WEEKLY GRAIN NEWSLETTER

By Jeremey Frost

This is Jeremey Frost with some not so fearless comments for www.dailymarketminute.com

Tis the season as they say, so what do US Farmers want in their stockings? What will they get?

USA Farmers Christmas Wish

#1 Want and need is demand, because demand markets last much longer than fear of supply markets. In particular, the US Farmer wishes for the strong Chinese buying of soybeans to continue. But what they want even more is for the Chinese buying to also include Corn and Wheat. The reason this is so important is not only fundamentally do we want more exports, but it is a headline that could cause fund buying. Lately, I have said that the Funds or Big Money, followed by China and Russia control our markets. Yes weather always will play a part in it, but money flow is the real fundamental that matters at the end of the day.

Next on our list at #2 is the US Dollar to get cheaper. Same thing here as above this helps demand fundamentally but it also creates a story for Big Money to get behind. As a tag-along or side gift that comes included with this one is a “Risk On” type of environment that a weaker US Dollar tends to give.

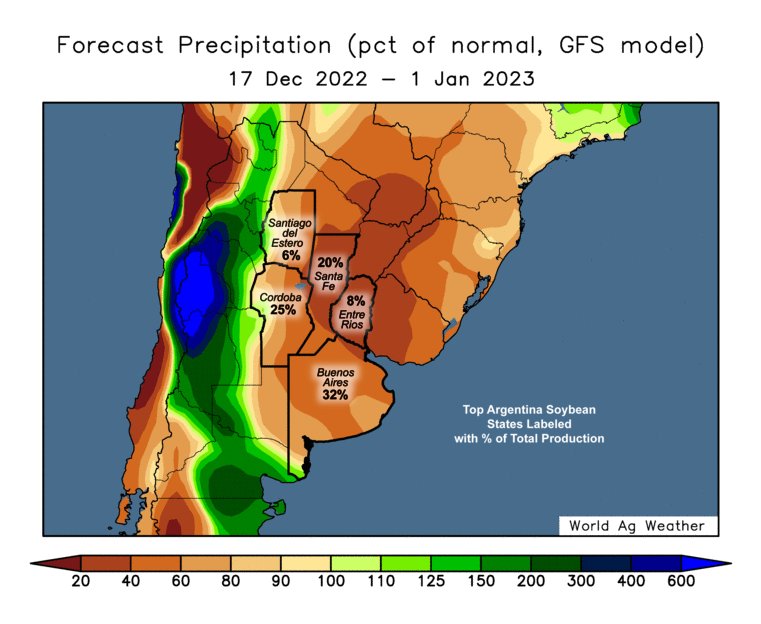

Christmas is hardly the time to wish bad Karma on a neighbor but number #3 on our list is for South American hot and dry weather and La Niña to continue with an expansion of the Argy drought into Brazil. The next 45-60 days will make or break the South American crop. Even simply more scares could lead to US export business. If it starts raining in Argy that crop has potential to stabilize in size. If it stops raining in Brazil that crop has potential to get cut tremendously in size. Plus this is also something that could cause the funds to want to “get long” grains and oilseeds.

Coming in at number #4 on our list is a bullish USDA January report. This report is the same report that in 2008 helped MPLS go nuclear shortly after. The major things to watch for on this report will be US corn and soybean production. Will we see Pro Farmer type numbers finally appear? Demand changes and updates, can our feed/residual usage increase enough to offset export slips that we have had? Is there a chance that the USDA prints a bean carryout sub 200 million bushels or a corn carryout sub 1 billion bushels. Could the Grinch show up and raise our corn carryout to over 1.5 billion bushels? This also has the chance to give the funds a story and reason to buy grains in 2023.

Coming in at number #5 on our list, but actually number #1 would be ANY REASON for the FUNDS or BIG MONEY to buy grains and oil seeds. Fundamentally our markets show many signs that we could and should go higher than a year ago. Such as stocks to usage ratio, days of supply, basis, and future spreads. But if we can’t get the funds involved, who is going to push our prices higher? End users don’t want to have to pay more, plus it's not like they need the product all at once.

Number #6 on our list is for the neighbors to not give grain away and for more farmers to become price makers. We need farmers to supply less at times to the market. That needs to be balanced with killing demand.

As an example, the US produces around 15 billion bushels of corn some years. That is about 3 million contracts worth of corn futures. Or 2.5 times what our total corn futures contracts have in open interest. Many advisors and farmers in the corn belt try to pre-sell 50% and I have seen some that try to have 100% of their insurance guarantees sold ahead of time. That is 1.5 million contracts at 50%.

I asked a good colleague of mine from SelectiveHedging.com what price would do if one wanted to buy 100,000 contracts. Along with several other questions regarding this.

Look at drought years and what happens to prices. Farmers stop pre-selling and prices come up as buyers have to buy. Eventually prices typically come back down after buyers are done and then farmers decide to re-engage and sell grain once it is “made”.

What would happen to prices if farmers sold 10-50% less than they typically do ahead of time? It would cause prices to go much higher.

The last couple of years you have noticed with all of the programs and such that farmers have had plenty of cash. When they have plenty of cash it causes them to sell less. It makes seasonal patterns work that much more.

I don’t want to tell everyone to not sell anything ahead of time. We need some of you to sell cheap so others can sell higher. But I want everyone to think of the big picture of what happens if farmers pre-sell much less grain than they typically do. I understand the risk and that this probably leads to more selling later which could lead to even lower harvest prices. But if farmers really want to become price makers, they simply just need not to sell as much as they presently do ahead of time.

This is kind of like voting, one vote or sale is seldom going to make a difference. But if half of the farmers in the USA would pre-sell half as much grain as they do, how high would our grain get?

To shorten up the explanation on the rest of the list we will really bullet point them.

