WEEKLY GRAIN NEWSLETTER

By Jeremey Frost

This is Jeremey Frost with some not so fearless comments for www.dailymarketminute.com

We had the USDA report out on Friday and it was a rather “blah” report. But it was also a report that would have had my daughter using terms like “sus”.

What the report did do was decrease corn exports as most of the market suspected it would. But at the end of the day we had corn trade higher fractionally despite our carryout increasing by 75 million. That to me was “sus”.

Ever heard the saying sell the rumor and buy the fact. Well today was just that type of price action for our corn market. We fed the bears a little bit via decreasing our exports and increasing our projected corn carryout. On the surface many will still say that we need to pickup exports in a hurry or we will see more export cuts and increases in our carryout numbers in the future. This may very well be true, but folks someone today was buying our corn.

When the bears get exactly what they want and then they can’t break the market it tells me that finally we have climaxed as everyone has sold that wants to sell and most likely we have put in our lows. To me it feels like now we just need to give the funds a reason to want to play the commodity game.

Fundamentally we are tighter than a year ago for all of the major grains. (See below portion of history repeating itself). We have much more uncertainty than we did a year ago in terms of the likelihood of production in the world at least today.

What we don’t have in fund interest in our grains and oilseeds. Our open interest is down huge versus a year ago. Funds are finding safer bets with the higher interest rates. We do have charts that look somewhat similar and to me have potential all over them. We just simply need something to spark a fire. Perhaps that fire was getting started today by the Chinese? Someone was buying corn despite the bearish report. Was it them?

Here are a couple of daily corn charts of the nearby futures.

You can see that in the Summer of 21 we traded up north of 7.00 futures near the 7.50 level. We then broke down to 5.00. We followed that from a rally from our September lows to trade sideways from Nov to January. Then come March we found life and before you knew it we had corn north of 8.00 in May.

I don’t know for sure how this year will play out, but I have a feeling that corn is going to trade from about where it is at up towards 7.00 for the next month or two. Then I look for a rally from an acre war starting about March. I look for this rally to continue into May June and then depending on Mother Nature to either explode to new all time highs that shatter old highs or stall out near them.

The biggest concern I have looking at the following couple of corn charts is open interest. We need funds to get a hold of some story that they like. That story can be demand, inflation, war, SAM weather, US weather, some other pink swan event that isn't on the radar. But we need that story, even if it is just simply a story that gets the emotions wanting to buy, when they should be selling. If we get some story and I am sure we will get it and most likely it will be a seasonal tendency that we get nearly every year.

If you connect the tops and the bottoms you have a channel that could be used for good price projections for 2023.

The good news is that we have plenty of room for someone to want to get back into our markets. Open interest down is disappointing but we just need to find that reason to draw spectators back in.

Here is the mentioned channel, the top of the channel is north of 9.00 corn futures come May/June time period.

Below I got from Wright on the Market. I have added my thoughts below.

“Back to the topic of soybean price outlook for the next two months. Please read this carefully:

Soybean price action is usually firm into the end of December but with up and down swings all the way making higher highs and higher lows. We think the mid December high is very near and we expect a modest sell-off and then make a higher high late this month.

Brazil's bean crop is made between 15 December and the end of January. The first two weeks of January, the market will assess the size of Brazil's bean crop and trade mostly sideways if weather is normal.

By the 14th of January, the two week weather forecast and current crop conditions will give the market the confidence to make an informed decision on the size of Brazil's crop.

If the weather outlook and the crop looks decent, the market will price-in a good Brazilian crop by removing the weather premium. Brazil's crop is normally a normal crop, which means bigger than the previous year's crop.

Last year was not a normal crop as it was the second year since Brazil started seriously growing beans in 1941 that a new crop was smaller than the previous year. Take a look at the four charts.

There are three weeks left in December. January beans have rallied 61 cents the past week. It is probable beans will correct down 30 cents or so next week or so and then make new highs the last week of December just like it has made new post harvest three times already this month.

If the weather looks normal in January, beans will trade sideways for two weeks, lose 40 to 60 cents into late January or early February and then rally into June, just like it usually does.

Now, please look at those charts and dates again until you see the pattern. Do you need income before the end of the year? Sell now or wait for a probable higher price the last week of December. In February, get long soybeans.”

Thank you Roger for your insights.

My thoughts are very similar to Roger, but I am probably more bullish then he is. I see the market set up to breakout if weather the next couple of weeks stays or gets hotter and drier in Argentina.

I think we have a major soybean meal chart change that just happened. We are a few more forecasts away from having beanmeal make new all time highs.

Take a look at this weekly nearby beanmeal chart.

The line all the way on the right, this past weeks move was one of the most powerful moves of all time. If we follow that up at all we are well within striking distance of all time highs. Why?

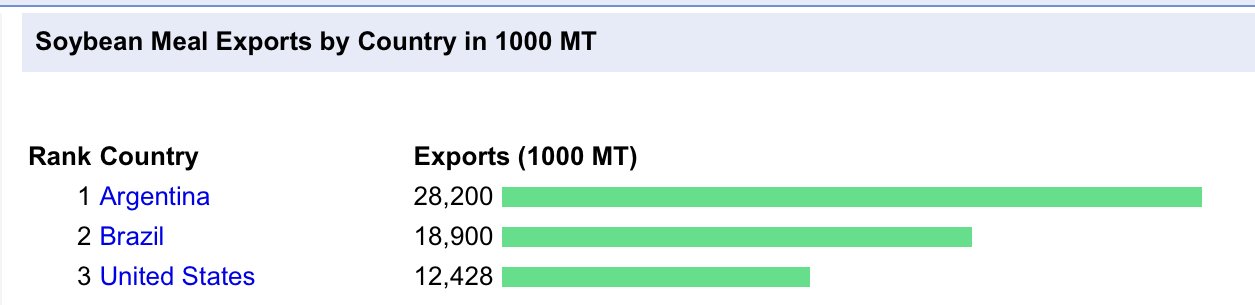

Argentina is by far the world’s biggest exporter of soybean meal.

