WHEAT FOLLOW THROUGH WHILE CORN & BEANS GIVE BACK

Overview

Grains mixed as beans lead us lower after 3 green days in a row, while wheat sees some follow through strength following yesterdays key reversal after we posted contract lows and have since rallied over +20 cents.

Friday is first notice day. Which means farmers will have to decide by tomorrow to price or roll their contracts vs the Sep. A good chunk of this is out of the way already.

Once we get past first notice day it should alleviate some pressure until we get closer to harvest and could offer some support short term. As first notice day has often times marked local bottoms. Farmer selling should be reduced until harvest.

Today we saw new crop flash sales of:

264k beans to China, 100k corn to Columbia, 166k corn to Mexico. Not huge numbers, and seen as routine business. Once those numbers start crawling up into the 500k+ at a time, then things could get interesting.

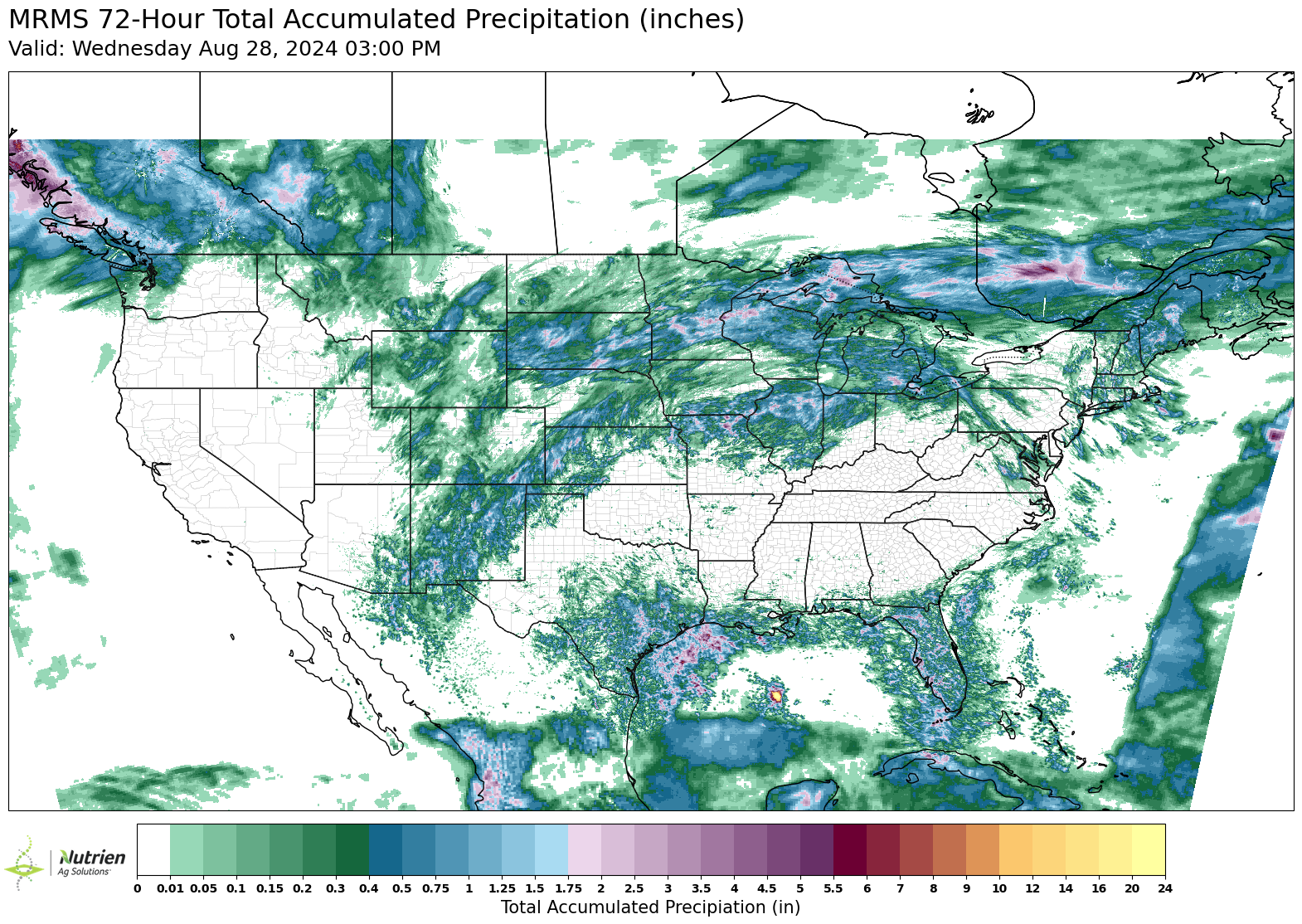

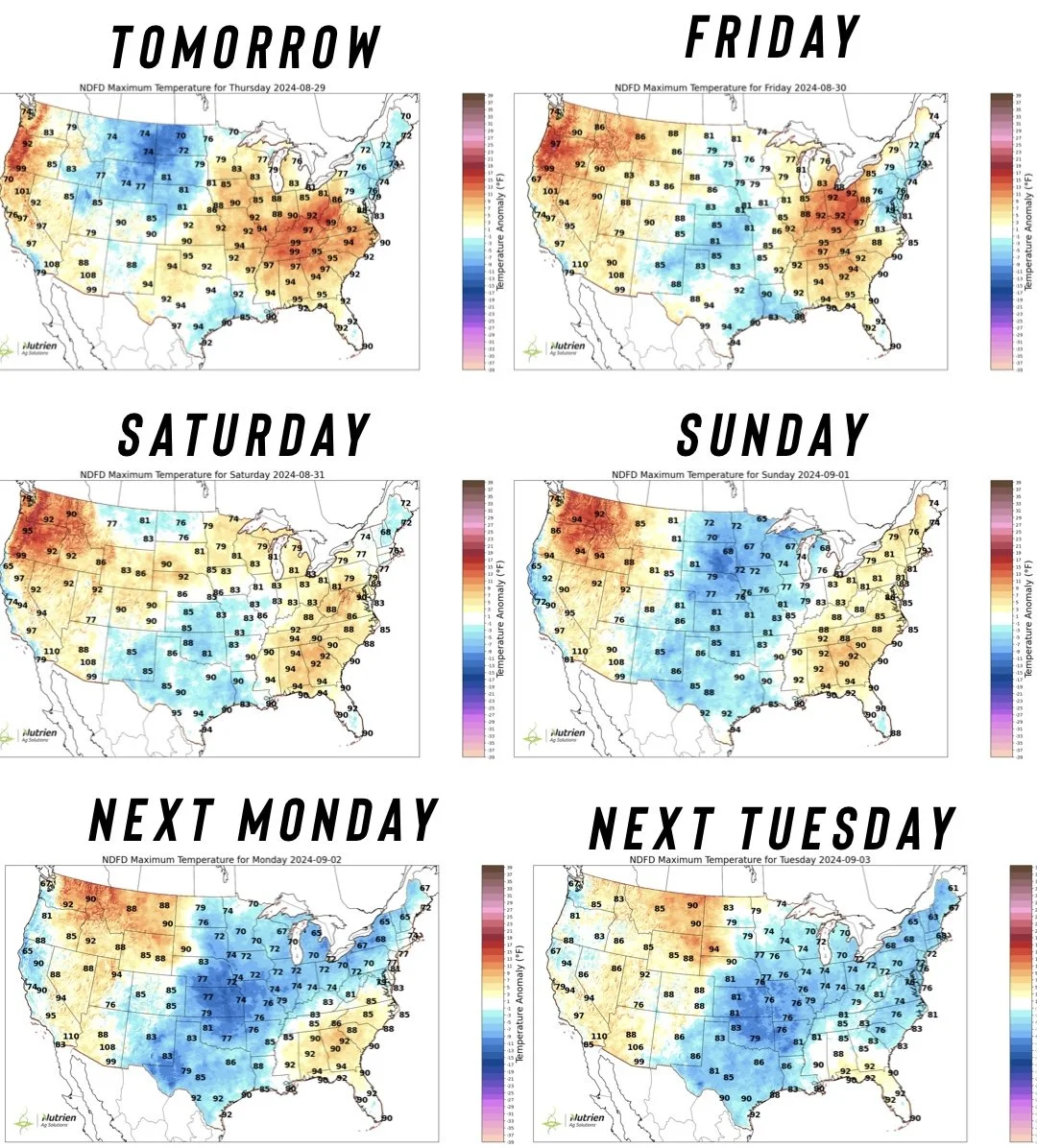

Corn & beans saw some weakness as a good portion of the midwest got rains overnight, helping relief some of that stress the recent brutal heat has brought. The recent heat had provided a little bit of support before the rains.

Some think that this recent heat could trim a little yield off the top of the crops, which it could, but most of the corn crop is made at this point.