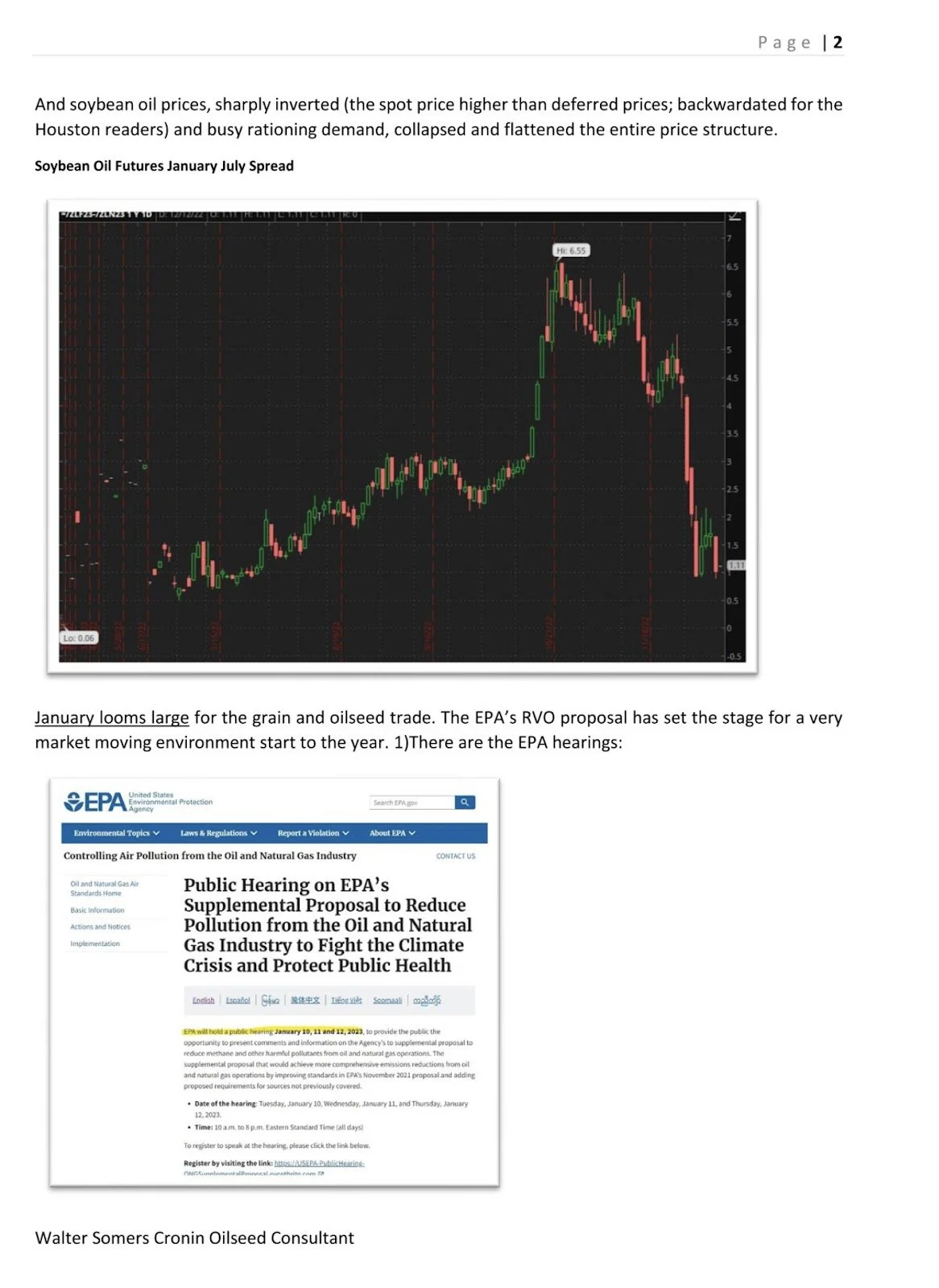

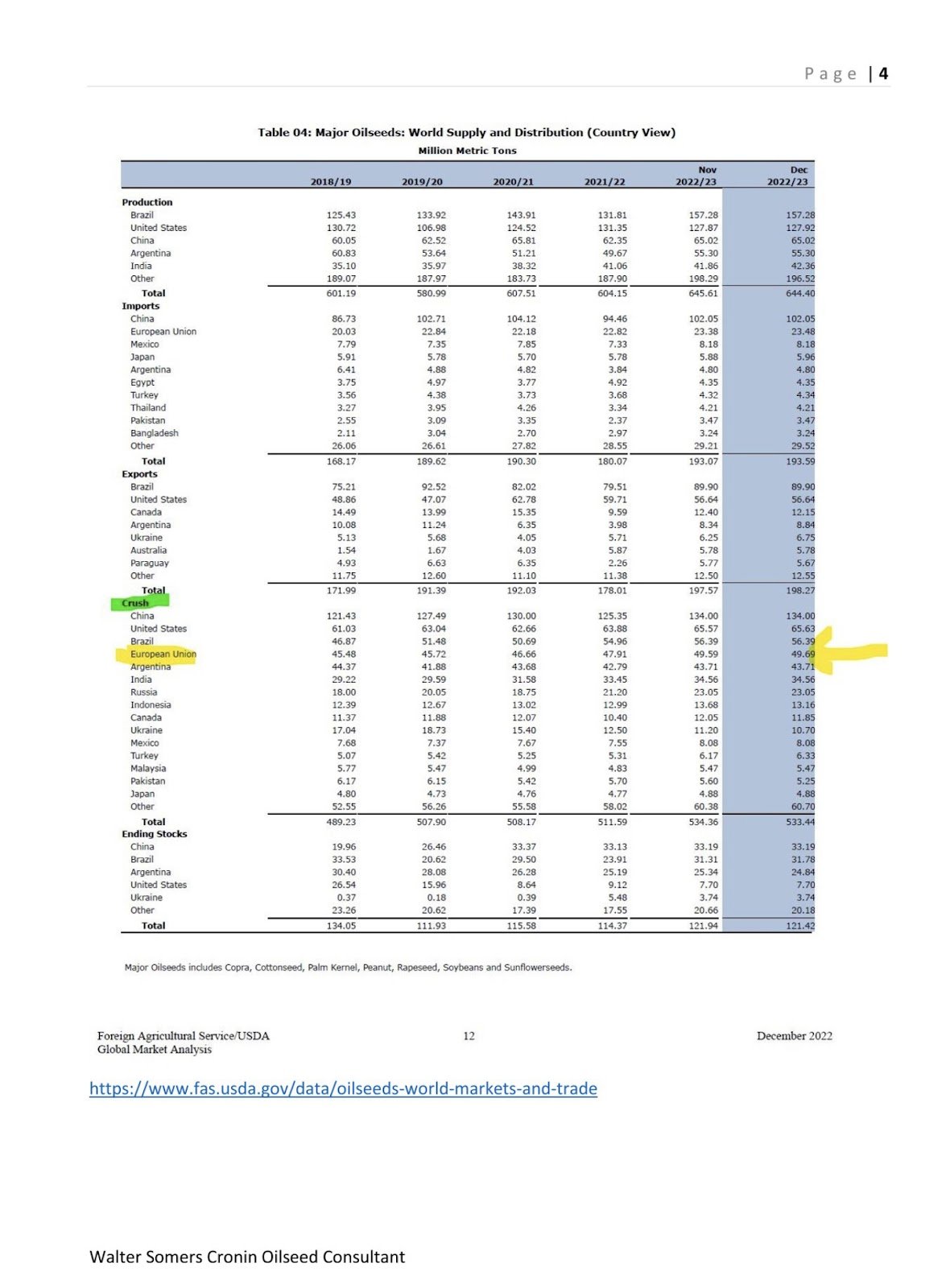

Number #7 EPA Public hearings in January to be supportive for Renewable Diesel

Number #8 Earning calls from major companies in the Renewable Diesel game to stay intact regarding expansion of soybean crushing plants.

Number #9 The FED to say something that drives the funds into buying commodities and grains.

Number #10 Is a Hot Pink Swan Event. I like to use the term hot pink because it is sexier than a Black Swan event. We need more color in this world anyways.

Bottom line is that if farmers get more than one or two things on this list our grain markets have potential to explode. If somehow farmers would get everything on this list I wouldnt even dare to write how stupid high I think our prices could get.

The risk is we don’t get anything on this list or worse yet we get the opposite as to what is on this list. If South America's weather turns cool and wet, that is not going to be good for our prices. If the Chinese demand slips that won’t be good. If the US dollar has yet to see its highs that won’t help out our demand.

I am a numbers type of guy and with the amount of bullish cards that are in the deck that could be drawn I am going to be patient making any sales. I don’t want to be a price taker, I want to be a price maker. So even though my one vote might not matter, I am going to do my part in an attempt to help get prices higher.

Bull Bullets

US Soybeans sales for export to China since September 1st the start of the marketing year are up 5% from a year ago. As are soybeans sales to all destinations = STRONG SOYBEAN DEMAND

World Wheat Production is pegged to lag World Wheat Demand for the 4th year in a row.

Fund wheat short position is largest since 2019

Hard Red Spring wheat carryout is projected at a 15 year low in the US.

Nearly 700 million bushels of US Soybean Crush Capacity is expected to come online in the next 2-3 years. If our exports and yield stay the same we could need an additional 14-15 million acres of beans.

Russia has over two times the whole USA Sunflower crop left in the field. Likely to stay in the field until Spring.

Make sure to give me a call at 605-295-3100 if you have sunflower offers or call Wade at 605-870-0091

China and Canada are having “girl” issues that could lead to more USA demand.

Below is from Mr Walter Cronin. His insights regarding the oilseed processing and renewable diesel are bar none. I follow him on LinkedIn. He writes about some of the important things that will be happening in January. The outcome of some are included in the farmers Christmas list.

Earlier in the week I talked about “will elevators go broke in 2023” and the fact that Goldman Sachs has a prediction of a 43% increase in commodity prices in 2023. You can listen to that here

I also mentioned this on Facebook.

I talked about this in my audio comments earlier in the week, so I am not going to spend a ton of time on it. But I want farmers to know that by selling early if we get a 2012 type drought you will be part of the reason your elevator or ethanol plant can’t pay you the money they owe you.

Roger from Wright on the Markets had a very good explanation of the issues we have between hedging and banking along with several times in history when many went broke or lost plenty of money having to blow out of hedges at the exact wrong time.

Do yourself a favor and sell less than normal, your elevator might appreciate it when corn takes off and they don’t have all of those margin calls.

For those of you that insist on being a price taker instead of price makers, do your neighbor a favor and buy puts instead of making sales.

