GRAINS START NEW YEAR LOWER

Overview

Grains start off the new year on a sour note, as all grains trade sharply lower. Giving up a majority of our gains made in last weeks rally ahead of the long weekend. A correction here wasn’t too surprising given last weeks rally, but the correction in soybeans and wheat was a little larger than bulls would have liked. With soybeans down -30 cents and wheat down around -20 cents.

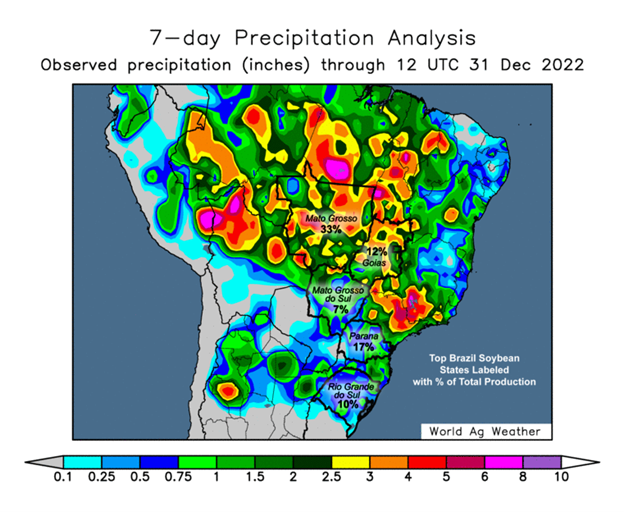

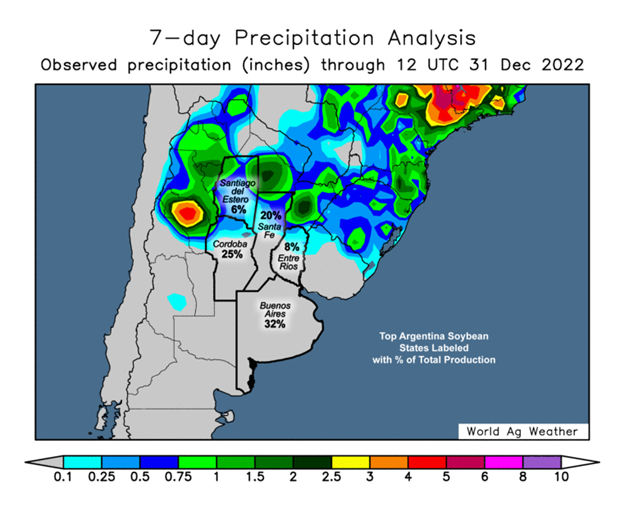

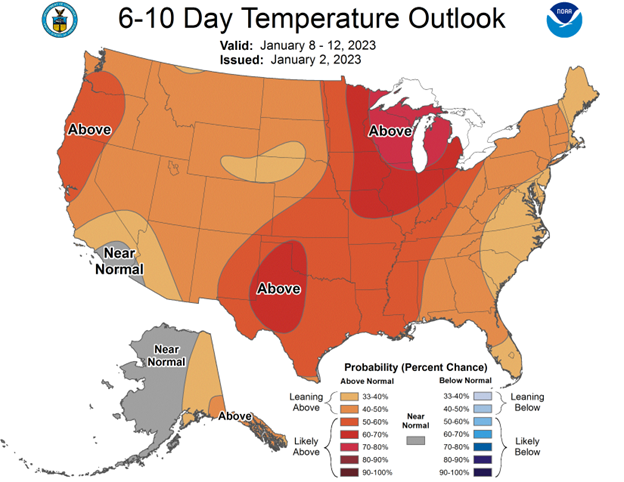

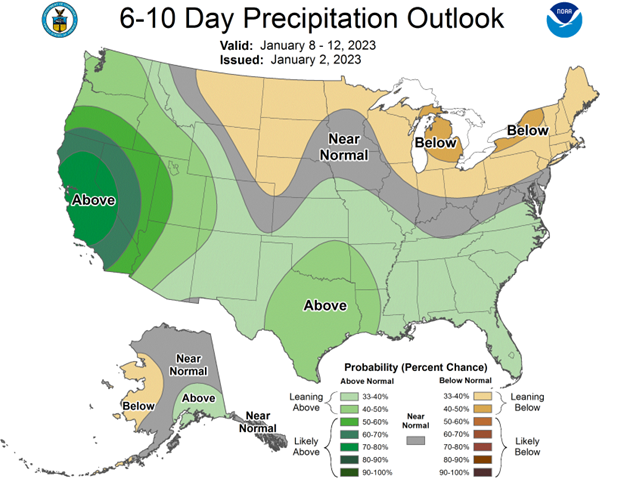

One of the main reasons for lower prices today were the better than expected rains in Argentina over the weekend. Which we all know is a negative for the grains and was a major factor to watch out for. However, the next 10-12 days aren’t expected to get any rain.