Past 72 Hours Rain

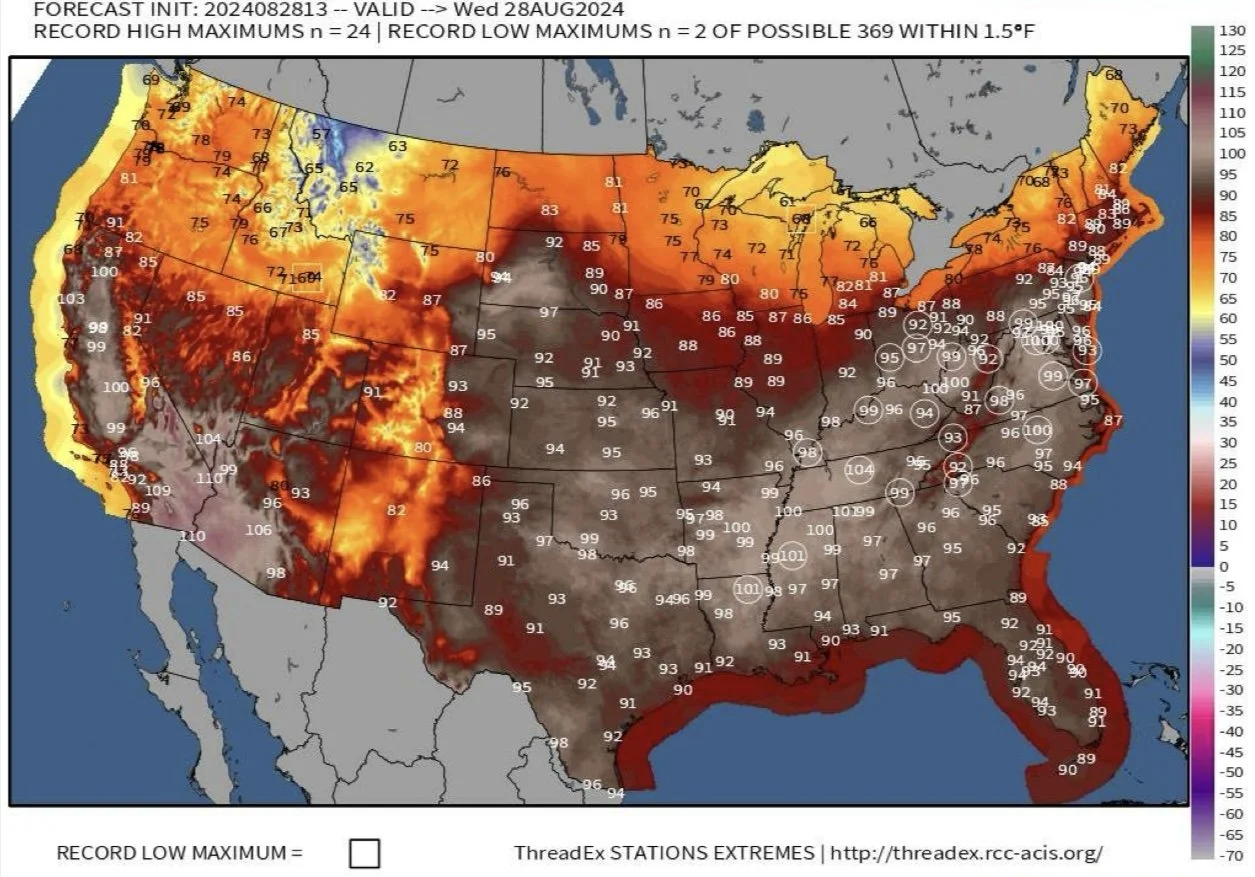

We saw record heat out east today.

The heat looks to cool off starting Sunday and into next week.

Yesterday it was announced that Argentina farmers are expected to shift up to 5 million acres of corn over to soybeans due to the leaf hopper disease they faced this past year.

Reuters announced:

Less than half of France's wheat crop meets the typical protein levels used by key importers and only 1/4 meets average test weight (usually 3/4 of the crop meets this standard). France's harvest will be the smallest since the 1980's after excessive rain this year.

Does this matter? It does, but not even close to the extent if it was the US or Russia.

France only exports roughly 1/2 of what Russia does.

France is the world's 6th leading exporter, & 6th largest producer.

The market has also known about France's issues for a long time.

Today's Main Takeaways

Corn

Corn slightly lower after yesterday’s strong move higher, but we did hold that $3.90 support.

We should start seeing less farmer selling pressure once first notice day is out of the way. At least until harvest starts. Most contracts that needed to be priced or rolled were done today, and all will have to be done tomorrow. So this could offer some support to the upside looking short term.

Here is a good argument from Craig Turner over at StoneX and why he thinks we are close to the lows in corn. He also believes that wherever we print this low, could mark a long term bottom.

His first argument was that a 2 billion bushel carryout before 2019 would’ve normally had us print our harvest lows around $3.30. But when you throw on a 20% inflation after COVID, that's $3.80.

With corn below the cost of production, acres next will very likely be down. Let's say 88 to 89 million. Then if the market at any point during the marketing or growing season next year thinks corn yield is 178-179, corn could easily be over $5 he said.

He then went on to say that historically, even 70 years ago. Corn has always traded in pricing eras.

"In the 1950-60's it was $1 to $2. In the 1970's we had huge inflation and went to a $2 to $4 market. Ethanol changed corn to a $3 to $6-7 market. Now we have this new pricing era since COVID. The old prices of $3 to $3.30 at harvest are probably now in the high $3's. Our old pricing range of when corn traded most of the year between $3.50 to $4.25 is most likely now $4.00 to $5.25. I think whatever the low is here will be the long term low going forward. Just as a general rule, worst case scenario is a $3.60 when you apply that 20% inflation when things got bad below $3."

Then he said that this is the first year since 2021 where we are going to start seeing either the same ending stocks as the year before or lower.

So that was Craig's arguement.

I pretty much agree with him. I think we are at the very least near the lows. Whether they come soon and we grind sideways through harvest, or even if we lose another 20-30 cents at harvest.

Long term we will be higher, led by demand. The only factor that has the ability to send this market 50 cents lower is if we wind up having a yield of 185.

On the other hand, if yield is closer to 180.. then our carryout falls below 2 billion. Then looking to next year, we will have a lot less acres. Then we are creating all of this demand right now at these prices. Throw on a weather scare next year and there could be a real opportunity.

Long term very optimistic of higher prices. Short term very cautious.

