WEEKLY GRAIN NEWSLETTER

By Jeremey Frost

The USDA report this week has the potential to do one of the following.

Take away potential for new all time highs

Pause the path to new all time highs

Accelerate the path to new all time highs.

We will be watching this week’s USDA report to see if there are any fundamental changes.

What are the big things we need to watch for?

Demand - will USDA decrease demand with our slow exports in corn? What about feed demand?

Final Yields - Any shocker in final yields going to come up? Could the USDA print a small number for corn or beans? Will they find or lose 200-300 million bushels or more of corn?

South American Production - Will it matter what the USDA prints here? If it is too big the market will ignore it. But if the USDA is aggressive in cutting production estimates will it cause the funds to aggressively buy grains and oils seeds again?

Other USDA curveballs? Production or demand side of things for any major buyer or exporter?

Two major things that I watch on USDA reports are what are the numbers versus expectations or pre-report estimates. But also what is the trend. Herein Lies some risk for corn, will the USDA drop exports again, sticking with our slow export trend? We don’t want to see month after month of usage dropping.

If they do drop exports can they increase our corn feed usage enough to offset it?

The other trend that I think the USDA will be starting is the trend of smaller South American production numbers.

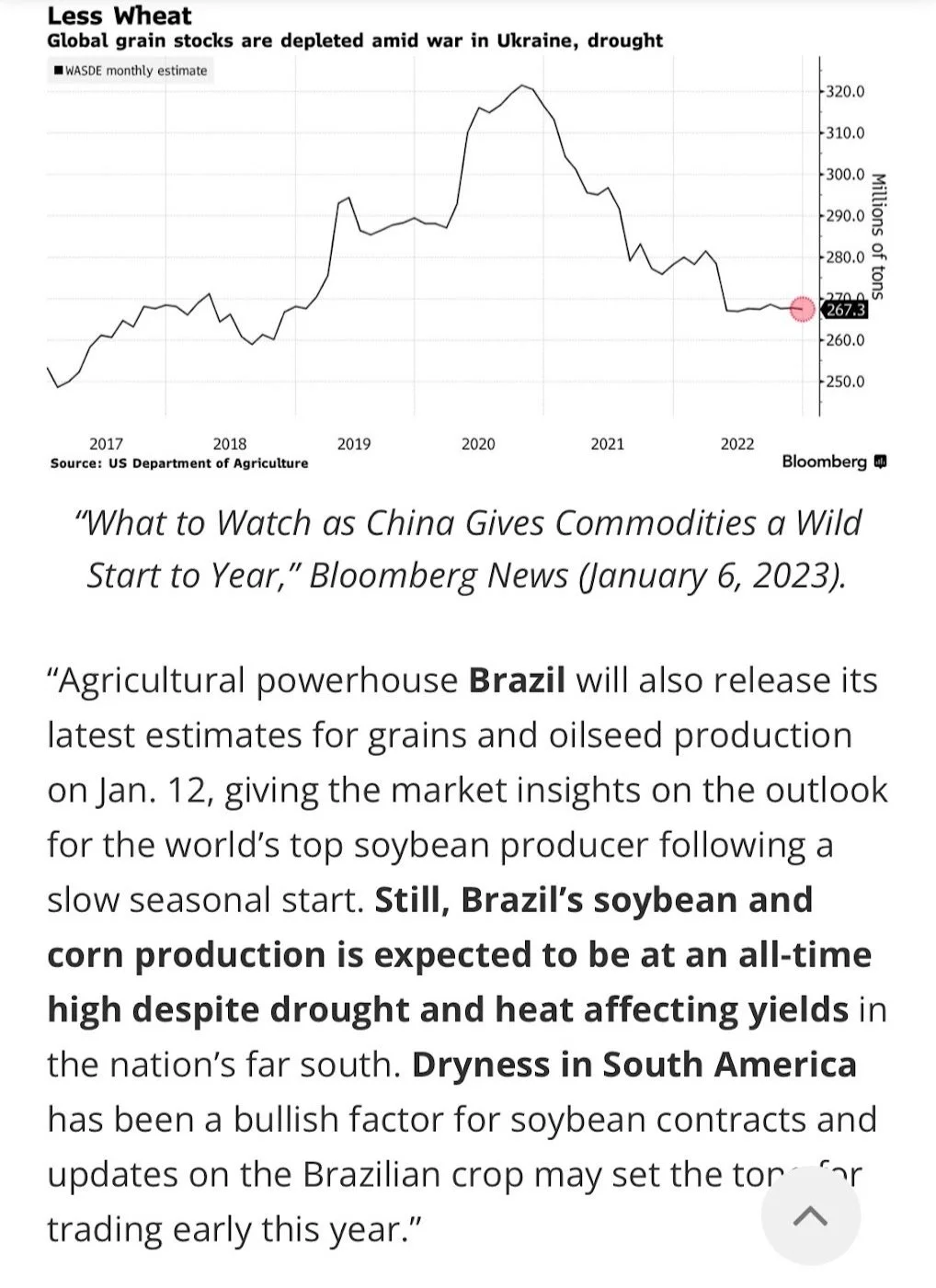

When one looks back at historical prices sometimes it is easier to see what was happening to drive the prices after the fact. On long rallies typically demand was getting stronger month after month or production was getting smaller month after month. This is one of the reasons I think we still have a great chance of taking out last year’s highs and then making new all time highs. The overall trend for demand has been stronger in the world for grains over several years in a row, despite COVID and recessions, etc. Well our production hasn’t kept pace. For wheat it has been 4 years in a row of demand outpacing production.

Soybean meal has made new contract highs. Remember the trend is your friend.

Will the next price stop be new all time highs? Once one commodity makes new all time highs, others should follow. Acre war 2023 hasn’t even had the cards shuffled yet. I may be jumping the gun a little bit on this comment, because we are nearly $100 a ton away from new all-time highs and we already have the funds record long. The good news is that funds are interested in at least some story in the grain market place.

December corn has some advisors being very bearish. If you are behind in making cheap FEAR sales, it might be a good time to catch up.

They have some points in thinking that SAM and the US could raise huge crops. First from what I am hearing the SAM crop is getting smaller.

Yes the US could have a perfect storm, giving us perfect planting conditions that lead to the biggest crop ever. And we might not even get one weather scare. Mother Nature has a history of zero weather scares during a planting and growing season. I am being a little sarcastic as we nearly always have some sort of weather scares. But by all means if you watch Chicken Little you will know that eventually the sky can fall.

How bad is the Argentina Drought?

I noticed some estimates in SAM already have our whole US carry out decreased in South American Production.

Below is a Tweet and below that is explanation of tweet.

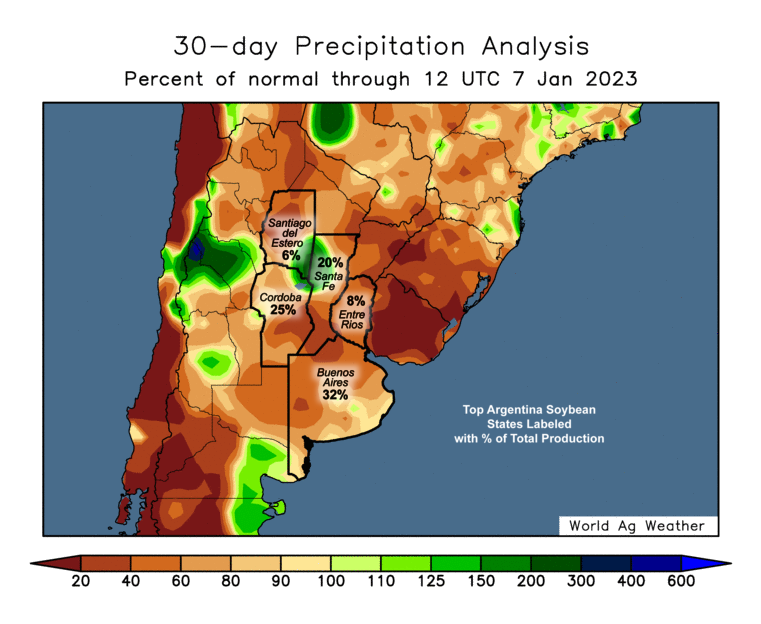

We have shared some of this info several times over the past several weeks. But some of the highlights include: Worst Drought since 1931, least amount of Sept-Dec moisture in the last 30 years.

