WEEKLY GRAIN NEWSLETTER

By Jeremey Frost

This is Jeremey Frost with some not so fearless comments for www.dailymarketminute.com

For those of you that listened to the audio comments from Friday the 18th I mentioned I would be listing off some of the reasons why I think we will most likely make new all-time highs in most of the gains in 2023.

But before I get to that I want to make sure to be clear that proper risk management is still needed for most. That risk management plan should be different for nearly every operation based on one’s risk and reward profile. If you need help determining where you should be, take our grain marketing plan questionnaire at https://www.dailymarketminute.com/grainmarketingplans. If nothing else, just looking at some of the questions should help one think outside of the box a little bit and determine what the correct approach for you and your operation is.

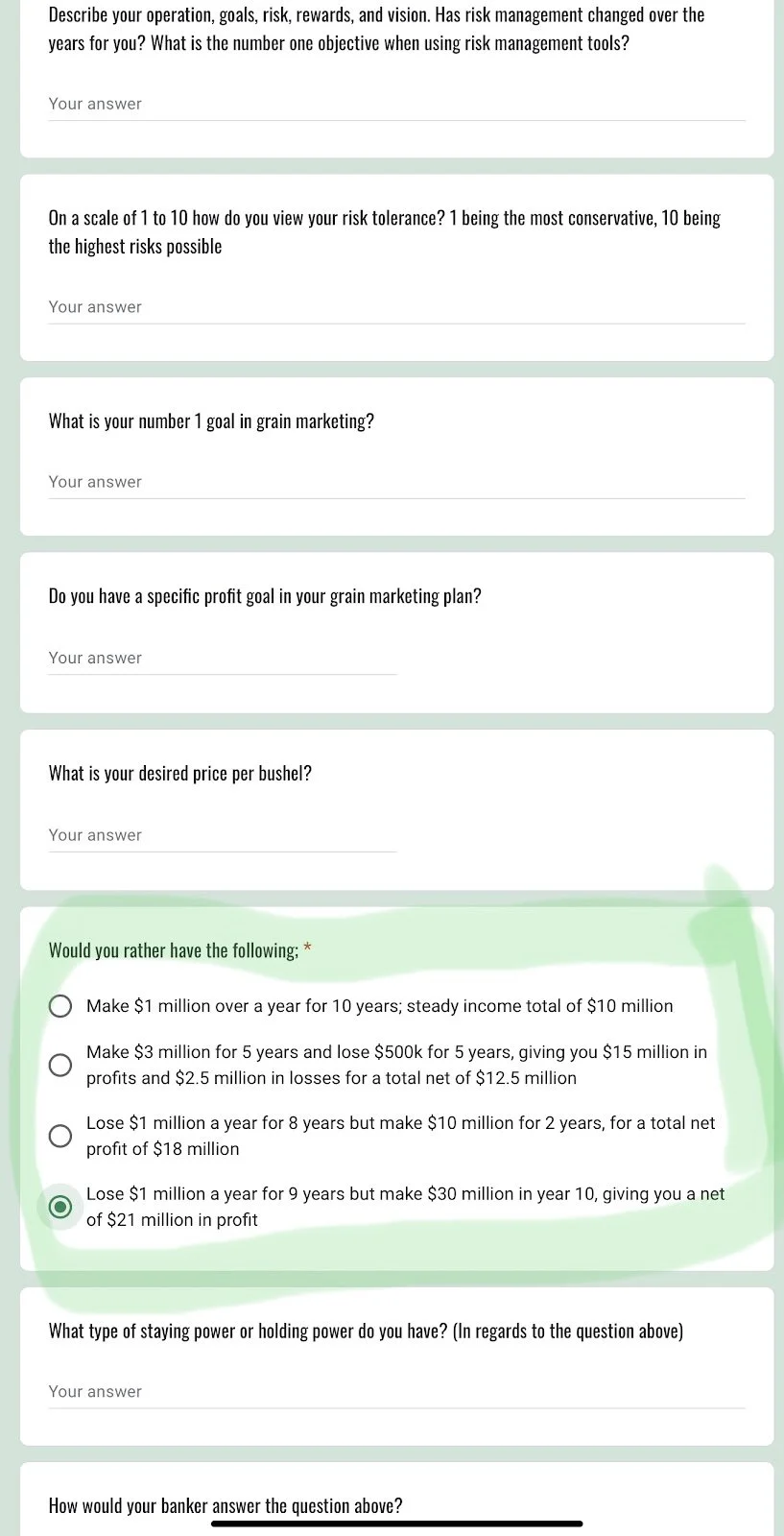

Here is a screenshot of just a few of the questions. But this screenshot includes what I feel are two of the most important questions and answers.

Risk tolerance rating 1-10 being very important. But the best answer that sometimes doesn’t align with any other answer for a marketing plan is the question highlighted below. Profits over time.

One has the choice to make $10 million, $12.5 million, $18 million or $21 million over a 10 year period. On the surface, everyone wants to answer $21 million, but very few can and will.

So please go ahead and do this marketing plan questionnaire and we will send you back a marketing plan based on your answers along with our market opinion.

The bottom line in all the answers to these questions will help you do what you already know you should be doing. Should you be selling? Should you be waiting? Grain Marketing advisor’s number one job is to help get it’s customers where they should be in terms of risk management. The job isn’t to always outguess the markets. It is important to have a valid opinion of what the markets may do and why, but it is more important to help your customers be successful. The definition of success according to Earl Nightingale is “Success is the progressive realization of a worthy goal or ideal.”

So in the example of having the choice of making $10, $12.5, $18, or $21 million over 10 years with the staying power that aligns with that choice reaching your objective is success. So both the guy making $10 million and the guy making $21 million can be equally successful.

In other words the guy that sells some corn at $6.00 because it is profitable and gives him comfort can be as successful as the farmer that waits for the new all-time highs and then cashes out.

Bottom line is I think we are going much higher and I am going to lay out some of those reasons in the rest of this article, but that does not mean that it is correct for you to not be doing some sort of marketing. Answer the questions on our grain marketing plan page and get a good sense of where you should be at.

Recommendations

For those of you that bought bean oil puts against sunflowers that you had raised but not sold, we recommend taking [profits on those short positions. Sunflowers have firmed while bean oil has come off of the levels we initiated the positions at by 6-7 cents.

Here is a bean oil chart, notice the candle left on Friday. This gives me a buy signal, it also is tight enough that one could easily have a stop below the low to re-enter on the short side. I don’t recommend it for everyone. I am buying this chart all day long, but I also would have a stop below Friday/Thursday's lows. It is a good risk reward setup.

This next chart is a chart that lends support to my bean oil theory, a crude oil chart. If bean oil is going to go up and make new highs it is going to be much easier done with crude oil also going up. Grains will struggle if crude oil has days like it did earlier this week.

Crude oil had what I call a mini reversal on the charts on Friday and we look for both crude oil and soybean oil to bounce back towards the top end of the range, eventually breaking out to the upside.

Now if you combine those two charts where does bean oil get to if crude oil goes back north of $100 per barrel?

Buy crude oil to help cover fuel needs.

Looking at the chart above, I am giving an alert to consider buying crude oil to help cover fuel needs. How one goes about it should depend on your risk reward profile and goals like I talk about above. If you have a futures account and are not afraid of margin then perhaps buying the board makes sense, for others buying cheap out of the money calls may make sense. As for my generic recommendation it is simple buy crude in a manner that you are comfortable doing to help lock in fuel needs. If you are not comfortable then don’t do it.

