IS THE TREND YOUR FRIEND?

WEEKLY GRAIN NEWSLETTER

This is Jeremey Frost with some not so fearless comments for www.dailymarketminute.com

TRENDS

Most everyone that has done trading knows of the saying “the trend is your friend”. When one attempts to buck the trend you will often hear the saying “catch a falling knife”. So those are two trading quotes that one might hear often, but how does one apply them to something other than technical trading or chart trading?

Here is a rather big list of questions and various trends to consider when one is doing grain marketing.

What size is the trend?

Is it a world trend, a country trend like a USA trend or a China trend, a regional trend, or an even smaller area trend such as a county or city trend?

What is the time period of the trend?

What type is the trend? What are you watching or quantifying?

Weather Trends

Is the drought getting better or worse? Are we in a dry pattern or wet weather pattern?

Do we have a hot or cool weather pattern?

Price Trends and other Measurement trends

Chart trends

Does the chart have an up trend, a down trend or a sideways trend?

What time period are you measuring?

Daily, weekly, monthly, longer or shorter time periods?

Seasonal trends

Is there a seasonal pattern that typically happens every year?

When does it start?

When does it typically end?

How reliable is the seasonal pattern or trend?

Basis trends

Is the basis getting stronger or weaker?

Versus the last week, the last month, versus historical, etc

Moving Average trends

Is the moving average moving higher or lower?

What time period is your moving average measure?

As an example, if the 5 day moving average is going down, but the 50 day moving average is going up; it would say that the short term is down, but the longer term is still moving higher.

Price momentum trends such as RSI and STOCH

Some such as Roach Ag use these trends to determine sell signals for grain marketing

USDA Carryout Trends/World Carryout Trends/ Private Forecasted Supply and Demand Trends

Is our carryout smaller or bigger versus the last month?

Versus the last year?

Versus where the USDA had it pegged at when the marketing year started.

Is the private forecasts higher or lower then the USDA, is the spread between the two narrowing or widening?

Demand Trends

Export inspections (shipment) & Export sales trends

Seasonal pace

Week over week pace

Year over year

Are we seeing more or less daily reports?

Supply/Yield Trends & Crop condition trends

Is our crop getting bigger or smaller

Year over. year

Versus estimates from traders, private sector, USDA

Monthly reports

Week over week estimates

Versus Averages

Versus previous year

Economic Trends

Is it profitable (Soybean Crush, Ethanol Margins, anything related to the profitability from those buying our grain)

More or less than year ago

Versus average

Versus a previous week

Inflation trends

Stock market trends

Other various thoughts and considerations regarding trends

Momentum & Volatility Trends

Money Flow & Fund Trends

Direction or Movement of trend

Is the trend compacting or growing? Is the trend moving up or down?

What is the trend scorecard?

There are a lot of questions above, my suggestion is to simplify it a little bit and find the handful of trends that you watch. Let those trends become triggers if you will to help one become more proactive in making decisions.

One of the things I have said many times over the past several weeks is that I don’t want to be making grain sales unless it is the right seasonal time to do it. I want to be making sales when I am scared if I am going to raise it, when my buyers are wanting to buy a product from me when they are scared and wondering if I will raise it.

So on my trend scorecard for grain marketing I might have the following listed

Is it the seasonal time to sell grain, am I near the end of the seasonal rally?

Next I might use what is the short term moving average, such as a 5 day?

What about the 20 and 50 day moving averages?

What is the trend of the carryouts? And the demand trends?

Is STOCH and RSI overbought and ready to turn?

At some point then I need to ask myself how much is priced in. Are the trends about to change?

It is at that point when I feel that the trends may be over and about to change that I want to become aggressive in getting protection or making sales.

The hard thing is with my scorecard I don’t have quantifiable non-subjective triggers for a few of my listings. Which is going to add back some emotion. I realize this and I am comfortable with it.

For some of you a better score card might just be.

Seasonal time period

Moving Average trend changes

Overbought

So as long as we are in the seasonal time period, above X breakeven price, recently been overbought and the moving average trend changes from up to sideways/down. One makes a sale.

