WHY WE WILL BE THANKING THE MARKET FOR LOWER PRICES

WEEKLY GRAIN NEWSLETTER

Here are some not so fearless comments for www.dailymarketminute.com

April was a brutally ugly month for grain prices and last week did a majority of that damage. The main headlines for the puke selling included China canceling corn purchases, fund technical selling, weather, and a lack of bullish headlines.

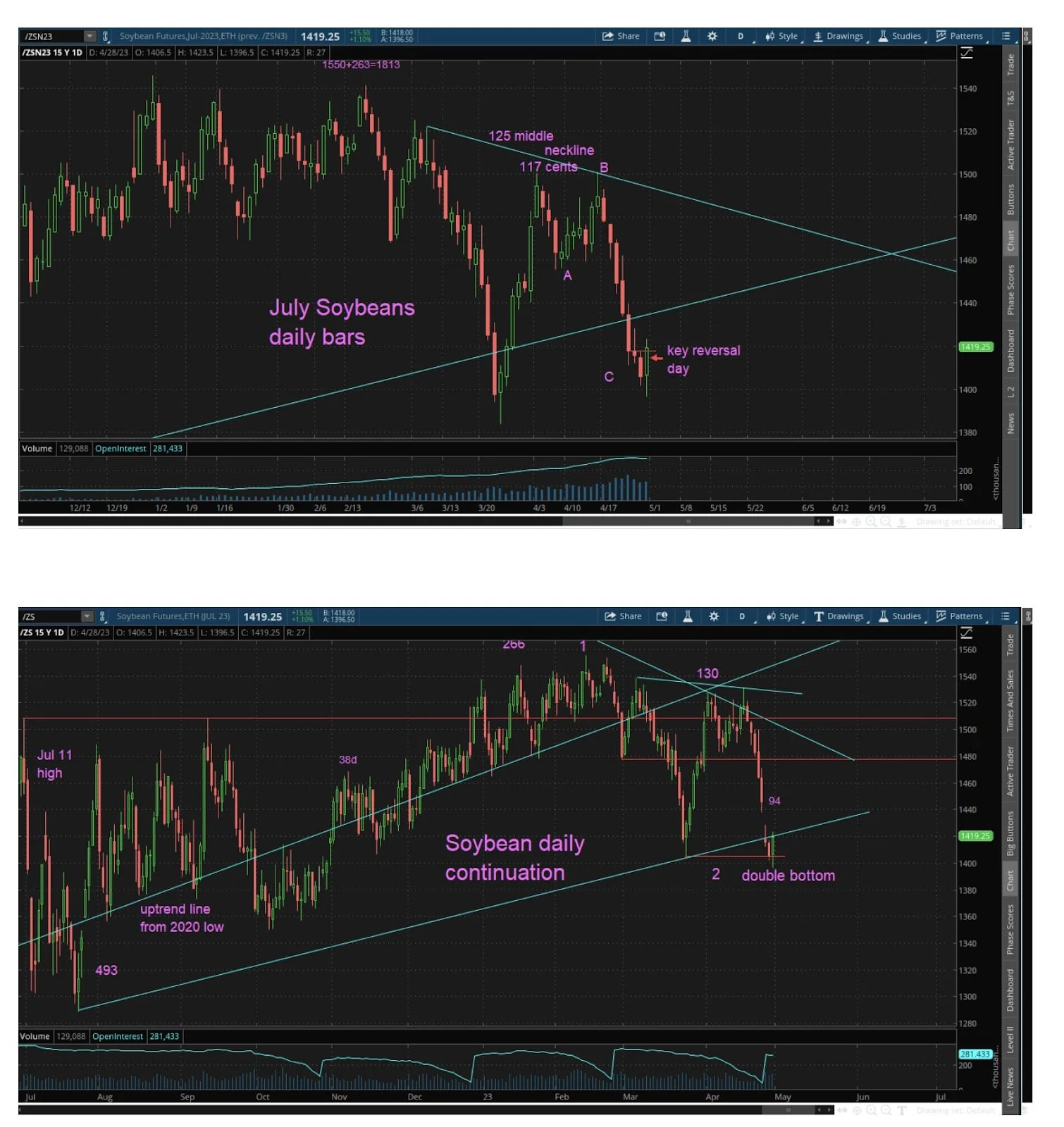

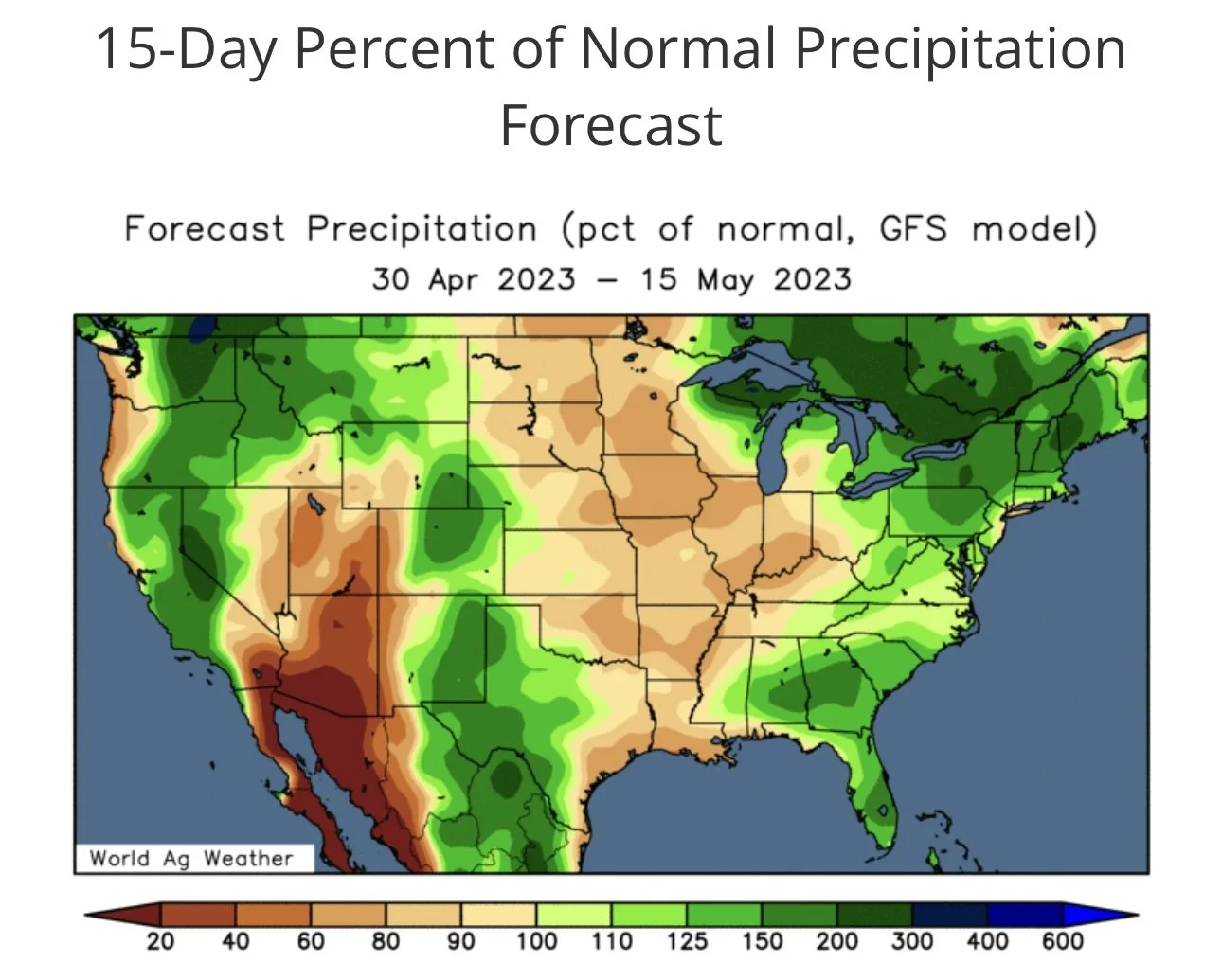

The good news is that on Friday the market left a little hope with markets reversing a little bit and in the case of July soybeans we had a key reversal on the charts.