Place spring wheat basis offers with your local elevator

The spot floor has been very strong. I don’t know if any local elevators will get rail cars and there is a chance that some of them get bought in, but if they do get extra rail cars the spot floor has been trading 200-300 over for a few weeks now. Freight rate and margin for an elevator give a farmer a chance of trading as high as a 1.50 over versus the -.45 to -.65 or so that most elevators in central SD are either posting or bidding for volume. Price makers will be offering basis levels on spring wheat that are much better then the negative basis levels that elevators are buying grain at from the price takers.

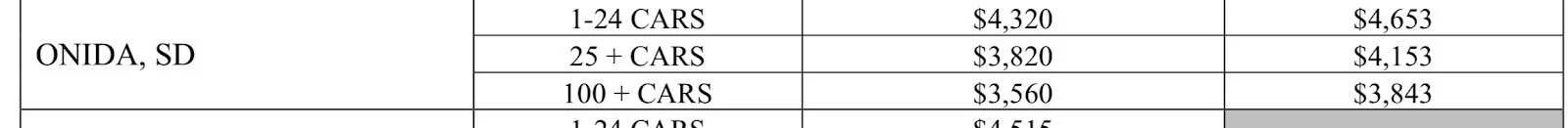

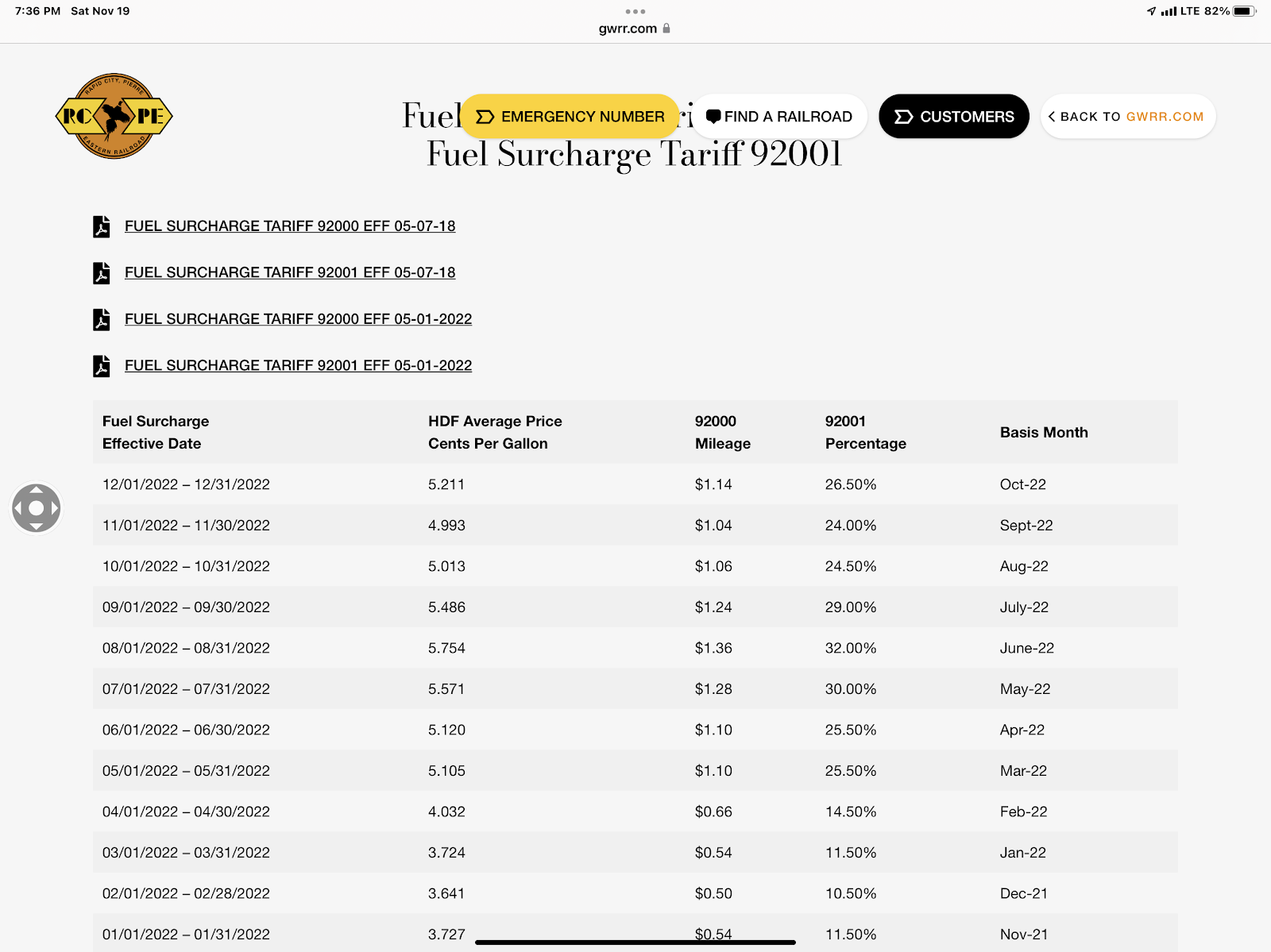

To see what the spot floor is doing go to https://www.mgex.com/cash_markets.html and click on Minneapolis Daily Cash. Then to find your freight rate for your elevator go to the local rail line website and click on tariff. So for Onida SD you can go to https://www.gwrr.com/rcpe/tariffs/ then you will look up on page 5 and see the rates out of Onida for CHIC and beyond.

You will notice rates for big cars are 4153 per car plus a fuel surcharge of 24%. Which will give one a rate of just under 1.40 for a big car that holds 3700 bushels. In December the rate for a train would be right around 1.42.

Here is the fuel surcharge rate

So you have cars trading at 3.00 or higher for most of the past few weeks on the top side, with stuff at the bottom side around 2.00. So if an elevator is taking 50 cents margin that means we should be able to trade some around 10 over to 1.10 over. Much better than posted bids. The issue is for those that don’t get enough cars, and they have sales made at weaker numbers, and now they might get discounted for being late.

The other thing to be considering is offering spring wheat FOB the farm trucking it to areas that need the wheat and are paying up for rail cars.

If you want to offer some truck spring wheat give Wade a call at 605-870-0091 or myself at 605-295-3100.

