TARIFFS PUSHED BACK. FUTURE OPPORTUNITIES?

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Overview & Tariffs: 0:00min

Updated Drought Story: 2:20min

Corn: 6:00min

Soybeans: 9:30min

Wheat: 11:40min

Want to talk about your situation?

(605)295-3100

Futures Prices Close

Overview

Big rally across the board in grains.

At one point corn took out its entire past 3 days of trade range with today's rally.

What happened?

This morning Trump announced there will be no tariffs on Mexico for USMCA goods which includes grains & corn.

He once again pushed them back, this time to April 2nd.

This initially had to corn market rally as much as +17 cents to $4.73 (closed at $4.64)

After market close around 2pm CT it was also announced that Trump would also be delaying tariffs on Canada as well.

He is now saying the "big tariffs" will come on April 2nd.

Can Mexico or Canada Afford a Trade War?

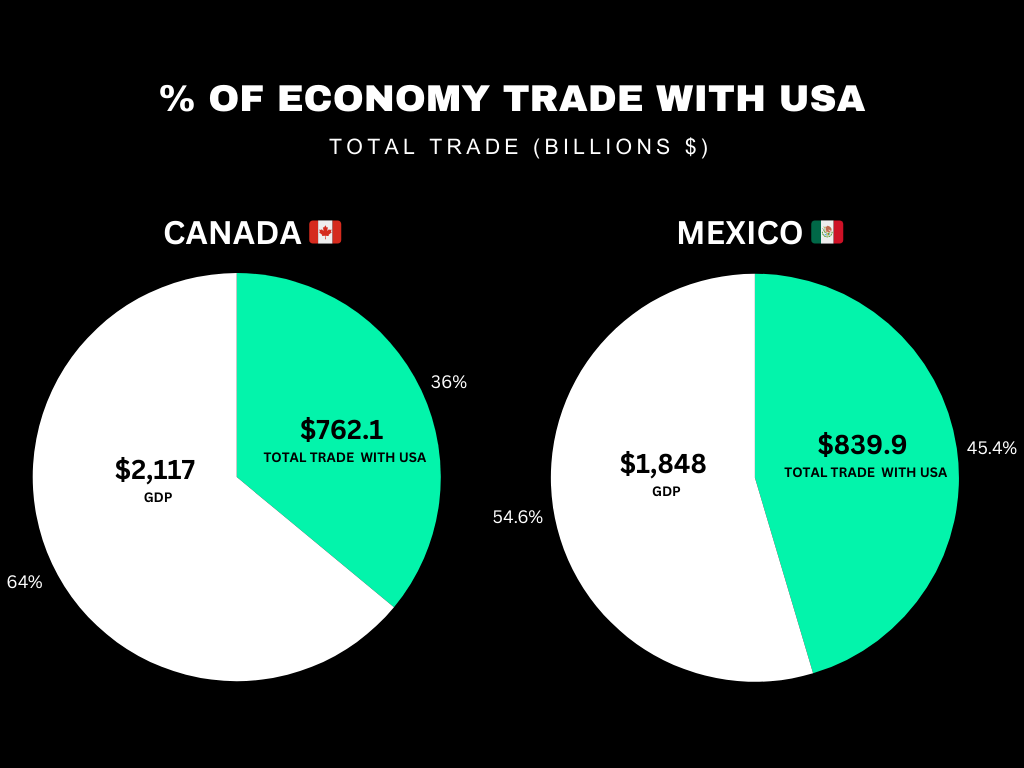

I showed you this graph on Tuesday on why Mexico and Canada will probably come to an agreement.

Neither simply can’t afford it. A trade war could very easily send both economies into recessions.

Trade with the US accounts for a massive 45% of Mexico's entire GDP.

Trade with the US accounts for 35% of Canada's entire GDP.

Trade with Mexico and Canada combined only account for roughly 5% of the United States entire GDP. So Trump has the upper hand.

Rest of Trade War News:

Lutnick said that hopefully by April 2nd both Mexico and Canada will have done enough on stopping fentanyl that this part of the tariff conversation is over.

Trump's call with Mexico's President went really well and both sides cleary have respect for each other.

It looks like Mexico will do anything they can to come to an agreement.

So I'd assume they do.

Canada is a little trickier, as Trump and Trudeau do not like each other.

So it will probably be harder for them to come to an agreement.

Trump claimed Trudeau is basically using these tariffs to try to stay Prime Minister.

Trudeau actually said the Canada and US trade war will persist for the foreseeable future.

All that is left is China.

China tariffs really only effect the soybean market.

China has bought zero US corn so it does not impact corn.

Updated Drought Story: Future Opportunities?