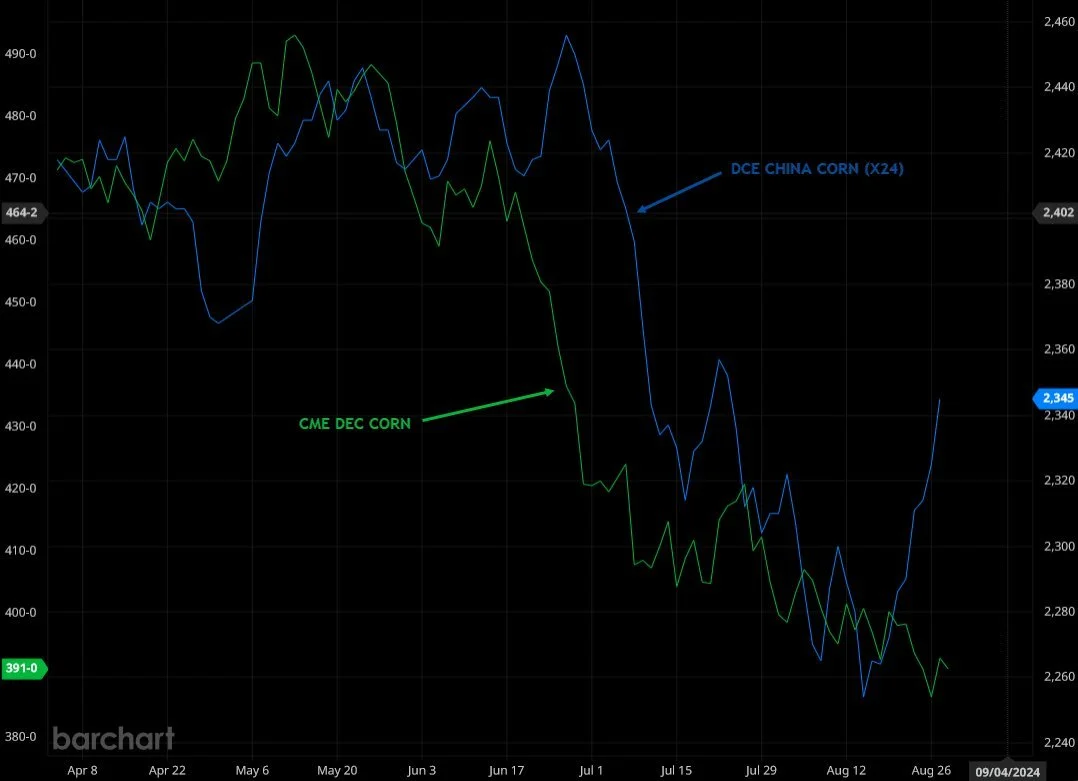

China corn just hit a month 1 month high today. Could perhaps spark some buying from them, as we have the cheapest corn in the world.

For those wanting to capture some carry, the corn spread is the 2nd highest in the last 20 years for this time of year.

If you want help doing so or want to talk through it, give us a call (605)295-3100.

