WHY YOU SHOULDN’T BE FEAR SELLING

WEEKLY GRAIN NEWSLETTER

By Jeremey Frost

This is Jeremey Frost with some not so fearless comments for www.dailymarketminute.com

When do you throw in the towel?

Not yet folks. That’s my answer if a farmer should make a sale now, throw in the towel, wave the surrender flag, give up, or whatever analogy one wants to put on if they should be making some grain sales. First off, some guys have made some sales and my recommendation is that everyone needs to be comfortable for their unique situation, and their risk reward profile. No one has the same situation, it can be perfect for one producer to have zero sold, holding old crop inventory while another can have nearly the exact opposite and be sold plus have some new crop marketed.

How can both be successful? Because it is not one size fits all.

The definition of success that I choose to use is from Earl Nightingale and that is “Success is the progressive realization of a worthy goal or ideal.” So keep in mind that success in grain marketing to me is simply being comfortable where one is at, with all of the unknowns.

So if I didn’t sell before the meltdown in prices some of the markets have had recently why would one sell now? I personally wouldn’t, as I don't view that a lot has changed. If anything we have had a weaker dollar along with weaker prices that will help support demand and therefore could help us get even higher later. All of our major markets, corn, soybeans, and wheat, have extremely tight balance sheets. The market’s job has been to make sure we curb demand like the magical USDA pencil said we would. The problem is that lower prices don’t curb demand, cheaper prices add to demand.

Take a look at corn exports, they have been horrible all year, but the past few weeks they have improved dramatically. We don’t have room for the exports to be good.

Technical view. Here is a technical view from Wright on the Markets Read Here

“Tech Guy Weekend Comments 12/3/22

The first thing I want to talk about is the Commitment of Traders report which is published every Friday afternoon. Both March Corn and Wheat continued their down corrections last week.

Open Interest includes all months combined. Remember, OI is the total number of open contracts. It includes all traders, merchants and producers who have open positions in the market - they are interested in making money or hedging their bets against the physical inventory on hand.

The Wheat open interest decreased 41,728 contracts last week. By the way, I use the short form legacy report. Some people look at other iterations that include more categories of traders. Here is the short form I look at: https://www.cftc.gov/dea/futures/deacbtsf.htm

The Corn open interest decreased by 136,254 contracts last week. Both Wheat & Corn sold off during that time allowing us to determine that the down moves are only corrective - small short traders taking profits and weak longs getting blown out (stopped out) of their positions.

Therefore, the primary trend (flow of energy) on the weekly charts is still up in both March Corn and Wheat. Another way to look at it - traders are becoming less interested as price falls - energy is decreasing.

On the other hand, when a market is in a strong trend and open interest is increasing, it means energy is being pumped into the market, adding fuel to the fire, so to speak. Roger sent out those nice charts of Dec Corn and March Wheat.

I agree with him on both charts. Open gaps are always unfinished business. Once they are filled, that market can return to the main business at hand - for the corn weekly chart this business is up. The volume on Friday for both Corn and Wheat was way above average, indicating capitulation.

March Wheat support was 760, the September low (unfinished business) - Friday tested this area marking a nice double bottom. Therefore, the odds favor strong fund buying next week - it's very reasonable to think that we will see March Corn and Wheat rally next week.

Here are the Dec Corn and March Wheat charts, respectively.

Soybean open interest increased 11,527 while price increased last week, supporting the up move. Also yesterday, Jan Soybean meal broke out of it's triangle to the upside. Meal's strength will bleed over to Jan Soybeans and support higher prices overall - want to see some follow through buying in Jan Meal Monday and Tuesday. Check out the triangle breakout in Jan Meal.

Jan Crude Oil Update: Friday's correction is probably complete because it had a nice structured A-B-C - 2 legged. C bottomed at 79.65 and the close Friday was 80.34. This is a pretty good sized inverted Head & Shoulders pattern and higher prices next week are likely. Please study the updated more zoomed in Crude chart.

I will re-visit the Dec S&P next week - however, the uptrend appears to remain intact. Have a nice weekend!”

-

After looking at the charts above and reading the Tech Guy’s Comments, do you think we should be selling if you didn't before? I for one don’t think fear selling makes a lot of sense at this time.

So what was the big melt down on bean oil all about?

First off to me it simply looked like a buy the rumor sell the fact type of price action, which left way too many on one side of the boat. When they tried to all leave at the same time it got too crowded. Lock limit happened. I didn’t hear any announcement that any planned soybean expansions were not eighty-sixed. But here is a good write up from LinkedIn and Walter Cronin. I think it sums up things very well, while longer term reminding me that markets never go in a straight direction.

Thank you Walter for your insight. But let this be reminder number two of this week’s newsletter that we don’t fear sell. We want to buy fear, and eventually, sell greed.