Outside markets also adding pressure, with crude oil hit over -$3 while the dollar is trading higher.

Spec funds increased their total net long position by 70,000 contracts last week. Looks like funds may have exited some long positions as the new year gets rolling.

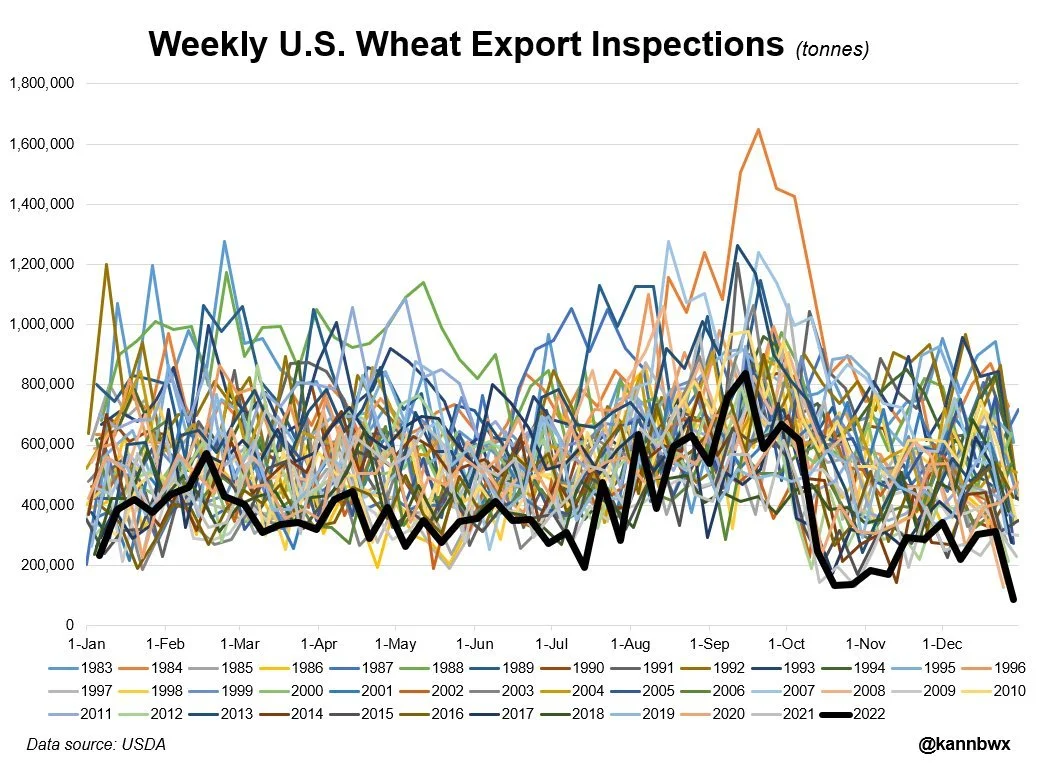

Export inspections come in very disappointing across the board with wheat seeing some all-time low volume.

Main headlines are more of the same. War in Ukraine continues. China still facing problems with covid, as there is worries over a potential recession in 2023. There is some uncertainty to how soon China can return to normal status. Then we of course have South American weather. Argentina outlook is still very dry for at least the next week.