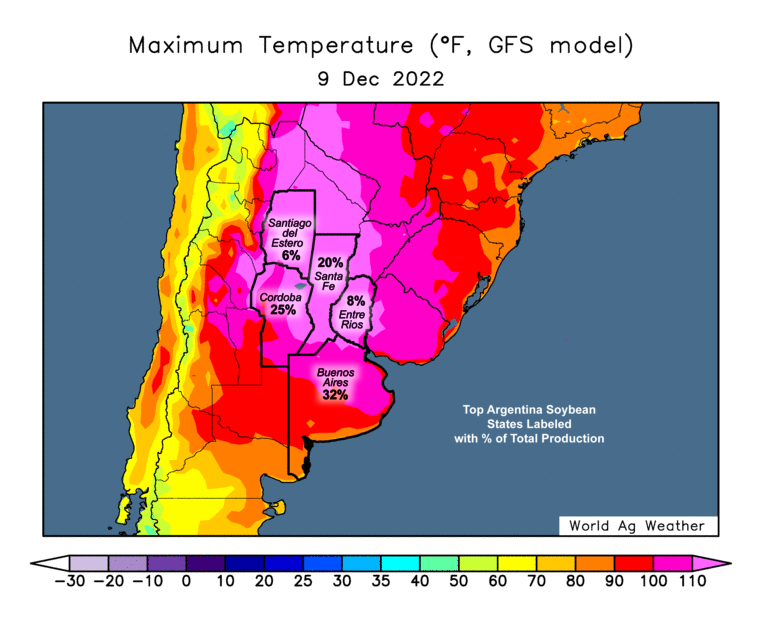

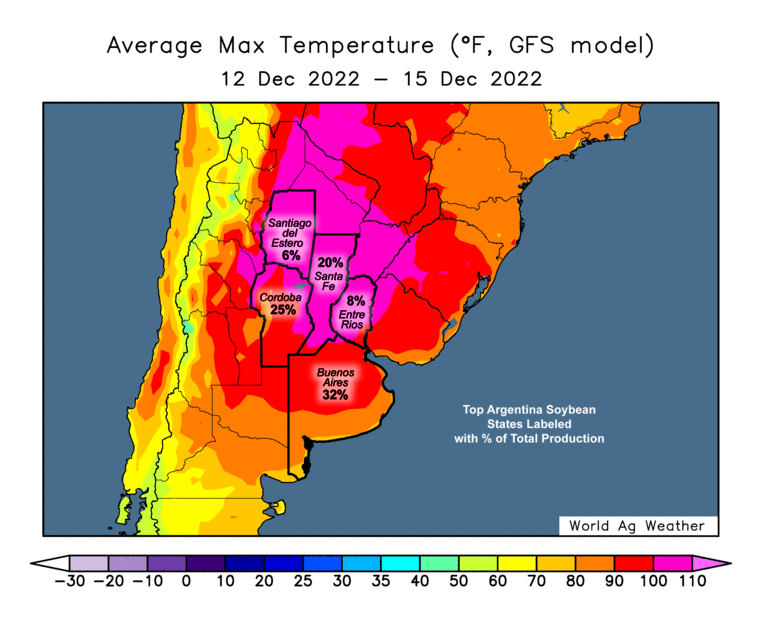

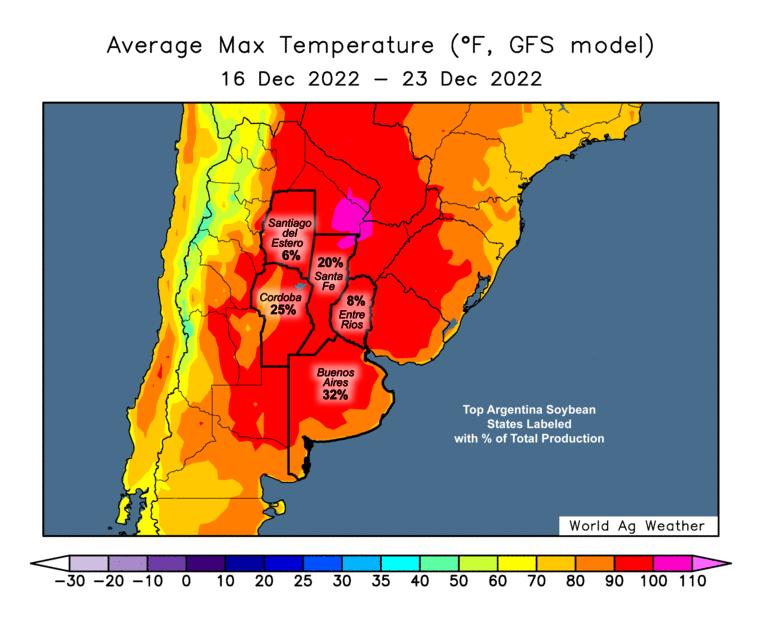

Here are some weather screen shots from World Ag Weather. I am writing this on Friday night, so these could change, but if you look at these updated on Sunday and Monday and they continue to show the 15 day with only 20-60% of normal, we have potentially a massive take off on the bean chart going to happen.

If these forecasts break a bit, then one might want to be ready to buy some bean meal puts. I think that is the best play for protecting both soybeans and sunflowers. Keep in mind what Roger said about weather above. Some of the weather guys I follow think that this La Nina is not going away, if that is the case why wouldn't our markets do exactly what they did last year around this time?

Bottom line is be very patient making any sales, get comfortable if you are not comfortable in your grain marketing plan, but NO FEAR SELLING IS ALLOWED. If anything we are at a time when one should be re-owning sales, or even Texas hedging. The time to make sales will be at higher prices and after some of these weather scares come to be.

I do want to thank those of you that stopped and saw us at the Prairie Grains conference.

As I mentioned the big highlight was demand for bean oil, plus the weather guy that placed up a couple of the following graphs.

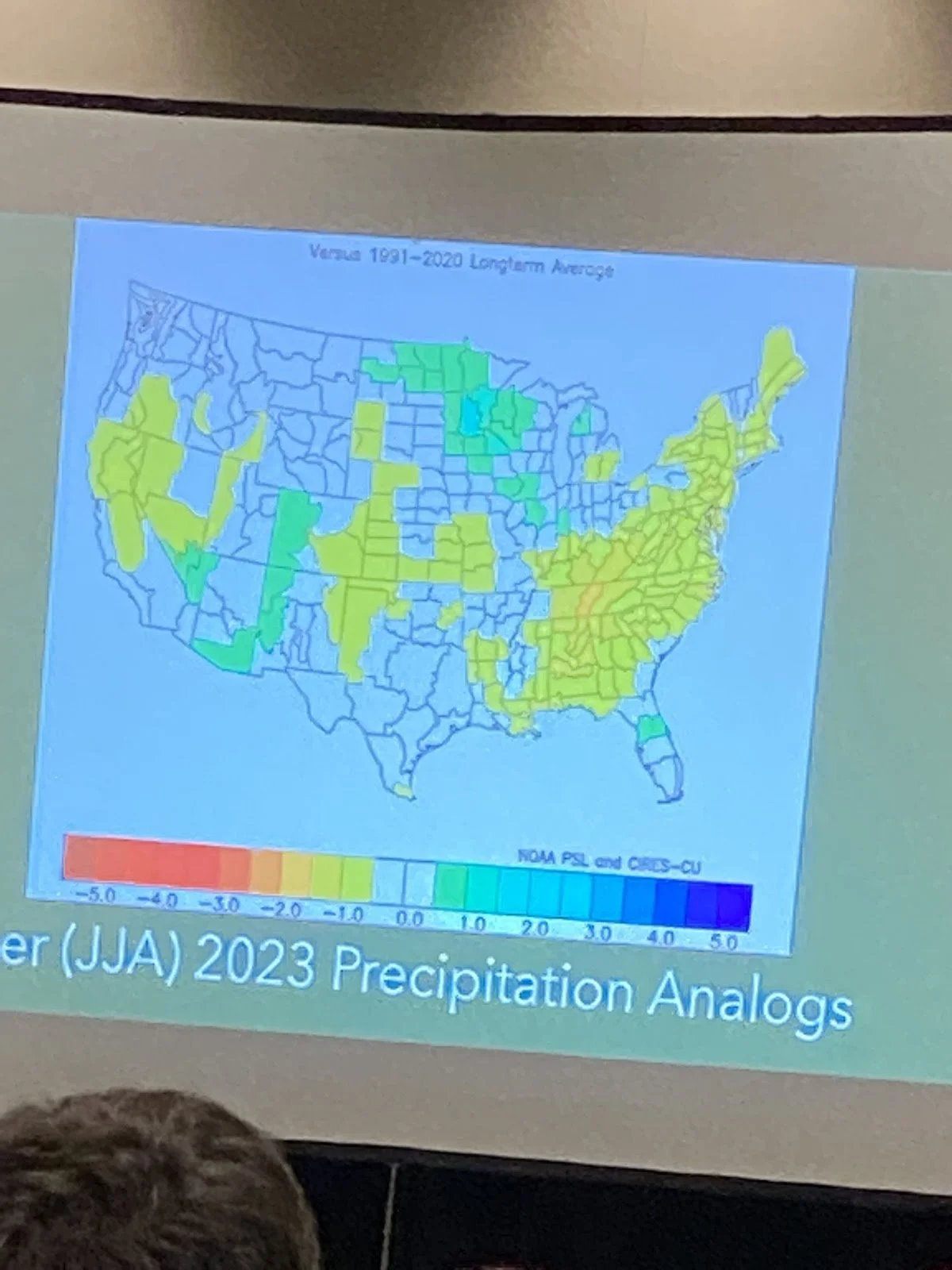

This first one is July-August-September precipitation versus normal. Most of the farmers in the room where smiles seeing this as this conference was in ND. But what I see is all of the areas in the corn belt.

