IS CORN STILL KING?

WEEKLY GRAIN NEWSLETTER

By Jeremey Frost

This is Jeremey Frost with some not so fearless grain marketing plan ideas for www.dailymarketminute.com

Last week reminded me of going to ValleyScare at ValleyFair

What a ride some of our grain markets have had. Last week we saw wheat nearly trade limit up a week ago when the market opened, then we got news that the wheat crop conditions are worse than even the lowest estimate as crop conditions for wheat came in the lowest ever. Then Wednesday and Thursday we saw the market take it on the chin and give up all the gains, as Russia said they would resume participating in the export corridor. When it was all said and done wheat was up nearly 20 cents on the wheat, but it also filled the gaps left on Sunday night.

One has to wonder if Putin has played Chicken Little just a little too much, if we will continue to see the market jump at his request. The present deal is set to expire on November 19th, what does that mean will happen? Will the market shoot up when he says that Russia won’t be renewing any deals? Will it take it on the chin when he says that they will renew? The problem that I see is that eventually Chicken Little was right.

The King (Corn) has been dethroned

At least temporary, corn has been a follower and not necessarily a willing follower. Last week’s real market mover wasn’t the wheat market. It was the soybean market and in particular it was the soybean oil market. Once thought of as the red-headed step child, soybean oil has been the leader of the grain complex. The difference between soybean oil leading the way and any other grain right now is simply what type of market rally we are in.