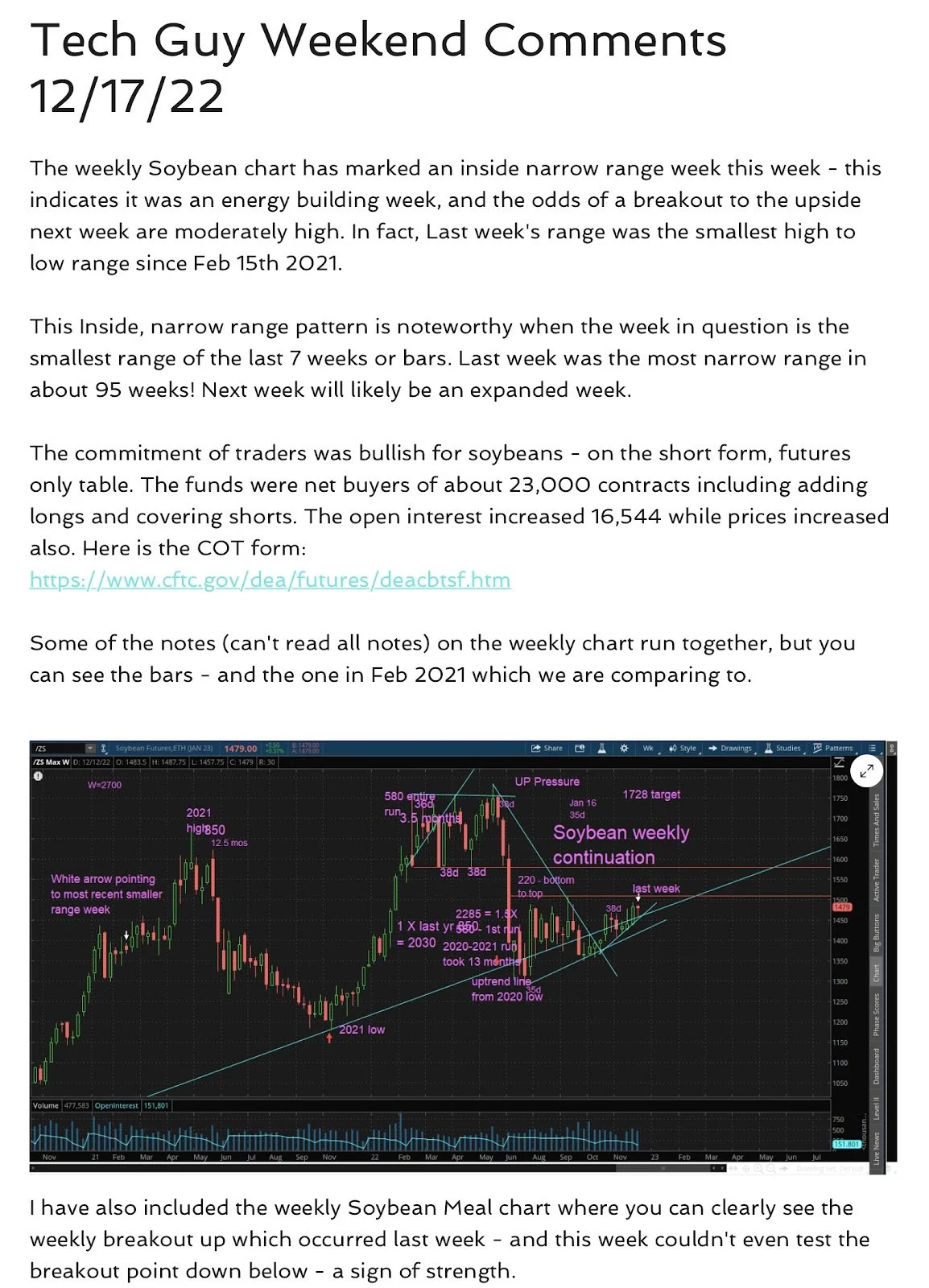

Here are some charts as to why. This is from the tech guy from Wright on the Market. Here is the link to the whole write up. https://www.wrightonthemarket.com/post/tech-guy-weekend-comments-12-17-22

When technicals align with what one thinks fundamentally, it makes a guy feel good. But that doesn’t mean that either will be right. Trading futures is risky and I always tell guys it probably isn’t for them. But if we do start going the right direction and break some resistance, then we get that self fulfilling prophecy starting to pop up. Basically until we break 7.00 corn we can’t hit the tech guys January/February targets. And until we break the January February targets we can’t get to 9.50 or 9.98. But if/once we do break the 7.00 level it opens the door to 7.60 and 7.80 corn targets. Which in turn then opens the door to test all time highs, which in turn opens the door for 9.50 corn.

It just takes one domino to start a chain reaction.

Inflation?

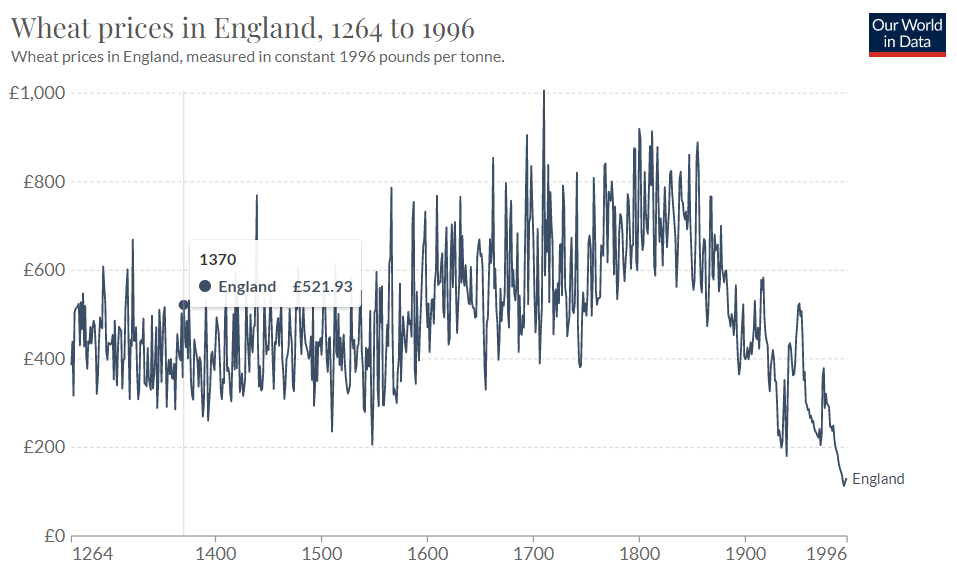

As my daughter would say this looks ‘sus’ and we may not have seen any inflation yet.

As the above graph shows, wheat in England is actually very cheap and doesn't look like it has had much inflation adjusted. At one time it was 1000 per ton in the 1700’s. Presently MATIF wheat is around 300 Euros per ton.

Does history repeat itself?

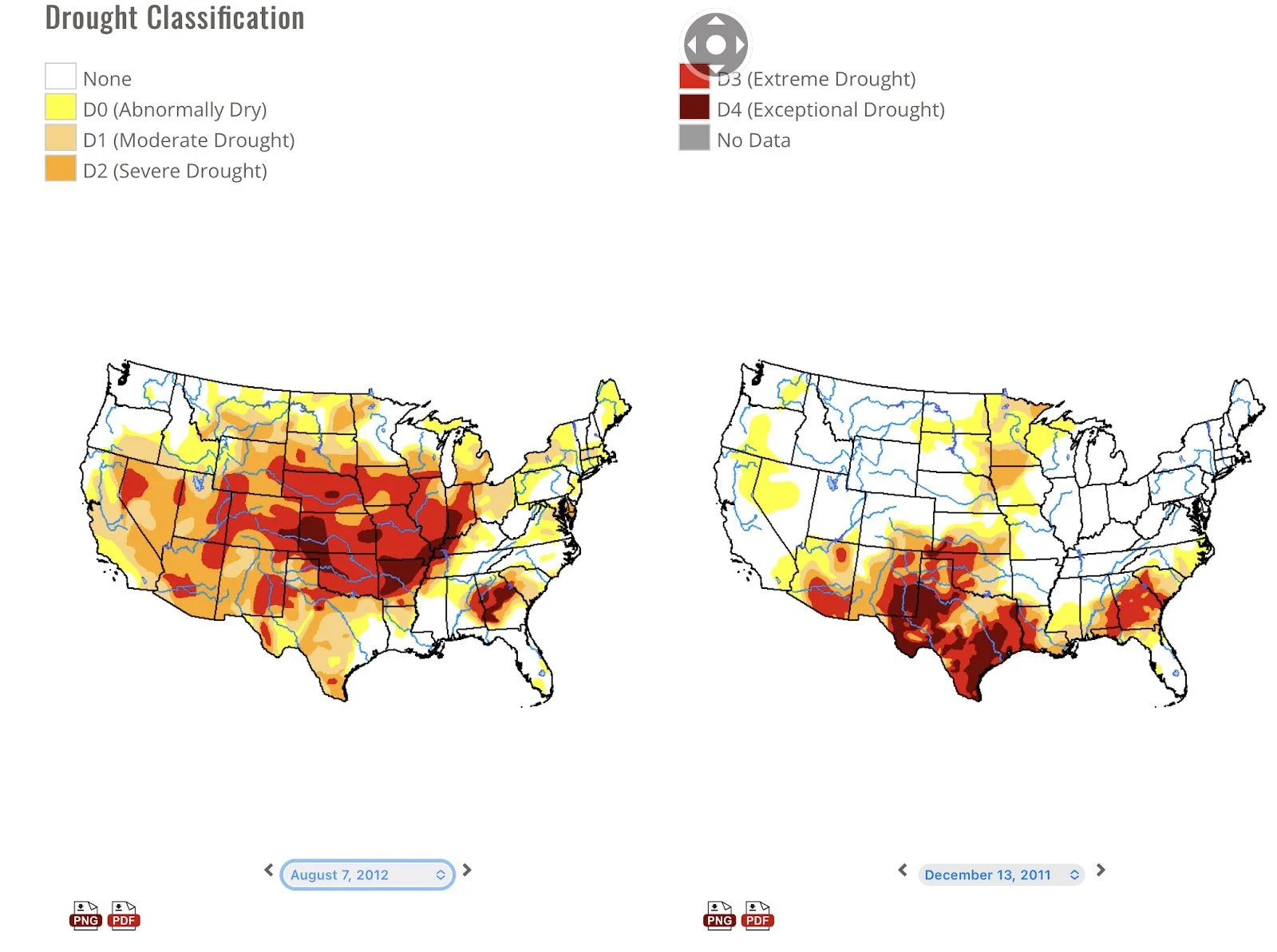

As I look at weather and do more research on it, I get this feeling like we have another 2012 drought in store for the USA. I think we take our drought from last year and simply move it North and East.