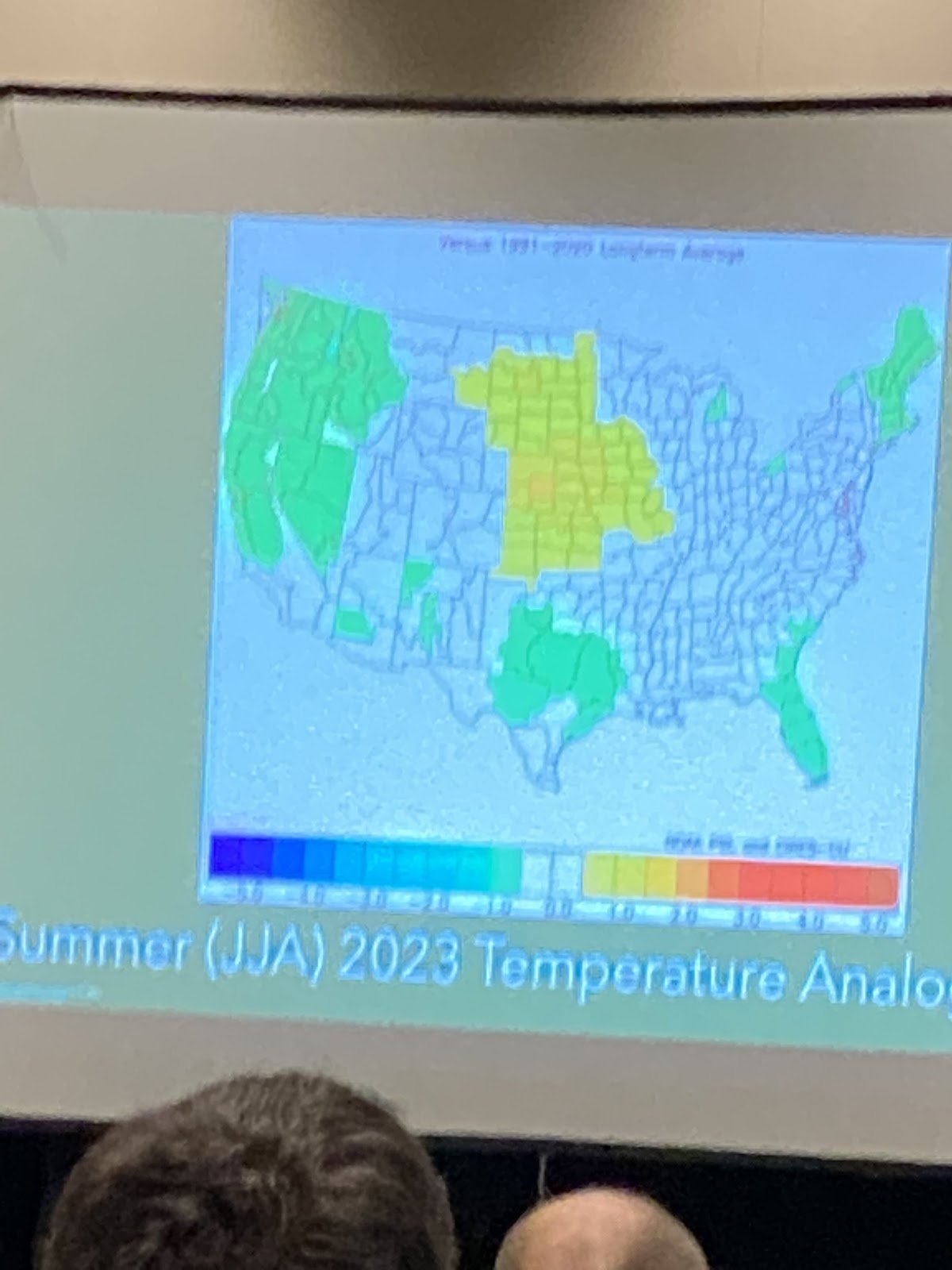

The next is temperatures, which warm is good for ND when it is wet as it helps the crops mature. But warm in the corn belt is not so good.