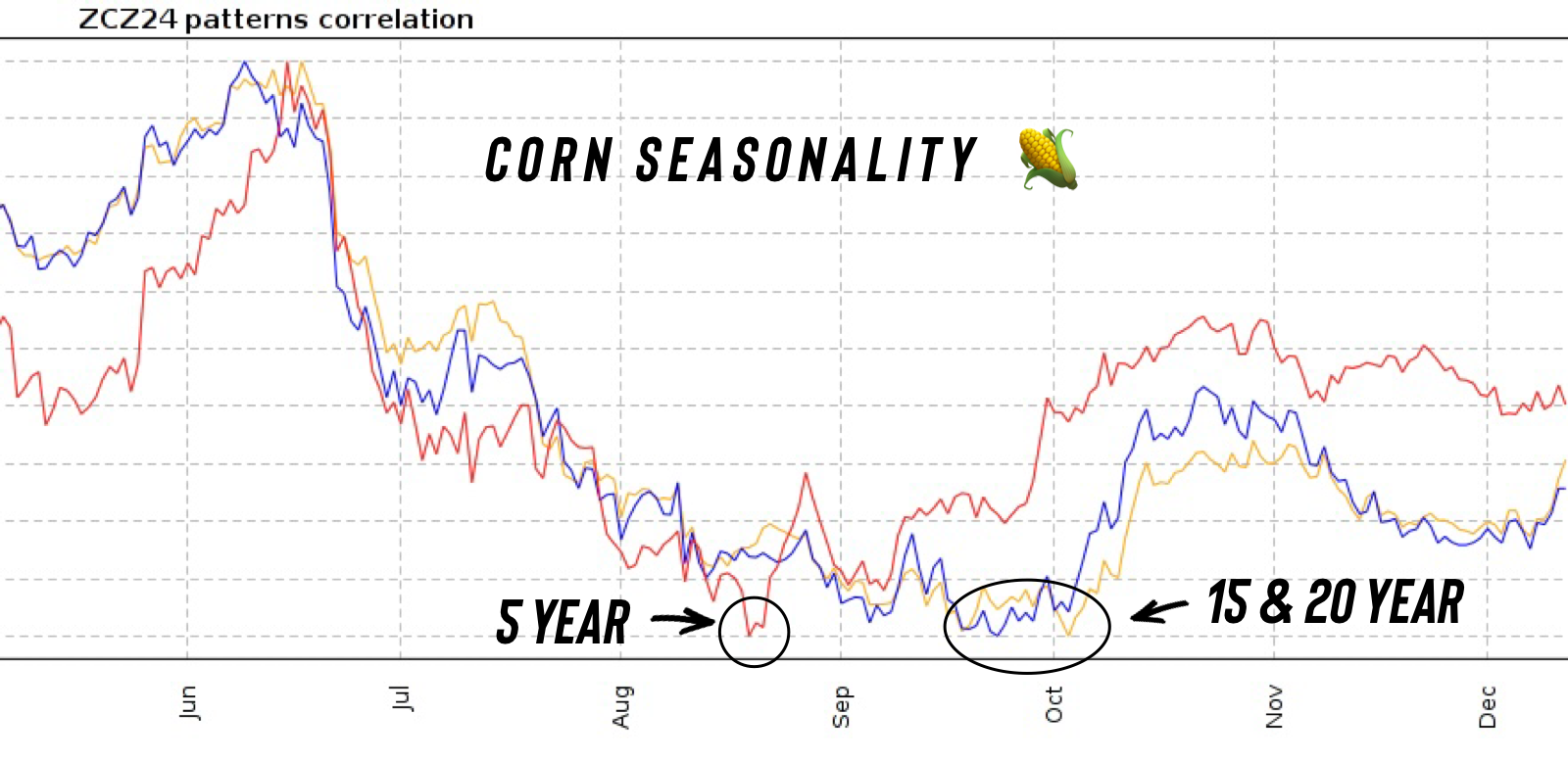

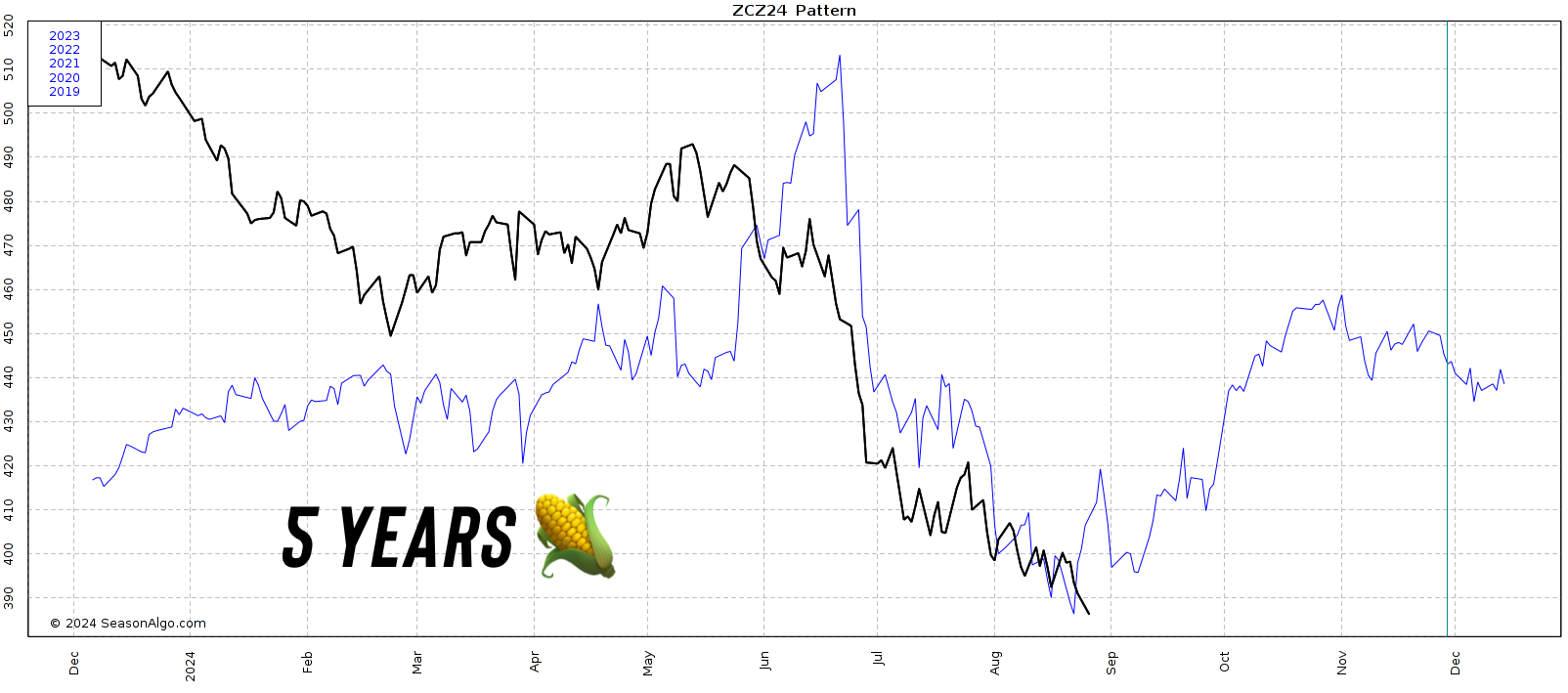