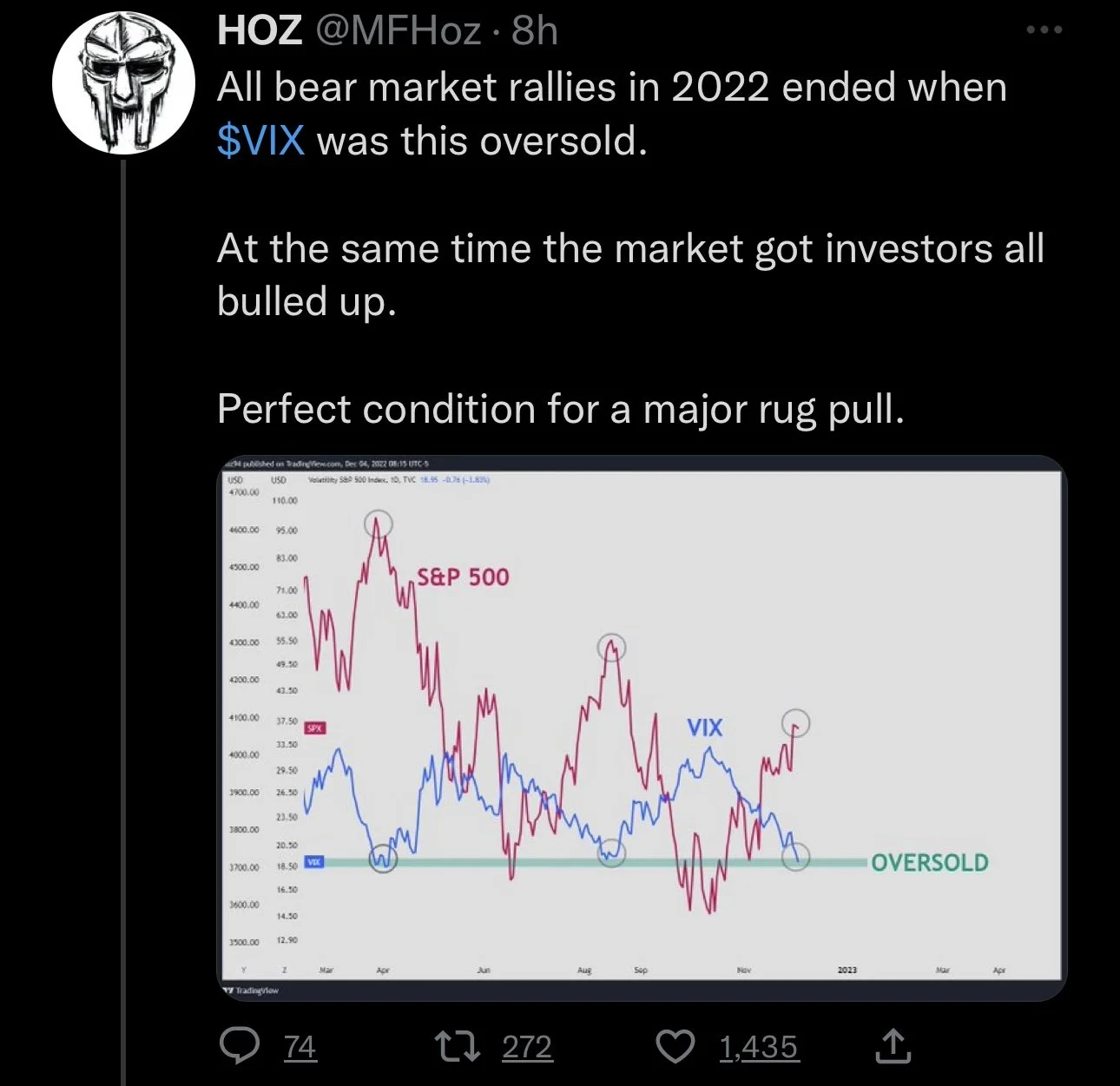

Has the stock market made its lows?

On October 13th, I said that the stock market had made its lows as we got too many on the wrong side of the recession going to happen on the side of the boat. Since then we have rallied tremendously.

Here is a monthly DOW chart, you can see we are very close to busting up and making new all time highs. At that point will the recession bears throw in the towel? Should they throw in the towel might be the better question. But what I remember is that spike down on equities when COVID hit and all of the sudden the sky was falling. Eventually turning into the start of the biggest bull market the grains have seen.

So I wonder if the recent pressure on the grains, with all of the sky is falling talk, could that be similar to what the future has in store for us. Could this time a resurchange in demand happen lead by China coming out of lockdown. It has been nearly 3 years, what type of pent up demand could they unleash to the world markets? Is the world prepared for China to come out of lock down?

This next chart is a daily DOW futures chart. You will notice that we had a major reversal on Oct 13th, where we made a new low and reversed higher taking out several sessions ranges in the process. Markets can give us signs. For me it is simply a chart pattern to watch for reversal signs for other markets.

As I was writing on the sky falling I came across another article about Chicken Little. https://www.insightag.com/post/chicken-little

The main theme I got from reading was the sky is not falling, but make sure one is comfortable in their current marketing position.

They did have a good chart on Canola that I found interesting and positive.