Mother Nature will eventually be nice, but it doesn’t have to happen starting today, nor next week, nor next month. It could but it is not written in stone.

Here is a great post with some info on Canola

https://www.insightag.com/post/umbrella

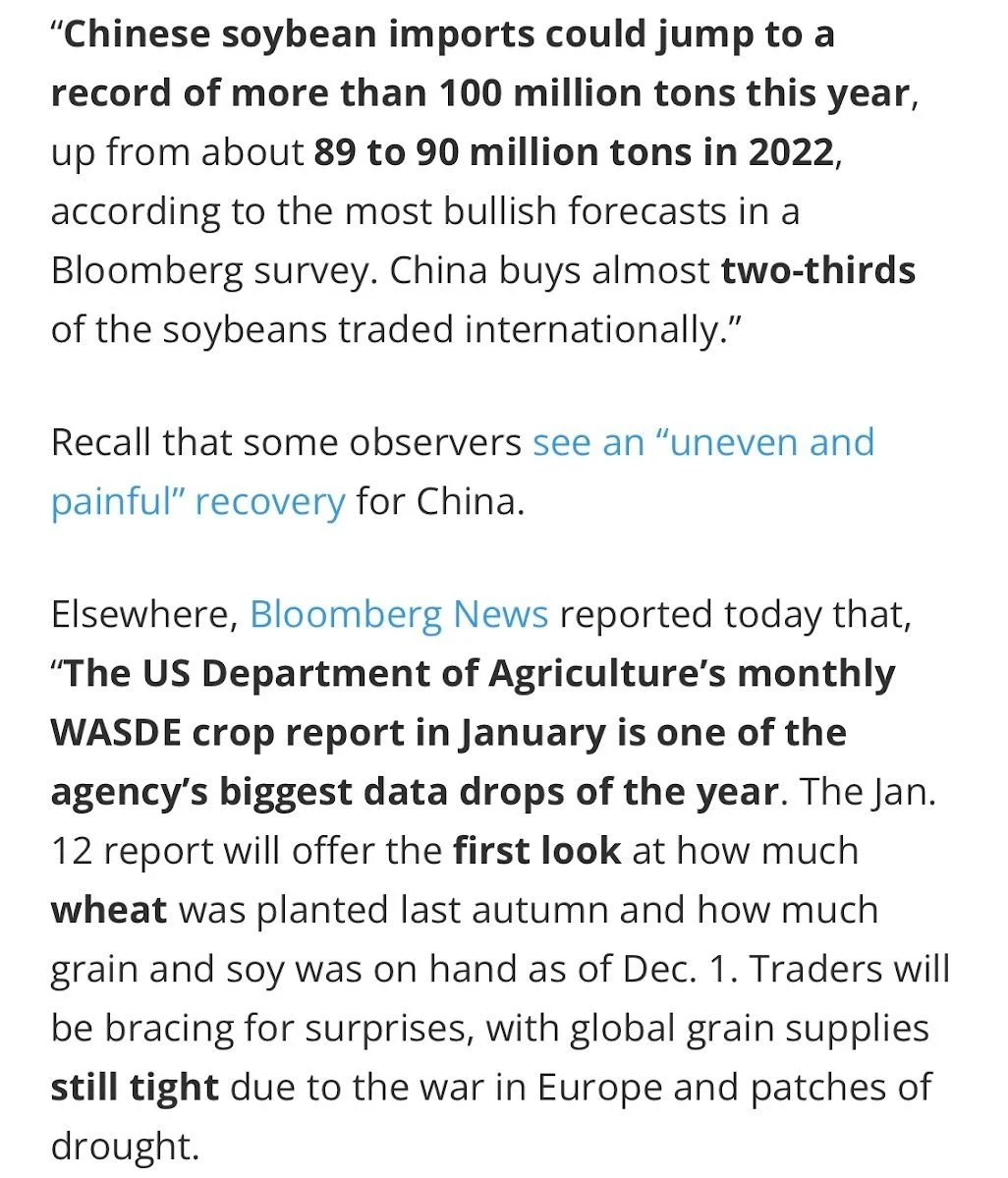

China

What is actually happening in China, and what will happen. What will the demand look like over the next several months and years? They continue to buy beans and have opened the door for the USDA to possibly increase our bean export demand. A couple months ago that was something not even possible but yet here again it looks like it could be.

From what I am reading and hearing there is also some possibility that China may be looking for some corn and wheat in the near future. Keep in mind until the second Brazil corn crop comes off in late spring early summer there isn’t a bunch of corn globally in the world for sale, other than the reliable USA corn and folks the reason we haven't been selling much is we don’t have much if any extra.

2023 USA Weather & Risk

Here is what I wrote on 11-20-22 in our weekly newsletter.

If history repeats itself, does the weather repeat itself too?

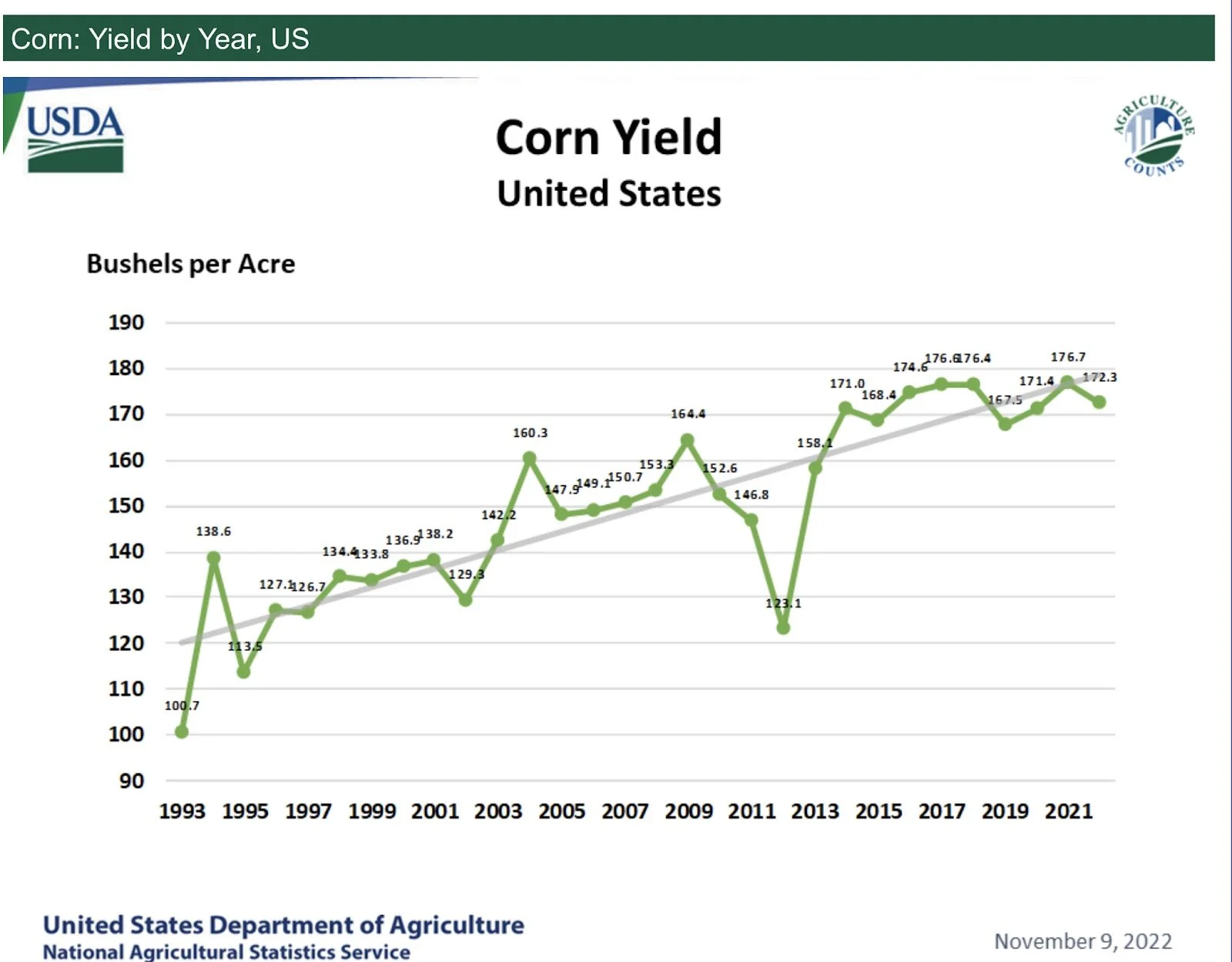

Question: what would happen if we saw #corn yields drop below trend like they did in 2012? How high would corn get if we only produced say 160 bushel an acre crop? What about if we only got 150 bushel an acre crop? What if we produce less than that?