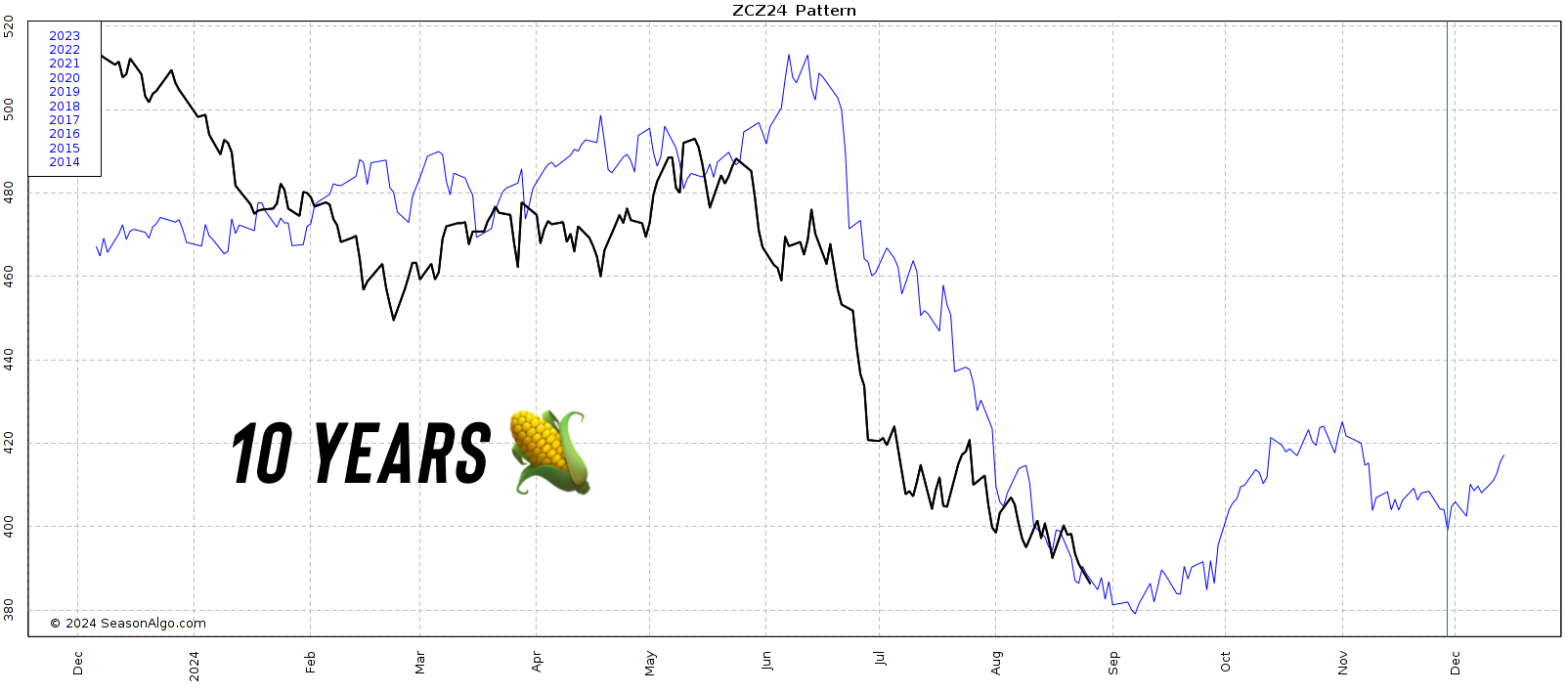

Looking at seasonals, October 1st has been the "magic date" the past 15-20 years.

