WILL WHEAT REPEAT LAST YEARS WAR RALLY?

AUDIO COMMENTARY

Highlights

Start of another wheat war rally?

Should you be making sales

Why we could see higher prices across grains

Listen to today’s audio below

For those of you on a trial, we are offering 50% OFF

MARKET UPDATE

War Headlines Rally Grains

Prefer to listen? Listen to an Audio Version

Futures Prices Close

Overview

War headlines spark a rally across the grains. As Russia launched a cruise missle from the black sea and the missle crossed over Moldovia and Romania before striking in Ukraine. Romanina is a NATO nation, this missle crossed over their air space. So by involving other countries especially those part of the NATO, has sparked a ton of concern surrounding further war escalation, resulting in the rally we saw here today.

Highlights

Russia escalates war

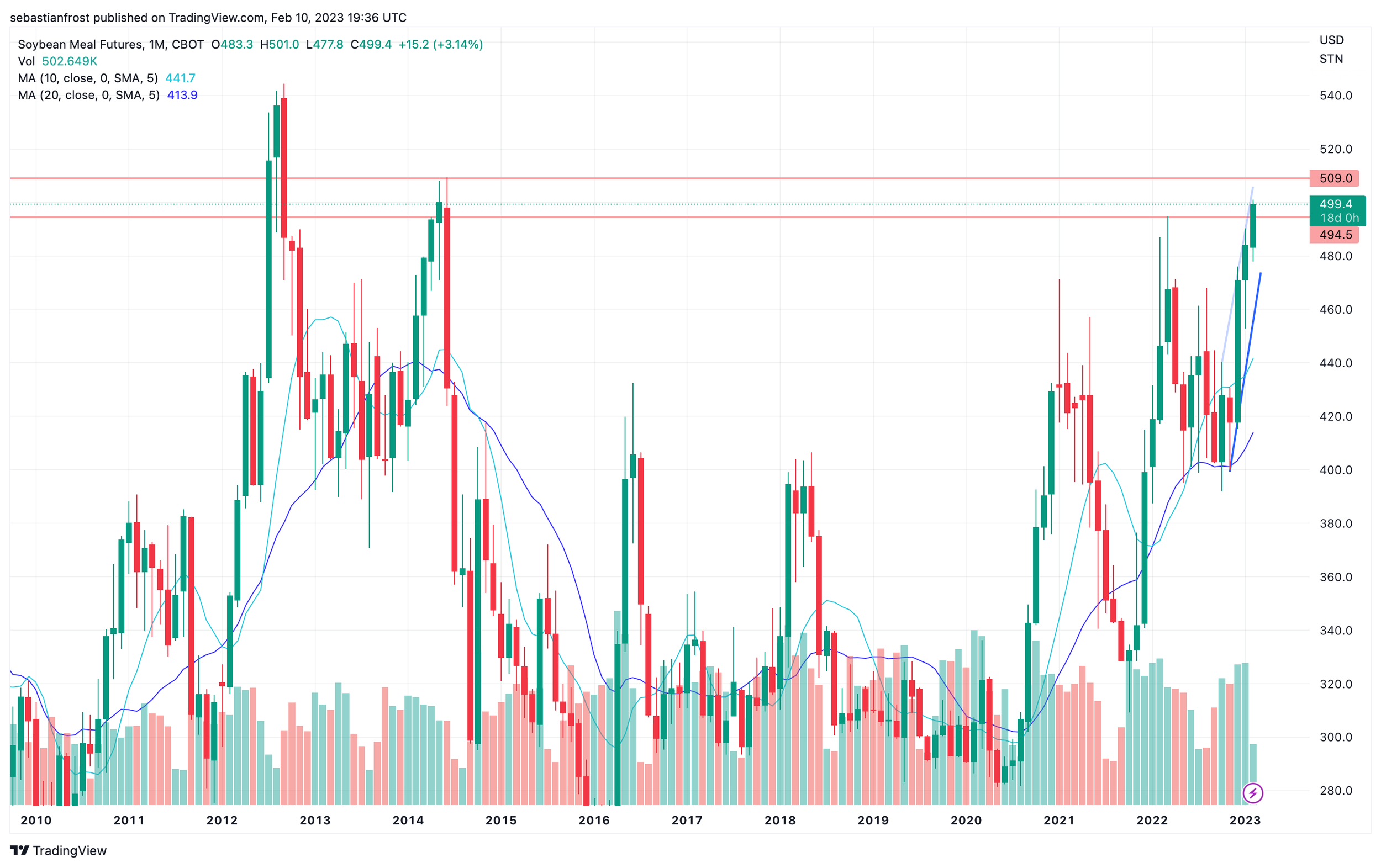

Meal approaches 2014 highs

Another Chinese balloon shot down

Today's Main Takeaways

Corn

Corn up almost a dime following the rest of the markets higher off the back of war escalation news.

Taking a look outside of the war headlines, one thing bulls would like to see is just overall better demand and export sales. As demand is one thing bears seem to keep pointing at. Of course war can push higher, but when the war shock fades, one would like to see a better demand story to keep pushing prices higher.

There is a bigger bullish story beginning to develop over in Brazil, as their wave of continuous rains is delaying their second corn crop plantings. If this continues, this will be a big factor to watch out for.

Here in the U.S. a topic that will continue to gain debating interest is average. It is still a little early to make any bold predictions here. But there is some talk that rains in the east might cause some problems for spring planting.

Overall, demand isn’t amazing. So unless this changes, we will have to continue to look for weather and war to continue to support prices.

From a technical standpoint, amazing bounce today. Now pushing us close to a point of resistance. A break above and I have my eyes set on $7.00

Corn March-23

Soybeans

Soybeans seeing a big rally here today. Trading at their highest levels since June of last year.