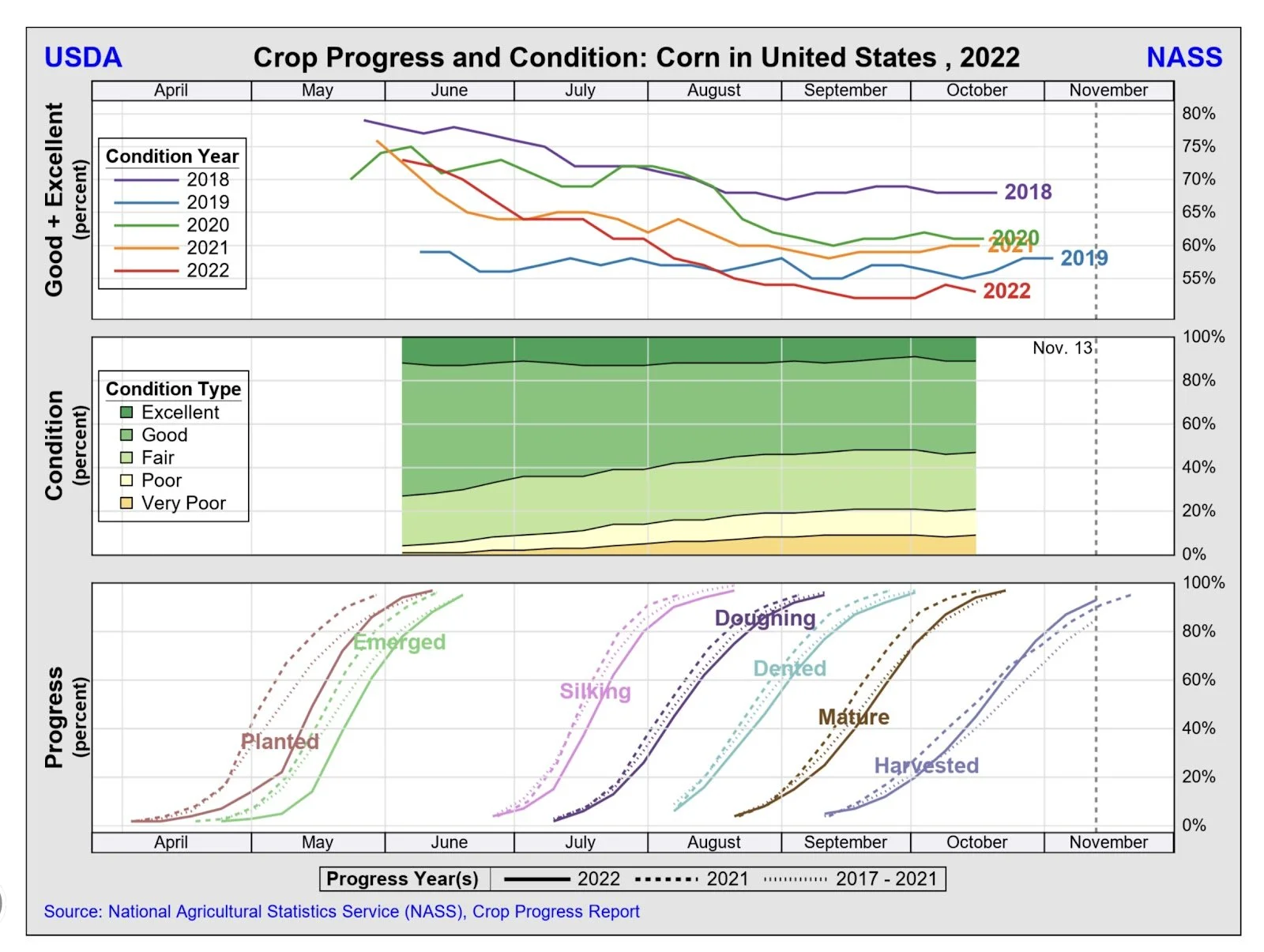

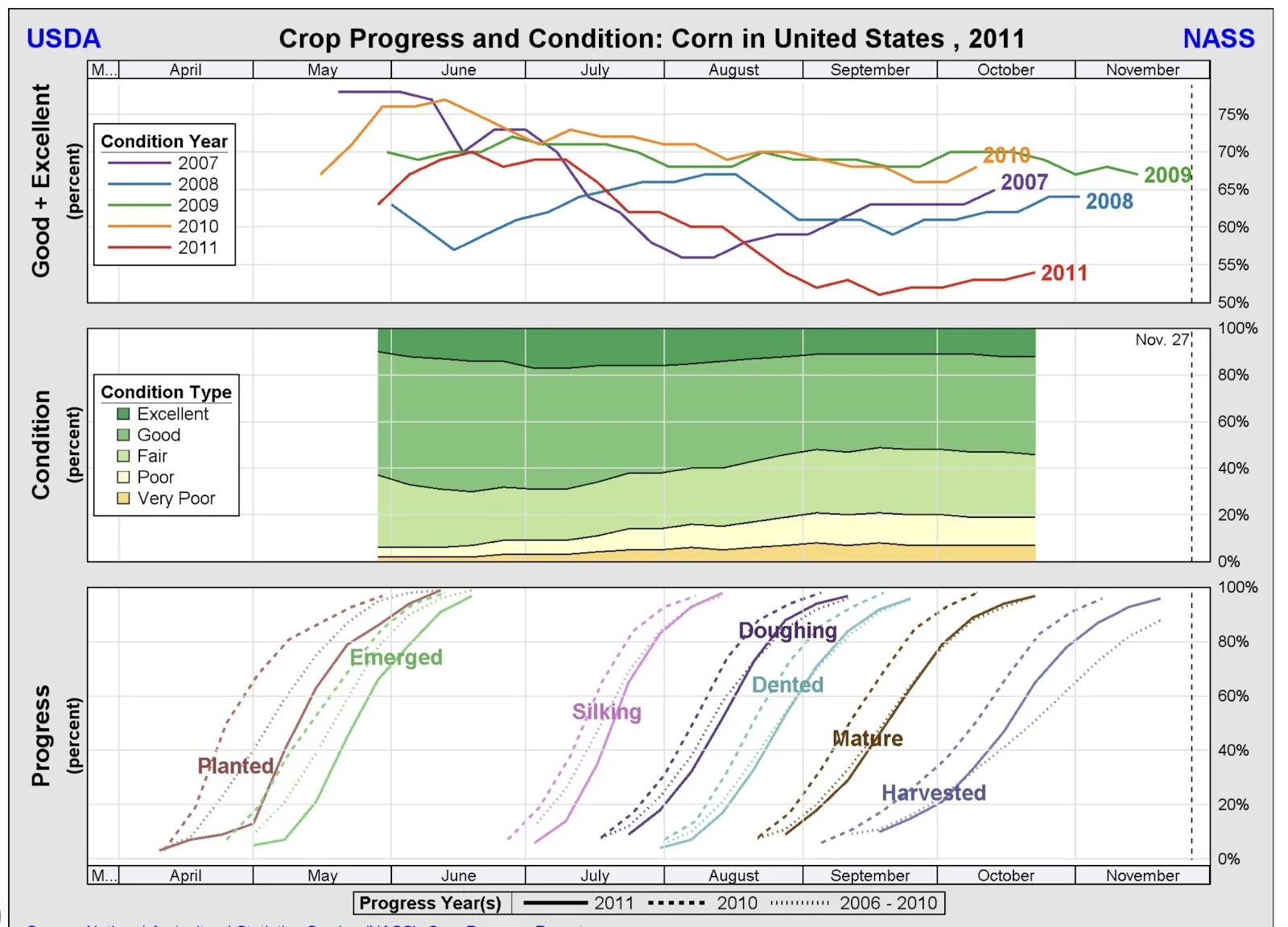

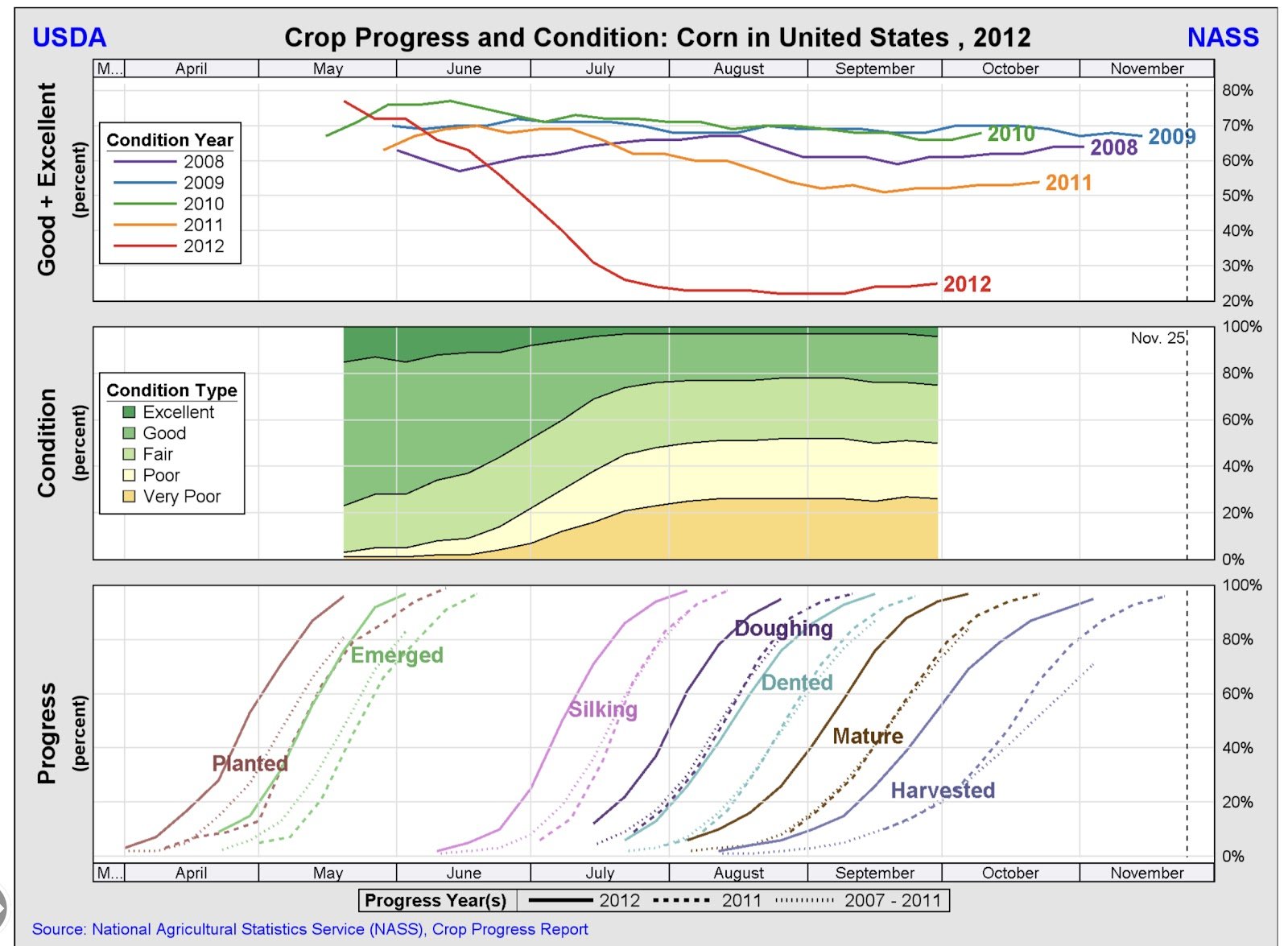

Look at the next 3 pictures, does the first one and the second one look very similar? It is comparing 2022 versus 2011. Once you look at the 3rd one, imagine what 2023 looks like if it is a repeat of 2012.

Very similar to the graph above, but watch out if we add a 2012 repeat on top of it.