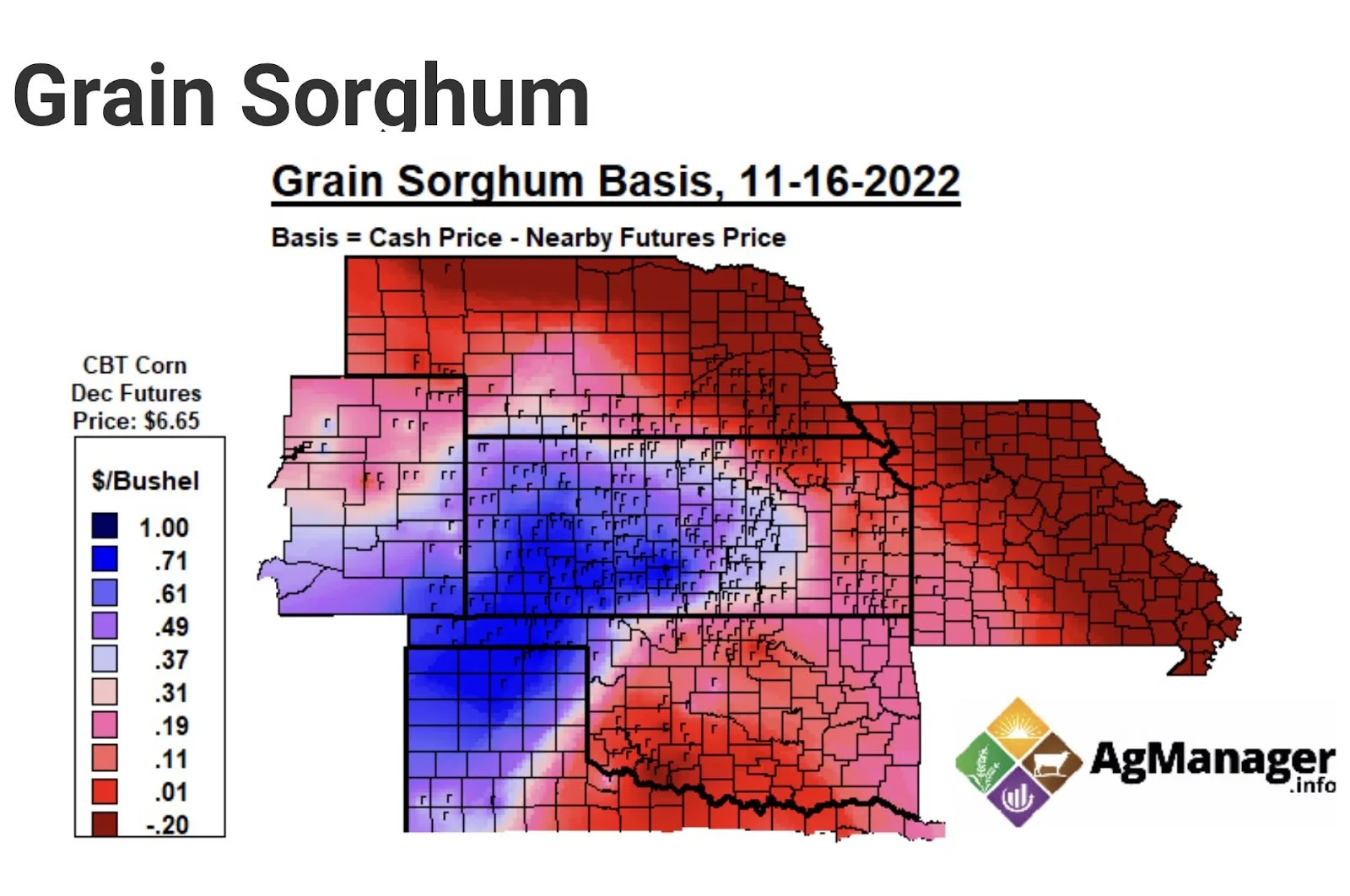

Corn basis continues to firm up in almost every area of the corn belt, locally many are now bidding as much as 65 cents better then they were a month ago. What does this mean for the market?

Watch for games to start getting played with basis, as farmers make some sales and take advantage of the good basis, thus giving coverage to some buyers we should see some buyers moving bids around to try and head fake farmers into selling cheap. The key I have found to watch for is when your deficit area starts seeing grain flowing into it from other non traditional areas.

The bottom line is however we need to curb demand quite a bit. We should see ethanol plants shutting down or reducing run speed because we don't have enough supply.

Let’s get to business on why we will make new all time highs in most of the grains.

Remember Sue Martin’s prediction, it was for 2023. Enough said there.

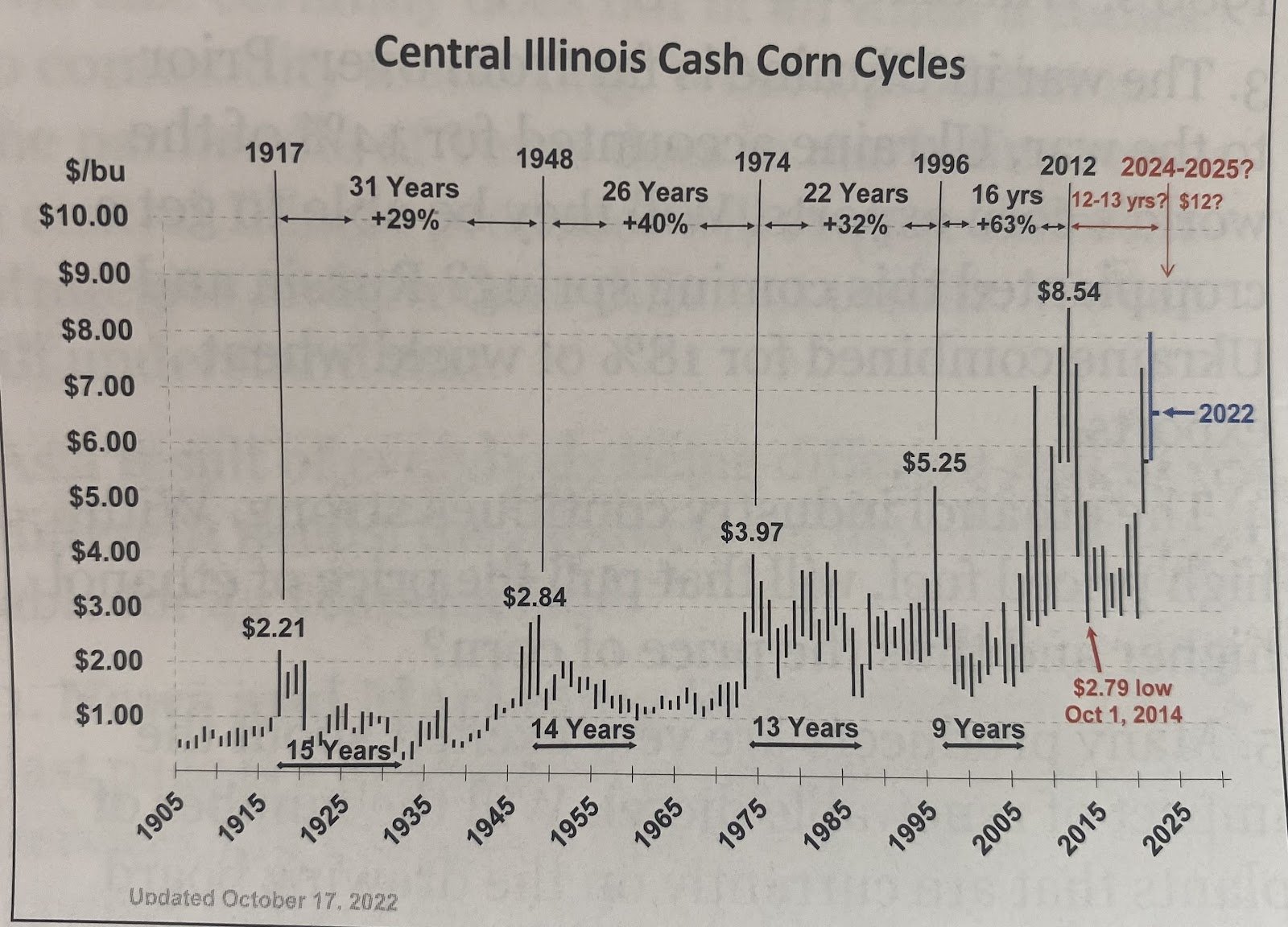

How about another prediction that few have talked about, I actually got this in my mail on Friday from Richard Brock and The Brock Report.

First off I am not a big fan of Brock, when I worked at CHS the joke was always that a major advisor made a fear recommendation that would let one of the ABC companies buy some cheap grain. Meaning his sell recommendations at times seem to fit with scare selling that the commercials wanted. But I will give him credit that his product has plenty of good information.