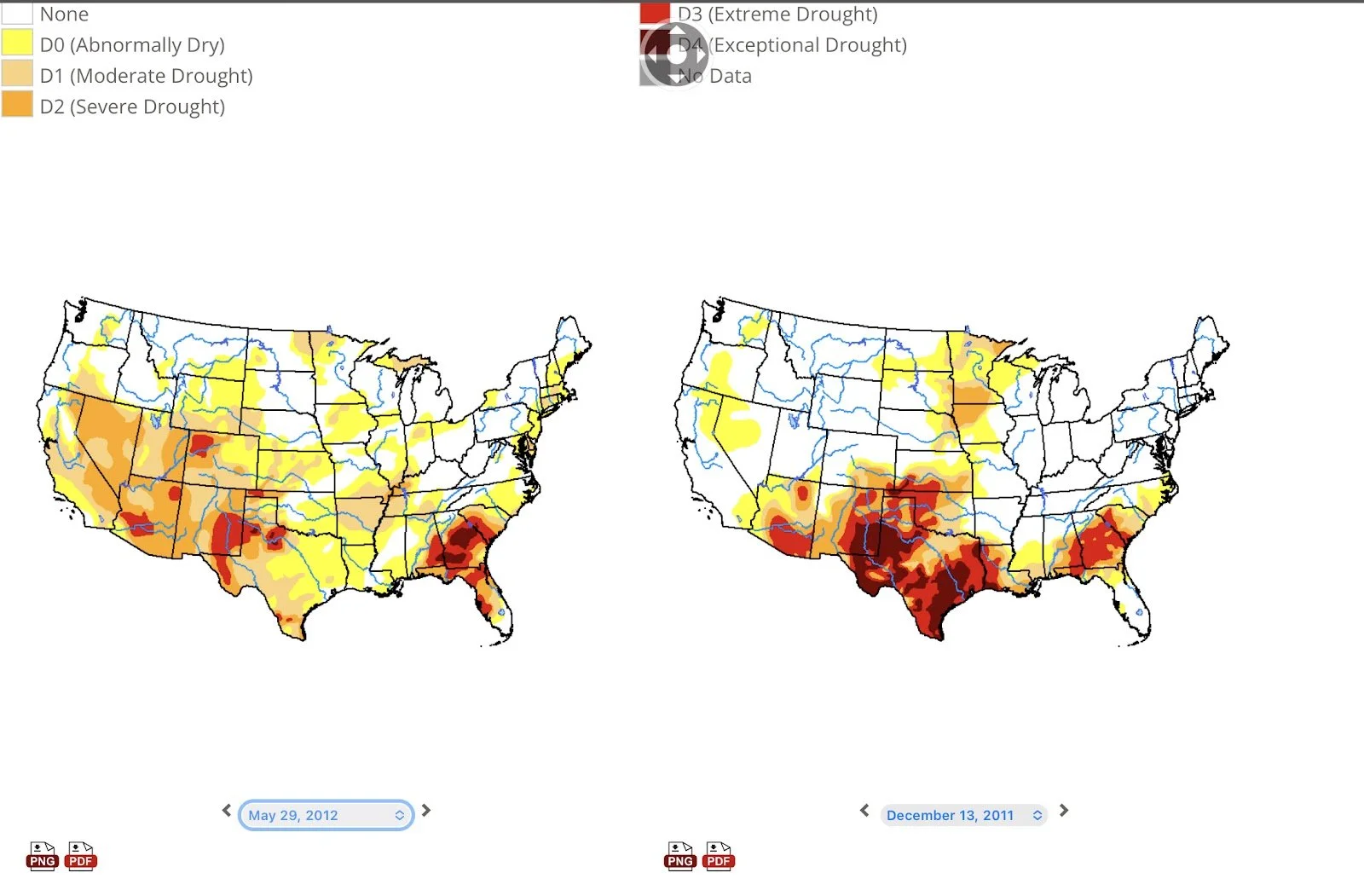

Here are several drought monitor maps. This first one shows Dec 13 2011 on the right, with August 7th 2012 on the left. If I just compare these two and ask myself how did we go from Dec 2011 to August 2012, I leave myself a lot of questions.

If I answer what changed, I would say that the drought moved North and East while expanding.

This next one is Dec 13th 2011 on the right and May 29th on the left.

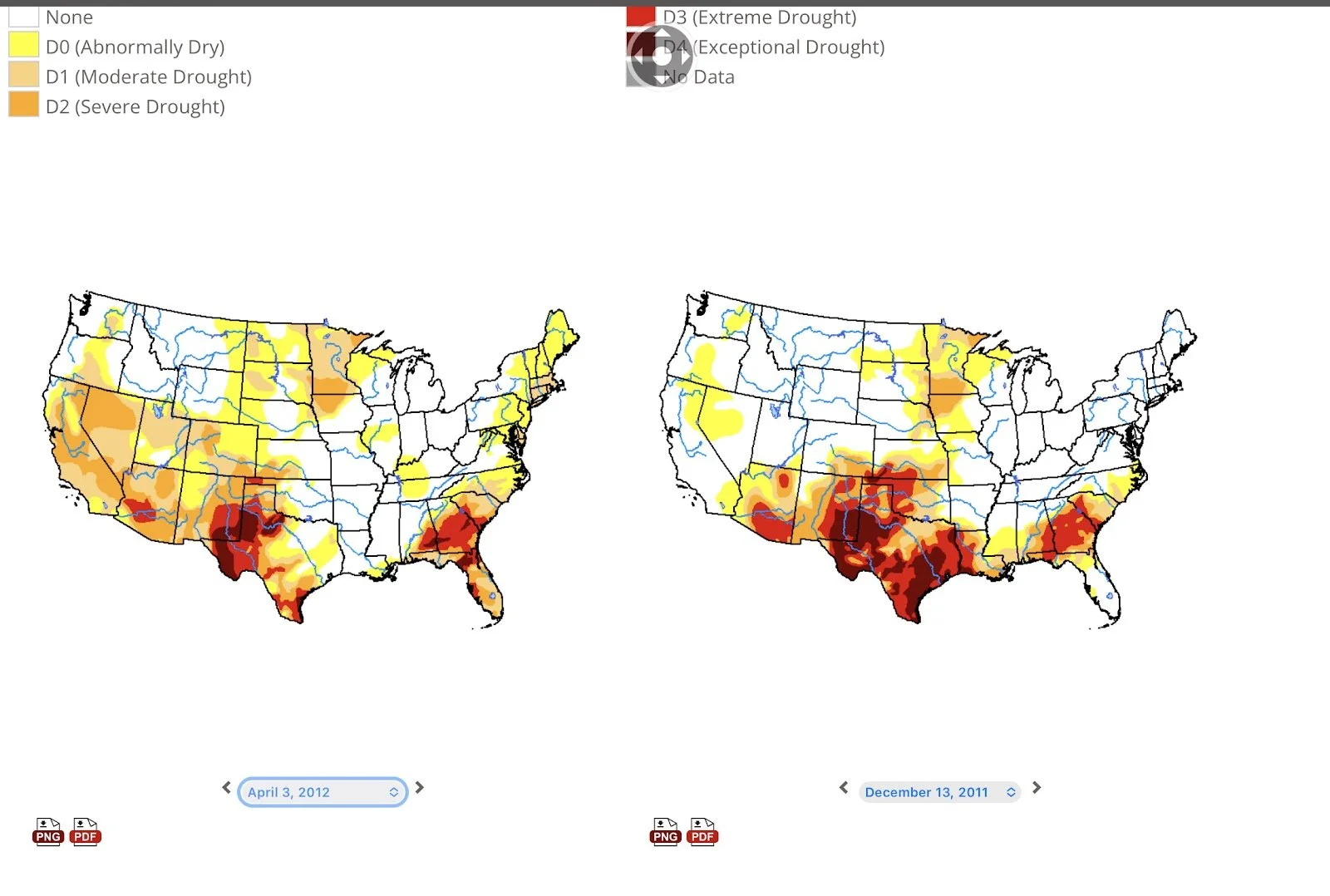

This is April 2012 versus Dec 2011. As you can see the drought had on the surface improved, but if you remember planting started off at a very fast pace.