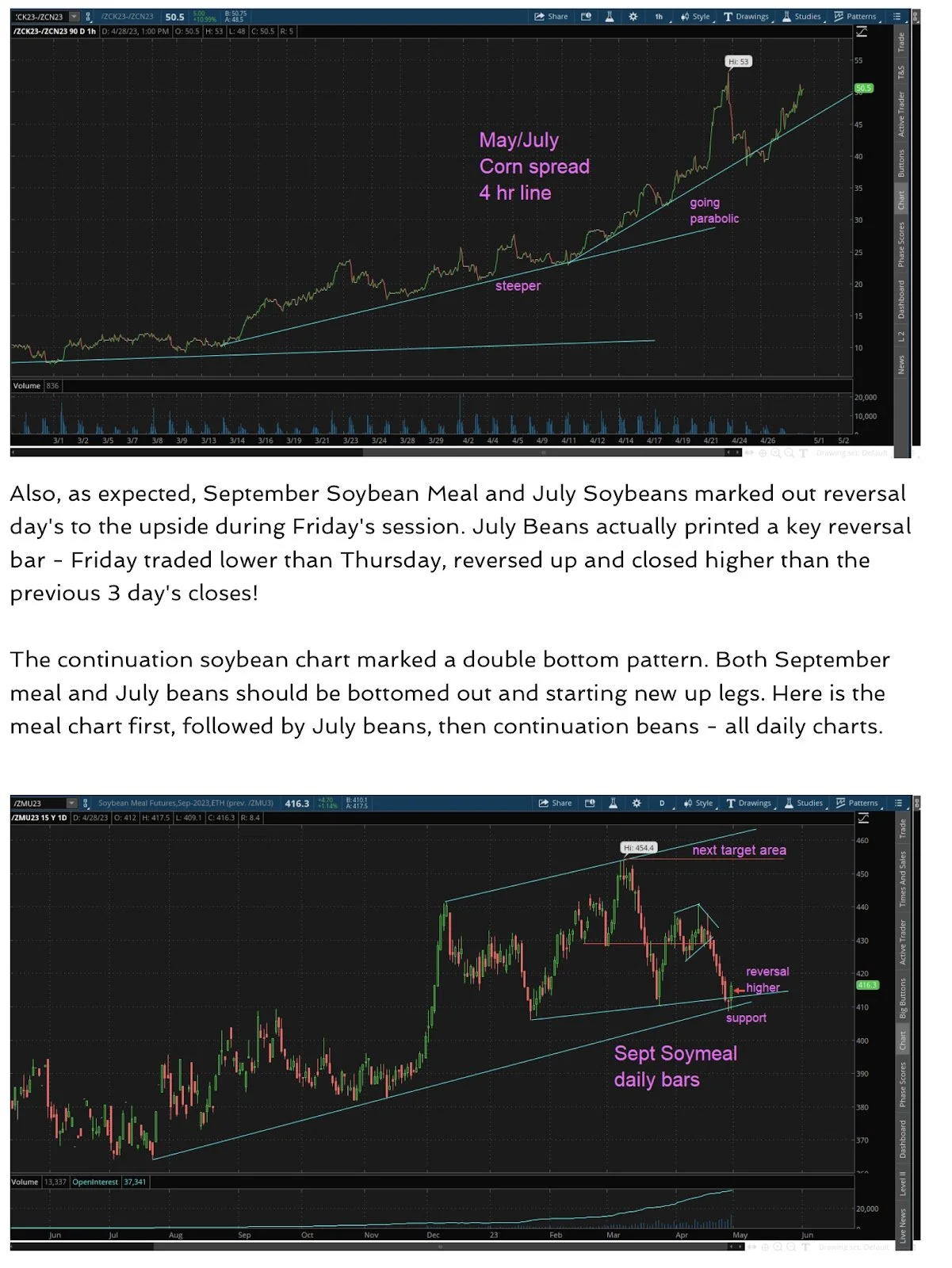

Now the question becomes what will happen in May, will the selling continue or can our markets add some weather premium back into the prices? Can our tightness with our old crop carry over which has had a very firm basis and inverted spreads lead to a bounce in the futures markets? As mentioned previously several times the way to get supply to the market is to firm basis, firm spreads, and then firm futures. With number 1 and number 2 already having check marks against them no one would be surprised at all if we get a bounce on the board.