Plus let’s face it talking about cycles and timing of rallies fits with what I am writing. Now I had know idea when I opened my mail that I would find this in it. But as for cycles and the fact that markets tend to repeat themself, that folks lines up with history and technical trading. It is a big reason why I think we will go higher.

Here is another technical from the Tech Guy from Wright on the Market

https://www.wrightonthemarket.com/post/tech-guy-weekend-comments-11-19-22

Here are a couple of the highlights

“As I talked about last week, the grains will most likely rally from last week's lows on the daily charts into at least mid to late December. Another farmer/trader who I respect has a 760 target for March Corn by December.”……….

“A note on the corn and bean cont. charts: Once Corn clears 740 and beans 1580 there is not any appreciable resistance (no bumps) above these prices. Since the trends will be strong at those prices, there is reason to think they could buy up to the highs on the left side on both charts - into Feb or March”

So this leads to my number one reason why I think we will make new all time highs. Because we are not that far away from really opening up the charts. When the charts open up, who knows how far emotion can and will take us. It is why Sue Martin and Richard Brock could be right, or also could be cheap in their predictions.

Let’s look at fundamentals a little bit. Not the market cares but how are margins for farmers right now with the higher interest costs along with higher inputs? Will farmers plant as much as needed for our demand?

World War 3 or Acre War?

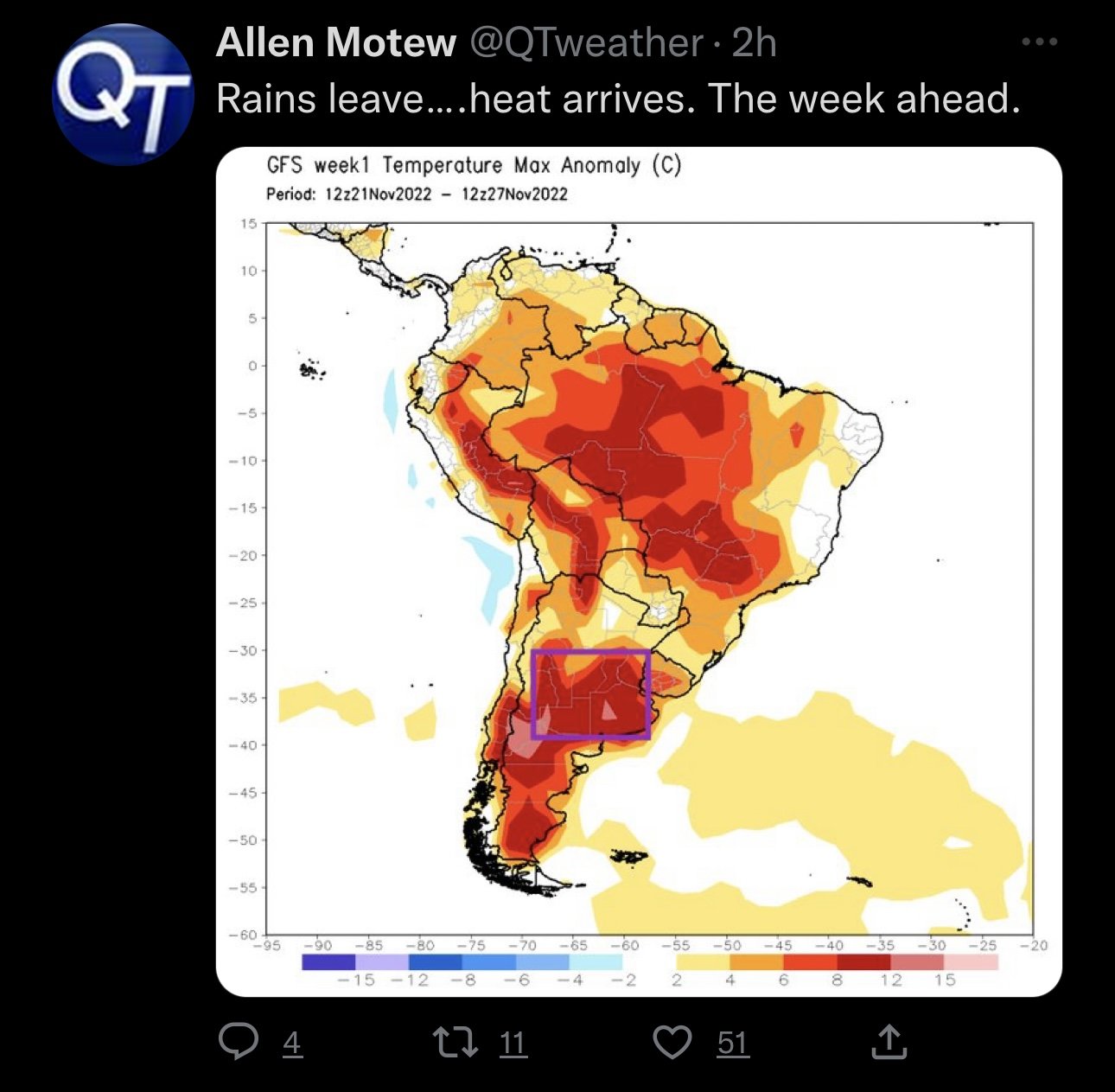

I think we have an acre war like we have never seen getting ready to develop and it magnifies and explodes if we have weather issues in South America.

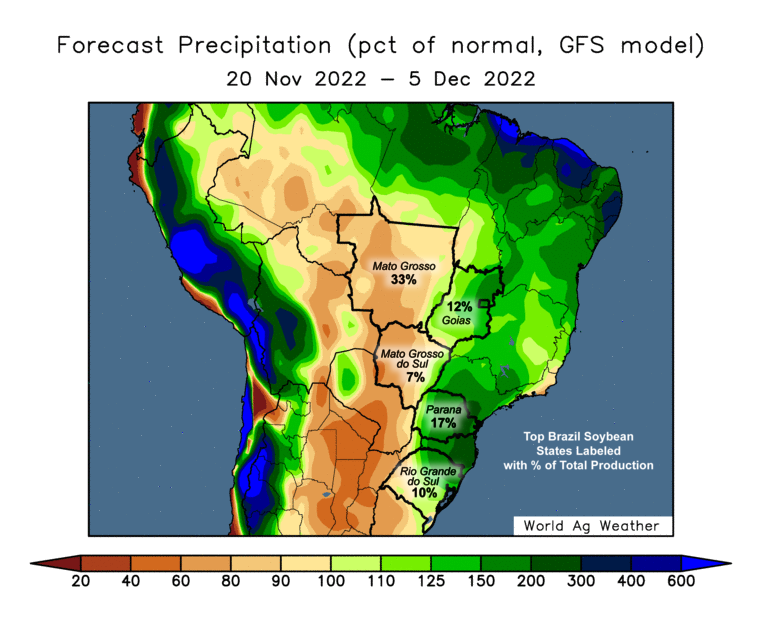

Speaking of South America, my favorite weather graph is simply the 15 day forecast versus normal for Brazil and Argentina. Here is a link to a good summary as to what the weather has been, and below are forecasts for the next couple of weeks. You can make your own opinion, but I don’t look at the forecasts as bearish. http://www.worldagweather.com/crops.php#summary

Here is Argentina, where the majority of the crop looks to be under normal precipitation.

Here is Brazil, where we have a rather mixed bag.

In my opinion the longer these areas have more brown then green, the more damage that could happen to the SAM crops.

When it comes to weather it feels like we continue to move towards bigger and bigger extremes. We have record wheat crops in Australia but it won’t stop raining and they are losing bushels fast. While some have downgraded the Argentina wheat crop to as low as 10 MMT, under ½ of last year.