Seasonal Trades

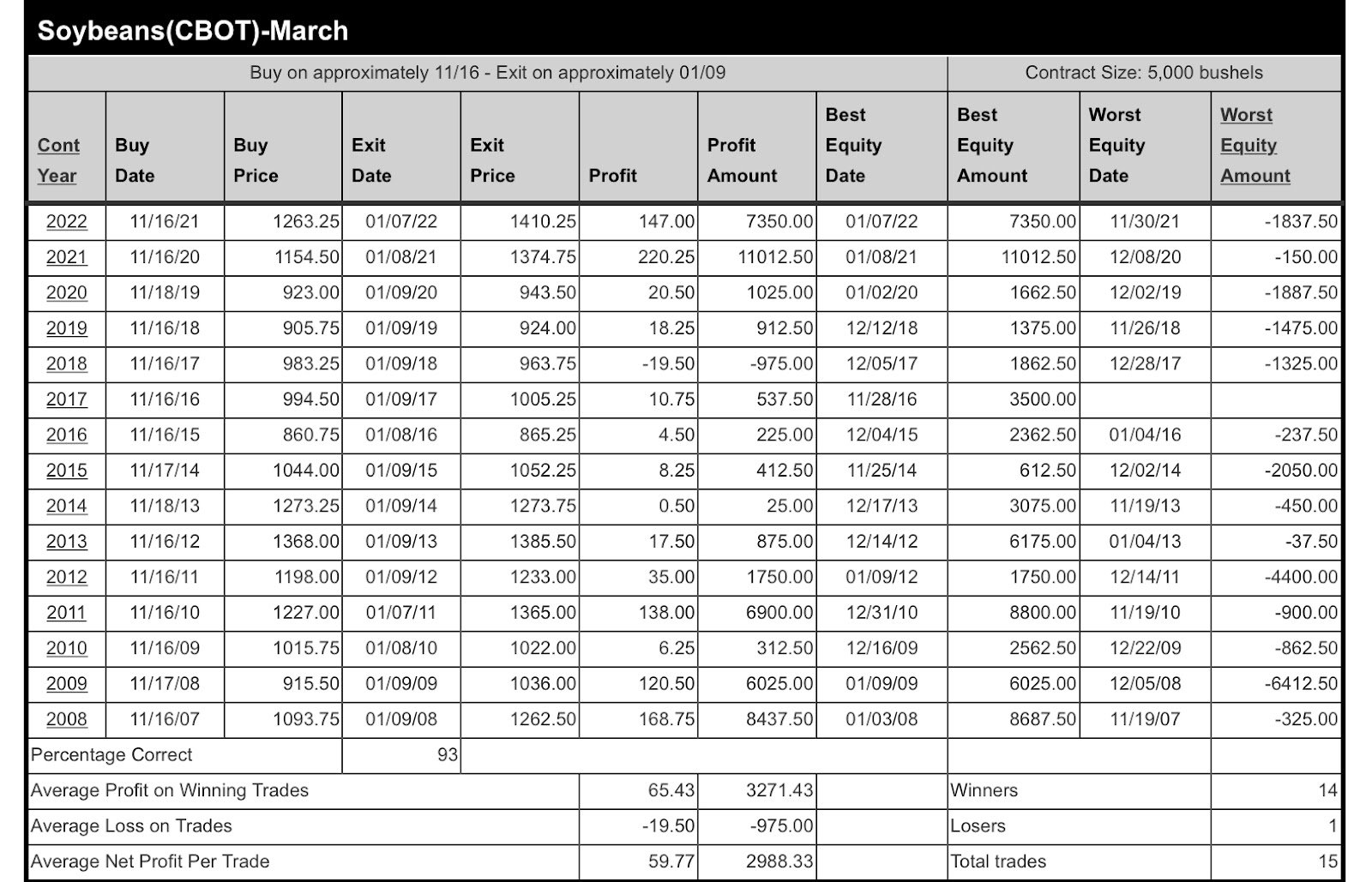

Here are a couple seasonal trades that I noticed, these were buying March Soybeans and March Corn. Around November 16th, while selling the 9th of Jan and the 4th of Jan respectfully.

If one entered either of these trades, one would be under water a bit. The bean one would depend on the exact time and day you entered, but corn made new lows on Friday. So now what? Well luckily for most of you I didn’t publish these seasonal trades. I waited and now is the time to consider entering, when you have a strong seasonal trade that is not working. But has other technical signals starting to align giving on buy signals.

So my bias would be to consider buying corn behind the seasonal trade, but add to it reasons that the first set of technical charts from the Tech Guy gave us.

Worth reading from ZeroHedge.

Very good article, talking about the US dollar, along with Russia - China - Ukraine. 34 Million Ukraines that may go without heat or be forced to become refugees.

To me, one thing that reading the big headline of the article reminds me is that as we go longer in the marketing year, wheat buyers will still come to the US. So we need to keep this in mind, that we have the best quality wheat in the world, quality demands higher prices, but that doesn’t mean we are going to be the first choice. Cheaper wheat is moving, but cheaper wheat is slowly getting grinded though and eventually buyers should come to the US for wheat.

Tools

What tools are you presently using in your grain marketing? What tools do you need to learn about?

First off when it comes to tools in grain marketing there is no tool that is one size fits all operations or situations. Sometimes that best thing for most farmers is simply using the KISS method. Keeping it simple smarty pants.

But for those of you that want more information I am going to go over a couple of tools.

First is buying a put. Buying a put is a way to put a floor in on future prices. It creates a minimum price on the futures component of a cash price. The biggest benefit is a put is a defined risk, (the cost of the put), while in theory it has unlimited profit.

As an example of buying a put, is buying a 6.00 CBOT March corn put, it gives you the right to sell futures at 6.00, should you choose to exercise, which you would only do if futures go below 6.00. If futures go to 5.00 your put is worth a dollar, now as long as you didn’t pay a dollar for it you made money on your put.

The next tool is buying a call. Typically one buys a call after they have sold grain and they think that futures price may rally. Buying a call gives you the right to own grain at a specific strike level. Once again no obligation should prices go down.

The most one can lose on a call is the premium one pays for it, and the potential gain is unlimited. A good example today would be buying an 8.00 CBOT March Wheat call. If CBOT wheat goes to 10.00 your call is going to be worth 2.00. Your profit will be determined by the price you paid for the call.