Meal continues to carry the bean complex, as meal rallied again. This time pushing past our recent highs. We are looking at highs we haven’t seen since 2014. The next upside target is 509. Meal closed the day at 499 1/2. The story will meal is that many believe we will see a meal shortage due to the worlds leading exporter Argentina continuing to see weather problems and complications.

There was also rumors that the Chinese bought 4 to 6 cargoes of U.S. beans, which added support to both the meal market and the beans.

Argentina continues to see their production estimates lowered, and I think we continue to see the USDA lower theirs as well. Crop ratings for Argentina came in at a whopping 48% of their beans rated poor to very poor. So the big question going forward is just how poor will their crop be.

Argentina weather is also shifting hotter and drier over the course of the next two weeks or so, which will look to continue to support the meal and bean market.

China will be another thing everyone will be keeping their eyes on. As today we again saw headlines of another Chinese balloon shot down. This time over Alaska. So there is some uncertainty there and how this all is going to effect the U.S. and China relationship. China really hasn’t provided a ton of business, or at least not as much as bulls would have liked as they recently ended their whole covid fiasco.

One thing that was bearish was the lowest weekly export sales we have seen in months. As they came in at 460k metric tons. This number is essentially half of what we have averaged the past month. But exports are running well ahead of pace so I don't see this as a major problem right now.

I am slightly nervous here as funds are very long beans and meal, as they hold close to a record long position in meal. The funds can certainly keep pushing this thing higher, but there is some uncertainty with Brazil's still expected massive crop.

Going forward, soybeans will be decided by how much worse the situations get in Argentina, whether we can see Chinese appetite grow, and what the funds decide to do here.

Looking at the charts, beans again are looking to test that stiff resistance around the $15.50 range. If we do happen to get a break to the upside, there is room to run as we have a massive gap to $16.80

Soybeans March-23

Soymeal

Meal is approaching highs we haven’t seen since 2014.. Will Argentina concerns allow us to keep climbing?