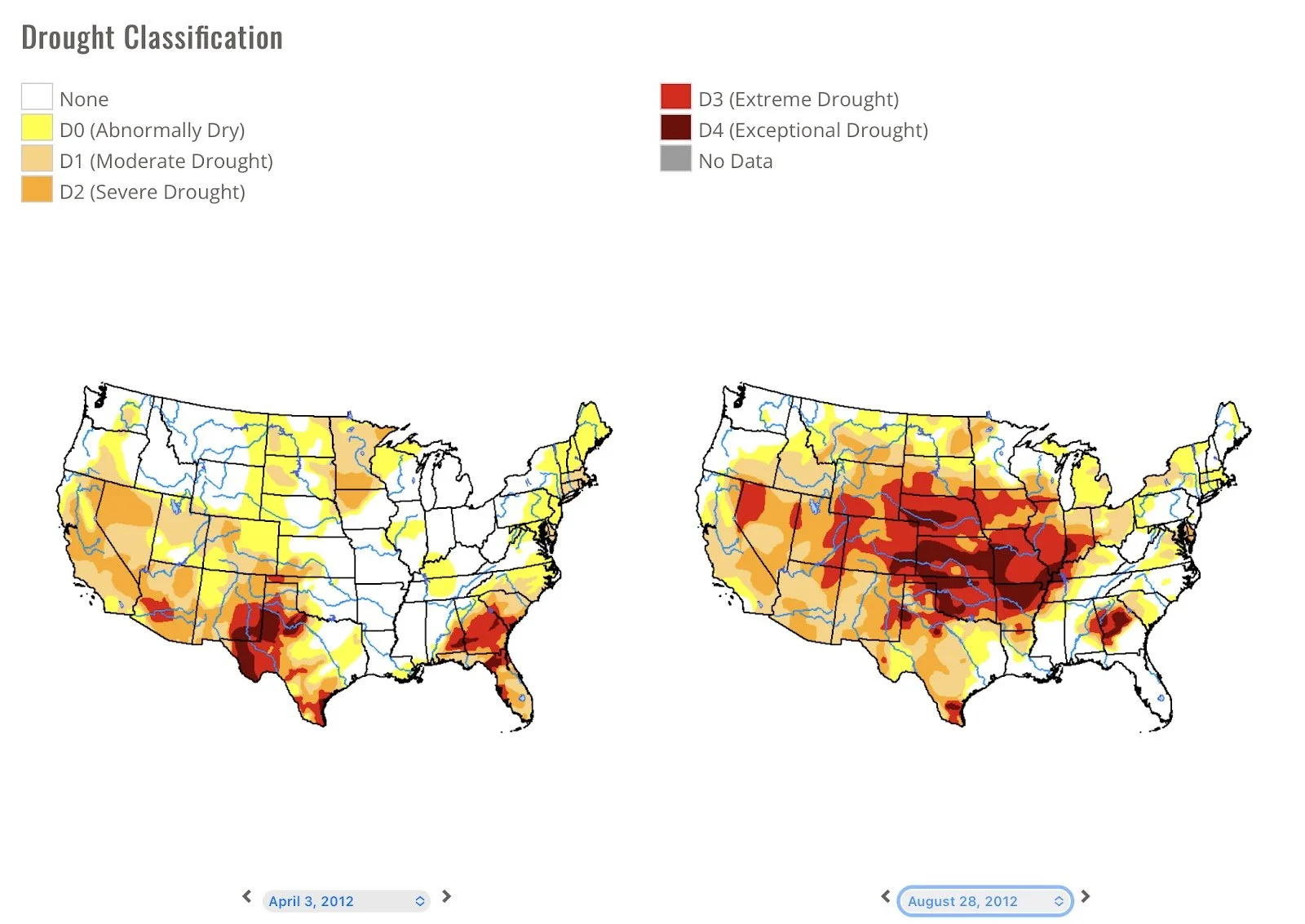

Next let’s look at some drought monitor comparisons.

Here is April of 2011 to November of 2011.

Next is April of 2012 to August of 2012. But look what happened from November of 2011 to April of 2012. We improved greatly. But by August of 2012 we had basically taken the November 2011 southern drought and moved it right to the heart of the corn belt.