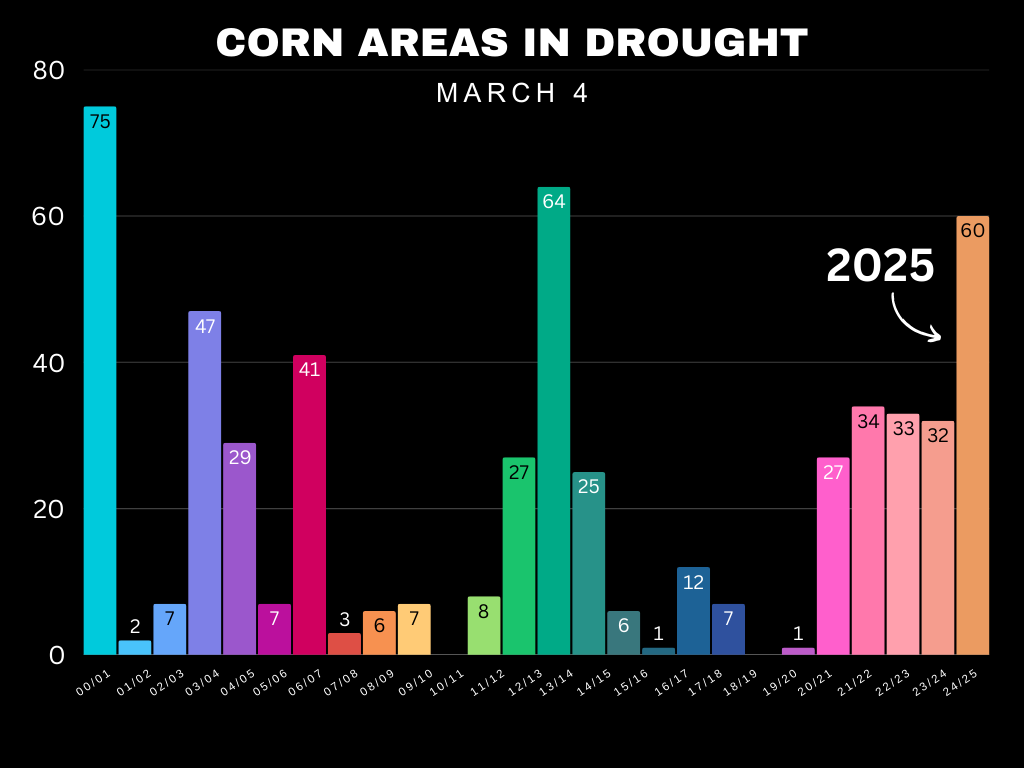

Currently we have the 3rd most drought for this time of year of all-time.

Does this correlate to drought this summer?

Well.. yes and no.

A dry fall and winter can often indicate to a dry following summer.

But if we look at the data, that doesn’t mean we will have some major drought event.

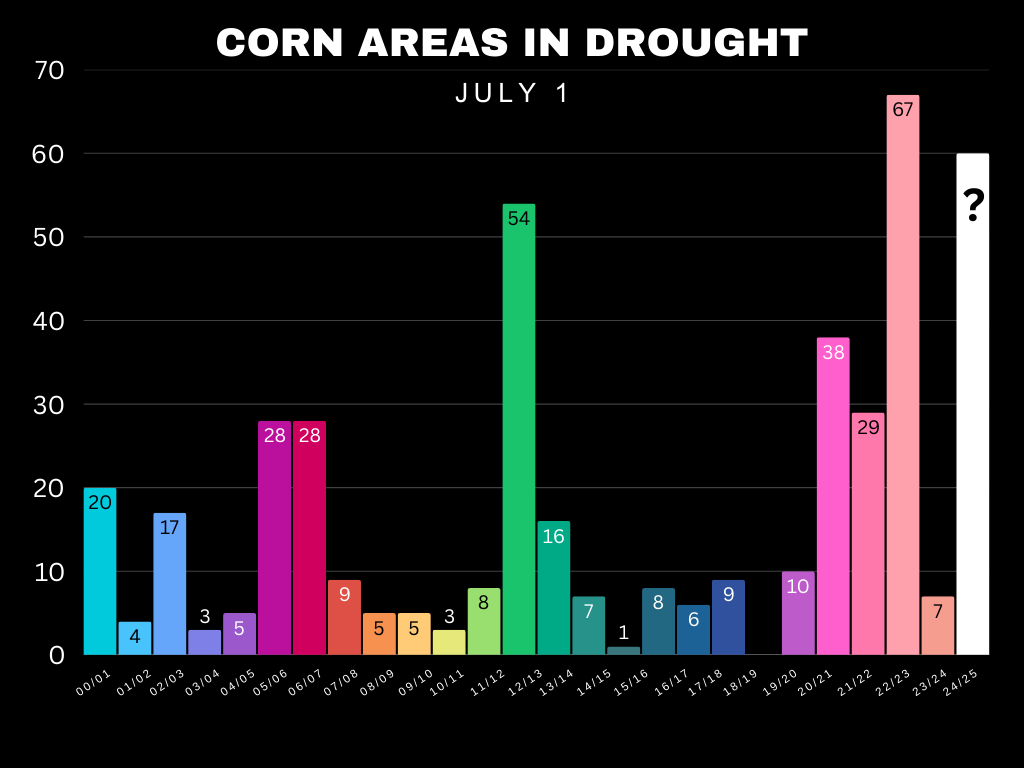

Here is what the areas in drought looked like on July 1st.

In 2013 we had a high drought in February. Come July it was virtually gone.

2012 and 2023 had the greatest drought on July 1st, both were dry in February but neither were "extremely" dry in February.

Why am I bringing this up?