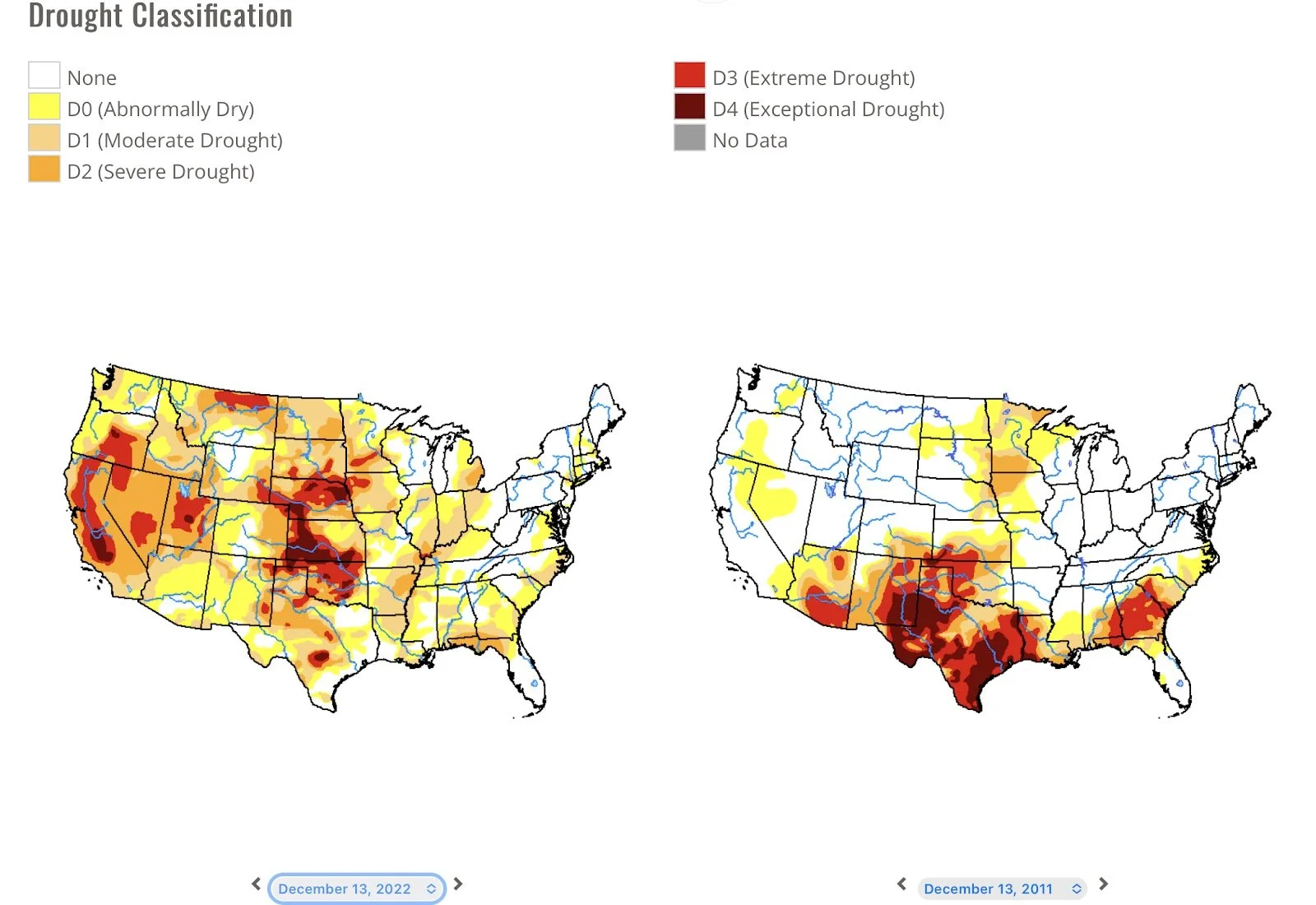

This is December 13th 2022 versus Dec 2011.

My worry remains that we see our present drought look like it is improving from now until May or so. But come next summer we have basically taken our present drought, moved it to the North East and expanded the D3 and D4 areas. What would corn prices do if that happens?

As for outlook it is early to see, but plenty of warm forecasts are out there for next spring/summer.

