BEANS BOUNCE BACK

Overview

Soybeans lead the way today following sharply lower prices yesterday as we see Argentina forecasts shift dry. Corn closed lower despite great export sales in a volatile trading day across the grains.

Yesterday the dollar hit its lowest level since last May as the stock market continues its 2023 rally following the Feds expected 25-point basis increase yesterday.

All eyes will be on the USDA WASDE Report next Wednesday, February 8th.

Today's Main Takeaways

Corn

Corn continues to leak lower off its recent highs, going back to test its previous trendline working its way below its moving average. Given the strong exports it was somewhat surprising to see corn close lower.

Bulls were happy to see some strong weekly export numbers this morning. Coming in at 62.7 million bushels. Which is the second largest number we've seen this marketing year.

StoneX Brazil increased their corn production estimates by over 1 million metric tons, to 129.9 million. Which is above the USDA's last estimate at 125 million. Brazil planting delays for their second crop corn are still definitely going to be a concern going forward, but won’t be having a huge impact right now.

US ethanol production creeped up to 1.03 million barrels a day. This number is on pace to reach the USDA's annual forecast.

The USDA US corn used for ethanol in December came in at a total of 425 million bushels. Down from November's 450 million and last years 478 million.

One thing I am slightly nervous about here is how long the funds are. Given the price action today and poor close, perhaps the funds are just too long. As we have a chance to start to see the funds switch their long corn and short wheat positions.