Even some of the biggest bears in the industry have said that the market is overdone to the downside and that there is still hope on old crop prices. The funny thing is that there are far less advisors still saying that old crop prices could or should bounce. Now after a 30 cent loss for corn and beans last week and a dollar or so loss for KC wheat in the past couple of weeks far fewer are predicting higher prices. While even more have jumped to the bear side for new crop price outlook.

To me the more that jump on the bear bandwagon, along with the cheaper the prices get, the higher the likelihood is that we do go much higher.

Everyone knows that high prices cure high prices. Some believe the high prices we have had the past couple of years have created a little demand destruction. I am not in that camp because our rally a few years ago started from demand, not from supply or production concerns. It was from demand growth. The only demand destruction I see is from a lack of supply availability. We have seen some beans from Brazil get sold to the East coast of the US and some are worried that corn could do the same thing. We should keep in mind that nearly every year those areas have to import some from Brazil because we simply don’t have the supply in the right areas where the demand is. Freight from the Midwest to the East Coast isn’t cheap, so naturally buying harvest crops out of Brazil to the East Coast is going to happen at the tail end of Brazilian harvest.

Keep in mind that we could also see the opposite happen when the US starts harvesting and the supplies in SAM are dwindled down. With the Argy crop this year, it wouldn't be a surprise at all to see US soybeans in Oct/November get sent that direction?

In this advisor’s opinion, as the world grows and economy’s grow we don't have supply growth in the same areas as demand growth. How could we if demand growth comes from cities expanding along with lifestyle improvements or food intake increases that demand more protein?

Timing

We have thought for a long time that we would see a seasonal rally around this time, but we also know that both timing and price prediction are easier said than done. We do know that emotion physcology of the market does help create repeat type price action.

We believe that this will create a boomerang on our prices in the future.

Here is a little more technical information from the Tech Guy at Wright on the Markets:

Notice that the tech guy mentions the reversal in beans as well as double bottoms and tests of support areas.

This week we will find out if these hold and we get some follow through positive price action from Friday’s reversal. Some of the fundamental things that we will have to watch will be outside market reaction of what happens with First Republic Bank and how that impacts money flow and possibly what the Fed does or says later in the week.

