WEEKLY GRAIN NEWSLETTER

By Jeremey Frost

This is Jeremey Frost with some not so fearless comments for www.dailymarketminute.com.

Did the January USDA report change the price destination that corn and beans have? We had a major report with several demand and supply changes earlier in the week, these changes caught some off guard. I think the report and other recent info have had enough friendly little tidbits that it has opened the likelihood that our 2023 acre war could create new all time highs for some of the grain and oilseed markets.

Tidbit #1 USDA acknowledged drought conditions via increasing the un-harvested acres and decreasing overall production in both corn and beans. If the USDA would have chosen to leave unharvested acres alone and just adjust yields lower our prices would have had more fund buying.

But the USDA helped keep a bigger headline “yield” from causing the algo’s to buy corn. What I mean by this is overall our production dropped by 200 million bushels, but not all wire services even list harvested acres. So via how the USDA decreased production they helped control price action as when the algo’s seen USDA increased corn yield the programs would have simply got a sell. This also longer term affects the trend line yields that the USDA uses.

Tidbit #2 USDA decreased demand to the tune of 150 million bushels of corn exports, 25 million bushels of corn feed usage, and 55 million bushels of soybean exports. Corn export number makes sense but is really jumping the gun considering the fact that the US is really the only corn game left for the next several months. If Brazil corn crop gets smaller our exports will likely get revised larger in the future.

The soybean export decrease only makes sense because we may not have beans to export.

As for the decrease in corn feed usage Wright on the Markets said this the other day “Take this to the bank also: By the end of this corn marketing year, corn for feed use will be 300+ million bushels higher the USDA stated. There is no way we will feed 425+ million fewer bushels of corn this marketing year.”

Tidbit #3 CONAB which is the equivalent of the USDA in Brazil pegged Brazil soybean carryout as decreasing to 206.5 million bushels from the present 220 million bushels. But that’s with an increase of nearly 955 million bushels more in production.

They are forecasted to grow nearly a billion bushels more soybeans but have fewer soybeans then before. Can you say the word demand.

Ask yourself what will happen if this Brazil soybean crop gets some hiccups? Folks Mother Nature needs to continue to be very nice to Brazil or we will see $20 beans sooner then later.

One other thing that CONAB noted was the fact that Brazil needs to see carryouts increase substantially in 2024 for national food security. Is this Brazil trying to tell China that they will be shutting off exports to them sometime in the future?

Tidbit #4 Funds sold a lot of grain in the past CFTC report. Stages are set that should accelerate prices to the upside if the funds decide to buy. Meaning some of the headlines such as a decreased carryouts have changed thus less will be as willing to sell. Exports decreased so those that wanted to sell corn because they thought our exports were overstated probably are not as likely to sell because the USDA has already acknowledged and trimmed our projected exports. Plus farmers have sold a lot of grain to start the year and I think the bin doors are not going to open as easily as they did right after the turn of the calendar.

Some of the charts have plenty of pockets of air that we funds could easily decide to go after.

If the funds do decide to join the party the technical picture looks fairly good, and will accelerate if we break the highs we had a few weeks ago.

Some targets that are still in place from the Tech guy include: https://www.wrightonthemarket.com/post/tech-guy-weekend-comments-1-14-23

Corn 7.05 uptrend line from 2020, 7.30 gap, 2021 high near 7.60, Break out measurements of 9.50 and 9.98

Beans 17.16 which is breakout of range.

Read more at the link above.

Demand is still for real

This is from the American Association of soybeans. “The American Soybean Association, along with others in the biofuels industry, weighed in this month on U.S. EPA’s draft “set” rule, which sets annual biofuel blending targets under the Renewable Fuel Standard, including proposed renewable volume obligations (RVOs) for 2023-’25.

EPA released its draft in early December, drawing surprise and concern from ASA and others. In a media statement on the decision, ASA said the draft set rule is “deeply disappointing for the biofuels industry and threatens the integrity of the RFS by significantly dialing back annual increases in volume obligations.”

On Jan. 10, ASA directors Dave Walton (Iowa), Chris Hill (Minnesota), Rob Shaffer (Illinois), Monte Peterson (North Dakota), Josh Gackle (North Dakota), Alan Meadows (Tennessee), Daryl Cates (Illinois), Steph Essick (Iowa), Dennis Fujan (Nebraska), Charles Atkinson (Kansas), and Jordan Scott (South Dakota), along with the group’s chief economist, Scott Gerlt, testified on the set rule during EPA’s virtual public hearing.

Soy growers said the new proposed rule will negatively impact producers by derailing the progress and growth made in biofuels investment. They said it also does not align with the administration’s previous commitment to mitigating climate change and lowering greenhouse-gas emissions.

As companies across the soybean-growing region have announced expanded crush capacity expected over the next three years that would increase soybean-oil supplies by about 5.5 billion pounds, Shaffer shared his concerns that EPA’s proposed rule will severely undercut those investments.

“EPA sent a signal to the market in its last rule that affirmed the government’s commitment to biomass-based diesel,” Shaffer said. “The market responded appropriately, announcing tremendous investments in the industry to spur growth and increase domestic soybean-oil supplies. The draft rule for 2023 and beyond would bring those investments to a grinding halt and prevent growth in the industry and our rural economy.”