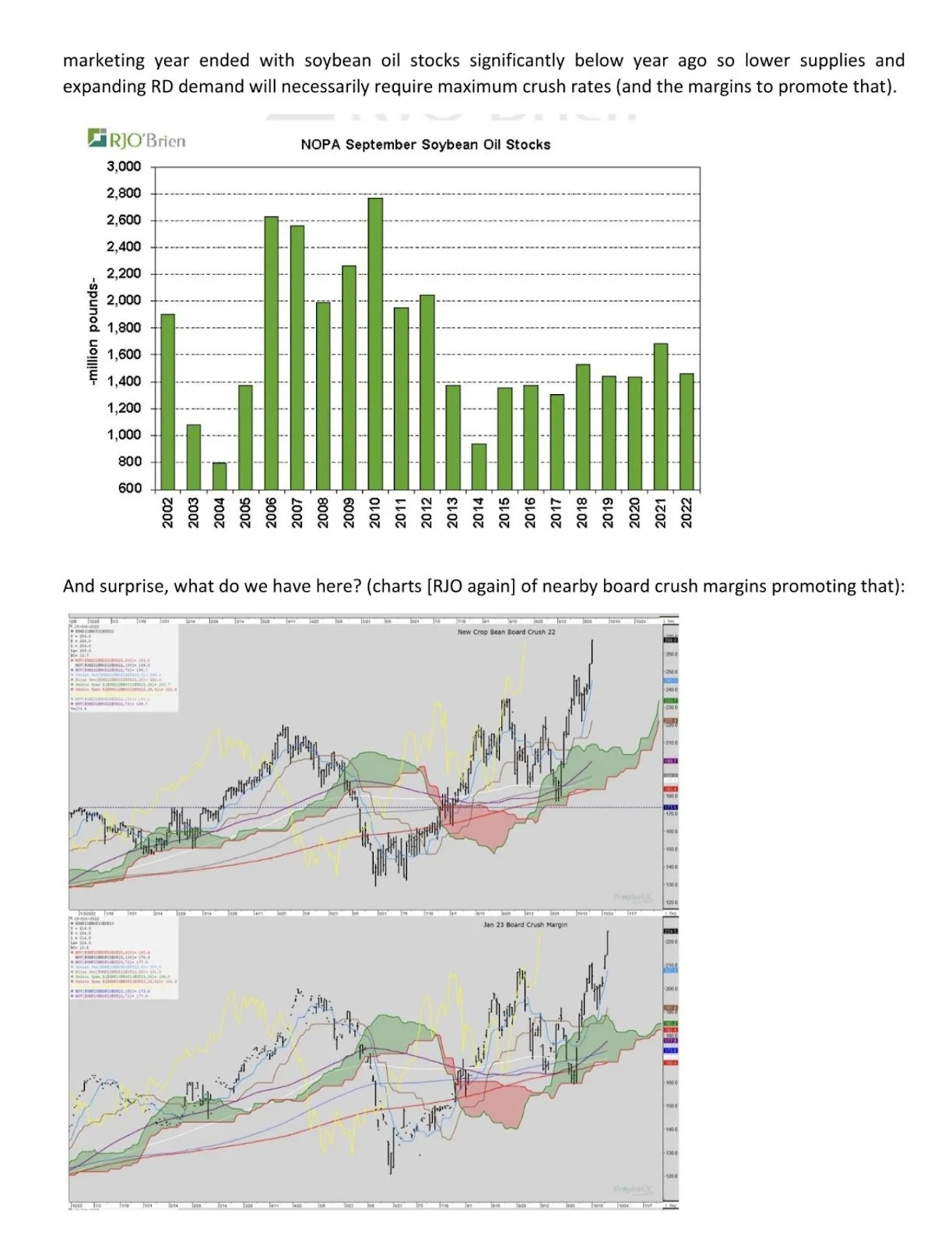

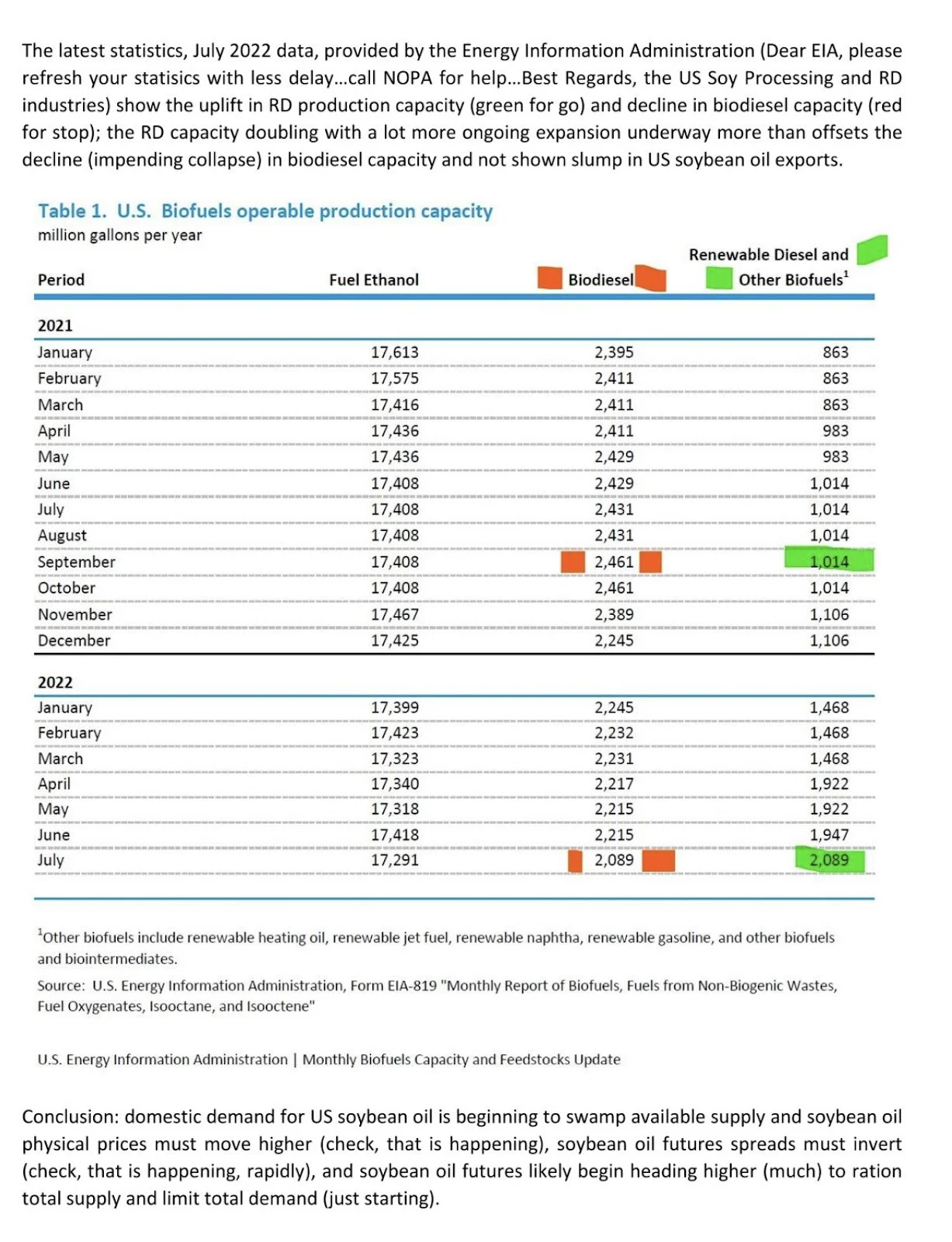

Soybean oil rally has been a demand-driven rally, a lack of supply along with crush margins that are super strong off of charts. Here is an article from LinkedIn from Walter Cronin.

The bottom line is that soybean oil, at least in the short term, is King. This King has been ruling with demand, and demand-driven markets are markets that usually last much longer than fear driven markets.

Look for the strong bean oil prices to give support to the sunflower market.

It may take a while with the great sunflower yields in most of the US, but eventually one should look for Hi Oleic sunflowers to show strength behind the strength in bean oil. Bean oil is presently around 77 cents a pound. Historically sunflower prices can track bean oil, and an old adage was ½ of bean oil would be sunflower price. That means sunflowers could have some room to go up. It also means that if we get some price action on the bean oil chart that looks like a top has been made one might want to cross hedge sunflowers via buying bean oil puts. To be clear we don’t have any sell signals happening yet on the bean oil chart. But with recent strength, it shouldn’t surprise one if we see some profit-taking or consolidation in the short term...

The rest of this Weekly Newsletter is subscriber-only. To continue reading please subscribe to receive all updates

Included in this week's Weekly Newsletter

Will Corn Be King Again?

Corn Basis Numbers

Continue Being Price Makers, Not Takers

Proper Risk Management

Not So Fearless Predictions

How Cheap Are Sunflowers?

Commodity Overview