MORNING MARKET UPDATE

Futures Prices 10:30am CT

Overview

Grains higher this morning, as we are seeing a nice boost from the outside markets. As crude oil is nearly $3 higher and the dollar index is lower again, back down to the 110.50 area. Making many wonder if the recession fears are approaching an end.

Today's Main Takeaways

Corn

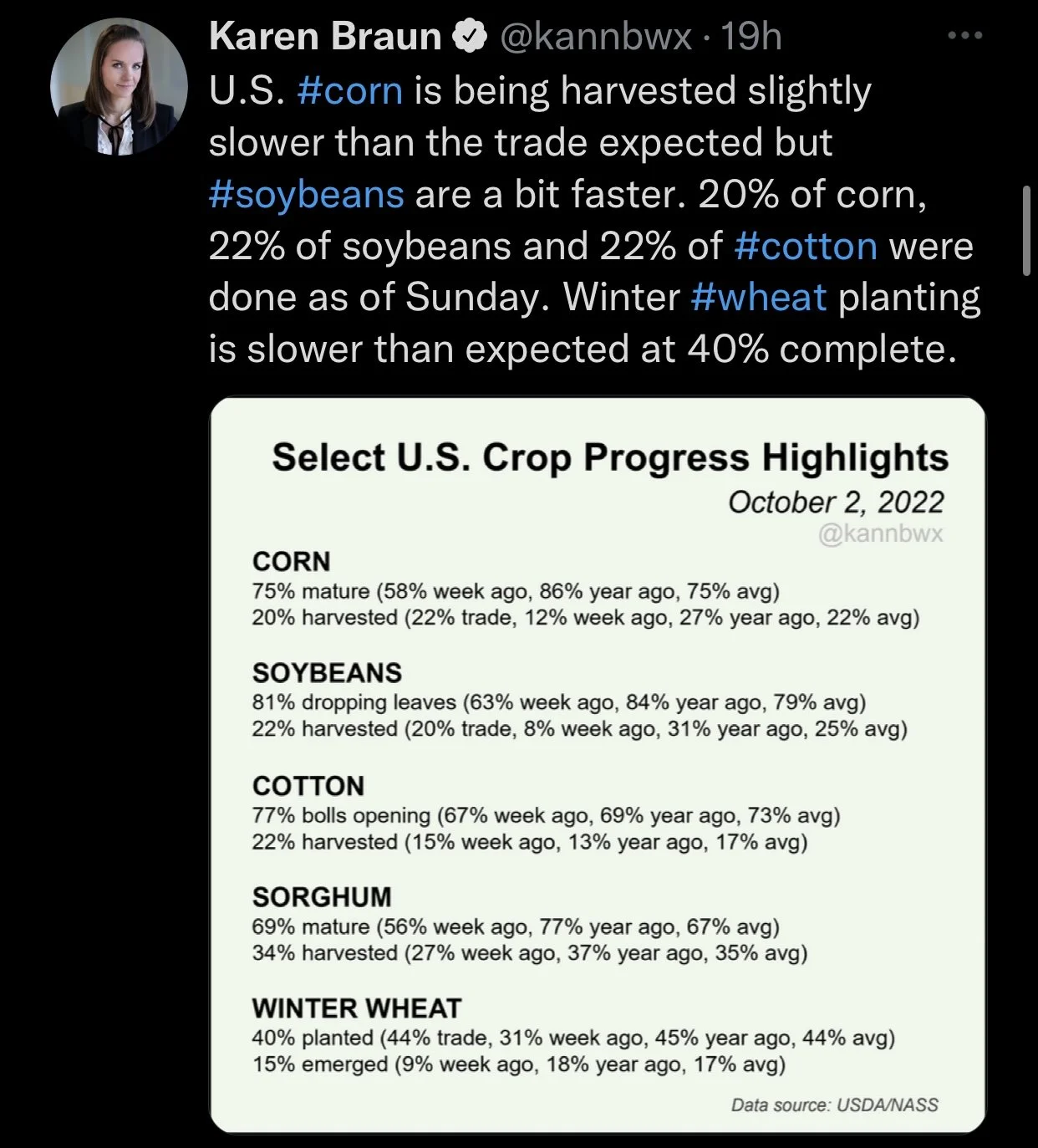

Friday we saw the USDA peg old crop stocks at 1.377 billion bushels vs the 1.512 billion bushel estimate. This bullish surprise sent corn much higher and up past the 20-day moving average. However, starting the week off yesterday corn wasn't able to capitalize and further extend the bullish reaction.