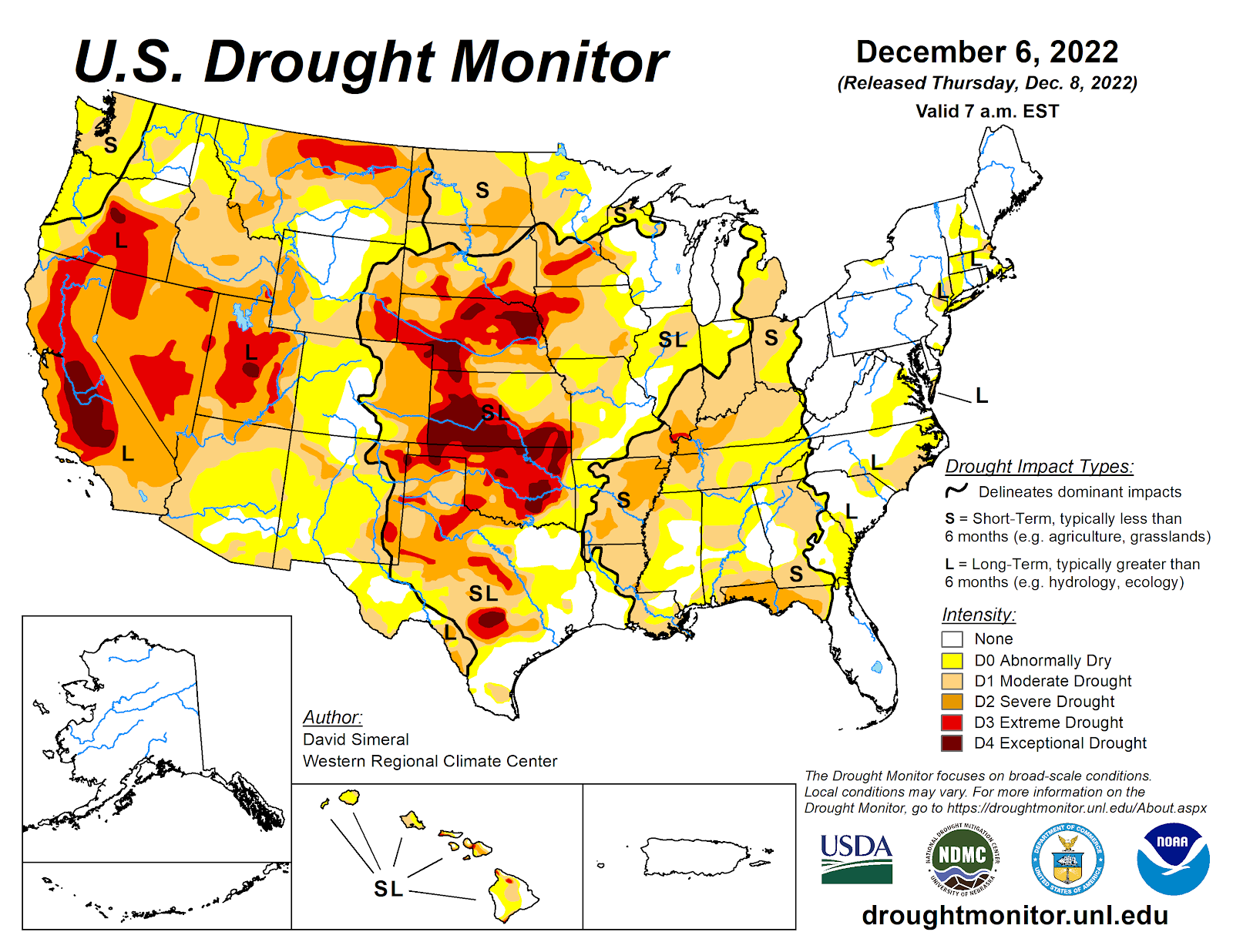

Here is the present drought monitor if any of you want to combine it with the above pictures.

As I mentioned a couple weeks ago I think we have a good chance that we see a repeat of the 2011-2012 cycle for corn yield versus trend.

The speaker at the conference made one very good point about moisture and how basically anything we get this winter will simply have a large percentage of it run off into the rivers and dams. It will not recharge the soil like many areas need.

As yourself what would happen to corn prices if we have the 2022 drought move to the NorthEast? If the D3 and D4 areas move over the I states, watch out folks. Keep in mind history doesn’t repeat itself but it does rhyme. (At least that was the quote on the screen at Prairie Grains Conference.)

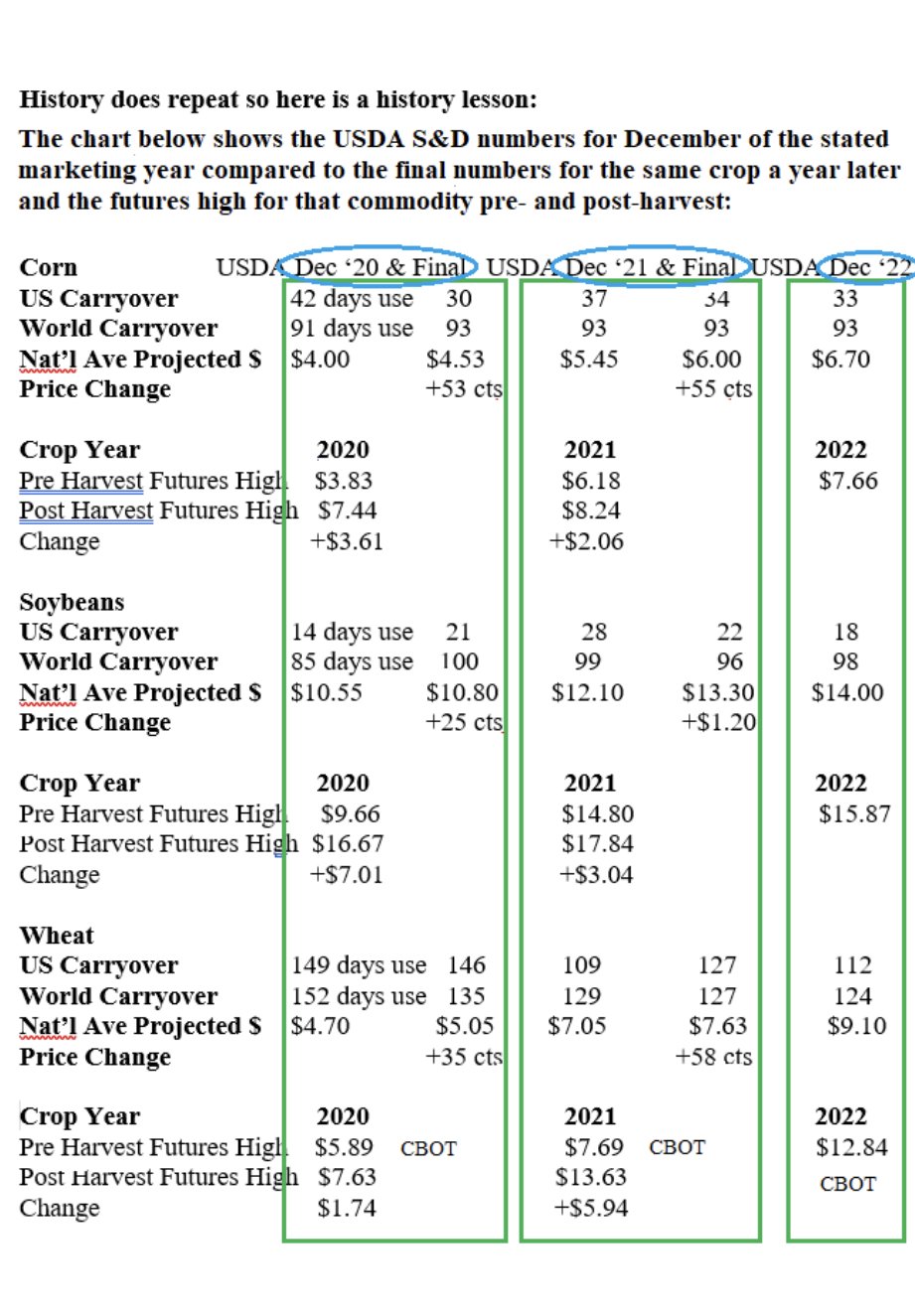

Speaking of History does Repeat itself.

Here is more great info from Wright on the Market. It is simply a great format of reporting why I think we are going to go much higher in the next few months.

For corn you will notice in December 20 we had a pre-harvest to post-harvest rally in corn of $3.61 per bushel. Stocks to usage in December went from 42 days down to 30 when all was said and done.

In 2021 we had 37 days usage, rallied $2.06 from our pre-harvest highs to our spring highs. Stocks to usage slipped down to 34 days.

Soybeans had rallies of $7.01 and $3.04 each year. With the stocks number increasing in 2020.

CBOT March wheat rallied $1.74 and $5.94 respectfully

The biggest thing that stands out to me is that our days to use carryout is less than a year ago for all 3 grains. As it sits today we don’t know how things are going to shake out for demand. The bears think we won’t get any additional demand and our demand will decrease. But the real wild cards that are still in the deck and could be drawn at any time are. Chinese demand, South American Weather, World Weather, and US weather.

If we get 1 of those cards dealt we will likely make new highs on any additional supply scares. If we get a combination or more then one card we could see prices shatter all time highs.

What happens if Chinese demand increases SAM weather curbs their supply and we get hit with a drought in 2023?

Let’s add one more possible wild card to the deck that many are not talking about.

Gold at $3000

What would $3000 gold do to our grain prices? Would grains also be a big inflation hedge? Listen to this prediction here.

What are others thinking?

As many of you know we follow a bunch of other advisors. One reason is to try to consolidate some of the info they have, but a more important one is to try to analyze their grain marketing moves. All of which can be good and bad at the same time depending on what situation a producer's operation is in. One thing I have noticed is some are talking about getting ready to sell some more soybeans both old and new crop. I don't have a problem with that, but my mind set is maybe I should consider selling what is overvalued, so instead of making soybean sales I like farmers to consider buying soybean meal puts.