If history repeats itself, does the weather repeat itself too?

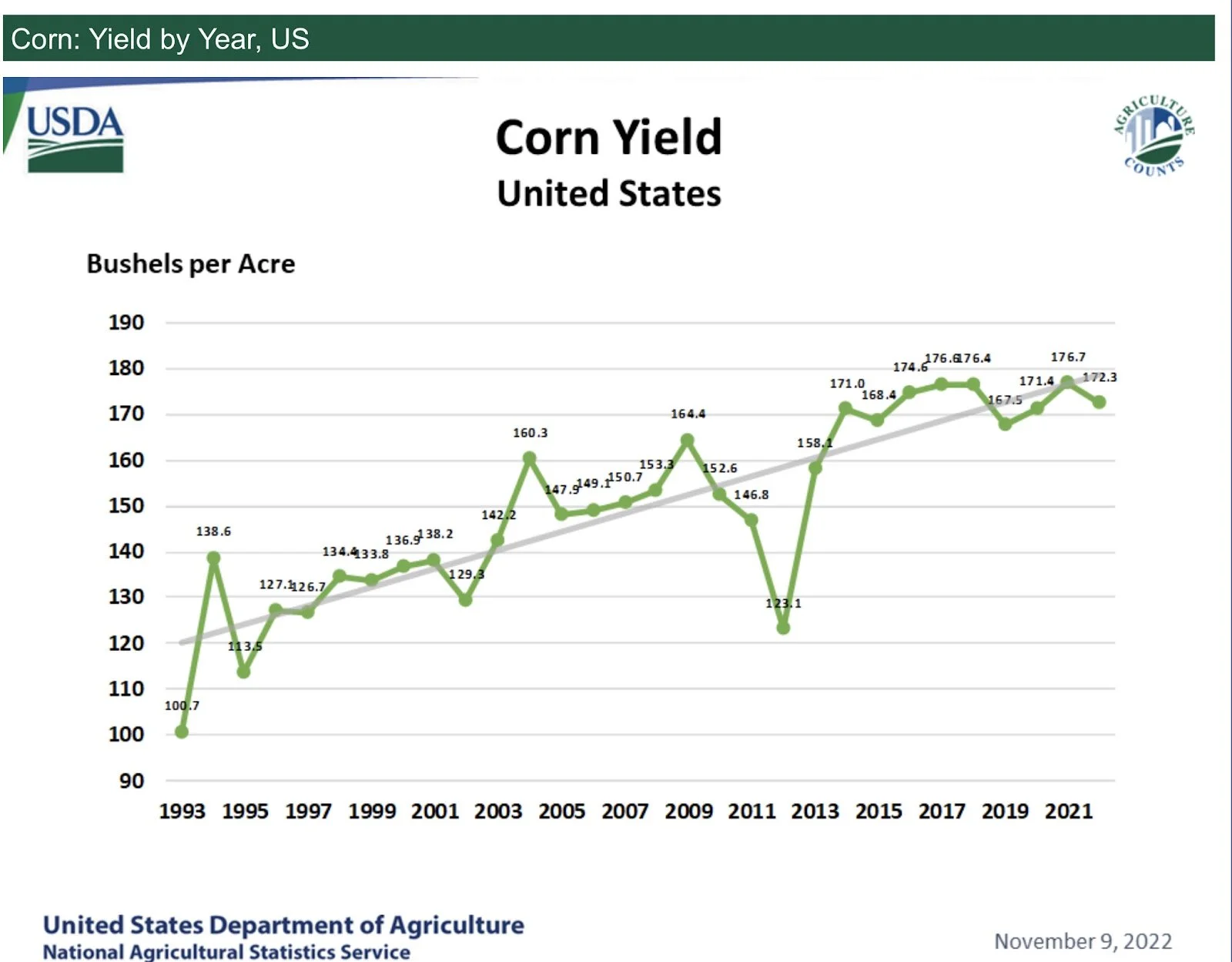

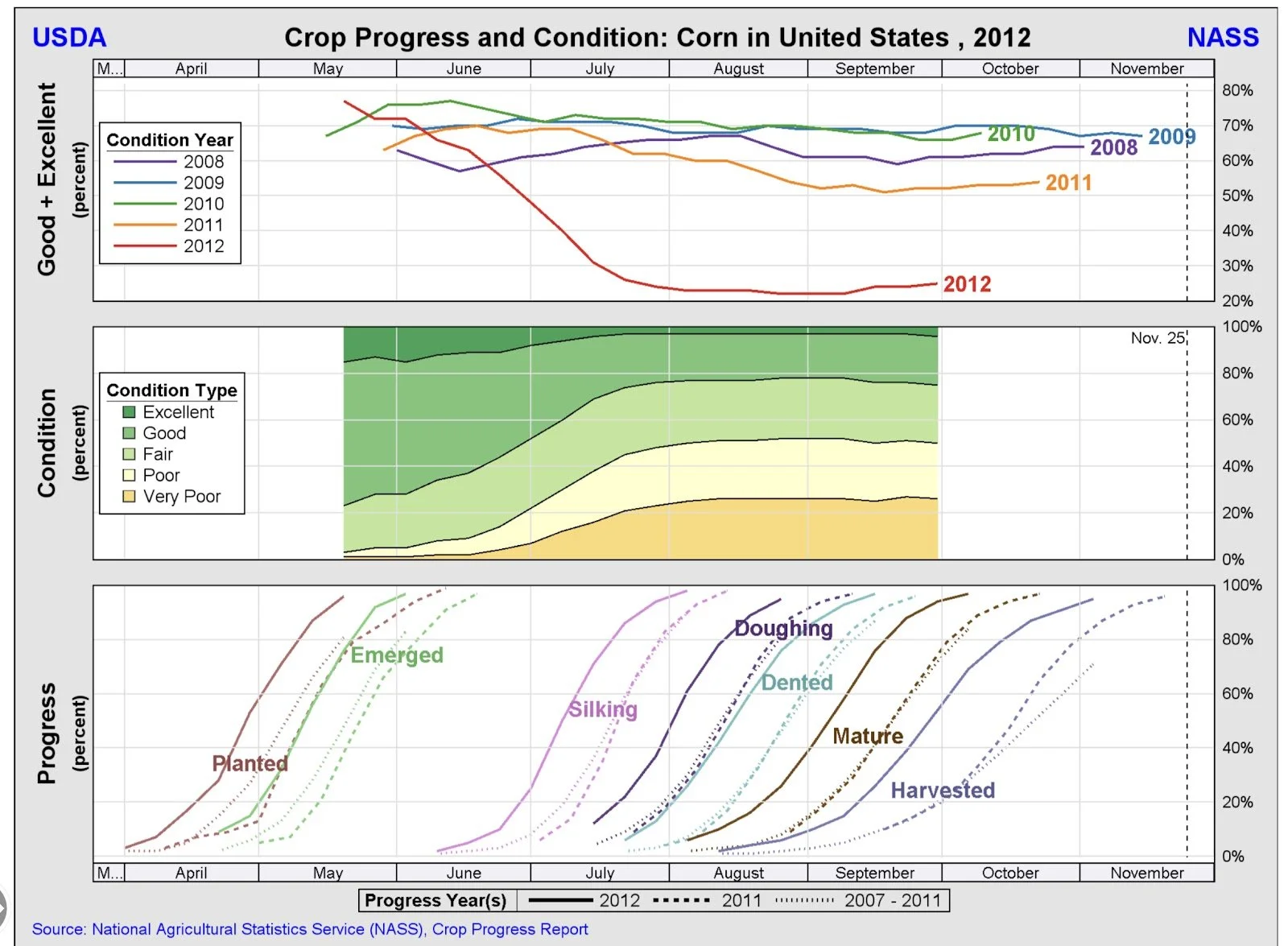

Question: what would happen if we saw #corn yields drop below trend like they did in 2012? How high would corn get if we only produced say 160 bushel an acre crop? What about if we only got 150 bushel an acre crop? What if we produce less than that?

