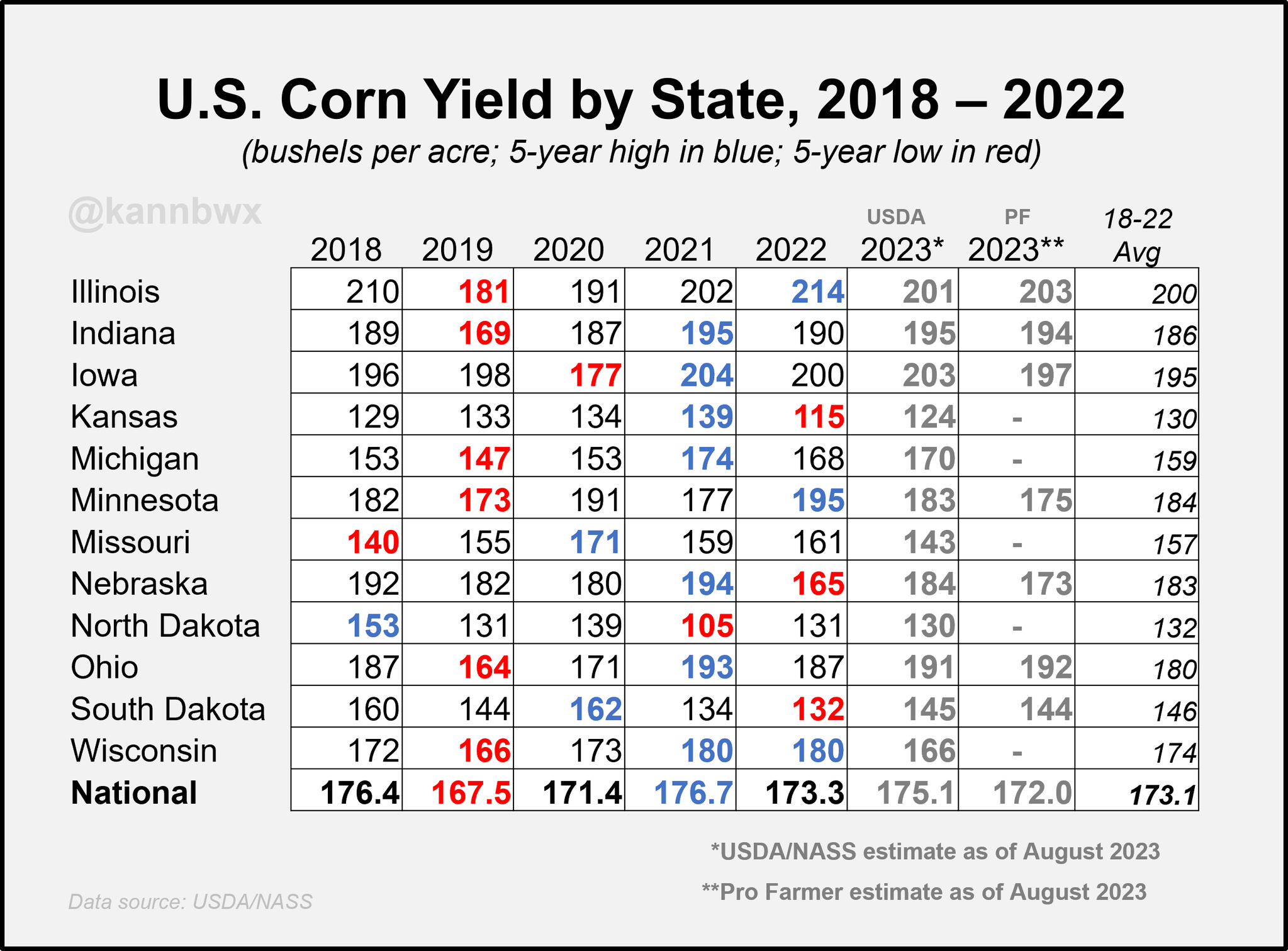

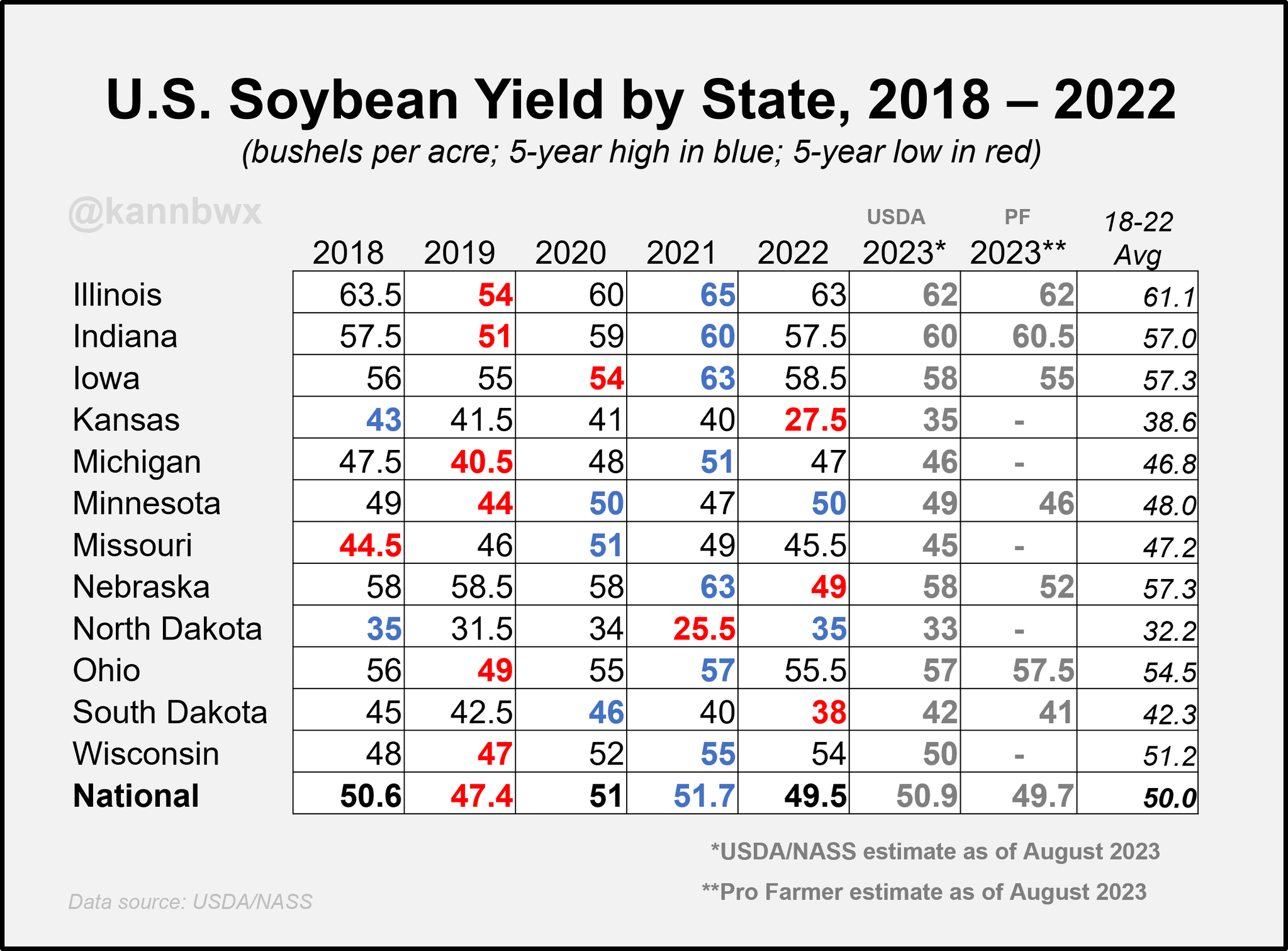

Here is the Pro Farmer vs USDA yield estimates from Friday in case you missed them. Both charts are from Karen Braun.

Pro Farmer sees big downside in Minnesota and Nebraska corn, and a sub-200 bpa crop in Iowa. However, Pro Farmer saw some small upside in Illinois.

Pro Farmer has their bean numbers similar to last year's. However, they have Nebraska, Iowa, and Minnesota far below the USDA's number.

Oats were up another 1% today. Now up nearly 9% the past 5 trading days alone. Historically, the oat market is often an indicator for grain prices prices.

So the question remains, do oats know?

Looking forward this week, I wouldn’t be surprised to see the disappointing crop conditions pressure corn and beans tomorrow. But after the trade soaks it in, I think they again begin to look at the bullish weather headlines we have coming next week.

For you sunflower guys, here was some news over the weekend.

Today's Main Takeaways

Corn

Corn follows beans higher, as we again near the $9 mark, closing today at $4.98. As we haven't had a close above $5 since August 2nd.

Crop conditions came in 2% lower than last week, coming in at 56%, which was less than expected. However, Iowa on the other hand looks to be declining extremely fast, falling 6% from last week. This also happens to be the bullseye of this upcoming heat wave and dryness. So something to definitely watch out for.

Pro Farmers final yield estimate came in at 172 bpa. With a range of 170.3 to 173.7 bpa. This number is well below the USDA's 177 bpa. Which had the bulls excited.