As bean oil was running up I was telling everyone that would listen to buy bean oil puts instead of selling sunflowers. Now I am in the boat that instead of selling sunflowers I would buy bean meal puts. I want to buy or keep what is undervalued and sell what is overvalued.

One of the trades that the best wheat farmers do is simply hedge or spread CBOT-KC-MPLS wheat well. There has been many times and will continue to be many times when those spreads will get out of whack, don’t sell what is cheap, utilize the spread in a manner that helps your bottom line.

If corn was $10.00 and beans were $10.00 would anyone plant beans? Prices for grain spreads naturally fix themselves because they compete for both supply and demand.

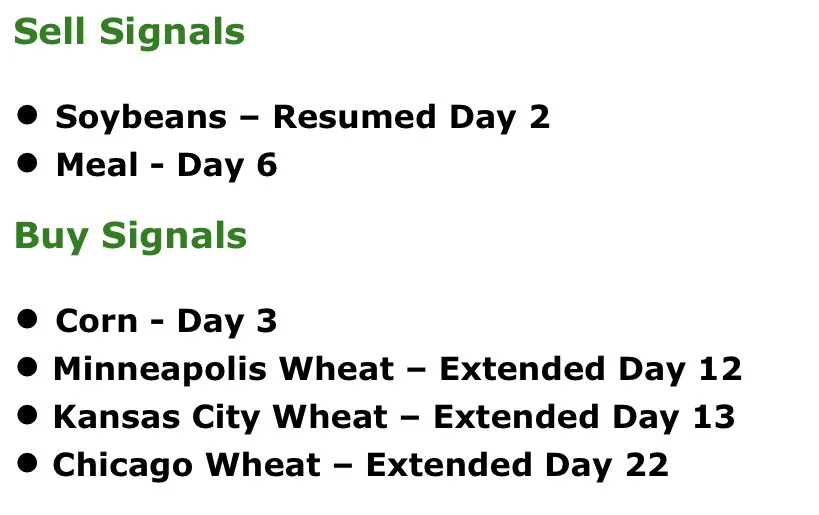

Here is a screenshot from Roach Ag and this shows what he is presently doing with some of the grains. I like his simple approach, but I think adding a little bit to it could add a lot of $$$ to many bottom lines.

I have also seen several that have been giving recommendations to cover feed needs. I 100% agree that if one needs to buy corn you might want to do it sooner than later.