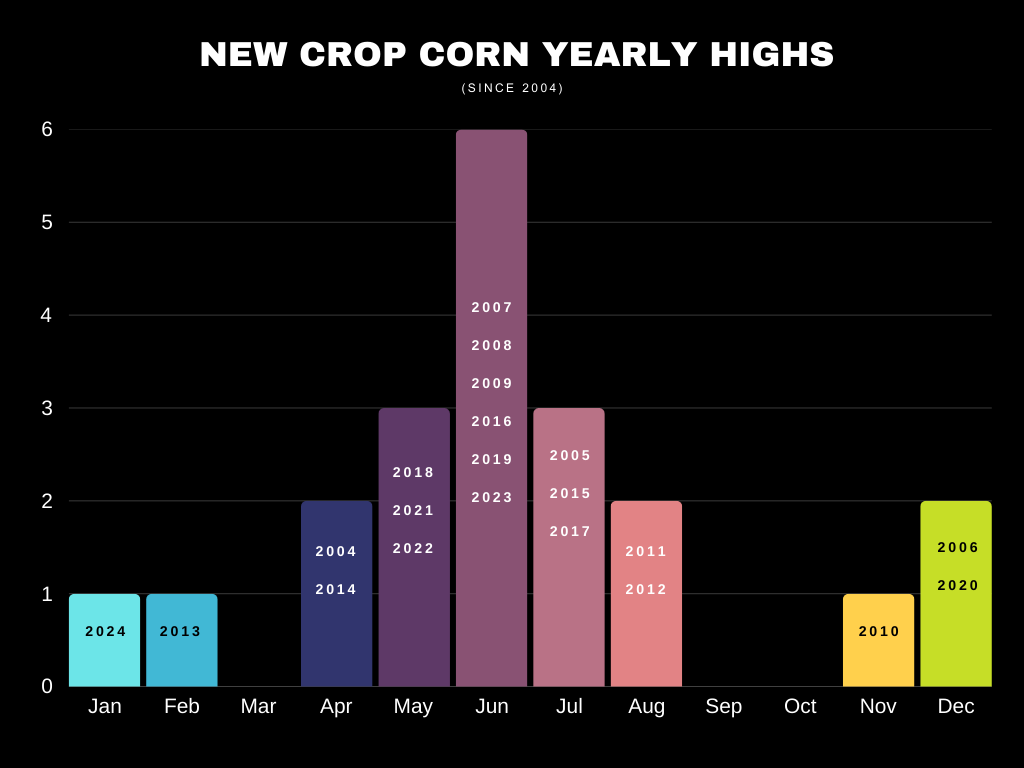

Because we "almost" always get an opportunity in the spring or summer.

There will always be exceptions such as last year where we topped Jan 1st or in 2013 where the drought vanished and we topped in February.

The point is, historical odds are on the farmers side.

I know a lot of you are nervous that you missed the boat.

I showed this chart recently, but wanted to again give you some optimism.

Why we "usually" get an opportunity:

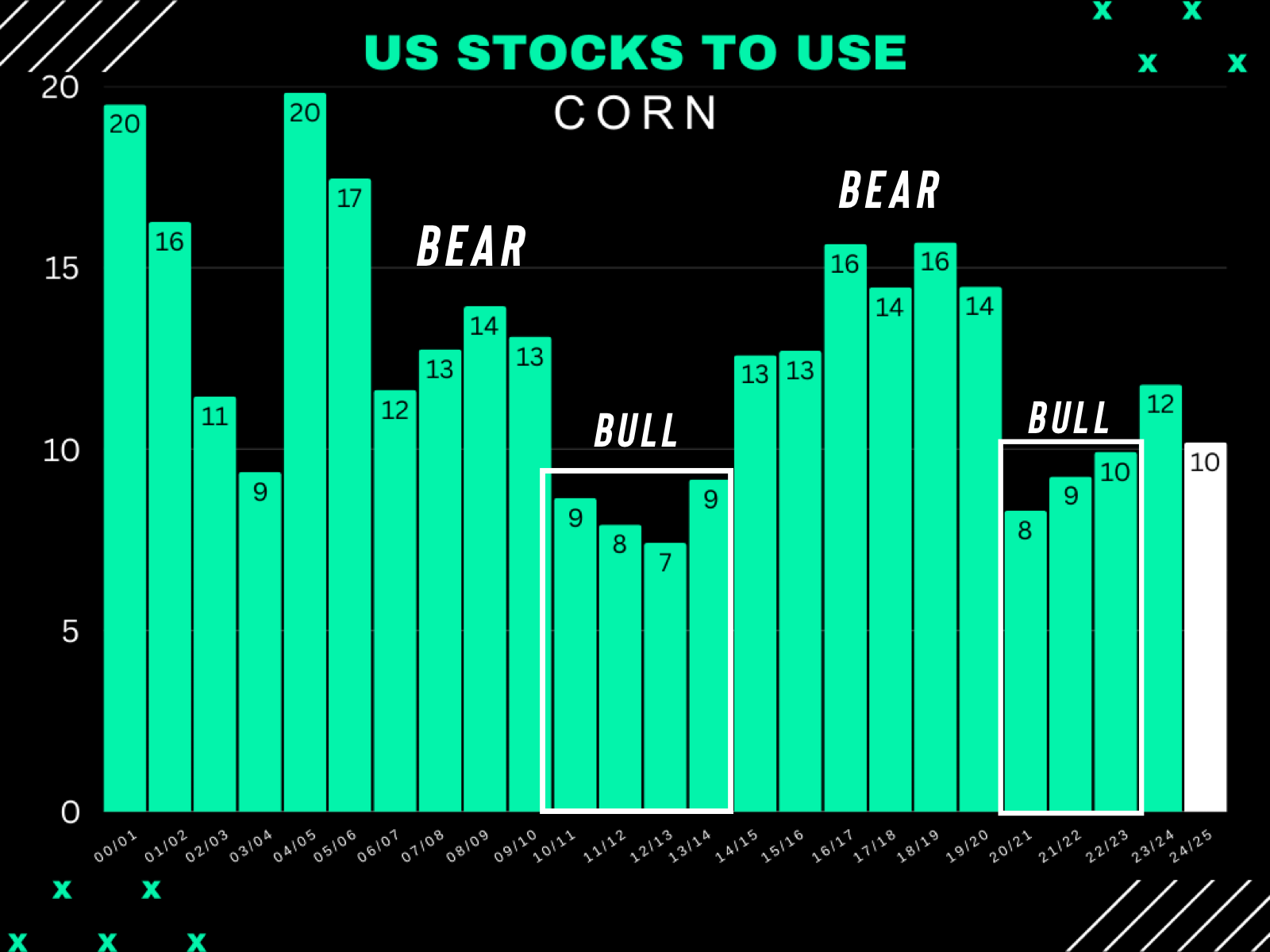

Here is the rough current new crop balance sheet.

With a 181 yield it is bearish.

As that gives us nearly a 2 billion bushel carry out and a 13% stocks to use ratio.

If you cut yield to even just 175, the situation becomes a lot more bullish.

With a sub 10% stocks to use ratio.

A sub 10% stocks to use is considered a bull market.

The actual drop in yield doesn’t even have to happen.

The trade just simply needs to think that is is possible for a short period of time. A dry forecast is all it takes.

When they think it is possible, they start pricing in that possibility and prices go higher.

It is called a futures market. It is forward looking.

Then we get rain and the market gets a brutal sell off.

If we get this type of opportunity this year, it will be a supply driven rally. Meaning it will happen fast. So you will not have much time to seize the opportunity before we come crashing down.

Here is a seasonal demonstrating that sell off.

Current Summer Forecasts:

The current forecasts for June, July, and August also suggest hot and dry. Especially for the central corn belt such as Iowa.

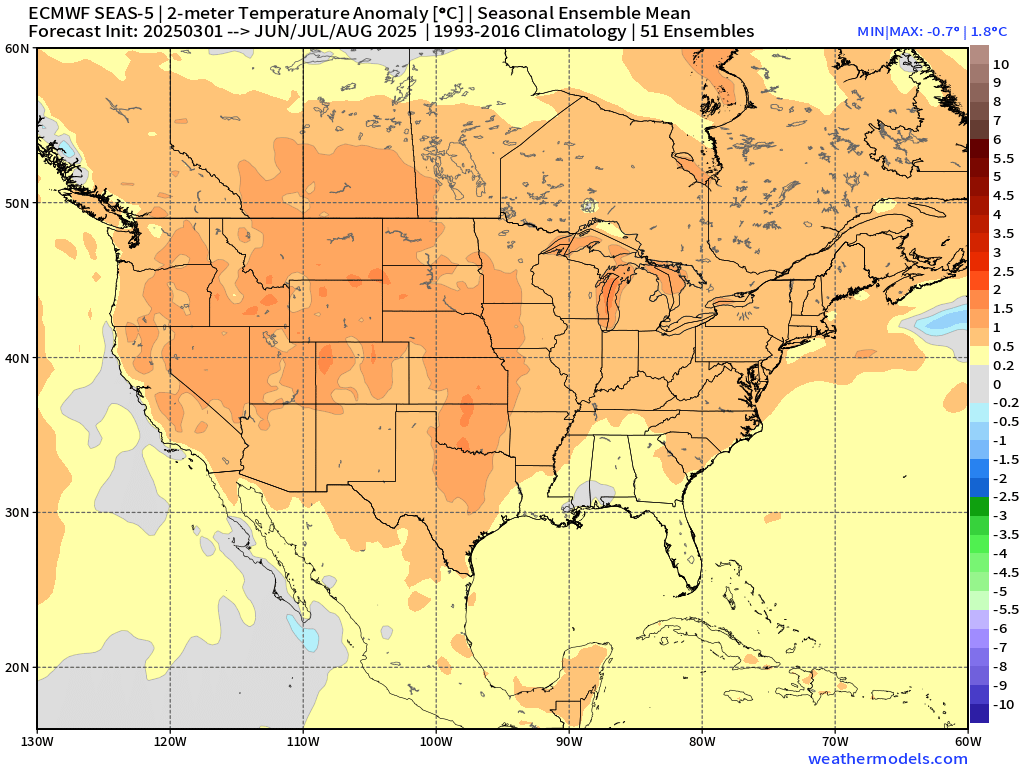

Here is the temperature anomaly for June/July/August.