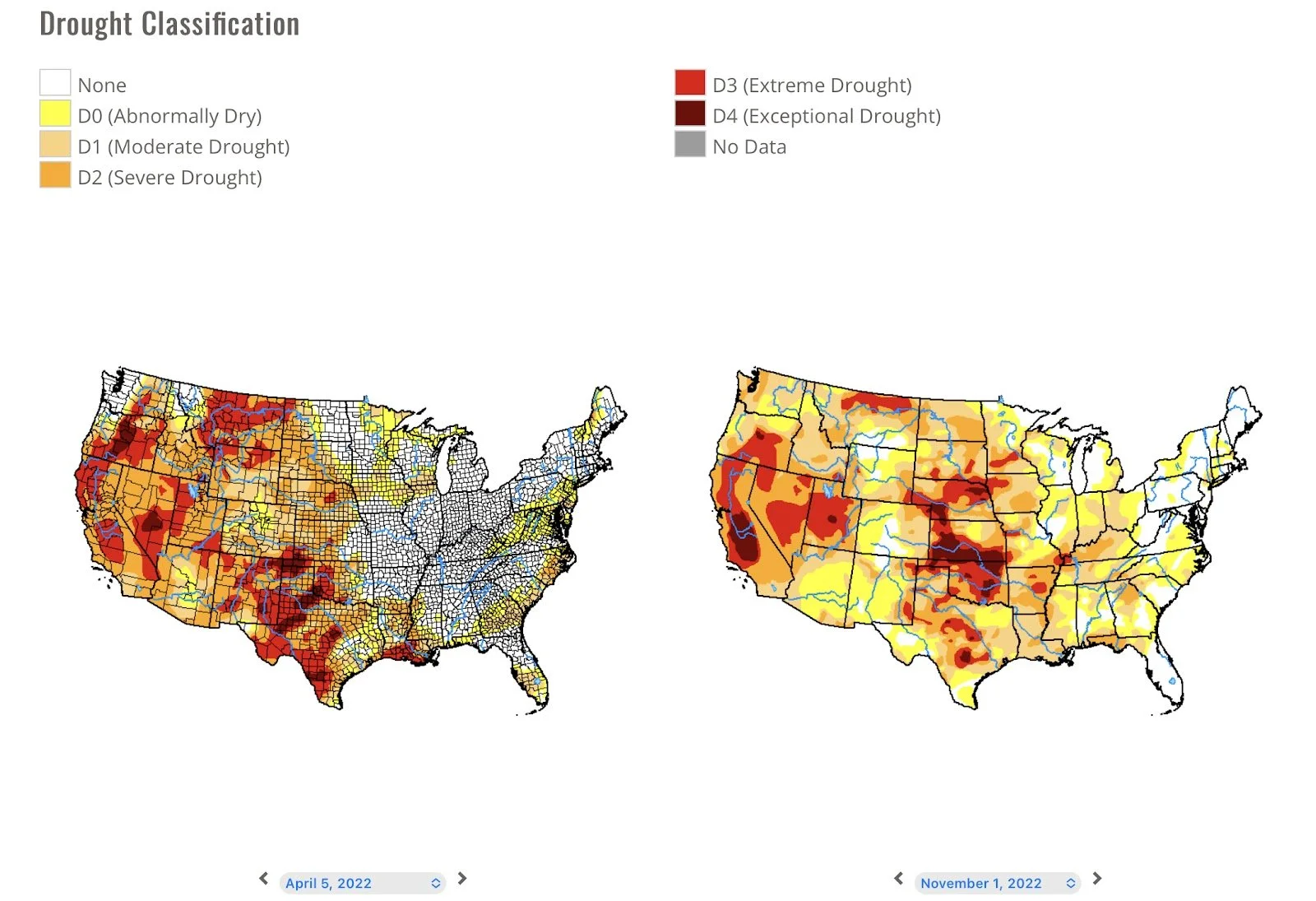

Here is a look at this year, folks the risk is we do the same thing as 2011-2012 and move that drought to the NE or right on top of the corn belt like we did in 2012.

Ok, so weather’s a risk. But I am not really telling you that we are going to new all time highs because I can predict weather am I? No, I can not predict weather, but some that I follow have done a good job of analyzing the effects that extremes have in one area to another.

I want to remind folks that we have some risk that our present drought gets a little better this winter, much like it did in late 2011 and into early 2012. Then expands and moves over the corn belt.

Weather in the US has been wetter the past couple of months but we are just getting back to about the same as we had been in September.

Other Good Info

From Wright on the Market.

China Tidbits from U of Illinois

From Oleg Shlovstov - Sunflower Oil

From Walter Cronin

Commodity Overview

By Sebastian Frost

Overview

Grains end their awful week on an optimistic note. Soybeans rallied and captured a lot of their losses from the recent sell off while corn managed to close green and wheat saw minor losses.

There hasn’t been much fundamentally that has changed from our pre Christmas rally until the sell off last week. A majority of the weakness has come from macro headlines such as Argentina rain and the possibility of a recession in China. Another thing that has been adding pressure to the markets that not many people are discussing is the fact that producers have been selling a lot of grain with the higher interest rates, taking some risk off the table.

All eyes are on the USDA report Thursday, as its a big one and will shake things up in the world of grains.

Today's Main Takeaways

Corn

Corn capped off its sub par week with a small amount of strength, closing Friday up just over a penny. On the week corn lost -23 cents on the sell off this week. Which in perspective isn’t all that bad considering the massive losses we saw in the wheat and soybean market.

Highlights

Biden will discuss the U.S. GMO corn dispute with Mexico's President next week. Mexico wants to phase out GMO corn imports by 2024. This would significantly reduce U.S. corn exports to its biggest buyer.

Export sales Friday morning came in very disappointing for corn. Coming in below expectations. Coming in at 0.319 million tons. Trade estimates were 0.4 to 1.0 million. Corn far trails the USDA pace by nearly 285 million bushels (14%).

Ethanol production fell to an 11-week low. As production was down -13% for the last week of the year and nearly -20% from the year before.

Gasoline demand was down -19% to its lowest level in nearly 2 years.

One thing adding some support to the U.S. corn market that has to be mentioned is the strong corn prices over in China. As they have seen over a week of consecutive gains. Their price equivalent to U.S. is $10.62 per bushel.

Overall, not much has changed in the corn market from the rally to the sell off. I think there is a good chance we see prices recover and bounce from these levels as we head into this week's USDA report.

Here is a technical analysis from Friday showing the triangle in corn. As you can see we are still in an uptrend from the end of summer. On Friday corn held its support of the trendline. I think we could definitely see prices bounce here and test the $6.70 to $6.80 range. But ultimately, the USDA will dictate the direction we go when Thursday comes.

Taking a look at the chart below. Yesterday corn found support on our uptrend from July, and we still hold an uptrend. Short term I think we easily retest the upper range of resistance and test $6.70-80 or possibly higher. But of course, we need to be aware of the USDA report next week as that could shake things up either way.

Corn March-23

Soybeans

Soybeans ended off the week giving bulls optimism, rallying over 20 cents following their brutal week long sell off. Soybeans traded in a near 60 cent range Friday. Despite the rally, beans still lost over 30 cents on this sell off. Now the question is, do we break higher or continue lower.

2 Factors Dominating Soybeans

There are two main things that have been influencing the bean market this week, and were the main reason for lower prices.

