USDA OUT TOMORROW

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Want to talk? (605)295-3100

Futures Prices Close

Overview

Grains mixed while soybeans rallied nicely off the early lows.

But tomorrow is all about one of the biggest USDA reports of the year.

USDA Estimates

The trade is looking for very slight cuts to both corn & soybean yield.

Seems like the trade is more inclined that we'll see a yield drop in corn vs soybeans.

Then for corn we of course have the demand discussions.

For the past 3 of 6 years, both corn & soybean yield has fallen outside of it's trade range estimates. Hence why this report can shake things up.

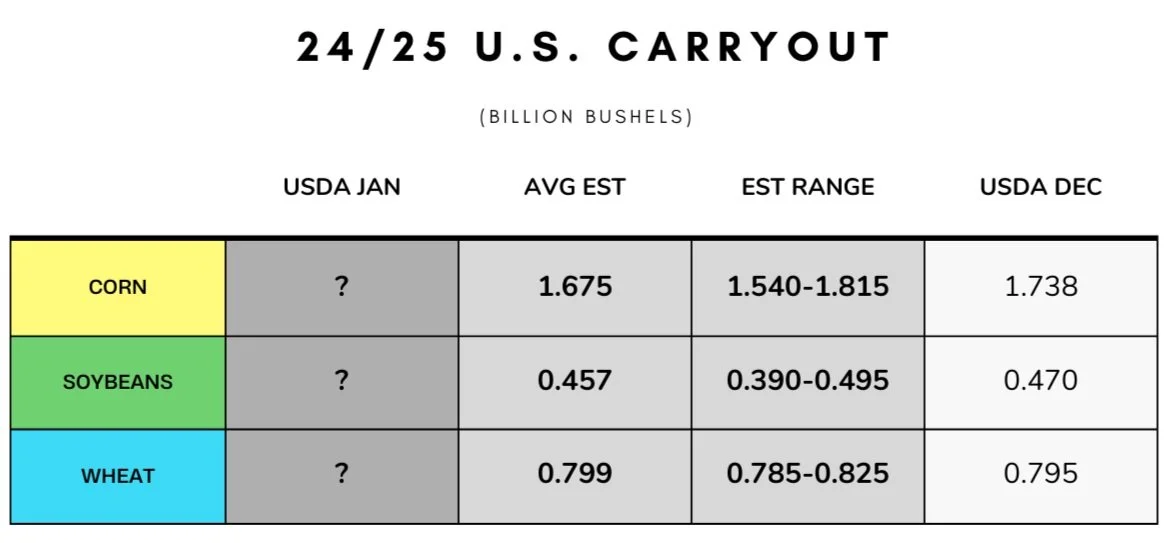

The trade is also looking for slight cuts to both corn & soybean carryout.

For the most part, it looks like demand might be priced in unless we get some major change. But it's not super likely the USDA plays around with demand a whole lot.

The trade does seem pretty confident corn carryout will be below 1.7 billion. If carryout is lowered, it will be the 7th month in a row we see carryout drop. That would be the longest streak in +20 years.

Not long ago there we plenty of talk about a 2.5 billion bushel carryout and now here we are.

Even if the USDA leaves demand unchanged, there are plenty of ways carryout could be lowered such as a cut to yield or change in acres.