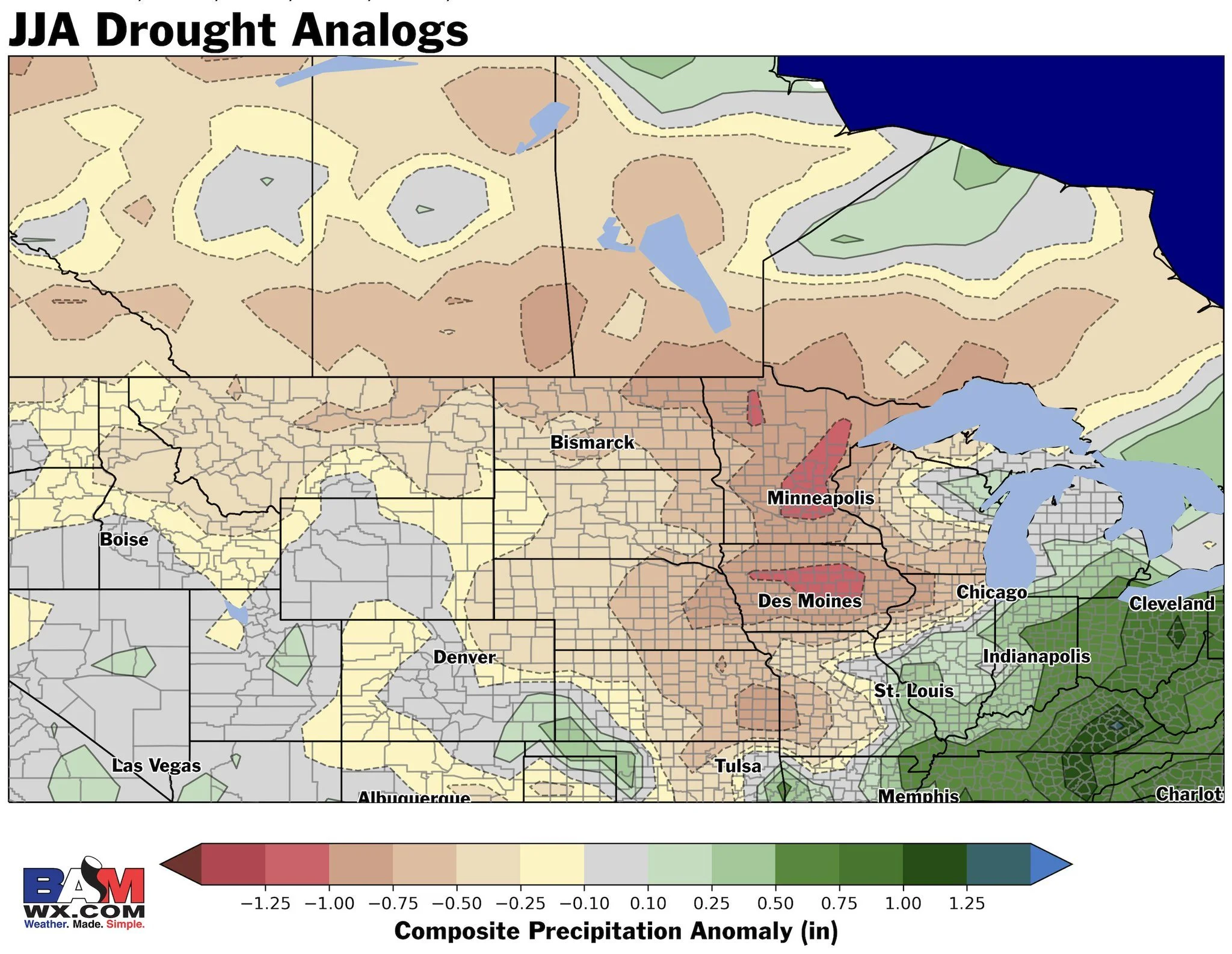

Here is the precip anomaly from BAM Weather for June/July/August.

Wet out east, dry in central.

Lastly here is the seasonal precip outlooks.

On the left is March/April/May. It is wet for the eastern corn belt.

On the right is June/July/Aug. It starts to get dry especially in the central areas.

Overall it looks like the eastern corn belt won’t be a concern, it will be the central areas.

Today's Main Takeaways

Corn

Fundamentals:

The market sold off on Mexico tariffs.

There is no longer tariffs. Which means the market sold off on a factor that didn't exist. It was a fear driven sell off.

I do not think this sell off in corn was justified. Which means I think we are undervalued here.

There is a reason we rallied from sub $4 corn to $5 corn. Because the fundamentals are buillish.

We have the tightest global situation in a decade as it continues to shrink.

Exports will have to be bumped, and after this sell off one could argue exports pick up even more steam as Mexico can now get it cheaper.

The funds hit the exit door with the tariff story, but I don’t see why they wouldn’t jump right back in here and wait to see what the US growing season brings after they realize Mexico tariffs "shouldn’t" be an issue (as I think it will be resolved).

As long as everything remains peachy with Mexico, I don’t see why corn wouldn’t be undervalued here.

I do think we will get that seasonal weather opportunity, but you can NOT solely bank on a drought scare happening.

Which is why I am looking to take risk off along the way and have had sell signals such as Feb 18th.

Technicals:

Finally finding signs of life right where I thought we would. Hence my first buy signal I have ever alerted for corn on Monday night.