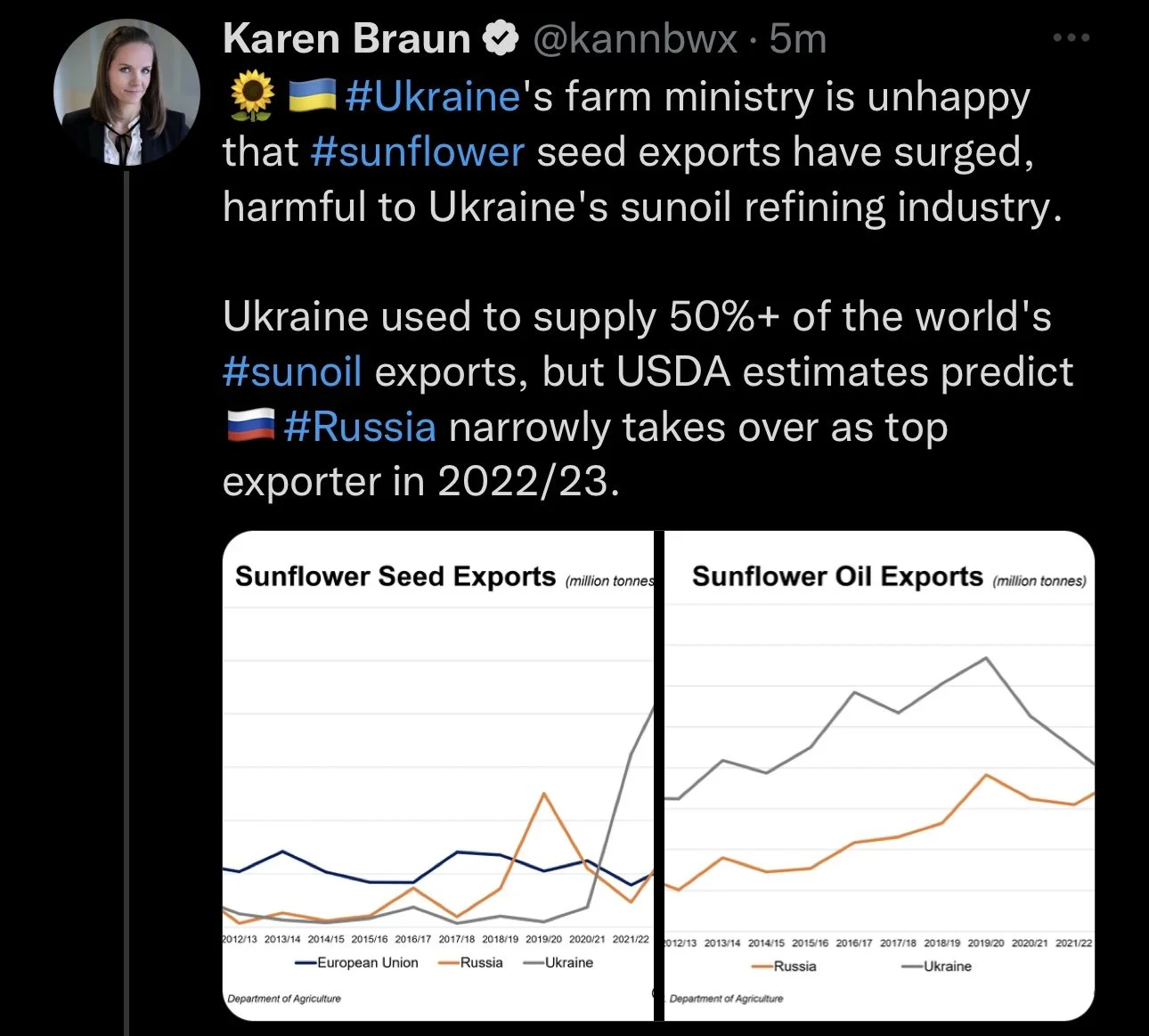

There is still some concerns regarding Ukraine exports, and if they are being slightly overestimated. The war isn't going away anytime soon and some recent headlines are talking about Russia heating things up even further.

Demand continues to be one of the biggest things keeping a lid on corn, as bulls would like to see an increase in Chinese appetite despite the strong sales this morning.

Corn again tried to test resistance but fell sharply off the highs and broke below its moving average. Now sitting at its previous trendline. The $6.85 level remains pretty stiff resistance.

Corn March-23

Soybeans

Soybeans posting a great follow through day of strength today following their sharp losses yesterday. Closing up +14 cents on the day.

Export sales this morning were on the disappointing side for beans. Coming in at the lower end of the estimate range.

Similar to corn, StoneX Brazil also increased their soybean production estimates. Seeing an increase of 400k tons, to a total of 154.2 million metric tons. Which is also above the USDA's current estimate of 153 million. So consensus thought is that Brazil is still expecting a massive crop. We will have to see if these harvest delays continue, and if so just how big of an impact they make.

Argentina on the other hand continues to see estimate reductions. As Buenos Aires once again cut theirs. This time to 36 million tons. Which is far below the USDA's estimate of 45.5 million. So we will definitely see the USDA lower theirs next week.

Brazi's soybean exports for January were down 65% from a year ago, as their heavy constant rain is a problem come harvest time.

Bears are looking at the December crush report for soybeans. As it came in at 187.4 million bushels. Below the 188 estimate and November's 189.4.

South American weather remains the main headline in the soybean market. Forecasts are shifting to the more dry side which was a big reason in the higher prices we saw today. The other thing traders are keeping their eye on is Chinese demand.

Soybeans could of course keep pushing higher and break our recent highs, but I'm still nervous that the forecasts and headlines can continue to support this rally. For beans to continue to push higher bulls would like to see further weather complications in South America to go along with an increase in Chinese demand. If Argentina weather continues to be dry we might have another leg higher.

A great reversal in beans today. Beans currently sitting right in the middle of their channel and still remain in a clear uptrend. A break above our recent highs opens the door to much higher prices but I'm still slightly nervous with the South American weather as it is constantly changing and throwing us curveballs.

Soybeans March-23

Soymeal

Soymeal continues its rally, hitting new highs once again. We will have to see if we can break the upside resistance or if we see a correction down towards our moving average or trend line. Again, I'm not super confident we continue to see meal make new highs, but you never know. The meal market has continued to prove bears wrong.