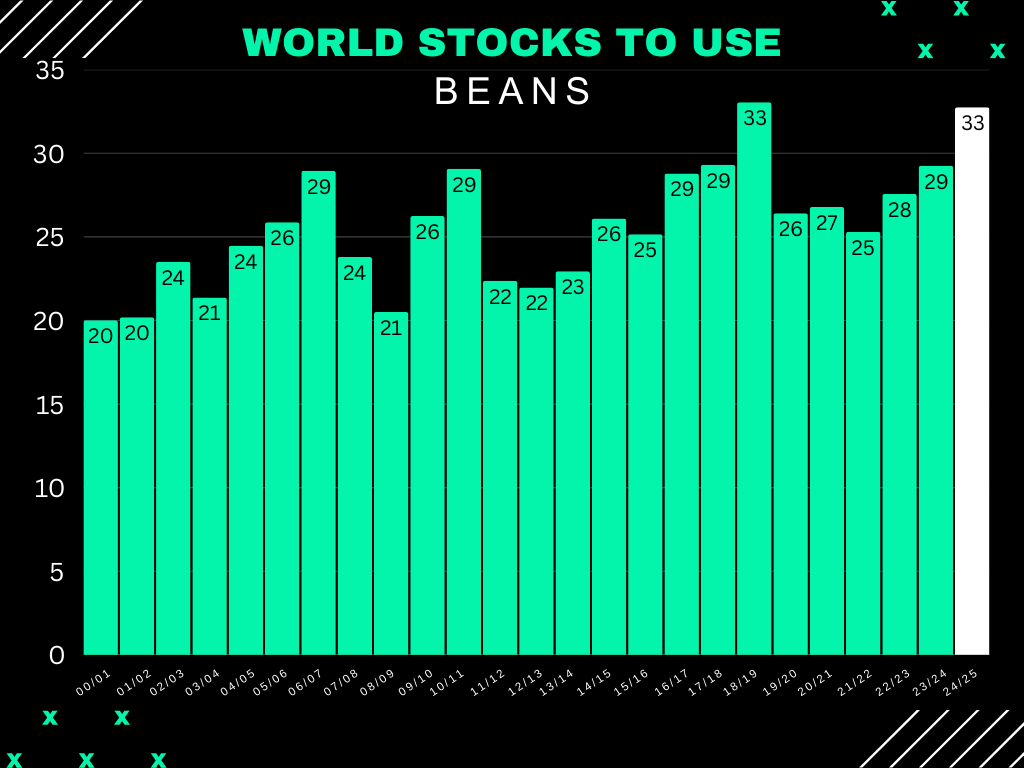

Here is the world carryout.

This is soybeans biggest problem.

Soybeans global stocks to use ratio is the 2nd highest of all-time.

Still the biggest bearish factor weighing down beans.

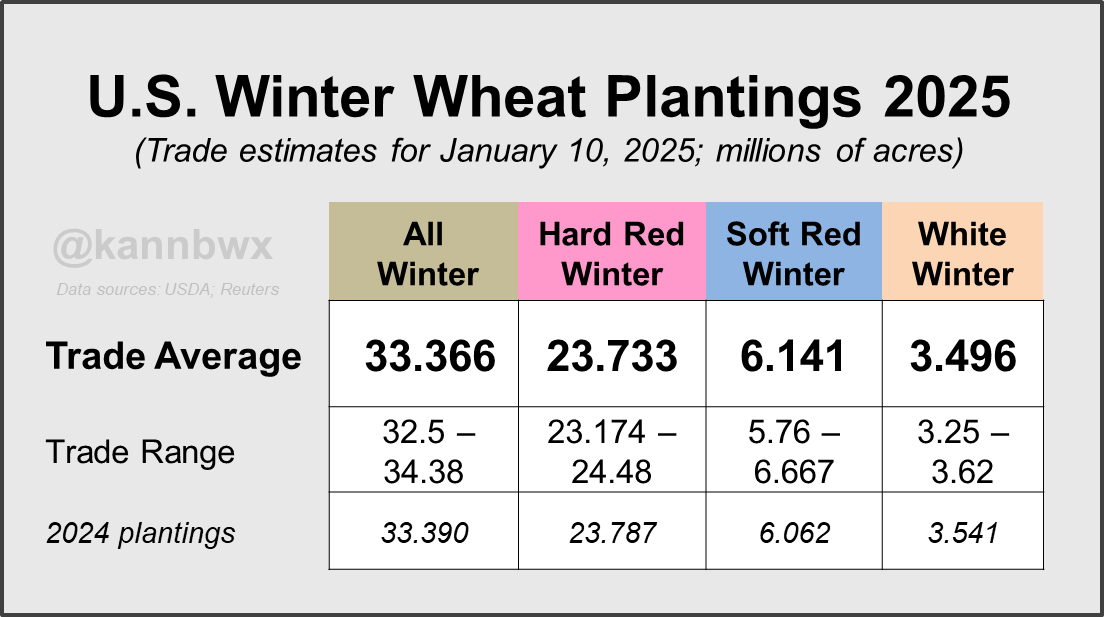

The trade is expecting winter wheat acres to be identical to last year, but in the past 2 years the trade estimates were off +/- 1 million.

Chart from Karen Braun

It's doubtful the USDA makes major changes in South America right before their reproductive phase.

If they do make any, it'll probably be a slight bump to Brazil production or a slight cut to Argentina production.

But this likely won’t be a big market mover. The market is more focused on the weather outlook. Right now all the eyes are on if Argentina will get rain or not.