For others your scorecard can be much more simplistic and just be 1 or two factors/triggers that enable one to make a sale.

The benefit is if you use a trigger that is measurable you can actually go back and back test your results.

The bottom line in all of this is to consider trends. It really doesn’t matter if a report shows something that is above or below expectations, it is what is the trend. If demand is getting better every week we know that the USDA will be having to adjust and that should help prices out.

Various info from other sources.

Here is an updated soybean crush expansion chart. From Argus.

Here is a good article from Argus showing some bean shipments from Brazil going to Argentina.

The below is from Wright on the Market. I strongly recommend trying them for a free trial. One from today Sunday a.m. and the other from Saturday a.m.

These are not complete, for his complete info please go give him a try at www.wrightthemarket.com

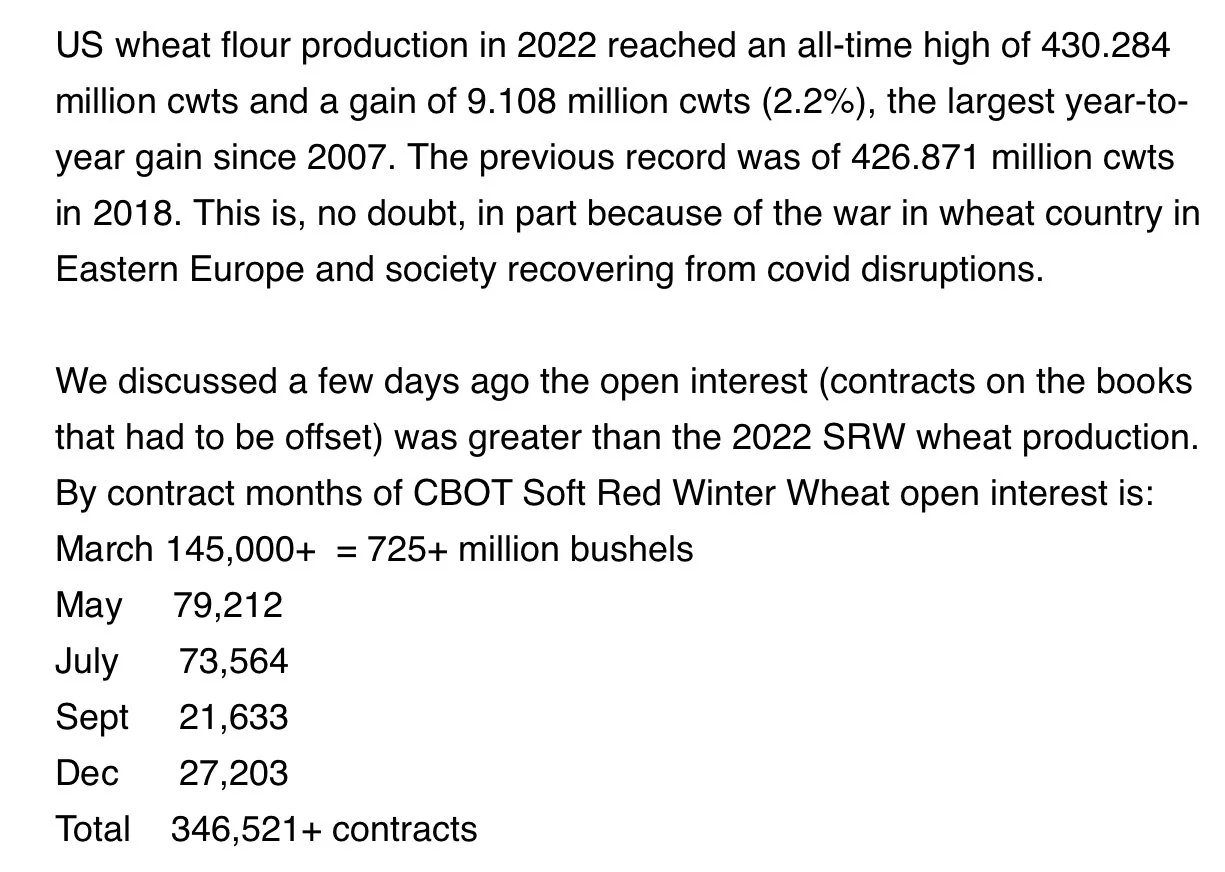

This shows the hay stocks change year over year. This is one reason why I think corn feed usage might be understated.