In the crop progress report, corn harvest came in at 20% complete. Which was 2% slower than most were expecting as well as the average pace. Conditions came in at 52% rated good/excellent which was left unchanged. Last year at this time we saw a 59% rating.

The big bounce we saw from crude oil yesterday has been supportive of prices. Crude oil strong again this morning further helping support corn. We also finally saw exports come in at the higher end of their range for a change. Adding additional support we saw the U.S. dollar lower again for the fourth day in a row. Many are wondering if we've seen the top for the dollar. Another question many have is, did crude oil fianlly find its bottom after weeks of falling lower, and will we see crude oil continue to make its run through out the rest of the calendar year. If either of these scenarios take place, it would be massively beneficial to helping push corn prices higher.

The Mississippi river is facing extremely low water levels. Where it is currently at its 8th lowest level we've seen. The majority is expecting levels to fall even farther, even though this is the lowest we've seen in the last 10 years already. This is a factor that is looking to add pressure to the markets. We also have harvest looking to continue to excel even faster, taking more risk out of the fields here in the U.S. with the cooperative weather.

It appears that corn is perfectly content trading between the $6.60 to $7 range. As we have still struggled to break up past that $7 resistance.

Dec-22 (6 Month)

Soybeans

Fridays report came in bullish for corn and fairly friendly for wheat. The same can't be said for soybeans. We saw the USDA come in with larger than expected U.S. old crop stocks where they came in at 274 million bushels vs the 242 million bushel estimate, 32 million larger than expected.

These bearish numbers sent soybeans crashing down Friday. However, yesterday we were able to hold above Fridays lows. Soybeans currently trading + cents higher this morning.

Crop progress for soybeans had soybean harvest at 22% complete (14% increase from last week), which was better than expected but still trailing the usual pace. As the 5-year average stands at 25%. Similar to corn, conditions were left unchanged at 55% being rated good/excellent.

Similar to corn, the outside markets have switched sides and been adding support to the markets, after weeks of keeping a lid on prices with the dollar surging to new highs every other day just a week or so ago. But the recent decline in the dollar has cooled some recession fears and opened a new window for buying. We will have to continue to see if the dollar really is cooling off, or if this is just a short temporary correction.

Looking long term, if China opens back up and we see demand pick up as well, that would be very beneficial to the soybean and grain markets. As demand has been one of the lackluster areas for some time now. We did see export sales to unknown destinations, most think it was China. However, this alone isn’t enough to shift the demand headlines. And there is still plenty of concerns surrounding the political tensions between the U.S. and China with the Taiwan story.

On the other hand, looking down the road, we do have the possibility to see some problems in South Africa which could ultimately send prices higher. But we can't count on that just yet.

Soymeal & Soyoil

Soymeal down -1.0 to 404.3

Soyoil up +1.76 to 65.10

Soybeans Nov-22 (6 Month)