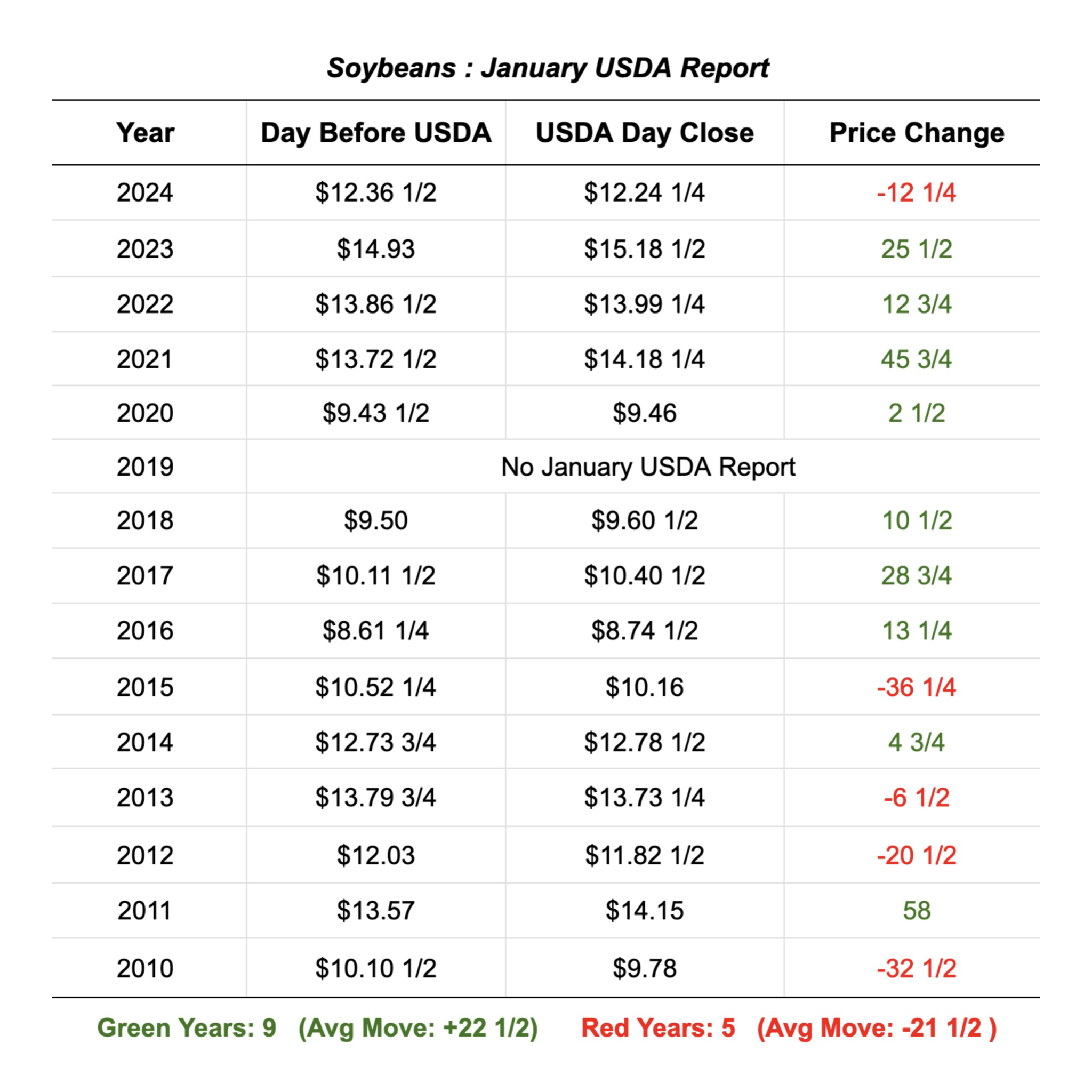

Past Jan Report Performance

Average Move: (Since 2010)

Corn: +/- 13 1/2 cents

Bean: +/- 22 cents

Average Positive Move:

Corn: +11 1/2

Bean: +22 1/2

Average Negative Move:

Corn: -17

Bean: -21 1/2

Hedge Ideas for Report

Here are some hedge ideas for the report as well as the next few months.

(NONE OF THESE ARE RECOMMENDATIONS)

First soybeans.

If you are undersold on old crop beans or worried about the risk of the USDA, you can consider these.

