BEANS HOLDING DESPITE LACK OF BULLISH STORY

MARKET UPDATE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

Want to talk? (605)295-3100

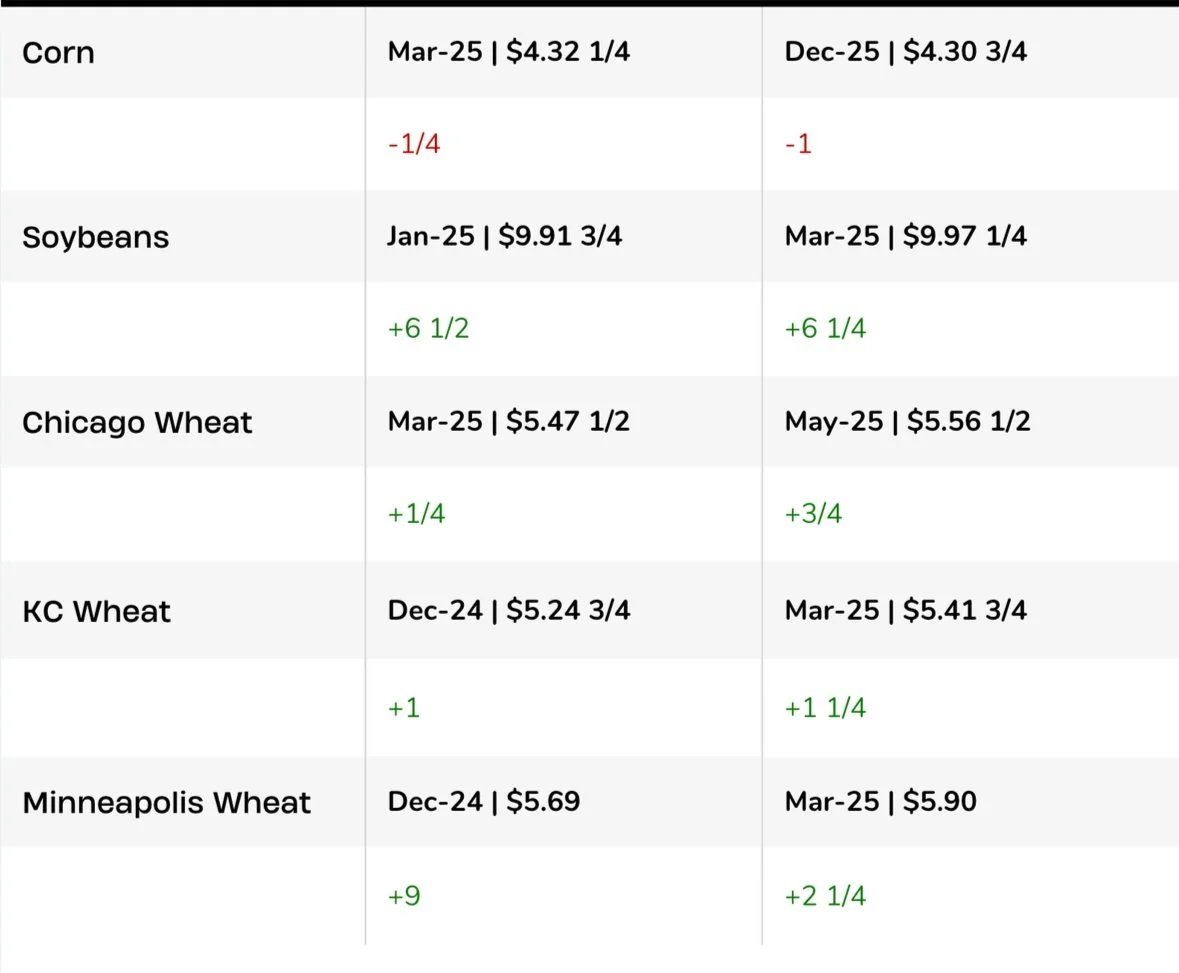

Futures Prices Close

Overview

Another quiet day in the markets following the holiday weekend, as there hasn’t been much news for either side to chew on.

