WHY YOU SHOULDN’T BE FEAR SELLING

WEEKLY GRAIN NEWSLETTER

By Jeremey Frost

This is Jeremey Frost with some not so fearless comments for www.dailymarketminute.com

When do you throw in the towel?

Not yet folks. That’s my answer if a farmer should make a sale now, throw in the towel, wave the surrender flag, give up, or whatever analogy one wants to put on if they should be making some grain sales. First off, some guys have made some sales and my recommendation is that everyone needs to be comfortable for their unique situation, and their risk reward profile. No one has the same situation, it can be perfect for one producer to have zero sold, holding old crop inventory while another can have nearly the exact opposite and be sold plus have some new crop marketed.

How can both be successful? Because it is not one size fits all.

The definition of success that I choose to use is from Earl Nightingale and that is “Success is the progressive realization of a worthy goal or ideal.” So keep in mind that success in grain marketing to me is simply being comfortable where one is at, with all of the unknowns.

So if I didn’t sell before the meltdown in prices some of the markets have had recently why would one sell now? I personally wouldn’t, as I don't view that a lot has changed. If anything we have had a weaker dollar along with weaker prices that will help support demand and therefore could help us get even higher later. All of our major markets, corn, soybeans, and wheat, have extremely tight balance sheets. The market’s job has been to make sure we curb demand like the magical USDA pencil said we would. The problem is that lower prices don’t curb demand, cheaper prices add to demand.

Take a look at corn exports, they have been horrible all year, but the past few weeks they have improved dramatically. We don’t have room for the exports to be good.

Technical view. Here is a technical view from Wright on the Markets Read Here

“Tech Guy Weekend Comments 12/3/22

The first thing I want to talk about is the Commitment of Traders report which is published every Friday afternoon. Both March Corn and Wheat continued their down corrections last week.

Open Interest includes all months combined. Remember, OI is the total number of open contracts. It includes all traders, merchants and producers who have open positions in the market - they are interested in making money or hedging their bets against the physical inventory on hand.

The Wheat open interest decreased 41,728 contracts last week. By the way, I use the short form legacy report. Some people look at other iterations that include more categories of traders. Here is the short form I look at: https://www.cftc.gov/dea/futures/deacbtsf.htm

The Corn open interest decreased by 136,254 contracts last week. Both Wheat & Corn sold off during that time allowing us to determine that the down moves are only corrective - small short traders taking profits and weak longs getting blown out (stopped out) of their positions.

Therefore, the primary trend (flow of energy) on the weekly charts is still up in both March Corn and Wheat. Another way to look at it - traders are becoming less interested as price falls - energy is decreasing.