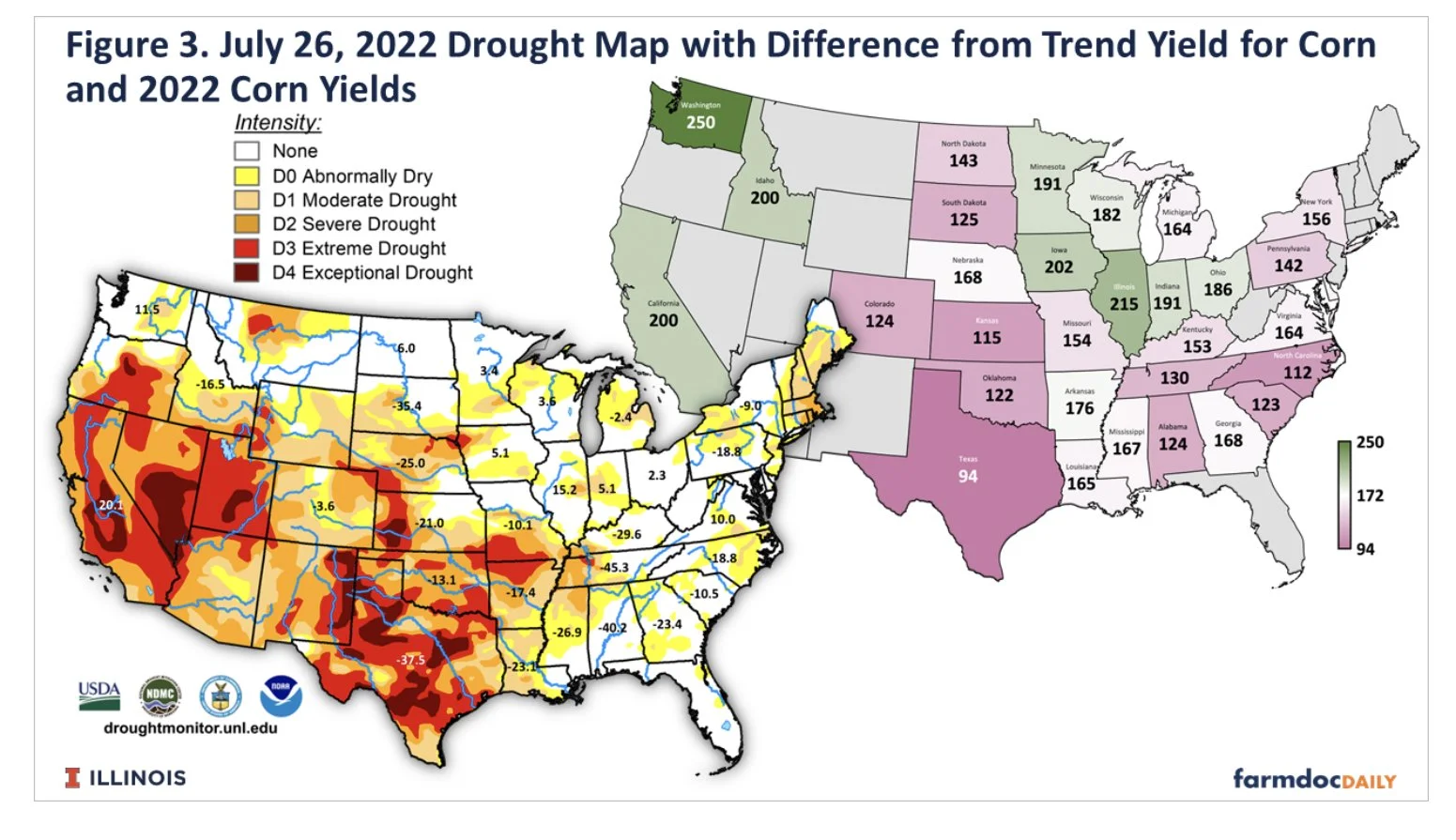

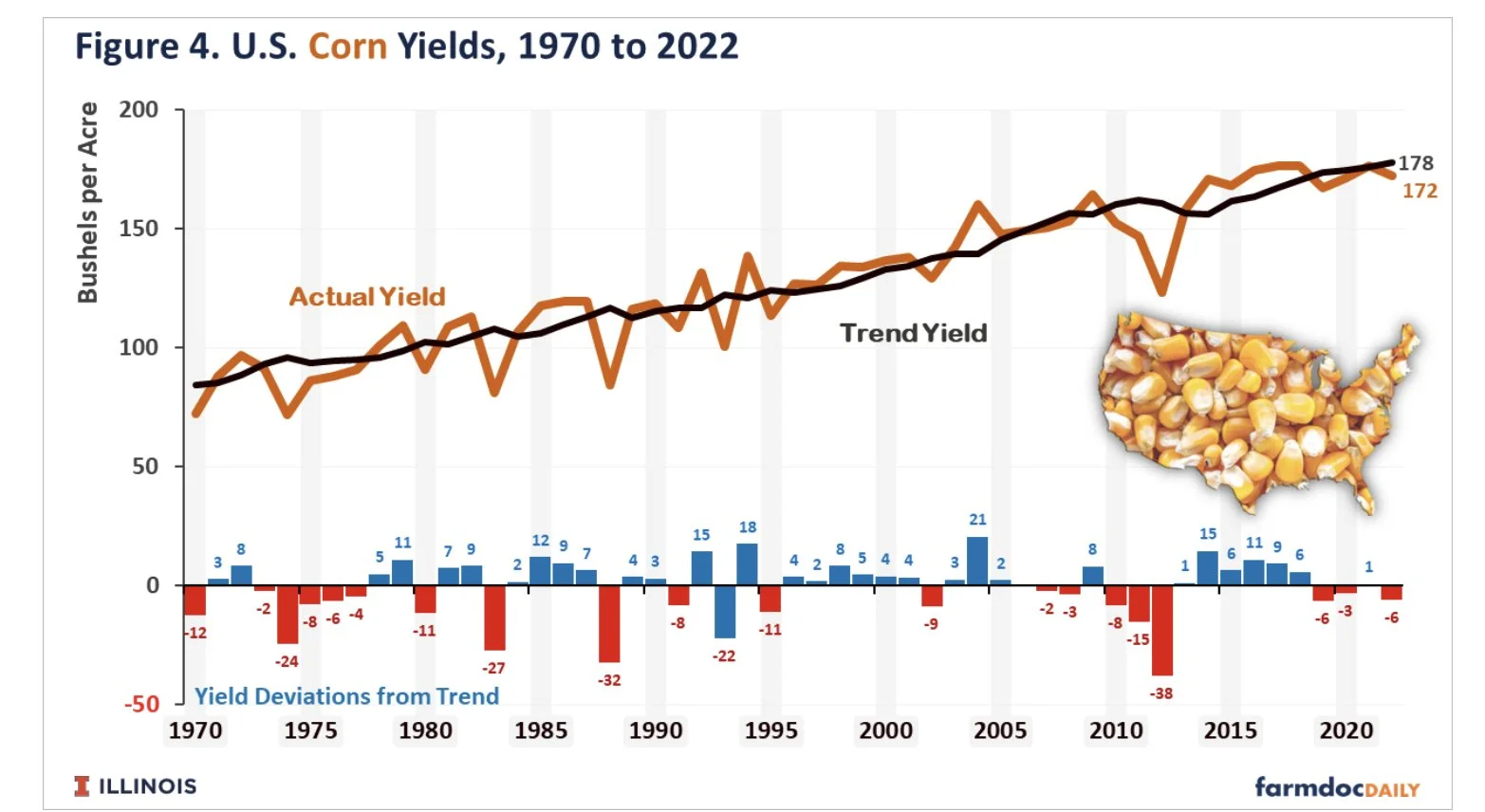

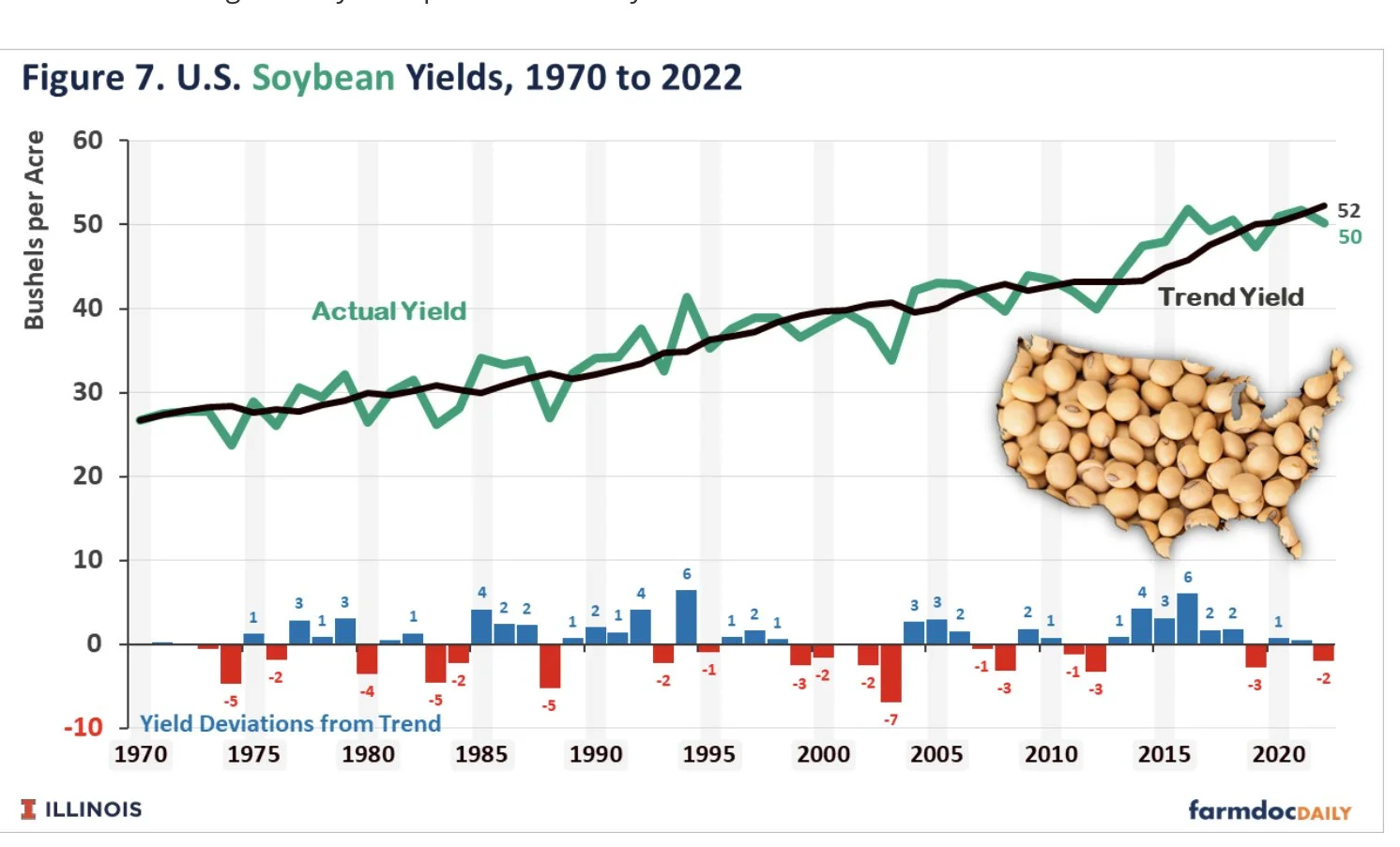

This is from U of Illinois and it shows yields versus trends. We can not afford to see those areas in green turn a different color. Our ‘I’ States this year had great crops. If our drought moves over them as I suspect it will we will have a train wreck.

Are we due for a bad corn crop? If history repeats itself, I could see 2023 being similar to 2011-2012. From 2007-2012 we had all but one year where yields came in under trend. Before that we had 9 out of 10 years when yields came in above trend. Presently we are on a streak of 3 out of 4 years below trend. Before that we had 6 years in a row of above trend line yields.

We have yet to have trends significantly below trend. Despite several places around the world have extreme swings in production for various crops. Look at Argentina wheat production, nearly ½ of what it was the previous year.

Here is the same for soybeans.

I could find more bullish points and write all day long about how I think grains will make new all time highs in 2023. But at the end of the day I am smart enough to know that I might be wrong. But I have also been in this industry for over 20 plus years and I see plenty of signs out there that tell me I am going to be correct.

At the end of a day as a farmer you need to balance your situation along with your risk/reward. If I can help just a few guys simply improve their grain marketing via utilizing tools such as options to put floors in versus selling grain and watching it go nuclear parabolic I will have done my job.

If guys read and listen to me and I have conveyed that they need to be comfortable not knowing where prices are going, but here are the reasons I think we could and should go higher and they find comfort in that and get comfortable in their grain marketing plan. Then I have done my job.

If guys read and listen to my stuff on the days and times when I am bullish and they get complacent in marketing while they are uncomfortable in their unique risk reward situation then I have failed to properly communicate the correct move for their operation.

The correct move is always going to be finding that sweet spot where a producer is comfortable knowing the factors that could drive prices higher or lower, and being comfortably contempt exactly how they are situated.

Please note that we will have regular updates during the week next week depending on the market price action, but we will not have a weekend newsletter. Have a Merry Christmas.

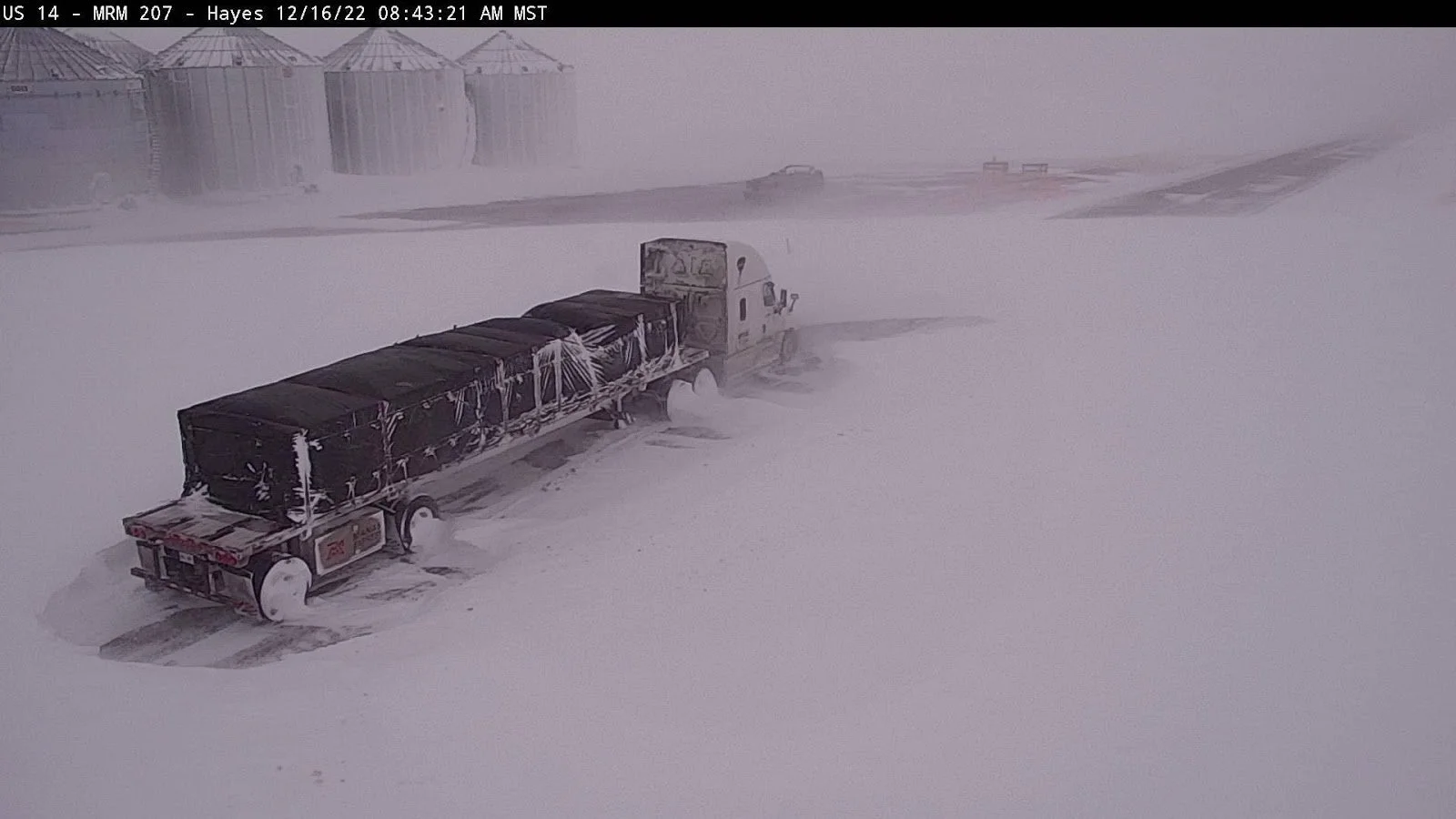

Various pictures of the 2022 Blizzard

Which brings me to one thing that I forgot to mention. We went to Walmart in Pierre SD yesterday and mad panic had set in. They along with the other grocery stores in the area had zero milk, bread, or meat. It made the COVID Panic scare of no toilet paper look tame.