Soybeans showed some strength, continuing to fight off those recent lows. As we saw some strength in the soy complex.

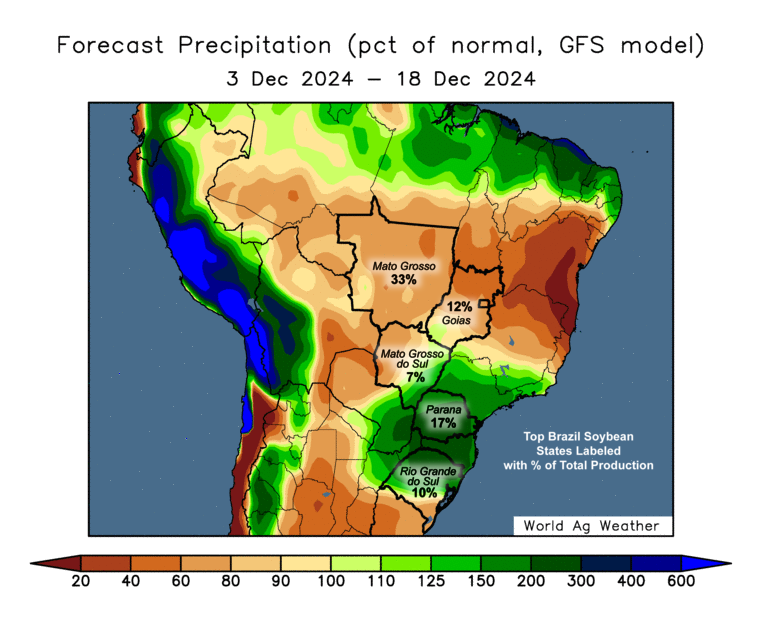

Despite today's strength, soybeans continue to be pressured by ideal weather in South America and the looming potential effects of tariffs from Trump.

The near perfect weather in Brazil does make it hard for bulls to come up with a real story to justify prices drastically higher from here.