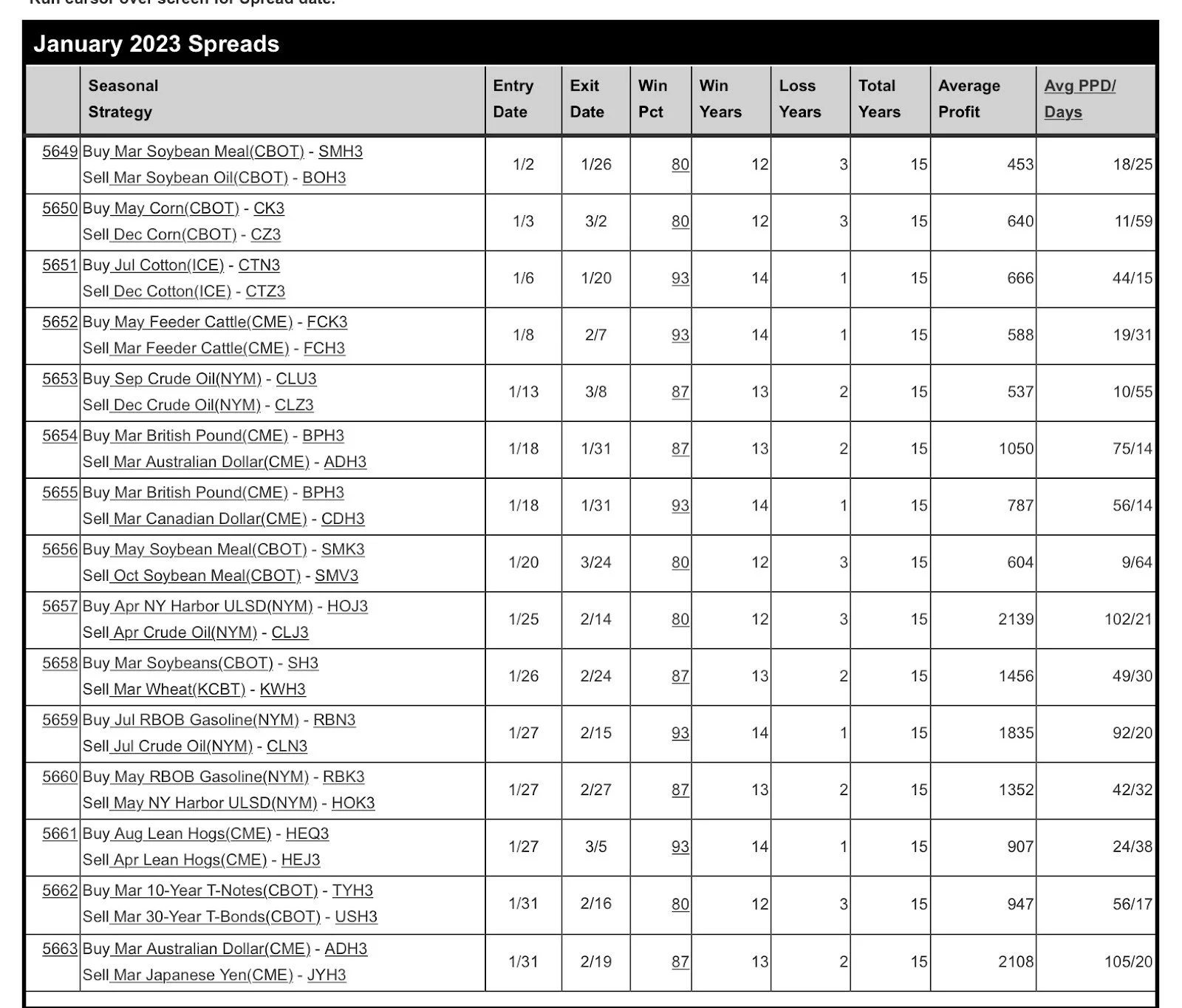

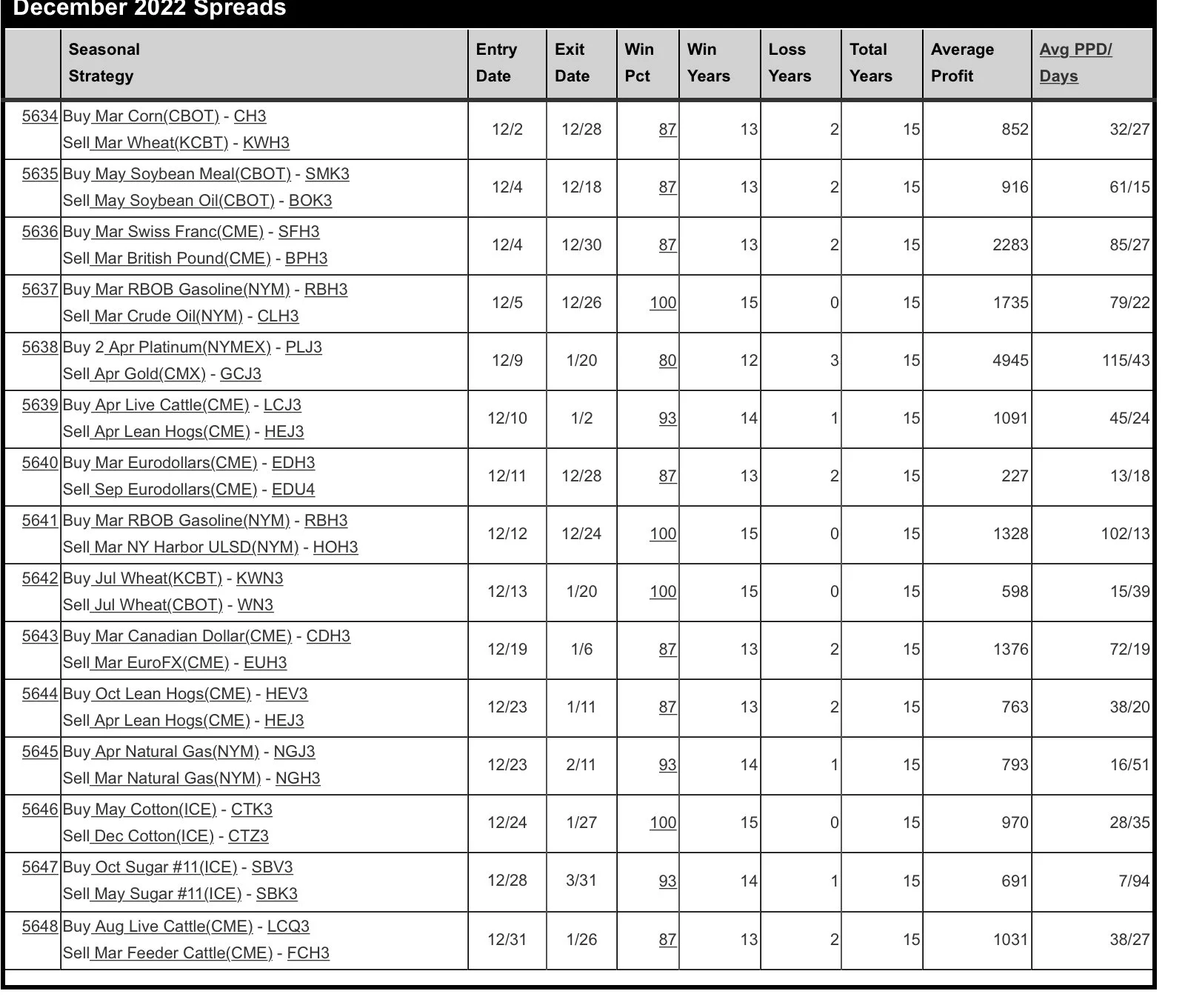

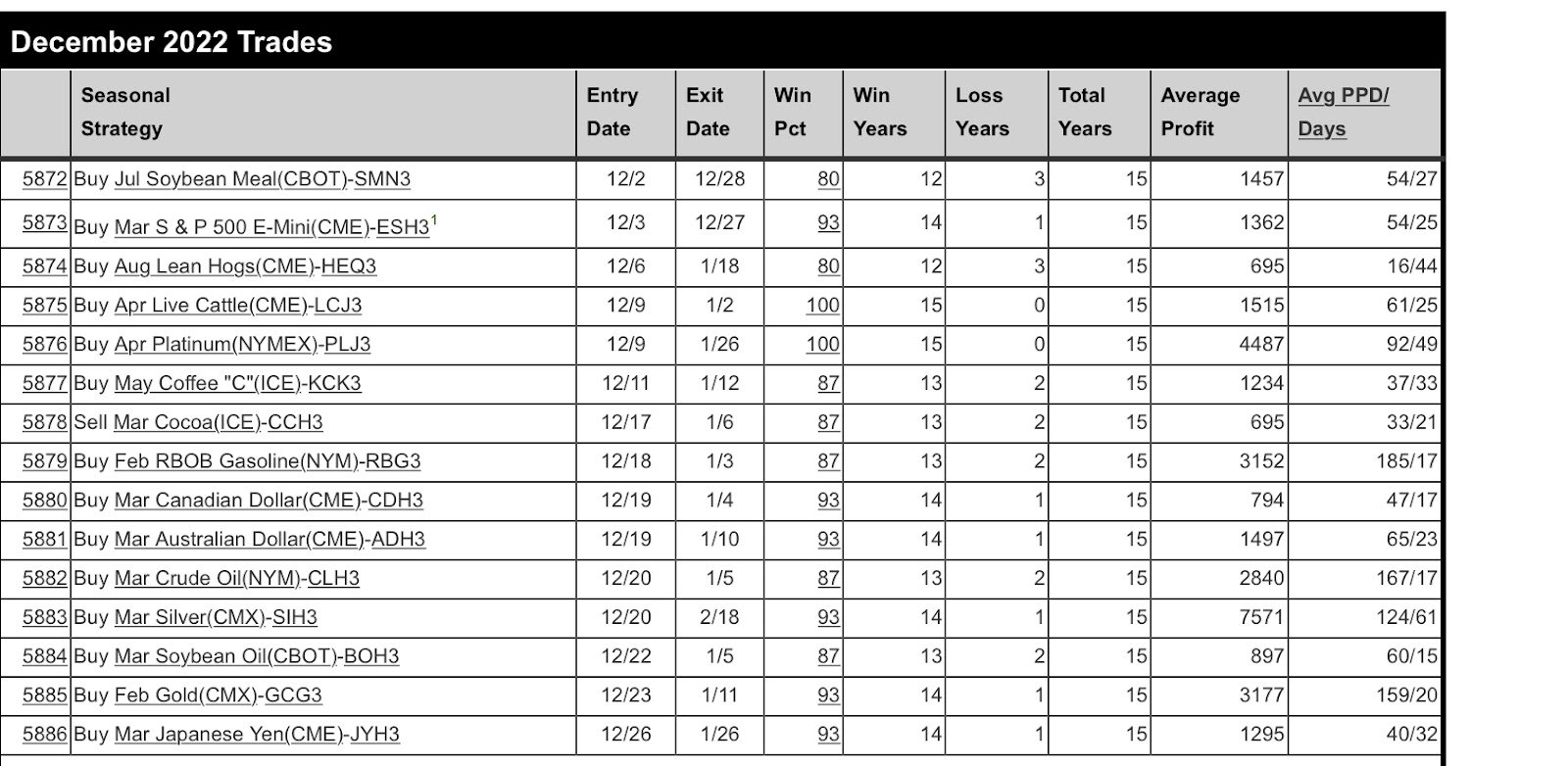

Seasonal Trade and Seasonal Spreads

More info on South America

This is also from Wright on the Market. More bullish info.