This panic going wide spread would be a possible Hot Pink Swan event that could cause massive demand increases in a hurry.

Weather forecasts for Argentina.

Here is the Argy Soybean crop condition versus a year ago.

Here is a soybean chart. Can we gap higher? I think that is a possibility but it might take until next week with the 3 day weekend for the markets with Christmas. So I look for a sideways market this week and if we get a bullish forecast or rains don't happen buy Christmas look for a rally starting the night of the 26th.

Check out our Ag Directory

To add value and efficiency the Ag Directory provides a way for users to have a “one-stop” shop in the palm of their hands and not have to search for contacts when they need a trucker, seed, fertilizer, parts, financing, etc.

In Case You Missed It..

Last Sunday's Weekly Grain Newsletter

If you want to read or listen to any of our old updates/audio you can do so here

Commodities Overview by Sebastian Frost

Overview

To end the week off Friday we saw grains under some pressure, with corn and wheat closing lower. Crude oil was also pressured from the rising interest rates. Soybeans on the other hand were the only of the major grains to close Friday green off the back of a near 2% rally in soymeal and the dry circumstances in southern Brazil.

Chinese covid situation is still an uncertainty in the markets. South American weather is mixed, with Brazil looking cooperative and Argentina looking dry. We now move into a very critical time period for South American crop, so this will continue to be a dominant factor in the grain headlines.

We also have continued escalation of the Ukraine and Russia war, but this hasn’t been much of a market mover for the grains thus far. Nonetheless this will be a major factor to keep your eyes on.

Traders can probably expect some volatility as we head into the holidays.

Today's Main Takeaways

Corn

Corn ended the week off on a pretty quiet note, finishing in the red half a cent as corn continues to trade a fairly tight range. Corn has seen a nice rebound from its lows back a few weeks ago, and continued higher this week. Ending +9 cents higher on the week.

We saw StoneX Brazil cut their estimates for Rio Grande do Sul, which is southern Brazil. This was due to very dry weather they have been experiencing which is also having a large effect on the bean crops. They made a fairly sizable adjustment, from 5.38 to 4.51 million metric tons.

Despite the war headlines, we haven’t really seen corn nor wheat for that matter budge as much as one would like. As prices haven’t been extremely effected by the war headlines thus far, even though there has been some escalation.

A third of Ukraines corn crop is standing in fields as winter further settles in. There is a full article from Bloomberg on this situation. You can read that here.

Aside from war, we do have some potential bullish factors. First of all we have the obvious weather worries out of Argentina which has been a point of topic for quite some time, and it's mostly the same story. The crop Is currently 43% planted (5% behind last year). We also had some better-than-expected weekly export sales which was a nice beneficial surprise.

On the other side of things, we have Brazil who hasn’t faced much of any issues (except southern Brazil is experiencing some drought, so this could shake things up). We also just don’t have amazing demand at the moment, as demand remains one of the larger concerns going forward. We also have recession fears continuing to impact all global markets.

Overall, if we want prices to be sustained at these actually relatively historically high levels. South American weather scare would obviously be a big one to push prices higher, but I think a bigger demand story would also be great in helping support prices at these levels and give us the opportunity to go higher.

5-Day Change

Mar-23 Corn: +9 cents

Dec-23 Corn: +4 1/2 cents

March-23 Corn (6 Month)

Soybeans

Soybeans were the only of the grains to end the week off Friday in the green, closing up +7 cents. As we also saw a near 2% rally in soymeal. Soybeans had a pretty up and down week, closing near the higher end of our recent trade range. While soymeal lost nearly -2% on the week despite its late week rally.

One of the largest supportive factor which pushed prices higher was the dry weather in Southern Brazil. It’s actually so dry that many think the pretty good crop in Northern Brazil won’t make up for the damage in the South. We also have tight global supply and had better weekly export sales which are both supportive factors as well.

Another big factor that helped beans was the strong export sales. In which we saw the fifth largest ever. A neat fact from Wright on the Markets is, there has been 2,614 weekly reports since they started tracking in 1972. And last week was the 5th out of those 2,614.

Soybeans also held up fairly well despite the pretty disappointing NOPA numbers we saw. As soybean crush came in at 179.184 million bushels. Which was far below expectations of 181.473 million. Soy oil stocks on the other hand came in above estimates, coming in at 1.630 billion pounds vs 1.619 estimates.

Argentina is the world leader in meal export, so continued dryness could continue to add support.

BAGE (Buenos Aires Grain Exchange) said that soybean planting in Argentina is 51% of the way through, vs 70% average. With the crop being rated at a mismal 19% rated good/excellent.

The next month or so will be the make or break window for most of South America's crops. So we will have to wait and see if we get more weather scares and how much of an impact the dryness in southern Brazil has. Of course, if Brazil does manage to have a record crop (which is far too early to tell just yet), we would likely see prices lower than they are currently. So from a risk management side of things, it wouldn’t be a bad idea to lock in some sales at these levels and manage some risk in the event Brazil does have a record crop or any other factor that could negatively impact the markets.

Biggest factors going forward into this week will be the updates we see out of Brazil and South America, as well as Chinese headlines and demand. Bulls would love to see that break above $15, which has acted as a fairly tough resistance every time we near the high $14.80-$15 range. One last thing to watch out for is China's covid situation, as we still have the chance to see them take further action given how bad their situation has got. A re-lockdown could cause some concern and lead to lower bean future prices.

5-Day Change

March-23 Beans: -4 1/2 cents

Nov-23 Beans: -9 1/2 cents

Jan-23 Soybeans (6 Month)

Wheat

All wheat closed lower Friday, with KC wheat getting hit the hardest again closing down double digits. Despite the losses Friday, it was a pretty solid week for wheat. As Chicago wheat ended +19 cents on the week, hopefully signaling that we did indeed find the bottom bulls had been looking for the past few weeks. Chicago wheat is in a fairly solid uptrend from a technical standpoint, as we have been making lower lows since early December after the brutal sell off.

We saw missile attacks on Ukraine knock out power in half of the country's businesses and citizens. War headlines are one of the bigger factors that bulls have their eyes on, as yes we have continued to see some escalation, but the markets haven’t reacted as aggressively as one would like. One could imagine that if we continue to see headlines escalate this should lead to some higher prices, but we will have to see where these headlines go. But it still does seem that the war is far from over.

Another bullish factor that has been mentioned but shouldn’t be forgotten is the historically poor condition U.S. winter wheat is in. But we did see a ton of snow and rainfall across a big chunk of the states this week.

Going forward, its more of the same as it still looks like war and weather will continue to be the largest impacting factors. I also still think we have some more upside, especially looking into the new year given all of the wild cards still in the deck, many of which would be considered bullish.

5-Day Changes

Mar-23 Chicago: +19 1/4 cents

Mar-23 KC: +11 cents

Mar-23 MPLS: +8 cents

March-23 Chicago Wheat (6 month)

March-23 KC Wheat (6 month)

March-23 MPLS Wheat (6 month)

Cattle

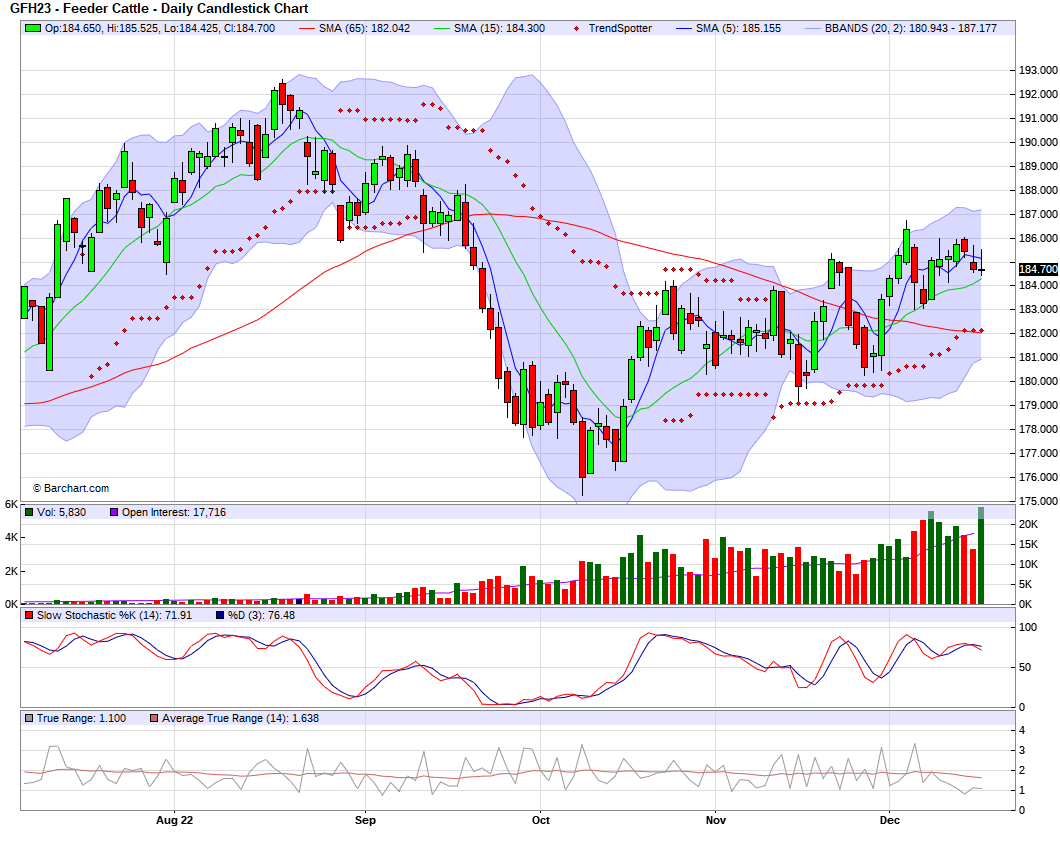

Feb live cattle futures ended Friday up +$0.925, up to $155.775. Finishing +0.225 higher for the week.