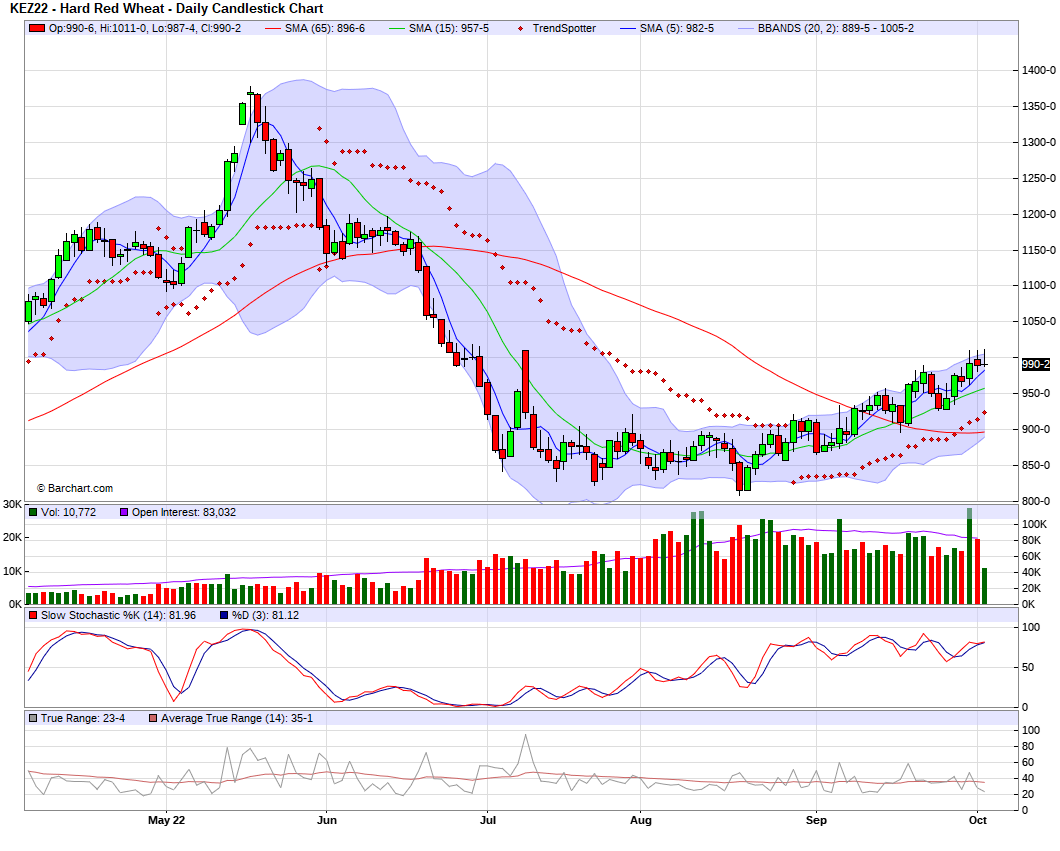

Wheat

Wheat saw a nice rally Friday following the USDA report, where U.S. production came in smaller than expected. Coming in at 1.650 billion bushels vs a 1.778 billion bushel estimate. Despite this Friday, wheat struggled to move even higher yesterday. This morning wheat is mixed with Chicago down -9 cents.