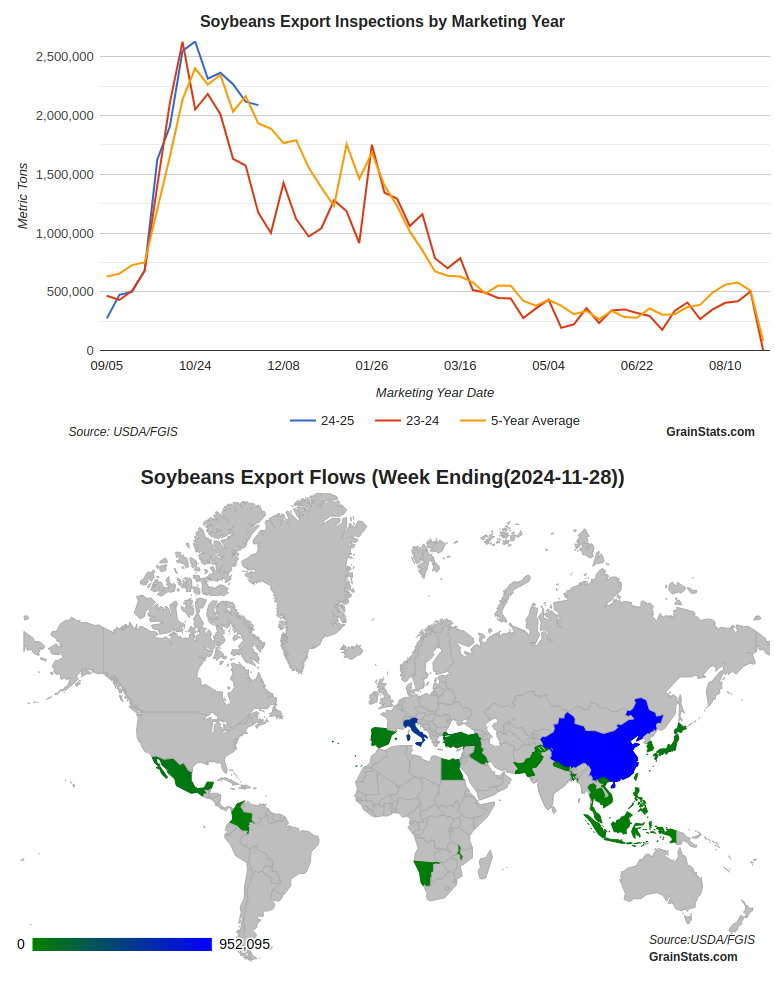

Along with corn, soybean demand has actually been relatively solid following the awful start. As bean exports are actually head of USDA pace now. So demand isn’t really an issue here.