Cates, president of ASA, shared similar concerns in his testimony.

“EPA made assumptions based on data that doesn’t take into account all the investments that have been announced across the biofuel value chain,” he said. “The fact that biomass-based diesel production has already surpassed the RVOs set forth in this rule tells you all you need to know—the proposal is deeply flawed and needs to be reconsidered to reflect the current state of the market.”

Essick urged EPA not to let weak RVOs stifle the progress being made in the low-carbon fuel sector.

“The rule shuts the door on growth in the biomass-based diesel sector and puts new soybean-crush plants like Platinum Crush in northwest Iowa that are being built with state support in jeopardy,” she said. “In northwest Iowa, the closest plant can be more than an hour away for some farmers, and it often has wait times of more than three hours. This new plant will save farmers time and money, and it will lower their emission outputs because of the shorter travel and wait times.”

ASA said it appreciated the opportunity for public comment and will continue to strongly urge EPA to reevaluate its proposed RVOs for 2023 and beyond before publishing a final rule.

Through a consent decree submitted by EPA and Growth Energy, EPA is required to release the final set rule by June 14.”

The bottom line is that globally our demand for biofuels seems to be off the charts. One of the reasons that Brazil is going to grow nearly a billion bushels more of soybeans yet have less bushels at the end of the year is the fact that their biodiesel blend will be increased to 15%.

The US dollar

The US dollar has been under some pressure and if that continues that could be the catalyst we need to get the funds to pile in buying grains. The price action lately has been trying to catch a falling knife. This is one where the trend is your friend and lately that trend has been down. Will it reverse?

China

I read an article that talked about China hoping to increase soybean production domestically by 40% by 2025. Some might say that is very bearish. But my view on it is that China realizes that both the US and Brazil in a few years will be using more and more beans domestically. We won’t have beans for them, so they better figure out how to grow some themselves.

All the plants that are coming online in the US is just the start of things.

World demand is going to continue to increase for grains and oilseeds and as 3rd world and middle world nations living increases so will demand.

Look at the amount of grain that the US produces and uses. We don’t have enough grain nor enough land in the world for everyone to be able to live like Americans can. We don’t. So as economies and standards of living grow, food shortage becomes real.

Grain Sales - what to do?

I think that the report we had last week increases the likelihood of my prediction of new all time high prices. So what is going to take for that prediction to happen? Hopefully it will just naturally happen with what seasonals tend to do to price action.

But we do have to watch for some of the following. We want to see our markets either building momentum or charging energy so that our charts and technical perspective align to higher prices. Charts and technical trading can be somewhat self fulfilling when a large number of traders use them.

Basically we need to break resistance on charts, or stall at resistance and gather energy then break resistance. Take corn as example, we obviously can not hit 9.98 corn without hitting 7.00 or 8.00 first. So the first thing we need to do is take out the highs we had a few weeks ago. If we can do that then some of those other targets mentioned above become real targets and by more and more traders.

So for grain sales, be patient and don’t be fear selling. Unless our fundamentals change we really have no reason to do anything other than wait for production scares. Our balance sheets are tight enough that we have to produce big crops or we will see our prices go parabolic. I got this feeling that even if we do produce big crops that we will see demand offset production increases. Be patient and let’s see what price action does in the coming weeks.

The one thing to have on your radar is buying bean meal puts. So one can layer into them or wait for a sign. Right now I am waiting for a sign.