Soymeal March-23

Wheat

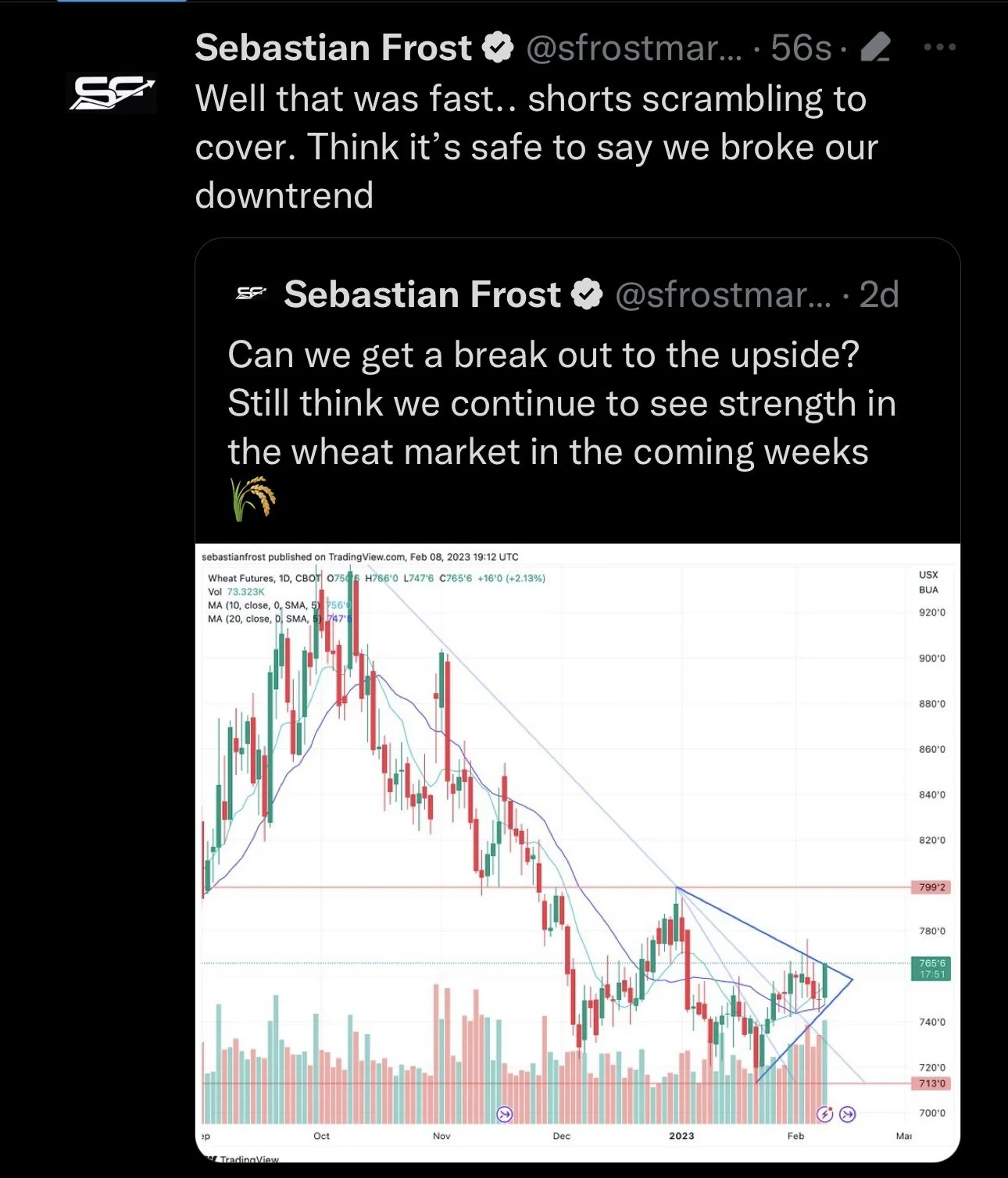

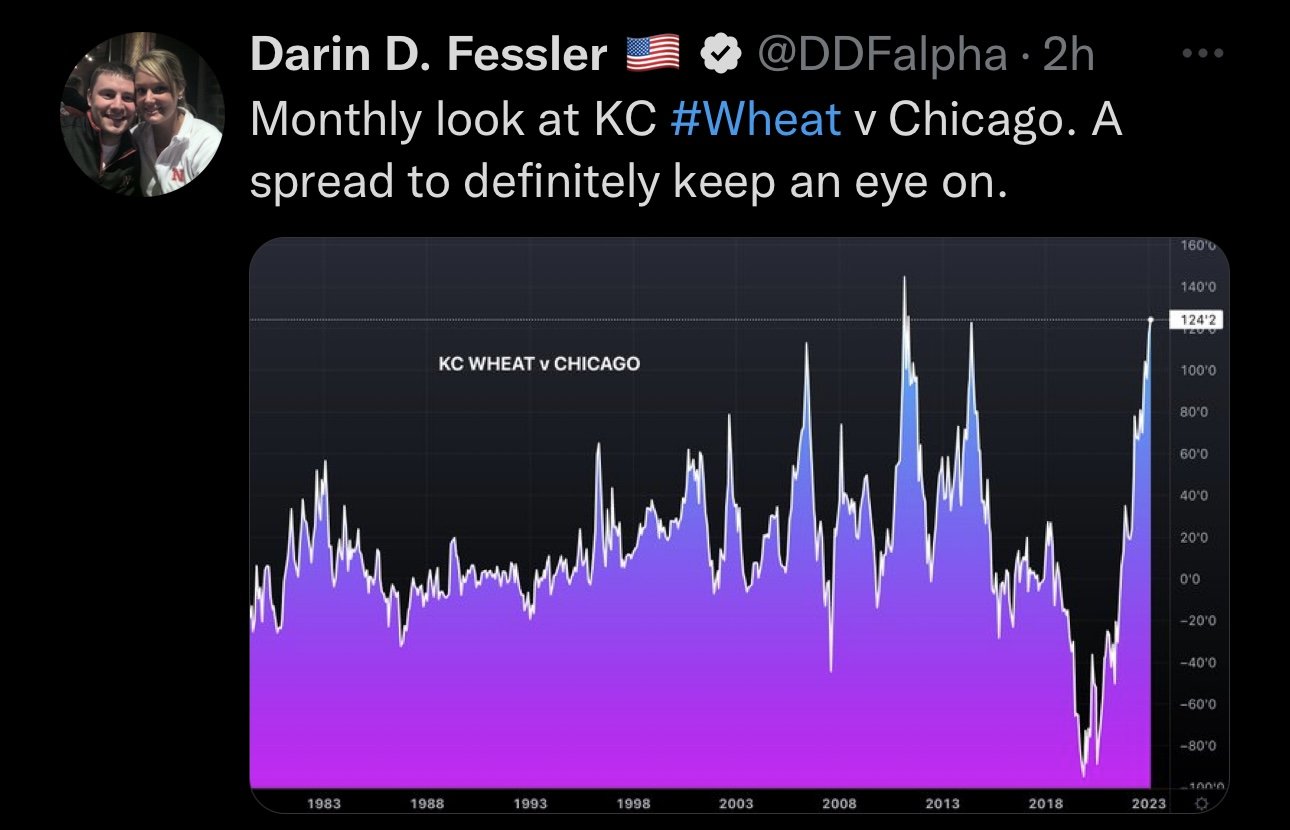

Wheat leading the grains higher on a massive rally due to Russia sparking the possibility of further war escalation. As Chicago and KC both rally nearly +30 cents.

The past week or so, I have mentioned several times that there was a strong possibility of Russia launching an attack on Ukraine. So to me, this news wasn’t all that surprising. Looks like the news did scare some shorts, and I think this news will continue to lead to a short covering rally as funds still remain extremely short. I didn’t make any sense in the first place as to why the funds were continuing to look to sell wheat when they knew war was still at large, as well as a multitude of other factors.

Headlines are saying that Ukraine has shot down 61 cruise missiles in the last 24 hours. So Putin and Russia still looking to be aggressive. Russia is also reportedly not happy with the current grain corridor deal. This deal expires in about a month, so we will have to see if they decide to renew it or not.