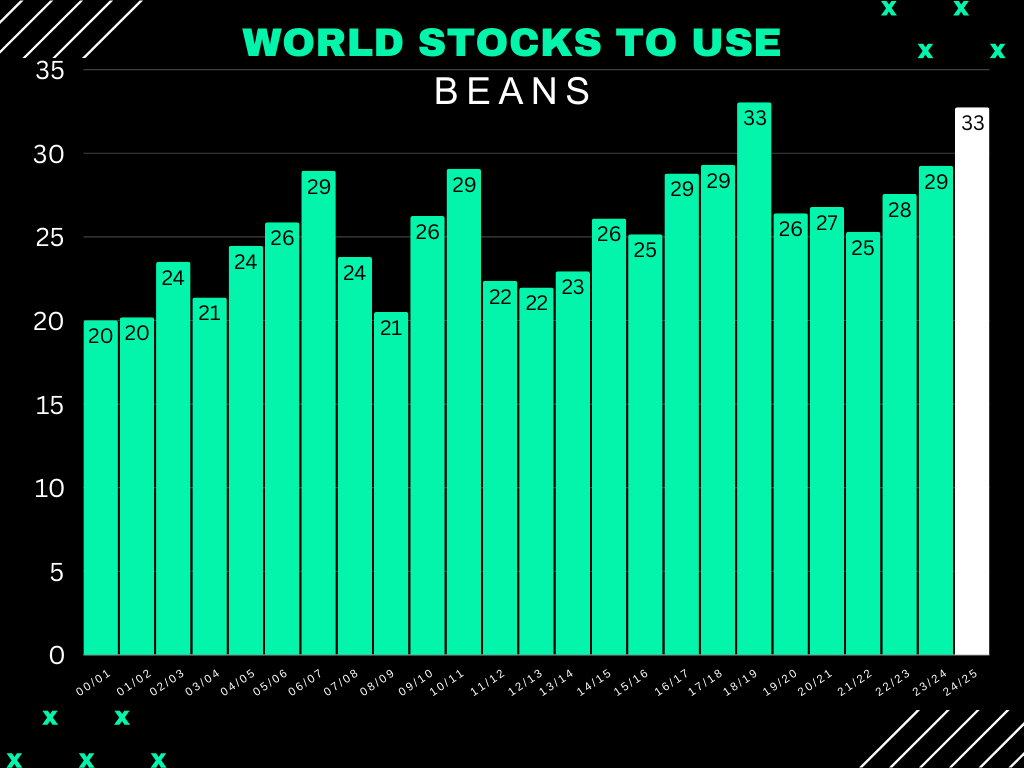

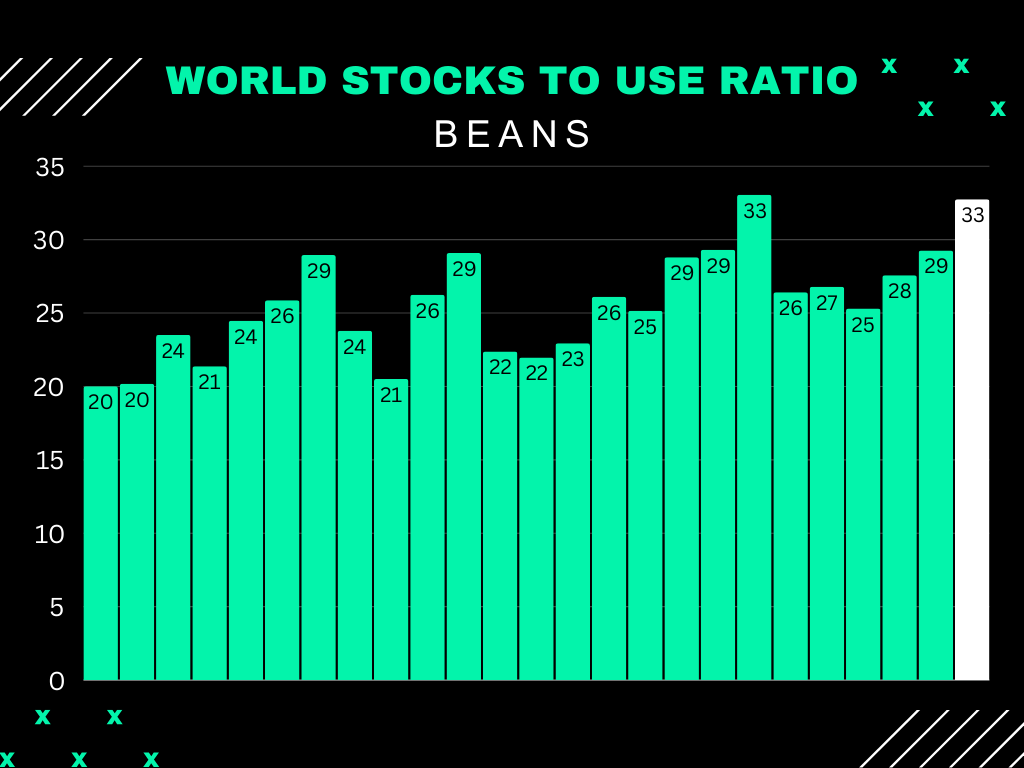

The tariff fears are not what is keeping a lid on soybean prices. It is the thought that Brazil is going to have a monster crop. Because if they do, this is what the global balance sheet will look like.

World stocks the highest ever. World stocks to use ratio the 2nd highest ever.

Private groups have also continued to project this record crop.

We saw some news from Russia and Ukraine that they might add price floors to implement an absolute bottom export price and restrict some exports to slowdown food inflation. This is a friendly story, but the market has not reacted to it.

Black Oil Sunflowers Offers:

We are looking for black oil sunflower offers.

Shoot Jeremey a call or text at (605)295-3100 with any new crop black oil sunflowers you have for sale.

With harvest over now, this is the time where you need to be proactive and have a marketing plan.

If you have yet to reach out to us please do so at (605)295-3100.

Many of you may want to be looking to establish floors above breakeven if we get that chance. So make sure you have a hedge account open and are able to take action when needed.

If you want to open one with us: CLICK HERE

Today's Main Takeaways

Corn

Not much new on corn. Very little news.

Overall, demand remains solid.