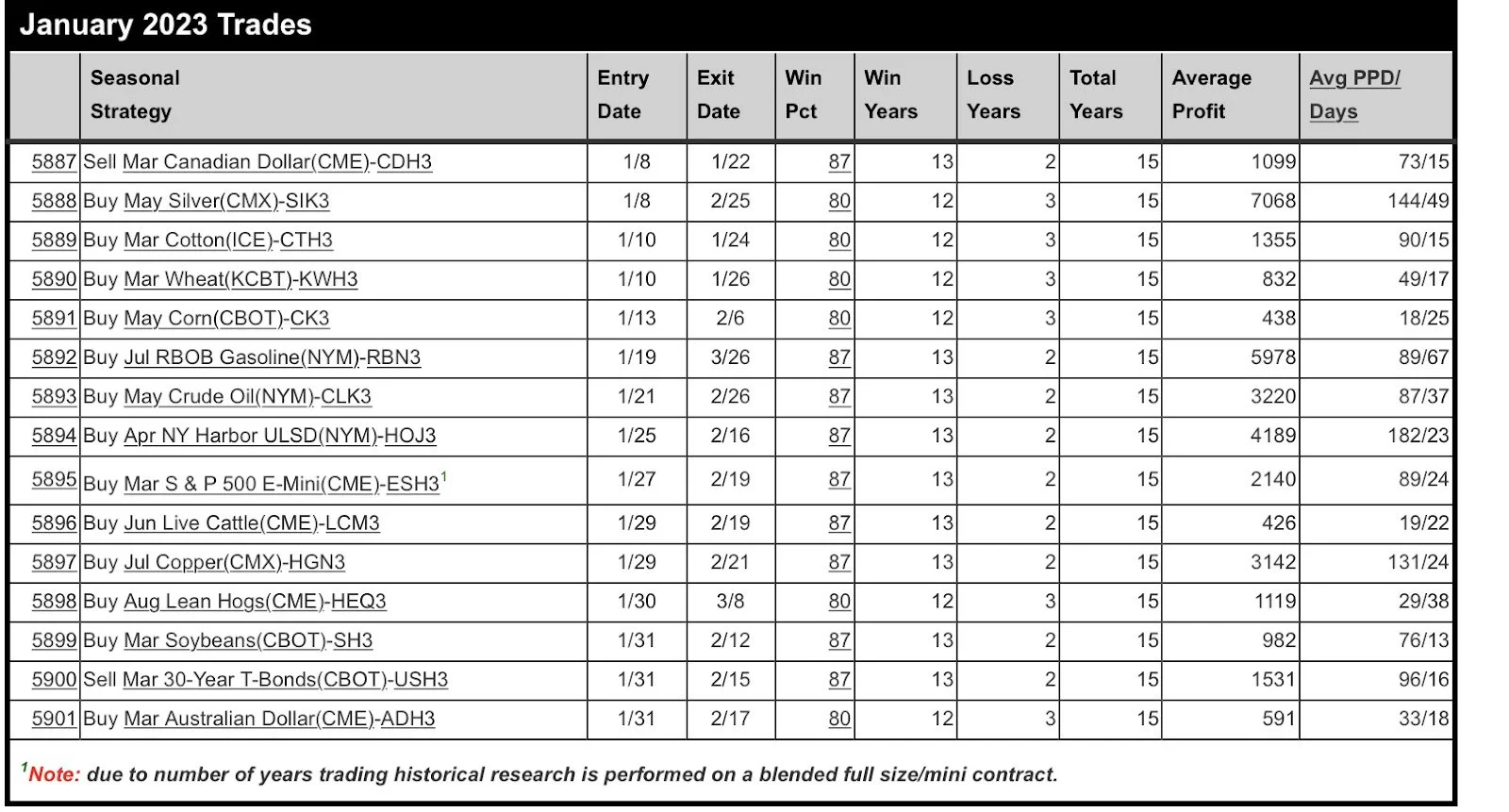

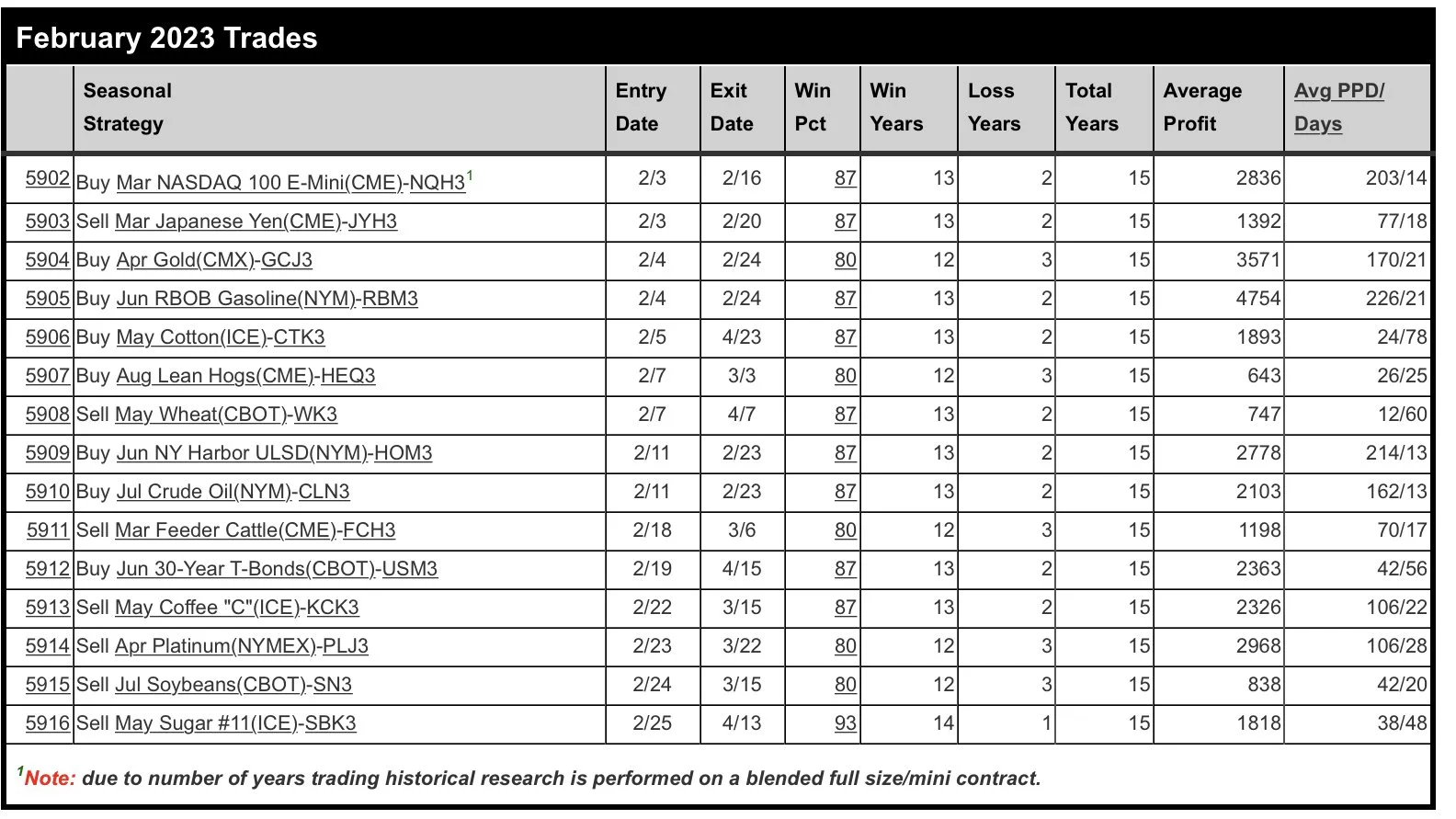

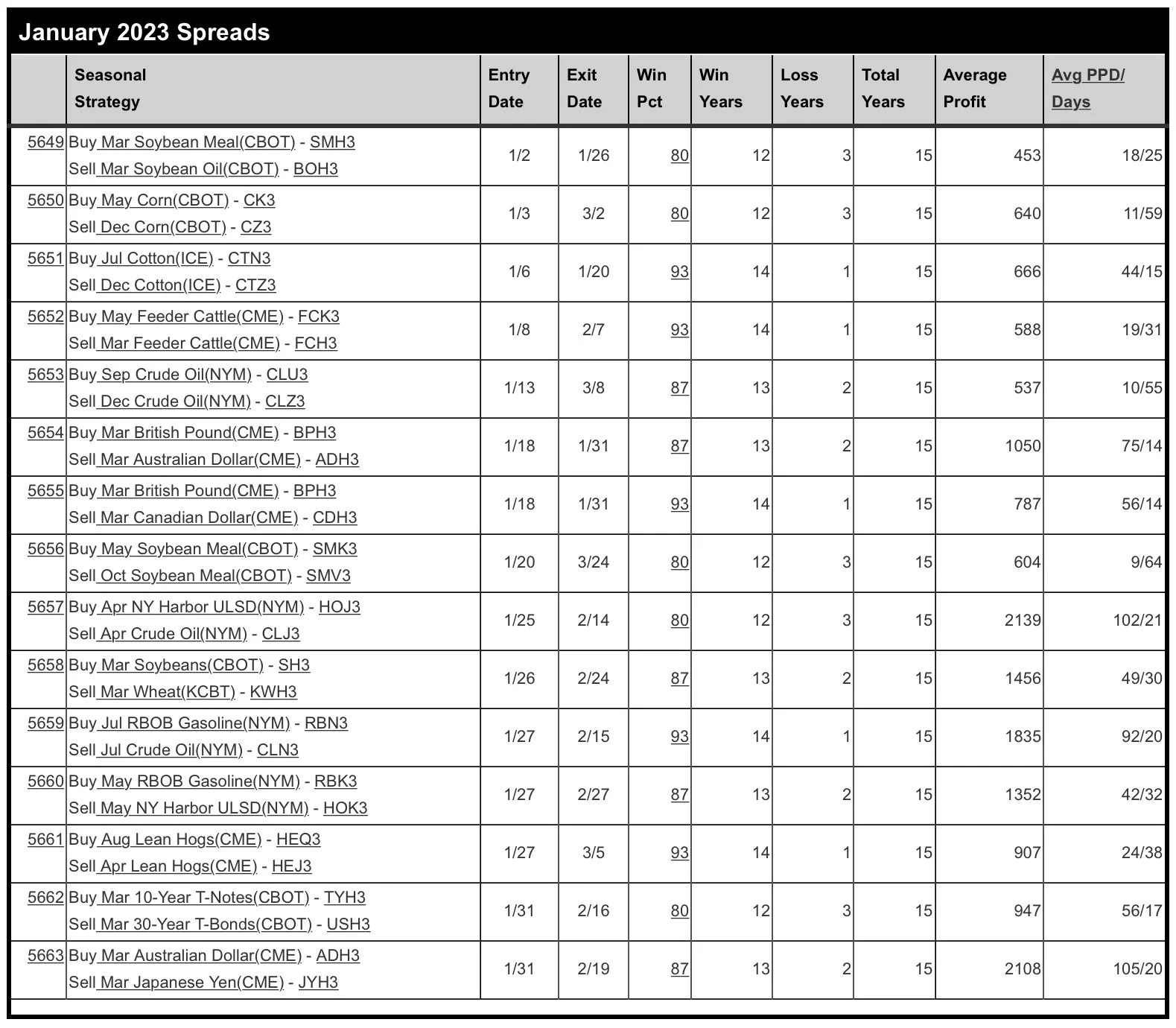

Here is list of seasonal trades and spread trades.

Commodity Overview

By Sebastian Frost

Overview

The USDA report provided the grains with two solid days of gains Thursday and Friday following our awful sell off the week prior. Most were actually anticipating pretty bearish news in the report, but that wasn't the case. As it was actually a very great report for the grains. With most numbers falling below estimates.

If you missed it, listen to Thursday's audio following the report.