Today's Main Takeaways

Corn

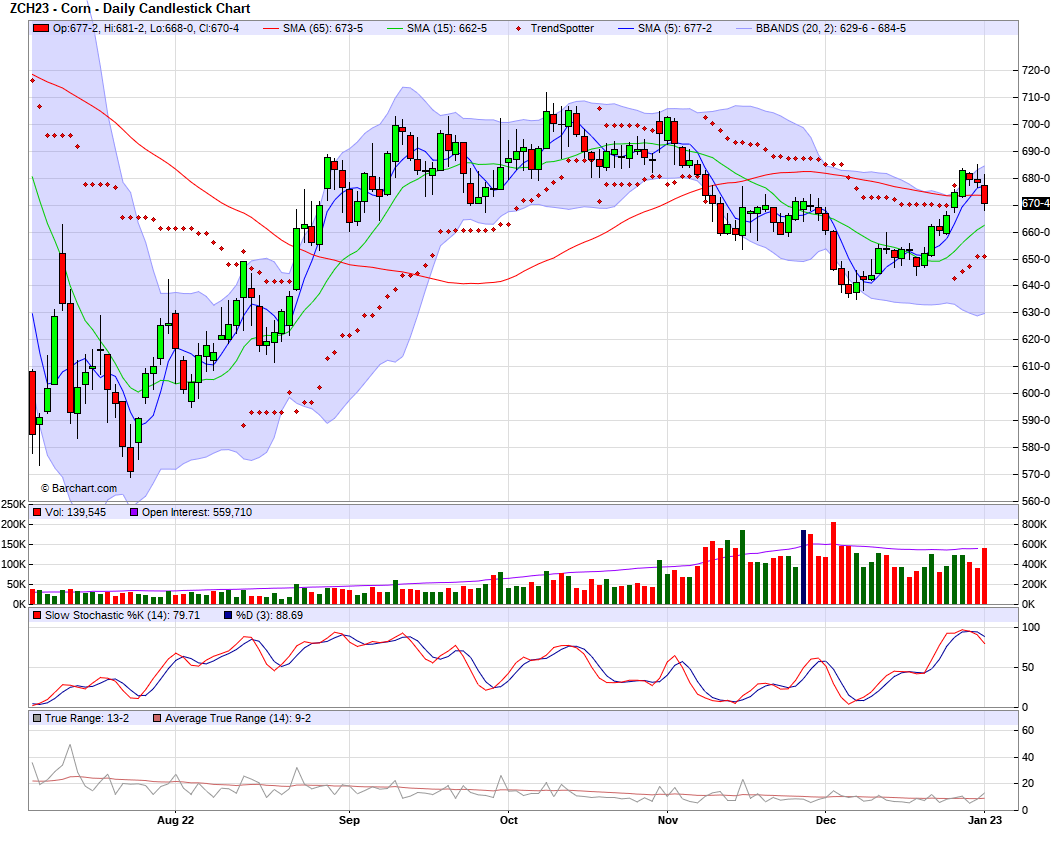

Corn following the rest of the markets lower but holding up the best amongst the three main grains. Towards the end of last week I said I wouldn’t be surprised to see corn correct towards to the $6.70 or so range before ultimately moving higher and retesting the $7 range. Corn is down X to X today, we will have to see if we get a mid week bounce.

Argentina weather will continue to be a major factor. As planting is still far behind, and roughly 25-30% is rated in poor condition. Looking at Brazil, they are starting to harvest their beans, so once they are finished with harvest focus will start to shift to their corn crop. Which means that there will be plenty of time for the potential to see some weather scares.

We will get our first USDA report of the year next Thursday, on January 12th. So there is definitely the possibility for a curve ball to be thrown and shake things up soon. Its looking like most are expecting the U.S. crop to be a little larger, while some also think we may see overall demand trimmed. The USDA will be facing some tough decisions as they attempt to forecast things related to Ukraine and the war.

From a technical standpoint we have created a nice uptrend and corn held up fairly well today considering the losses around the grains. We have support to the downside around $6.60 while bulls on the other hand are still trying to capture that $7.

Biggest Factors

South American Weather

Demand

Exports & Ethanol

Fund Rebalance

USDA report next week

March-23 (6 Month)

Soybeans

Soybeans run into a wall following their stellar last week or so where they completely broke through $15. Soybeans end the first trading day of the year down over -30 cents and close nearly 8 cents below $15 at $14.92.

Argentina got some better than expected rain over the weekend which is the main reason for the sell off in beans today. But this rain wasn’t a drought buster. Forecasts are still very hot with no expected rain in the next 10 days or so. So overall their forecasts aren’t great for their crop that I. already suffering. Argentina has less than 75% of their crop planted, with just a mere 10% rated in good condition. Some are saying that 50% of Argentina crop is facing drought.

Another main reason for the pressure today was Brazil's President saying he was exempting fossil fuels from tax, which means the Brazilian government will be out $10 billion in revenue. This sent the Brazilian currency lower and pressured crude as well.

We are only a few weeks away from Brazil getting into the real swing of harvest which will create a lot more supplies. The window for a weather scare with their record crop is slowly closing.

The China situation is still one to keep your eyes on. Covid cases are still surging. The main question with this is how soon will we see things return to normal and if it gets worse how will this impact Chinese demand. There is still definitely some concerns regarding China's economy and their potential recession.

From a technical standpoint it was an ugly day. Breaking below $15 which acted as major resistance not too long ago. We will have to see if we get a bounce in the coming days and can again secure a break over $15, or if continue to trickle lower. As the next stop lower could be the $14.70 range if we do see prices continue lower.

Perhaps we see a turn around tomorrow. But either way, for prices to continue higher we will almost certainly need to see Argentina forecasts remain dry and see temps stay elevated.

Biggest Factors

South American Weather

Argentina Rain & Drought

Brazil’s expected record crop

Brazil nears harvest

China

Demand

Covid headlines

China Economy / Recession

How soon will things return to normal?

Fund Rebalance

USDA report next week

Here is a technical analysis from Jeff Peterson @jeffpeterson1 on Twitter. As you can see from the channel, we found resistance right at the top and broke down to the very bottom of the support line. The question is now, do we bounce or break lower from these levels.

Soybeans March-23 (6 Month)

Wheat

Wheat futures all lower today along with the rest of the grains. As wheat futures lose -15 to -19 cents. Bulls such as myself were hoping for a $8 break in Chicago wheat as we were only 8 cents away at the end of last week. Looks like we will now have some more work to do if we want that break higher. Today's lower price action took out all of last weeks gains.