Closing Thoughts

Not so fearless closing thoughts remain the same, I am bullish. Very bullish and I think we will see new all time highs in 2023 for most of the grains as well as cattle. I want to remain patient until my scorecard of trends tells me it is time to sell. My scorecard might be very complicated, but I am comfortable with that. Your scorecard should be something that you are comfortable with. It should include information that I provide, but it should also include information that is only for your operation as it will be key so your triggers for making sales align with your operational goals as well as risk reward profile.

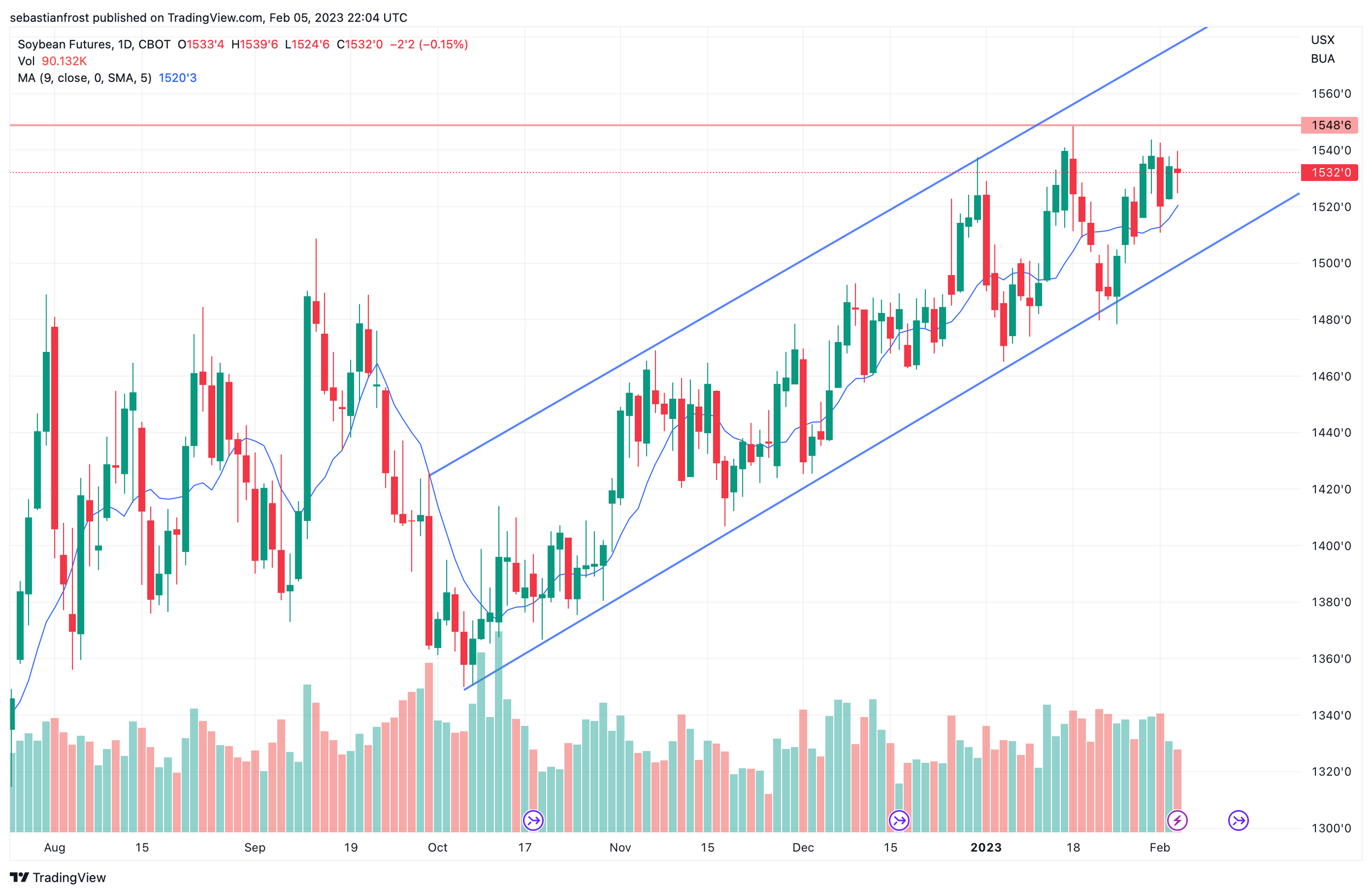

This next week we get an updated USDA report. We will be watching to see if the USDA changes our demand at all. And what they put out for world supply numbers. Some privates have very small numbers in Argentina. Will the USDA buck the trend or jump on board?

Technically all of the grains are close enough to some highs that if we get a good USDA report we could easily bust through resistance and make another leg higher. For corn and beans that means our next resistance point could easily be contract highs. If we hit those then we will see others start to talk about all time highs. That would trigger momentum to the upside in a hurry.

If you fear sold grain in the past few weeks, I am not opposed to buying short term calls to protect the upside. If you sold futures and have money in them, I like taking the profits.