How Bullish was the USDA Report? - Listen Here

Today's Main Takeaways

Corn

Out of all the grains, corn probably had the most bullish numbers in the report, hence the higher prices to close out the week. Corn ended +20 cents higher on the week despite the lower prices before the report. Corn futures are now over 25 cents off our early year lows.

I mentioned this in Friday's update, but the biggest bullish surprise was harvested acres coming in down -1.6 million as the USDA lowered production by 200 million bushels, even though most were actually expecting increased production. What makes this even more of a bullish surprise is that we actually saw a yield increase.

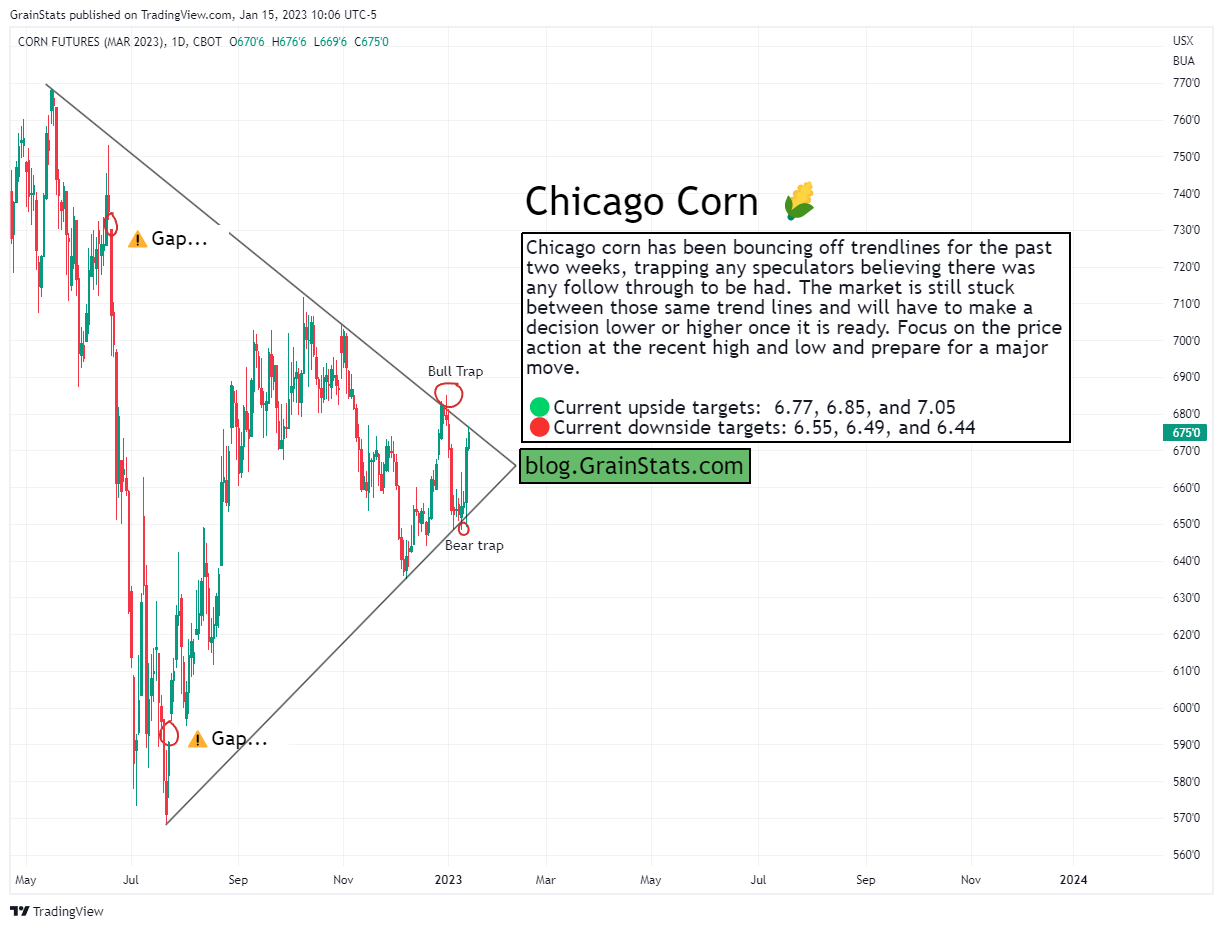

We will have to see if strength from the report carries into the new week or if we see some profit taking. From a technical standpoint, corn is at the very top of their recent trendline. So we will have to see if we break higher or bounce back into the trade range.

Factors for the corn market going forward will be Argentina weather, China, Demand, Funds, and other macro headlines.

This is a great technical analysis from Grain Stats.

They said,

"Chicago corn has been bouncing off trendlines for the past two weeks, trapping any speculators believing there was any follow through to be had. The market is still stuck between those same trend lines and will have to make a decision lower or higher once it is ready. Focus on the price action at the recent high and low and prepare for a major move."

🟢 Current upside targets: 6.77, 6.85, and 7.05

🔴 Current downside targets: 6.55, 6.49, and 6.44

Soybeans

Soybeans also had a pretty friendly USDA report, which caused the soybean market to rally to close out the week. Soybeans rallied +34 cents on the week and are now well off our early year lows as soybeans firmly pushed far past the $15 mark.