Export inspections were awful for wheat. As they come in at an all-time low volume.

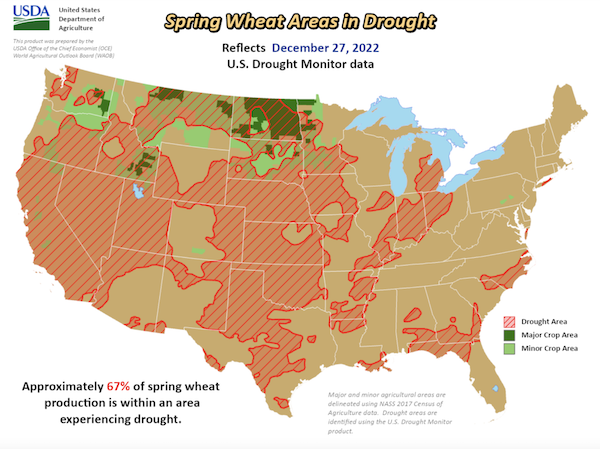

Many parts of the Midwest are seeing snow storms right now. We will have to see if we get any winter kill given the recent warm temps did melt a lot of snow cover for the crops.

We saw some escalation over the weekend, but the war situation hasn’t really made a ton of impact on the grains as of late. But nonetheless continues to be a wild card with the potential to support grains.

Looking forward to the USDA report on January 12th. The USDA will be releasing its year end report along with its Quarterly Grain Stocks report, and winter wheat seedings report. So there is definitely some potential for the USDA to make some sizeable adjustments here. Many such as myself still think we see the USDA lower its Argentina production forecasts. There is also a chance the USDA is a little too optimistic about Russia and Ukraine exports.

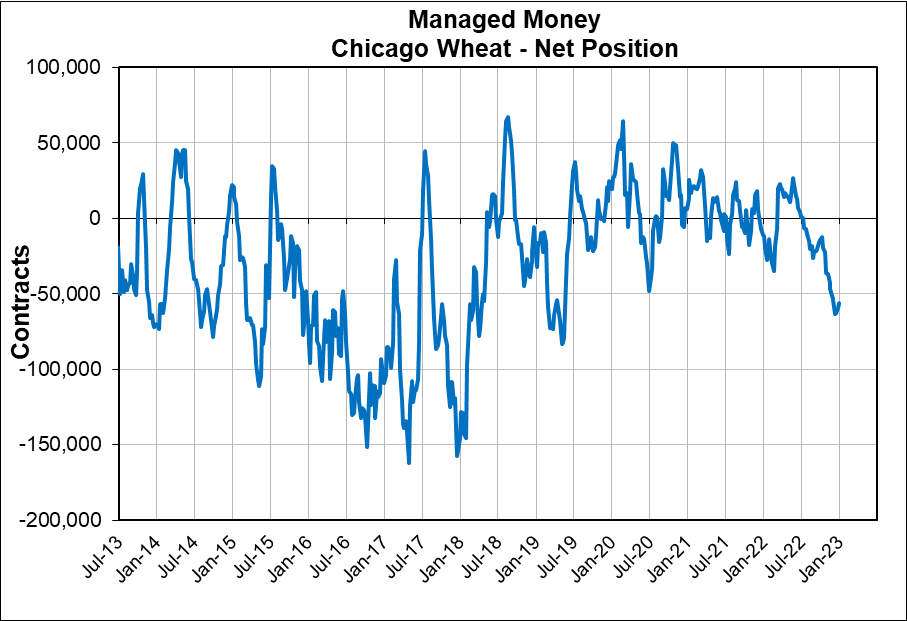

Funds have exited some of their short positions but are still very short wheat. I'd expect them to continue to liquidate these shorts.

Short term there isn’t a ton of huge major factors. But looking long term we have plenty of factors that could further support the wheat market.

Biggest Factors

Funds. Will they liquidate these short positions.

Winter Kill

U.S. Weather

War Headlines

Russian Ruble & Global Competition

USDA report next week

U.S. Dollar

Chart Source: Roach Ag

Chicago March-23 (6 month)

KC March-23 (6 month)

MPLS March-23 (6 month)

Bullish & Bearish Corn

Here is a good write up from Jon Scheve over at Wright on the Markets where he lists out all the bullish & bearish factors surrounding the corn market.

He wrote;

As the market moves into 2023, there are many reasons corn prices could go up or down. The following provides rationale for both.

Reasons The Corn Market May Go Higher

Ukraine produced around 45% less corn in 2022 compared to 2021, a drop of 800 million bushels.

Europe also produced nearly 500 million fewer bushels than expected.

Argentina has had limited precipitation so far, and forecasts indicate dry weather may continue for at least another 2 weeks. This may mean 250 million fewer bushels will be produced than expected.