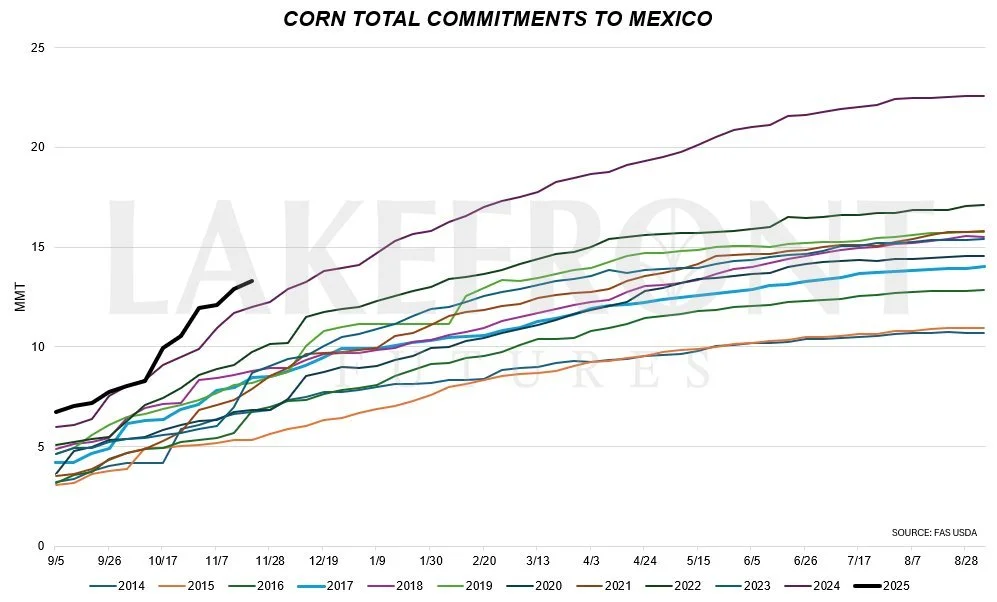

One argument bears try to make is that perhaps all of this export demand we saw from Mexico was entirely front ran as they wanted to buy before Trump got in office.

Yes this argument might have some marrit. But in all reality, they are buying more than last year but are not totally out of line with expectations.

Sales for Mexico last year were well ahead of pace and kept that pace all year. There was no Trump tariff news to suggest this pace couldn’t stay.

At this pace, Mexico purchases are up +1.3 MMT from last year.

Overall, not much else.

Demand is still the biggest story going for corn. Exports are great if they can continue along this relative pace. Ethanol production is at records which alone can add tremendous demand to the balance sheets.

Biggest thing I am watching here is the charts.

We are currently range bound in this symmetrical triangle. A bust above or below that blue triangle will dictate where we go next.

My first target to take off some risk is still that 200-day MA.

This is why that 200-day MA is so significant.

It has acted as a lid several times.

Hence why it makes sense for some to de-risk there.

March-25 Corn

Dec-25 Corn

Soybeans

Soybeans continue to cling on to those lows. As we have now bounced off that level over 10 times or so.

Overall, you still have to thread carefully here in soybeans.

There really is not anything to get super bullish on here if Brazil's weather stays ideal.

Even though there is plenty of downside risk, it doesn’t mean we have to come crashing down lower.

When looking at demand, this was one bearish argument not long ago. We had the worst new crop book of beans sales to China on record.

But after that start, we have seem demand get a pick up. Beans are actually somehow ahead of the pace to meet the USDA estimates and above last year's exports.

China buying is still lower than last year, but other countries have stepped up.

Many thought China would stop buying beans the moment Trump was elected.

We still have the looming "potential" effects of tariffs, but China didn’t just completely stop buying like some thought they would.

Chart from GrainStats

So demand isn’t the problem. Demand is somewhat holding this market afloat here.

The biggest problem is BY FAR Brazil.

A trade war doesn’t directly impact the balance sheets and nobody really knows how it will shake out.

But with Brazil's monster crop, you can directly see just how big of an issue this is.