The question now is, do we continue higher, or do we run into resistance and see a sell off. Looking back at just before the new year when prices rallied to $15.37 1/2 at their peak, closing at $15.24 which is just about where we are at currently. The next trading day we lost -32 cents and fell back below $15. We will have to see if history repeats or if beans can push higher.

Prices are at their highest levels they’ve been at since May, so there is nothing wrong with rewarding these rallies. Just be comfortable in your operation. Especially given all the uncertainties surrounding the soybean market, there is risk there.

Now that we have the USDA report in the rearview mirror, the trade will largely focus on two things. Those being #1 South American weather especially Argentina for the time being. #2 Will be China, and where their covid and economy situation goes. Both of these main factors are essentially a wild card.

The trade keeps debating Brazil vs Argentina. As Brazil is expecting a record crop, while Argentina on the other hand is facing a historic drought with some of the lowest production we've seen in a while. However, there is some talk that most think Brazil’s large crop will offset the losses in Argentina enough.

This is another great technical analysis from GrainStats.

They said,

"It sounds like a broken record at this point, but the soybean market is still assessing the supply/demand situation in South America with Brazil expected to harvest a record crop and Argentina expected to have a +5 year low in production. Regardless of how the fundamentals play out, if you're a bull, you better hope that soybeans exhibit enough strength to break the local high of 15.37 and attempt to trade the pocket of open air above it rather quickly, otherwise gravity may bring us back to the uptrend line which continues to be tested."

🟢 Current upside targets: 15.37 and 15.45

🔴 Current downside targets: 14.86 and 14.64

Visit GrainStats website here

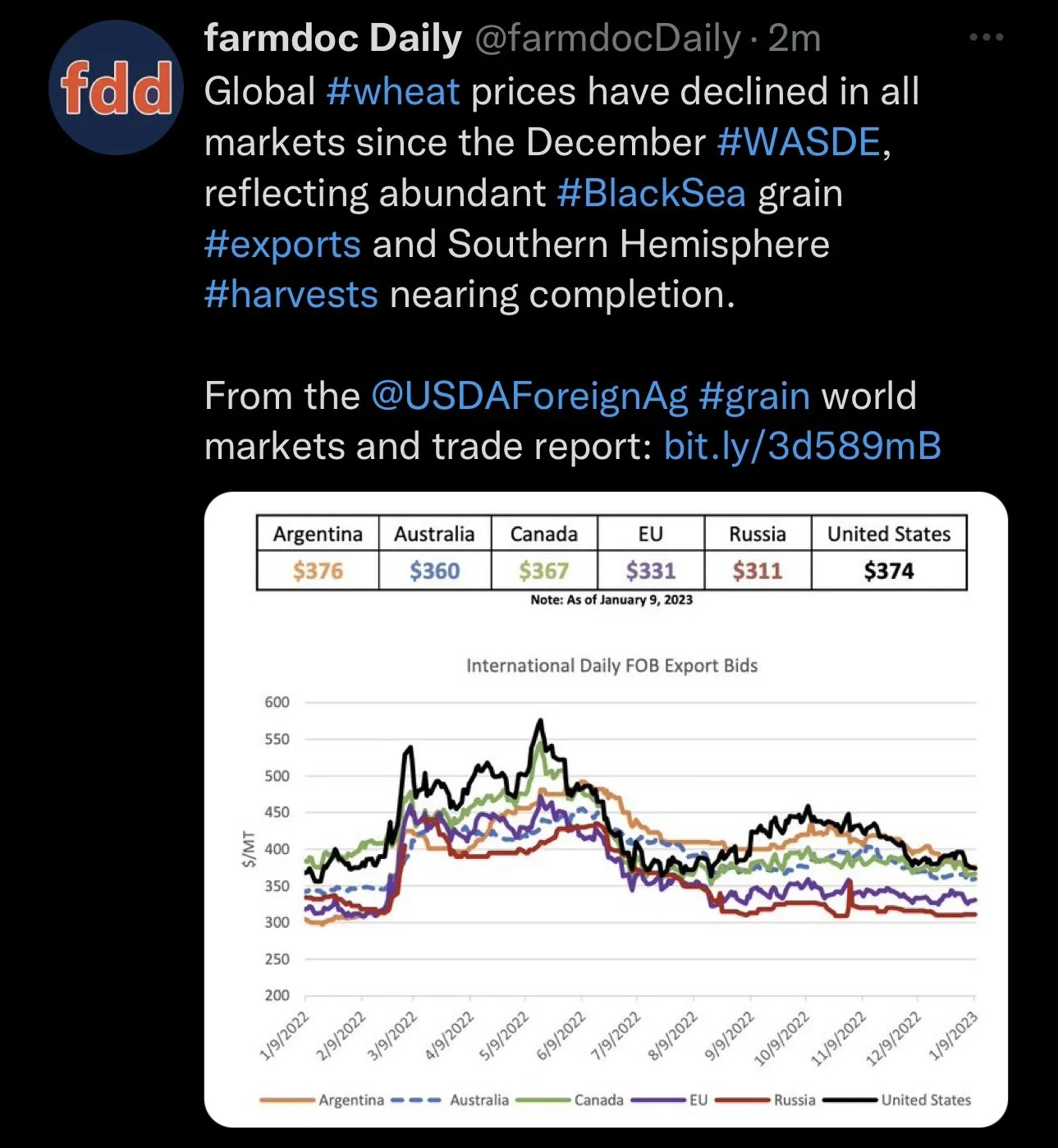

Wheat

Out of all the grains, wheats report was the least bullish. I wouldn’t say it was necessarily bearish however. As the report could have turned out far worse. Wheat ended green on the week, with Chicago just gaining +1 cent while KC and MPLS both saw +11 cent gains on the week.