But the past 5 years we typically bottom right about now. The past 10 years on average we bottom in early September.

Looking at the chart, every week we have gotten this early pop, just to go lower the rest of the week.

Until we take out some resistance it is impossible to say where the low is. We won't know the low was made until we are well off them already.

We need to get AT LEAST above $4.03, until then nothing has changed and we are in a clear downtrend.

Ideally to call the bottom I want above $4.23-26. But that big bold pink line would be a huge area to break. It was our previous support, then on our mini bounce in July that is exactly where we found resistance.

Daily Dec Corn

If we miraculously close above $4.01 by Friday, we would also have a key weekly reversal on the weekly chart. Altough I am not too optimistic about that happening, just something to watch.

Weekly Dec Corn

Soybeans

Beans lower after 3 days higher.

Originally this heat had some thinking that perhaps we were going to trim the top off of yield, but rains relieved some of that concern. If the market cared about the heat, we would’ve probably traded higher today. But we didn’t, so I don't think they see it as a major concern.

We also had palm oil falling in the Asian markets, which led to some weakness here overnight in the soy complex. Would assume this issue is short lived with the expectations for tighter palm oil supplies.

One negative factor I mentioned is that Argy is going to shift corn acres to beans. Up to 5 million acres. That's more of a long term factor. But this would be the biggest acres increase YOY in over a decade.