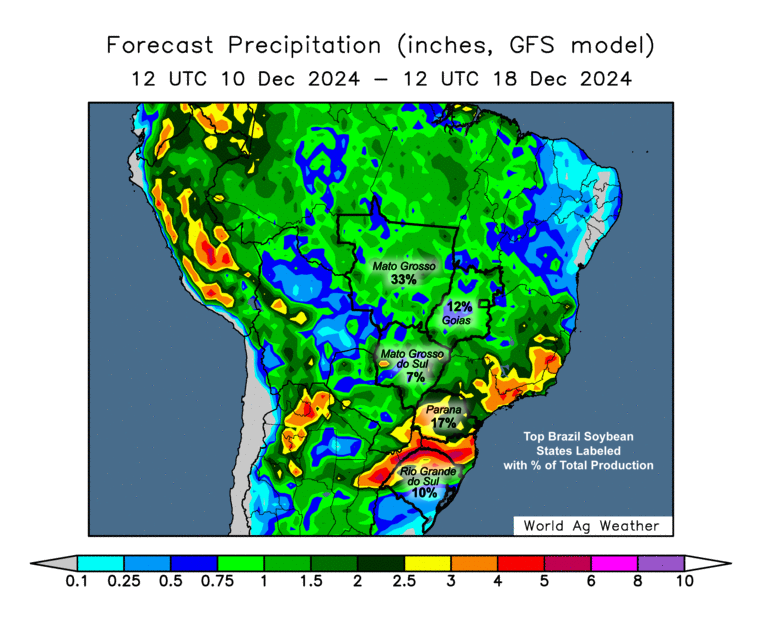

Here is Brazil's current outlook. A tad drier than normal but nothing to worry about for now. Especially considering they've received abundant moisture.