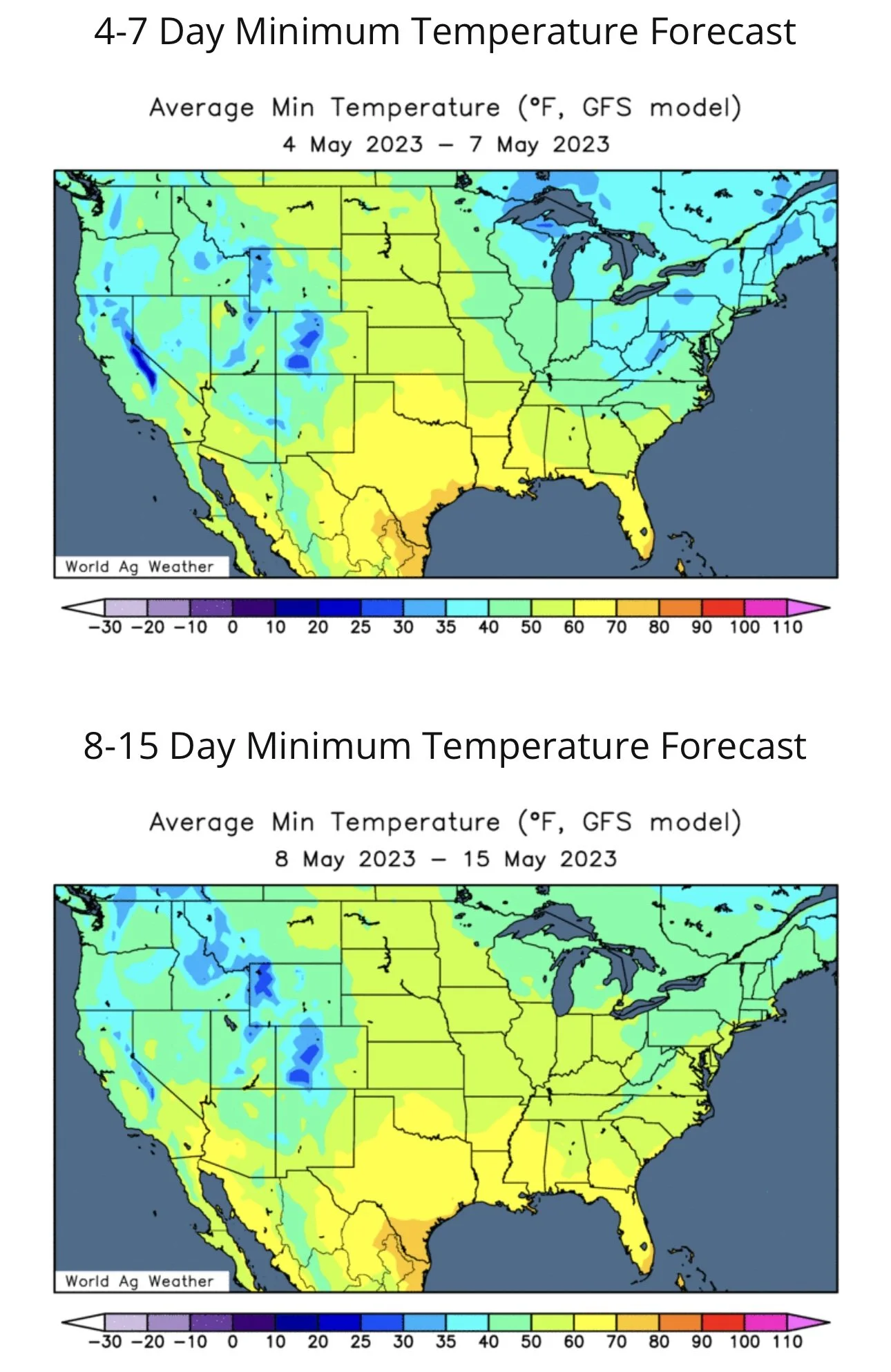

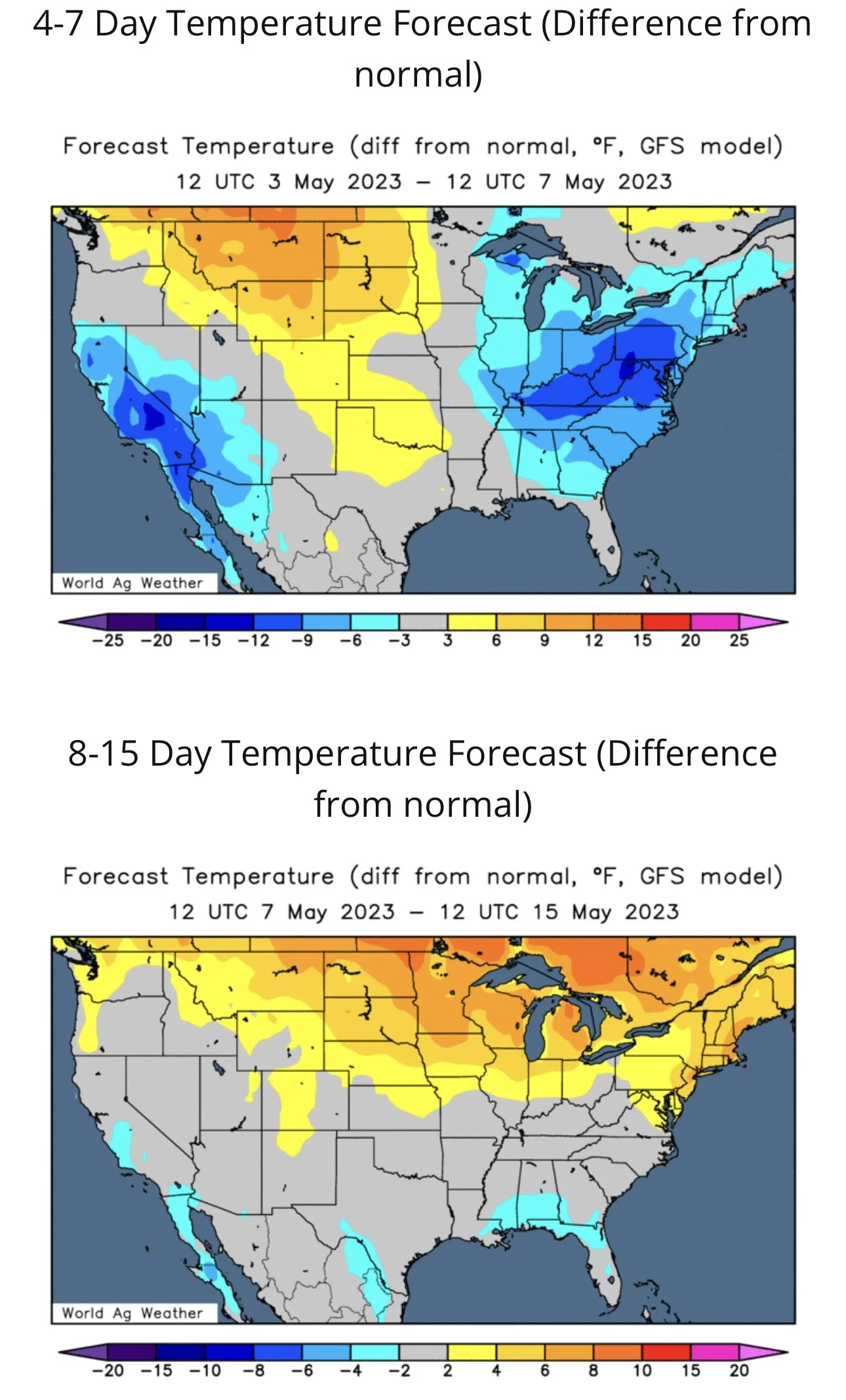

Crop conditions and progress will be something to be watched, but more important will be how weather and weather forecasts develop as we move into May. If we continue to see planting progress go smooth or fast in areas that will be something to watch with a double edge sword. Many of the comments we have seen over the past few days include either cold and wet or a lack of subsoil moisture. Basically the upper plains continue to slide further behind, while the eastern states seem to be gaining, but many that have said they are ahead of normal are also those that seem to be more worried about the dryness.

The bears continue to think that we will see El Niño lead to record crops with very little weather scares. While a few advisors and weather guys out there talk about how the transition from La Niña to El Niño will lead to major production issues in the US. We remain in the latter camp, believing that we have a high probability of having weather issues along with major heat ridges/domes forming. We also believe that many areas are deficient in subsoil. Many areas had wet winters that lead to drought improvement, but very few if any had major re-charges in subsoil. Too high a percentage of winter moisture runs off, so moisture during the winter is beneficial but I would ask any of you what is the difference in moisture in Dec-Feb versus moisture in June/July? Especially you in the upper northern plains.

I know in South Dakota we have plenty of fields that have very wet spots in them, but other parts of the field have hardly any subsoil. Plenty of ditches and tree banks have plenty of snow in them still, while tractors are running in the field beside them.