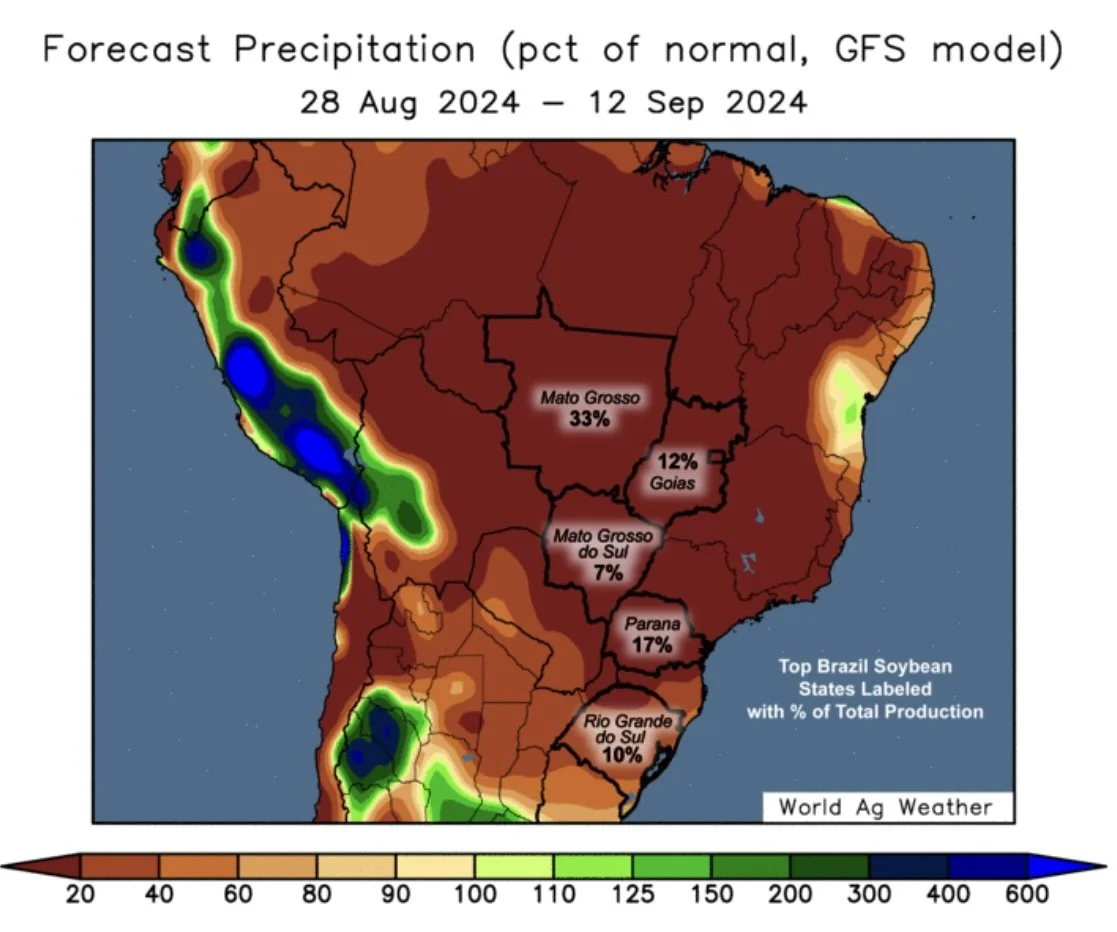

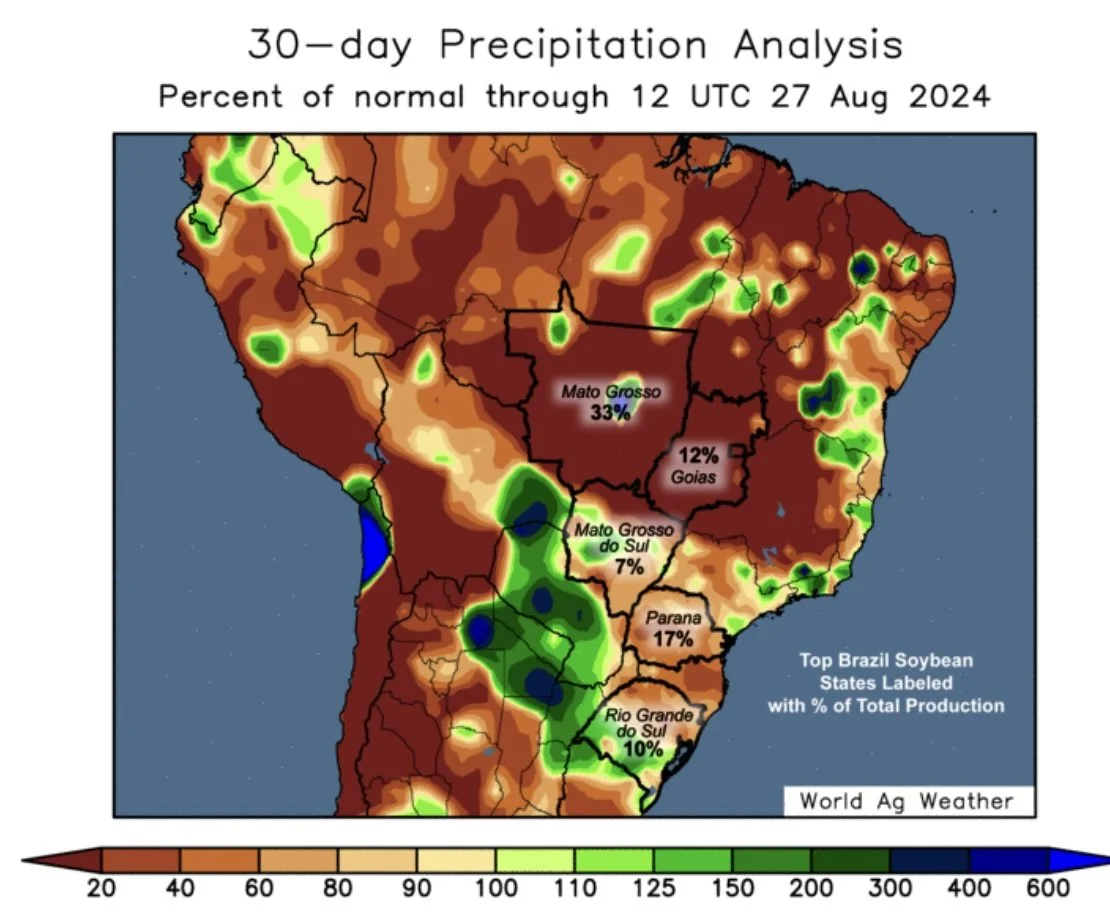

Brazil remains hot and dry, but of course it is dry season. September 7th is their official start to bean planting. Not a concern yet, but if it stays dry this could potentially be a big factor.

But remember, one monsoon rain could fix this. Their rainy season picks up in September.