Other reasons farmers buy calls include Texas Hedging, giving one confidence to make sales that they might not make if they didn’t have ownership in some manner. Courage calls are what some brokers refer to them as, meaning owning the calls give farmers courage to make sales that they might not make if they didn’t have the calls.

Once you have sold grain and you buy a call you have created a minimum price contract for your grain.

Buying a call or a put is a real simple tool one can use to help achieve higher prices. But they are also strategies that can easily just end up being a cost and taking away from your net price achieved.

In next week’s newsletter we will discuss a little bit of when to buy calls and when to buy puts along with how calls and put prices are determined. Meaning we are going to talk a little bit about Greeks Theta and Vega. What time value and volatility do to call and put option prices.

SAM Weather

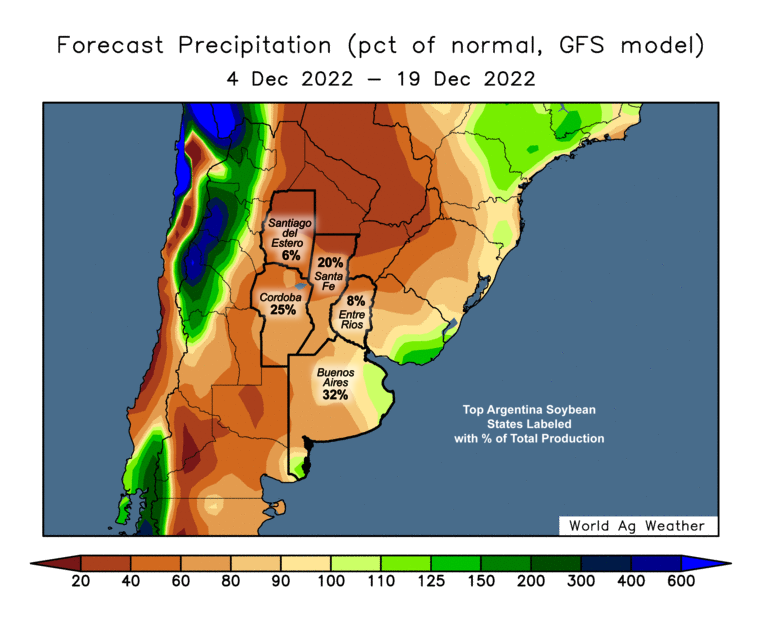

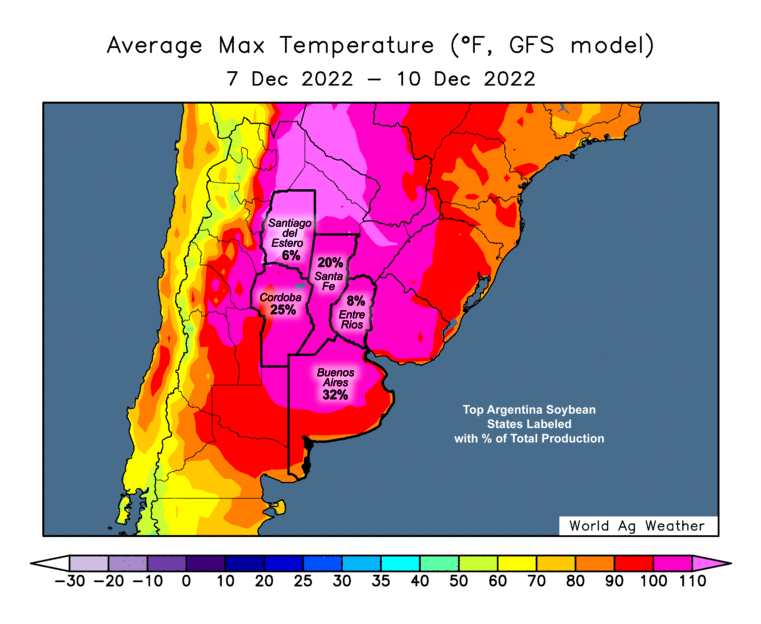

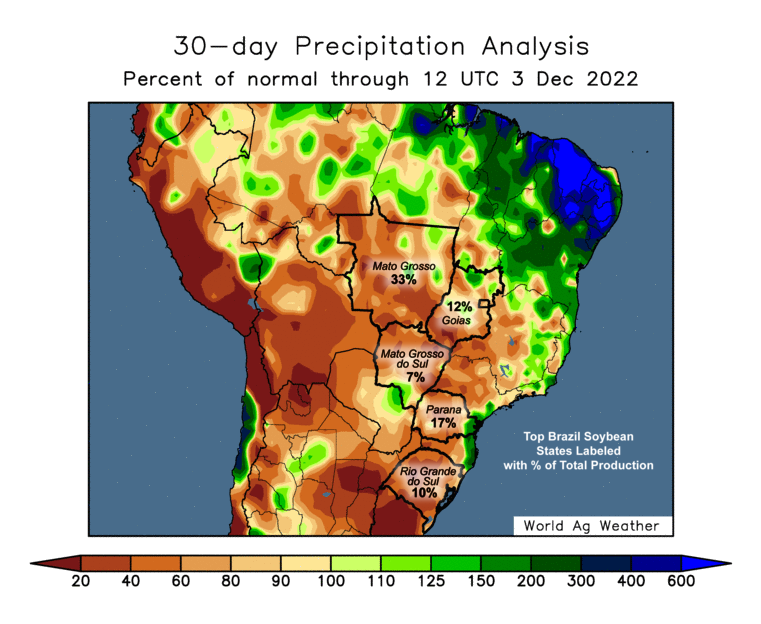

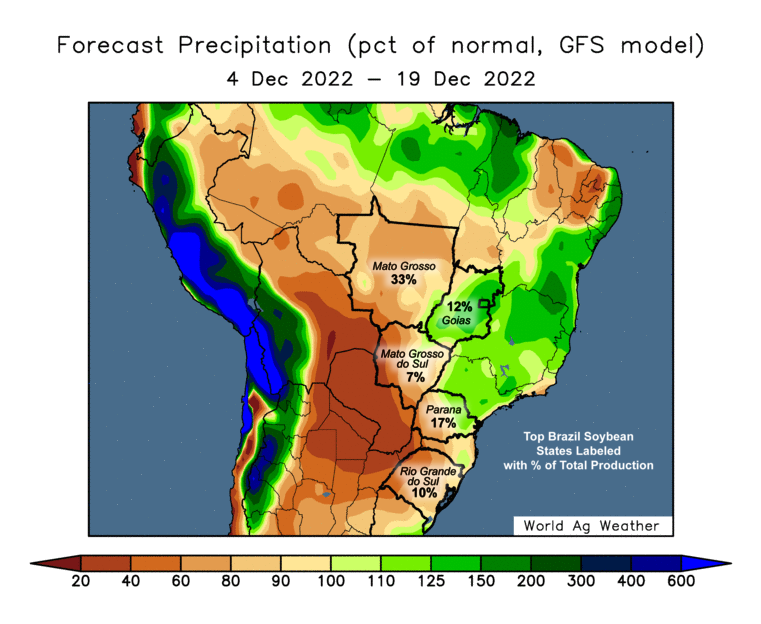

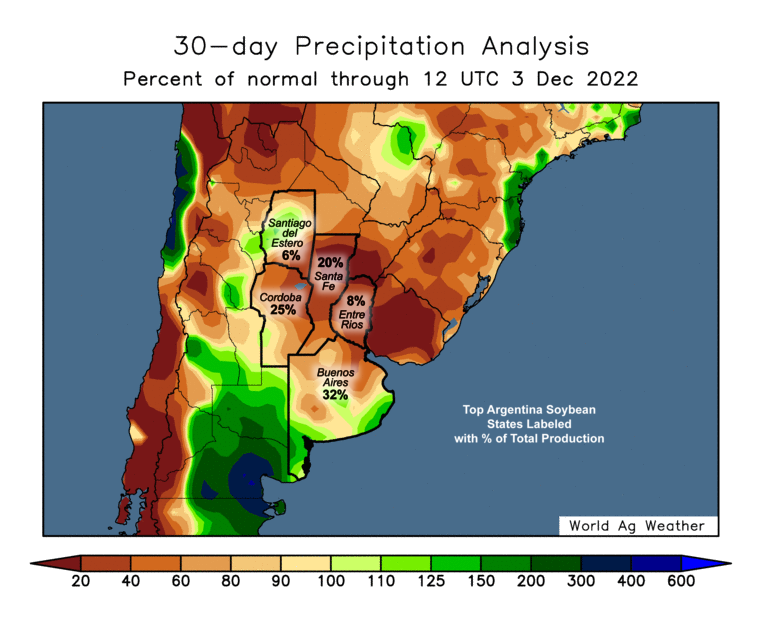

Keep an eye on South America weather. In my headlines to watch list it is up there as a potential market driver

What is going to drive the Grain Markets

South America Weather

China Policies

Fund Money - buying or selling

Recession or the world is perfect. It can’t be in the middle, one extreme or another

War - Russia - Ukraine has been moved to the back burner

How much damage has already been done and what type of a winter do they have in store. It’s difficult shipping during a war, but a war with winter and a lack of power?

Demand

Ag Horizon’s

Thank you for all that stopped at our booth at Ag Horizon’s. We hope to see many of you at the Prairie Grains conference this week.

Below are a few slides from Ed Usset’s presentation at Ag Horizon’s. Thank you for the presentation Ed.