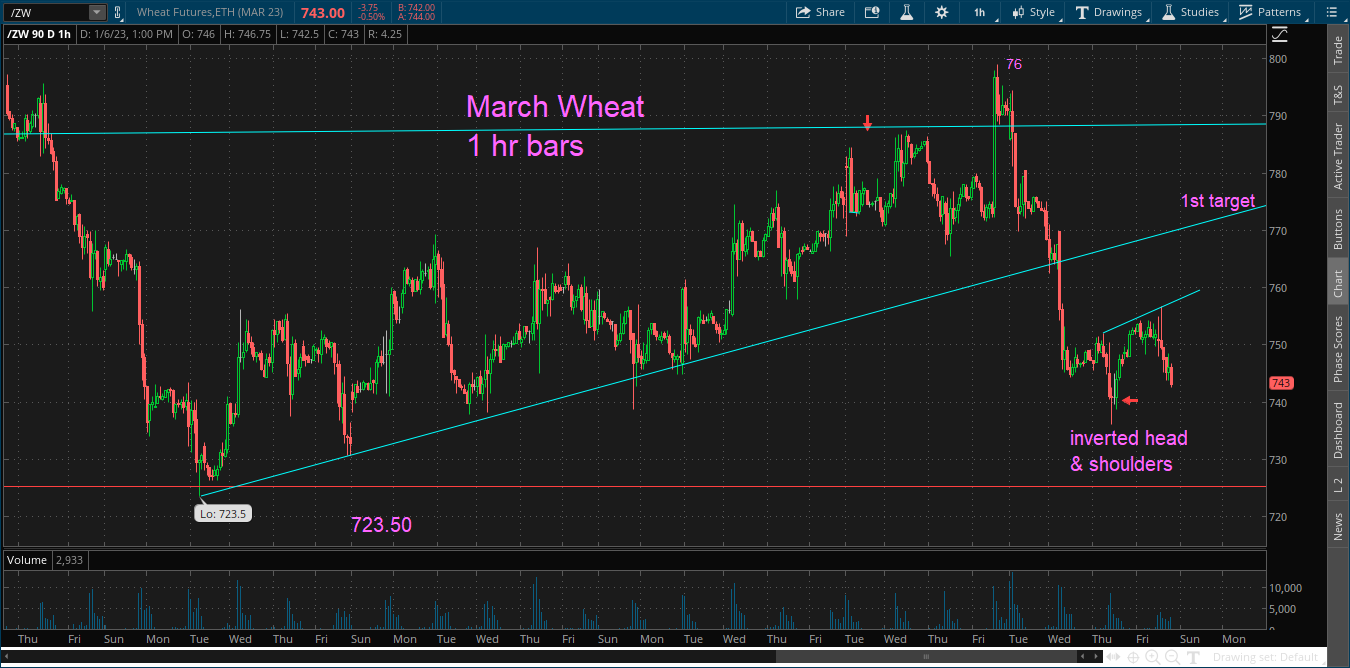

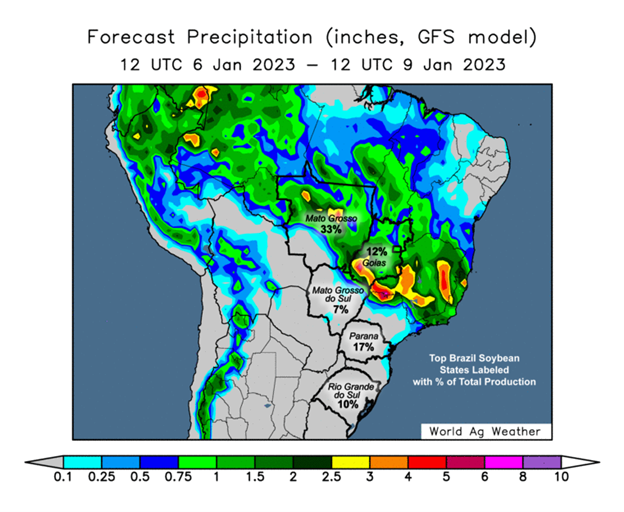

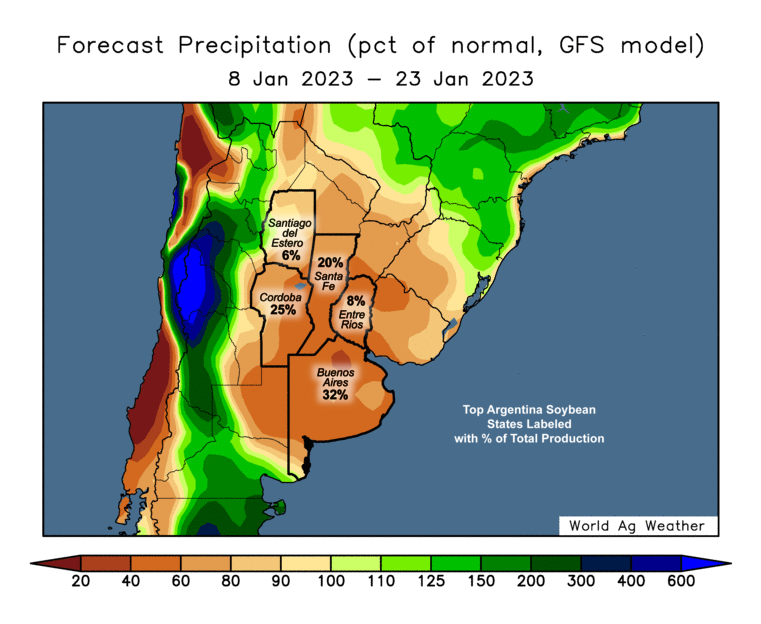

The first one is Argentina weather and forecasts. Some are saying Argentina might get up to an inch of rain next week. Any sign of rain pressures the soybean market. While continued dryness will support prices. Overall, the forecasts are still pretty dry. But, they are expected to see some rains this week. So we will have to see how much they get or don't get.

The second main factor is China. China increased their export corridors in crude oil. This is an indicator that their economy is under pressure as there is plenty of talks that China may be going into a recession or perhaps is already in one. So this definitely added pressure to the bean market.

China really just remains a while card for now. Will their covid situation get worse or get better. Will they go into a recession, or are they already in one. There are plenty of uncertainties and question marks surrounding China. If China does signal signs of a recession this wouldn’t be good news for the soybean market.

Insights from South American Agronomist

Here is a snippet from Wright on the Markets where he shared some insights from Francisco Mariani who is an agronomist in South America.

He predicted, "The Brazilian states of Parana and Rio Grande will drop Brazil’s soybean crop to 143-147 million metric tons. Paraguay will be 8 million mt and Argentina might make 38 million mt. Bolivia will also be less than normal." With that being said, the USDA currently has their Brazil forecast at 152 million, 49.5 for Argentina, and 10 for Paraguay. If he is right South America could far under perform what the USDA is expecting. Based on his estimates South America could be looking at over 340 million less bushels of soybeans than the USDA currently has forecasted.

In conclusion, soybeans will continue to influenced by South America and China which are both wild cards for the time being. We also have the USDA report this week. So there is definitely some uncertainties. Soybeans are still relatively high, so if one is nervous there is of course nothing wrong with making some sales here. If you are interested in other ways to manage your risk you can listen to a few of our past audios where we further discuss managing risk.

Thursday's Audio - Will Grains Bounce Here?

Listen Here

Dec. 28 Audio - Is $9 Corn & $20 Beans Possible?

Listen Here

Dec. 27 Audio - Is It Time to Sell Soybeans?

Listen Here

This is a write up from Jon Scheve over at Wright on the Markets where he goes over a list of reasons we could see soybeans higher or lower. You can read his write up here

This is what he had to say,

"As the market moves into 2023, there are many reasons bean prices could go up or down. The following provides rationale for both.

Reasons The Bean Market May Go Lower

When Brazil’s harvest is in full swing mid-January, US export sales pace likely drops significantly. This could lead to US sales being swapped to Brazil, which could in turn lower US prices.

La Nina is forecasted to end in February, which could help stabilize southern Brazil’s crop that was just planted, and the balance of Argentina’s bean crop being planted right now.

Brazil is expected to produce 20% more beans than last year, which is the equivalent of 50% of Argentina’s entire production. Total South American production is expected to be a record with normal precipitation from this point forward.

World economy concerns may mean a decrease in grain demand globally.

While China’s economy may be coming out of lockdown, some people may continue to self-isolate, which could keep food and feed demand suppressed for several more months.

As China opens up there are concerns a new covid variant may emerge and quickly spread around the world, causing widespread demand issues.

While the biofuel market is a bullish factor long term, most additional crush plants will not be operational until late 2024 or 2025.

Reasons The Bean Market May Go Higher

Export sales pace has been adequate, which could keep US carryout tight.

Argentina has had limited precipitation so far, and forecasts indicate dry weather may continue for at least another 2 weeks. This may mean nearly 20% fewer bushels will be produced than originally expected.

Southern Brazil, where 15% of their crop is grown, as well as Paraguay and Uruguay have been dry too and may have yield reductions.

China appears to be opening up again, which could lead to more feed demand.

Soy plants in the US continue to have healthy margins and will continue to grind as much as they can.

Over the long term, additional biofuel demand should keep bean demand strong.