Brazil is nearly done exporting corn until their second crop is harvested in June. Ukraine has logistical issues due to the war. This leaves the US as the main corn supplier globally over the next 5-6 months.

China appears to be opening again, which could lead to more feed demand.

Year over year animals on feed estimates indicate feed demand may be understated by the USDA.

Currently, the stocks to use ratio in the US is 8.7%. In 5 of the last 6 years, when the final US carryout stocks to use ratio was below 9.2%, the market rallied in January. In 4 of those 5 rallying years, the market increased over 7% in value which would translate to about a 50 cent increase this year.

Generally, farmers seem to have enough cash on hand, and may not be interested in selling grain until more is known about the summer weather.

La Nina continues to last longer than expected.

Reasons The Corn Market May Go Lower

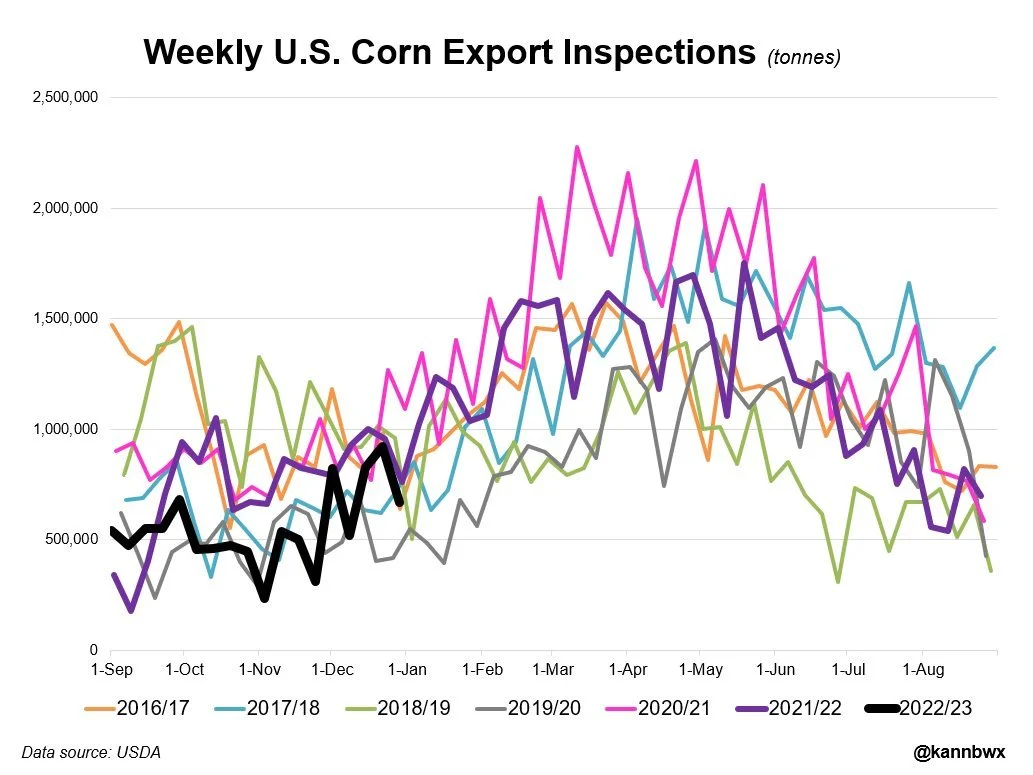

Export sales pace is substantially behind the USDA forecast, which could lead to carryout increases.

Ethanol stocks are high, and the grind rate is slipping. This could lead to reductions in upcoming USDA reports and eventual carryout increases.

Rail logistics can be a challenge in the winter, which could lead to both export pace and ethanol movement issues.

La Nina is forecasted to end in February, which could mean normal weather for Brazil’s second corn crop planted in late February.

Russia and Australia produced big wheat crops and the commodity could be used as a substitution for corn in feed around the world.

Spring 2013 was the 1 of 6 years when the stocks to use ratio was tight and corn didn’t rally in January. Instead, by mid-January futures dropped 10% in value from $6.60 to $5.94. However, by March of 2013 futures were trading back to levels similar to the last trading day of December 2012.

There are concerns over the world economy and the potential for a drop in grain demand as a result.

While China’s economy may be coming out of lockdown, some people may continue to self-isolate, which could keep food and feed demand suppressed for several more months.

There are concerns that as China opens up a new covid variant could emerge and spread around the world quickly and cause demand issues everywhere.

Bottomline

South America’s weather over the next two months, China opening up, and global demand are variables that could impact prices moving forward. Plus, one of the biggest USDA reports of the year on January 12th will provide the final yield and stocks numbers and give the market direction.