Please note that on Thursday the map that I seen for soybean crush expansions now has 18 listed with 689 million bushels of added demand.

Does anyone know what a 60 million bushel miss on a USDA report typically does for soybean prices? Typically it would be limit or close to limit type of move.

The bottom line is despite the weakness seen from the EPA announcement earlier in the week we have very strong demand behind the soybean market.

Check out our all-new Ag Directory

To add value and efficiency the Ag Directory provides a way for users to have a “one-stop” shop in the palm of their hands and not have to search for contacts when they need a trucker, seed, fertilizer, parts, financing, etc.

Commodities Overview by Sebastian Frost

Overview

The volatile week ended in sharp losses to corn and wheat while soybeans saw a small rebound following its 40 cent loss Thursday due to EPA forecasts being a lot smaller than traders had thought they'd be. Overall demand has continued to pressure grains, while some improved Argentina rains have also added some pressure

Today's Main Takeaways

Corn

Corn ended the week -14 1/4 cents lower on Friday with March closing at $6.46 1/4. This loss sent corn futures trading at their lowest levels we haven’t seen since the middle of August. This 14 cent (-2.2%) loss was also the biggest single day loss corn futures had seen since August 16th. Corn has been pressured by weak export sales as well as the EPA numbers not helping the cause.

Friday's loss led to use breaking a key support level of $6.53 1/2 cents, as we now are trading at levels we haven’t seen in four months. So we will have to wait and see if buyers step back in here at these levels or if we continue to trade lower until we get some bullish headlines or news. Support to the downside appears to be around the $6.38 level.