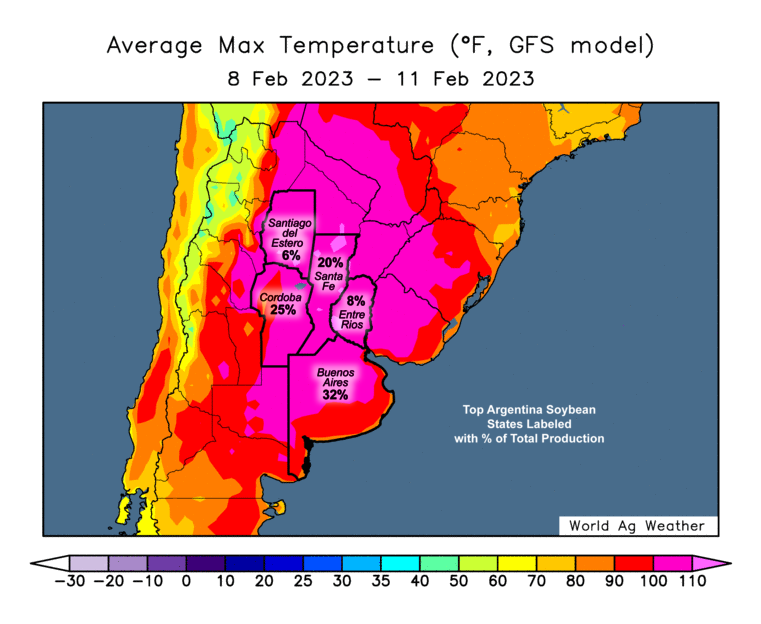

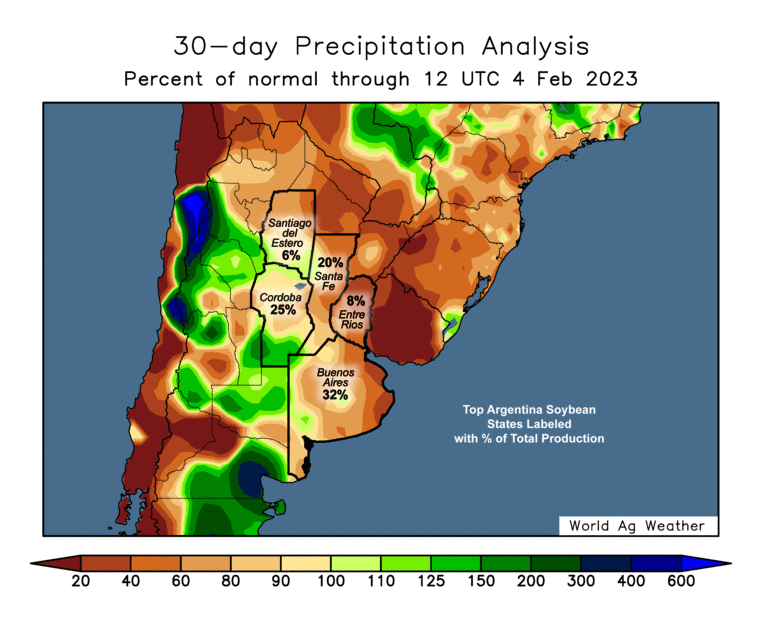

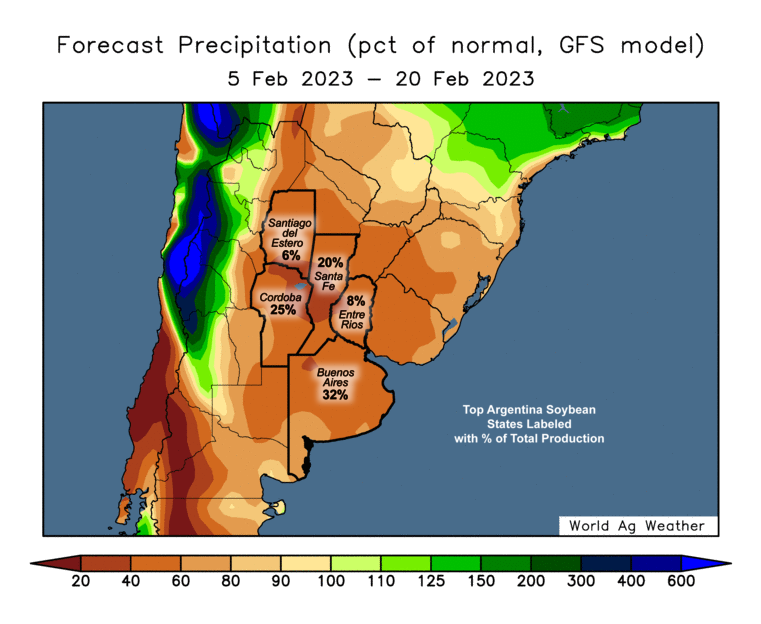

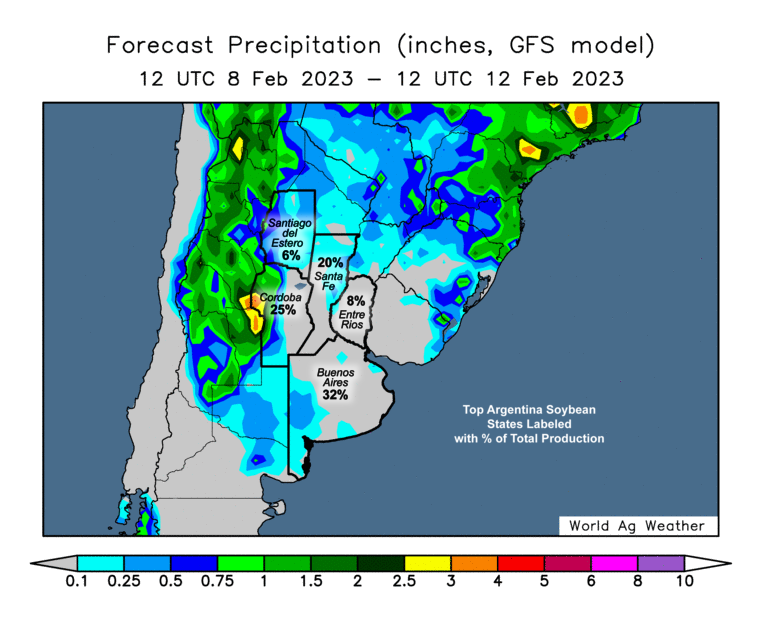

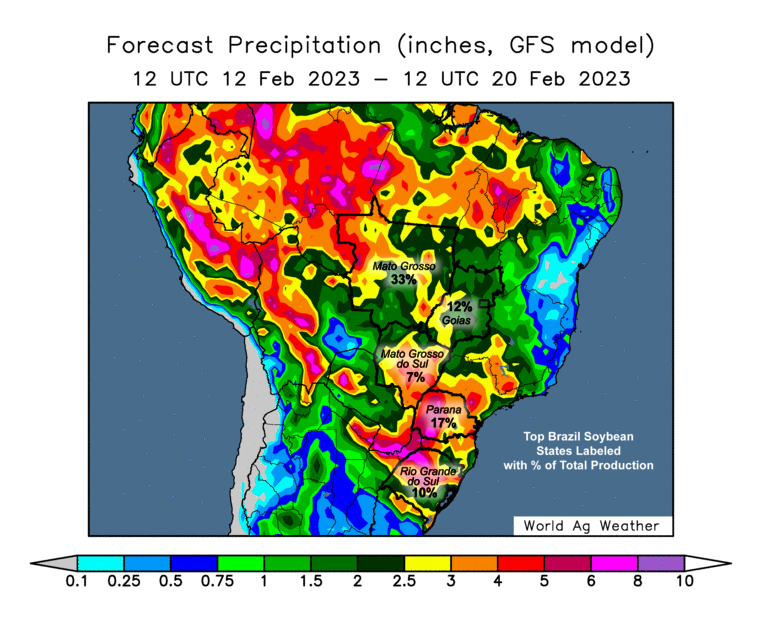

On my radar remains buying bean meal puts. But