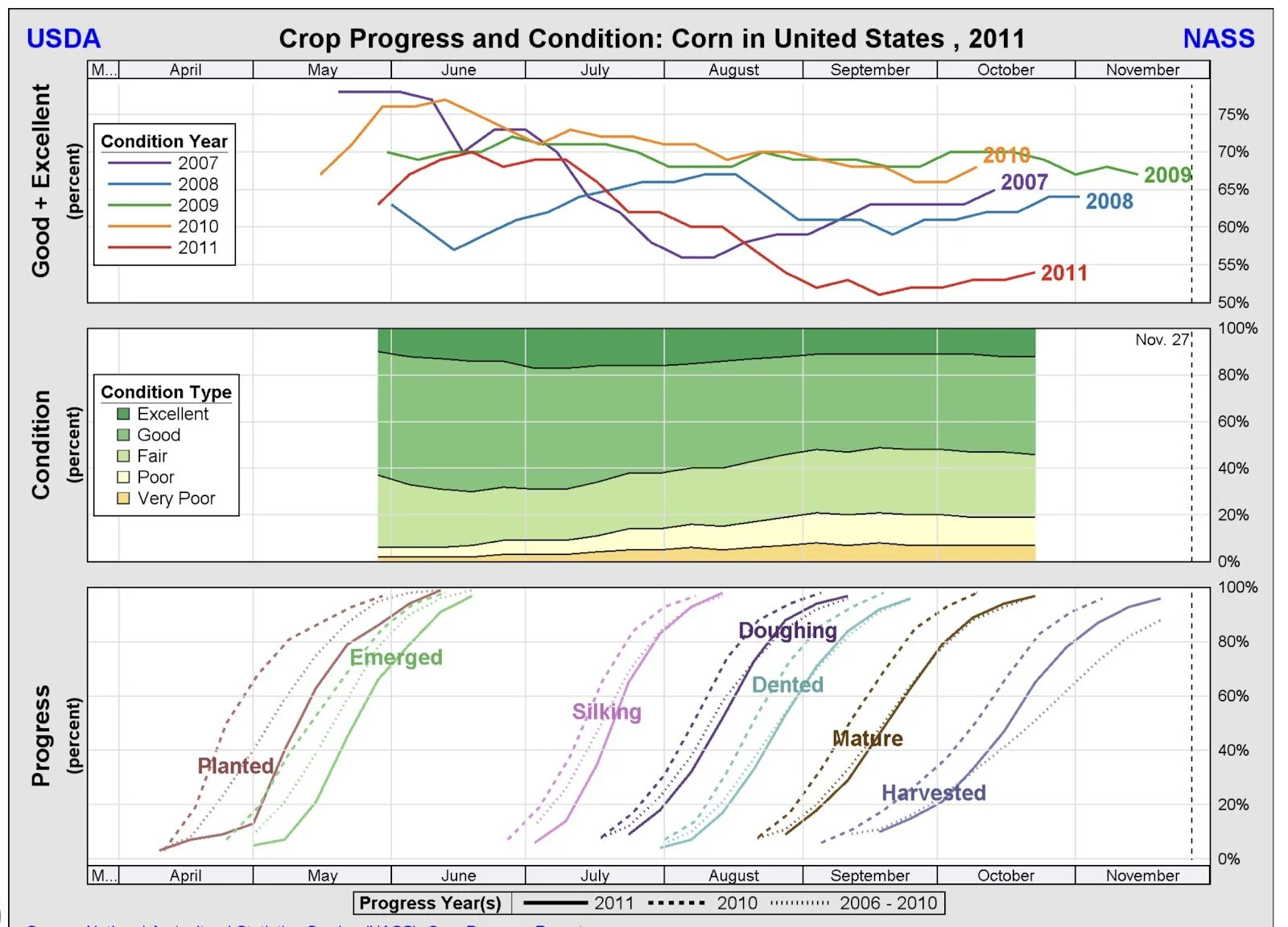

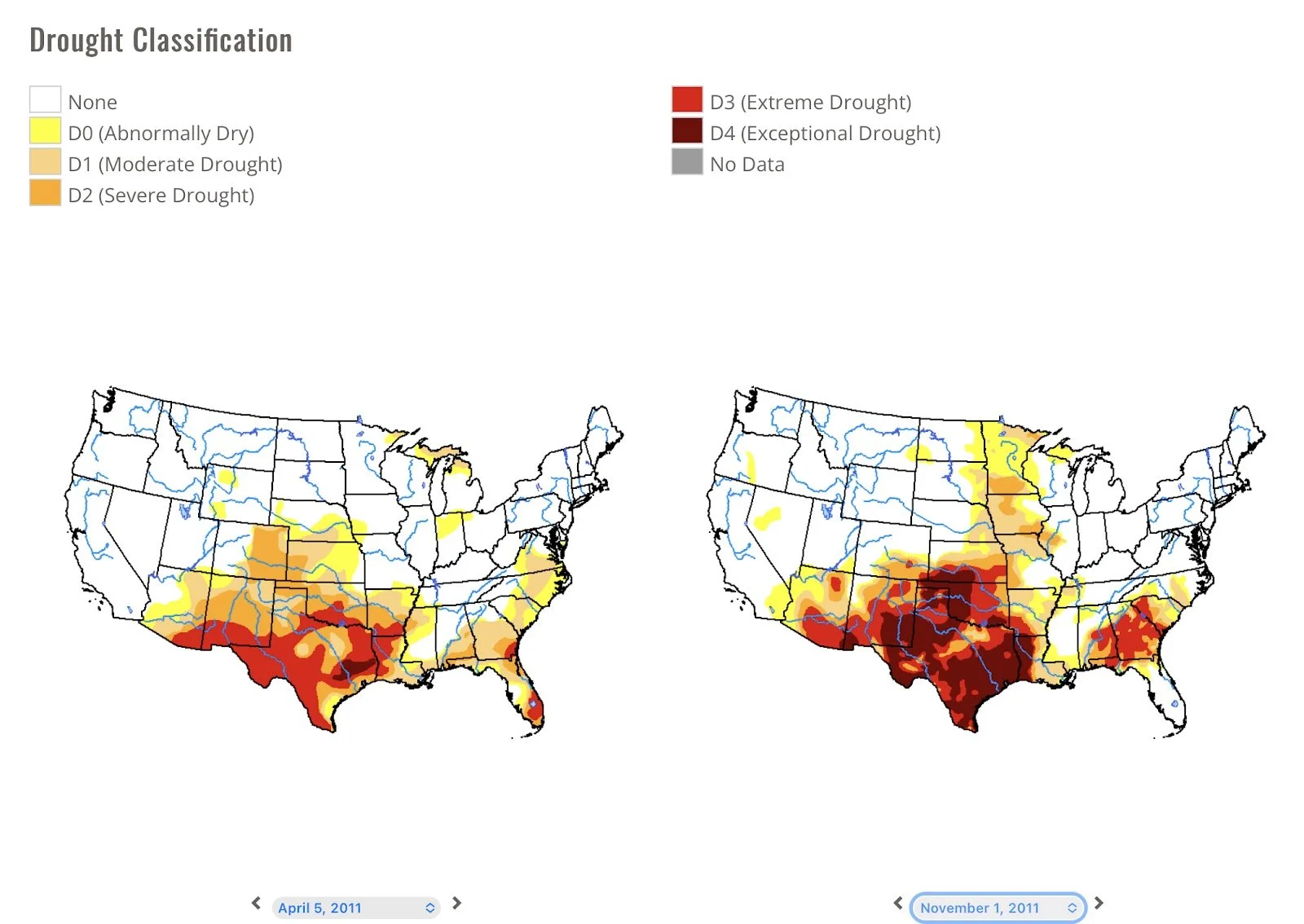

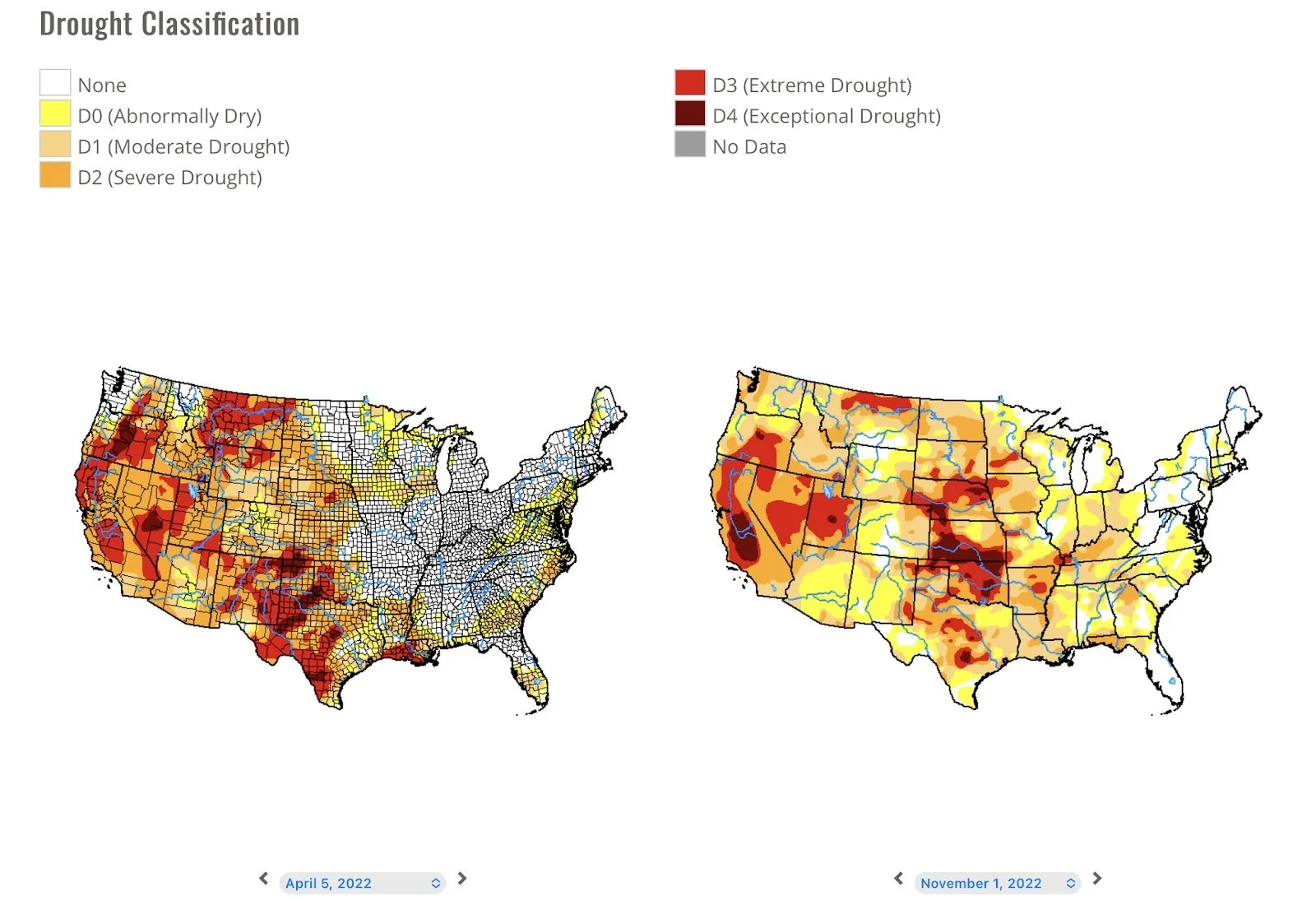

Look at the next 3 pictures, does the first one and the second one look very similar? It is comparing 2022 versus 2011. Once you look at the 3rd one, imagine what 2023 looks like if it is a repeat of 2012.

Very similar to the graph above, but watch out if we add a 2012 repeat on top of it.

Next let’s look at some drought monitor comparisons.

Here is April of 2011 to November of 2011.

Next is April of 2012 to August of 2012. But look what happened from November of 2011 to April of 2012. We improved greatly. But by August of 2012 we had basically taken the November 2011 southern drought and moved it right to the heart of the corn belt.

Here is a look at this year, folks the risk is we do the same thing as 2011-2012 and move that drought to the NE or right on top of the corn belt like we did in 2012.

Ok, so weather’s a risk. But I am not really telling you that we are going to new all time highs because I can predict weather am I? No, I can not predict weather, but some that I follow have done a good job of analyzing the effects that extremes have in one area to another.

Keeping on the weather trend, is anyone talking about China? This is a tidbit from Wright on the Market.

“The water level in China’s Three Gorges Reservoir is the lowest level this month than any November since the reservoir was filled twelve years ago. The water level is nearly 50 feet (15 meters) lower than normal. Even though they do not export any, China grows more wheat than any country. Drought will substantially reduce China’s wheat carryover in 2023, which is currently more than they annually grow, so they will not starve, but they may import a substantial amount of wheat. Right now, USDA has China importing 9.5 million mt, about the same as the last two years. “