The EPA proposal we saw Thursday that sent soybeans and soyoil crashing also effected the corn market, adding some pressure. But on the bright side the ethanol numbers were more in line than those of the biofuels.

The problem with corn right now is weak demand. As year to date U.S. export sales are less than 50% of what they were last year. So to justify corn trading over $7 we almost certainly need to see demand increase.

Another thing that could help support prices would be some South American weather woes. But for now, there isn’t a whole lot to that side of the story to push corn higher either for right now. This story could always change in the future, and yes one could argue that we see Argentina production slip due to their problems which is still a real possibility.

5-Day Change

Dec-22 Corn: -15 cents

Mar-23 Corn: -25 cents

March-23 Corn (6 Month)

Soybeans

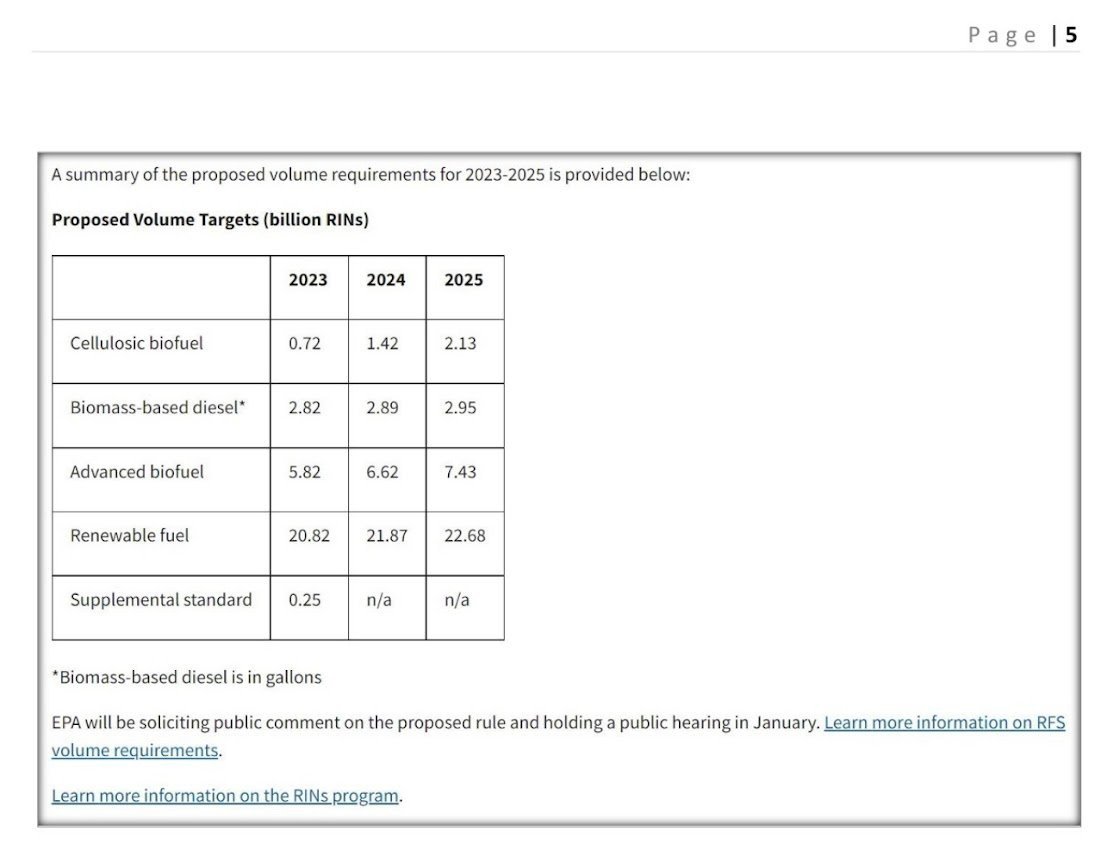

Soybeans had quiet the wild week. With the EPA forecast leading to extremely sharp losses in soy oil which pulled soybeans lower, ending Thursday's session over 40 cents lower. Despite this major loss, soybean futures actually ended green on the week. Closing up +2 1/4 cents on the week.

We went over this in the past few updates but basically the loss in soybeans and soyoil was due to the EPA forecast numbers which came in at 2.76 billion gallons in 2022 to 2.82 billion in 2023, 2.89 billion in 2024, and 2.95 billion by 2025. That is just a 7% increase of 190 million gallons over the next few years. Traders were expecting a much larger increase upwards of over 1 billion gallons, which was the reason for the sell off we saw Thursday following the numbers.

After Thursday's loss where we also soyoil fall 6% and hit lows we haven’t seen since August, soyoil continued to trade lower Friday while soybeans saw a small rebound of +8 cents. The funds are still long soybeans, soy oil, and meal so we will have to see what they ultimately decide to do. But if soybeans were to continue trading lower they have some really stiff psychological support at the $14 level.

The biggest factors going forward for the soybean market are South American weather as well as China. As currently we haven’t seen much concern in Brazil as they are facing a record large crop. We also have the covid lockdown and protest situation in China. As their lockdowns have pressured soybeans due to decreased demand, while we saw protests earlier last week that sent soybeans higher due to optimism that China would be a little more relaxed and perhaps call off their lock downs.