Bulls are also looking at the recent brutal heat possibly leading to further stress on the crops. But bears then point out that our planted acres could offset any reduction in yield. Even if we get a reduction to yield, they argue US ending stocks will still likely be large. As demand is still one of the biggest things keeping a lid on corn.

In yesterday's newsletter, we pointed out that the spread between US and China corn is over $5 a bushel. The largest it has been since the fall of 2021. The exact reason why we think China will be buying our corn very soon.

Corn production in the EU is expected to be 10% below their average.

Seasonally, we are nearing lows. Are this year's lows in? Maybe, maybe not.

Last year we made our lows on July 22nd. In 2021 we made them on September 10th. In 2020 it was August 4th.

So bottom line, although there is potential for another leg lower before we find a definite bottom, we are close.

The following is from Wright on the Market,

"If you have September basis contracts you need to price this week…"

That sentence meant exactly what it said, September basis contracts. That did not include corn in the bin and it did not include December, March, May or July corn basis contracts. Corn is going higher this fall.

For those of you who cannot roll September basis contracts to December, we recommend buying futures or December call options just before or just after the September 12th USDA S&D Report to replace (re-own) the corn you had to sell this week on September basis contracts.

Here is what I included Friday that still pertains to today,

If you made sales around $6, this area isn’t a bad spot to be looking at cheap calls over the course of the next 1 or 2 months. Remember, we don’t want to chase a rally. That is why it is called hedging. We like buying calls while they are still on sale.

If you are worried about the market dropping even further, perhaps look at cheap puts. Using puts to establish a floor is not the worst idea in the world.

Every operation is different and requires different strategies to meet their needs. If you need help making any decisions at all, give us a call or text anytime at 605-295-3100.

Taking a look at the charts, we need a break above that bear downward trendline. My first upside target is still a gap close above in the $5.25 range. With support in the $4.60 if we were to make one more leg lower.

Corn Dec-23

Soybeans

Beans continue their rally, up 18 cents on the day, adding to last week's 34 cent gains. As beans are now over $1.20 off their lows from 3 weeks ago.

Today marked the 6th straight Monday in a row that we saw an export sale for soybeans.

Crop conditions were disappointing for bulls. Only dropping a 1%.. I still think we are due for some much larger drops in the coming weeks especially if these forecasts are at all accurate.

Similar to corn, although overall the conditions disappointed bulls. Iowa bean ratings also dropped a big 6% from last week. As mentioned, this is smack dab in the middle of this upcoming brutal heat and lack of rain coming over the course of the next week or so.

Pro Farmers final yield estimate is 49.7 bpa, with a range of 48.7 to 50.7 bpa. What would happen if yield did come in sub 48.5 to 49.5?

Currently the USDA has bean yield at 50.9 bpa, on 82.7 million acres with a carryout of 245 million bushels. If yield does fall and we lose 3 bushels, we would end up with a negative carryout if the demand was the same as the USDA printed.

Now this can’t happen, because we cannot use what is not there. So how do we curb demand? The most common solution would be to see higher prices.

We can't afford to lose bushels in beans, and demand isn't slowing down.

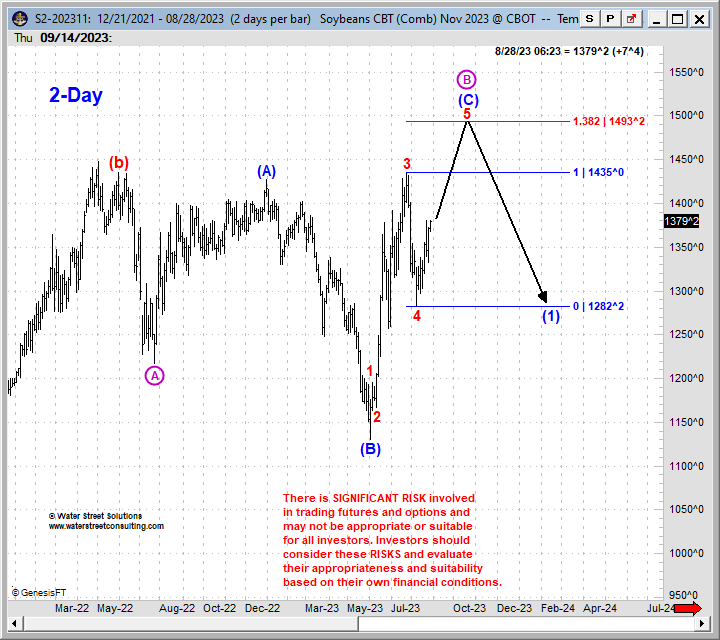

I included this chart from Darren Frye last Friday, but again wanted to throw it out here. This is what he sees happening if yield falls below 49.5 bpa. He thinks we will top out at nearly $15. One thing to keep in mind, this guy is actually known for traditionally being bearish. So him thinking the soybean situation could play out this way says a lot.