How a hedge works:

Strike of your put - cost of put = price floor

You could buy a $9.90 put expiring tomorrow for 5 cents.

This gives you a floor of $9.85 if the report is negative. This is only good for a day.

For protection that takes you out a little further, you could buy the $9.90 February puts for 10 cents.

This gives you a floor of $9.80 and gives you an extra 2 weeks of protection.

Which is also when we do seasonally see pressure from the South America crops.

You could also look at the March $9.90 puts for 20 cents that expire in 42 days.

This gives you a floor of $9.70

There are several advivors recommending to purchase bean puts to cover you for the next month, as they think we will make new lows and could could lose 50 cents to $1.00

The same concept can be applied to new crop, but you are paying for a lot of time value.

My preference on new crop for those wanting protecting is to have protection on during the seasonal times where you should. Then lift that protection when you seasonally should. So ideally simply buying Feb or March puts.

After the South America harvest is over and we do not have beans in the ground yet, I would want to life my puts and look for a seasonal pricing opportunity.

Once we get into late June to September, I would once again look to start protecting prices again on rallies. I just prefer to not spend a ton of time or value to buy something that takes you to new crop.

A $10.00 November put is 55 cents, which gives you a $9.45 floor.

Why would I want to create a floor 30-50 cents less than the floor is for old crop beans, when new crop is at a 15 cent premium? I don’t really want to.

Next corn.

If you are undersold or worried about the negative report you can consider these.

A $4.55 put that expires tomorrow is 4 cents.

Giving you a $4.51 floor.

The February $4.55 puts that expire Jan 24th cost 6 cents.

Giving you a floor of $4.49

The March $4.55 puts that expire Feb 21st cost 11 cents.

Giving you a floor of $4.44

As for new crop corn, I don’t like protecting it as it is undervalued vs old cropo.

We went from a big carry, to an inverted market.

If the corn market decides to go lower, it should be old crop leading us lower, with new crop not losing as much comparatively.

So to protect new crop, I like doing so by buying old crop puts.

If you have any questions about any of this, please give us a call or text anytime:

(605)295-3100

Again, these are not recommendations. Simply possible strategies depending on your situation.

If you don’t have a hedge account and would like one with us: CLICK HERE

Cattle Update

Cattle continues to impress.

Cattle really has bullish news on bullish news.

We have the Mexican border close, and Mexico supplies 4% of the cattle that goes into beef supply.

On top of this, we have a cold snap here in the plains.

BUT there is a rumor that the border could be re-opening January 20th.

Again it's just a rumor, but if it happens a good amount of this rally could be erased.

1st and 2nd targets have been hit. There is one final target of $273 on March Feeders, but it's not a guarantee.

We are still advising to place hedges here and to take risk off the table.

Give us a call or text if you want to chat:

Lauren: (979) 587-9252

Jeremey: (605)295-3100

Today's Main Takeaways

Corn

Last Time Funds Were This Long:

The last time the funds were this long was February 14th, 2023.

The price of corn?

$6.80

Here is an overlay of the fund position vs corn futures.

Now I am NOT saying corn is going to $6. But you have to ask yourself, why are the funds this long corn?

We've seen massive fund buying since July, but compared to actual price action it has been disappointing.

Yes we have to be cautious that in other bear markets the funds do usually exit their long position around 200k contracts. So if the corn bull doesn’t continue to get fed, they could start to exit that long.

But the funds don’t magically go from record short to long +230k contracts without a reasoning behind it.

From Jason Britt, President of Central States Commodities:

"Corn market went down on a large fund short positon for months and months and now that the funds are long, all you can hear is that the funds are long you better look out below. They are a long way from record long position, and I look at it as that the funds are usually right."

Spread Action: Telling?

The spreads are one of the biggest reasons why I believe carryout will continue to decline over the next several months.

This doesn’t have to happen in tomorrows report, but the spreads are signalling that demand is outweighing supply here and something doesn’t add up.

Some reasonings behind this could be that yield isn’t quiet there or demand is greater than advertised.

Looking at the chart, if we get a negative report I am looking for a bounce in the green box. Ideally holding the 200-day MA.

If we get a positive report, the next target is still $4.67

My bias remains higher unless we take out that uptrend from the lows (bottom blue line).

(If you missed Dec 11th's signal: Click Here)

Soybeans

All about the report tomorrow.

If we get a negative report, this support could be taken out and it opens the door to test those recent lows.