Ultimately it's somewhat difficult to make reasons to be super bullish on soybeans without any South American weather scares or other bullish headlines, but if we do end up seeing problems over in South America this would obviously send prices higher. If China calls off their lockdowns this could also lead to a knee jerk reaction type of rally.

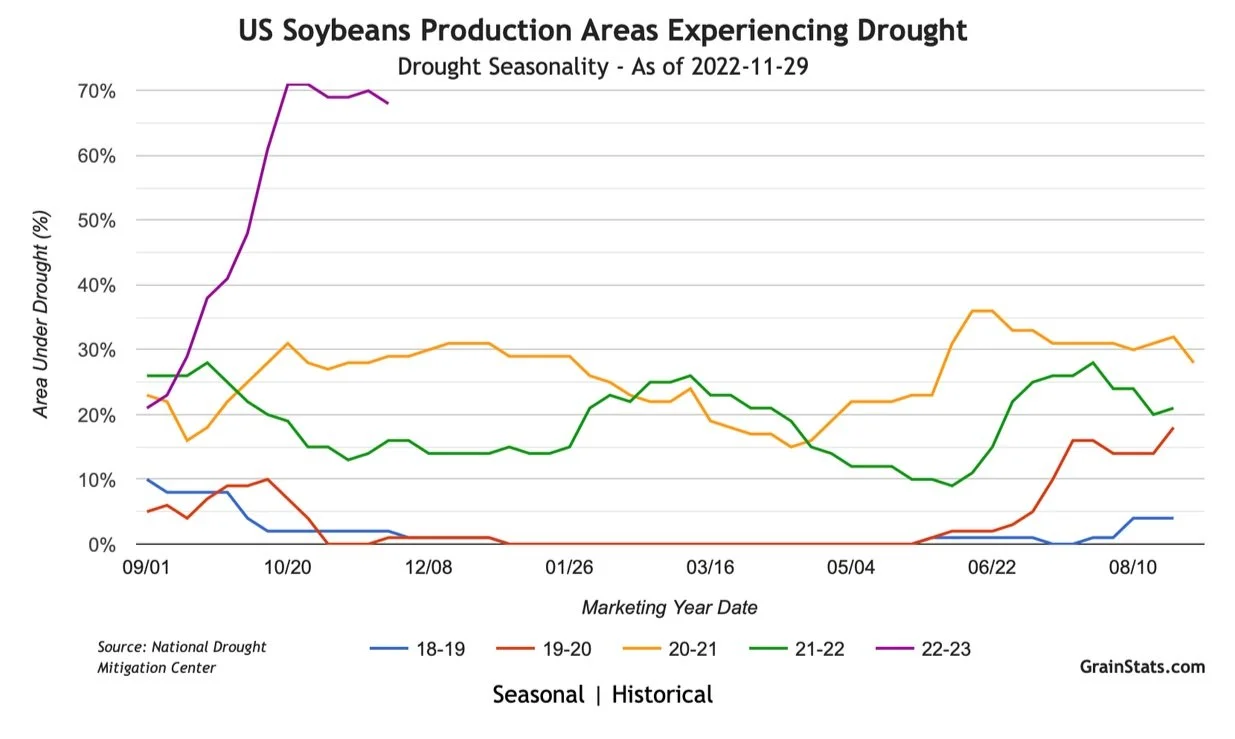

We also have to keep in mind that drought has effected crops across the globe. With 1/3 of the early planted soybeans over in Argentina are already seeing problems, and we have nearly 70% of soybean acres here in the U.S. suffering from drought.

5-Day Change

Jan-23 Beans: +2 1/4 cents

Jan-23 Soybeans (6 Month)

Wheat

Wheat capped off the poor week with some more losses on Friday. Closing down over -20 cents and ending the week -36 cents lower. With Friday's loss we have wheat sitting very close to some major support. As March Chicago sits at $7.61 and we have major support at the $7.60 1/4 level, which was our lows we saw back on August 18th.

One would love to see prices hold here and rebound from these lows. As if we break this support we could possibly see prices trade back to our lows we saw in January which was at $7.48 3/4. On the flip side, if we can see prices rebound here and break through $8 I think we would very easily see prices climb to $8.20 or higher. On our mid week rally we saw prices peak at $7.96 3/4.