I think the drag we are going to see to yield from the recent and upcoming weather is going to be much worse than the trade had originally been anticipating.

Today was the 18th day out of 160 days this year that soybeans have been over $14.

From Chris Robinson of the Robinson Report,

"If you hated managed funds when we were at $11.30, take vengeance on them today when they helped get us back to $14. They just gave you $2.70 per bushel back of revenue. $13,500 on every 5k bushels you grow. Sell or hedge, but get off the bench and into the game."

I agree with what Chris is saying. Although I completely believe there is a strong argument that we will be going higher, potentially to the $14.90 to $15 range if the cards get played right. We still need to be doing what makes you comfortable and profitable. If that is by making sales, then make some. Scared of the downside? Look at puts. If you sell and we do rally, you can always lock in puts to make money on the way down that you didn't on the way up. There is nothing wrong with taking risk off the table when it makes sense to do so.

Yes, I think we will go higher than where we closed today ($14.06), but we know how quickly things such as the weather can change. We need to keep in mind we just rallied $1.20 in less than 3 weeks, and earlier this summer we were trading sub-$12.

If you need help or have any questions at all, do not hesitate to reach out at 605-295-3100 anytime and we'd be more than happy to help.

With crop conditions not falling as much as bulls would have liked, I wouldn’t be surprised to see this rally take a short breather. But that doesn’t mean the rally is over. Weather remains bullish. Demand remains strong. And I think we are in for higher prices in the near future. But don’t let that stop you from making calculated and smart decisions based on your situation and operation.

If forecasts stay this hot and dry, we likely continue to add weather premium and push higher. If this heat breaks and we get rain, we probably go lower.

Taking a look at the charts, the next target is our July highs of $14.35, then our contract high in April of 2022 at $14.48. Both of which are reasonable targets from here barring any major shift in the weather.

Soybeans Nov-23

Wheat

Wheat continues to be the weak spot of the grains to no ones surprise. As we add some more losses on to last week's 10 to 20 cent losses. As both Chicago and Minneapolis made new lows.

Bulls are trying to get some of those losses back with potential war and weather premium sitting there, but have struggled this far.

Down the road, global problems will start to unfold and paint a brighter picture and give wheat a reason to rally, but as mentioned last week, there isn’t a timeline for when this will happen. Could still be weeks or even months from now.

There is still definitely the possibility to see further war escalations, but of course those are impossible headlines to try and predict. We are still looking at the possibility of Ukraine disrupting Russian exports, but that is still a bit what if scenario.

Seasonally, this is a point and time where we tend to make our lows.

Taking a look at Chicago, we did make a new low, and are sitting right at support of our lows from earlier this month. Will we hold or make another leg lower? I wouldn’t be surprised to see KC join Chicago and Minneapolis here and look to test its yearly lows which are only a nickel away, before finding a bottom.

Overall staying patient and waiting for the lows to be put in, not trying to catch a falling knife in the process. While keeping in mind there is still the possibility for weather or war wild cards to be dealt at any moment.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

8/27/23 - Weekly Grain Newsletter

ECON 101 APPLIED TO GRAIN SALES

Read More

8/25/23 - Market Update

BEANS CONTINUE BULL RUN

Read More

8/24/23 - Audio

BEAN DEMAND STORY CONTINUES TO GROW AS CROPS GETTING SMALLER

8/23/23 - Market Update

CROP TOURS, BRUTAL HEAT, & NO RAIN

8/22/23 - Audio

DON’T PANIC. TODAY REINFORCED HIGHER PRICE OUTLOOK

8/21/23 - Audio & Market Update

MARKETS PLAYING LEAP FROG

8/20/23 - Weekly Grain Newsletter

WHY THIS IS MORE THAN A DEAD CAT BOUNCE..

Read More

8/18/23 - Market Update

GRAINS BOUNCE. WEATHER REMAINS BULLISH

8/18/23 - Audio

WEATHER,WAR, & MANAGING RISK

Read More

8/16/23 - Audio

CAN DEMAND & WEATHER LEAD TO A BOUNCE?

8/15/23 - Audio

GRAINS LOWER WITH IMPROVEMENT TO CROPS

8/14/23 - Audio

BEANS RALLY BUT CONDITIONS IMPROVE & WHEAT DISAPPOINTS

8/13/23 - Weekly Grain Newsletter

WHAT’S NEXT FOLLOWING DISAPPOINTING USDA REPORT?

8/11/23 - Audio & Report Recap

USDA REPORT BREAKDOWN

Read More

8/10/23 - Audio