Next 2 Weeks Rain

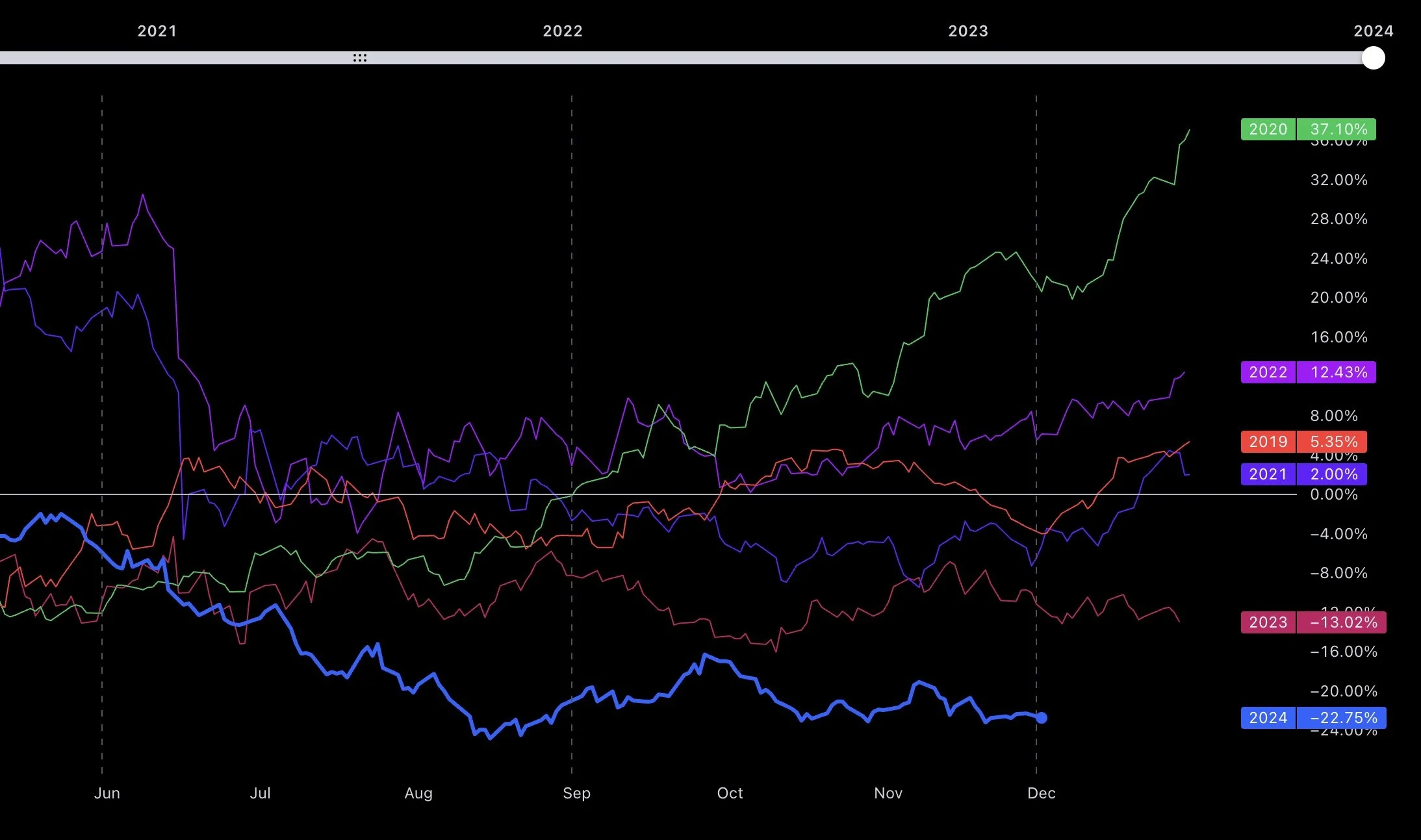

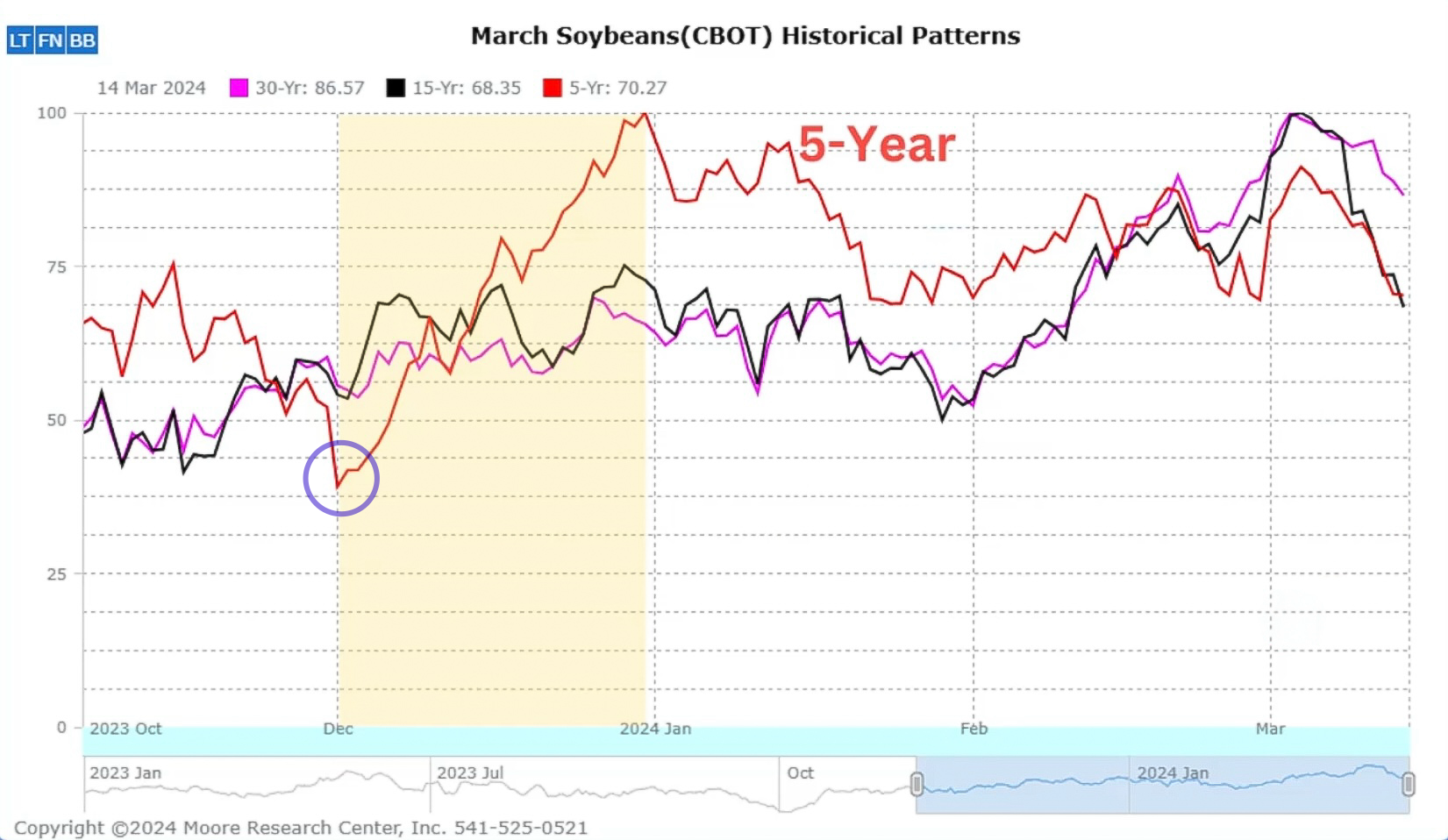

Seasonally, we do however go higher from here.

The past 5 years we have bottomed right around today and then went on to rally throughout the month of December. (Aside from 2023)

This is about the only friendly thing beans have going for them.

If you entered a long soybean position in mid-November and sold it on Dec 31st it would have been a winning trade the past 13/15 years. (2017 & 2023 were losers)

However, you have to keep in mind that this recent seasonal pattern does correlate to Brazil's weather season. If they do not get any scare at all, it could very easily wind up being like the US weather season this past summer. Where we simply do not get one and prices do not get that seasonal rally.

Past 5 Years

Moore Research Seasonal Pattern

The biggest thing I am watching is if we can hold these lows.

They are a MUST HOLD. If we break below, the implied move is sub $9.00

To negate this, we need to bust that downward trendline we have respected since May.

On the bright side, the indicators suggest a possible bounce here. But how high we go remains to be seen.

The stochastic bottomed and are turning up.

The MACD is on the verge of flipping bullish. Last time it happened we got that mini rally in November.

Wheat

Not great action in wheat as we fell well off our early highs.

We saw a small amount of strength with the weakness in the dollar, possible winter weather in the upper plains, along with that potential Russia demand story I mentioned earlier.