I need to see some trigger, I think for me that trigger would be seeing the SAM crop size stabilize and the weather maps I am looking at don’t indicate that we are doing that in Argentina, nor do they appear that Brazil will be planting corn in a timely manner.

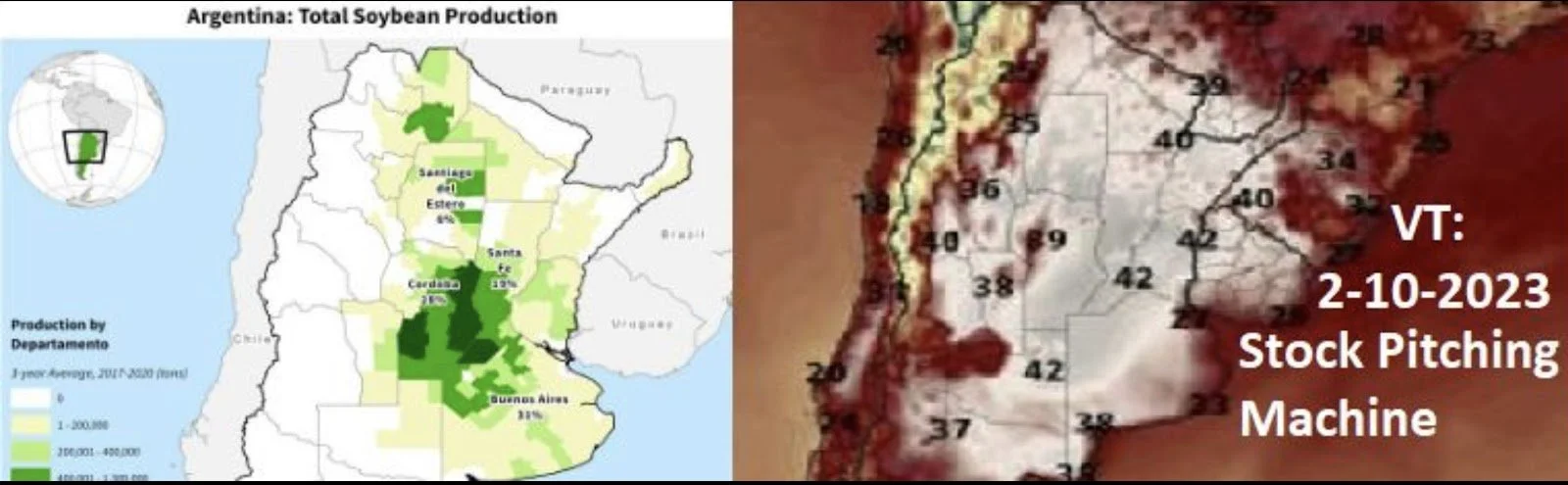

SAM Weather

Charts

Corn 🌽

Soybeans 🌱

Wheat 🌾

Important Upcoming Dates

Wednesday, February 8th

USDA WASDE Report

11:00am

Brazil's CONAB Report

Thursday, February 9th

Weekly Export Sales

Wheat data