From the Conspiracy Corner and Out of the Box Thinking. The number one reason we will make new all time highs. Is not the weather, it is not because Sue Martin or Richard Broke, or any other Tech Guy think we could………..before unveiling the top reason let’s list reasons that we could make new all time highs for the grain markets.

Reasons we could make new all time highs.

Drought in USA

World Weather extremes

Inflation

Interest rate drop causing money to flow into commodities as an investment

Might be more tangible than other investments and have some collateral behind it

Demand

Margins for ethanol plants and soybean plants

China will eventually have to let people live and they will figure COVID out?

Carryout is tight and weather scares happen every year

Farmers get bigger, better, and smarter every year, which add’s volatility to prices especially when they have more and more staying power.

Funds have been selling wheat, they are shorter wheat than they have been for 3 years.

Wheat conditions, wheat crop is off to worse start on history

Breakeven costs are up

Cycles of prices, technical charts that are a self fulfilling prophecy.

Moneyflow for some black swan reason decides to come into the grain markets

Brazil farmers and truckers are protesting, thus China has to come to the USA to buy grain.

Weather

War

Other not mentioned black swan events

How much money could the commercials make if we have a repeat of 2012 weather and they get farmers to fear sell ahead of time?

How many farmers would go broke if they forward sell $6.00 Dec 2023 corn, and they raise ½ of a crop, inputs continue to go out of control and corn gets to $12.00 with a national average yield of only 150?

Too many are bearish for 2023 and that will lead to the above possibility

Have we ever been able to curb global corn demand like what is forecasted?

When is the last time we have had global wheat stocks as tight as they are with exporting wheat countries?