Soymeal March-23

Wheat

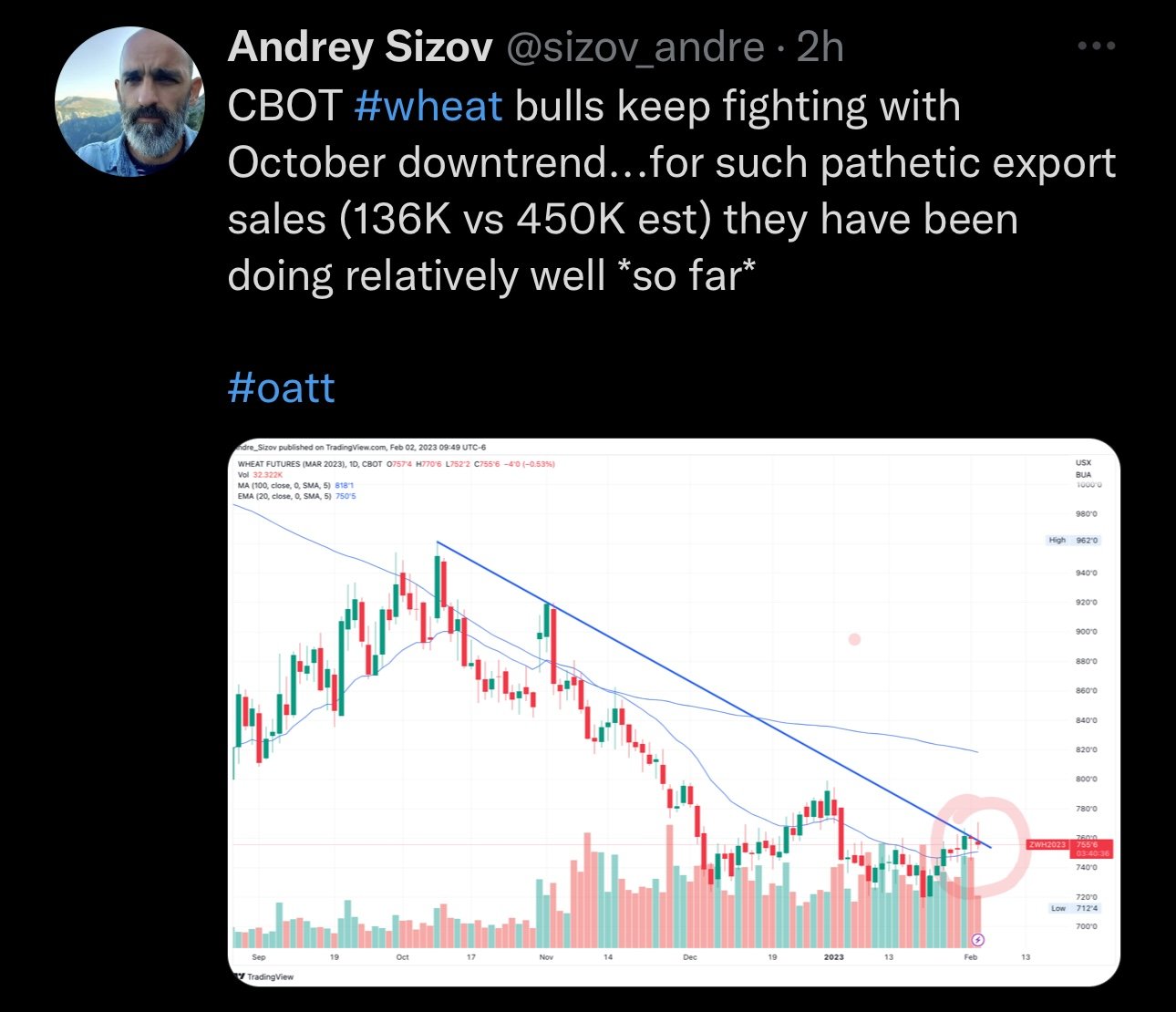

Up and down day for wheat futures today. Trading in a 20 cent range. Closing right in the middle, up over a penny and 11 cents off our lows despite the pathetic export sales.

Export sales this morning came in very disappointing for wheat, falling well below the trade estimates. Coming in at 136k vs 300-600k estimates. Given how poor the sales were and how we bounced back from our lows, I see that as a good sign in strength.