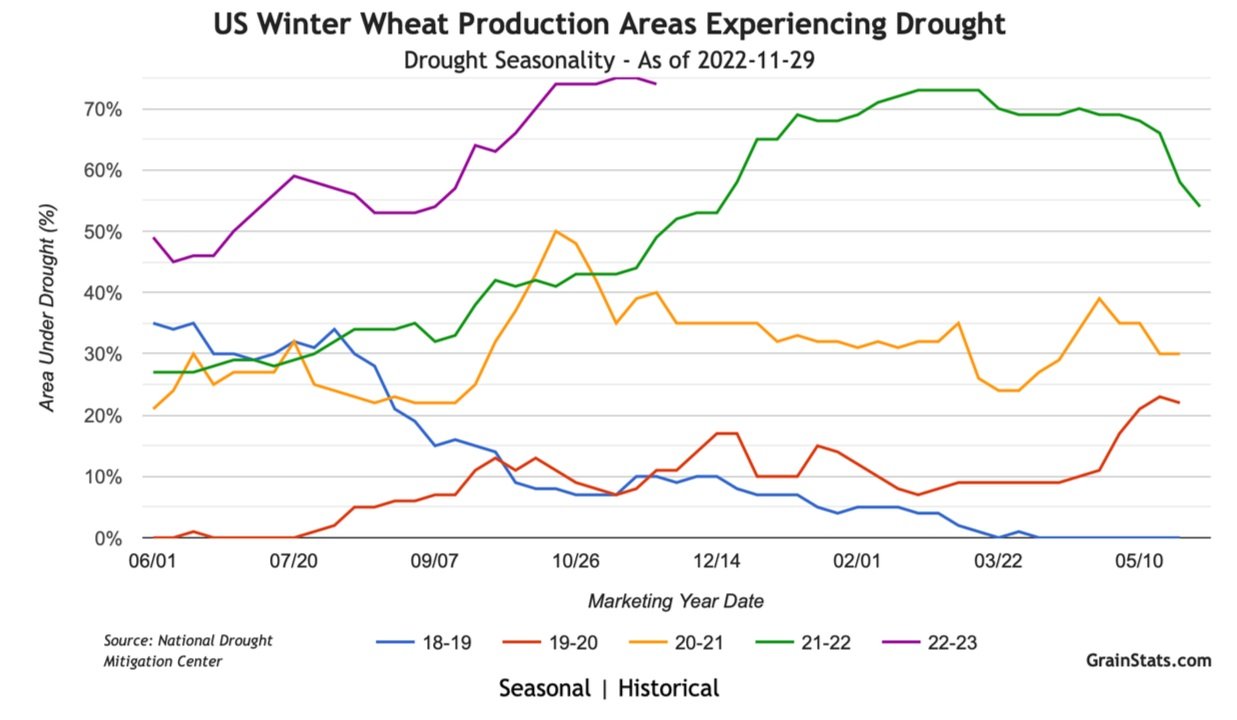

We have seen improving weather conditions add some pressure to wheat. But even with this slightly improved weather, we can't ignore the fact that Argentina has seen some serious problems and even here in the U.S. we have one of the worst winter wheat crops on record.

BAGE pegged Argentina wheat crop at 23% harvested and left their conditions unchanged at 9% rated good/excellent. This is significantly behind last years 65%.

BAGE also has their production estimate far lower than that of the USDA. As they have theirs at 12.4 million metric tons vs the USDA 15.5 million. So I think its only a matter of time before the USDA makes some sizeable adjustments.

Going forward the biggest factors to look out for are likely global weather and the Russia/Ukraine headlines. I think global weather is a bullish factor just simply given the conditions of wheat crops across the globe are already in tough shape. Russia and Ukraine on the other hand is still a pretty big wild card, as further escalations send prices higher while any signs of peace pressure prices.

5-Day Changes

Mar-23 Chicago: -36 cents

Mar-23 KC: -41 1/4 cents

Mar-23 MPLS: -28 1/4 cents

March-23 Chicago Wheat (6 month)

March-23 KC Wheat (6 month)

March-23 MPLS Wheat (6 month)

Cattle

Dec live cattle futures ended Friday up +$0.45, up to $155.875. Finishing +$0.75 higher for the week.

Jan feeder cattle ended the week higher +1.375 to $182.450 and was +$4.15 higher on the week.

Feb-23 Live Cattle (6 month)

Jan-23 Feeder Cattle (6 month)

Other News

U.S farm income hit a new record of $160.5 billion. A 14% increase from last year.

Ukraine exports via Poland rise by 50%

Argentina corn and soybean planting still behind but hasn’t fallen further behind pace

44% Soybeans planted

45% Corn planted

Canada's 2022 harvest turned out smaller than expected

China cities have announced they would start reopening businesses as they ease the covid lockdowns per the Guardian

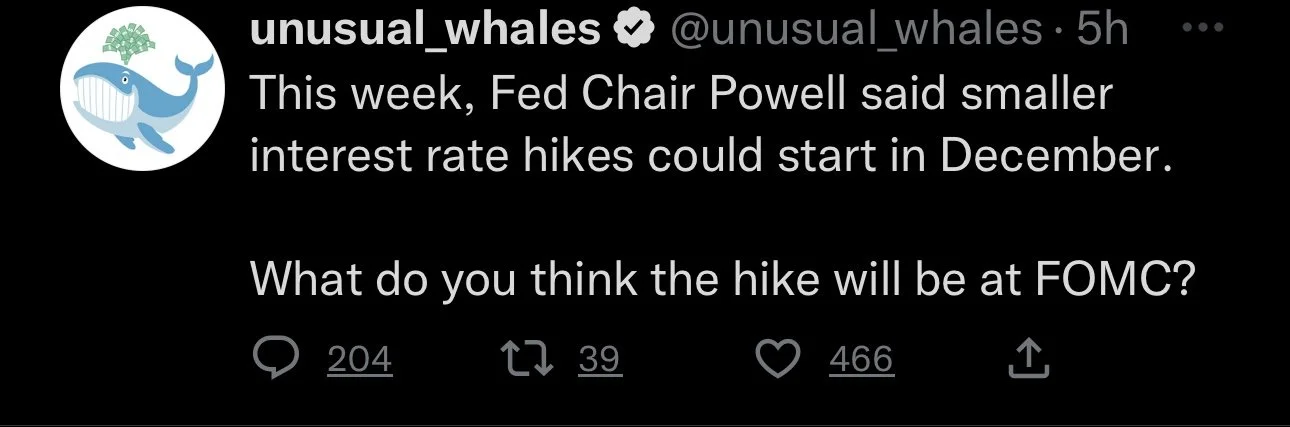

Fed chair Powell said smaller interest rate hikes could start in December

Social Media