In my opinion we will make new all time highs from a combination of the above reasons and many more that I don’t have listed. I will include more in the weeks to come, but this week’s newsletter article has already got plenty long.

I will leave one asking themself why China can’t control COVID like the US has been able to. For some reason I have always given the Chinese credit for being very smart. Is the real reason they continue to have to go on lock down a simple ploy to keep demand down? Is there not enough food for them should they run at full speed?

This is the number one reason I think we are going much higher, the fact that China will not be able to hold demand back for very much longer. You can not tell me that if Joe **** Biden can get control of COVID that the Chinese can’t.

With everything said and done, remember what’s right for one, maybe wrong for another. And what is wrong for one might be right for another.

P.S. Make sure to watch the Market to Market podcast this week, as I will have an interview on it. I will forward it out once it is released.

BINS FOR SALE

For those of you that follow me on Facebook you will know that I have some grain bins for sale. They are located in Agar, SD. Presently they are getting disassembled. They are 21 ft diameter 5500 bu bins. The bin site has over 100 bins. They make great gazebos but can also be used for storage. They are just too small for the operations in my area to use for storage. For more info call me at 605-295-3100

Sunflower Market

We still have buyers looking for some sunflower offers and we have trucks available to pick up even before Thanksgiving. Give Wade (605-870-0091) or myself a call (605-295-3100) if you need to pull some tops off of some bins.

Ag Horizons Conference

Make sure you stop at our booth and say hi at Ag Horizons Conference in Pierre on the 29th and 30th of November.

Prairie Grains Conference

We will also be at the Prairie Grains Conference the following week on December 8th in Grand Forks.

Check out our all-new Ag Directory

To add value and efficiency the Ag Directory provides a way for users to have a “one-stop” shop in the palm of their hands and not have to search for contacts when they need a trucker, seed, fertilizer, parts, financing, etc.

To get your business listed in our Ag Directory simply

contact me at 605-295-3100.

Commodities Overview by Sebastian Frost

Overview

To close out the week Friday we saw grains mixed. With soybeans seeing a much needed bounce after being down -30 cents on the week up until Friday.

It was quiet an eventful week, with missile strikes landing in Poland on Tuesday. Which initially shot the grains higher on thoughts that the war headlines were escalating. As it was initially believed to be a Russian missile. However, Wednesday and Thursday we saw grains give back the majority of those gains made.

We also saw crude oil sharply lower on the week. Trading -$8 (-9%) lower on the week. However, dispute the down fall in crude, corn held its own. Being the only one of the grains to end higher on the week (+9 3/4 cents).

This week is a short trading week with the holidays, and we will likely continue to see plenty of volatility going into this week.

Today's Main Takeaways

Corn

Corn close just higher on Friday but closed near its lows of $6.65 after seeing a high of $6.72 in a pretty tight trading range, as Dec-22 closed at $6.67 3/4. Ending +9 3/4 cents higher on the week. This is following the -23 cent loss last week.

We of course saw Russia agree to extend the grain export agreement. Which was bearish news as expected. We also saw crude oil completely fall apart this week, trading below $80 and ending the week down -$8 (-9%). Dispite this corn was actually relatively strong. So perhaps the corn market just ran out sellers.

The basis across the western region of the corn belt further confirms the scarcity of corn. There are plenty of areas already at record high basis levels. So the question remains, where will they get their bushels from?

We also have to mention that globally we are seeing production cuts. With the USDA recently cutting its EU production from 56.2 MMT down to 54.8 MMT, and many believe we will continue to see these numbers lowered. We could be looking at a possible -25% decline from last year, as last year they harvested 71 MMT.

Overall, there will be a ton factors going forward. We have South American weather which will play a big role. We have the recent poor exports situation.As exports are trailing the USDA forecast by almost 300 million bushels. As well as macro headlines such as the dollar and recession which will all likely play a role. Long term I think we do have the potential to see more upside here, but I am waiting to see how some of these other factors play out here short term.

5-Day Change

Dec-22 Corn: +9 3/4 cents

Mar-23 Corn: +7 cents

March-23 Corn (6 Month)

Soybeans

Soybeans had the worst week amongst the grains. Ending the week over -20 cents dispute the nice rally to close out the week Friday.

Late in the week we saw soybeans fail to hold some big support levels. Pushing below their 50-day average, and briefly pushing past their 100-day average as well with the sell of Thursday.

Problems the soybean market is currently facing are; South American weather which for the most part has been cooperative thus far, China lockdowns, as well as recent weakness in palm oil and crude oil.

On the flip side, we saw a pretty large export number last week, of over 3 MMT. Which was above estimates and significantly higher than the week prior. Nearly 4 times as large.

Argentina is looking like they need some rain, or we could likely see production estimates lowered. As the planting pace is already well behind that of last year.

Brazil soybeans on the other hand, are currently looking far better than last year. And analysts are starting to push their estimates slightly higher.

Going forward, my biggest concern with soybeans still has to be Brazil and their expected large crop. Yes, we still have a ton of time to see changes which could ultimately play out into soybeans favor. But currently Brazil isn't facing any major threatening weather issues just yet.

5-Day Change

Jan-23 Beans: -21 3/4 cents

Jan-23 Soybeans (6 Month)

Wheat

Wheat had an interesting week with the missle news and with Russia extending the grain export deal. Chicago ultimately ended the week down over a dime, while MPLS was the only one to end green on the week.

With the Russian news Thursday, we saw prices trade near lows we haven't seen September. But with all the factors in place, one would think its only a matter of time before buyers step back in here.

We have global issues with Argentina. Their wheat crop is roughly half of what it typically is. With their crop continuing to lose a ton of production every week. We also have Australia, who was expected to have a record crop. But that crop has quickly been diminished. Losing around 1/3 of their crop due to their heavy rain and flooding they have experienced.

In the U.S. we have also seen some problems with the winter wheat crop. With this crop being in one of the worst conditions in recent history. The USDA currently has WW conditions at 32% rated good/excellent vs 46% at this time last year, so you can put into perspective what condition this crop is in. We also have 74% of winter wheat and 79% of spring wheat in the U.S. still suffering from drought.

Another thing to note, I saw this on Wright on the Markets update today. It said "2023 will be the 4th consecutive year global wheat consumption will exceed global wheat production. With La Niña causing weather problems around the world for at least another four months, world wheat carryover will decline at a faster rate than the previous three years."

Overall, I think wheat has a lot of upside. With all of the concerns we are seeing globally and here in the U.S. I think it is just a matter of time before buyers come back into the picture and start buying wheat at these levels.

5-Day Changes

Mar-23 Chicago: -13 1/4 cents

Mar-23 KC: -15 1/4 cents

Mar-23 MPLS: +1/2 cent

March-23 Chicago Wheat (6 month)

March-23 KC Wheat (6 month)

March-23 MPLS Wheat (6 month)

Cattle

Dec live cattle futures ended Friday up +$0.45, up to $155.850. Finishing +$2.60 higher for the week.

Jan feeder cattle ended the week higher +0.800 to $180.775 and was +$2.20 higher on the week.

Feb-23 Live Cattle (6 month)

Jan-23 Feeder Cattle (6 month)

Other News

Elon Musk reinstated former President Trump on Twitter

The U.S. dollar has remained at its recent lows through out the majority of last week

In a recent poll, 68% of Americans said they support the legalization of marijuana, a record high.

In a recent report, 2/3 of Americans said that inflation has outpaced their income

37% of real estate agents couldn’t pay their rent in October, a 10% increase from the month prior according to Bloomberg

Social Media