Why I thought we would bounce here:

1) It was 61.8% of the entire rally. The most common correction level.

2) This area coincides with that old resistance. Where we struggled to break through in 3 straight months (Oct, Nov, & Dec). Old resistance is new support.

3) We closed the big air gap. Everytime prices have fallen in this range they slice through it like butter. No support or resistance in between.

Now what?

We have resistance at $4.66. As this was the Feb lows.

Once we break above here, my short term targets are 50-61.8% of this sell off. ($4.80 to $4.89)

The 50% at $4.80 also happens to be that old support and must hold level we couldn’t hold.

This would also lead to the air gap being filled once again. This time to the upside.

I will be looking to take some risk off if we get up there. As that will be our next point of resistance.

Just like May corn, Dec corn also bounced right where we needed to.

Short term upside targets are $4.60 to $4.65 (50-61.8% of the sell off).

Weekly Chart:

That is a nice looking weekly candle if we can close up here tomorrow.

Looking long term, the big level to break is still $4.96 as there is no resistance beyond that until $5.30's

IF we can stay strong tomorrow, it would leave a bullish hammer pattern.

Which would indicate more upside.

Soybeans

Fundamentals:

It is hard to get "super" bullish short term unless we get a deal with China worked out.

As China accounts for nearly 20% of all US soybean demand.

(Exports account for 42% of all US demand. China accounts for 47% of exports)

Brazil still has a monster crop that is hitting the market which will keep a lid on a major rally. But we did just endure their harvest, so it shouldn’t result in the market tanking.

At the same time, the thought of less acres here in the US should help keep a floor under prices.

Moving forward, less acres could drastically change the US balance sheet if we don’t get a perfect growing season.

The possibility for a super tight US balance sheet has me remaining mostly patient on beans especially new crop.

It is hard to tell anyone to go out and sell a bunch of soybeans well below the cost of production.

If soybeans aren’t making you money right now, I can’t justify going out and selling a bunch of beans here at a loss with all of the possibilities out there, even if that possibility results in lower prices or a trade war with China.

I think we are going to see way less bean acres this year, which could wind up being the story bulls need for an opportunity.

Technicals:

We bounced right in that support box and off the 61.8% retracement of the entire rally.

If you are looking for a short term target, I have $10.42 to $10.53 (50-61.8% of the recent sell off).

My bigger picture target is the $11.35 range. If we can somehow crawl up there I'd look to be more aggresive.

Still have the potential inverse head & shoulders pattern playing out.

Just like May beans, Nov beans bounced right where they needed to.

Need to continue to hold the $10.00 level and 61.8% retracement of the entire rally.

Wheat

Fundamentals:

The wheat market has sucked but the fundamentals are still far from being bearish.

Friendly factors:

1) Russia has worst crop ever

2) Russia exports are forecasted to drop -30% for next year compared to last year (-15% this year and next)

3) Tightest global balance sheet in a decade and continues to shrink

4) Stocks to use ratio for major global exporters tightest since 2008

5) Wheat isn’t winning over any extra acres. No one is excited about planting spring wheat at these prices

I simply cannot find many reasons to get overly bearish here.

Wheat could very well have the most bullish story of all the grains moving forward. Just might take some time to be realized by the market.

Technicals:

Perfect bounce off that support box in KC.

Need to continue to hold.

Do not have an upside target until I'm confident the lows are in.

Continuous Chicago wheat once again bounced in this support box just like it has done a dozen times the past +1 year.

Must hold level.

Not much to update for May wheat.

Bouncing right where we need to despite posting a new low Monday.