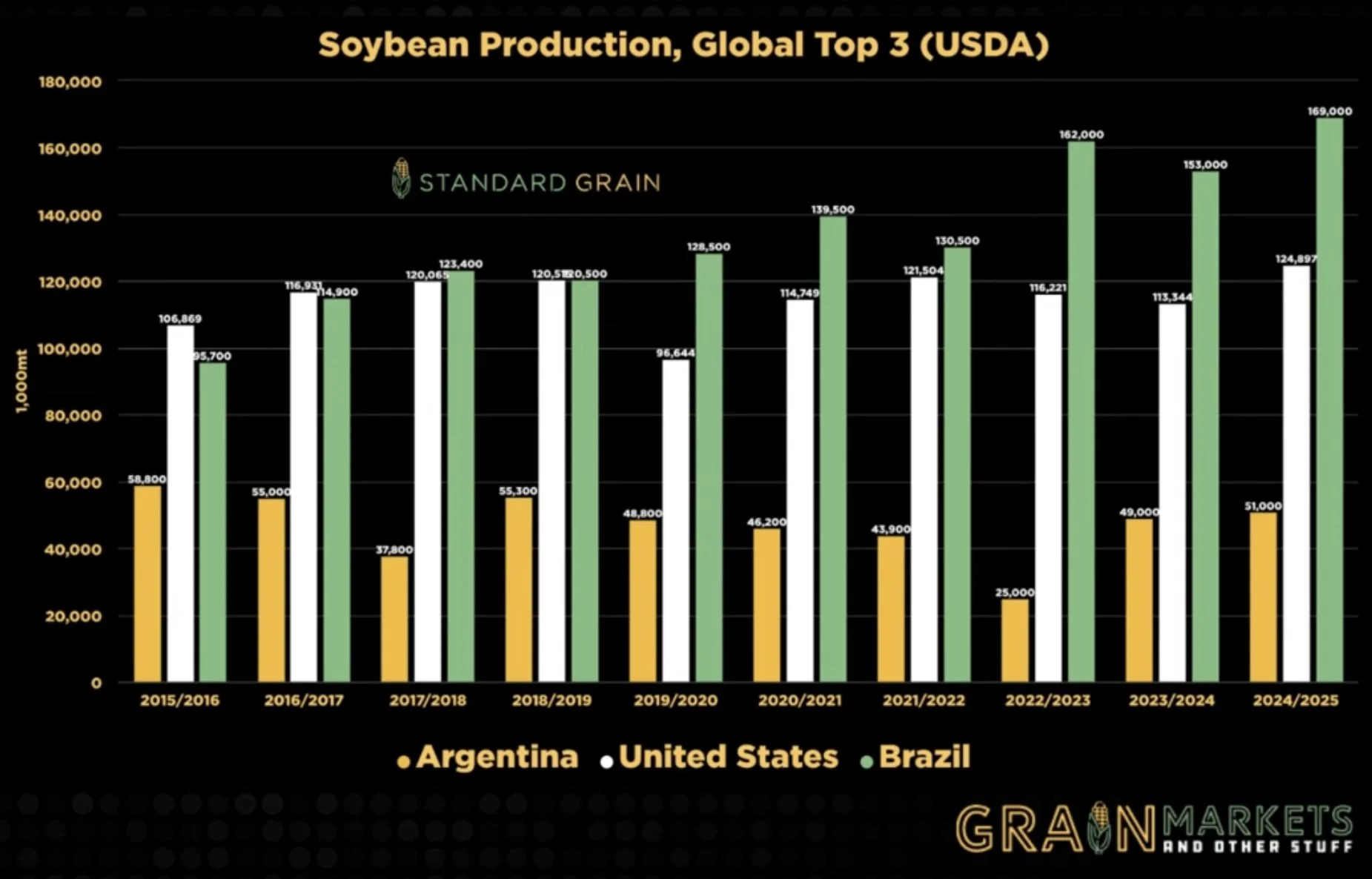

Currently the USDA is projecting a monster 169 MMT Brazil crop.

You could argue the Brazil crop is actually more influential to prices than the US.

Take a look at this chart from Standard Grain. The US and Brazil used to be neck and neck for largest producer. Now it's not even close as they continue to expand bean acres. Here in the US, we are pretty much capped and have no room to add more like they do. So they are now by far the biggest producer.

This soybean market needs China. Even though China is severely under bought, the problem is what if they do not need soybeans yet. What if they want to wait until they see who they are going to be dealing with in the US election? What if they just buy the bare minimum until Brazil has beans to export? It's hard to guess, those are just some arguments being made.

A major rally will probably be hard until halfway through harvest.

Risks:

If this bean crop is close to Pro Farmers 55

If China continues to be hand to mouth

Potential Upside Factors:

China starts buying

Bean crop isn’t as big as everyone thinks

South America scare

Until the charts tell me we are done going down or China steps in massively, the risk is still lower.

The 20 day moving average on is heavy resistance (yellow line). We haven’t closed above it since May. A break above would look friendly.

We also have that downtrend from May (blue line). We have heavily respected that for months. So a break above would look friendly.

It was somewhat of a buy trigger when we got the Pro Farmer numbers, yet closed higher Monday. So bearish news but positive price action. A trigger like that is something you often look for when putting in highs or lows.

Daily Nov Beans

Wheat

Wheat actually gets some follow through strength following yesterday’s bullish key reversal. Something we haven’t seen in a while. As of lately, everytime we get one we fail to follow it up.

Yesterday we made new contract lows, but rallied back closing above the previous days highs. Known as a key reversal.

We got news that France's wheat crop looks awful. So that is friendly.

We also got news that Canada's wheat crop was up from last year, but not by as much as was expected. So that was also somewhat friendly.

Here is another argument from Craig Turner of StoneX as to why we could be putting in a long term bottom in wheat:

"I see a very long term bottom for wheat. We are below the cost of production. Major exporter stocks are projected to be the lowest since 2007. It is the long term effects from the Black Sea war. We just can’t get global production high enough to build on major exporter stocks. It is the only grain or oilseeds who's is lower since 2021."

"When exports come back into wheat, it is telling us the rest of the world is tapped out. The rest of the world will have lower priced wheat, as the US is a far higher cost provider. So if we start seeing wheat in those daily announcements instead of just corn & beans, those funds will start going long. It doesn't feel like the funds will keep hammering wheat knowing the risk of a snap back."

I agree with Craig. The world has consumed more wheat than it has produced for 4 years in a row now. Wheat is going to be looking at lower acres.

I am not saying the bottom is in. But I do feel comfortable saying we will see wheat higher in the coming months.

The past 2 days price action also looked very good. Back above $5.45 would look good, above $5.80 would have me saying the bottom is in.

Recommendation:

For those that sold off the combine, it might not be a bad idea to look to re-own here with futures/options. Call Jeremey for specific risk management & various strategies.

Daily Dec Chicago

Daily Dec KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

8/27/24

DECENT PRICE ACTION. BASIS CONTRACTS. ROLLING VS FUTURES. NOT FALLING FOR BIG AG TRAP

8/26/24

FIRST NOTICE DAY PRESSURE & CROP TOUR RECAP

8/23/24

CROP TOUR SHOWS MASSIVE BEAN YIELD

8/22/24

UGLY DAY FOR WHEAT & BEANS, STILL RISK, CROP TOURS, CAPTURING CARRY

8/21/24

CROP TOUR DAY 3. NOT HUGE MOVEMENT

8/20/24

CROP TOUR SO FAR & COMPARISON TO USDA

8/19/24

CROP TOUR BOUNCE

8/16/24

RISK REMAINS LOWER. MANAGE YOUR RISK

8/15/24

DEMAND, BIG US CROPS & BRAZIL DROUGHT

8/14/24

DEAD CAT BOUNCE

8/13/24

POST USDA SELL OFF

8/12/24

USDA REPORT: BEARISH BEANS. SMALLER CORN CARRYOUT & RECORD YIELDS

8/9/24

USDA REPORT MONDAY

8/7/24

HUGE USDA REPORT MONDAY

8/6/24

WHEAT UNDERVALUED? CORN YIELD? WHAT TO DO WITH GRAIN OFF COMBINE

8/5/24

GRAINS STRONG WHILE WORLD PANICS

8/2/24

GRAINS RALLY, YIELD ESTIMATES, CHINA STARTS TO BUY

8/1/24