The bottom line is we feel like weather still demands some premium to be built into the market. We feel that the likelihood remains high that we don’t raise trend line yields. We believe that too many continue to jump on the bear bandwagon. The more that jump on that bandwagon, the more farmers that throw in the towel, the more buyers that don’t extend coverage because they think they might be able to buy it cheaper, the shorter the funds get, the more demand we see and the bigger the boomerang.

Last year wheat had this massive short covering rally that took wheat into the teens. Now those fundamental scares that lead to the short covering rally could actually come to life. All of the reasons that the Black Sea’s War created a rally are ready to actually come to life in the near future, as they didn’t plant or grow the grain like they historically have. There is very little more grain that the Russians can steal and sell. That's done and soon we will see the buyers that have gone from being hoarders back to hand to mouth, become hoarders again.

That likely happens around the same time a short squeeze or short covering happens. Why because of the psychology of the emotions of the market participants.

As an example, part of what has been happening to corn and bean prices has simply been buyers such as China and other commercials waiting for cheaper prices, farmers panic selling, along with funds selling. The reason that some farmers have been panic selling, while end users have not been buying, and the funds have been selling is the idea that we are going to raise this huge crop. So farmers fear sell because they are worried about new crop prices going below break even. End users don’t want to have ownership above the market, so they wait to buy, the natural tendency of the two that should actually make up our prices creates some of the technicals that funds follow, while also creating the headlines that lead to fund price action.