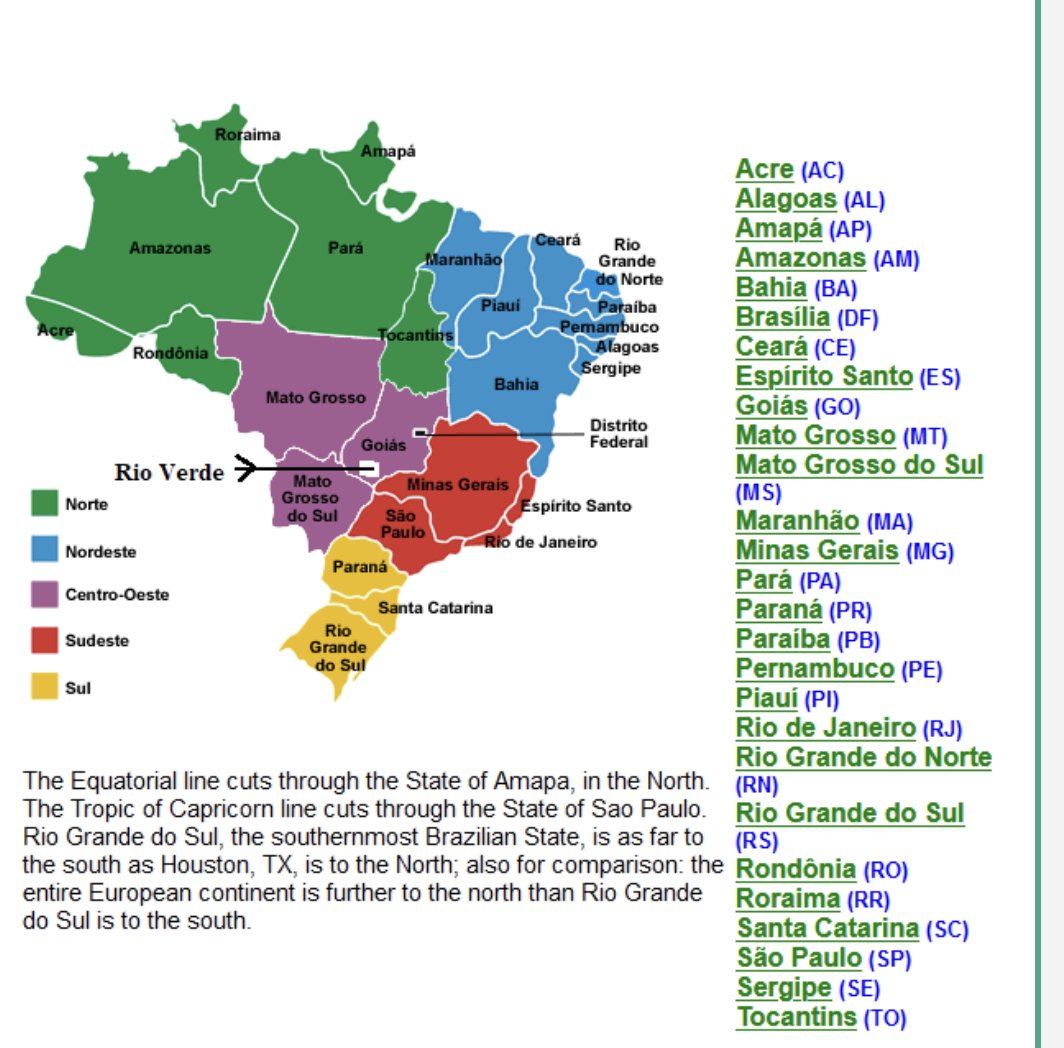

“Aluísio Pancracio farms near Rio Verde, Goias, Brazil. He was annoyed that the USDA left the Brazil and Argentine bean and corn crops unchanged. His comments after the report: "If the rest of the season will be favorable, which I doubt, we can already count on 25% less production in Argentina and Brazil for soybeans and corn. If the effects of La Ninã continue in this trend, we will have losses between 35 and 40%..."

Here is the map of Brazil with Rio Verde marked lower center. Aluísio is located where he should know what he is talking about as far as crop conditions.

SAM Weather is on Fire

As I mentioned I wrote most of this on Friday evening, here Sunday afternoon I updated a couple weather graphs for SAM.

Look at this 7 day temps versus the 7 day temps above for Argentina. It looks like it is getting hotter, much hotter.

Next is the 15 day forecast. Not huge changes, but slightly drier for most of Argy.

Here is Brazil. Plenty of areas that are also very dry in the next 15 days.

This is the past 30 days in Brazil. Same story as it is very dry in most areas.

This last one is 15 day temp for Brazil. The thing to watch for is if the hot pink dome expands or moves over the main growing areas.

To me right now Mother Nature has told us that she put a couple of wild cards in the deck that should they develop we may easily see new all time high prices in January. My prediction is still that we will see these prices later in the US growing season.

Bottom line is we have accelerated wild card cards now in our deck. If these cards get drawn we move up much faster than previously forecasted.

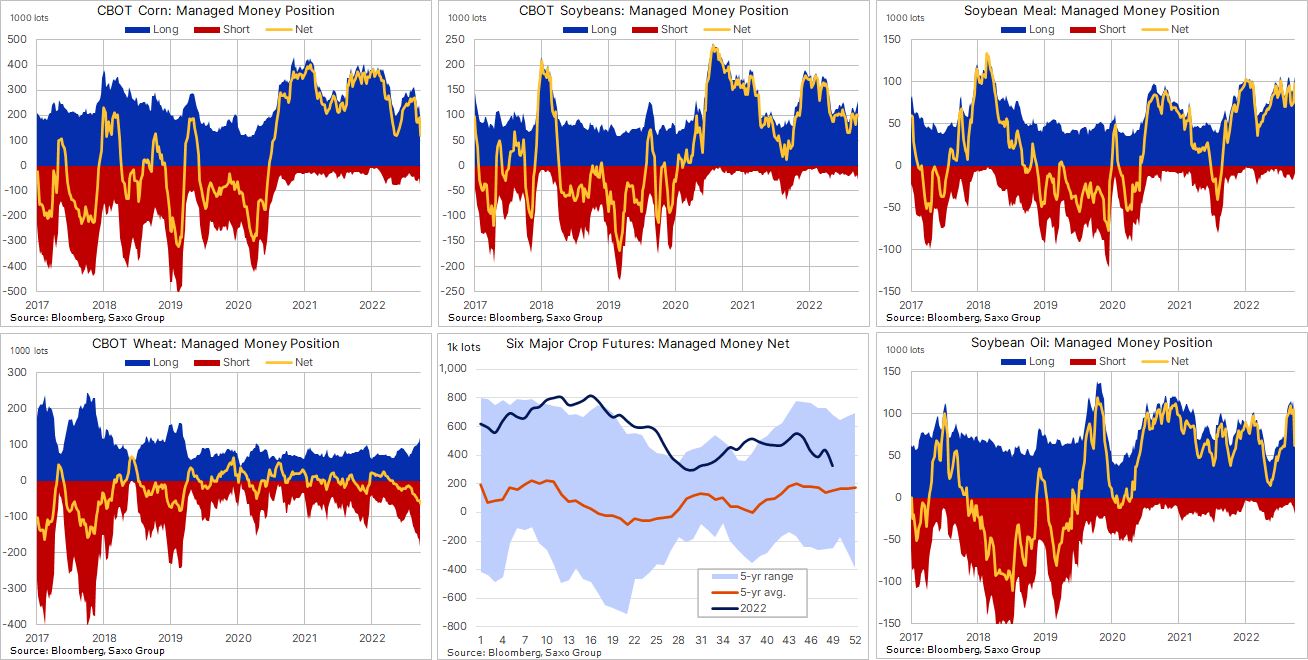

Fund positions

Below are a few screenshots of fund positions. Main takeaway here is that someone has been buying all of the contracts that the funds have been selling in corn, wheat, soybean oil. That has been the commercials. The other thing I get from the below is we have plenty of room to add fund buying if one of our wild cards get drawn from the deck.

The cheaper we get the higher we go.

I have mentioned many times the past few months that the cheaper we get the higher we go. We have got cheap enough that we are competitive for exports. If weather scares continue to develop in SAM look for China to come in and try to buy US corn and even more beans.