You can visit Wright on the Markets Here

Export Inspections

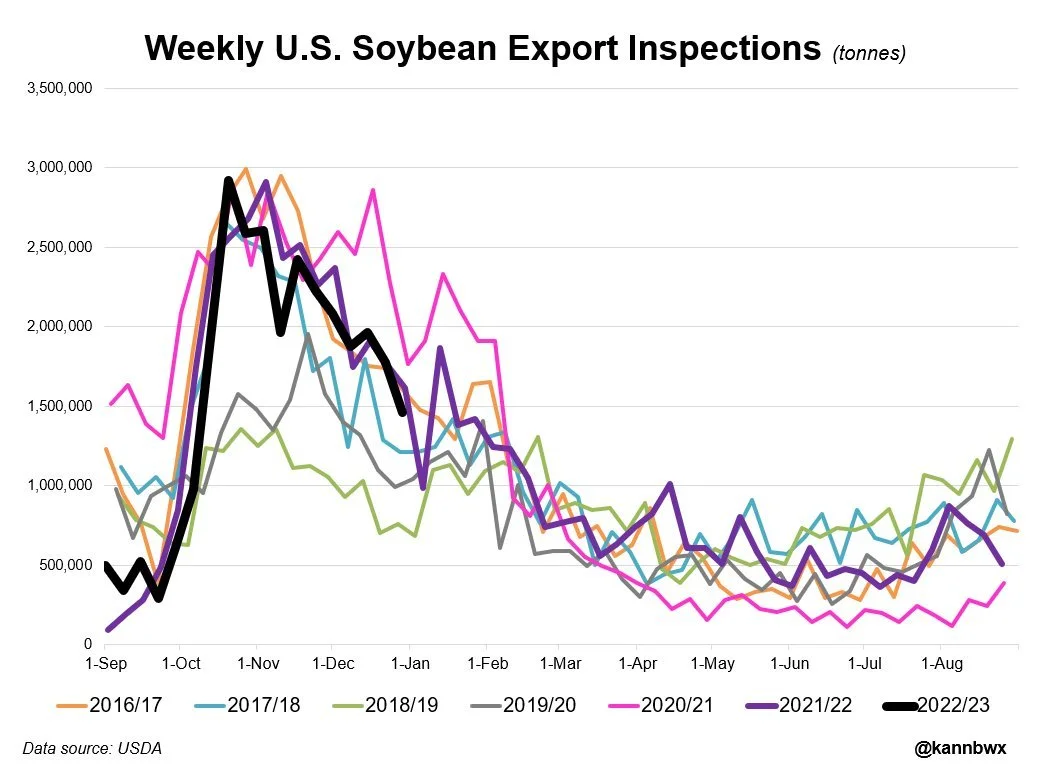

U.S. export inspections come in very disappointing across the board, with both soybeans and wheat coming in below expectations and corn on the light side of well. Wheat saw some all-time low volume.

Numbers (Thousands of Tons)

Corn

Today: 667

Trade Range: 650-900

Last Week: 922

Total YOY % Change: -27%

Soybeans

Today: 1,463

Trade Range: 1,500-1,865

Last Week: 1,775

Total YOY % Change: -7%

Wheat

Today: 86

Trade Range: 250-450

Last Week: 314

Total YOY % Change: -3%

Chart credit to Karen Braun @kannbwx on Twitter

International Exports

Brazil

During December, 2.02 million metric tons of soybeans were exported, which is down from 2.71 million compared to December of 2021.

Brazil corn exports were sharply higher compared to last year. Last December was 3.41 million metric tons, while this December we saw 6.41 million.

Ukraine

For the first half of the marketing year (July-Dec), Ukraine exported 12.5 million metrics of corn. Which was actually more than last years 10.8 million.

Ukraine wheat exports on the other hand are just half of what they were a year ago, as they were 8.4 million metric tons, compared to last year’s 15.8 million.

A Look Back at December

December was an excellent month for grains. Here is a recap from early in the month after our lows. The first day of the year is taking out some of these gains.

Corn

+50 cents

Soybeans

+106 cents

Chicago Wheat

+97 cents

South America Update

Brazil

Brazil remains in pretty good shape as forecasts have been favorable. There is some talk that there overly abundant rain may perhaps slow harvest.

There current forecast calls for pretty good rain in January across the central/eastern region while southern Brazil is still facing some concerns as they have been receiving less rain.

Brazil's expected record crop is still one of the larger concerns surrounding the soybean market.

Less than 1% of beans have been harvested thus far.

Argentina

Soybeans were 72% planted vs 87.5% last year. Current pace is they finish planting in 2-3 weeks.

Soybeans were rated;

28% poor/very poor

62% fair

10% good/excellent

Corn is 63% planted vs 71% average.