Putin and the war continue to make headlines. He recently said; "They they threaten us with Germany's leopard tanks, we will deplot more than just tanks." and "We are sure in our victory." So I think its pretty evident that this war isn't going anymore. Headlines have cooled off and markets haven't had that bull knee jerk reaction they used to have everytime war news broke the headlines. But the war will continue to support the wheat markets. Keep in mind, this war is between two of the worlds leading exporters of wheat. There is also some rumors that we might not see the export agreement renewed when the current deal expires. But this deadline is still almost 2 months away.

Not a whole lot has changed. Funds are still short, war is intact, and I think we are still oversold here. Russia and Ukraine estimates might be too optimistic. We have a poor crop here in the US despite some slight increases in conditions recently.

So overall I think wheat continues its recent uptrend. Looking at the charts, we might have broke our downtrend. I think its just a matter of time before the funds step in here to push us higher to go along with all the other possible bullish wild cards.

Wheat bounced well off our lows and found support at the trendline. The current upside target is $8. If we break $8 that opens the door to even higher prices. We are still 40 cents away but I think we get there in the coming next few weeks.

Chicago March-23

KC March-23

MPLS March-23

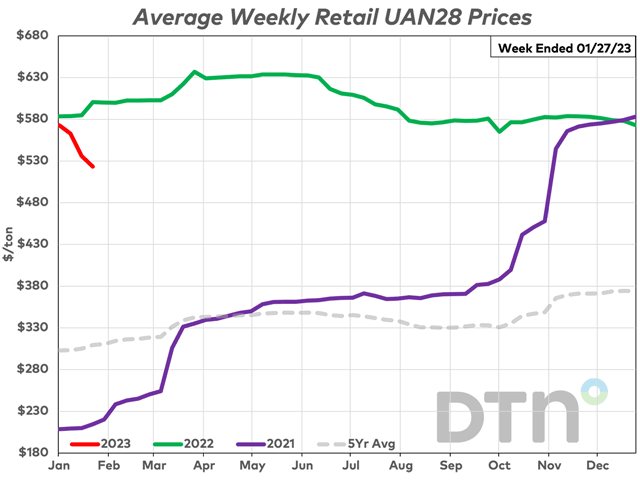

Fertilizer Continues to Decline

Read the full DTN article here

Seven of the eight major fertilizers are lower compared to last month. Of these seven, five fertilizers were substantially lower (5% move or more).

Leading the way lower is UAN28. The nitrogen fertilizer was 9% lower in price compared to last month and had an average price of $523/ton.

Significant Changes

Potash, anhydrous and UAN32 were 7% less expensive looking back to last month.

Potash had an average price of $714/ton, anhydrous $1,237/ton and UAN32 $630/ton.

Urea was 6% lower in price compared to the prior month.

It had an average price of $708/ton.

Both DAP and MAP were slightly lower looking back to last month.

DAP had an average price of $855/ton while MAP was $865/ton.

One fertilizer was just slightly higher in price compared to a month earlier.

10-34-0 had an average price of $754/ton.

All fertilizers are now lower compared to one year ago.

DAP is 3% lower

Both MAP and 10-34-0 are 8% less expensive

UAN32 is 10% lower

Potash is 12% less expensive

UAN28 is 13% lower

Anhydrous 17% less expensive

Urea is 22% lower compared to a year prior.