If we get a friendly report, hopefully it'll offer an opportunity. Green box is where I am looking for a short term target if you want one.

The report is going to be pretty important on the charts.

Outside of the report, eyes are on Argentina to see if it rains or not.

Meal Chart

First we rejected right off the downtrend & golden retracement zone.

To the downside, we have now hit 61.8% retracement from the recent rally.

If we are going to bounce, it would be here.

If not, we likely go test those old lows.

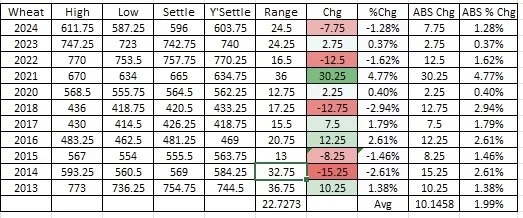

Wheat

Very little to update on wheat.

No one is expecting major changes, but just like corn & beans it can be a market mover.

Here is the past price changes from the report.

Average move is 10 cents.

Bottom line, I think wheat will have an opportunity down the road and there are several factors suggesting wheat has potential. But again, this is months from now.

Looking at the chart, we still are waiting for one simple confirmation.

A bust above that downward trend from May. We have spent 8 months battling it.

This is a big support level in continuous wheat. If this support level fails, can’t rule out $5.00 wheat.

Looking at March wheat, I still think we are sitting in a falling wedge. Which is usually a bullish pattern.

Just like continuous we need to break that downtrend.

The sucky part of this pattern is we can go all the way down the bottom of the wedge and still remain in a bullish pattern. Which means yes, we can make new lows.

KC continues to hold it's lows.

First step for bulls is to break downward trend from November (red line).

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

1/8/25

2 DAYS UNTIL USDA. BE PREPARED

1/7/25

THE HISTORY OF THE JAN USDA & MORE

1/6/25

MAJOR USDA REPORT FRIDAY

1/2/25

LONG TERM CORN UPTREND? JANUARY DROP OFF IN BEANS? LONG TERM WHEAT FACTORS

1/2/25

CATTLE HEDGE ALERT

12/31/24

MASSIVE DAY FOR GRAINS. FLOORS? 2025 SALES? GAME PLAN? CHART BREAKDOWNS

12/30/24

GRAINS FADE EARLY HIGHS

12/27/24

STILL LONG TERM UPSIDE POTENTIAL, BUT TAKE ADVANTAGE OF 6 MONTH CORN HIGH

12/26/24

CORN ABOVE 200-DAY MA. ARGY DRY. BEANS +44 CENTS OFF LOWS

12/23/24

CORN & BEANS TALE OF 2 STORIES. BEANS REJECT OLD SUPPORT

12/20/24

PERFECT BOUNCE IN CORN. SIMPLE BEAN BACKTEST BEFORE LOWER?

12/19/24

THE SOYBEAN PROBLEM. NEW WHEAT LOWS. CORN UPTREND

12/18/24

BEANS BREAK SUPPORT & OPEN FLOOD GATES

12/17/24

SINK OR SWIM TIME FOR SOYBEANS

12/16/24

SOYBEANS & WHEAT FIGHTING LOWS. WILL CORN DEMAND CONTINUE

12/13/24

POST USDA COOL OFF

12/12/24

CORN CORRECTION. WHY WE ALERTED SELL SIGNAL YESTERDAY

12/11/24

USDA PRICED IN? FAIR VALUE OF CORN? BEAN BREAKOUT?

12/11/24

CORN SELL SIGNAL

12/10/24

USDA BREAKDOWN

12/9/24

USDA TOMORROW

12/6/24

CORN TRYING TO BREAKOUT. MAKING MARKETING DECISIONS

12/5/24

OPTIMISTIC BOUNCE IN GRAINS

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24

CORN SPREADS, CRUCIAL SPOT FOR BEANS, SEASONALITY SAYS BUY

11/26/24

TARIFF TALK PRESSURE

11/25/24

HOLIDAY TRADE, SEASONALS, TARGETS & DOWNSIDE RISKS

11/22/24

CORN TARGETS & CHINA CONCERNS

11/21/24

BEANS NEAR LOWS. CORN NEAR HIGHS. 2025 SALE THOUGHTS

11/19/24

WHAT’S NEXT FOR GRAINS

11/18/24

WHEAT LEADS THE GRAINS REBOUND

11/15/24

BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24