Corn was rated;

28% poor/very poor

57% fair

15% good/excellent

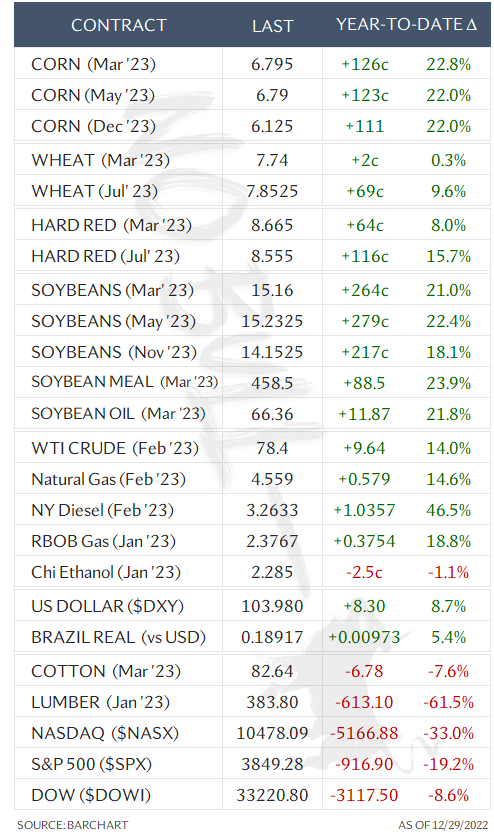

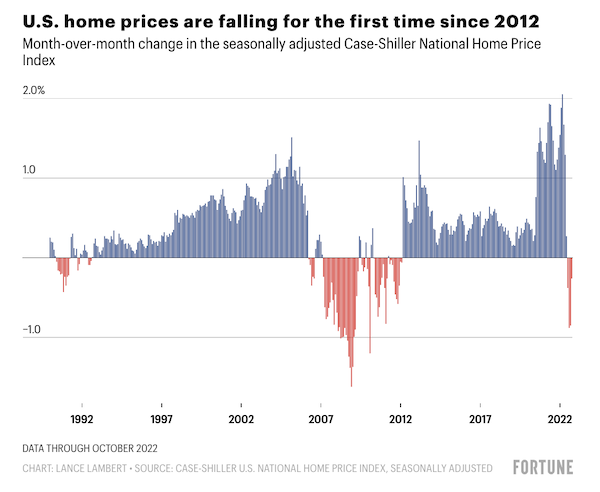

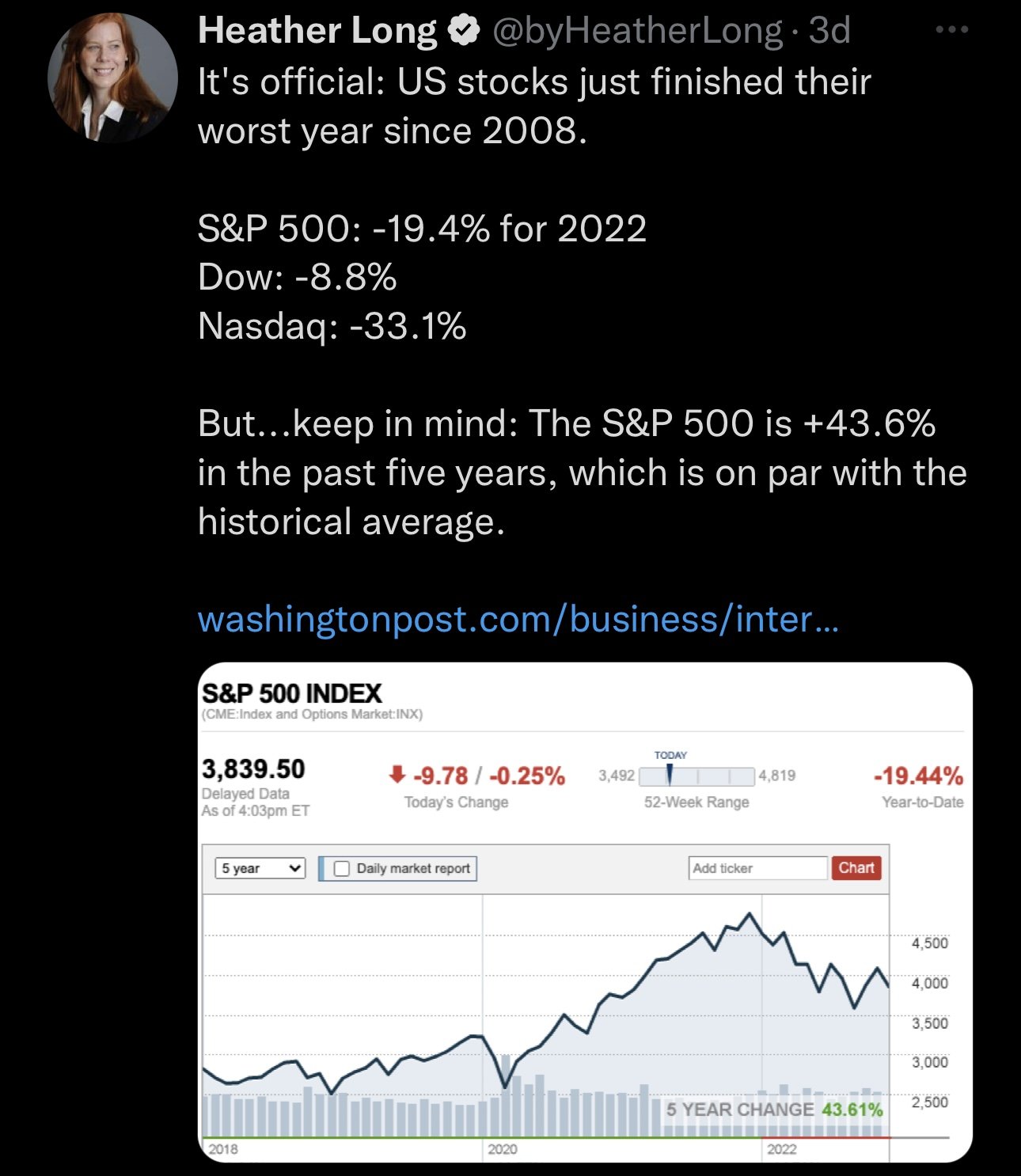

2022 Winners & Losers

This is a chart from Susan David's Twitter over at No Bull. Showcasing how all the markets performed. For a recession, the grains performed well. The stock market.. not so much.

Other Markets

Crude oil down -3.10 to 77.18

Dow Jones down -39

Dollar Index up +1.146 to 104.415

Cotton down -0.23 to 83.14

Highlights & News