Overall wheat is really struggling to find a story to sway bulls or bears either way.

Russia raising price floors is a very positive potential sign, as Russia dumping their cheap wheat on the market was one of the biggest reasons wheat prices have sucked since the war.

Short term, it is anyone guess where we go from here. Bulls do not have a real argument to be made that prices should be drastically higher here soon.

But looking towards next year wheat still has potential.

We have one of the most bullish global balance sheets in a long time. Russia has seen plenty of issues with their wheat crops and those effects will pop up eventually.

Bottom line, I am cautious short term. Optimistic long term.

Looking at the chart, we do really still need to hold those lows.

If we do not, we could very easily go test that long term support line which could lie below $5.00. Something to be aware of.

Unless KC wheat bounces here soon, that downward support could very well be the next big area.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

11/22/24

CORN TARGETS & CHINA CONCERNS

11/27/24

CORN SPREADS, CRUCIAL SPOT FOR BEANS, SEASONALITY SAYS BUY

11/26/24

TARIFF TALK PRESSURE

11/25/24

HOLIDAY TRADE, SEASONALS, TARGETS & DOWNSIDE RISKS

11/22/24

CORN TARGETS & CHINA CONCERNS

11/21/24

BEANS NEAR LOWS. CORN NEAR HIGHS. 2025 SALE THOUGHTS

11/19/24

WHAT’S NEXT FOR GRAINS

11/18/24

WHEAT LEADS THE GRAINS REBOUND

11/15/24

BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24