Funds are net short all wheat contracts that trade on U.S. exchanges. We will have to see if they exit some of these positions, but with low prices comes less pressure to exit these. So funds will be a big factor in the wheat market going forward.

The other major factors that can shape the future of wheat include global and U.S. weather such as warm temps and possible winter kill. Global competition and prices. And war.

Personally, I think there a solid chance we see wheat futures rally in the coming months. Now of course, we can see prices possibly lower here as demand isn't there quite yet, and there aren’t a ton of things that can cause a massive bull run 'right now'. But regardless, I think with all the factors going on in the wheat market, there are far more bullish cards than bearish ones especially looking long-term towards early spring. A few other analysts also share this opinion, such as SovEcon who believes we made our lows in December, and Wright on the Markets who thinks we see wheat rally in the next two months.

SovEcon (Andrey Sizov) said that "The global wheat supply & demand is tense and it relies too much on the Black Sea with all its war risks threatening supplies. The Russian crop is huge but its not easy to convert it into huge exports because of the infrastructure bottlenecks that got worse thanks to the war." So essentially he thinks people are still underestimating the damage caused by the war, which is a very valid argument to be made.

This is a great write up from Roger at Wright on the Markets, where he talks about wheat and the Ukraine war.

"On Sunday, Russian news service reported Ukrainian agents intentionally destroyed a grain elevator in northeast Ukraine to accuse Russia of destroying grain reserves to provoke famine and destroying the grain export corridor deal. Russian media claims Ukraine will present the grainery destruction as “another atrocity committed by Russian troops requiring a tough response from the world community.”

Who destroyed the grain? Who knows? For grain producers and users, all that matters is that the act destroyed a lot of grain and escalated a war that still has no end in sight in the most productive wheat area of the war. Ukraine is also the world’s fourth leading corn exporter.

Given all the known factors, Roger expects wheat to rally in the coming two months and better than a 50/50 chance the new crop futures will rally into May. However, Roger recommends any of you who cannot afford or do not want to risk the price following the seasonal trend lower from now, then price as much wheat as your nerves can stand. If wheat does go significantly higher after you sell wheat, be emotionally and financially prepared to buy put options on every bushel to make the money on the way down you did not make on the way up.

To improve your marketing, you must do some things you never did before.

We will not recommend you buy any corn, wheat or soybean puts for at least two more months. Now is the time to do whatever you need to do to get educated and financially prepared to buy puts which will greatly increase your net income 19 out of 20 years. One out of 20 years, you probably will breakeven at the worst."