New all time highs seem more likely to me today than they did a few months ago despite corn much lower and wheat having lost dollars. Because now that we are cheaper we are looking like we are going to get some export business that we really can’t actually handle. Stay tuned, if our soybeans sale stay strong or we start selling some corn to China, you might want to have some long calls to protect sales or re-own grain. Our upside is tremendous for corn, soybeans, and wheat.

Check out our all-new Ag Directory

To add value and efficiency the Ag Directory provides a way for users to have a “one-stop” shop in the palm of their hands and not have to search for contacts when they need a trucker, seed, fertilizer, parts, financing, etc.

Commodities Overview by Sebastian Frost

Overview

Grains ended the week on a pretty 'blah' note. With the USDA report being mostly a sleeper, which was what most had expected. Overall it was a pretty neutral report with not a ton of significant changes. However, one change we did see was world corn carry out being far less than expected while U.S. carry out was slightly more than expected.

Over the weekend, we saw Russia launch some more strikes. This time striking Odessa’s two energy facilities (We need to keep in mind, Odessa is Ukraines largest grain port). With this strike, it left Odessa’s grain loading facilities and over 1.5 million without power. Reports are saying it might take a few months to fix the damage and restore power. So this will be a headline to watch this week, as this news is bullish for wheat futures and might also add some support to corn futures as well.

Today's Main Takeaways

Corn

Despite the fairly poor numbers from the USDA report where we saw exports lowered and U.S. ending stocks come in higher. With the USDA lowering its export forecast by -75 million.

Overall, no huge changes and this report didn’t change much of the landscape for corn. We saw production estimates in South America left unchanged, but many think we will continue to see Argentina's lowered in the future with all the problems they face. We also have lower productions globally in many countries such as Russia, Ukraine, and EU. As we did see Ukraine’s 2022 crop reduced by 4.5 million metric tons. But this change should have been made a few months ago. We also have to note that roughly half their crop is still in the ground, and we have continued to see some escalation with attacks, so this could be a supporting factor to look out for. We also have the recent Russia strikes headlines which could also add some additional support.

Despite the slightly negative report, corn is still pretty strong today which should be a good sign, as corn is trying to rebound following its filled gap lower we saw not too long ago.

Despite the not so great report, corn actually held pretty strong, being the only one of the three grains to close in the green come close on Friday. Overall,it was a quiet week for the corn market and corn ended down -2 1/4 cents on the week.

Going forward bulls would like to see Chinese become larger buyers and further support demand. From a technical standpoint bulls want to see corn hold the $6.20 to $6.40 range (Currently $6.44). As a break below and we have the potential to see prices climb back down to $6 range. South American weather, Chinese demand, and war headlines are the factors to look out for going forward.

5-Day Change

Dec-22 Corn: -1/4 cent

Mar-23 Corn: -2 1/4 cents

March-23 Corn (6 Month)

Soybeans

Soybeans had another stellar week following the wild week we saw the week prior with the poor EPA guidance causing a massive sell off. Soybeans have since rebounded and were +45 cents higher on the week this week.

As for the USDA Report, Soybean numbers came in neutral as well to maybe slightly bullish. With no changes to the U.S. balance sheet. With U.S. ending stocks being left unchanged coming in below estimates and world stocks coming in slightly over. South American production was unchanged. As expected it looks like the USDA is going to wait before making any substantial changes. The recent $1.20 rally has been supported by strong bean meal and Chinese purchases.

Soybeans have created a pretty solid uptrend, but with the USDA numbers not providing much and with not a ton of bullish headlines right now, we could possibly see prices see a small correction this week as it’s not too unlikely we see soy meal impressive rally see some correction here as well. Soy oil on the other hand is looking to find support with its recent sell off.

Looking long term, we definitely still have the potential to see soybeans trade over $15, but for prices to go any higher than that, we will need to see strength in demand and maybe some weather scares over in Brazil as for the moment they are still expecting a record crop. We also have to keep in mind that people are always expecting record crops and this isn't the first time. But if the crop is record size, that’s obviously a negative sign for soybean futures, but a weather scare should add some additional support.

5-Day Change

Jan-23 Beans: +45 1/4 cents

Takeaway from Wright on the Market Tech Guy

This is a very good post and technical analysis from Wright on the Markets Tech Guy. You can visit their website and Tech Guy's full post Here

Here is what he had to say about the soybean market,

Bean Oil - "The inside/narrow range tells us a tremendous amount of energy has built up for a move higher. Check out today's chart where I have labeled all the pertinent facts."

Tech Guy Bean Oil Chart

He also added,

"The rest of the soybean complex (meal & beans) continued to rally today up close to some possible resistance. Perhaps beans and meal will correct while Bean Oil begins to rally.

Jan Soybeans has successfully broken out to the upside from a large triangle which began forming last June - this means the daily trend is firmly up, alongside Jan Meal's strong uptrend.

The Jan Soybean chart has a triangle target of 1753, which is derived by taking the width of the triangle and tacking that amount onto the triangle breakout point. Here are the Jan Beans and Meal daily charts in that order."

Again you can read his full post Here. I highly recommend checking out some of their stuff as they provide very valuable information daily.

Tech Guy Soybean Chart

Tech Guy Soy Meal Chart

Jan-23 Soybeans (6 Month)

Wheat

Wheat again had a very poor week, seeing -27 cent losses in Chicago March. Leaving bulls again scathing their heads looking for a bottom.

Taking a look at the report, we saw slight production cuts in global wheat. With Australia seeing a 2 MMT boost which somewhat offset the other cuts we saw. As Argentina came in 3 MMT lighter, and Canadian crop came in reduced by 1 MMT. Wheat exports were upped by 2.2 MMT.

One thing we have to look at from the USDA is Argentina. Where we saw the USDA lower its production estimates by 3 million metric tons to 12.5 million. But many others have their estimates still lower than this, as some think we could actually see their production closer to the 10 million range.

Taking a look at some Russia & Ukraine headlines we mentioned earlier, we saw the largest grain port in Ukraine (Odessa) get hit with some Russian strikes. As Russia used drones to knock out Odessa's two energy facilities yesterday. It is being reported that it may take months to restore the damage and power. Over 1.5 million people as well as their grain loading facilities are without power currently. This is pretty bullish news and should give some support to wheat futures as we begin the week, and may add a little bit of support to the corn market as well.

Overall it’s hard to find any reason to get bearish at these levels. We have war headlines which should add some support here. But we still have quiet a few problems with the wheat crop globally as well as here in the U.S.. I as well as many other bulls have been wrong the past few weeks, but I still think we find a bottom here sooner rather than later.

5-Day Changes

Mar-23 Chicago: -26 3/4 cents

Mar-23 KC: -37 3/4 cents

Mar-23 MPLS: -19 3/4 cents

March-23 Chicago Wheat (6 month)

March-23 KC Wheat (6 month)

March-23 MPLS Wheat (6 month)

Cattle

Dec live cattle futures ended Friday up +$1.625, up to $155.550. Finishing -$0.325 lower for the week.

Jan feeder cattle ended Friday higher +0.450 to $183.925 and was +$1.475 higher on the week.

In the USDA Supply & Demand report we saw the USDA increase Q4 beef production by 70m lbs. That has the full year at 28.417 billion lbs.

Feb-23 Live Cattle (6 month)

Jan-23 Feeder Cattle (6 month)

Other News

Will see November CPI numbers on Tuesday

Fed Interest rate decision on Wednesday

Fun fact: The S&P 500 returns from 2000-2011 were zero.

Russia sent strikes to Ukraines biggest port Odessa

Social Media