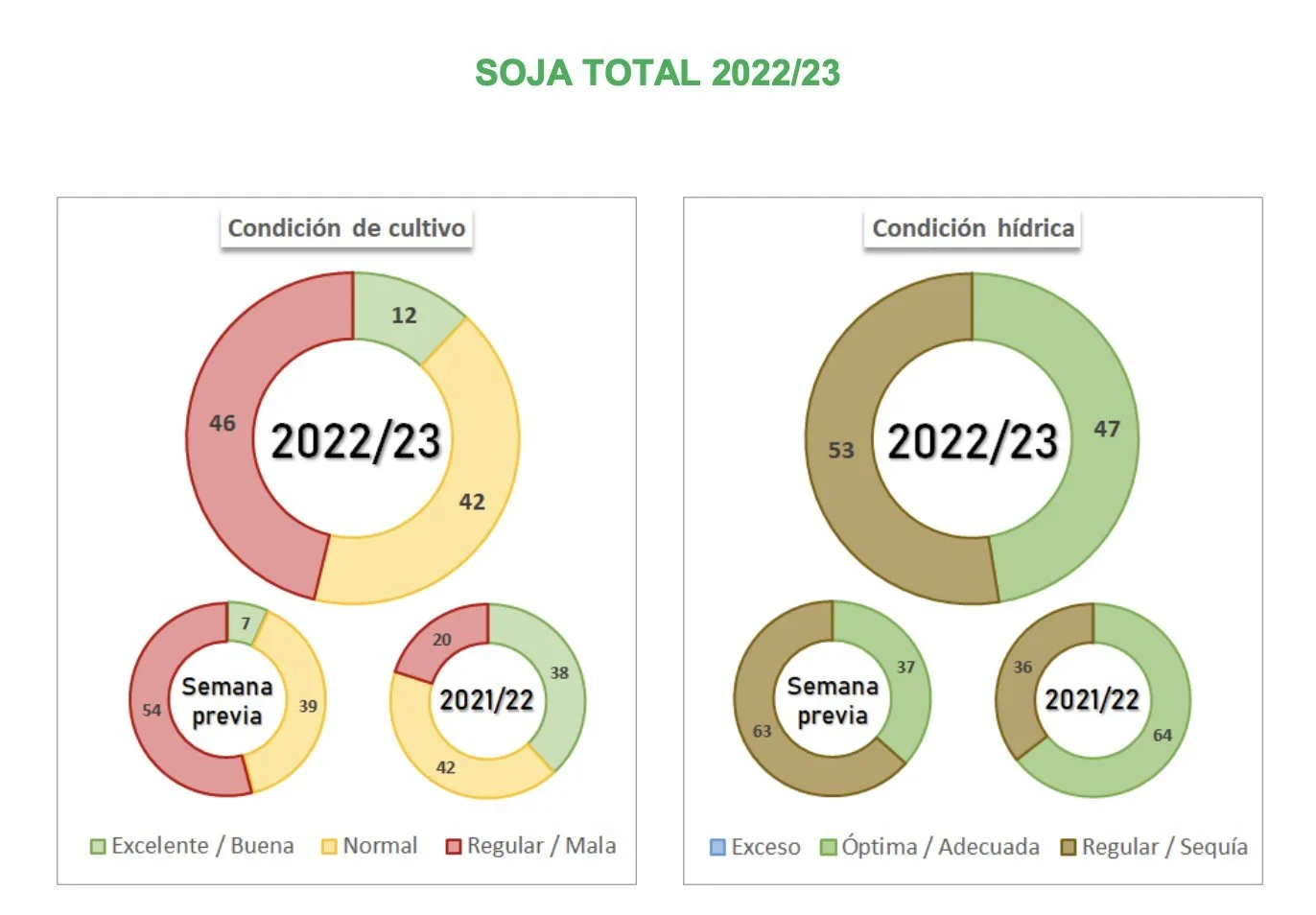

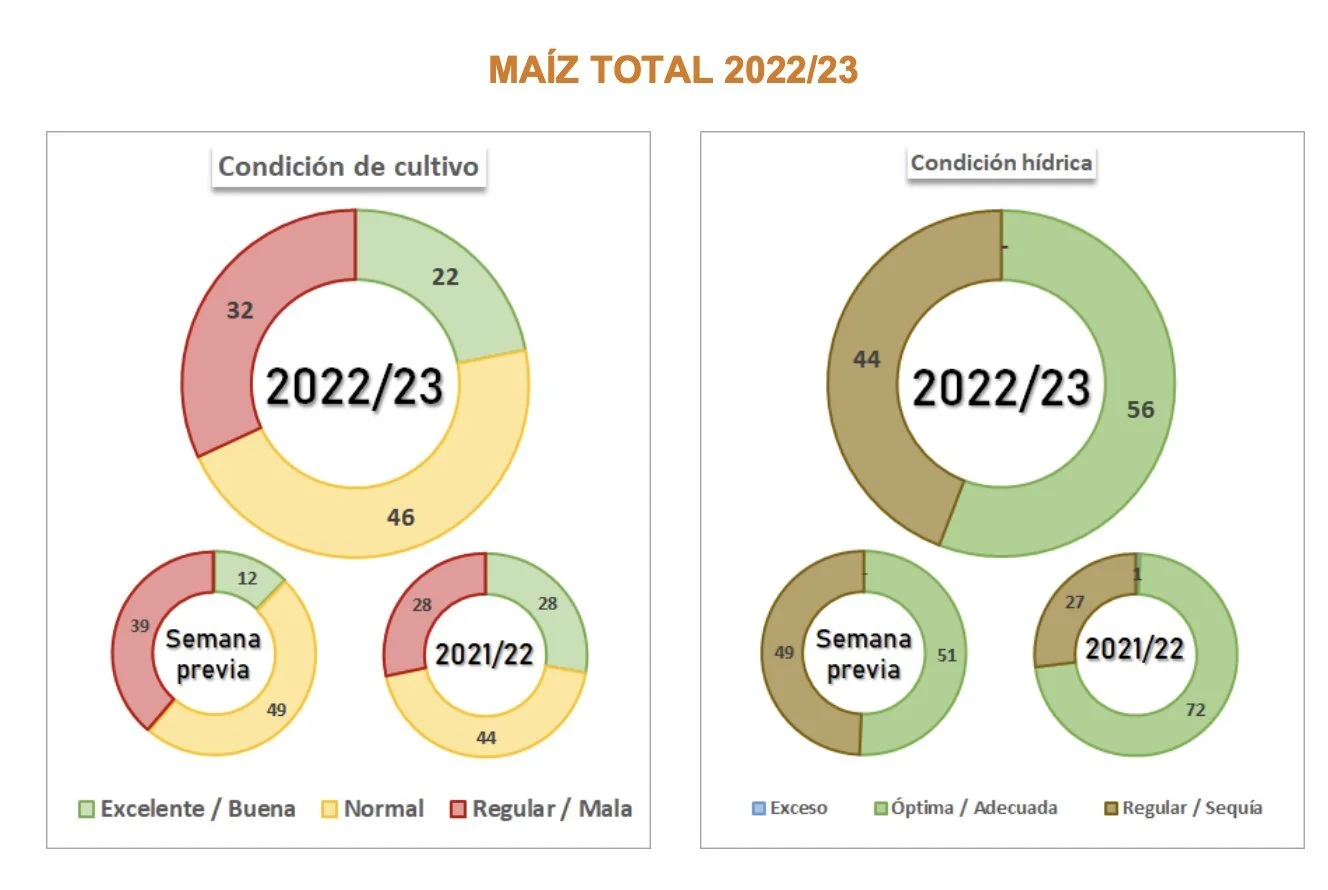

Argentina Crop Conditions

Following their recent rains, crop conditions have seen a pretty decent improvement.

Soybeans move from 7% to 12% rated good to excellent

Corn moves from 12% to 22% rated good to excellent

Export Sales

(Million Tons)

Corn was the outlier, seeing great numbers. While soybeans and wheat were both pretty disappointing.

Corn

Actual: 1.593

Estimate: 0.6 to 1.2

Soybeans

Actual: 0.736

Estimate: 0.7 to 1.3

Wheat

Actual: 0.136

Estimate: 0.3 to 0.6

Highlights & News

Argentina launches a relief fund for farmers that were struck by drought.

Ukraines grain harvest may drop even further, to 49.5 million metric tons. Down from the previous estimate of 51 million.

The S&P 500 had its best January in 4 years.