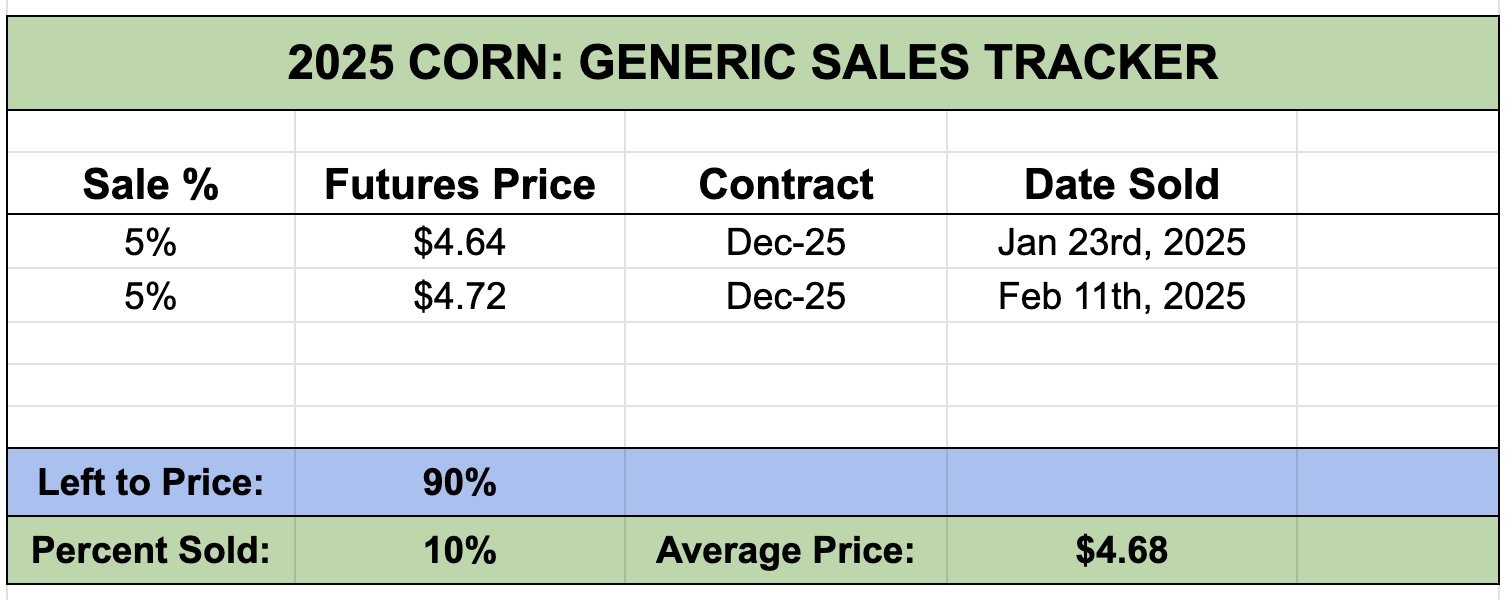

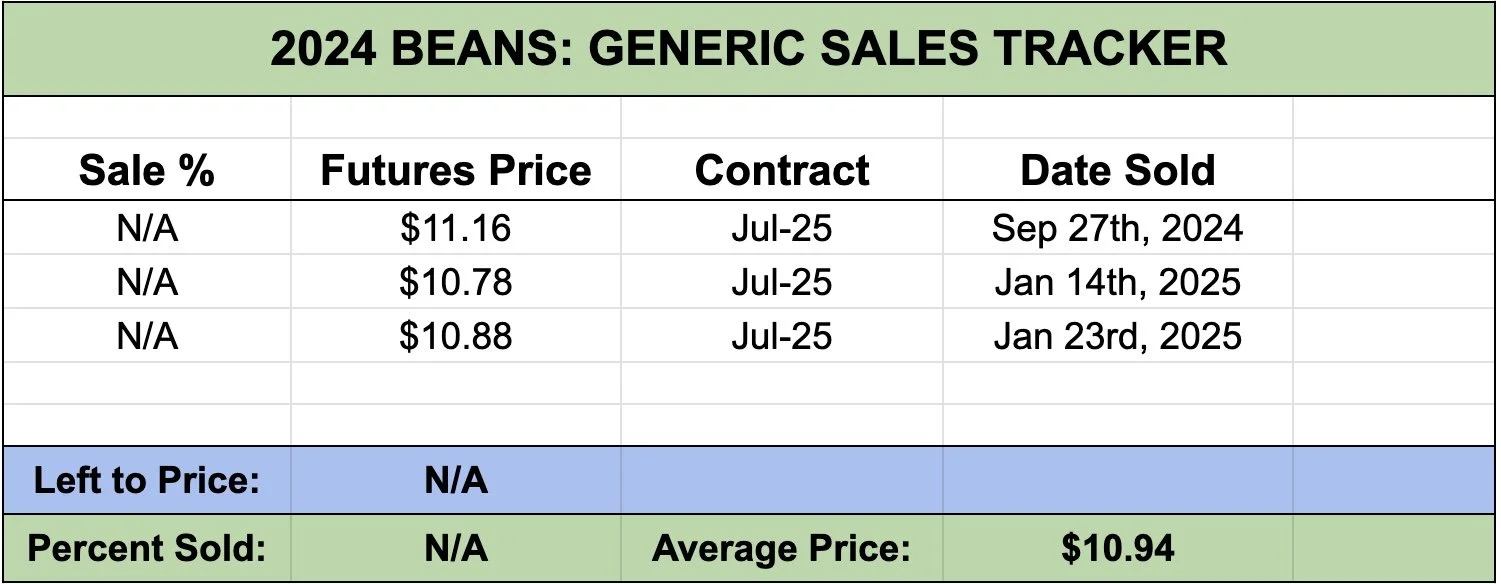

Generic Cash Sales Tracker

Due to requests here is our generic cash sales trackers.

This does not include any hedge recommendations etc. Simply cash.

This is futures prices.

For old crop there is no percentages as we only recently started tracking our generic sell signals. Future new crop sales will have percentages as we continue to make sales.

This will be included at the bottom of every update.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

3/5/25

IS GRAINS BIGGEST RISK WEAK CRUDE & DEFLATION?

3/4/25

TRADE WAR BEGINS. 8TH DAY OF PAIN FOR GRAINS

3/3/25

TARIFFS ON TOMORROW. BUY SIGNAL

3/3/25

BUY SIGNAL

2/28/25

WHEN WILL THE BLEEDING STOP?

2/27/25

CORN AT CRITICAL SPOT. USDA ACRE REPORT. WAY TOO EARLY DROUGHT TALK

2/26/25

HISTORY SUGGESTS CORN TOP ISN’T IN? ACRE OUTLOOK TOMORROW

2/25/25

POSITIVE CLOSE. WHAT TO KNOW ABOUT USDA OUTLOOK

2/24/25

USDA OUTLOOK, FIRST NOTICE DAY & BRAZIL

2/21/25

WHAT TO EXPECT MOVING FORWARD IN GRAINS

2/20/25

FIRST NOTICE DAY CONCERNS. MASSIVE CORN ACRES OR NOT?