Now sometime in the future the opposite will happen, farmers will stop selling or hedging because Mother Nature will create some fear of production. That fear will also lead to end users deciding that they need coverage. The combination of those two will also create technical buying, which will lead to fund or algorithm buying, that along with the headlines will lead to more fund buying. How far that takes us will be determined by how real the fear is multiplied by the amount that is on the wrong side of the boat times the threat of the fear. Meaning if we get a headline that leads some to believe we could see corn yields could be 150 is going to have a much bigger boomerang effect then a headline that believes we will see corn yields at 175.

We continue to recommend being patient as we think we will see a weather scare, we believe that the longer it takes for a weather scare to develop, the more that will be on the going lower side of the boat, which leads to a bigger boomerang effect.

But as I have mentioned for years one needs to be comfortable with the assessment of what you believe the probability as well as the potential outcome of prices with the information that you know along with the unknown yet to happen events. That means you need to know what you will do or be forced to do if corn decides to lose another dollar, while also knowing what you will do or be forced to do if corn decides to rally 3 bucks after you pre sold it and then you realize you don’t think you will actually raise it.

You have to find a way to be comfortable. One way to make one more comfortable is the use of options. Presently options for corn are cheap in my opinion. With a 6.00 July corn call a little over a dime. Owning those might make one more comfortable to sell corn and lock in a strong basis. While buying puts might make one comfortable via creating a price floor at a minimum price level.

If you need help with getting comfortable, please reach out to Wade at 605-870-0091 or myself at 605-295-3100 and we can help get you set up with a hedge account so that you can utilize tools available that should help one take a little fear and greed out of grain marketing. You can open a hedge account with us here. https://www.dormanaccounts.com/eApp/user/register?brokerid=332&utm_source=substack&utm_medium=email

Below is from Roger Wright at Wright on the Market, he wrote this Saturday night/Sunday A.M. I feel it flows well with some of what I was saying above.

“Grain market guru Jerry Gulke, in his weekend report said, "The drop in grain prices has caught many farmers off guard as they never thought prices would get down to these levels for old-crop bushels because of the tight carryover and strong cash basis levels."

“He is correct; but what is more important in determining price outlook than carryover and basis? Only one thing: money flow. In the long run, nothing is more important than carryover and basis.

A year ago today, the USA corn carryover was projected to be a 35-day supply; this year it is the same. The world corn carryover was 93 days, the same as this year. A year ago, USDA expected the national average price to be paid to farmers for old crop corn was $5.80; this year, it is $6.60.

A year ago today, the USA soybean carryover was projected to be a 21-day supply; this year it is an 18 day supply. The world soybean carryover was 90 days, this year, it is 100 days. A year ago, USDA expected the national average price to be paid to farmers for old crop beans was $13.25; this year, it is $14.30.

A year ago today, the USA wheat carryover was projected to be a 130-day supply; this year it is an 116 day supply. The world wheat carryover was 128 days, this year, it is 122 days. A year ago, USDA expected the national average price to be paid to farmers for old crop wheat was $7.60; this year, it is $8.90.

Traders were selling last week, in large part, because China canceled about half a million mts of corn spread over two days. What the market forgets is China bought 4.105 million mts of corn since the first week of March before canceling a half million mts, which they will buy back plus a more at a lower price. Such tactics were standard operating procedure before the Trump years.

Which would you rather have? Sell no corn to China and have no cancellations or sell 4.1 million mts of corn to China and cancel a half million mts? May corn settled at $6.30 on February 28th. On Friday, May corn settled at $6.36 Granted, July corn is down 37¢ and December corn is down 41¢ since March first, but which contract is most connected to the cash market this time of year? May is here and now. July and December prices are subject to greed, fear and the flow of money.”

Past Updates

4/28/23 - Market Update

Grains Green for First Time in 10 Days

4/27/23 - Audio Commentary

Will Markets Reverse Second You Throw In Towel?

4/26/23 - Market Update

6th Straight Day of Losses

4/25/23 - Audio Commentary

Can You Get $1.50 Better Than Best Price?

4/24/23 - Market Update

Funds Continue to Sell

4/23/23 - Weekly Grain Newsletter