Visit Wright on the Markets website here

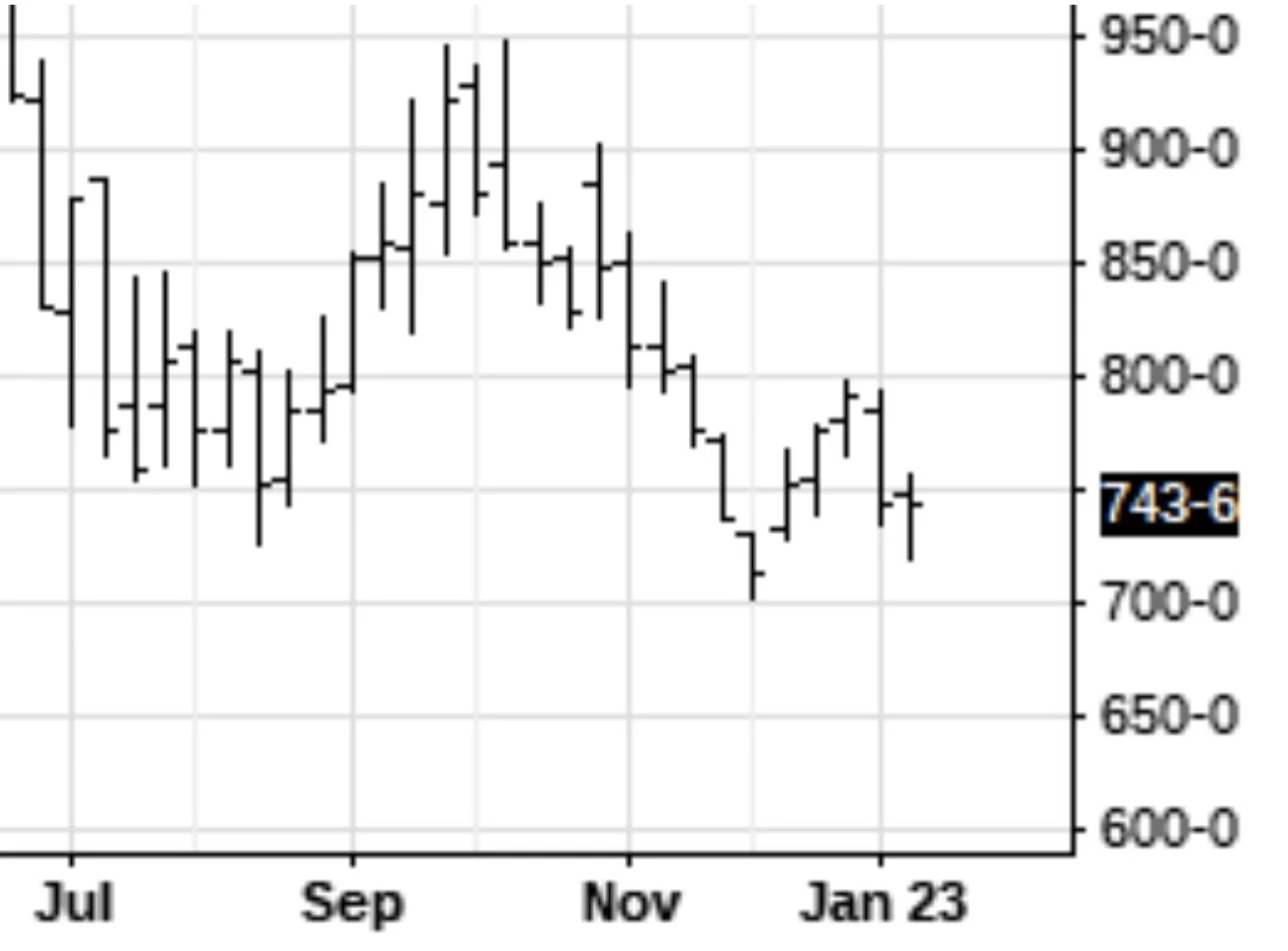

Here is a technical analysis from Wright on the Markets Tech Guy.

He said,

"March Chicago Wheat put in a Doji on last weeks weekly chart. Because of where the Doji is in relation to the rest of the chart (very near a previous low), this fact is more evidence that a rally is beginning.

I overheard another technical analyst say that Thursday's bar was a key reversal day because it marked a lower low than Wednesday then closed above it. I have placed a red arrow on the daily chart where this phenomena occurred - it is the 2nd and 3rd bar from the right. A Key reversal up is bullish.

The first chart is a blowup of the weekly wheat and the 2nd on is a blowup of the daily March Wheat chart highlighting the last few days of trade. Notice the Doji on last weeks bar where the open and close are near each other."

"Here is the daily chart highlighting the key reversal in March Wheat and 2nd close in-a-row above the bottom of the broadening pattern. What this reversal bar is saying - lower prices were attempted but they were met with furious fund buying - the lower price was vehemently rejected which translates into strength."

"The price targets for March Wheat are 760, then 799 in the nearterm."

I highly recommend checking out the rest of his technicals here

KC March-23

MPLS March-23

Highlights & News

It appears China is reopening, as according to Bloomberg they are seeing a spike in flights to and from Beijing indicating covid cooling down.

The personal savings rate for Americans hit a 17-year low.

Jim Cramer said the stock market charts suggest the market could rally for the next couple months..

The House of Representatives has voted to ban sales of US oil reserves to China. How will this impact oil prices?

Following the losses in 2022, the S&P 500 is up 4% to start the new year.

Bitcoin is up 25% to start the new year.

Egg prices have soared, in some places in the world they are up +550%.

Elon Musk said, "I think 2023 is going to be quite a serious recession. Its going to be, in my opinion, comparable to 2009."

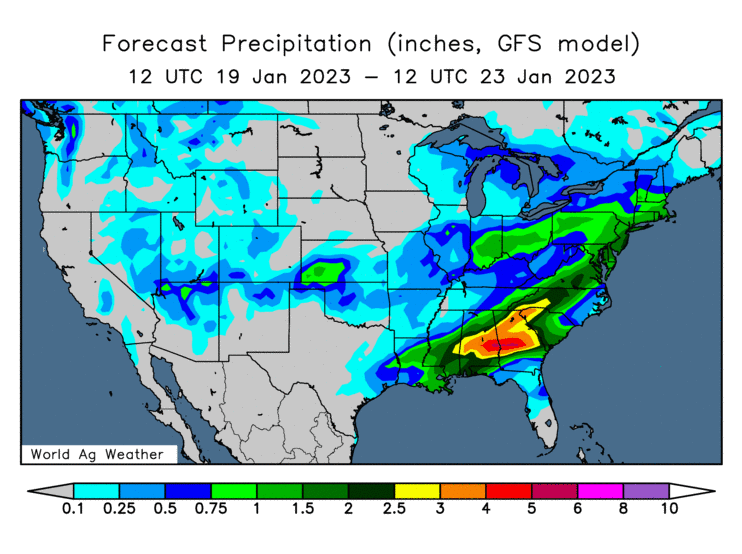

South America Weather

Argentina 4-7 Day Precipitation Forecast

Argentina 8-15 Day Precipitation Forecast

Argentina 8-15 Day Max Temp Forecast

Brazil 4-7 Day Precipitation Forecast

Brazil 8-15 Day Max Temp Forecast

Social Media

U.S. Weather

Source: National Weather Service