China covid cases are surging, but their government announced a round of stimulus to help their sagging economy.

There are rumors that China is looking to buy U.S. corn.

China is launching a new grain reserves company in 2023.

No expected rain in Argentina for 10 days.

U.S. stocks finished their worst year since 2008.

S&P 500 down -19.4%

Dow down -8.8%

NASDAQ down -33%

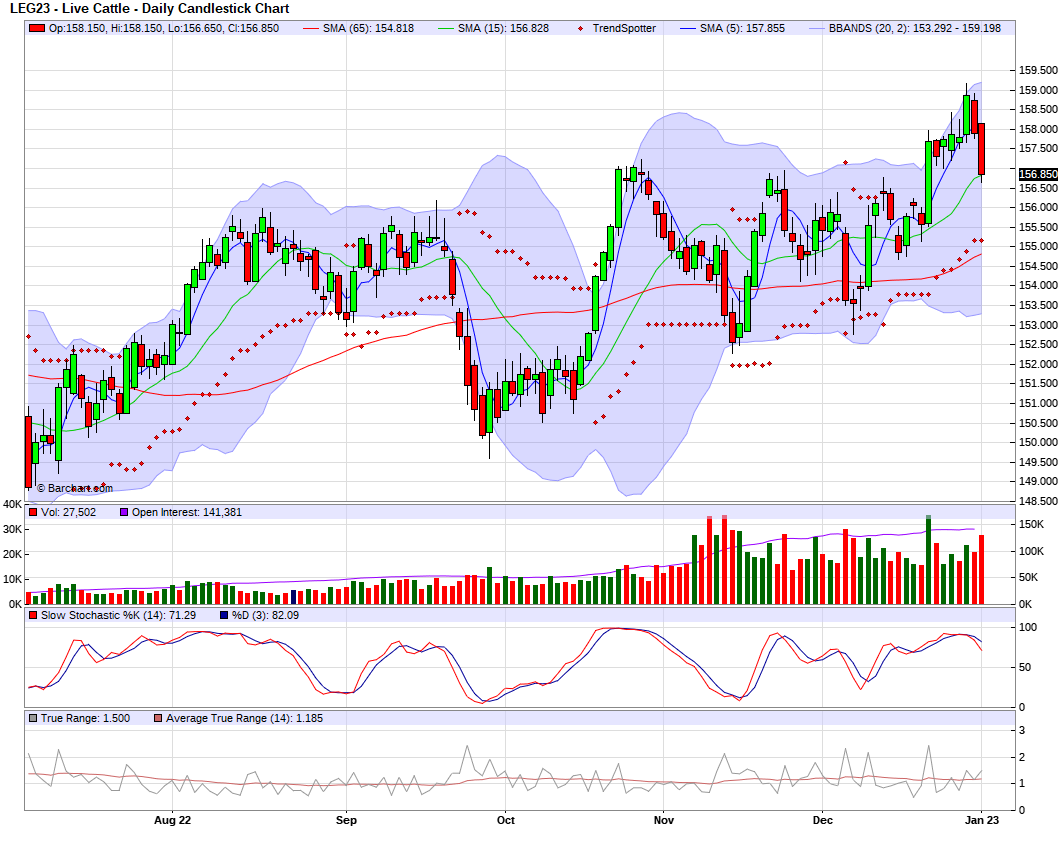

Livestock

Live Cattle down -1.050 to 156.850

Feeder Cattle down -1.450 to 184.775

Live Cattle (6 Month)

Feeder Cattle (6 month)

South America Weather

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service