March feeder cattle ended Friday higher +0.025 to $184.700 and was -0.400 lower on the week.

Friday's rally in live cattle futures left the board close to break even for the week. The week got off to a slow start but saw some heavy volume Thursday. The USDA mentioned some Friday cash cattle sales of $157 in the WCB.

Feb-23 Live Cattle (6 month)

Jan-23 Feeder Cattle (6 month)

Other News

Diesel prices down for 6th week in a row

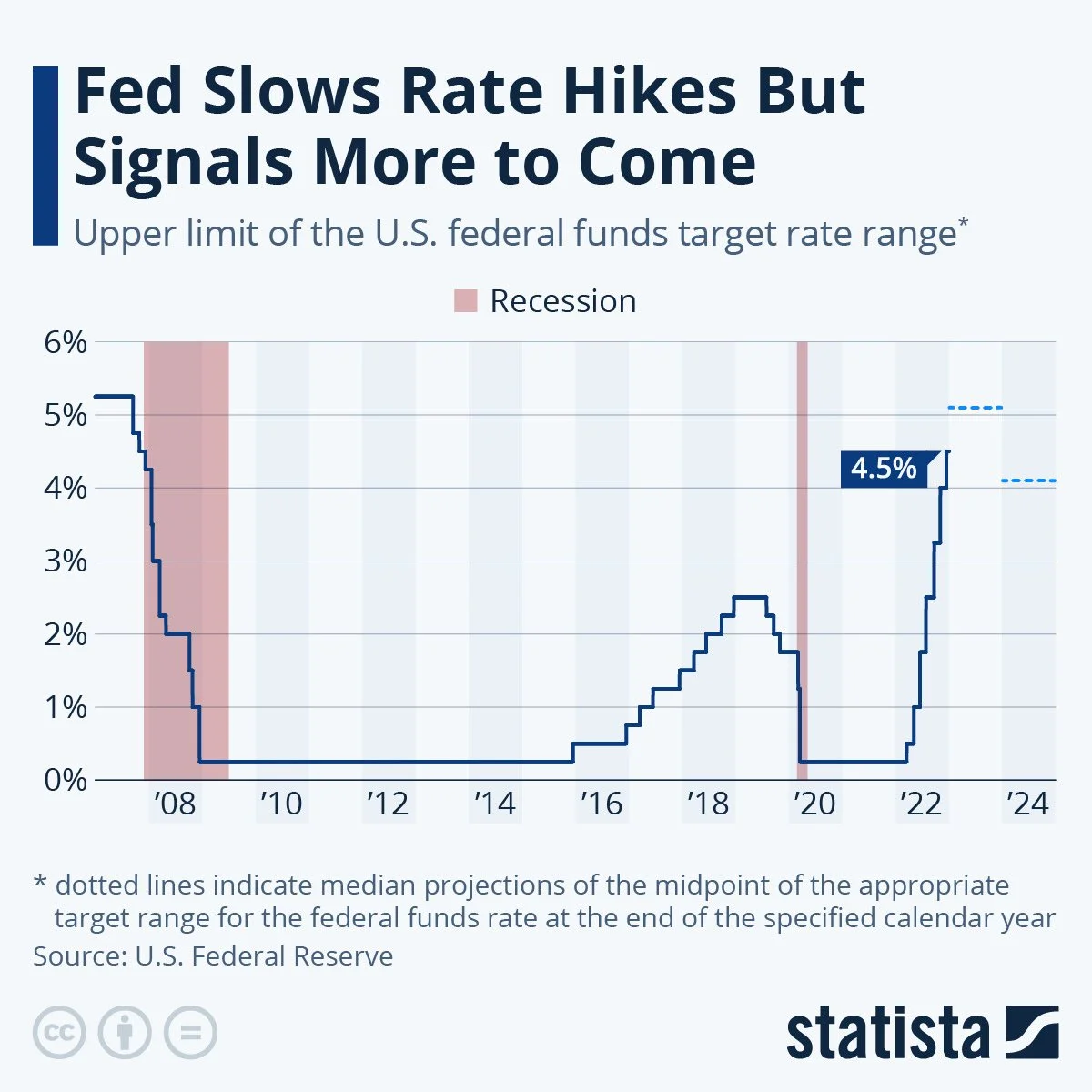

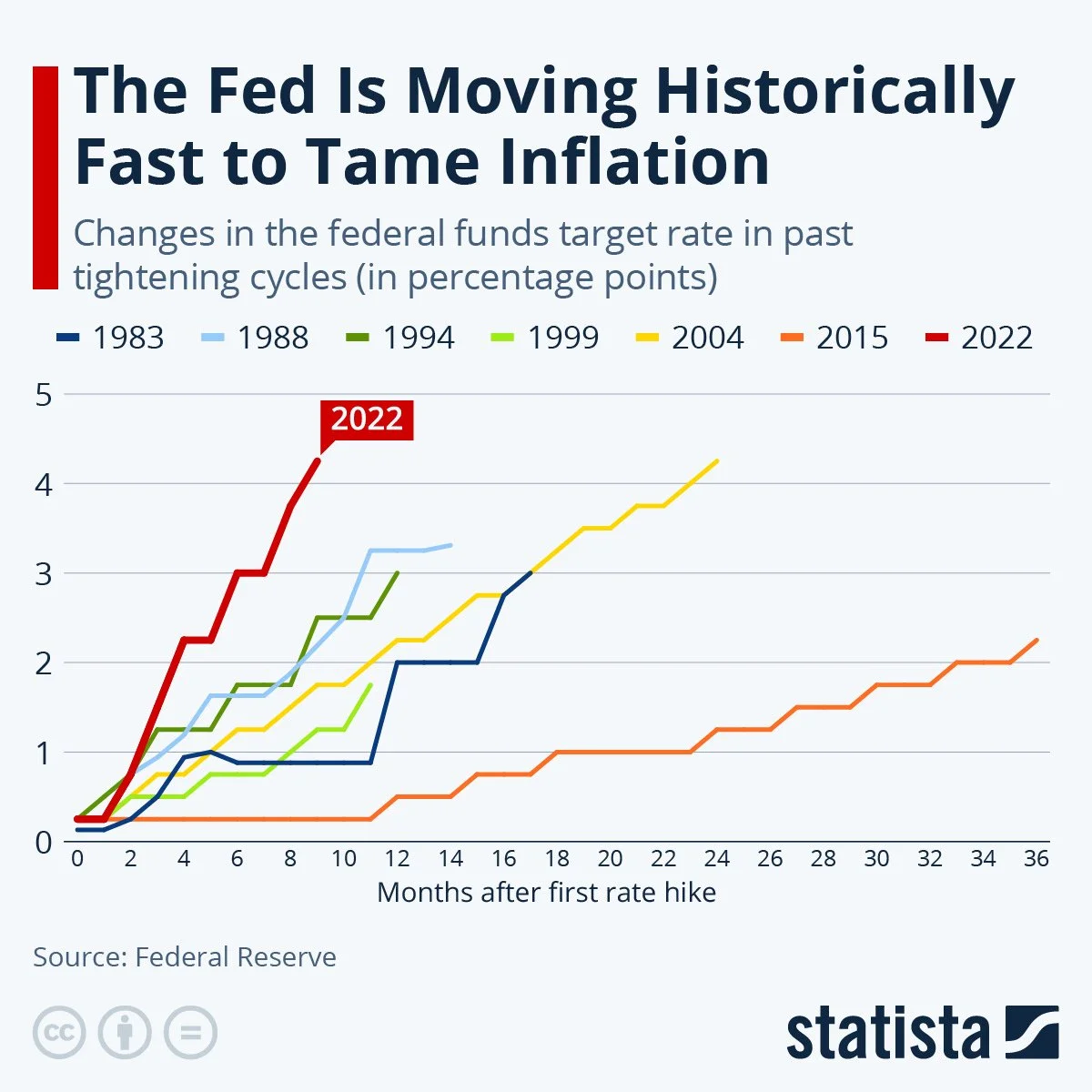

We have now seen 7 rate hikes this year, and is looking like we will probably see more through out next year.

Russia over took Iraq as the biggest oil supplier to India

Social Media