The NASDAQ had its best January since 2001.

Brazil's January corn exports hit all time highs of 6.4 million metric tons.

Mortgage rates drop below 5% for first time since September.

Other Markets

Crude oil down -0.62 to 75.79

Dow Jones down -125

Dollar Index up +0.542 to 101.570

Cotton up +0.78 to 86.39

In Case You Missed It..

Here are a few of our past updates in case you missed them

Yesterday's Market Update - Harvest Delays & Wheat Outlook

Read Here

Jan. 31 Market Update - Did Wheat Break It's Downtrend

Read Here

Meal Made Contract Highs, Will Other Grains Follow

Listen Here

Jan. 30 - Market Update

Read Here

What Does ADM Think About Chinese Demand

Read Here

What to Expect Going into This Week

Listen Here

Jan. 26 - Will History Repeat Itself?

Listen/Read Here

Jan. 25 - When to Make Sales

Listen Here

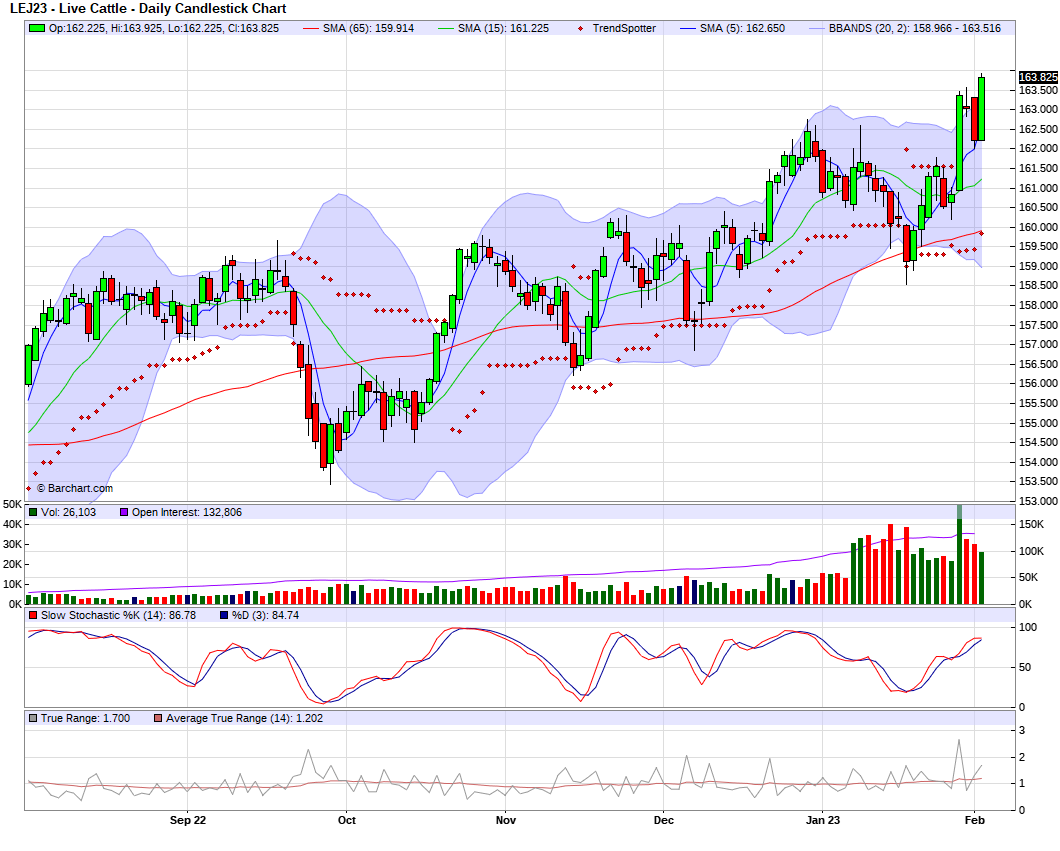

Livestock

Live Cattle up +1.600 to 163.825

Feeder Cattle up +2.675 to 185.925

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service