Generally, farmers seem to have enough cash on hand, and may not be interested in selling grain until more is known about the summer weather.

La Nina continues to last longer than expected.

Bottomline

There are several major unknown variables that could impact prices moving forward. The first will be on January 12th, when one of the biggest USDA reports of the year, will provide final yield and stock numbers for 2022 and give the market direction. After that South America’s weather over the next 45 days will be a major factor the market looks at. Longer term the value of the US dollar compared to the Brazilian Real could dramatically affect prices. And finally, the world will continue to watch to see what is going on with China to gauge future demand from the world’s largest consumer of soybeans."

Thursday we saw soybeans break down and touch the trendline, but we bounced right off that trendline Friday. Do we climb back into the upper range of the channel or break the trendline?

Soybeans March-23

Wheat

Wheat ended their already awful week with some more minor losses, with Chigao losing 3 cents and both KC and MPLS losing 7. But one thing to note is that Friday Chicago was trading roughly 10 cents higher at one point, so perhaps there is some strength there.

Going forward, one thing to note that may pressure wheat futures is the large crop out of Australia. As they are expecting a record 42 million metric tons. Australia is the world’s 2nd largest exporter of wheat.

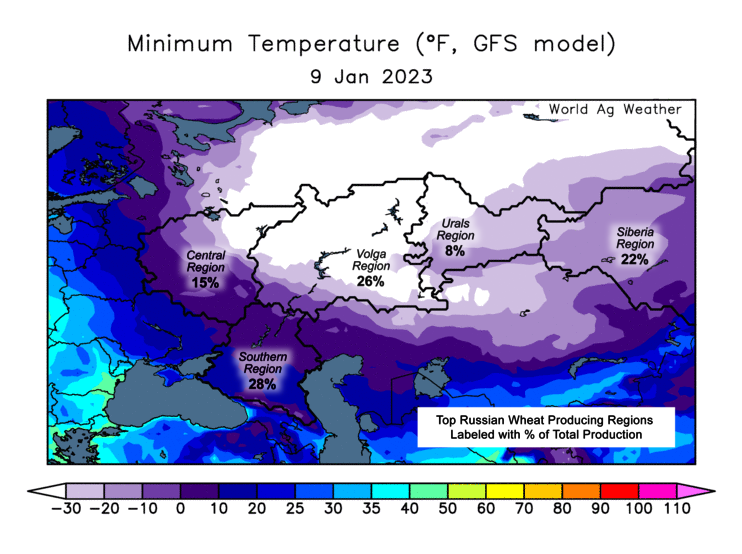

Now for the world's number 1 exporter of wheat. Russia. We already know they have a rather large crop. But they are facing some possible complications this coming week with possible winter kill. As they will have extremely cold temps with no snow cover. We will have to see how much damage their crop sees, but nonetheless this is a potential bullish factor.

One of the biggest things for wheat that's keeping a lid on prices is poor demand. Demand just hasn't been there. Tough global competition from countries like Russia who have cheaper product further weakens our demand.

A bullish headline was news that China would be auctioning off 140k MT of wheat from reserves this week. This is bullish because China only sells government stocks when domestic prices get very high. China always replaces government stocks which is half of the worlds carryout for all the grains.

Despite prices usually falling as spring approaches, SovEcon said they believe wheat prices bottomed out in December and are headed higher. Personally, I also think there is a fairly good chance we made our lows in December. Yes typically we see lower prices as spring comes, but this past year didn't follow any normal trends because it wasn't a normal year with the war and everything going on. I think there is a good chance we see prices climb higher looking long term towards spring.

SovEcon (Andrey Sizov) also said that the global wheat supply & demand is tense and it relies too much on the Black Sea with all its war risks threatening supplies. The Russian crop is huge but its not easy to convert it into huge exports because of the infrastructure bottlenecks that got worse thanks to the war. So essentially people are still underestimating the damage caused by the war.

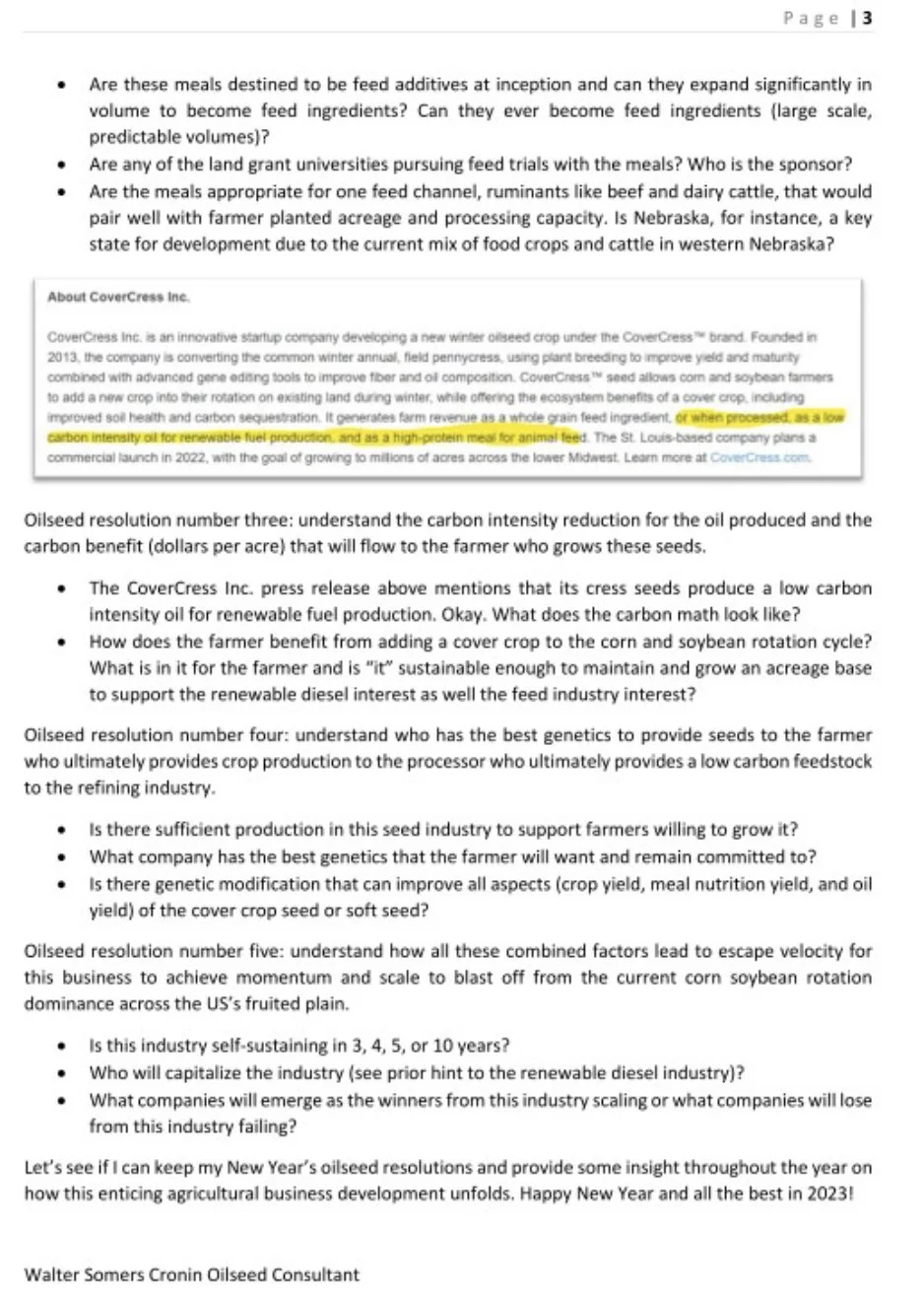

Here is a technical analysis from Wright on the Markets Tech Guy.

He said,

"Although March Wheat's price action was disappointing Friday as far as a rally, it still marked a higher high in a small inverted head & shoulders pattern which projects about $7.75"

"I expect higher prices next week where $7.70 will be tested first. Sometimes it will take a day or 2 for a market to get moving the other direction after a Doji day. The bears are still holding on to hope. Check out the pattern."

I highly recommend reading Tech Guys full breakdowns of all the grains here

Tech Guy March Chicago Chart

KC March-23

MPLS March-23

Predictions from Zero Hedge

Here is a few predictions for 2023 from Zero Hedge. I will just be highlighting a few. You can read the full article here.