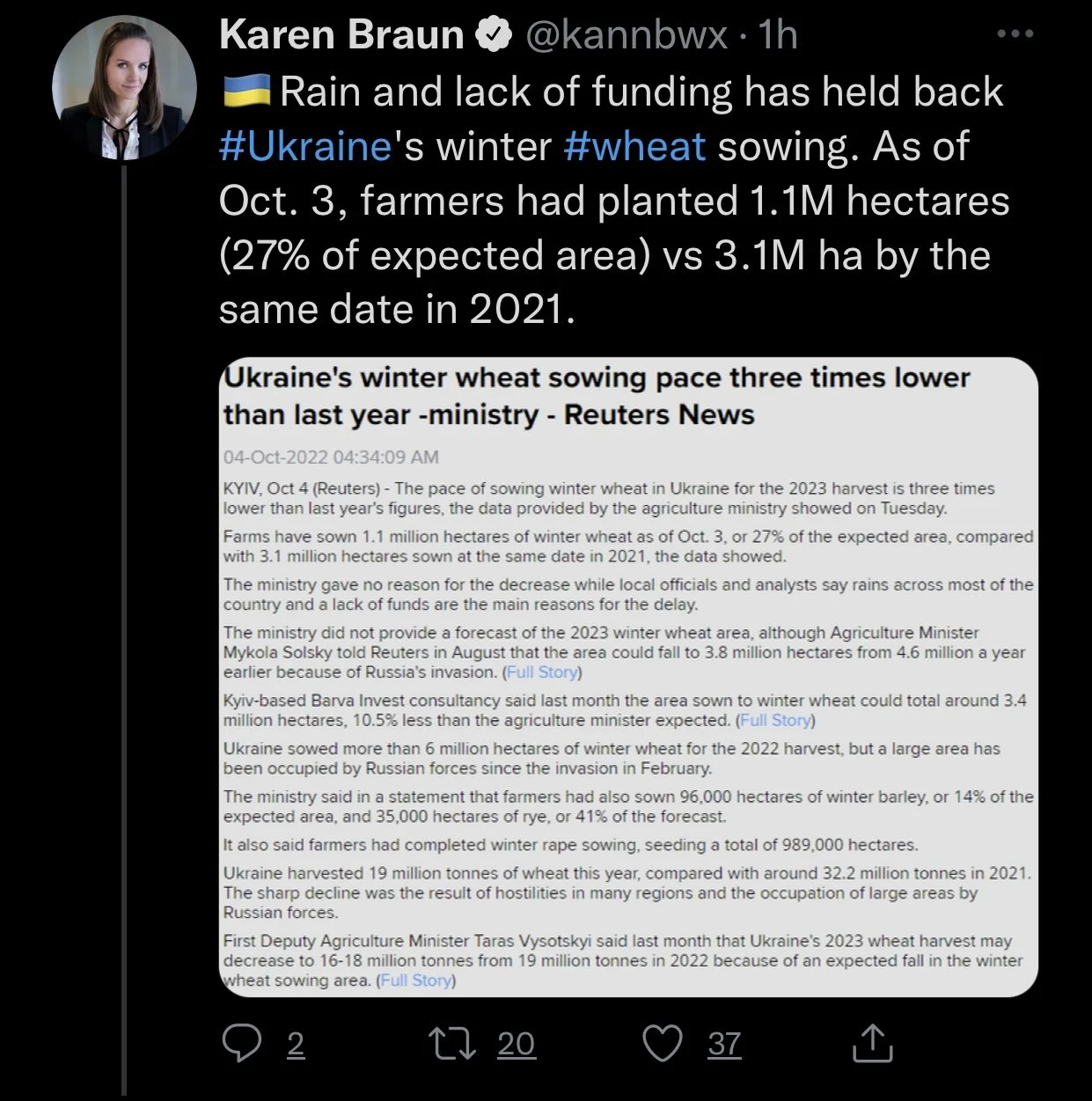

The Russia and Ukraine headlines will continue to dominate the direction of the wheat market. As not a soul knows whats coming next from Putin. So really, the entire situation is just a mixed bag full of surprises.

We saw crop progress for wheat yesterday, where U.S. winter wheat came in at 40% complete. This number was roughly 4% lower than the average pace.

We have seen a great run from wheat, but we are still nowhere near our highs we saw back just after the war news was released back in May. Many are wondering if wheat can use these recent headlines and continue to push higher, or if we are close to the end of the run.

Weekly exports were slightly better which was supportive, but it wasn't anything game changing. As mentioned above, if the dollar continues to fall further from its recent highs, this would be very supportive of wheat and all the markets.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil up nearly +$3 to $86.60

Dow Jones up +750

Dollar Index down -1.176 to 110.480

Cotton up +3.89 to 88.09

News

Rain in Brazil is slowing soybean planting

S&P 500 posted their best day of the 4th Quarter since 2009. Many are wondering if this was just a relief rally.

North Korean missles fly over japan, causing japan residents to seek cover

Elon Musk tweeted a poll that striked some controversy. Where he asked the annexed countries whether they would rather be in Ukraine or Russia.

Low river levels in the Mississippi are at historic levels

70% of the western U.S. is experiencing a drought

EU cuts corn crop forecast to 15 year lows

South America Update

Planting for Brazil is off to a pretty good start. However, there are some rains that are now looking to slow planting progress. As of last week, their 2022-23 soybean crop came in at 5.2% planted. This is compared to last year's 4.5%.

Argentina on the other hand hasn’t had as easy of planting. As their record drought they saw not too long ago is hurting progress. With lack of moisture is putting pressure on their winter wheat crops as well as planted corn. They are also not expected to get much more beneficial rain really anytime soon which isn't helping their cause.

Argentina corn was at 5.8% planted as of last week. This is compared to last year's 16.8%. Argentina has yet to plant any soybeans.

Yesterday StoneX raised their Brazil production estimates. Where they had Brazil soybeans at 153.8 million tons and corn at 126.3 million tons.

Previous Newsletters

Check out a few of our other posts in case you missed them. Would love any feedback or things you would like to see.

This Weeks Weekly Newsletter

What if we don't go into a recession?

Social Media

Credit: All credit to users of posts

Precipitation Forecast 2-Day

Weather

Source: National Weather Service