As I've been saying since December, Im still bullish wheat. I think we have a ton of upside going forward. We have have a ton of key growing regions here in the states still experiencing severe drought. Funds are very short. I think we continue to see escalation grow and see the shorts caught off guard scrambling to buy wheat.

Now the question is how high can we go?

Taking a look at the charts, our first point of resistance is right under $8.00 which is where we saw prices reverse following our December rally. Once we break that key $8.00 level the we present ourselves with a ton of more upside. I wouldn’t be surprised to see us climb to $9.00 if we continue to break higher. Nonetheless, I think its safe to say we broke our downtrend.

Chicago March-23

KC March-23

MPLS March-23

Some Tidbits from Wright on the Market

Highlights

Yesterday’s weekly export sales had soybeans at their lowest or second lowest sales of the marketing year. Before you panic and sell every bean, note that the lowest weekly soybean exports of the marketing year (which began 1 September) is always a month or so after Brazil starts to harvest soybeans. In fact, the lowest sales week of the marketing year usually comes the first or second week of January because Brazil’s soybean harvest usually starts in late December. This year, their harvest has been delayed due to persistent rains. The US has sold more than 400,000 mt of old crop soybeans in January that normally would not have been sold because Brazil beans are normally available in January.

By the way, cotton export sales (see our chart below) were a marketing year high. If cotton prices go as high as some analysts think, it will really add to the 2023 acreage bidding war about to begin.

Reuters Karen Braun researched the past three years crop ratings on Argentina’s bean crop for the second week of February. You can see this year’s crop is far worse than last year’s poor crop.

2023: 48% poor, 13% good

2022: 19% poor, 40% good

2021: 8% poor, 23% good

2020: 0% poor, 66% good

Tidbits

Eleven members of Congress have recommended the USA stop providing military and financial support to Ukraine for many reasons, which included Pentagon officials saying the deliveries of weapons to Ukraine has led to "significant depletion" of the arsenals of the United States itself, weakening its military potential. They also mentioned the money sent to Ukraine had no audit capability and not even a requirement for a paper trail.

China’s balloon which crossed the US last week was salvaged and it carried equipment that was clearly for intelligence surveillance.

India’s distressed Adani Enterprises Ltd stock price was down 11.2% Thursday.

Still no Commitment of Traders (COT) Report for last week.

Thirty years ago, South Africa was the world’s #3 corn exporter. Ten years ago, it was the #5 corn exporter. It is now in a “state of disaster,” according to South Africa’s president due to the country’s raging energy crisis. All the problems are due to poor management caused by corrupt government officials. The “green” media is saying the lack of energy is because they rely on coal fired generators, which worked just fine before 2000.

Reuters News Energy Editor reports the sanctions on Russia diverted tens of billions of dollars to shipping and refining firms. The EU and the USA embargoed Russian crude on December 5th, but continued to buy Russian diesel, gasoline and natural gas until February 5th.

Now that Russia cannot sell refined products to the EU and USA, Russian crude oil is being sold to refinery firms in China, India, Greece and the United Arab Emirates. Since those countries were already buying all the crude they needed for domestic use, they are buying additional Russian crude, refining it and exporting some gasoline and a lot of diesel fuel around the world. The refineries will not be close to producing at capacity for another month at least, which is another reason not to pay ahead for your diesel fuel just yet.

Check out Wright on the Markets website Here

Highlights & News

Pentagon downed second object over Alaska, reports are saying it was the size of a car.

Commitment of Traders delayed again, will not be released today. Last report was January 27th.

Brazil's corn exports in January reached record volume.

Argentina crop conditions continue to come in lower.

Argentina's Buenos Grain Exhange again cuts soybean harvest forecasts.

In Case You Missed It..

Here are a few of our past updates in case you missed them

Livestock

Live Cattle up +0.325 to 163.950

Feeder Cattle down -0.425 to 186.400

Feeder Cattle

Live Cattle

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

Social Media

U.S. Weather

Source: National Weather Service