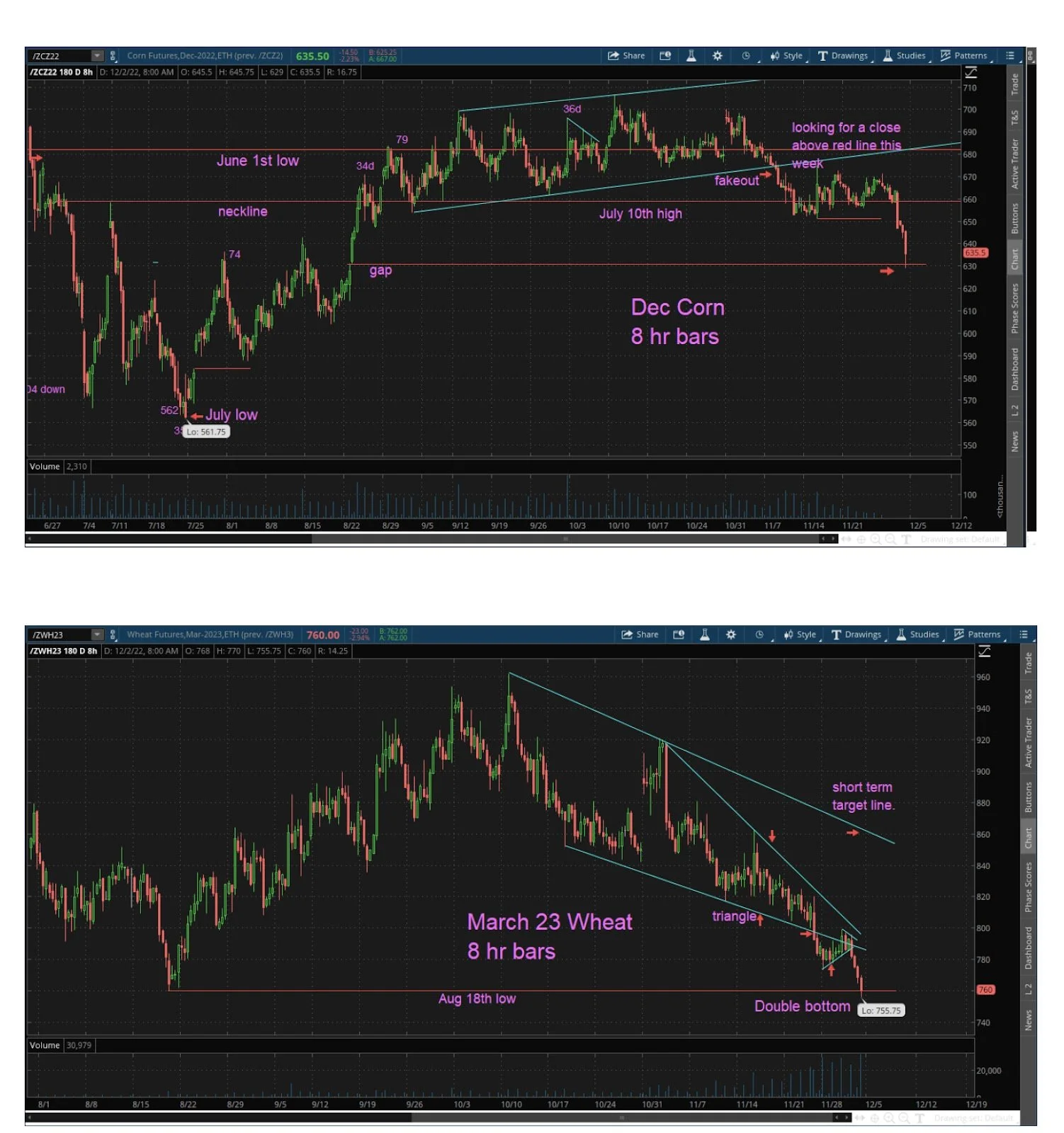

On the other hand, when a market is in a strong trend and open interest is increasing, it means energy is being pumped into the market, adding fuel to the fire, so to speak. Roger sent out those nice charts of Dec Corn and March Wheat.

I agree with him on both charts. Open gaps are always unfinished business. Once they are filled, that market can return to the main business at hand - for the corn weekly chart this business is up. The volume on Friday for both Corn and Wheat was way above average, indicating capitulation.

March Wheat support was 760, the September low (unfinished business) - Friday tested this area marking a nice double bottom. Therefore, the odds favor strong fund buying next week - it's very reasonable to think that we will see March Corn and Wheat rally next week.

Here are the Dec Corn and March Wheat charts, respectively.

Soybean open interest increased 11,527 while price increased last week, supporting the up move. Also yesterday, Jan Soybean meal broke out of it's triangle to the upside. Meal's strength will bleed over to Jan Soybeans and support higher prices overall - want to see some follow through buying in Jan Meal Monday and Tuesday. Check out the triangle breakout in Jan Meal.

Jan Crude Oil Update: Friday's correction is probably complete because it had a nice structured A-B-C - 2 legged. C bottomed at 79.65 and the close Friday was 80.34. This is a pretty good sized inverted Head & Shoulders pattern and higher prices next week are likely. Please study the updated more zoomed in Crude chart.

I will re-visit the Dec S&P next week - however, the uptrend appears to remain intact. Have a nice weekend!”

-

After looking at the charts above and reading the Tech Guy’s Comments, do you think we should be selling if you didn't before? I for one don’t think fear selling makes a lot of sense at this time.

So what was the big melt down on bean oil all about?

The rest of this newsletter is subscriber-only. To continue reading and to receive every update via text and email please subscribe.

What's Included?

In-depth commodities overview 3-5 times a week, going over everything you need to know about what's going on in the grain markets

Audio Commentary updates 2-3 times a week

Weekly Grain Newsletter every Sunday

In this week's Weekly Grain Newsletter

Implications of the soybean crush expansion

Season Trades

What tools are in your grain marketing plan?

South America

Commodity Overview