2/19/25

HOW TIGHT IS THE CORN SITUATION?

2/18/25

MORE DETAILS ON TODAYS SELL SIGNAL

2/18/25

OLD CROP KC WHEAT & CORN SELL SIGNAL

2/14/25

WHEAT BREAKING OUT ON WEATHER RISK. TECHNICALS & FUNDAMENTALS

2/12/25

GLOBAL GRAIN SITUATION, ACRE TALK, CHARTS & MORE

2/11/25

USDA: NOT A BEARISH REPORT. DISAPPOINTING PRICE ACTION

2/10/25

USDA TOMORROW. LONG TERM PATH FOR SUB 10% CORN STOCKS TO USE?

2/7/25

WHY WOULD THE FUNDS EXIT THEIR LONGS?

2/6/25

WHEAT FINALLY CATCHING A BID

2/5/25

COMPLETE THOUGHTS ON MARKETS: BACK & FORTH DISCUSSION

2/4/25

STRONG JANUARY LEAD TO STRONG YEAR? TARIFFS, CHARTS & MORE

2/3/25

TARIFFS PUSHED BACK

1/31/25

TARIFF NEWS ALL OVER THE PLACE. ARE YOU PREPARED FOR POSSIBILITIES?

1/30/25

WHEAT BULL ARGUMENT. TRUMP ADDS TARIFFS

1/29/25

CORN APPROACHES $5.00

1/28/25

TARIFFS, CORN FUNDS, SOUTH AMERICA & MORE

1/27/25

HEALTHY CORRECTION WE TALKED ABOUT & TARIFF NEWS

1/24/25

GRAINS DUE FOR SHORT TERM CORRECTION?

1/23/25

OUR ENTIRE NEW CROP SALES THOUGHTS & OLD CROP SELL SIGNAL

1/22/25

GRAINS TAKE A BREATHER. IS CORN IN A BULL OR BEAR MARKET?

1/21/25

HUGE DAY IN GRAINS. WHAT TO DO WITH OLD CROP VS NEW CROP

Read More

1/20/25

VIDEO CHART UPDATE

1/17/25

TRUMP, CHINA, ARGY & USING THE SPREADS INVERSE

1/16/25

OLD CROP LEADS US LOWER. MARKETING THOUGHTS

1/15/25

SIGNAL & HEDGE ALERT QUESTIONS EXPLAINED. IS $6 CORN EVEN POSSIBLE?

1/14/25

MORE DETAILS ON TODAYS HEDGE ALERT & SELL SIGNAL

1/14/25

CORN & SOYBEANS HEDGE ALERT/SELL SIGNAL

1/13/25

USDA GAME CHANGER OR NOT?

1/10/25

BULLISH USDA FOR CORN & BEANS

1/9/25

USDA OUT TOMORROW

1/8/25

2 DAYS UNTIL USDA. BE PREPARED

1/7/25

THE HISTORY OF THE JAN USDA & MORE

1/6/25

MAJOR USDA REPORT FRIDAY

Read More

1/3/25

UGLY DAY ACROSS THE GRAINS

1/2/25

LONG TERM CORN UPTREND? JANUARY DROP OFF IN BEANS? LONG TERM WHEAT FACTORS

1/2/25

CATTLE HEDGE ALERT

12/31/24

MASSIVE DAY FOR GRAINS. FLOORS? 2025 SALES? GAME PLAN? CHART BREAKDOWNS

12/30/24

GRAINS FADE EARLY HIGHS

12/27/24

STILL LONG TERM UPSIDE POTENTIAL, BUT TAKE ADVANTAGE OF 6 MONTH CORN HIGH

12/26/24

CORN ABOVE 200-DAY MA. ARGY DRY. BEANS +44 CENTS OFF LOWS

12/23/24

CORN & BEANS TALE OF 2 STORIES. BEANS REJECT OLD SUPPORT

12/20/24

PERFECT BOUNCE IN CORN. SIMPLE BEAN BACKTEST BEFORE LOWER?

12/19/24

THE SOYBEAN PROBLEM. NEW WHEAT LOWS. CORN UPTREND

12/18/24

BEANS BREAK SUPPORT & OPEN FLOOD GATES

12/17/24

SINK OR SWIM TIME FOR SOYBEANS

12/16/24

SOYBEANS & WHEAT FIGHTING LOWS. WILL CORN DEMAND CONTINUE

12/13/24

POST USDA COOL OFF

12/12/24

CORN CORRECTION. WHY WE ALERTED SELL SIGNAL YESTERDAY

12/11/24

USDA PRICED IN? FAIR VALUE OF CORN? BEAN BREAKOUT?

12/11/24

CORN SELL SIGNAL

12/10/24

USDA BREAKDOWN

12/9/24

USDA TOMORROW

12/6/24

CORN TRYING TO BREAKOUT. MAKING MARKETING DECISIONS

12/5/24

OPTIMISTIC BOUNCE IN GRAINS

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24