1) Inflation will return with a vengeance

What we’ve experienced so far came from the big commodity pump-and-dump post-COVID. Commodities went through a massive run as more money chased broken supply chains in 2020-21. Then in 2022 the inevitable bust happened, but left us with commodity prices across the board at levels which used to be resistance on the long-term price charts which has now become support.

The next round of commodity-based cost-push inflation will mix dangerously with the growing realization that we can’t avoid things breaking. There will be no ‘soft landing.’ The hard landing may not happen in 2023, but the set up for it will certainly take place.

Cost-push will mix with Loss of Institutional Confidence to light the fire of real inflation versus tangible assets in a way we haven’t seen since the late-1970’s. We should see a return to increasing YoY CPI levels beginning in Q2 after the baseline effects are past and China’s reopening keeps a bid under commodities.

January will not set the tone for commodities in 2023, but more likely be a ‘false move’ overcorrecting against the primary trend, which is clearly higher.

4) The War in Ukraine Will Continue Dangerously

The West is suffering under many illusions about what’s going on in Russia and, by extension, its war in Ukraine. The UK/US neocons believe, like the EU, that history is already written about Russia’s future –balkanization and collapse.

All pressure that the West places on Russia only exacerbates their demographic time bomb. China’s as well. And in that sense this is the race they are running. Can they grind up enough Russians to ensure that even if Russia wins the war in Ukraine the West wins because the long-sought breakup of the USSR/Tsarist Empire will be achieved.

For this reason neither the UK/US Neocons nor Davos believe having a reverse gear vis a vis Russia is the right play. This is their strategic vision, regardless of the costs to the West itself.

For Russia there is no other play for them but to continue increasing the costs on the West. The longer the war goes on the deeper divisions within the EU get. Those divisions then drive even more animosity within the Eurocracy towards the Brits and the Yanks, who some feel are taking advantage of the situation.

When as ardent an Eurocrat as Guy Ver Hofstadt is now frothing at the mouth about the costs of sanctions, you know the Mafiosi in Brussels are getting nervous. They are beginning to crack under the strain of this war of financial and political attrition Russia is so good at playing against its European partners.

Even though I’ve argued strenuously that the EU leadership walked into Ukraine with its eyes open, the 2nd tier of the Eurocracy did not. And those are the ones having cold feet now and who the Russians are hoping will drive a pivot from Davos off Ukraine.

At the same time, expect Putin to keep opening up new fronts for the US/UK to deal with, see my next point.

The UK/US Neocons’ only play, then, on the battlefield then is further escalation to the brink of a nuclear exchange, which these insane people think they can win.

The other option is assassinating Putin in the hopes that Russia goes mad, nukes someone and that justifies the unthinkable.

Either way we’re inching way too close to midnight for my tastes.

6) De-Dollarization Will Accelerate / USDX Will Rise

Along with the collapse of the euro, the US dollar will lose more ground in the global payment system for international commodities and trade.

These two dynamics will create a very weird moment where the USDX — the US Dollar Index — will rise but the US dollar will be under sincere pressure vs. gold, commodities, and other rising emerging/developed market currencies.

The USDX is heavily weighted towards the euro and the British pound but the Chinese yuan is not represented at all. So, from one perspective the US dollar could be in a bull market but from another be in a bear market.

The one thing holding gold back has been its lack of bull market versus the dollar. It’s not a ‘secular’ bull market in gold until it’s rising versus all currencies. Even if the USDX does nothing but hold its ground in 2023 versus the rest of its fiat competition, a rally in gold will still be fed by people the world over ‘losing their religion’ with respect to the dollar.

That said, that fall in faith will likely not outpace the fall in faith of the “Fed Put.” I expect the ‘religion’ of the Fed Put is still stronger than the dollar itself which should put upward pressure on the US dollar overall. Because, let’s not forget that overseas US dollar synthetic short positions, known as US dollar-denominated debt, are still pretty biblical in size, keeping a strong bid under the dollar globally even as its position as a reserve and trade settlement currency erodes.

Because of all of these competing forces — inflation, de-dollarization, war, etc. — the last US dollar bull market for the foreseeable future should be on tap in 2023. For how long? It’s a good question, I can’t answer.

8) Oil will Open 2023 Near the Yearly Low

The fundamentals for oil are truly bullish. China ending Zero-COVID just after the EU put its idiotic price cap on seaborne Russian oil was a strategic move to subvert “Biden’s” wish to refill the now nearly depleted US Strategic Petroleum Reserve at or below $70 per barrel.

He may get that from domestic producers for a while. But Brent ended 2022 at $86 and a little downside momentum may be in place with early US dollar strength, but then fundamentals easily overcome this.

“Biden” will not refill the SPR at $70 per barrel now that China just blew up the entire “deflation through higher rates” narrative. The US economy has held up better to the Fed than expected. Even Q3 GDP wasn’t uniquely terrible. The jobs report and low unemployment rate, while possibly artifacts of a changing labor market, still give us signals that the US economy isn’t as bad as many want it to be at 4.5% Fed Funds Rate to validate their place in the commentariat.

Europe is getting a small reprieve with the extremely mild winter so far, pushing energy prices down, especially natural gas, for now.

The global recession talk is vastly overblown until something fundamentally breaks. Anyone looking at the end of the year book squaring in things like the Reverse Repo balance (+$300b in one week) is overthinking the problem. The banks are allowed to tailor their reserves to present whatever quarterly numbers they want. It’s been going on since the Bernanke Era.

As such, I see a kind of perfect storm for oil here. Russia will pull production off the market and shift exports from St. Petersburg (Urals grade) to Kosmino, near Vladivostok (ESPO grade), nabbing higher prices in the long run.

Arab OPEC can’t hit its production quotas as it is and China’s reopening its entire economy.

The Davos demanded ESG investment protocols have the oil industry anywhere from $600b to $1trillion underinvested in exploration and production and that number is rising.

Increased demand, tight supply, low replenishment investment and WAR. Even a moron or Joe Biden can see that $70 per barrel Brent is out of the question for any significant period of time.

9) Dow Jones 40,000+

As we enter 2023 the Dow Jones Industrials sit right around 33,000. It was a tumultuous 2022. After hitting a new all-time high a year ago at 36952.53 it was all downhill for most equity indices.

The stronger USD fueled a lot of capital reorganization, interest rates were finally forced higher by the Fed and incessant talk of recession kept everyone selling first and asking questions later.

But in this ‘pivot-obsessed,’ low pain environment, relief rally after relief rally was snuffed out until finally in Q4 the Dow made everyone stand up and take a little notice as to what was happening… flight to quality into tangible assets with deep liquidity pools.

The Dow lost 8.7% in 2022. The S&P 500? 15.8%. The NASDAQ? 27.7%

For all of the bitching gold bugs did in 2022, gold was up 1.6%

If we begin to move into the next stage of stagflation (#1) then the Dow will continue to outperform the broader US equity markets as well as major foreign equity markets.

2022 Foreign Performance:

German DAX in 2022: -9.2%

Euro Stoxxx 50: -7.2%

FTSE 100: 1.2%

Are those indexes sustainable given the economic outlook for Europe and the ECB following the Fed up the rate curve lest everyone ‘lose their religion’ in it? Or will the still weakly expanding US economy look more tasty to global investors and the hopeless Brits look insanely overvalued?

If we have another year like we did in 2022 where high inflation outpacing nominal growth drives tangible asset investment we should see an outperformance from the US vs. Europe as the currencies collapse and the ECB’s tools prove inadequate. Emerging Markets, depending on their proximity to China and the US may have banner years, especially those that underperformed in 2022.

Highlights & News

U.S. wages increased 4.6% annually, which is only about half of the rate of inflation.

Unemployment rate dropped to 3.5% which is the lowest in 50 years

Buenos Aires Grain Exchange lowered their Argentina bean and corn ratings.

Lowering beans -2% to 8% rated G/E

Lowering corn -2% to 13% rated G/E

Bean harvest is about 5.5% behind pace in Argentina

Fun Fact: The U.S. currently plants nearly 50% less wheat than it did 100 years ago. (16.3 million acres vs 11.2 million acres.)

South America Weather

Russia 24 Hour Forecast

U.S. Weather

Source: National Weather Service